Tuesday, September 29, 2009

Maxis Relisting – The Race for the Pathetic Limited Shares

Excitement returns once again, at least to the employees of Maxis Communications Berhad who enjoyed their fortunes via ESOS not many moons ago. Will their big boss Ananda Krishnan be generous enough to distribute some pink forms to them, again? It may or may not happen because the situation is quite unique now. The whole re-listing of Maxis is still sketchy especially to the employees. The whole plan is still at draft level and until the official IPO prospectus is out Maxis together with the guaranteed underwriter, CIMB Group (CEO Nazir Razak – brother of PM Najib Razak) with Credit Suisse and Goldman Sachs, can still go back to the drawing board for amendments.

The re-listing is of course for real. As a matter of fact the moment PM Najib Razak announced he was persuading Maxis to relist again (after privatization on June, 2007) in the Kuala Lumpur Stock Exchange in his effort to lure foreign investors’ hot money into the country, you know the decision (to relist) had been made many weeks earlier. The only concern is definitely the timing for the listing considering many are still cautious about the global economy especially in the United States. And do I need to tell you again the main problem of the U.S.’s economy currently? If the IPO of Maxis proceeds as planned, it would definitely be the biggest IPO ever.

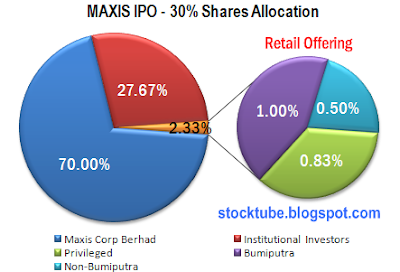

There’ll be no new share issued but 30% of the IPO shares will be from the current stakeholders. Post-IPO, Maxis Communications Berhad will hold 70% stake in Maxis Berhad while the remaining 30% goes to retail and institutional investors. The bad news – retailers will get only 2.33% (174.795 million shares) and institutional investors get the lion 27.67% (2.075 billion shares) portion. The worse news – if you’re not privileged Maxis customers, dealers, directors and whatnot you’re cannibalizing each other in the retail segment because the allocation is actually 1.50% (112.5 million shares) of the 2.25 billions shares to be floated in the stock exchange. The worst news – the segregation of 1% (75 million shares) and 0.5% (37.5 million shares) for bumiputra and non-bumiputra respectively means you’re into “gladiator games” fighting the wild animals (institutional investors and privileged retailers) and your fellow comrades (average Joes from bumiputra or non-bumiputra).

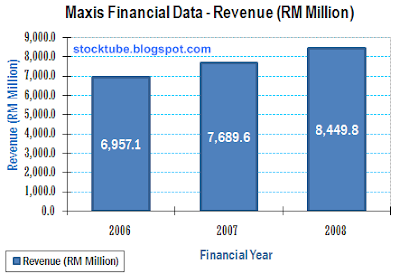

Another fact that you may need to know about Maxis is this company is a different animal now compared to seven years ago. The market is already saturated with very little room for growth regardless whether in the postpaid, prepaid or wireless broadband segment. In fact the monthly ARPU of postpaid is in declining mode (from RM140.2 in 2006 to RM112.3 in 2008) whereas the prepaid and wireless are not growing at all (have I told you Maxis’s wireless broadband sucks big time?). Maxis’s latest sexy offering is of course the exclusive partnership with Apple Inc.’s (Nasdaq: AAPL, stock) iPhone via 3G. Seriously without iPhone 3G which is gaining momentum (hope they can slash the freaking high price) the IPO story is less attractive.

So, how much is Ananda Krishnan asking from the 30% public offering? The price is still very sketchy with fluctuations ranging from RM3.60 to RM6.20 a share. Some analysts predicted RM5.40 per share justifying the Maxis brand may commands 18-multiples (compared to DIGI.com’s 16-multiples) of financial-year-2009’s 30 sen EPS (earnings per share) hence raising RM40.5 billion to Ananda Krishnan and his shareholders. However I would think such valuation is too high considering the current telco market scenario but then with retailers fighting tooth and nail for the freaking pathetic limited 2.33% shares allocated, the risk of under-subscription is almost none. Furthermore the promise of dividend payout of 75% of earnings is sufficient to attract investors.

Other Articles That May Interest You …

Tuesday, September 22, 2009

Malaysia F-1, Made-in-Malaysia or Made-for-Cronies?

Remember how Janet Jackson’s right breast was exposed during the halftime show at the Super Bowl - more than five years ago? Some 72,000 fans in Reliant Stadium and more than 100 million watching around the world got more than what they expected to see when Justin Timberlake who was singing “I’ll get you naked by the end of this song” when he ripped off Janet’s top, exposing her bare breast – the nipple covered by a metal “solar”medallion. Of course Justin claimed it was an accident and blamed it on “wardrobe malfunction”. But if you were to talk to anyone back then, nobody would believe it was “unintentional” but rather part of a stunt simply because it’s quite unusual for anyone to put a star on the breast for personal or private viewing *grin*.

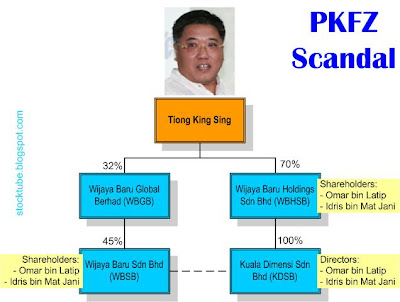

The ruling government tried to block RPK’s Malaysia-Today website but they knew better than anyone that it was a fruitless effort. Hence Najib’s cousin, Home Minister Hishammuddin changed the strategy and is tracking the identity of the “insider” who passed the documents to RPK. Now you know why Tiong King Sing wasn’t disturb a bit with Ong Tee Kiat’s action to expose the PKFZ scandal. Tiong knew nobody will be prosecuted because the stake was too high. If he were to be brought down, he’ll make sure he’ll bring along Transport Ministers, Finance Ministers and many of Najib’s administration top officials to become his cell-mates *grin*. Although this is a golden opportunity for Najib to prove to the voters that he’s a greater leader than Mahathir in fighting corruption, he couldn’t afford to shake the already sinking ship he’s commanding. Thus he would try his very best to cover or divert the attention from the PKFZ scandal.

Najib’s only silver bullet now is to perform exceptionally in the economy sector. He knew voters especially the Chinese voters were throwing their votes behind his advisor, former PM Mahathir, despite the dictatorship and numerous scandals because Mahathir did well in driving the country’s economy. Besides economy agendas, he also needs to do branding so that people can remember him for something he did. The mention of Mahathir and you’ll immediately think of Proton, KLCC, Cyberjaya, Putrajaya and others. Thus, Najib needs an icon associate with him. Nope, he can’t glorify the Scorpene submarine because that would bring back the bad memory of Altantuya. Neither can he imitate his predecessor Abdullah Badawi in “Corridoring”. So far he has not find anything as gigantic as KLCC or Corridors but he’s learning fast and still accepting ideas.

His recent idea for Malaysia to have its own 1Malaysia F1 team in Formula One next year was indeed a very brave (and risky) and raised many eyebrows. Leveraging on Proton-owned Lotus-powered racing team the initiative would be better than sending a space tourist into space if the team could give giants like Ferrari and McLaren-Mercedes a run for their monies. The team will be a partnership between the government and private sectors especially AirAsia Berhad’s (KLSE: AIRASIA, stock-code 5099) and Naza Group. Nobody can deny the fact that Formula-1 is indeed one of the greatest platforms in advertising and marketing and if this latest stunt by Najib works it would move his rating several notches up, not to mention that it would put Malaysia on the world map once again *ahem*.

You can argue that the expenditure is the problem of the private sector, in this case AirAsia and Naza Group. But why would smart peoples like AirAsia and Naza decided to waste hundreds of millions of dollars in a project such as Formula-1? Wait a minute, AirAsia Kamaruddin mentioned the company is spending only £10 million (RM57 million) initially so it seems Proton or the government (public’s money) will be spending huge amount of monies for this project. Have they forgotten the disastrous experience and humiliation experienced by the country in 2001? It took the main sponsor Magnum three F-1 races before the lottery company threw in the towel, sending the then Malaysian F-1 driver, Alex Yoong, to drive A-1 instead.

As for advertising it wouldn’t do AirAsia or Naza any favor if the team continuously fails to finish the race, let alone winning. It’s a known fact that the Formula-1 via FIA is desperate for participants especially after the giants Honda and BMW decided to leave the race. Hence, it was speculated that the bar has been lowered to new participants. Nevertheless, Najib’s administration has to be transparent in disclosing the spending of public’s money in this Formula-1 project because it’s nobody will believe the government and Proton will not be spending a single cent in such a high-profile project. But one thing is for sure – if this project fails, you can be assured that some companies (or rather cronies) have made hundreds of millions in the process. One has to remember the ruling government is flush with monies because it’s holding back the money for development in developed states captured by the opposition especially Selangor and Penang.

Other Articles That May Interest You …

Thursday, September 17, 2009

Unloaded AAPL with 200% Profit

It's been many moons since I last publish my profit. It's definitely not easy to score 3-digits percentage profit and with the expiration about two days away, AAPL has been kind to me. The stock jumped a whopping $7 bucks a share prompting me to unload with profit well above 200%. With Dow Jones approaching 10,000 and Apple breaching $180 a share there's no reason I shouldn't dump it, not that I've any option since the expiration is two days away.

Monday, September 07, 2009

MCA’s Leadership to Change - minus a Ministry?

Corruption and racial politics are two main top ala-cartes on the ruling government’s menu headed by UMNO. These two authentic cuisines are so delicious that after 52-year of independence they (corruption and racial politics) are still being practiced by the ruling BN government. Just like in the stock market whereby the stock prices are determined by sellers and buyers, the corrupt and racist BN can still survive simply because the voters strangely endorse such culture. It’s true that you can’t put the blame entirely on the ruling BN government for the massive corruptions and the politics of racism. Hey, if there’s no demand then there should be no supply, literally, so blame the voters.

Of course one can argue that the people were to scare to voice their dissatisfaction after the “May 13, 1969” racial riots that killed many innocent people. Malaysia is a great country not too much because she is disaster-free but because this country seems to enjoy endless refill of wealth. The discovery of oil led to the formation of Petronas in 1974 of which the actual accounting remains the greatest government secret till today. Coupled with other natural resources the country is so cash-rich that it would be impossible for the ruling government not to plunder the wealth. Of course the standard modus operandi to do so is to jack-up many times the original cost of projects. Hence the name of the game is to create many gigantic projects, never mind it’ll become white elephants.

Even though Ong Tee Kiat may have made the wrong political move by sacking the “sex-actor”, deputy Chua Soi Lek, the fact remains that Najib likes Chua Soi Lek more than Ong Tee Kiat for obvious reason – both of them take care of their women well *grin*. Seriously, Najib prefers Chua Soi Lek because both of them speak the “same language” and share the “same channel”. Chua is definitely a “yes-man” to Najib’s UMNO but the same cannot be said about Ong. If not because of the changes in the political landscape Ong Tee Kiat would have been “ordered by UMNO” to vacate his president seat for violating BN’s code of conduct – exposing ruling government’s scandal publicly thus embarrassing the premier. Now political analysts are predicting that both Ong and Chua may shake hands, hug and kiss each others and start packing their stuffs together.

That’s why the “cow head” incident was orchestrated – as the backup plan to divert PKFZ scandal and MCA crisis from the public. The main objective for such racial tactic (cow is considered sacred to the Indians) was of course to create havoc to the opposition who is governing the Selangor State. The fact that Najib’s cousin, Home Minister Hishammuddin, was biased and very protective of the “cow head” demonstrators was disturbing although the UMNO’s plan would be perfect if it could excite some Indians to the streets. Government’s demand for the video on the “cow head” protest to be removed from MalaysiaKini also shows attempt to cover-up the disgusting provocation allegedly involving UMNO leaders. If it was true that the “cow head” protest involved members from PKR, PAS and UMNO as alleged by the Home Minister then by all means put all of them under ISA or at least interrogate them. The ruling government is embarking on a full-scale of destructions and chaos to the states controlled by the opposition – the next is no doubt Selangor after Perak was captured.

Other Articles That May Interest You …

Wednesday, September 02, 2009

September – the month of Ghost Investing

Besides studying the fundamental and technical analysis of stocks there’re many other things you need to be aware of. One of these is the history of the stock markets itself. Too bad if you hate history but I found history to be very interesting although I’ve to admit I scored my history papers by memorizing the facts. Yes, history is about facts although there’re many politicians who are trying to re-write the history even from primary schools’ text-books – to ensure their individual’s survival based on racial cards. We learn from history and because of history we may not see another world war (hopefully) again, at least we’ve the will to prevent it because the Hiroshima and Nagasaki’s destructions were enough to spook us. The month of September started with a bang – Dow Jones and Nasdaq went down the drain plunging 185.68 and 40.17 points respectively or 2 percent each. In fact, since 1929’s Great Depression September has been the worst single month in the history of U.S. stocks. With September and October traditionally being two worst months of the year, you should find this as an excuse not to enter the stock markets. Who can forget the Sept 11th terrorist attacks that left many stock punters flabbergasted? On Sept 2007 we saw queues of panic customers withdrawing their monies from Northern Rock while Sept 2008 witnessed the collapse of Lehman Brothers and the rest is, well, history.

The month of September started with a bang – Dow Jones and Nasdaq went down the drain plunging 185.68 and 40.17 points respectively or 2 percent each. In fact, since 1929’s Great Depression September has been the worst single month in the history of U.S. stocks. With September and October traditionally being two worst months of the year, you should find this as an excuse not to enter the stock markets. Who can forget the Sept 11th terrorist attacks that left many stock punters flabbergasted? On Sept 2007 we saw queues of panic customers withdrawing their monies from Northern Rock while Sept 2008 witnessed the collapse of Lehman Brothers and the rest is, well, history.To the Chinese it’s the seventh month in the lunar calendar where all the souls from the “underworld” are coming to pay us visits *grin* - the Ghost Festival. And these ghosts do visit stock markets, mind you. So while you’re busy glueing yourself to the display board at the stock gallery, remember to leave some seats to these “brothers or sisters”, will ya? Heck, I was joking and you should not adopt investing by the calendar. Take it with a pinch of salt although it’s wise not to put all your monies on the table simply because investors are taking some of their monies off the table. This is natural after the recent rally from March to May although I think it won’t do any harm if you can spend some time monitoring the Shanghai Stock Exchange – hopefully S&P 500 is not following Shanghai’s pattern, if the Chinese stock market is indeed experiencing a huge correction.

But let’s not panic after the Dow’s overnight 25% plunge because the DJIA is still above 9,000-level. Maybe we can press the panic button only if it tumbles below this level. Furthermore recent investor sentiment survey showed 51.6% bulls, 19.8% bears and most importantly 28.6% actually expecting a correction after the recent rally. However I suppose in a market where the bull is taking its rest, rumors of more bank failures can easily send stocks players run helter-skelter. It seems investors have pulled a staggering $4.77 billion from two Cerberus hedge funds. That amounts to almost 20% of Cerberus’s total $24.3 billion in assets and although the managing director of Cerberus Capital Management LP has promptly denies the rumor that the fund has made huge losses on private equity investments in Chrysler and GMAC, the damage has been done.

But let’s not panic after the Dow’s overnight 25% plunge because the DJIA is still above 9,000-level. Maybe we can press the panic button only if it tumbles below this level. Furthermore recent investor sentiment survey showed 51.6% bulls, 19.8% bears and most importantly 28.6% actually expecting a correction after the recent rally. However I suppose in a market where the bull is taking its rest, rumors of more bank failures can easily send stocks players run helter-skelter. It seems investors have pulled a staggering $4.77 billion from two Cerberus hedge funds. That amounts to almost 20% of Cerberus’s total $24.3 billion in assets and although the managing director of Cerberus Capital Management LP has promptly denies the rumor that the fund has made huge losses on private equity investments in Chrysler and GMAC, the damage has been done.Supposing the rumors were untrue and the stocks are set to rebound soon, do you dare to jump in? Where is that buy when everyone is selling and sell when everyone is buying motto of yours *grin*? Anyway watch out for the Friday’s employment report from the U.S. government – it could send another round of selling if the reading is not right.

No comments:

Post a Comment