Tuesday, October 27, 2009

Ong, Chua - You May Kiss Each Other, for now

Budget 2010 revealed by PM Najib Razak was so boring that one was wondering if it was so difficult to draft a better budget that could benefit the average Joes. Why on earth would anyone care about the 1% reduction in income tax for those who earn above RM100,000 per annum? The cost of living was so high that it would be interesting to see the reaction from average-Joes when Najib’s administration is set to introduce the much talk about GST soon (budget 2011?). The fact is although Najib may like (was he?) to do more to win back voters’ confidence he couldn’t do so simply because the escalating corruption is beyond his control lest he wish to start a new war with the UMNO warlords.

Sure, the PM was reported to be concerned about the recent leakages in the audit report but nobody in the right minds believe Najib would do anything except merely sloganeering – just like his predecessor Abdullah Badawi. The whole government’s structure is so corrupted that people has accepted such culture to be part of the country’s administration led by BN. Najib should thank his advisor, former premier Mahathir, because without his mentor the country would not flourish with corruption till today hence the PM does not have to quietly minus about 30% off the budget expenditure as leakages. Was the country so broke that the government has to re-introduce the previously scrapped property tax at this juncture?

Anyway, there is a more interesting drama happening than the boring budget 2010. Many people had predicted MCA President Ong Tee Kiat and his former deputy Chua Soi Lek to follow the history of their predecessors’ fate, Team-A and Team-B, of which will see the departure of both for “younger” successors. You may not like Ong Tee Kiat but in the latest political move you just got to admire this lone ranger. At last he understood that in politics sometimes you have to eat humble pie and do the unexpected such as to hug and kiss your enemy for support when you’re cornered by a deadlier enemy – betrayed by your most trusted lieutenant. There’s no doubt that the newly appointed deputy MCA president Liow Tiong Lai belongs to the “third force” who was trying to take Ong Tee Kiat and Chua Soi Lek out of the equation. Some said Liow was the leader of the third force but I’m not too sure. Liow can easily rival former President Ling Liong Sik as the greatest puppet to Najib’s UMNO party. You do not have to be rocket scientist to guess who are the members of the third force – former Transport Minister Chan Kong Choy, former MCA president Ong Ka Ting and his own brother Ong Ka Chuan, former MCA president Ling Liong Sik and of course the controversial billionaire Tiong King Sing who was the big boss affected by the PKFZ scandal. Emerging members of the third force are people like Tiong King Sing’s buddy Wee Ka Siong, Chew Mei Fun (Ong Tee Kiat’s boot-licker) and other former ministers.

There’s no doubt that the newly appointed deputy MCA president Liow Tiong Lai belongs to the “third force” who was trying to take Ong Tee Kiat and Chua Soi Lek out of the equation. Some said Liow was the leader of the third force but I’m not too sure. Liow can easily rival former President Ling Liong Sik as the greatest puppet to Najib’s UMNO party. You do not have to be rocket scientist to guess who are the members of the third force – former Transport Minister Chan Kong Choy, former MCA president Ong Ka Ting and his own brother Ong Ka Chuan, former MCA president Ling Liong Sik and of course the controversial billionaire Tiong King Sing who was the big boss affected by the PKFZ scandal. Emerging members of the third force are people like Tiong King Sing’s buddy Wee Ka Siong, Chew Mei Fun (Ong Tee Kiat’s boot-licker) and other former ministers.

It’s almost impossible to fight such a powerful third force who has billions to spend in their attempt to gain control of MCA and indirectly the ticket to richest (more corruptions and scandals) so it must be really hard for Ong Tee Kiat to put his principle on back seat and temporary makes up with Chua Soi Lek. Credit should be given to Ong for his latest brilliant political move in joining forces with Chua to check-mate the third force representative, Liow Tiong Lai. The third force was speechless as it did not expect Ong to hold the hand of a person (Chua) whose cuckoo was exposed in his sex-DVD scandal. But the biggest question was did Najib’s administration played any part in the third force as well?

It was quite easy to justify why speculators believed Najib’s administration was somehow involved in the initial plan to kick and hang Ong’s (and later Chua) balls on the wall. Ong’s revealation about PKFZ’s scandal was disastrous enough to Najib’s administration. Ong has breached the basic rules of BN political games and that is exposing scandals to the amusement of the oppositions and voters. Ong should have sweep the scandals under the carpet and for him to open up the can of worms was tantamount to slap Najib on the face. Even Mahathir has suggested that Najib should “interfere” in the MCA’s power struggle (and in the process appoint someone obedient to UMNO?). It’s not easy to find someone like Ong Tee Kiat who was willing to expose such scandal, regardless of whatever reason he did that in the first place. On the other hand there’re thousands of MCA politicians who are willing to become puppets as long as there’re millions to make. It’ll be interesting to see if Ong can still bark about PKFZ issue now that the scandal is slowly swept under the carpet after taken over by Najib’s other boys. The next episode should see how Chua Soi Lek tries to wrest back his deputy President post from the traitor Liow Tiong Lai. But with Registrar of Societies (ROS) adopting “hear no evil, see no evil” over Chua’s status, Chua and Ong needs to work together to get rid of traitors from the third force team.

It’s not easy to find someone like Ong Tee Kiat who was willing to expose such scandal, regardless of whatever reason he did that in the first place. On the other hand there’re thousands of MCA politicians who are willing to become puppets as long as there’re millions to make. It’ll be interesting to see if Ong can still bark about PKFZ issue now that the scandal is slowly swept under the carpet after taken over by Najib’s other boys. The next episode should see how Chua Soi Lek tries to wrest back his deputy President post from the traitor Liow Tiong Lai. But with Registrar of Societies (ROS) adopting “hear no evil, see no evil” over Chua’s status, Chua and Ong needs to work together to get rid of traitors from the third force team.

Without Chua’s support Ong is history and without Ong’s remaining popularity, Chua would find it hard to comeback especially after his sex DVD scandal refuse to die the natural death. If a principled Ong can accept Chua’s past sex scandal it was hope naturally the rest of MCA members can do the same. No doubt Ong and Chua’s feud will restart again but that has to take a back seat, at least for the time being. Now is the crucial time to ensure the survival of both Ong and Chua. If both of them can stay united during current trying moment, not even dictator Mahathir can do anything about it. But the journey to dispose the third force will take many months, not to mention the huge resources required since the third force’s veteran team members are loaded with money.

Other Articles That May Interest You …

Monday, October 19, 2009

Hong Leong to Acquire Public Bank – A Matter of Time?

Public Bank is perhaps one of the stocks everyone would like to own for obvious reason. If you owned 1,000 Public Bank Berhad (KLSE: PBBANK, stock-code 1295) shares back in 1967, you would have 129,720 shares which is worth a whopping RM1.38 million today. If that is not enough to raise your eyebrows consider another RM391,000 gross dividends paid to you ever since and you’re looking at an investment that gives you compounded annual return of more than 20% for each of the 42 years. With your Public Bank stock’s investment you can easily place a call to Warren Buffett and claim your trophy.

Public Bank is also one of the banking stocks that stood stubbornly without a free-fall during the global financial crisis. I’ve wrote that while I like Public Bank for its conservative yet prudent management style which made the stock able to stand against the strong turbulence over the numerous past crisis or recessions, this is also a company that does not spell out its succession plan clearly enough to convince investors that should the founder Teh Hong Piow was no longer around, the company will continue its journey without much hiccups.

It’s no secret that the 78-year-old Teh Hong Piow has a “close model friend” from East Malaysia who was crying over a business deal gone sour but finally managed to get the sole Malaysian franchisee rights to the prestigious Ford Supermodel contest. Hmm, wonder who will be her sponsor for the contest *grin*. It’s also a well known fact that billionaire Teh Hong Piow was hospitalised for so-called minor operation recently. But not many know the seriousness of his health. Of course you don’t expect Public Bank’s spokesperson to tell you the truth about the tycoon’s condition lest the company wish to see the stock tumbles.

It’s no secret that the 78-year-old Teh Hong Piow has a “close model friend” from East Malaysia who was crying over a business deal gone sour but finally managed to get the sole Malaysian franchisee rights to the prestigious Ford Supermodel contest. Hmm, wonder who will be her sponsor for the contest *grin*. It’s also a well known fact that billionaire Teh Hong Piow was hospitalised for so-called minor operation recently. But not many know the seriousness of his health. Of course you don’t expect Public Bank’s spokesperson to tell you the truth about the tycoon’s condition lest the company wish to see the stock tumbles.

While many investors sing songs of praises of Public Bank’s stock the same cannot be said about the bank’s employees. Most of the employees do not like the idea that they’re somehow being force to commit certain quota in bringing sales to the company although they’re not in the sales department. Some were heard complaining about being forced to perform during the annual dinner to the delights of the tycoon. But if the recent indefinite postponement or cancellation of annual dinners is anything to go by, you may wish to evaluate your portfolio especially if you’ve Public Bank stock. Speculation is running wild “quietly” that Teh Hong Piow’s health is deterioting and the risk of holding the stock has since gone up. From a mere S$130 a month working as a clerk in Oversea Chinese Banking Corp (OCBC) in 1950 to becming Malaysia’s third richest person with an estimated RM8.2 billion in wealth, it is sad to note that none of Teh Hong Piow’s four children (three daughters and a son) will continue to build or at least maintain the empire built more than four decades ago. Although Teh Hong Piow has his most-trusted man, Managing Director Tay Ah Lek, in position to continue the banking business after he’s no longer around, the most likely scenario is a Merger and Acquisition will take place. The question – who will be the lucky person to be granted the authority to acquire the crown jewel Public Bank Berhad?

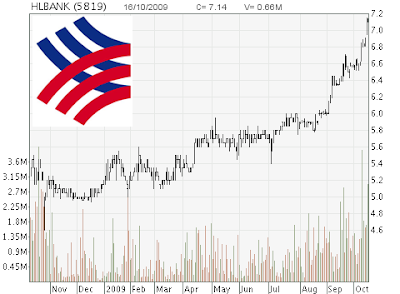

From a mere S$130 a month working as a clerk in Oversea Chinese Banking Corp (OCBC) in 1950 to becming Malaysia’s third richest person with an estimated RM8.2 billion in wealth, it is sad to note that none of Teh Hong Piow’s four children (three daughters and a son) will continue to build or at least maintain the empire built more than four decades ago. Although Teh Hong Piow has his most-trusted man, Managing Director Tay Ah Lek, in position to continue the banking business after he’s no longer around, the most likely scenario is a Merger and Acquisition will take place. The question – who will be the lucky person to be granted the authority to acquire the crown jewel Public Bank Berhad? With the current political landscape it’s easy to point the finger at none other than tycoon Quek Leng Chan, the founder of Hong Leong Group Malaysia which owns Hong Leong Bank. Prime Minister Najib’s fourth brother, Mohamed Nazim Razak, is the non-executive director of Hong Leong Bank Berhad (KLSE: HLBANK, stock-code 5819). With not much time left you can’t blame the senior Teh for enjoying his life to the fullest now but he would have definitely negotiated for the best price for his stake in Public Bank Berhad. After all he has been working very hard in building the empire so it’s only natural for him to claim the last trophy (premium).

With the current political landscape it’s easy to point the finger at none other than tycoon Quek Leng Chan, the founder of Hong Leong Group Malaysia which owns Hong Leong Bank. Prime Minister Najib’s fourth brother, Mohamed Nazim Razak, is the non-executive director of Hong Leong Bank Berhad (KLSE: HLBANK, stock-code 5819). With not much time left you can’t blame the senior Teh for enjoying his life to the fullest now but he would have definitely negotiated for the best price for his stake in Public Bank Berhad. After all he has been working very hard in building the empire so it’s only natural for him to claim the last trophy (premium). Nevertheless Quek is no ordinary businessman so expect him to put in all his efforts in acquiring the best managed bank with cheapest possible offer-price. Furthermore political advantage is on Quek’s side hence there should not be any hindrance from the Central Bank. The biggest question is whether the current Najib’s administration would allow Hong Leong Bank to become such a giant (if merged with Public Bank) that it would undermine government-linked-banks such as largest lender Malayan Banking Berhad’s (KLSE: MAYBANK, stock-code 1155). But then Najib can always grant his brother Nazir Razak’s Bumiputra-Commerce Holdings Berhad (KLSE: COMMERZ, stock-code 1023) the go-ahead to acquire MayBank, can’t he?

Nevertheless Quek is no ordinary businessman so expect him to put in all his efforts in acquiring the best managed bank with cheapest possible offer-price. Furthermore political advantage is on Quek’s side hence there should not be any hindrance from the Central Bank. The biggest question is whether the current Najib’s administration would allow Hong Leong Bank to become such a giant (if merged with Public Bank) that it would undermine government-linked-banks such as largest lender Malayan Banking Berhad’s (KLSE: MAYBANK, stock-code 1155). But then Najib can always grant his brother Nazir Razak’s Bumiputra-Commerce Holdings Berhad (KLSE: COMMERZ, stock-code 1023) the go-ahead to acquire MayBank, can’t he?

Other Articles That May Interest You …

Wednesday, October 14, 2009

Earnings Season send Bull Charging, Next Target - 10,000

Earnings season is here again and all eye-balls are watching for indicators that U.S. economy is indeed on its way to recovery. Even if the recovery is not in full-scale at least it would provide some consolation if companies’ earnings could show momentums. At the moment the important 10,000-level is what everyone is hoping to see the Dow Jones to breach. So far so good with strong third-quarter earnings from JPMorgan Chase & Co which reported $3.59 billion profit and earn 82 cents a share, easily beat analysts forecast of 52 cents per share.

But JPMorgan, U.S.’s largest bank by assets, is one of the strongest financial companies thanks to it’s relatively exposure in subprime mortgages problem. It would be disastrous if a company such as JPMorgan could not beat market analysts. The fact that residential mortgages and credit cards still defaulting at a pace that is eating into JPMorgan’s profit pie is indeed worrying. Even Chief Financial Officer Mike Cavanaugh said during a conference call with reporters that the bank "can't at the moment be certain" that the (bullish) trend will continue.

On the technology stocks Intel Corp. also beats analysts’ estimates, reporting a smaller-than-expected decline in profit and sales. Intel’s expectation that the final quarter of the year should beat analyst projections raised hope the computer market was improving, hopefully. Nevertheless Intel’s third-quarter revenue of $9.4 billion, operating income of $2.6 billion, net income of $1.9 billion and earnings per share (EPS) of 33 cents were sufficient to send cheers into the overall technology stocks. It would be interesting to see if other companies could follow the same sentiment because it would certainly help Dow Jones’s journey into the 10,000-level territory. In any case if there are negative signals from big-boys’ earnings it could easily reverse the current bullish trend. During current stage it’s always a wise move to take some money off the table if your portfolios are in profit because it’s a fact nobody can say for certain the U.S. housing market and unemployment has bottomed.

It would be interesting to see if other companies could follow the same sentiment because it would certainly help Dow Jones’s journey into the 10,000-level territory. In any case if there are negative signals from big-boys’ earnings it could easily reverse the current bullish trend. During current stage it’s always a wise move to take some money off the table if your portfolios are in profit because it’s a fact nobody can say for certain the U.S. housing market and unemployment has bottomed.

That’s right – the housing did not collapse because the U.S. government was supporting it but you need more than government’s involvement to say for sure the worst is over. Now, analysts are worry that Federal Housing Administration (FHA), which has guaranteed about 25% of all new U.S. mortgages written in 2009, may need a bailout. Naturally the scream of Sucker’s Rally re-emerged again. But there’s good news for gold investors because the metal has hit another new high of $1064 on Tuesday *WoW*. Anyway, it’s not easy to surpass the psychology 10,000-level and it’s purely a bet whether it would cross the line or not.

Other Articles That May Interest You …

No comments:

Post a Comment