Monday, June 09, 2008

Not sure where to park your money? Follow Kiyosaki

Robert Kiyosaki is the name synonym with personal-finance and has attracted millions of followers. His flagship product was definitely “Rich Dad, Poor Dad” book that has taken the world by storm. His other books titled “Rich Dad's CASHFLOW Quadrant” and “Rich Dad's Guide to Investing” was equally good and hits the top 10 best-sellers. The fourth generation Japanese American also made his fortune from “Cashflow” boardgames and series of audio cassettes. His most famous trademark was probably the “Cashflow Quadrant”, a conceptual diagram entails four groupings of people earning their money - “E”mployee, “S”elf-employed, “B”usiness owner and “I”nvestor.

There’s one thing that Robert highlighted regarding saving money which you should take note. With the dollar basically flushing down the toilet, it’s no longer accurate to tell your kids to “save money” because that would be telling the children to “save currency” which is equivalent to keeping depreciating dollar. Instead of buying certain currency, Robert Kiyosaki hedges against dollar by buying basket of Asian currencies through ETFs such as iShares MSCI Singapore Index Fund (NYSE: EWS) or iShares MSCI Malaysia Index Fund (NYSE: EWM).

At first I thought Robert’s only forte was in property investment and probably investing certain property-stocks but he really knows what to invest. He mentionedhis favorites are gold, silver and oil via ETFs. You can basically get exposed to such commodities via ETFs such as SPDR Gold Shares (NYSE: GLD) or iShares Silver Trust (AMEX: SLV). Robert has even venture into commodities business in a copper-mining company in Vancouver. And guess what, Robert Kiyosaki loves Apple Inc. (Nasdaq: AAPL, stock) stock but not because he was hooked to iPhone. Rather it was Steve Jobs whom he likes.

So, if you’ve tons of money and do not know where to invest, you might just want to follow your favorite books’ author. However there’re rumors and grumblings thatRobert created the fictitious character of “Rich Dad”. Kiyosaki had stated in his books that Rich Dad had died in 1994 but some have claimed that Rich Dad was a person named Richard Kimi, the deceased founder of Sand and Seaside Hawaiian Hotels.

Sunday, June 08, 2008

Still steamy hot with fuel hike? Why not kick Badawi’s arse?

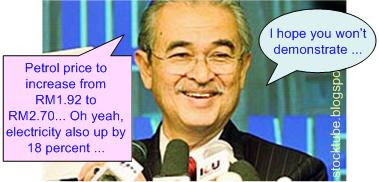

Don’t you hate Monday? It’s not end of the month so there’s no reason to celebrate. If you didn’t manage to squeeze some drops into your tank last week, chances are you already felt the pain of pouring extra 40 percent for the fuel by now. But seriously do you think this time around people will take to the street in a big wave or at least the same crowd as previous Bersih rally? I doubt so.

The oppositions have captured five states and there’re enough foods on the plates for them. In other words, they would be pretty “occupied” with their busy schedule to think of a demonstration. It’s not like before the 12th general election whereby they’ve nothing to loose and everything to gain, not to mention the time they have in co-ordinating and organizing such event. Anwar claimed the defections plan will proceed as planned (Malaysiakini reported) and if you still believe his trumpet, it doesn’t worth the risk of a demonstration that would lead to nowhere but could turn the table in favor of PM Badawi to declare an emergency with absolute rule?

This recent fuel hike could be Badawi’s bait to create havoc. It could a bait to lure the traitors out of the cave to speed-up the cross-over of BN’s MP to oppositions. It could be a bait to see who’re against him within UMNO itself. It could be just another attempt to test the water before going for higher fuel hike. Heck it could be thousands of possibilities but it sure was an ingenius plan as Badawi would not lose anything. So what if you call him Bodowi, Sleepy-head, Father of Destruction, Stupidwi etc as long as he can accumulate billions of dollars with a sudden announcement that caught even Shahrir Samad offguard for his next mission / plan? If you didn't know, Shahrir had just announced that the fuel price of RM2.70 will remains until next year 2009, that's if you're lucky that global oil prices will not go beyond $200 a barrel and his boss Badawi doesn't flip-flop again.

As for the poor people on the street, they have no choice but to bite the bullet and change their lifestyle (again?). Of course you heard that they might need to change to cycling to work instead of driving but it was really a joke. It was just an expression of frustration. Being pampered and with no sight of improvement in public transportation, they just have to eat less and buy less. And for these people to change their travelling mode from car to motorcycle or from motorcycle to bicycle would be extreamely hard. To think of the possibility of becoming snatch-thief’s next victim would force many women drivers to maintain status quo.

Of course Malaysians being Malaysians are never out of creativity. They cursed and whined a while of the fuel hike and then discussed with great length on how to “cheat” the RM625 rebate such as to buy a damn a cheap car, leave it to rot but keep claiming for the annual money. Well, first of all the rebate is a one-off thing and the flip-flop government will most likely change the rules of the game sooner than you can blink your eyes. So it would not be wise to rush out there to buy an old car fit only to be used as chicken-den and start claiming. Anyway, in case you’ve not fully release your steam, here’s how you can kick Abdullah Badawi’s arse. Hope this will lighten up your Monday blues. Tell the whole world how you enjoyed kicking (your score) Badawi’s arse at the comment section.

Other Articles That May Interest You …

Saturday, June 07, 2008

Windfall Tax - why Discriminate and Petronas not in?

Windfall Tax is not something new but neither was it started from the Jurassic Age. It so happened that certain industry suddenly experienced extraordinary profits and the mouth-watering government came with an ingenious idea to levy such companies under the name of windfall tax. The classic example was Exxon Mobil which reported unusual profits of US$36 billion in 2005 due to high oil prices although historically it went as back as 1970s. Such windfall tax would benefits a nation (and the people) if the government is transparent and knows how to channel the money back to area where it needed the most. However certain quarters would argue that such tactic would reduce the companies’ drives and initiatives to seek more profits – a typical scenario of a communist country whereby nothing belongs to you, so why work hard?

With the current oil prices above $130, both Hillary Clinton and Barack Obama have both pushed the idea of “Windfall Profit Tax” on oil companies. Heck, almost all U.S. Presidents somehow fancy such idea. First it was Richard Nixon in 1973, then Jimmy Carter in 1977 and now Obama, Clinton and McCain. In Malaysia, PM Abdullah Badawi had announced windfall tax on plantation stocks and IPP although today the steel millers plan to ask the government not to impose a windfall tax on them despite their good profits (Good Luck!).

That’s right - light, sweet crude for July delivery officially finished the day at $138.54, up $10.75 on the Nymex Friday but after the settlement, the contract jumped as high as $139.12 and the Dow plunged 400 points (let's see if KLCI could take that on Monday). Israeli Cabinet minister said his country will attack Iran if it doesn't abandon its nuclear program and instantly the oil prices made their biggest single-day leap – a whopping $11 for the day. If the black gold remains at current status, get ready for at least RM4.00 a liter come this August. Gosh! It happens so fast that I bet nobody has the time to prepare for the so-called demonstration involving 100,000 protesters. I meant what should you write on the boycott cards – “People suffers with RM2.70” or “People suffers with RM4.00”?

Meanwhile, it was reported that miraculously some IPPs (independent power producers) may be able to pass on the cost of a windfall tax to Tenaga Nasional Berhad (KLSE: TENAGA, stock-code 5347) if their agreement with TNB has such clause. Now, whose stupid idea was it to include such bias clause in favor of IPP in the first place? And to think of the possibility that TNB will pass on the cost back to the consumers (again) is simply horrifying. And what about those banks and telecommunication companies – shouldn’t they be subject to Windfall Tax as well? Yeah, impose such tax on all of them and the money derived from it should be able to help towards the so-called fuel subsidy until a better method that would not burden the poor people is ready. Hey, we gotta be fair, right?

Other Articles That May Interest You …

Friday, June 06, 2008

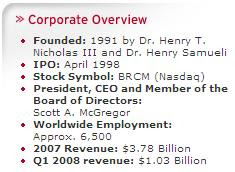

Al Capone of Broadcom, he did it in the wrong country

There was a saying that two Malaysian could not outsmart one Singaporean; four Singaporean could not outsmart one Hongkies (Hong Kong) and four Hongkies could not outsmart one Chinese (China). I’m not sure about Chinese against American or Jewish though and please, there’s no racial element in the statement. Take it as a joke if you can’t think in straight line. Of course the above “comparison” referred to corporate-business although I’m pretty sure when comes to politics, the reverse makes more sense.

When you’re into business expansion, please remember to borrow as much as possible. It would be an achievement if you could borrow RM1 billion for your RM2 ringgit shell company. The fact is the more you borrow and the deeper your company is in debt the better. When you owed banks billions of dollars in loan you’re a celebrity, so much so that the banks were so scared of your security they might even provide you bodyguards foc. And if you can further convinced the banks to lend you more money to turnaround your company, you’re basically a genius.

Short of committing murder, the successful entrepreneur was indicted on federal narcotics charges that include allegations he slipped ecstasy into the drinks of business associates, maintained a drug warehouse and concealed his illegal conduct with bribes and death threats. Whoa! Al Capone reincarnation! The billionaire also is accused of committing conspiracy, securities fraud and other violations - Broadcom was eventually forced to write down its profits by $2.2 billion in January 2007, believed to be the largest-ever restatement related to improperly accounting for backdated options.

Other Articles That May Interest You …

Thursday, June 05, 2008

Could the country pushed to the brink of Recession?

As expected when I and my buddies step into the kopitiam for our routine of breakfast this morning, everyone was talking (or rather yelling) about the fuel hike tsunami. I believe this was the second time within this year that the crowds were so energetic debating the 40.62 percent or 78 sen per liter hike? The first time was when the ruling government lost five states to the opposition in Mar and three months later, it was this ridiculous fuel hike. This brings back the happy memory of 1993 KLSE Super Bull Run.

15 years ago, restaurants were basically packed during lunch hour. Customers ranged from remisiers, dealers, IT guys, fishmongers, low-ranking settlement officers and even students. You can see happy faces basically everywhere and the dishes such as shark-fin soups, abalones and other expensive foods are quite common. The cheapest one would settle for hotel’s buffet. It was an era of no-brainer – as long as you belong to the homo-sapiens species, you were making money.

It wasn’t so hard to make money because as long as you follow the trends on the top-20 active stocks, you basically hit the jackpot. And if you have a little bit more brain-cells, you go and buy the lower part of top-40. You can’t miss the boat and with the settlement period of T+7, the whole stock market was like a paradise. One punter who later I found out to be a 16-year-old student claimed he made almost RM100,000 from playing contra. Not sure if he survived thereafter though.

Plantation stocks were affected by the government’s decision to impose a windfall tax (aren’t these people creative in getting easy money?) on oil palm companies effective from July 1 but the rest of the stocks were affected either directly or indirectly by the huge quantum of fuel hike and could be heading to the Niagara Falls. The worst has yet to come. It’s all about chain-reactions and I’m flabbergasted why the government didn’t learn their lesson. Let me get one thing clear. I agreed that it’s about time to take away the fuel subsidy but it should be on gradual basis and not with a big-bang approach. No doubt over the long run, we cannot live under the subsidy honeymoon but we got to be realistic.

Former premier Mahathir today wrote that roughly Malaysia produces 650,000 barrels of crude per day. We consume 400,000 barrels leaving 250,000 barrels to be exported. Three years ago the selling price of crude was about USD30 per barrel. Today it is USD130 – an increase of USD100. There is hardly any increase in the production cost so that the extra USD100 can be considered as pure profit.Our 250,000 barrels of export should earn us 250,000 x 100 x 365 x 3 = RM27,375,000,000 (twenty seven billion Ringgit). But Petronas made a profit of well over RM70 billion, all of which belong to the Government. By all accounts the Government is flushed with money.

Maybe the government has forgotten to calculate the sudden increased in taxes from the plantation companies, oil companies and banks. I hope Scomi pay their taxes accordingly. Bottom line is the country’s economy is still generating profit and going by the simple arithmetic, the government can subsidize (if you still want to use the word) and gradually increase the fuel price but not before an effective mechanism is put in place to check for leakages (or rather corruptions). And please improve the public transports first which is still in the sucky situation.

I believe the people are still waiting for the 2006’s promise of improve-transportation system after the 30 sen a liter hike. People had tightened their belts since the deputy PM advised us to change our style of living since then. But to repeat the same old excuses and advices without doing a single thing on the government part is simply outrages. Just where all those billions of ringgit saved have went to? I’m pretty sure not a single cent has goes into my pocket.

Other Articles That May Interest You …

Wednesday, June 04, 2008

Fuel and Electricity Hike, Money needed for final battle

Why did Abdullah Badawi press the “Self Destruct” button by raising the fuel price by a whopping 40.62 percent or 78 sen per liter? Not satisfied that the self-destruct button might work, he put in the second-layer security with another explosive - raising electricity rates by 18% for homes and 26% for business users. You just got to respect this sleepy head for the guts. Really, I doubt Mahathir has even half the guts to do what Badawi has done.

Just out of curiousity I went to join in the party, the queue, to feel the excitement of filling up the petrol before the midnight bell strikes. It was havoc with motorists squeezed two lanes out of the already two-lane road, so basically it became a three-lane road. I skipped the first and second lane and proceeded to create a “new third lane” (yes! I’m a violent person) thus divided the supposely two-lane to four-lane road *grin*. The fact was I won’t be able to get a drop of petrol if I remained at the original 2-lane queue. And guess what! after I created the third queue everything seems to move more smoothly. It’s because the petrol pump operators realized the serious bottleneck and began to get his ass out from the air-cond counters to help divert the customers plus helping with the payments.

It’s time to rip off as much as you can. Damn the popularity because it doesn’t works in Malaysia. Even if you can get only 49% of the votes, you’ve basically secured the throne. Who says the government is subsidizing you, your family members and your dog’s petrol expenses? Malaysia is a net exporter of crude oil. This means the country is selling more oils than buying it for domestic consumption. In this transation it makes money (via Petronas) so it’s not true that the government is subsidizing the people, mind you. It just that the difference (sell minus buy) is not sufficient for the government to do whatever that it wanted to do. You might argue that I’m twisting the fact but the arithmetic is correct.

The newly launched Proton Saga drinks 40 liter for a full tank. Assuming each full tank can last you 1-week, you’re paying RM307.20 per month based on the old rate of RM1.92 a liter but a whopping RM432 a month based on new rate of RM2.70 a liter. That’s a difference of RM124.80 a month dude. Unless you can further cut down on the usage, the RM625 annual cash rebate is barely enough and definitely a lose-lose proposition for you. But why would the government cares? The best part is the government will review the fuel price on monthly basis, so there could be more surprises in the closet.

Other Articles That May Interest You …

Fuel hike from RM1.92 to RM2.70, Char-Kuey-Teow RM7.50?

Breaking News: In-line with the government previous practices in announcing fuel-price hike last minute, it appears Abdullah Badawi government has did it again. Effective midnight tonight, 4th June 2008, the price of petrol would be increased by a whopping 78 sen and diesel by RM1.00. This means you’ve to pay 40.62% more for petrol from the previous RM1.92 a liter to RM2.70 a liter. The price of diesel meanwhile goes up from RM1.58 to RM2.58.

I’ve received the sms on the new rate earlier this morning but I thought it could be another hoax. It’s true after all. So there you go, trapped with the talks that any fuel hike would be enforced only after August. Didn’t Domestic Trade Minister Shahrir Samad say earlier that the idea to hike fuel prices would only be revealed after a comprehensive subsidy system is re-structured – in August? Old tricks always work huh?

Other Articles That May Interest You …

Things are getting uglier; I wish ringgit goes back to 3.80

Not many moons ago, I’ve wrote why I don’t really fancy the local Ringgit to appreciate further against U.S. dollar. In fact I would love the local currency to float at RM3.80 to US1.00 or even weaker. Why am I so cruel and unpatriotic? The reason is pretty simple (hey I’m not a complicated person in the first place) – I don’t see how stronger ringgit would benefits the people, period. Do you see foods especially the imported types are getting any cheaper? Heck, can you see any happy faces at the market buying those “local” products? You hardly can smell the buying-power with the ringgit nowadays, RM3.80 or RM3.20 to a dollar does not make any difference.

When the dollar was strong suppliers were screaming that imported raw materials were expensive hence the pricey stuffs from chicken to building raw materials. But now the dollar has weaken not only the stuffs such as foods are not getting any cheaper but instead it is getting more expensive. Sure, blame it on global short-supplies and speculators etc but how about local manipulators? And nowBernanke signaled that further interest rate cuts are unlikely because of concerns about inflation. So the dollar will make a U-turn and strengthen against major currencies including ringgit and the same old song will be on the air again.

I found it amusing when Bank Negara (Central Bank) Malaysia’s Governor Dr Zeti Akhtar Aziz said the ringgit will not be a tool of monetary policy to curb inflation. She said the strength of the ringgit has been and would continue to be determined by the market. Yeah, try to say that to the face of Mahathir during the 1997-1998 Asia Crisis and see if the old man would not spank her. The fact is the country was taking the free ride on the weakening dollar when Bernanke began the adventure of rate-cutting due to sub-prime crisis. Bank Negara did nothing but to sit and watch the show. And it is puzzling why there wasn’t any impact to the imported goods despite the appreciation of more than 15 percent in local currency.

Of course the silly PM Badawi has came out with the brilliant idea of scrapping the global future markets on the black-gold, the same way silly Mahathir screamed till his throat sore to eliminate currency (trading) speculation 10 years ago. In a way Goldman Sachs & Co. was right in certain way when it cut the nation’s equities to "underweight" from "market weight" although the main reason was political uncertainties. It was all about fear of contagion effect from Vietnam’s surging inflation, not that Malaysia’s own inflation is in any good condition. Cash is king my fellow readers. And I believe many people whose income is in U.S. dollar would love to see ringgit weaken to RM3.80 and beyond.

Other Articles That May Interest You …

Monday, June 02, 2008

Beyond $600 again? GOOG stock might needs Android

Developers were particularly happy with Google’s Android program though they hope Apple could grant them the same priviledges on iPhone. If there would be one day the Google’s phone could overtake iPhone as the most popular smart phone, the credits would definitely go to the developers, thanks to the Android SDK (software developer’s kit). Just take a look at Facebook that encourages applications developed by developers.

You either love iPhone or hate it but whatever reasons people who despise iPhone would somehow find some comfort with Android. Apple Inc. (Nasdaq: AAPL, stock) looks almost certain to release the 3G version of its popular iPhone. But Google’s Gphone or Android would not be able to make it this year (hopefully in 2009) despite huge number of people are hard at work to give reasons to celebrate at least this Christmas. Android is based on the Linux open operating system is a project jointly developed by Google and Open Handset Alliance which consists of 34-member group.

At Google “developers conference” in San Francisco, the giant search engine showcased the enhanced version of its Android since the previous news late last year. The so-called smart Android phone has some cool applications operated with touch screens. You cannot help but to boo Android as small applications such as calendar and address list bring back the image of iPhone almost instantly. iPhone die-hard fans would laugh at the primitivity of the Android for obvious reason.

One similiarity with iPhone and Apple’s Safari browser is that Android’s browser uses the same open source engine from WebKit. Apple iPhone is still the coolest smart phone though but if Google Inc. (Nasdaq: GOOG, stock) could throw in really cheap Androids, it could create the buzz that might move the stock price beyond $600 since the plunge late 2007.

Other Articles That May Interest You …

Get guidance of hosting from Web Hosting Bluebook

Blogging has entered a new horizon when politicians including former premier Mahathir could not resist the temptation to start his own blog. Mahathir blog registered 1 million hits within a month, an achievement most of bloggers would dream of. Since the recent 12th general election, mysteriously bloggers were recognized as the new force that could turn the table on the government. In fact blogging is a marathon and only time will tell if a blog could survive over a period of time. The cheapest way is definitely to use the free blogging platform such as blogspot or wordpress although the best practice is to have your own domain.

To cut cost you can have your own domain (which you paid less than 10 bucks per year) but leverage on free hosting under blogspot platform. But still you’re at the mercy of Google and should the internet giant decided that it doesn’t like you, it could just shut you off leaving all your articles with them unless you’ve a backup copy. So the best way is still to have your own domain plus hosting it elsewhere which would lead to another headache - which hosting company? I found out that no matter how much research you do, there’re tons of complaints about that particular company.

It’s a never-ending process and what is good for someone might not be the best solution for others. However I can see that while GoDaddy is the preferred place to go to purchase domain name, it’s definitely not a wise move to host your blog or websites with them.

Smart people become Jokers after joining BN, how come?

Ithought I could get a good rest today after a tiring house-warming party yesterday but somehow amazing stories kept coming. People familiar with the local political scene once said (after the recent 12th general election) although UMNO (main component party of National Front) was made of mostly brainless retarded leaders since the departure of Mahathir (yes he was a dictator but he has the brain-cells), it had since improved its image relatively with the appointment of certain intellectuals such as Zaid Ibrahim (Minister in the Prime Minister's Department), Shahrir Samad (new Domestic Trade and Consumer Affairs Minister) and Amirsham Aziz (former Maybank CEO).

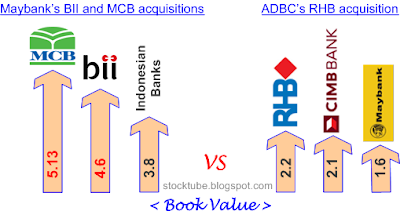

Don’t get me wrong though as these so-called incapable leaders are miraculously very capable in other area such as acquired foreign bank at mind-boggling 4.6 times book value, erased victim’s immigration records, lost sovereignty on Pedra Branca (Pulau Pulau Batu Puteh) yet could scream it was a win-win situation and many other great success stories. However if you care to notice, any good people (if you think they were in the first place) would somehow become dim-witted and losses the sparks as if they were under some sort of spells after joining the BN government.

Being a Johorean, I thought Shahrir understood the fact that the state especially Johore Bharu needs Singaporean more than Singaporean needs JB’s fuel, no? You expect the Singaporean to

But the biggest joke was still on Rais Yatim. Realizing his mistake for saying it was a win-win situation after losing Pedra Branca, the senior chap now said Malaysia is not giving up hope on the island yet. The government is now scrambling to find the ancient letter written by British Governor William T. Butterworth to the Temenggong and Sultan of Johor seeking permission to build the Horsburgh Lighthouse on Batu Puteh. Why go all the way to ICJ knowing such important evidence was not in your hand in the first place? Only fools will proceed to a battle with guns but without bullets.

Rais further said “If we can gain sight of that letter, the gate can be opened again. There is a maximum 10-year period but preferably it should be done within six years … The letter could be in London, the British being too good at archiving. We have searched with them but it has not been conclusively proven that they don’t have it … Probably it is in Singapore”

Of course Singapore would not entertain such a request you idiot. It’s like going to the residence of Najib and asked if he still has a copy of the authorization memo or letter to take out some hamburger-like C4 explosive from the military storage. What do you think, was Singapore that stupid? It is better if Rais shut his mouth, admit the country just lost and island but won back some tiny rocks and let the people forget the whole shameful defeat over time. Probably he should just tai-chi the whole thing to his predecessor. Hmm, I wonder where the Attorney General is since the ICJ’s verdict.

Other Articles That May Interest You …

Sunday, June 01, 2008

Apple 3G iPhone – Broadcom the winner?

Apple’s two bucks jump in the stock price Friday was primarily due to Dell Inc.’s strong earnings result that pushed up technology shares and the expectation that Apple Inc. is preparing for the much talked-about 3G iPhone launch. This time it’s for real considering that it was Apple itself that was spreading the news of its own retail vacation blackout days. Taking the lead was AT&T who is blacking out vacation days for its retail staffers from June 15th to July 12th – reported AppleInsider.

On the other hand Apple Inc. is making the preparation for the back-to-school carnival - targeting third week of July and running through the second week of August. In order to push sales, Apple was planning for crazier incentives than last year (buy one free one? *grin*) and the details could be out as early as Monday after the company brief its partners.

So, while I’m still yelling “Apple, Go! Go! Go!” I was kicking myself for missing out on Broadcom Corp. How could I miss this guy, a low-entry stock that could ride on the 3G iPhone wave, not that I’ve not play the stock before? Oh well, maybe there’re still chances to catch the tail.

Other Articles That May Interest You …

Friday, May 30, 2008

MPs grill Maybank CEO – let the worms come wriggling

Even if Maybank or some other hidden hands in this matter would eventually pull it through, the real reasons for paying exorbitant price for Indonesian PT Bank Internasional Indonesia (JAK: BNII) should be revealed to the public especially the stock investors. At least investors who are thinking of going into the river of Maybank be warned of the potential risks of getting their body parts snapped off by crocodile or piranhas. I’ve since put up a sign-board at the river bank that says “Beware of BN”, in case the attractive stock price got me seduced.

I can’t recall when was the last time Members of Parliament were so enthusiastic in grilling chief executive of a corporate organization. Perhaps it didn’t ever happen considering the government had never (since 1969) lost their precious two-third majority and hence strong voice before. Malayan Banking Berhad’s (KLSE:MAYBANK, stock-code 1155) new CEO, Wahid Omar, just joined the company and sympathizers might argue that he knows nut about the whole transaction but this argument is not strong enough to sweep the RM3 billion over-paid money under the carpet.

During the grilling process, Wahid was reported to admit that the acquisition price was at the top end. He also denied that the advisor in the transaction was EMC Libra. There was also doubt as to whether Maybank would breach the SPP as CIMB Group already had a presence in Indonesia. But the cream of the whole transaction is – did Maybank bid alone all this while? Some MPs threatened to show documents that allegedly showed the bid was by Maybank alone and if it’s true then the Maybank shareholders were being taken for a ride again.

Other Articles That May Interest You …

Thursday, May 29, 2008

Facebook Redesign? Who cares, I just want the Stock

Whenever the discussion about Google vs Facebook pops there’s always a group of people who would scream “Huh? Google and Facebook are of different business dude!” Of course I know that silly. Every Tom, Dick and his dog knew Google is in online search business while Facebook is in one of Web 2.x businesses - that’s social utility that connects people. Yeah, I know that Nokia had used the “Connecting People” slogan. There’re more than “same business sector” that qualify this fight between Google and Facebook.

For a start when top brains were scrambling to join Google’s payroll, Google employees on the other hand were jumping out from Google Inc. (Nasdaq: GOOG,stock) into Facebook. What on earth were these ex-employees thinking by joining a social-networking company? Forget about making money based on online advertising as social networking is second worst to chat rooms - CPM was ridiculously low as can be witnessed by the MySpace advertising trial. But if you were to travel 10-years back to 1999, Google’s business model was even worst. In fact Larry Page said there won’t be any content at all for Google – Huh?

And now Facebook is working on a redesign that will allow popular applications to become more accessible to users - Chief Executive Mark Zuckerberg said Wednesday. Zuckerberg did not say what the redesign might look like, but indicated that Facebook might eventually have functions similar to “search”.It makes perfect business sense to go out of your square box once you’ve outgrown your own creation and who says Facebook cannot venture into search business? The fact is Facebook still hosts the lion's share of Web applications created by developers and have no intention to switch side to Google’s OpenSocial platform. For example Facebook users have installed Watercooler's applications about 17 million times.

Facebook is not in a hurry to recognize OpenSocial obviously. The conclusion,everyone is waiting for Facebook to go public. Heck, this could be the second chance in the lifetime to buy stocks with Google’s potential. Wondering what could be the stock-code for Facebook – FB, FBK, FCBK?

Other Articles That May Interest You …

Greed & Corruption turn the country into Gangster-State?

When I was young my mum always reminded me to get far away from any fight-scene and never be busy-body trying to find out what was the excitement about. Can’t blame her though as she is a living testimony of the May 13 incident. I guess that was exactly what happened to the innocent Chang Jiun Haur, 21, for allegedly running over FRU personnel (reported MalaysiaKini). The curiosity–seeker was at the wrong place at the wrong time when he was stopped and surrounded and then beaten till he was “soaked in his own blood” – by some 20 policemen (or thugs?). What the heck, you simply can’t differentiate gangsters from the policemen nowadays, can you? Luckily the policemen didn’t drag and gang-rape his sister who was inside the car at that time.

Police’s brutality continues

A high-ranking police officer at the scene claimed that Chang had run over a FRU personnel with his car.

“He asked for it. He ran over a policeman and he got what he deserved,” the officer told Malaysiakini a few minutes after the

incident.Asked to identify the person who was hit by the car, the officer had initial difficulty in persuading the individual to come forward.

When he did so, the man - who appeared unscathed - claimed: “He tried to run me over … look at my baton, it is broken. What more evidence do you want?”

What happened as reported?

According to theStar, a fracas ensued at about 7.15pm when a group of unidentified men armed with sticks and helmets attacked the residents. Several residents were taken to hospital. Also injured was a photographer from Utusan Malaysia, Roy Azis Abdul Aziz, who was beaten up when he tried to snap some photographs.

The group of men sat on the blocks, not allowing the residents to remove them and threatened to attack those who tried to go near the barricade. However, the group disappeared when the police arrived later. Cool, you have a group of readily-armed thugs threaten to beat up residents and the police couldn’t catch even one of them until this hour. And what did the Kajang OCPD Asst Comm Shakaruddin Che Mood said when asked why police didn’t help? His men were busy diverting traffic because it was more important than to guard the lifes of innocent people. Shouldn’t this guy be rewarded with a medal?

The group of men sat on the blocks, not allowing the residents to remove them and threatened to attack those who tried to go near the barricade. However, the group disappeared when the police arrived later. Cool, you have a group of readily-armed thugs threaten to beat up residents and the police couldn’t catch even one of them until this hour. And what did the Kajang OCPD Asst Comm Shakaruddin Che Mood said when asked why police didn’t help? His men were busy diverting traffic because it was more important than to guard the lifes of innocent people. Shouldn’t this guy be rewarded with a medal? Of course the Grand Saga spokeman responsed in lighting speed that the company has nothing to do with those thugs or gangsters. Sure, and we’re suppose to believe those thugs have nothing better to do than to guard the concreate slabs not belonging to them? How come I smell something fishy with this Grand Saga’s executive director who happened to be the former Dang Wangi Police Chief?

Of course the Grand Saga spokeman responsed in lighting speed that the company has nothing to do with those thugs or gangsters. Sure, and we’re suppose to believe those thugs have nothing better to do than to guard the concreate slabs not belonging to them? How come I smell something fishy with this Grand Saga’s executive director who happened to be the former Dang Wangi Police Chief?Why the residents are so crazy to get rid of the barricades?

The whole crisis is quite simple. The toll concessionaire Grand Saga is simply too greedy to suck the money out of motorists and the residents of Bandar Mahkota Cheras are furious that they are being forced to travel another 6.7 km (one way) just to pay the RM0.90 toll to go to Kuala Lumpur. Despite an access road connecting Mahkota Cheras town-ship to the Cheras-Kajang highway built by Lion Diversified Holdings Berhad, Grand Saga decided that the only way to collect more money from tolls was to block the road, forcing the residents to make a huge merry go-round.

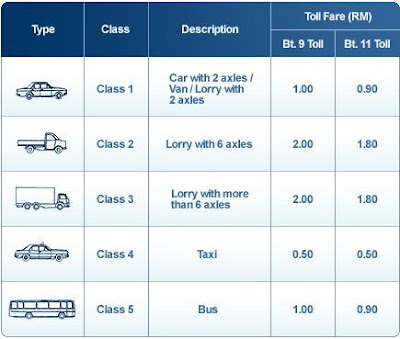

There are two tolls on the 11.5km Cheras-Kajang highway, RM1.00 at the 9th-mile toll plaza and RM0.90 at the 11th-mile toll plaza. The short-cut (shorter 1.5km route) have great impact on Grand Plaza's toll collection at the 11th mile but not on the first toll located at the 9th mile of the highway hence the crisis. Can you see the tyranny at works here?

There are two tolls on the 11.5km Cheras-Kajang highway, RM1.00 at the 9th-mile toll plaza and RM0.90 at the 11th-mile toll plaza. The short-cut (shorter 1.5km route) have great impact on Grand Plaza's toll collection at the 11th mile but not on the first toll located at the 9th mile of the highway hence the crisis. Can you see the tyranny at works here?Grand Saga and Taliworks, a cash-rich company

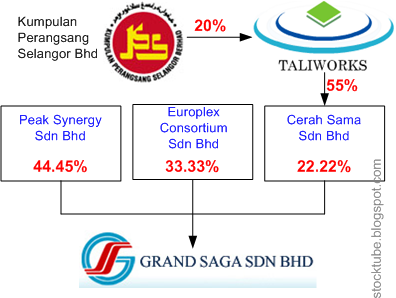

Isn’t it strange that a toll concessionaire such as Grand Saga could be so powerful? What’s the relationship between Grand Saga and Taliworks and who’re the bosses? Taliworks Corporation Berhad (KLSE: TALIWRK, stock-code 8524), the water specialist, currently operates and maintains the Sungai Selangor Water Treatment Works Phase 1 in Ijok, Selangor, and a water concession in Langkawi. The company manages six water treatment plants with a combined design capacity of 1,039 million liters per day that serve approximately two million people in Kuala Lumpur, Selangor and Langkawi, Kedah. The ambitious company is looking to expand overseas when its Chief Executive Officer Abdul Rahman Siraj said the company was seriously looking at four more water and waste management projects worth RM400 million in China.

Taliworks has also expanded its operations to include toll highway operations via the acquisition of a 55% (for RM55.5 million) interest in Cerah Sama Sdn Bhd (CSSB) from Bunga Abadi. Interestingly both Taliworks and Bunga Abadi have a mutual substantial shareholder - the family of the late Datuk Lim Ah Bak (The son, Lim Chee Meng, is Taliworks executive Director) who was the business partner of Abdul Hamid Pawanteh, the former Perlis Menteri Besar (Chief Minister).The company is cash-rich after it has successfully raised RM225 million of convertible bonds for business expansion purposes. Locally the company is banging on thePahang-Selangor inter-state raw water transfer project, which it hopes to secure. So, Mr Chief Minister of Selangor, you have your trump cards to play here.

Taliworks has also expanded its operations to include toll highway operations via the acquisition of a 55% (for RM55.5 million) interest in Cerah Sama Sdn Bhd (CSSB) from Bunga Abadi. Interestingly both Taliworks and Bunga Abadi have a mutual substantial shareholder - the family of the late Datuk Lim Ah Bak (The son, Lim Chee Meng, is Taliworks executive Director) who was the business partner of Abdul Hamid Pawanteh, the former Perlis Menteri Besar (Chief Minister).The company is cash-rich after it has successfully raised RM225 million of convertible bonds for business expansion purposes. Locally the company is banging on thePahang-Selangor inter-state raw water transfer project, which it hopes to secure. So, Mr Chief Minister of Selangor, you have your trump cards to play here.There’s another big-gun who’s the majority shareholder in Grand Saga, National Front’s (Barisan Nasional) Syed Sobri Syed Hashim, the State Assemblyman for Kuala Nerang. Hey, isn't that a conflict of interest?

Selangor government plays dumb?

Analysts think Taliworks stands a good chance of grabbing some jobs since Kumpulan Perangsang Selangor Bhd (KPS), a subsidiary of the Selangor government's investment unit, Kumpulan Darul Ehsan Bhd owns about 20 percent in Taliworks. Gosh! Doesn’t this means the Selangor government is equally tainted in this Grand-Saga Bandar Mahkota Cheras clashes? Is Khalid Ibrahim, the Chief Minister of Selangor from PKR, plays dumb or simply that stupid to not realize this fact? What a way to go to milk motorists for another 20 years.

For the financial year (FY) ended Dec 31, 2007, Taliworks registered an increase of 33.6% in revenue to RM191 million from RM142.9 million in the previous year. Net profit, however, fell to RM33.1 million from RM35.6 million the year before. Could this justifiable enough to suck 60,000 residents of their money, never mind risking the lifes of innocent people? However, don’t expect the federal government to do anything because it was their intention to play-up the tension – the dirtier the crisis blows, the better.

For the financial year (FY) ended Dec 31, 2007, Taliworks registered an increase of 33.6% in revenue to RM191 million from RM142.9 million in the previous year. Net profit, however, fell to RM33.1 million from RM35.6 million the year before. Could this justifiable enough to suck 60,000 residents of their money, never mind risking the lifes of innocent people? However, don’t expect the federal government to do anything because it was their intention to play-up the tension – the dirtier the crisis blows, the better.Grand Saga Big Bosses

Management Team:

- Ahmad Ishak Haron - Managing Director

- Chee Lean Thong - Executive Director, Operation & Administration

- Zainal Abidin Ali (former Dang Wangi Police Chief) - Executive Director, Business Development & Corporate Affairs

- Datin Lee Li-May - Director, Tender & Purchasing

- A. Rajasolan - General Manager

- Patrick Wong - Assistant General Manager, Business Development & Corporate Affairs

- Paramjeet Singh Nahar Singh - Finance Manager

- Nurashid Noordin - Human Resource & Administration Manager

Board of Director:

- Ahmad Ishak Haron

- Chee Lean Thong

- Zainal Abidin Ali

- Datin Lee Li-May

- Dato' Wan Puteh Wan Mohd Saman

- Minhat Mion

- Lim Yew Boon

Other Articles That May Interest You …

Wednesday, May 28, 2008

AAPL breached $184 with second hurdle at $192

One of the strategies to tell the speculators that they’re screwed with their greediness in making money by jacking up the oil prices is to boycott them. How? Use less fuel or stay at home. That’s precisely what happened during the Memorial Day when analysts predicted that people were going out less and with the summer driving season just started, the consumption of gasoline is closely watched. Oil prices plunged more than $3 to below $129 a barrel.

Almost instantly, investors were betting that the sharp drop in oil prices will help shore up consumer spending – sending shares higher including technology stocks such as Apple Inc, (Nasdaq: AAPL, stock), Google Inc. (Nasdaq: GOOG, stock) and Baidu.com, Inc. (Nasdaq: BIDU, stock). On the Nasdaq, Apple shares climbed to $186.43 while Google shares rose to $560.90. Baidu on the other hand closed at $336.50 well below the resistance of $350.

Other Articles That May Interest You …

Monday, May 26, 2008

From stockbroker to selling ePetrol, goldmine for Rashid?

Ask yourself if you’ve voted the opposition namely DAP, PKR or PAS during the 12th general election three months ago and if the answer is “yes” then give a round of applause to yourself. I was pretty sure there were hidden hands at work in manipulating the price of rice ever since the Padiberas Nasional Berhad (KLSE: BERNAS, stock-code 6866) was given the exclusive right as the sole importer and distributor of rice in the country but strangely controlled by politician. Compared to fuel price, the impact of escalating rice prices could be seen as minimal.

Supposing the government won the general election with more than 90% seats again, can you imagine what will be the fuel prices today? So, thanks to your support (in voting opposition) the government simply can’t increase the fuel price as and when it likes. If the government couldn’t care less by increasing the petrol price by a whopping RM0.30 a liter when the oil prices were at $60 a barrel, I would be over-generous to estimate that the government would have increased it by RM1.00 a liter to RM2.92 a liter based on current global oil prices of above $130 a barrel. But knowing the arrogance and corruptness of the government, even RM3.92 a liter could be an understatement. Thank God you voted the opposition to at least show the power of Makkal Sakti.

All you need to do is to insert your MyKad into the petrol pump reader, pumps the amount of fuel needed (or available from the information shown) and you’re set to go. Somehow it works like a credit or mobile prepaid system – you’re allowed to enjoy the subsidy based on a total amount pre-determined. This leads to the question of how much of fuel subsidy would be allocated and what are the basis for applying such formula on an individual. It would be difficult, not to mention silly to say Tom is entitled RM400 of subsidized petrol per month but Dick gets to enjoy $700 a month. A salesman would scores more mileage than a normal administration officer.

And don’t forget that freaking rich bosses might be stingy enough to ask their drivers to use their MyKad to fill-up their Benz or BMW tanks with subsidized fuel. On the other hand I can ask my neighbor’s son or daughter to fill up my tanks as well. Can the government guarantee that credits stolen using clone MyKad chips will be compensated? I know if someone cloned my CitiBank credit card to pump in petrol, I just need to make a report or deny such transaction and their “system” is intelligent enough to verify my claims and offset the transaction automatically.

Other Articles That May Interest You …

Tiger at Home but Useless and Hopeless against Outsiders

Actually the article I wrote yesterday was rather long, too long that I need to split it into two or three articles. Although both, of which the second part will be revealed in this article, seemed to be of different topics it was in actual fact related - it’s about Jaguh Kampung or Village Champions. You might argue that Malaysia does not have any more top brains to fight for the nation’s own sovereignty (as in the case of Pedra Branca or Pulau Batu Puteh) because the government was so successfully with their “brain-drain” program to shoo away intellectuals. But why didn’t the country engage lawyer VK Lingam *grin*? This guy might be corrupt and arrogant to the highest level but at least he could deliver the result and by the time Singapore discovered that all the judges from the ICJ (International Court of Justice) were “fixed” from day one, it would be 20 years late so what the heck right *grin again*?

Anyway, about 10 years ago I often drove to this place to buy pirated-VCD. Yes, I know I shouldn’t promote piracy but it was the buzz and almost a sin to not own any pirated VCD during those days. This place by the name of Desa Setapak was probably the VCD-heaven within the whole Klang Valley. You could almost swear that there were hundreds of stalls selling VCD, naturally converted the parking lot into what seemed to be a bazaar. And when I asked how they could evade the law enforcer, DBKL, almost everytime, the young chap (seller) just smile and saideverything had been “settled”. Sometimes you could see even the DBKL themselves were busy choosing the latest VCD on sales, during the pirated-VCD glory days. Of course those happy days were history and the memory of the stalls normally flashed in together with the infamous pink-colored mini-buses.

The second reason could be the loser (previous MP) was at work to punish the voters. One has to remember that this curly-hair ex-MP was the same person whostarted the chair-throwing at MCA assembly (can you guess under whose instruction?) during the MCA internal fight between Team-A and Team-B. So he’s someone you don’t want to mess around unless you fancy your head gets beaten.His career skyrocketed and was made Territories Ministry parliamentary secretary. It’s hard to imagine this guy will just keep quiet and play PS3 at home after the defeat. Strangely from the hearsay I gotten, most of the hawkers whom their stalls were demolished were MCA diehard fans.

Don't you wish the authorities were as efficient as this bunch of DBKL demolition-men in taking down the structures built by Singapore to show the country’s sovereignty on Pulau Batu Puteh years ago. Can you imagine how havoc could it be if the Anwar-led Pakatan rakyat (People's Pact) managed to topple the current government this year? Why only knows how to bully your own people but was helpless and hopeless against outsiders (Singapore)? If this is not Jaguh Kampung or Village Champions, I do not know what is.

Other Articles That May Interest You …

Saturday, May 24, 2008

An island for Singapore, rocks for Malaysia – Amazing!

Ialmost fell off my chair, not because I was extremely sad that Malaysia lost her island but from the extreme laugh, probably one of funniest episodes - the verdict of 28-year territorial dispute on a small island. The International Court of Justice’s 12-4 decision in favor of Singapore on Pulau Batu Puteh (known as Pedra Branca to Singapore) was actually a slap on Malaysia’s face, considering that the small island is merely 7.7 nautical miles from Malaysia but is a whopping 25.5 nautical miles from Singapore. The fact is Malaysia has just lost her sovereignty on Pedra Branca.

Malaysia did not only lose the island but also all natural resources and mineralsin the territorial waters of Pedra Branca. But could the result be any difference if Malaysia engaged better lawyers. Singapore engaged two top international lawyers - Professor Alain Pellet of the University of Paris X-Naterre and Queen's Counsel Ian Brownlie. On the other hand, the team from Malaysia comprising Foreign Minister Syed Hamid Albar, Attorney-General Abdul Gani Patail and his son Federal Counsel Faezul Adzra Gani Patail had to resort to using a blog’sunverified photo of Pedra Branca (Right) to present their case to the judges at the International Court of Justice (ICJ). The blog was said to be newly created and the jokes were that Malaysia was so complacent (arrogant?) and ill-prepared that they have to resort to present false evidence.

Maybe Malaysia government thought it could win the case easily since the top brain AG Abdul Gani Patail was leading the team. Furthermore how many lawyers in the world could make a public announcement that only three people and no others are involved in the murder case (Altantuya), even before the trial started? If this was not a show-case of top-brains I do not know what is *grin*. Perhaps Malaysia Attorney General should be confined to domestic case only such as to suppress oppositions or anyone who dare to question the government’s policy and nothing else. That was the AG’s specialization area so do what he was good at.What a bunch of arrogant “Jaguh Kampung” or Village Champions – simply unbelievable!

Maybe Malaysia government thought it could win the case easily since the top brain AG Abdul Gani Patail was leading the team. Furthermore how many lawyers in the world could make a public announcement that only three people and no others are involved in the murder case (Altantuya), even before the trial started? If this was not a show-case of top-brains I do not know what is *grin*. Perhaps Malaysia Attorney General should be confined to domestic case only such as to suppress oppositions or anyone who dare to question the government’s policy and nothing else. That was the AG’s specialization area so do what he was good at.What a bunch of arrogant “Jaguh Kampung” or Village Champions – simply unbelievable!Friday, May 23, 2008

BIDU stock trend reversing? Cool! A New Asian Tiger

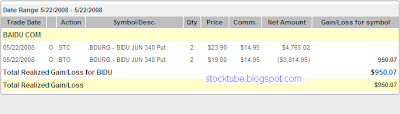

Netease.com Inc. (Nasdaq: NTES, stock), a leading Chinese Internet and online game service provider, reported its first-quarter profits fell 10% due to higher tax charges from a new income tax law despite a jump in revenue. Shares of NTES sold off sharply by 6% to $22.60. The weakness in shares of NetEase.com spilled over into China's search engine giant Baidu.com, Inc. (Nasdaq: BIDU, stock) – what did they say about when it rains it pours? Traders pushed shares of BIDU down by 5.6% to $335.

So, when you saw such opportunity you simply just can’t ignore it, can you? Scalped the BIDU Jun 340 Put Option, entered my limit price to sell (close) and once it got triggered, there’s another happy person for the day. If the latest reverse in trend is true, then you should start filling up your bullets as well because thenext support is $300, that’s $35 bucks down and a great vacuum for you to make money. If you still do not know what I’m talking about, the support of $350 had been breached yesterday after BIDU found the $380 too tough a target to push, silly.

This country, dubbed the "The Next Asian Tiger in the Making" and the "Next Economic Miracle" is none other than Vietnam. Yeah right, everyone knew that but how to take advantage of it even if the research by Goldman Sachs is true? You can’t because it’s hard to find a Vietnam-related stock listed in U.S. stock exchange, let alone a pure-play stock. But you can see lots of American companies such as Intel and General Electric, not to mention many more Japanese companies have setup their business playground there. Can someone please wakes Malaysia up from its’ fantasy dream?

The Richest Malaysians, Robert Kuok scored the perfect 10

The Malaysians who made it to the richest list is out as compiled by Forbes Asia. Leading the list is the undisputed sugar king Robert Kuok who made the score of US$10 billion, up by $2.4 billion. If only he could put someone else other than the idiot politician who was the former president of MCA (you know who) to take care of Transmile, his fortune is definitely higher than $10 billion. As for Ananda, well, what else can I say? Interestingly, Robert Kuok and Lee Shin Cheng’s fortune jumped tremendously thanks to palm oil from Wilmer International and IOI respectively.

It appeared the iron chef Vincent Tan (his fortune tripled) managed to cook up his shares to qualify for the billionaire clubmembership. I’m rather surprise that the brother of deputy Prime Minister, Nazir Razak managed to squeeze in for the last place as the 40th richest person in Malaysia as I always thought his fortune is more than $100 million. Not sure if his elder brother would be laughing at him and say “What is this? Told you to join me in politics, $100 million is peanuts to me”.

- Robert Kuok - $10 billion (Kuok Empire, Shangri La, Wilmer International etc)

- Ananda Krishnan - $7.2 billion (Maxis, Astro)

- Lee Shin Cheng - $5.5 billion (IOI Group)

- Teh Hong Piow - $3.5 billion (Public Bank)

- Lee Kim Hua & family - $3.4 billion (Genting Berhad, widow of late Lim Goh Tong)

- Quek Leng Chan - $2.4 billion (Hong Leong Group, Guoco Group)

- Yeoh Tiong Lay & family - $2.1 billion (YTL Corp)

- Syed Mokhtar AlBukhary - $1.8 billion (MMC, Johor Port, Malakoff)

- Vincent Tan - $1.3 billion (Berjaya Group)

- Tiong Hiew King - $1.1 billion (Rimbunan Hijau)

- Azman Hashim - $700 million (AmCorp Group, formerly Arab-Malaysia)

- William H. J. Cheng - $660 million (Lion Group, Parkson)

- Lee Swee Eng - $495 million (KNM Group)

- Ong Beng Seng - $470 million (Hotel Properties Ltd, Natsteel)

- Lim Kok Thay - $345 million (son of late Lim Goh Tong, Genting Berhad)

- Vinod Sekhar - $320 million (Petra Group, known for its Green Rubber Global)

- Lee Oi Hian - $300 million (Kuala Lumpur Kepong or KLK)

- Yaw Teck Seng - $295 million (Samling Group)

- Anthony Fernandes - $290 million (AirAsia, Tune Hotels)

- Mokhzani Mahathir - $285 million (Kencana, authorized Porsche importer son of former permier Mahathir)

- Kamarudin Meranun - $280 million (AirAsia, Tune Hotels, Tony Fernandes’s lover *grin*)

- Jeffrey Cheah - $275 million (Sunway Group)

- Lee Hau Hian - $250 million (Batu Kawan, KLK, brother of Lee Oi Hian)

- Chong Chook Yew - $245 million (Selangor Properties, widow – son is MD now)

- Yaw Chee Ming - $240 million (Samling Group, son of Yaw Teck Seng)

- G. Gnanalingam - $230 million (Westports Malaysia)

- Lim Wee Chai - $200 million (Top Glove, world’s largest rubber gloves manafacturer)

- Kua Sian Kooi - $195 million (Kurnia Asia, insurance)

- Lau Cho Kun - $185 million (Malaysian Mosaic)

- Abdul Hamed Sepawi - $180 million (Ta Ann, timber conglomerate)

- David Law Tien Seng - $165 million (Australian iron ore MidWest, T.S. Law Holdings)

- Tiah Thee Kian - $163 million (TA Enterprise)

- Liew Kee Sin - $160 million (SP Setia)

- Ahmayuddin bin Ahmad - $155 million (Westports Malaysia)

- Eleena Azlan Shah - $150 million (Gamuda – largest individual shareholder)

- Lin Yun Ling - $145 million (Gamuda – founder and MD)

- Ong Leong Huat - $130 million (OSk Group)

- Lim Thian Kiat - $115 million (former head of Multi-Purpose)

- Khoo Kay Peng - $110 million (MUI, U.K. retailer Laura Ashley)

- Nazir Razak - $100 million (Bumiputra Commerce Holdings, brother of deputy PM)

Thursday, May 22, 2008

It’s above $135, House to sue OPEC over high oil prices

Another day another 200 points plunge as jaw-dropping investors watched the oil prices hit the roof of $135 ($135.04 in after-hours electronic trading) a barrel for the first time Wednesday thanks largely to the report from the Energy Department's Energy Information Administration which said crude inventories fell by more than 5 million barrels last week. Adding salt to the injury was the minutes from last month's Fed meeting revealed that while policymakers expected sharply lower economic growth and higher unemployment later this year, inflationary risks are likely to keep the central bank from cutting rates again.

This is cool. The oil prices have breached my prediction of $130 a barrel. I dare not say anything more as I could be spanked if I were to say it will goes up to $150, easily. Anyway, U.S. senators are making the hoo-haa out of it talking aboutcorporate conscience while the oil companies said it was all about supply and demand. Who could blame these corporations when their profits suddenly ballooned to unbelievable figures? Since when do oil companies care about the public, not that it could do anything in the first place? It’s all about money, money and more money.

Other Articles That May Interest You …

Wednesday, May 21, 2008

Soros, Buffett and Trichet said It Ain’t Over Yet

Oil prices going for $130 a barrel – StockTube screamed back in early Mar 2008, slightly more than two months ago when the black gold was traded at $102 a barrel. While there’re only a handful of readers who thought it was possible, many readers wrote personally to say it was nonsense to think for a minute that oil could reach such level. My justification was quite simple and in fact it was over-generous. The June contract shot to a record intraday high of $129.60 before settling at $129.07 a barrel yesterday. Guess what, the oil futures are now selling for about twice what they were just a year ago *Holy Cow!*.

Although there’re some financial institutions that allow you to purchase gold, my investment in gold was quite primitive. I had

And so, my collection of gold has appreciated in values but I’ll keep it for the rainy days. Anyway if you think the bull is about to charge again in the local stock market in the middle-term, say within six-month, then you might be disappointed. Even if U.S. sub-prime problems were to vanish overnight, the local political situation would be the biggest obstacle. European Central Bank President, Jean-Claude Trichet and Warren Buffett on Monday warned that the credit crunch problem still persists.

"These are demanding times, challenging times... It is an ongoing, very significant market correction," Trichet told BBC radio in Britain. "I'll talk about the United States. I don't think the effects of the credit crunch are far from over at all. I think there will be rippling secondary, tertiary effects." – said Warren. Meanwhile billionaire George Soros said in an interview with BBC Radio 4 “Financial institutions have been severely damaged and we are currently in a situation that will probably, I think almost inevitably, result in a recession certainly in the United States and most likely in England also.''

On the other hand, U.S. Federal Reserve Chairman Ben Bernanke said last week the healing process from the credit crisis would take some time – said Reuters. While the above three individuals do not own any crystal balls, their opinions carry weight and could be the closest we have in predicting the near future. So, what can you do? Allocate a healthy cash reserve proportionate to your stocks, unit trust, property and others because “cash is king” during bad period.

Other Articles That May Interest You …

Tuesday, May 20, 2008

Microsoft, Yahoo and Facebook’s Threesome vs Google

Have you ever had a threesome before? The saying goes that you should never have a threesome with someone that you wish to keep. If you think Microsoft Corp would leave Yahoo Inc. alone and let Google Inc. continues to dominate the lucrative online advertising, think again. It appears Microsoft might launch a threesome act – buy Yahoo’s search business before buy Facebook and enjoy the excitement of threesome.

Microsoft Corp. (Nasdaq: MSFT, stock) has proposed to buy Yahoo Inc. (Nasdaq:YHOO, stock) search business and take a minority stake in the company, stopping short of a full-blown merger at this moment. In this deal, Yahoo would sell its Asian assets namely Yahoo Japan and China’s Alibaba Group. Financier Carl Icahn has launched a proxy fight last week to force Yahoo to reopen talks with Microsoft. It’s not sure if Yahoo would prefer to sleep with Google Inc. (Nasdaq:GOOG, stock) or Microsoft.

Facebook on the other hand is said to be the next internet giant, the equivalent if not bigger than Google. There’re people who believe that the actual fight is between Google and Facebook. However if Microsoft indeed is planning to buy Yahoo search business and Facebook, then the battle would takes a new twist with Microsoft vs Google after all. It makes sense for Microsoft to acquire a “third company” because even with Yahoo under its belt, the company is still a distance from the giant Google.

So, the battle continues between the "close-society" (Microsoft) and the "open-society" (Google) and the winner will definitely be their partners – Yahoo, Facebook and FriendFeed. Facebook Mark Zuckerberg meanwhile is punching his calculator and might only consider selling his company for nothing less than $20 billion.

Other Articles That May Interest You …

Monday, May 19, 2008

Mahathir quits UMNO, so what? It’s Lingam-Gate diversion

Almost all the local news media be it government-controlled electronic or print media and bloggers screamed “Mahathir quits UMNO”. Should this former prime minister and dictator’s decision be given such a coverage? Perhaps his decision to quit was the hottest news so far hence the front-page privilege. Seriously I would only be surprise if he quit Malaysian citizenship to take-up the Zimbabwe’s citizen so that he could spend his remaining years with his close buddy, Robert Mugabe. Heck, if he hates Abdullah Badawi so much don’t you think he should goes to the extreme to prove his disappoval of his own hand-picked successor? Only then I believe UMNO members might (hopefully) desert the party in droves *grin*.

But no, this hypocrite 82-year-old chose to play the same dirty and obsolete child-game of throwing tantrums just because Badawi decided to punish this stubborn child of UMNO after the Royal Commission of Inquiry found there was evidence that the former premier Mahathir, lawyer Datuk V.K. Lingam, tycoon Tan Sri Vincent Tan, Umno secretary-general Datuk Seri Tengku Adnan Tengku Mansor and former chief justices Tun Eusoff Chin and Tun Ahmad Fairuz Sheikh Abdul Halim were involved in a conspiracy to manipulate the appointment of judges.

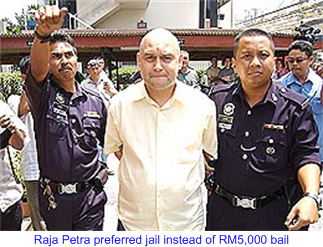

If Raja Petra’s master piece landed him on sedition charges, I don’t see why Mahathir couldn’t be charged the same way. He’s now calling all the UMNO members to quit which is tantamount to inciting hatred against the existing government. If Badawi couldn’t see through this, then either he’s stupid enough and deserved to be kicked out from this throne now or he dares not pick up the gauntlet. Badawi could easily throw Mahathir into ISA if not for the latter’s old age. I guess that was the reason why Mahathir dares to publicly challenge the government to charge him and put him into jail on the Lingam-gate scandal.Mahathir is now diverting the issue of the judge-fixing scandal.

But do we really need to kick out Badawi now? He might be weak but at this moment, I believe Anwar would perfer the weak and indecisive Badawi to warm the chair before all the missing pieces are glued together for him to take over as the new prime minister. Dictatorship under Mahathir was a nightmare that nobody would wants to taste anymore, let alone having this senile old man controls the administration from behind the curtain. And to have another candidate who strangely fancy tossing around military-grade C4 explosives as if those are hamburgers would makes Abdullah Badawi a darling, don’t you think so? The joke on the street is Mahathir quit UMNO because he admires PKR so much that he’s joining the party and in the process ask UMNO members to follow him *grin*.

Other Articles That May Interest You …

Saturday, May 17, 2008

The Reflection of your Values, do you do Charity?

This weekend will be quite a happy one for most of the employees because Monday is a holiday – Wesak Day. There’s a saying which roughly translates to “On Monday staffs work like a worm but on Friday the staffs work like a dragon” – meaning your staffs are most unproductive on Monday and vice-versa on Friday. In the world of stocks investing and option trading, Friday holds a special place in the hearts of investors simply because it is the last trading day of the week. For the simple reason that risks increases along the time, people normally reluctant to hold their shares during weekend hence the extra volatility. Of course long-term investors such as Warren Buffett would disagree. Anyway, I closed one of my profitable positions yesterday – AAPL May 155 Call Option which I opened on 17th Apr 2008. Remember that day, the day which saw Google Inc. jumped after the great earnings announcement, thanks to international revenue that contributed 51% for the first time? Immediately thereafter most of the technology stocks followed Google’s tail and one of them was Apple Inc (Nasdaq:AAPL, stock). In short, the profit was 240 percent within about one-month thus I can’t complain much, can I? The last five trading days saw the stock traded between the resistance of $192 and the support of $184. Above $192 and you know the stock is trying to reach the $200 again but if it dives below $184, get ready with lots of Put Option.

Anyway, I closed one of my profitable positions yesterday – AAPL May 155 Call Option which I opened on 17th Apr 2008. Remember that day, the day which saw Google Inc. jumped after the great earnings announcement, thanks to international revenue that contributed 51% for the first time? Immediately thereafter most of the technology stocks followed Google’s tail and one of them was Apple Inc (Nasdaq:AAPL, stock). In short, the profit was 240 percent within about one-month thus I can’t complain much, can I? The last five trading days saw the stock traded between the resistance of $192 and the support of $184. Above $192 and you know the stock is trying to reach the $200 again but if it dives below $184, get ready with lots of Put Option.

Believe it or not, eight out of 10 of my friends did not realize the importance of “charity”. We can debate until the cows come home but the fact is, not many people are aware of the concept to give freely in terms of charity. Just ask any of your friends and chances are most of them are not “willing” to part away with their little treasure (money) unless they’re rewarded first. It’s puzzling to hear people asking why they should donate when they’ve been working so damn hard for it. Gosh! Can you believe how selfish our societies have become? Charitable donations are a direct reflection of your values and it goes a long way to help those unfortunate ones. Don’t just do it for the sake of your religion alone but expand your horizon to other people as well.

Believe it or not, eight out of 10 of my friends did not realize the importance of “charity”. We can debate until the cows come home but the fact is, not many people are aware of the concept to give freely in terms of charity. Just ask any of your friends and chances are most of them are not “willing” to part away with their little treasure (money) unless they’re rewarded first. It’s puzzling to hear people asking why they should donate when they’ve been working so damn hard for it. Gosh! Can you believe how selfish our societies have become? Charitable donations are a direct reflection of your values and it goes a long way to help those unfortunate ones. Don’t just do it for the sake of your religion alone but expand your horizon to other people as well.

I’ve to admit I didn’t donate much in terms of hard-cash during the 2004 tsunami that saw hundreds of thousands of people died in Indonesia alone. On the other hand, I managed to convince scores of my friends to donate in other way – foods. There’re reasons for doing so. First I do not trust the money will leave the hands of Malaysian authorities to the victims. Second I do not trust the money will leave the hands of Indonesian authorities to the unfortunate victims. Call me whatever you like but past donations had proven how creative certain corrupt officials were in doing magic to the monies donated. It’s not that these creatures cannot do the same with instant-noodles, rice, sugar, mineral water, salt etc but at least these consumable products are less liquidable compared to hard-cash.

Other Articles That May Interest You …

Friday, May 16, 2008

StemLife and TMC Life - Vincent Tan to strike a deal?

Two stocks seemed to be courting each other. Before that these two stocks seemed to emulate kids’ story – Rabbit and Turtle. There’s a small twist though. While the arrogant rabbit decided to take a nap the turtle slowly crawled past the rabbit to the finish line. The rabbit tried to catch up but it was too late. But in this story directed and written by Steven Spielberg, there was an old fox watching both rabbit and turtle with saliva dripping all over the place. The fox knew the saying "slow and steady win the race" and hence he sat there waiting.

So, who is this rabbit, turtle and the fox? The rabbit is StemLife Berhad (KLSE:STEMLFE, stock-code 0137), the turtle is TMC Life Sciences Bhd (KLSE:TMCLIFE, stock-code 0101) and the fox is, you guess it, Berjaya Group tycoon Vincent Tan. I’ve wrote in my previous articles that there’re many options and reasons for this tycoon who was also involved in the infamous Lingam-Gate scandal. What he plans to do with TMC Life is not important. What is important is he is hooked with TMC Life and we shall follow his foot steps, if you haven’t done so. Read on.

Interestingly Dr Colin Lee, TMC’s founder and managing director, has alsoup his stake, although on a much smaller scale to 24.02 percent or 44,485,209 shares. Both Dr Colin Lee and his deputy Dr Wong Pak Seng (Executive Director) are conservative persons who despise speculating or frying their own shares; at least that was my impression when I happened to chat with them not many moons ago. They would go crazy when you tease them that their stock sucks compared to StemLife which skyrocketed during that period of time. Of course if I were to joke about it again this time, most probably they will grin from ear to ear and throw it back at me.

On another note, Vincent Tan has reduced slightly his stake in StemLife from 13.6 percent to 13.5 percent as of Feb 2008 and has been quiet since then. The million-dollar question is what he plans to do with both companies – StemLife the Rabbit and TMC Life the Turtle. While it’s true that StemLife’s business is pretty straight forward and depends on marketing for stem-cell storage, the same cannot be said about TMC. Colin’s company depends heavily on fertility treatment which contributes about 80 percent to the revenue. It’s indeed hard work; Colin hoped TMC could derive 50 percent of revenue from non-fertility services for the financial year 2008 and stem-cell storage was identified as the main service for this purpose.

Other Articles That May Interest You …

Thursday, May 15, 2008

Apple ceased production of 8GB & 16GB, 3G coming soon

This can only happens during sales time at hypermarket such as Carrefour or Giant -limiting customers’ purchases. It appeared Apple Inc (Nasdaq:AAPL, stock) has ceased the production of the popular 8GB and 16GB iPhone models ahead of the earlier speculated new version that supports3G networks. Therefore customers are allowed to purchase only one of the handsets until further notice. AppleInsider got hold of the memo issued by AT&T Inc. dated May 14th 2008 which mentioned the new policy to its internal department.

AT&T further said all requests to purchase more than one of the touch-screen handsets must be approved by a director or general manager, adding that cash and checks will no longer be

On Wednesday, AT&T said it plans to boost the speed of its 3G wireless network to 20 megabits per second in 2009, paving the way for over-the-air downloads that are more than five times faster than what customers can achieve today. The company said engineers already have a version of AT&T's HSPA (High Speed Packet Access) 3G network up and running in the labs at speeds of 7.2 megabits per second. This iPhone gadget is getting more powerful and could be easily the top must-have gadget for consumers.

Wednesday, May 14, 2008

Does Anwar has all the missing pieces to create history?

Ever since the arrogant National Front lost its precious two-third majority in the Parliament, life was never the same again. Life is now full of entertainment. If you’re one of the Formula-1 fans, you should understand what I’m talking about. It was so freaking boring when even a schoolboy could predict with utmost accuracy that Michael Schumacher would emerge champion again - not so long ago. He was Ferrari’s trump-card and champion from 2000-2004 *yawn*. People started to question the wisdom to buy thousands of dollars of ticket just to see the same old face over and over again.

The talks inside any coffee-shops nowadays is definitely the second wave of tsunami – the possibility of Pakatan Rakyat (People’s Alliance) comprises PKR-DAP-PAS but led by Anwar to form the new government. On the surface it’s possible. How hard could it be to fish for another 30 seats to create history? The de-facto leader Anwar already hinted a new episode would be crafted come latest by this September. The multi-billion dollar question is, was he serious about the announcement and even if he was damn serious, could he pull it through successfully without major disruptions?

Losing the throne to become opposition for the first time since independence is definitely not an option for the National Front. It would be too embarrassing to continue living in this country, let alone picking up the pieces and build the coalition again for the next battle. Most likely the National Front would just rot for decades to come if somehow it losses the throne. But if that were to happens, the first thing you should do is to stock up foods, lots and lots of them. Throw away your sofas and furniture to make room for foods. Am I too obsessed and exaggerated? Hell no! You can watch how the Federal government is sabotaging the states under opposition government now.

You can see how the Federal government is using Sedition Act to clamp down on anyone they

Yeah, you have Sabah top guns such as Anifah Aman, Ghapur Salleh and the latest Yong Teck Lee who gave the deadline to Prime Minister to buck-up or else. But these people are opportunist who can’t be trusted. And talk about Pairin Kitingan – once a traitor forever a traitor. If these so-called leaders are people-champion, why hide their tails until now? Oh yeah, forgive me as I have forgotten these people have their "files" kept in Putrajaya. But I guess compared to Federal’s top-guns these Sabahan are angels. So I suppose nobody will blame Anwar if these people were to cross-over.

Really, what is keeping Anwar from a speedy takeover of the Federal government? UMNO is letting its partners to bark now as its own house is in a mess. If and only if UMNO managed to crawl back, you can bet your last dollar that a comprehensive and systematic “pay-back” will be in order. Anwar hinted that he’s holding backbecause the Federal is in “panicky” mode and as a veteran, he knows better than to chase and corner a dog to a dead corner. Desperate people do desperate things thus Anwar do not wish to win the battle but lose the war. Anwar might inherit an empty shell with tons of problems. Investors might pack and leave overmight leaving the stock market crumbles while the "old guards" from previous administration holidaying elsewhere.

Other Articles That May Interest You …

Tuesday, May 13, 2008

HP to pay $13 billion for EDS?