ajib Razak who will become Malaysia’s sixth Prime Minister in less than a month has revealed the much talked about mini-budget today. Make no mistake about it because going by the quantum of the budget it’s more like a major-budget instead of a mini-budget – a whopping RM60 billion to be spent over two years, 2009 and 2010. But why the extraordinary RM60 billion which is equivalent to 9% of the country’s GDP (gross domestic product) and why spread over two years? Didn’t this Finance Minister claims the country won’t going into recession come rains or shines? Wouldn’t this tantamount to a tight slap onto his face for twisting the facts about the nation’s economy? Maybe he was as clueless as his boss Abdullah Badawi about economy 101 but he can always read the blogs to get some ideas *grin*, can’t he?

The figure RM60 billion is indeed very attractive in title but were there any substances in bringing cheers to the people on the street or at least to attract investments? I think Najib is trying to play safe after his earlier arrogance that the country was insulated from the global recession which saw his balls nailed on the wall for public view. If you read the mini-budget Najib admitted that despite 2009’s original budget of RM206 billion plus the first stimulus package of RM7 billion plus this second stimulus package (also known as mini-budget) of RM60 billion, the country can only afford to see GDP growth of merely negative 1% to positive 1% for 2009. But we still do not know if this GDP (-1% to +1%) growth requires all the RM60 billion to be spent in 2009, forget about the multiple "thrusts" proposed.

To play safe Najib proposed RM60 billion and if the GDP growth is within expectation (-1% to +1%) using only half of the RM60 billion then so much the better and he can claims some trophies. If things go bad and it requires the whole chunk of RM60 billion for 2009 alone then by all means blame it on the worsening global economy and propose more billions for 2010 in the coming annual budget.Either way RM30 billion is insufficient and even if it is enough there’re little spaces left for leakages. You don’t believe the efficiency in terms of procurement and implementation can reach 80% do you? It’s back to the school – aim high shoot low. Furthermore Najib has admitted that both exports and FDI are going down the toilet bowls so he would be foolish to hide under the “we’re insulated from recession” slogan again. Let’s digest what are there on the table for you.

- Income tax cut for employees and corporate tax reduction – not a single word can describe the disappointment from the many faces of the people I asked after the mini-budget. So there’s nothing for the average-Joe on this much-awaited goodies.

- RM674 million in subsidies for sugar, bread and wheat flour – not much effect to the people since the damages from the previous fuel hike to RM2.70 a liter is still around, alive and kicking.

- RM480 million compensation to toll operators to ensure toll rates remains – but those RM480 million belongs to the taxpayer in the first place, no? And why no proposal to privatize the highways? Sure, how stupid I am to think that would happen because UMNO is the greatest beneficiary from these toll hikes.

- Government to create 163,000 training and job placement for retrenched workers and unemployed graduates – just make sure unemployed Mat Rempits are not given free money (training allowance etc) but skipped training classes for illegal races *grin*. It would be a great waste to flush the RM700 million into the drains.

- Tuition fees assistance of RM20,000 and RM10,000 for PhD and Masters program – do you think retrenched and jobless people could still afford such program in the first place?

- Company’s current year losses be allowed to be carried back to the immediate preceding year – cool but why limit the losses to the cap of RM100,000 per year?

- Employers who employ workers retrenched from 1 July 2008 be givendouble tax deduction (not exceeding RM10,000 per month) on the amount of remuneration paid – this is a good measure.

- Government will recruit 63,000 staff to fill vacancies and serve as contract officers in various Government agencies – while the intention is good the same cannot be said about the productivity since it’s more like squeezing more sardines into the already overlapping job functions.

- Allocation of RM1.95 billion to build and improve facilities in 752 schools, particularly in rural areas as well as Sabah and Sarawak – again make sure the leakages (or rather corruption) can be contained but don’t be surprised if only a fraction of the dollars ended up in such schools. Besides, it was never the intention of the federal government to breed smart people from these two states since it would be easier to control and buy their votes if their status quo remains.

- RM230 million to increase Sabah and Sarawak’s electricity and water supply coverage – it’s strange that after half a century of independence Sabahan and Sarawakian are still without the basic amenities.

- More goodies for Sabah and Sarawak with RM1.2 billion allocation for projects such as Sibu Airport expansion, Miri Port, Kota Kinabalu Electricity Transmission System, Queen Elizabeth Hospital etc – again, leakages, leakages and more leakages.

- Banking institutions to defer the repayment of retrenched workers’ housing loans for one year – as if the bank has other choice and would like to take over these properties which would generate no cash-flow to them. The banks have indeed learnt from the 1997-1998 Asia Crisis.

- Government will assist in the auto-scrapping scheme whereby a RM5,000 discount will be given to car owners who trade in their cars, which are at least 10 years old, for the purchase of new PROTON or PERODUA cars – why limit it to proton and perodua and not other models as well? Are you trying to simulate the automobile industry as a whole or merely to prevent proton and perodua from going bust?

- Malaysia Airports Holdings Berhad will build and operate a new LCCT at Kuala Lumpur International Airport (KLIA) at an estimated cost of RM2 billion which is expected to be ready in 2011 – is this an admission that the current LCCT was built in haste with the intention to force AirAsia to pull its growing passengers to the dying KLIA? I still couldn’t find the real reason why AirAsia could not operate from the Subang Airport but instead to operate from factory-converted-liked LCCT terminal at KLIA.

It was also revealed that from the RM60 billion proposed, RM15 billion is fiscal injection, RM25 billion Guarantee Funds, RM10 billion equity investments, RM7 billion private finance initiative (PFI) and off-budget projects, as well as RM3 billion in tax incentives. So after injected RM5 billion to Valuecap Sdn Bhd previously to invest in undervalued companies now you’re looking at additional RM10 billion for the same purpose? Now you need double the money to help the cronies? And why is it so hard to help the average-Joes by reducing their income-tax so that in the process they have more disposable money which in turn can generate the country’s economy? The country does have the money to spend with such a magnificent mini-budget, no? Anyway let’s hope the RM60 billion is spent wisely although I doubt many would benefits from it.

In short, can we assume that the 12 million members’ “dividend money” was used for Valuecap’s so-called equity investment programme? Can the members’ hard-earned money loaned to Valuecap be returned to the rightful owners thereafter then, together with interest of course *boy, I am stupid for asking such question*? You can’t simply take away contributors’ money, presume everything is in order, everyone will forget about it after some grumbling and blame it on global financial meltdown, can you? For God’s sake, we need to have some transparencies here because the money is our only retirement fund. No matter where the money has been siphoned to (if any), EPF contributors are still the victims (or rather suckers) ultimately. Let’s hope the EPF’s total investment funds of over RM342 billion (as at Dec 31, 2008) still exists and this is not another big-time Ponzi-scheme *grin*.

In short, can we assume that the 12 million members’ “dividend money” was used for Valuecap’s so-called equity investment programme? Can the members’ hard-earned money loaned to Valuecap be returned to the rightful owners thereafter then, together with interest of course *boy, I am stupid for asking such question*? You can’t simply take away contributors’ money, presume everything is in order, everyone will forget about it after some grumbling and blame it on global financial meltdown, can you? For God’s sake, we need to have some transparencies here because the money is our only retirement fund. No matter where the money has been siphoned to (if any), EPF contributors are still the victims (or rather suckers) ultimately. Let’s hope the EPF’s total investment funds of over RM342 billion (as at Dec 31, 2008) still exists and this is not another big-time Ponzi-scheme *grin*.

Sure, Citigroup Inc. (NYSE:

Sure, Citigroup Inc. (NYSE:  Clearly this old man is not senile given that fact that he acknowledged the backdoor takeover of Perak State by his endorsed PM-in-waiting Najib was not done according to the law. Mahathir also said "UMNO-BN was too careless and did not wait for an assembly but instead asked the Ruler (Perak Sultan) to sack the menteri besar (chief minister)". It may be strange that he only opened his mouth after a month since the takeover occurred which led to the current constitutional crisis. Maybe Mahathir did not anticipated that the Pakatan Rakyat government would fight this battle to the end no matter what, not to mention the “coup” backfired with many Perakians are disgusted with the way it was done. So he decided to go with the trend and said UMNO-BN should have "followed the laws of the country, especially the constitution." But his opinion opened up some questions.

Clearly this old man is not senile given that fact that he acknowledged the backdoor takeover of Perak State by his endorsed PM-in-waiting Najib was not done according to the law. Mahathir also said "UMNO-BN was too careless and did not wait for an assembly but instead asked the Ruler (Perak Sultan) to sack the menteri besar (chief minister)". It may be strange that he only opened his mouth after a month since the takeover occurred which led to the current constitutional crisis. Maybe Mahathir did not anticipated that the Pakatan Rakyat government would fight this battle to the end no matter what, not to mention the “coup” backfired with many Perakians are disgusted with the way it was done. So he decided to go with the trend and said UMNO-BN should have "followed the laws of the country, especially the constitution." But his opinion opened up some questions. In spite of what many think could be the reason why Mahathir went berserk whacking his own-picked successor Abdullah Badawi, the actual reason is none other than that Badawi did not keep his promise to push Mahathir’s own son to become the next rising star – UMNO Youth Chief. Instead Badawi allowed his son-in-law Khairi the free hand not only in running his administration but also to groom him as the next UMNO Youth Chief, indirectly telling Mahathir to fly kite. And this really sent Mahathir’s blood pressure to record high. In reality UMNO is rich with corrupt leaders but only a handful (if you can call that in the first place) of sincere leaders who can put country’s interest above self-interest. Mahathir is barking up the wrong tree and definitely beating around the bush if he thinks Najib would or could announce a corrupt-free team of Cabinet. There simply aren’t enough candidates for such tasks and the old man knows it. Maybe his statement was meant to raise warning to Najib that certain individuals are plotting for his son’s failure in the coming Mar UMNO election and Najib should do something about it.

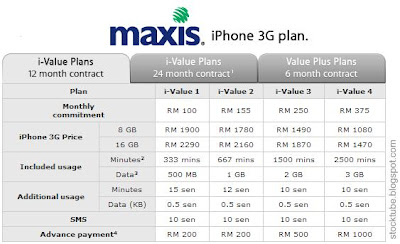

In spite of what many think could be the reason why Mahathir went berserk whacking his own-picked successor Abdullah Badawi, the actual reason is none other than that Badawi did not keep his promise to push Mahathir’s own son to become the next rising star – UMNO Youth Chief. Instead Badawi allowed his son-in-law Khairi the free hand not only in running his administration but also to groom him as the next UMNO Youth Chief, indirectly telling Mahathir to fly kite. And this really sent Mahathir’s blood pressure to record high. In reality UMNO is rich with corrupt leaders but only a handful (if you can call that in the first place) of sincere leaders who can put country’s interest above self-interest. Mahathir is barking up the wrong tree and definitely beating around the bush if he thinks Najib would or could announce a corrupt-free team of Cabinet. There simply aren’t enough candidates for such tasks and the old man knows it. Maybe his statement was meant to raise warning to Najib that certain individuals are plotting for his son’s failure in the coming Mar UMNO election and Najib should do something about it. If you sign up for the i-Value 4 package (RM375 monthly commitment) over a 24-month period *ouch*

If you sign up for the i-Value 4 package (RM375 monthly commitment) over a 24-month period *ouch*  Rate Plan Terms & Conditions :

Rate Plan Terms & Conditions :

Now do you know why I keep on screaming “Cash is King” and “Preserve your Cash”? Don’t you feel good looking at your escalating buying power now? And

Now do you know why I keep on screaming “Cash is King” and “Preserve your Cash”? Don’t you feel good looking at your escalating buying power now? And According to a report by ADP Employer Services private sector job losses increased in February with private employers cut 697,000 jobs in Februarycompared with 614,000 jobs lost in January. Economists’ estimation for February job losses were 610,000. President Obama on the other hand is hoping that his plan to help up to 9 million home borrowers via refinanced mortgages modified to lower monthly payments will bear fruits. Obama also intend to revamp wasteful spending especially the way federal contracts are being awarded. It was hoped tens of billions of dollars could be saved when the procurement process are to be refined.

According to a report by ADP Employer Services private sector job losses increased in February with private employers cut 697,000 jobs in Februarycompared with 614,000 jobs lost in January. Economists’ estimation for February job losses were 610,000. President Obama on the other hand is hoping that his plan to help up to 9 million home borrowers via refinanced mortgages modified to lower monthly payments will bear fruits. Obama also intend to revamp wasteful spending especially the way federal contracts are being awarded. It was hoped tens of billions of dollars could be saved when the procurement process are to be refined. Second remembrance of the month – fresh state election could be around the corner in Perak state. In a historic move an emergency meeting of the Perak State Assembly was convened this morning with three motions passed, under a tree about 200 meters from the state secretariat building:

Second remembrance of the month – fresh state election could be around the corner in Perak state. In a historic move an emergency meeting of the Perak State Assembly was convened this morning with three motions passed, under a tree about 200 meters from the state secretariat building: I believe after this many gamblers and 4-D punters will build a shrine under this tree hoping to strike it big as this is the first time in the country’s 50-year of independence that a state assembly is being held under a tree. The writing is on the wall and constitution that the Speaker (the person they forgot to buy over) of the Legislative Assembly of Perak is entitled in law to convene the Legislative Assembly for today, March 03, 2009. However the police who only serve the present government that is tainted with corruption has proven to be a reliable business partner yet again *applause* – desperately set-up road blocks and barred the main entrance of the state secretariat building to prevent the proceedings by state representatives voted by the people.

I believe after this many gamblers and 4-D punters will build a shrine under this tree hoping to strike it big as this is the first time in the country’s 50-year of independence that a state assembly is being held under a tree. The writing is on the wall and constitution that the Speaker (the person they forgot to buy over) of the Legislative Assembly of Perak is entitled in law to convene the Legislative Assembly for today, March 03, 2009. However the police who only serve the present government that is tainted with corruption has proven to be a reliable business partner yet again *applause* – desperately set-up road blocks and barred the main entrance of the state secretariat building to prevent the proceedings by state representatives voted by the people. And according to constitutional expert Tommy Thomas since the Third Sitting of the First Session of the 12th Legislative Assembly of Perak was actually “adjourned” (postponed) sine die in November 2008, the Speaker has the right to recall the assembly into session. Hey, don’t blame the constitutional experts and the written laws because it was the previous BN government that granted the Speaker with such power. So why play the pathetic childish dirty game of crying for the police to block the proceedings and dragging the Ruler into the picture? Thankful they didn’t asked the same street gangsters UMNO Youth to set-up road blocks and take over the state secretariat.

And according to constitutional expert Tommy Thomas since the Third Sitting of the First Session of the 12th Legislative Assembly of Perak was actually “adjourned” (postponed) sine die in November 2008, the Speaker has the right to recall the assembly into session. Hey, don’t blame the constitutional experts and the written laws because it was the previous BN government that granted the Speaker with such power. So why play the pathetic childish dirty game of crying for the police to block the proceedings and dragging the Ruler into the picture? Thankful they didn’t asked the same street gangsters UMNO Youth to set-up road blocks and take over the state secretariat. This episode may be the

This episode may be the  Of course you can bet your last dollar that Najib will not open his big mouth again claiming something which even the first year economic students think otherwise, at least for now. After Citigroup and Nomura Holdings said Malaysia will see economic contraction of 1.5% and 4% respectively this year, RHB Head of Research Lim Chee Sing say the country is already in recession or perhaps is entering the recession depending on your definition of it. Malaysia’s export and industry production index have both contracted for the third month and if this is your measurement then the recession has already entered your door.

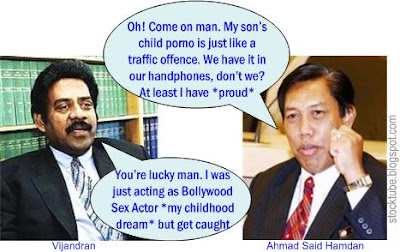

Of course you can bet your last dollar that Najib will not open his big mouth again claiming something which even the first year economic students think otherwise, at least for now. After Citigroup and Nomura Holdings said Malaysia will see economic contraction of 1.5% and 4% respectively this year, RHB Head of Research Lim Chee Sing say the country is already in recession or perhaps is entering the recession depending on your definition of it. Malaysia’s export and industry production index have both contracted for the third month and if this is your measurement then the recession has already entered your door. Equally sad is to have chief commissioner of the newly cosmetic-upgraded Malaysian Anti-Corruption Commission (MACC), Ahmad Said Hamdan, who thought it was perfectly alright for his son to import child pornography into Australia as he believes it was comparable to just a minor traffic offence. As long as you pay the summons then the story should ends there *and commit the same offence again?*. Also the chief commissioner does not think he should be linked to his son’s (child pornography) offence as if he didn’t play any part in his son’s upbringing. But the most puzzling yet amazing part was he actually endorsed his son’s action when he exclaimed that his son’s disgusting child pornography could be found on most men’s cell-phones. Now this is what I call a pervert mentality and I dare not imagine the contents of his hand-phone. He could have video clips that if revealed, would be more explosive than former deputy

Equally sad is to have chief commissioner of the newly cosmetic-upgraded Malaysian Anti-Corruption Commission (MACC), Ahmad Said Hamdan, who thought it was perfectly alright for his son to import child pornography into Australia as he believes it was comparable to just a minor traffic offence. As long as you pay the summons then the story should ends there *and commit the same offence again?*. Also the chief commissioner does not think he should be linked to his son’s (child pornography) offence as if he didn’t play any part in his son’s upbringing. But the most puzzling yet amazing part was he actually endorsed his son’s action when he exclaimed that his son’s disgusting child pornography could be found on most men’s cell-phones. Now this is what I call a pervert mentality and I dare not imagine the contents of his hand-phone. He could have video clips that if revealed, would be more explosive than former deputy