New Bull Run – Already Started or Another 10-Years?

How long can the current rally last? That is a multi-billion-dollars question everyone would like to know. Boy! It’s not easy being either a bull or a bear. Damn the bull when the market tumbles and damn the bear when the market skyrockets. Many fundamentalists claimed they are not affected or rather they don’t care because they are long-term investors and equate themselves to Warren Buffett. The truth is you can really count with your fingers if these people are really who they claimed to be – cloning the investing strategy of the Oracle of Omaha. But these same people do not have what Buffett has and that is billions of free dollars waiting to buy into the right stocks at the right time.

They have forgotten they do not have deep pocket such as Warren Buffett yet they fantasize themselves as the great investor. Warren can make mistake, losses billions of dollars in investment and yet shareholders will still call Warren the greatest investor of all time. He can negotiate to buy ailing companies with great discount and still get very attractive dividend coupons. Most importantly he can hold for 10-year, 20-year or even forever in the name of long-term investment and nobody dares to say he would bankrupt the shareholders’ fund. But can the Warren Buffett wannabes do that?

But the American’s economic crisis is over. The worst is over and many economists had said so. The Japan and Germany are out of the woods and Federal Reserves’ Ben Bernanke was praised for the job well done. The only problem is the, well, hundreds of thousands of jobless Yankees but given time they’ll be out of their misery soon. Have we forgotten that we’re seeing the sunshine because all these governments gave the boost of “stimulus packages” hence it’s not a genuine recovery. Hey, you shouldn’t argue on this (stimulus package) because if all the economic superpowers were doing it then it should be the right thing to do. Let’s not complicate the matter and be happy about it and heck, if need arises, there will be second, third, fourth and more stimulus packages to be introduced if this stubborn recession won’t go away.

Now, assuming that we’re already into the tenth year of consolidation since the bull market in 2000, we still have another ten more years before the next super bull-run. But can we actually use the chart to predict safely the prophecy of 20-year consolidation cycle on current modern days – the internet whereby you can literally buy and sell stocks at the comfort at your home and in the process create volatility? Maybe we’ve actually entered a shorter consolidation period of say, 10-year, before the next climax come. And if that’s true then we’ve actually entering the next Super Bull Market. But do you dare to bet your fortune on it? On the other hand if you’re Buffett wannabe you can place your bet now and wait for another 10, 20 or 30 years to claim the trophy *grin*.

Other Articles That May Interest You …

Monday, August 17, 2009

Get the Facts Right and You’ll Know What to Do Next

Uh oh! It seems the rally got stuck in the mud. Analysts who screamed at the top of the voice that the bull is out for revenge didn’t seem to get it. You just got to filter out such analysts because they could help to burn a big hold in your pocket. At this moment most of us will probably laugh at the idea of Dow Jones going back under 8,000-point. The world’s largest stock market is building its foundation about 9,000 now so don’t make me die laughing. OK, I can’t (or rather not) imagine the possibility of such event but let’s get and agree to the current realities.

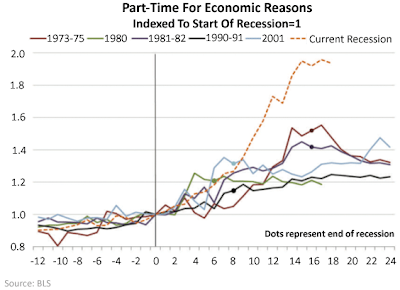

The first fact is there’re still hundreds of thousands of jobless Americans hunting for jobs, not to mention many more are not getting their usual increments. But they’re so lucky to have a job when their friends are forced to join the “part-time workers”. Compared to the previous recessions the numbers of part-timers have actually doubled. But why do you care that these bunch of people who spent more than what they earned are now literally jobless and has to beg for part-time jobs to pay their bills? Well, it’s because they would influence the U.S. economy (the next fact).

While it’s true that the blame on weaker retail sales should be put on jobless Americans, the weaker consumer confidence from existing “full-time” employees who are not spending as much as before is putting the U.S. market on the radar. Not even the news that Japan, Germany and France are out of recession are enough to pacify the analysts. In fact many analysts have turned cautious and are advising people to take profit in anticipation of a major correction after the double-digit gains this year.

The third fact is while it “may” be true that the worst is over, the U.S. economy will definitely take years to recover to pre-financial-crisis level. And one of the best indicators to watch is how the global oil prices will perform, now that it had tumbled below $66 a barrel. As long as the consumer sentiment index is bearish, you can bet your last dollar that the oil prices will follow accordingly unless of course there’ll be another hurricane such as the Katrina which destroyed many oil fields. So it’s not a long-term investment strategy for the time being (yeah, try to tell that to Warren Buffett).

In reality, those who are making good money are the short-term traders who sell or buy and immediately close their positions the moment their portfolios are in the profit. Do this repetitive task and you’ll see your portfolio grows. But it’s true that it’s easier said than done because greed and fear will always come to trick your emotions. However now is the best time to train yourselves to minimize the seduction from these two evils. Nobody can tell you what to do because only you know how evil your “twin brothers” are *grin*.

Other Articles That May Interest You …

Sunday, August 09, 2009

Thank Goodness the Jobs Report was Great - What Now?

Not everybody dare to declare this year will be a great year despite the fact that Dow Jones Industrial Average has been sending many stock traders smiling from ear to ear. They may dare to say that the worst is over (unless huge bubble such as credit card debt burst) but still they’re not putting more than 50% of their monies into the equities for obvious reason. Like it or not the sentiments are bullish and that’s all that matter. The latest jobs report was good with job losses of only 247,000 versus 325,000 consenses while unemployment rate of 9.4% against consensus of 9.6%.

From the stock market point of view, the strength demonstrated by Dow Jones when it confidently climbed above 9,000-level and stays above it thereafter brought the relieve much sought after. You can call this the turning point or whatever you may wish to call it but to me, this is the event that triggered buying positions. But you shouldn’t put all your monies into the game, not to mention you should take profits off the table when your target has been achieved. However certain captain of the economy is not buying the bull story. At least not John Mauldin, president of Millennium Wave Investments, who isn't convinced the next bull market has already begun but would rather see companies adding jobs.

There’re also concerns about Japan’s economy – its’ debt and unemployment may trigger another round of panic selling. China is expected to surpass Japan this year as the world’s second largest economy is not doing Japan any favor either. Japan’s unemployment rate has spiked to an astonishing 5.2%, thanks to aging baby boomers – the population is expected to fall to 90 million by 2055 after peaked in 2004 at 128 million. Fortunately unlike the Westerners, Japanese have good savings hopefully be able to help them sail through the rough sea of economy uncertainties, not to mention the close family-ties which could extend the helps needed.

Other Articles That May Interest You …

Sunday, August 02, 2009

Let the Peaceful Marchers Walk, Stop Wasting Bullets

So, another round of massive demonstration and another round of horrible traffic jam within the city. The capital of Malaysia, Kuala Lumpur, was actually shut-down on Friday itself. I planned to go back early on Friday after a gathering but somehow couldn’t make it and spend some good hours wasting expensive fuels, thanks to the super-efficient police force in setting up road-blocks as if a batallion Genghis Khan’s army was invading. If only the police force would do the same to catch snatch thieves, murderers or at least the mat rempits. I bet people would applause to watch FRU sending their tear-gas and spraying acid rain to mat rempits, no?

PM Najib Razak was super quiet during the massive “Bersih” demonstration - happened early Nov 2007 when his predecessor Abdullah Badawi was in office. Heck, who can forget those days when Badawi’s administration was laughed and joked at for having an Information Minister such as Zainuddin Maidin, who took offence by Al-Jazeera? But now that Najib Razak has taken office he has to face the same massive demonstration, estimated to be between 50,000 to 100,000 people who took part in various parts of the city. Unlike Badawi who wasn’t prepare for such scale of voluntary demonstrators, Najib with the help from his cousin, Home Minister Hishammuddin Hussein, is well prepared this time around.

The rally by “Bersih” succeeded in penetrating (or rather tricked) the police and intelligence unit during Badawi’s administration but today’s (Saturday) rally was not able to deliver their memo to the palace. But this was expected because it would be a slap on the face of Najib, not to mention his administration would look really silly and stupid, if today’s demonstration was successful. In reality, the PAS has shown its strength – it could mobilize its’ “troops” without paying a single cent while Najib’s friendly “pro-ISA” was a letdown. Of course you don’t expect Najib’s UMNO party could order even 1% of its so-called 3 million members to show their muscles without giving away “allowances”, do you?

Some may accused the demonstration had caused inconvenience especially the unbearable traffic jam but the fact is none of this would have happen if the police did not prostitute themselves to the politicians. The road-blocks were the main culprits although it was unnecessary. If only the police could stay independent and grant the organizers (both pro-ISA and anti-ISA) the permits to rally peacefully, one after another, the demonstration would have went smoothly and before you know it, it’s over. Past anti-government demonstration has proven that these people just wanted to have a peaceful walk. Instead of sending rounds of teary gas and in the process anger the people, the ruling government could try the gentle way to show that they (the ruling government) are not barbarians and respect human rights.

Mahathirism way of adopting dictatorship, oppression and suppression no longer work and is outdated. Relying on illiterate Sarawakians and Sabahans to deliver the seats in maintaining federal government is a risky business. The way police showed double-standard and cruelty to the peaceful marchers will be well-documented in the cyberspace especially blogosphere hence Najib Razak may just be the last Prime Minister from the BN coalition parties (until the next general election) if he continues to use the same old method from his predecessors. He should know better than anybody else that he can’t shut the mouth of the voters as long as internet exists. If you can oppress and suppress your own people literally you can do worse things to foreign investors.

The old chap Mahathir may be senile and thought he was the GodFather of the country and everybody should listen to him. He may still be very sentimental and proud of his past achievements but the youngsters are not only smarter and literate, they are also brainwashing their parents about the reality – who is the real corrupt-monsters. The political landscape has changed and if Najib Razak continues to have “advisors” such as Nazri and Hishammuddin, his mentor Mahathir may be still be alive to see his UMNO Baru dies before Mahathir himself. That would not be such a bad scenario though. Just let the peaceful marchers walk on the street. It’s a good exercise to reduce their fats. If this had happened in other countries such as South Korea, USA or European countries, the police would have been kicked, spitted and probably slapped for their brutality. Thank God the demonstrators have been extremely peaceful so far.

Other Articles That May Interest You …

No comments:

Post a Comment