Thursday, December 17, 2009

Economy is Crawling - Scrap the 4% GST, Idiot

Allright, here are more signals that the global economy will neither skyrockets nor drops like a stone into the ocean. Basically people are convince that the U.S. economy will most likely crawling for years instead of months before the worst enemy – unemployment – is over. We, and to a large extent the Americans, may be lucky that this round of recession did not suffer the same fate as the 1929 Great Depression. But this recession may have created a new economy landscape that we have to live on for decades to come – the scale-of-employment model pre-recession is history and a new employment model may have emerged.

It’s true that layoffs have slowed, at least for now, and (hopefully) the housing problems have bottom. However jobs remain scarce and the economy will not stage a V-shape recovery anytime soon. The fact that the Federal Reserve holds the bank lending rate at zero to 0.25% speaks volume of the U.S. economy’s health. But who can blame Ben Bernanke and his boys when the figures still show consumer spending remains sluggish, hiring remains weak, wage growth is almost stagnant and the banking sector is not lending as much as Obama’s administration hoped they would.

Low inflation also means companies couldn’t raise prices of their products simply because the once fearless American consumers are not spending as they used to be pre-recession. Of course you shouldn’t blame some of the analysts who predict that 2010 will be an explosive year for the U.S. economy when everything will be back to normal, though I would take that as a new-year wishlist instead *grin*. In actual fact you don’t really have to go very far to ascertain the health of the U.S. economy. The financial sector will tell you whether what those good-for-nothing analysts’ “wishlist” that you should be buying stocks is a good advice.

The banking stocks are literally still in disarray as if they’re headless chickens moving without clear directions. Otherwise you wouldn’t see Citigroup Inc. (NYSE: C, stock) shares still trading at three bucks a share and the attempt to unload 5.4 million Citigroup shares at $3.15 share (8.7% discount). Heck, why sell at a discount (and at the current low price) if indeed everything is so rosy – get the picture? I would hold the shares if I know I can make many times the profit in another year or two, unless of course I’m not sure if the bright sky is in the horizon.

Well, maybe Rosmah was right after all considering she has chosen the right man to marry; the highly intelligent Prime Minister Najib Razak who thinks the time is right to push for the GST (Goods and Services Tax) - scheduled to be implemented by the middle of 2011, never mind that the average-Joes are having difficulties putting food on the table. Thanks to former PM Mahathir’s cheap labor economic model which is obsolete by now, the fact remains that the proposed 4% GST will bring hardship to the poors due to inflation.

Supposingly the economy fully recovers by 2011, do we have the same buying power like the Singaporeans whose government also implemented the GST?

Other Articles That May Interest You …

Tuesday, December 08, 2009

Ong to Exit – 1Corruption, Together We Prosper

It’s easier to move a mountain than to change a person’s character – goes a Chinese saying. By the same logic, it is definitely many times harder to change the Malaysian ruling government’s policy of worshipping corruption. Whatever the result from the PKFZ multi-billion scandal, you can kiss your money (yes, part of the billions of dollars belong to you) goodbye simply because you won’t be able to see it again. And you can bet your last dollar that MCA Pesident Ong Tee Kiat would see his political career ends very soon.If the government-control’s print and electronic coverage on three fighting factions is anything to goes by, you can actually smell that Ong Tee Kiat will be history while “sex actor” Chua Soi Lek and betrayal Liow Tiong Lai would most likely win this battle. Liow and Chua were given wide media coverage even before Ong’s sudden illness. From the beginning Ong Tee Kiat’s fate was written on the wall after his disclosure of PKFZ scandal. To pick a fight with politicians, new and veterans, who are flush with monies (from the scandal) is tantamount to poking Mike Tyson’s butt while laughing like Phua Chu Kang.

The ball is at Chua Soi Lek’s court now that he still commands huge supporters which in turns made him the kingmaker in this political comedy, sex scandal or not. Given a choice, Najib’s administration would prefer Chua than Ong to lead the ailing party simply because Chua is flexible to be nose pulled anywhere UMNO likes. But can a person who was caught with his pant down in sex-scandal become MCA President? If a person who was allegedly murdered a pregnant lady can become the Prime Minister, Chua’s sex scandal can be equate to a 2-year-old kid caught putting his hand in the jar stealing cookies so it’s perfectly fine.

The ball is at Chua Soi Lek’s court now that he still commands huge supporters which in turns made him the kingmaker in this political comedy, sex scandal or not. Given a choice, Najib’s administration would prefer Chua than Ong to lead the ailing party simply because Chua is flexible to be nose pulled anywhere UMNO likes. But can a person who was caught with his pant down in sex-scandal become MCA President? If a person who was allegedly murdered a pregnant lady can become the Prime Minister, Chua’s sex scandal can be equate to a 2-year-old kid caught putting his hand in the jar stealing cookies so it’s perfectly fine.Would it be better to have Liow as the new President with Chua as his running mate? Possible, but it would be too obvious on how the ruling government, present and the past tainted leaders, brokered and endorsed the plan in bringing Ong’s presidency down due to PKFZ scandal exposure. Either Liow or Chua becomes the new MCA president is fine with UMNO but definitely not the loose cannon Ong. On paper, Chua as President warming up the seat for Liow to take over looks like a good plan. Najib may wish to project himself as independent and to tell the Chinese that UMNO does not interfere in MCA’s internal affair but he did so through his deputy, Muhyddin, who openly support a new party poll, something which Liow has been fighting for.

Of course Ong’s sudden illness was insurance, just in case he officially instructed to pack his things. The standard way of telling someone you’re fired in Malaysian politics is to tell him to pretend he has health problem. But what does this tell of Najib’s administration about the corruption which always breaks the world corruption index record? Who cares? If former PM Mahathir who was allegedly squandered RM100 billion away during his 22-year-old iron-fist rule is still treated as a statesman, to hell with those criticisms about escalating corruption. Corruption is here to stay and has been part of the culture. If you’re not happy with it then you can migrate to other countries because the country only cares about losing brains of those who do not corrupt, otherwise voters won’t vote them in *grin*.

If everything goes according to the plan, UMNO together with MCA may set a new direction for the future leaders. Besides endorsing corruption, you would see more and more leaders such as Youth Chief Wee Ka Siong and Wanita Chief Chew Mei Fun who openly cried like a baby without shame the moment they were removed from MCA Presidential Council. Can you imagine what these two persons would do the moment they loose their current deputy ministry-ship? Guess the sight of losing all the perks and potential huge incomes are too much to bear for the politicians manufactured from Mahathirism’s built- factory.

Other Articles That May Interest You …

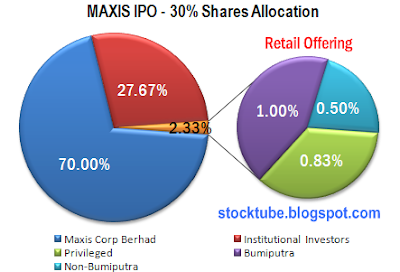

Well, it’s hard to imagine Maxis were to re-privatise again in the near future but anything is possible considering political climate in Malaysia. If it’s alright to broker top judges’ appointment, kill innocent people before pushing them out of the building, plunder the nation of billions of dollars in project such as PKFZ and whatnot, you can’t blame investors when even local business owners lost confidence and relocated their monies elsewhere, what more with foreign investors. Hence it was hope that Maxis relisting will bring back the foreign investors’ confidence (and their hot money) into the country.

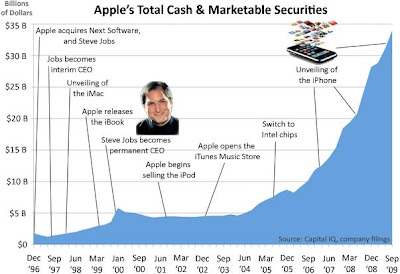

Well, it’s hard to imagine Maxis were to re-privatise again in the near future but anything is possible considering political climate in Malaysia. If it’s alright to broker top judges’ appointment, kill innocent people before pushing them out of the building, plunder the nation of billions of dollars in project such as PKFZ and whatnot, you can’t blame investors when even local business owners lost confidence and relocated their monies elsewhere, what more with foreign investors. Hence it was hope that Maxis relisting will bring back the foreign investors’ confidence (and their hot money) into the country. Maxis IPO price of RM4.75 also means it was priced at 15.83 multiple times of the company financial year 2009’s 30 sen EPS. At RM6.00 a share the stock will be trading at an EPS of 20 times and this is expensive considering the saturation in the mobile telecommunication sector. The local and global stock markets are currently at the junction whereby the economy recovery is still questionable. Hence if you were to chase the stock you may be buying at the highest. Don’t try to buy for the sake of buying or out of revenge just to show that you’re also belong to the Maxis shareholders group. Take your time and wait for the right time to buy at a later stage (price consolidation). Hey, it could be blessing in disguise because you didn’t get a single share out of Maxis IPO. Who knows, maybe Maxis share price will not venture too far away from its’ RM4.75 a share. If you’re too loaded with cash why not go and invest in stocks such as Apple Inc.? Stop sulking and invest your hard-earned money another day.

Maxis IPO price of RM4.75 also means it was priced at 15.83 multiple times of the company financial year 2009’s 30 sen EPS. At RM6.00 a share the stock will be trading at an EPS of 20 times and this is expensive considering the saturation in the mobile telecommunication sector. The local and global stock markets are currently at the junction whereby the economy recovery is still questionable. Hence if you were to chase the stock you may be buying at the highest. Don’t try to buy for the sake of buying or out of revenge just to show that you’re also belong to the Maxis shareholders group. Take your time and wait for the right time to buy at a later stage (price consolidation). Hey, it could be blessing in disguise because you didn’t get a single share out of Maxis IPO. Who knows, maybe Maxis share price will not venture too far away from its’ RM4.75 a share. If you’re too loaded with cash why not go and invest in stocks such as Apple Inc.? Stop sulking and invest your hard-earned money another day. However we’re no longer living in the age of manufacturing, at least not United States, a country which inherited such business model when one-third of their workforce were in the manufacturing. Of course the new manufacturing hub now is China but in the meantime what shall the U.S. men and women who lost their jobs do? With automation, technology and the shift in the services sector as the new way of doing business, employers may just have found the excuses of not hiring as many as they did before the recession. Hence it's interesting to watch the next month's jobless rate data.

However we’re no longer living in the age of manufacturing, at least not United States, a country which inherited such business model when one-third of their workforce were in the manufacturing. Of course the new manufacturing hub now is China but in the meantime what shall the U.S. men and women who lost their jobs do? With automation, technology and the shift in the services sector as the new way of doing business, employers may just have found the excuses of not hiring as many as they did before the recession. Hence it's interesting to watch the next month's jobless rate data.