Tuesday, December 05, 2006

FARMBES Ready To Take Off Again?

I watch with great interest the way Farm's Best Bhd (FARMBES : stock-code 9776) and its' daughter stock Warrant (FARMBES-WA : stock-code 9776W) perform right after 4 pm (1 hour left before closing bell) today. While the mother share up almost 12% to close at RM 1.22, the daughter share closed 55% up at RM 0.28.

I watch with great interest the way Farm's Best Bhd (FARMBES : stock-code 9776) and its' daughter stock Warrant (FARMBES-WA : stock-code 9776W) perform right after 4 pm (1 hour left before closing bell) today. While the mother share up almost 12% to close at RM 1.22, the daughter share closed 55% up at RM 0.28.As of my composition at this moment, I couldn't find any concrete news to justify the run-up. This stock which seems to break-away from its' resistance at RM 0.27 (FARMBES-WA) triggered StockTubeand MACD "Buy" signal after today's closing.

The Stochastic just crossed and RSI is gaining momentum with good volume since end of Oct-2006. The ratio today registered356 Bulls : zero Bears from 12 Bulls : zero Bears yesterday, the highest since 22-Sept-2006.

Recently, Aeneas Portfolio Co LP disposed of 1.68 million shares or 3.02% in poultry-based Farm’s Best Bhd on Sept 22 and Sept 25.

On Sept 19, Aeneas, a US hedge fund company run by former SAC Capital Advisors LLC money manager Thomas Grossman, came underinvestigation by US Securities and Exchange Commission and the Securities Commission after bets on Malaysian stocks caused losses of about 60% in its Priam fund.

On Sept 19, Aeneas, a US hedge fund company run by former SAC Capital Advisors LLC money manager Thomas Grossman, came underinvestigation by US Securities and Exchange Commission and the Securities Commission after bets on Malaysian stocks caused losses of about 60% in its Priam fund.

Priam and Aeneas Portfolio amassed stakes of over 10% in the four counters in 4 (four) stocks, including Iris Corporation (IRIS, stock-code : 0010), Farm’s Best (FARMBES : stock-code 9776), MoBif Bhd (stock-code : 0042) and Kosmo Technology (stock-code : 9636)before the shares collapsed after regulators began probing, prompting Deutsche Bank AG to demand repayment of loans that finance the trades.

What could be the reason for this run-up? Could it be a real stock-price catch-up since the KLCI bullish started recently? Could it be another speculative play? Or to think out of the box, it could be a target for another M&A(merger & acquisition) since its' the buzzword lately in the financial market.

Options Trading - Assignment

Some guidelines when you might be more likely to be assigned on a short-option position:

- Only about 17% of options end up being exercised; the percentage hasn't varied much over the years. That does not mean that you can only be assigned on 17% of your short option, however. It means that, in general, option exercises are not that common.

- The majority of option exercises (and the corresponding assignments) take place as the option gets closer to expiration.

- Generally, a put which goes in-the-money is more likely to be exercised than a call which goes in-the-money. Why? Think about the result of an exercise. An investor who exercises a put uses it to sell shares and receive cash. A person exercising a call option uses it to buy shares and must pay cash. People are more likely to exercise options if it means they can receive cash sooner.

Other Articles That May Interest You ...

Options Trading - Exercise

Have Camera Phone Will Travel - Become A Photo-Journalist

The project is among the most ambitious efforts in what has become known as citizen journalism, attempts by bloggers, start-up local news sites and by global news organizations like CNN and the BBC to see if readers can also become reporters.

The project is among the most ambitious efforts in what has become known as citizen journalism, attempts by bloggers, start-up local news sites and by global news organizations like CNN and the BBC to see if readers can also become reporters.“There is an ongoing demand for interesting and iconic images,” said Chris Ahearn, the president of the Reuters media group. He said the agency had always bought newsworthy pictures from individuals and part-time contributors known as stringers.

In fact, many news organizations turned to photographs taken by amateurs to supplement coverage of events like the London subway bombing and the Asian tsunami.

End Of The Year Merger - Momentum Afresh

Latest financial breaking news from AP reported that Bank of New York Co. (NYSE :BK, quote) has agreed to take over Mellon Financial Corp. (NYSE : MEL, quote) in a $16.5 billion all-stock deal that will create the world's largest securities servicing company and one of the biggest asset managers.

Latest financial breaking news from AP reported that Bank of New York Co. (NYSE :BK, quote) has agreed to take over Mellon Financial Corp. (NYSE : MEL, quote) in a $16.5 billion all-stock deal that will create the world's largest securities servicing company and one of the biggest asset managers.The new company, which will be called Bank of New York Mellon Corp., will be the world's leading asset service with $16.6 trillion in assets under custody. Both companies expect it will result in the elimination of about 3,900 jobs, or nearly 10 percent of their combined work force (within 3 years after the deal closes). The companies expect to cut costs by about $700 million a year with the exercise.

The deal received strong support from investors, who sent New York-based Bank of New York shares up $3.51, or nearly 10 percent, to $38.99 in morning trading on the New York Stock Exchange. Shares in Pittsburgh-based Mellon rose $1.98, or nearly 5 percent, to $42.03 on the NYSE.

Thomas A. Renyi, chairman and chief executive of Bank of New York, will serve as executive chairman of Bank of New York Mellon for 18 months following the close of the deal. On the other hand, Robert P. Kelly, currently president, chairman and chief executive of Mellon, will serve as chief executive of the new company and will succeed Renyi as chairman of the board.

So, I guess that the tradition of mega-mergers which normally happen during end of the year is very true and it's happening again and I'm pretty sure this will not be the last announcement for this year, 2006.

Other Articles That May Interest You ...

Monday, December 04, 2006

Why Mega-Mergers Happens End Of The Year?

- Nov-20-2006: Blackstone Group agreed to buy U.S. office building owner Equity Office Properties Trust (NYSE : EOP) in a deal valued at nearly $19 billion.

- Dec-16-2005: Global security software maker Symantec (Nasdaq : SYMC) is to take over Veritas Software in a merger deal valued at $13.5bn (£7bn).

- Dec-15-2004: Sprint and Nextel (NYSE : S)announced plans for a $36 billion merger creating a new major wireless phone power.

The same flu is catching up fast in Asia particularly Malaysia considering the following (confirmed and rumor):

According to Thomson Financial, 8 of the 20 largest deals in the last four years have taken place in November and December. Why is this trend so obvious - coincident or valid reason behind this? The answer - due largely to the fat bonuses for all involved in the deal, especially the bankers.

According to Thomson Financial, 8 of the 20 largest deals in the last four years have taken place in November and December. Why is this trend so obvious - coincident or valid reason behind this? The answer - due largely to the fat bonuses for all involved in the deal, especially the bankers.

But the counter-argument was these investment bankers themselves don’t collect any fees unless and until the deal is completed, typically months later in the next calendar year. Furthermore approval from regulators could take as long as a year to close.

But many bankers still play what some people in the business called “The Double Bonus Game”. As far as Wall Street is concern a banker can receive a little extra bonus money for a deal announced this year, and get paid a little extra again next year when the deal closes. It's a way to say "If you don't pay something this year as recognition, I'll be scouting for a job in January".

Most managing directors salaries are at only about $200,000 per annum, so the bonus which averaged at about $1 - $2 million (though some top bankers can easily expect $ 20 million) would mean a lot to their bank accounts.

It seems Asia is catching up fast with this culture from Wall Street if the pace of mergers announcement are anything to go by. How much do you think Nazir Razak, chief executive officer of CIMB Group will be getting looking at the passion he shown in closing the merger of the World's Largest Listed Oil Palm Company?

It seems Asia is catching up fast with this culture from Wall Street if the pace of mergers announcement are anything to go by. How much do you think Nazir Razak, chief executive officer of CIMB Group will be getting looking at the passion he shown in closing the merger of the World's Largest Listed Oil Palm Company?

Other Articles That May Interest You ...

Sunday, December 03, 2006

World's Largest Plantation Merger Details

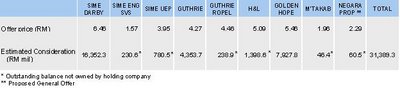

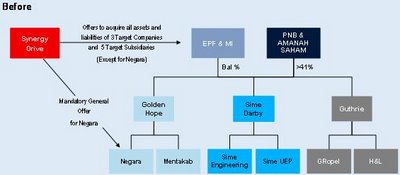

CIMB Investment Bank Berhad (CIMB) officially announced a proposal for the merger of Sime Darby Berhad, Golden Hope Plantations Berhad and Kumpulan Guthrie Berhad to create the world’s largest listed oil palm plantation player valued at RM 31 billion.

CIMB Investment Bank Berhad (CIMB) officially announced a proposal for the merger of Sime Darby Berhad, Golden Hope Plantations Berhad and Kumpulan Guthrie Berhad to create the world’s largest listed oil palm plantation player valued at RM 31 billion.A special purpose vehicle, Synergy Drive Sdn Bhd will acquire all the businesses including assets and liabilities of the nine (9) listed companies. Synergy Drive is held by two trustees for a charitable purpose. Synergy Drive’s

directors are Tan Sri Dato’ Md Nor Yusof (Chairman), Dato’ Zainal Abidin Putih and Wan Razly Abdullah. CIMB will provide initial financing for Synergy Drive.

directors are Tan Sri Dato’ Md Nor Yusof (Chairman), Dato’ Zainal Abidin Putih and Wan Razly Abdullah. CIMB will provide initial financing for Synergy Drive.- Mentakab Rubber Company (Malaya) Berhad (MTAKAB : stock-code 2518)

- Highlands & Lowlands Berhad (H&L : stock-code 2402)

Synergy Drive’s proposed offer price for the nine companies is about five percent premium to the closing price of the last trading day prior to suspension of each counter.

The purchase consideration will be settled by the issue of Redeemable Convertible Preference Shares (RCPS) which shareholders can immediately convert to Synergy Drive’s shares valued at RM5.25 per share or redeem for cash. Upon completion of the merger, Synergy Drive would seek a listing on the Main Board of Bursa Securities whilst all the companies which businesses have been acquired would be de-listed.

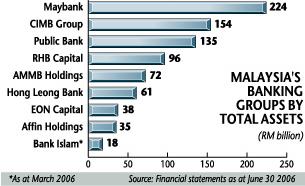

On the assumption that all shareholders accept shares, Synergy Drive’s share capital would be approximately 6 billion ordinary shares of 50 cents each. Based on merger exchange price of RM5.25 per share in market capitalization would be RM31.4 billion making it among Malaysia’s top five listed companies, after Tenaga Nasional (TENAGA : stock-code 5347) currently at RM46.1 billion, Maybank (MAYBANK : stock-code 1155) at RM44.0 billion, MISC (MISC : stock-code 3816) at RM33.9 billion and Telekom Malaysia (TM : stock-code 4863) at RM32.1 billion.

Other Articles That May Interest You ...

Other Articles That May Interest You ...

Telekom Malaysia TM To The Rescue - TimeDotCom

Will TM, previously known as Telekom Malaysia (TM : stock-code 4863) finally acquire Time DotCom Berhad (TIMECOM : stock-code 5031) after talk about it was in the air for some time? The news resurfaced again in a local media.

Will TM, previously known as Telekom Malaysia (TM : stock-code 4863) finally acquire Time DotCom Berhad (TIMECOM : stock-code 5031) after talk about it was in the air for some time? The news resurfaced again in a local media. assistance in the provision of broadband services by Time DotCom which boasts an estimated 5,200 km of fiber-optic cables laid alongside Time's highway projects. Khazanah Nasional Berhad, the state-controlled investment arm owns 35 percent of TM and 45 percent in Time Engineering.

assistance in the provision of broadband services by Time DotCom which boasts an estimated 5,200 km of fiber-optic cables laid alongside Time's highway projects. Khazanah Nasional Berhad, the state-controlled investment arm owns 35 percent of TM and 45 percent in Time Engineering. 3G license despite being one of the fastest and profitable mobile phone company, losing to the loss-making Time DotCom and new unlisted pay-TV operator MiTV Corp. It createdcontroversial as the decision supported rumor that DIGI might lose on the basis that it was foreign-owned, parent being Telenor Asia Pte Ltd and Telenor ASA. It was also seen as a way to force DIGI to pay and leverage on Time DotCom's 3G license but DIGI's CEO Morten Lundal was quick to counter that DIGI has other alternative and not necessary 3G to roll out 3G-equivalent services. Others said it was because the relevant authority needs to protect Maxis (MAXIS : stock-code 5051) and Celcom from further onslaught by DIGI which no doubt is the leader in rolling out innovative services and products and has been consistently eating into both's market share.

3G license despite being one of the fastest and profitable mobile phone company, losing to the loss-making Time DotCom and new unlisted pay-TV operator MiTV Corp. It createdcontroversial as the decision supported rumor that DIGI might lose on the basis that it was foreign-owned, parent being Telenor Asia Pte Ltd and Telenor ASA. It was also seen as a way to force DIGI to pay and leverage on Time DotCom's 3G license but DIGI's CEO Morten Lundal was quick to counter that DIGI has other alternative and not necessary 3G to roll out 3G-equivalent services. Others said it was because the relevant authority needs to protect Maxis (MAXIS : stock-code 5051) and Celcom from further onslaught by DIGI which no doubt is the leader in rolling out innovative services and products and has been consistently eating into both's market share.

Other Articles That May Interest You ...

Friday, December 01, 2006

How To Benefit From A Weaker Dollar

The recent pattern in the currency market can be pretty much summed up this way: another day, another decline in the U.S. dollar. The greenback hasfallen to its lowest levels since March, 2005, when compared to a basket of major currencies.

The recent pattern in the currency market can be pretty much summed up this way: another day, another decline in the U.S. dollar. The greenback hasfallen to its lowest levels since March, 2005, when compared to a basket of major currencies.So, shall we just sit tight and pray for a better time? In fact, there are vast financial instruments out there where investors can hedge against any drop/decline in any situation. The financial market is full of excitement and there're so many ways to make money - just to list some of the popular approaches:

Buy Euro Currency - euro is up almost 10.9% vs. the greenback on the year, which means European exporters are losing their price competitiveness against U.S. The European Central Bank is expected toraise a key interest rate by a quarter of a percentage point next week because of inflation worries. The U.S. has left the Fed Fund rate of 5.25% intake and unlikely to move to raise rates as long as the housing slump is depressing growth. In fact there is speculation the Federal Reserve might cut interest rates next year.

Buy Euro Currency - euro is up almost 10.9% vs. the greenback on the year, which means European exporters are losing their price competitiveness against U.S. The European Central Bank is expected toraise a key interest rate by a quarter of a percentage point next week because of inflation worries. The U.S. has left the Fed Fund rate of 5.25% intake and unlikely to move to raise rates as long as the housing slump is depressing growth. In fact there is speculation the Federal Reserve might cut interest rates next year.

Investing Stocks/Option of companies with business abroad - when the dollar is weak, international sales denominated in foreign currency translate into more revenue in dollars. For example FedEx (NYSE : FDX, quote) generated 37% revenues internationally, beverage giant PepsiCo (NYSE : PEP, quote) and Coke (NYSE : KO, quote), Warren Buffett's favorite drink, which have more than a third of its business in exports.

Investing Stocks/Option of companies with business abroad - when the dollar is weak, international sales denominated in foreign currency translate into more revenue in dollars. For example FedEx (NYSE : FDX, quote) generated 37% revenues internationally, beverage giant PepsiCo (NYSE : PEP, quote) and Coke (NYSE : KO, quote), Warren Buffett's favorite drink, which have more than a third of its business in exports.

Investing Energy-based Stocks/Option (covered in my article yesterday, here) - the justification was that a greenback's decline will take off the interest rates and inflation and a more severe one will trigger panic. Analysts agreed the commodities would do well with heightened inflation. Some of the energy-related stocks are:

Investing Energy-based Stocks/Option (covered in my article yesterday, here) - the justification was that a greenback's decline will take off the interest rates and inflation and a more severe one will trigger panic. Analysts agreed the commodities would do well with heightened inflation. Some of the energy-related stocks are:

Investing Metals-based Stocks/Option - metals such as copper, zinc, silver and gold are the normal ways to hedge against currency risk by investors which might see rises in the prices (Gold price closed up $11.10 to $652.90 per oz as of yesterday, 30-Nov-2006). Some of the metal stocks with good ratings includes:

Investing Metals-based Stocks/Option - metals such as copper, zinc, silver and gold are the normal ways to hedge against currency risk by investors which might see rises in the prices (Gold price closed up $11.10 to $652.90 per oz as of yesterday, 30-Nov-2006). Some of the metal stocks with good ratings includes:

So, the choices are yours on which platform serve you better in making money - be it stocks,option trading, bonds, currency trading and others.

Other Articles That May Interest You ...

Thursday, November 30, 2006

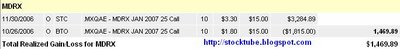

Take Profit On MDRX

So the punishment was a couple of days of constipation before I decided to ring the register today, finally.

So the punishment was a couple of days of constipation before I decided to ring the register today, finally.

Time To Relook At Oil Stocks

Oil climbed to a two-month high near $63 today - Thursday, building on the previous session's gains after an unexpected drop in U.S. winter fuel stocks and signs of solid economic growth in the world's top consumer. U.S. crude was up 15 cents at $62.61 a barrel after hit $62.68, itshighest since Oct. 2.

Oil climbed to a two-month high near $63 today - Thursday, building on the previous session's gains after an unexpected drop in U.S. winter fuel stocks and signs of solid economic growth in the world's top consumer. U.S. crude was up 15 cents at $62.61 a barrel after hit $62.68, itshighest since Oct. 2.Energy Information Administration (EIA) on Wednesday said the U.S. inventories of crude oil and refined products fell last week as imports eased and demand was robust.

AccuWeather said colder temperatures would hit the Northeast, the world's biggest heating oil market, by the end of the week.

AccuWeather said colder temperatures would hit the Northeast, the world's biggest heating oil market, by the end of the week.Cold air drilling southward will produce an icy mix of precipitation all the way to central Texas, which is sure to create treacherous travel conditions.

The thunderstorms will produce damaging straight line winds, hail and even a few twisters. This will be a significant early season storm, and the situation should not be taken lightly.

The thunderstorms will produce damaging straight line winds, hail and even a few twisters. This will be a significant early season storm, and the situation should not be taken lightly.The demand for heating gas is normally high during the winter period couple with the potential of damage and logistics of oil for transportation.

- Transocean Inc. (NYSE : RIG, quote) - primary business is to contract these drilling rigs, related equipment and work crews primarily on a day-rate basis to drill oil and gas wells - specializes in sectors of the offshore drilling business with a focus on deepwater and harsh environment drilling services.

- Valero Energy Corporation (NYSE : VLO, quote) - owns and operates 18 refineries located in the United States, Canada and Aruba that produce refined products, such as reformulated gasoline (RFG), gasoline meeting the specifications of the California Air Resources Board (CARB), CARB diesel fuel, low-sulfur diesel fuel and oxygenates (liquid hydrocarbon compounds containing oxygen).

Wednesday, November 29, 2006

FRK - Billion Dollars Cement Leader

Nov-2006 AMC. FRK is engaged in three business segments: construction aggregates, concrete products and cement and calcium products. The Company also has an investment in a crushed stone plant in Charlotte County, New Brunswick, Canada and a distribution yard in New York City, New York.

Nov-2006 AMC. FRK is engaged in three business segments: construction aggregates, concrete products and cement and calcium products. The Company also has an investment in a crushed stone plant in Charlotte County, New Brunswick, Canada and a distribution yard in New York City, New York.FRK depends very much on housing industry as it supplies most of its cement for the construction. Housing sector has been on downtrend since and some of the small players were beaten badly. However based on the yardstick of the stocks from the same sector such as Eagle Materials, Inc. (NYSE : EXP) which beats earning recently, FRK might just follow the path.

FRK missed its' earning for the last quarter, the first one in many quarters. Should FRK beat the earning this quarter with good earning's data, this stock should gap-up nicely. The downsides are quite limited considering it has consolidated to the lowest of $36 before recover to current level of $43. Furthermore it was reported that home sales rise for the first time in eight months, though partly because of falling prices.

FRK missed its' earning for the last quarter, the first one in many quarters. Should FRK beat the earning this quarter with good earning's data, this stock should gap-up nicely. The downsides are quite limited considering it has consolidated to the lowest of $36 before recover to current level of $43. Furthermore it was reported that home sales rise for the first time in eight months, though partly because of falling prices.

Some of the Indicators for FRK :

- wall street consensus : 0.75

- stockscouter rating : 9 /10

- whisper number for this stock : NA

- smart-estimate for this stock : 0.75

- schaeffer rating for this stock : 5 / 10

- power rating : 5 /10

- insider trading (last 52 weeks) : NA

- option : Mar 2007 40 Call

- IV for Jan 2007 $40 Strike : 39.81%

In order to play this stock, we need time-value to be on our side. I would be more comfortable withMar 2007 40 Call option. Let's wait and see after the bell today if this stock can help me make money.

NSTP And UTUSAN - Another Merger Again?

said merger, which will create the country’s largest media group. Similar to the palm oil producers plan, this merger will see the de-listing of both NSTP and Utusan and shareholders will be offered new shares in a new entity ( Synergy Drive Two? ).

said merger, which will create the country’s largest media group. Similar to the palm oil producers plan, this merger will see the de-listing of both NSTP and Utusan and shareholders will be offered new shares in a new entity ( Synergy Drive Two? ).Tuesday, November 28, 2006

Berkshire Buffett Is UnStoppable

Warren's baby, Berkshire Hathaway (BRK.A) hit the $ 100,000 per-share mark days ago - the highest share price ever recorded. The A-Shares are up more than 5,500 times since 1965 when Warren Buffett bought over the textile company.

How does this stock managed to achieve this remarkable feat? By not splittingthe shares of course. Does this scenario ring a bell to you on another technology stock which is the forte of search engine? Yes, that stock is Google (Nasdaq : GOOG) which hit the $ 500 per-share figure days ago. So, by now you know why Google doesn't have any intention in splitting the share.

How does this stock managed to achieve this remarkable feat? By not splittingthe shares of course. Does this scenario ring a bell to you on another technology stock which is the forte of search engine? Yes, that stock is Google (Nasdaq : GOOG) which hit the $ 500 per-share figure days ago. So, by now you know why Google doesn't have any intention in splitting the share. While most stocks declare 2-for-1 or 3-for-1 splits whenever the boards think the share is getting unaffordable for investors, Warren doesn't believe in stock splits (equivalent to bonus-issue in Malaysia Bursa Stocks Exchange - KLSE) simply because expensive stock discourages buying by short-term traders. Berkshire Hathaway New known as the B-Shares (BRK.B) is the alternative to A-Shares but with about 1/30 of the A-Share price (without voting rights though).

While most stocks declare 2-for-1 or 3-for-1 splits whenever the boards think the share is getting unaffordable for investors, Warren doesn't believe in stock splits (equivalent to bonus-issue in Malaysia Bursa Stocks Exchange - KLSE) simply because expensive stock discourages buying by short-term traders. Berkshire Hathaway New known as the B-Shares (BRK.B) is the alternative to A-Shares but with about 1/30 of the A-Share price (without voting rights though).- earnings from insurance

- earnings from investing the huge amount of insurance's cash profit

- earnings from non-insurance arm

Warren's Berkshire Hathaway's lifeblood of earnings can be seen in the insurance sector. For example:

- in 2004 the pre-tax profit was $ 387 million.

- in 2005 when the Katrina made the headline, the insurance business turned 360 degrees to record a loss of $ 897 million.

- in 2006, the earlier loss made the same 360 degrees change for a $ 2.5 billion profit

That's the risk or excitement in insurance business, either you'll make it big or sunk big time. Nevertheless it's a known fact that the biggest problem with Berkshire which kept Warren's head spinning is the huge war-chest it has. Though with numerous multi-billion acquisition, Berkshire still has $ 42 billion in cash and cash-equivalents for its' shopping spree. It's simply too difficult to find more good companies to buy and apply the same growth rate on the billion notes.

That's the risk or excitement in insurance business, either you'll make it big or sunk big time. Nevertheless it's a known fact that the biggest problem with Berkshire which kept Warren's head spinning is the huge war-chest it has. Though with numerous multi-billion acquisition, Berkshire still has $ 42 billion in cash and cash-equivalents for its' shopping spree. It's simply too difficult to find more good companies to buy and apply the same growth rate on the billion notes.

Other Articles That May Interest You ...

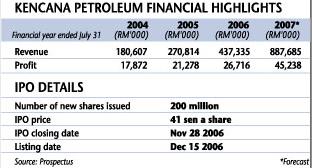

Kencana Petroleum - A Cheap IPO Worth Investing

Kencana Petroleum Bhd ( KENCANA : main-board ), which provides integrated engineering and fabrication services to the oil and gas industry, is aiming to raise 82 million rgt via an initial public offering (IPO) at an offer price of RM 0.41 per share, according to the company's prospectus.

Kencana Petroleum Bhd ( KENCANA : main-board ), which provides integrated engineering and fabrication services to the oil and gas industry, is aiming to raise 82 million rgt via an initial public offering (IPO) at an offer price of RM 0.41 per share, according to the company's prospectus. Group chairman Mokhzani Mahathir, a son of former prime minister Mahathir Mohamad, controls a 69.28-percent stake in Kencana Petroleum, via privately-owned Khasera Baru. Mokhzani said the company currently has projects worth about RM 1 billion on hand, which will last until early 2008.

Group chairman Mokhzani Mahathir, a son of former prime minister Mahathir Mohamad, controls a 69.28-percent stake in Kencana Petroleum, via privately-owned Khasera Baru. Mokhzani said the company currently has projects worth about RM 1 billion on hand, which will last until early 2008.Besides partnering with Thailand-based Cuel Ltd, Kencana also works with Petronas Carigali Sdn Bhd, Murphy Sarawak Oil Co Ltd, Sarawak Shell Bhd, ExxonMobil Exploration and Production Malaysia Inc, and Talisman Malaysia Ltd.

For the financial year ended 31 July 2006 :

For the financial year ended 31 July 2006 :- total revenue : RM 473.3 million

- net profit : RM 26.72 million (forecast RM 45.2 million for year ended 31 July 2007)

- ratio of Local vs Overseas revenue : 45.4 % vs 54.5 %

The offer price values the stock at 7.98 times its forecast earnings of 5.14 cents per share.

Some of the Risks Analysis:

- fluctuations in market price of hydrocarbon, iron & steel and aluminum will affect the demand

- oil producers (OPEC) may lower forecast of hydrocarbon prices

- any global economy slowdown may affect demand for hydrocarbons - will affect demand for supporting products and services

- fluctuation in foreign exchange rates will have direct impact on price of imported raw materials such as steel and stainless steel (stringent specification requires raw materials from particular sources - not locally, be used only).

Based on turnover, Kencana Petroleum Group is ranked fourth among operators within Metal Structure Fabrication Industry in Malaysia.

Earlier this year, Kencana Petroleum clinched its biggest contract worth RM790mil from the Thailand-Malaysia Joint Development Authority to build an offshore oil rig facility some 150km from Kota Baru.

Listing Schedule :

- Prospectus Date : 21-Nov-2006

- Closing of Applications : 28-Nov-2006 (today)

- Balloting Date : 30-Nov-2006

- Listing Date : 15-Dec-2006

With its' low price-earning-ratio of 7.98 which is lower than industry P/E, StockTube would think this is another investing opportunity (StockTube in fact almost forgotten about this IPO and rushed to apply it yesterday afternoon) as there's upside potential to the IPO price of RM 0.41.

Cue From Wall Street - KLCI Should Correct Itself

Based on the U.S. stock market closing yesterday, Bursa Malaysia (KLSE) Composite Index should start the long-overdue correction today. The index has risen more than 3 percent over the past week. On Wall Street, the blue-chip Dow Jones Industrial Average fell 1.29 percent while the tech-heavy Nasdaq Composite Index slid 2.21 percent, registering their biggest losses (since the blue-chip index fell 166 points on July 13) after a disappointing sales estimate from Wal-Mart Stores Inc. (NYSE : WMT).

Based on the U.S. stock market closing yesterday, Bursa Malaysia (KLSE) Composite Index should start the long-overdue correction today. The index has risen more than 3 percent over the past week. On Wall Street, the blue-chip Dow Jones Industrial Average fell 1.29 percent while the tech-heavy Nasdaq Composite Index slid 2.21 percent, registering their biggest losses (since the blue-chip index fell 166 points on July 13) after a disappointing sales estimate from Wal-Mart Stores Inc. (NYSE : WMT). What make this correction more imminent is the across the board drop in Russell, Dow Transportation and Dow Utilities which shed more than 1%. The bullish trends of Dow Jones Industrials, Standard & Poor's 500 Index , Nasdaq Composite Index , FTSE started toreverse.

What make this correction more imminent is the across the board drop in Russell, Dow Transportation and Dow Utilities which shed more than 1%. The bullish trends of Dow Jones Industrials, Standard & Poor's 500 Index , Nasdaq Composite Index , FTSE started toreverse.Factors affecting the sell-off were :

Wal-Mart Stores (NYSE : WMT) - The retail giant, a Dow component, said November same-store sales will decline for the first time in a decade, and the stock fell 2.7% on the day. While retail analysts insisted Wal-Mart has a unique set of problems, retail stocks generally were lower.

Wal-Mart Stores (NYSE : WMT) - The retail giant, a Dow component, said November same-store sales will decline for the first time in a decade, and the stock fell 2.7% on the day. While retail analysts insisted Wal-Mart has a unique set of problems, retail stocks generally were lower.

The dollar's decline - The dollar hit a 20-month low against the euro on Friday and was still falling today. A number of traders said that European investors were starting to sell U.S. stocks to protect the big gains they'd seen since the market bottomed in July, CNBC's Bob Pisani said. The dollar is down about 10% against the pound and euro and 1.5% against the yen in 2006. The decline hit stocks like Boeing (NYSE : BA), down 2.7%; and IBM (Nasdaq : IBM), down 2%.

The dollar's decline - The dollar hit a 20-month low against the euro on Friday and was still falling today. A number of traders said that European investors were starting to sell U.S. stocks to protect the big gains they'd seen since the market bottomed in July, CNBC's Bob Pisani said. The dollar is down about 10% against the pound and euro and 1.5% against the yen in 2006. The decline hit stocks like Boeing (NYSE : BA), down 2.7%; and IBM (Nasdaq : IBM), down 2%.

- Tech weakness - Techs stocks were broadly lower, in part because of heavy profit-taking. The Philadelphia Semiconductor Index ($SOX.X) was down 2.4% with 17 of 19 stocks lower on the day. It had been up 7.6% for the fourth quarter quarter after Friday trading; that gain has been trimmed to 5.3%. Also, a Barron's suggested Google (Nasdaq :GOOG) was overvalued at more than $500. The stock was down 4% to just under $485 today, and it affected Amazon.com (Nasdaq : AMZN), down nearly 3.7%; eBay (Nasdaq :EBAY), down more than 3.7%; and Yahoo! (Nasdaq : YHOO), down 2.7%.

Oil prices - Crude oil was at $60.32 a barrel in New York, up $1.08 from Wednesday's close. Crude moved higher because of the possibility of colder weather in the country, an attack on Iraqi oil facilities and hints of another production cutback by members of the Organization of Petroleum Exporting Countries. The oil price increase was good for energy stocks; their losses were smaller than the market as a whole. Airline stocks were creamed with the Amex Airline Index ($XAL.X) falling 4.6%. Continental Airlines (NYSE : CAL) was down 7.3%; American Airlines parent AMR (NYSE :AMR) was down 5.9%. Like chips, airlines were also ripe for profit-taking.

Oil prices - Crude oil was at $60.32 a barrel in New York, up $1.08 from Wednesday's close. Crude moved higher because of the possibility of colder weather in the country, an attack on Iraqi oil facilities and hints of another production cutback by members of the Organization of Petroleum Exporting Countries. The oil price increase was good for energy stocks; their losses were smaller than the market as a whole. Airline stocks were creamed with the Amex Airline Index ($XAL.X) falling 4.6%. Continental Airlines (NYSE : CAL) was down 7.3%; American Airlines parent AMR (NYSE :AMR) was down 5.9%. Like chips, airlines were also ripe for profit-taking.

Reuters financial news reported Asian stocks fell on Tuesday as investors dumped exporters such as Canon Inc. on worries about the key holiday shopping season in the United States, Asia's top export market, and following a sharp fall on Wall Street. By 0019 GMT, Tokyo's Nikkei average had lost 1.29 percent, wiping out Monday's 0.96 percent rise, as chip-tester maker Advantest Corp. fell 1.85 percent, Canon dropped 2.17 percent and electronics components maker Kyocera slid 1.66 percent.

In South Korea, declines of 1.25 percent for Samsung Electronics and 1.84 percent for memory chip maker Hynix Semiconductor pulled the key KOSPI down 1.19 percent to levels seen nearly a week ago.

"Everything seems to indicate we'll see a correction today, especially since our markets have had good gains this month," said Choo Hee-yeop, deputy general manager of asset management strategy at Korea Investment and Securities.

Other Articles That May Interest You ...

Monday, November 27, 2006

Amazon Game-Over

This quarter has been particularly good for Amazon (Nasdaq : AMZN) when it reported net income of $19 million or 5 cents a share, beating estimates by 2 cents, on sales of $2.31 billion.

However analysts are shying away from Amazon reasoning it hasn’t proven that it can grow profitably, operating margins slipped to 1.7%, from 2.2% last quarter and 3.0% in the year-ago period. Worst still gross margins also slipped 1.1% year-over-year to 23.8%.

There're some issues which need to be tackled if this stock needs to shine again. To begin with, Amazon’s free shipping program is very costly and continues to pressure margins. Amazon’s entry into the low margin grocery business certainly won’t help matters. Added expense of promoting new business areas (recently auto parts business) is another bottleneck to its profit.

There're some issues which need to be tackled if this stock needs to shine again. To begin with, Amazon’s free shipping program is very costly and continues to pressure margins. Amazon’s entry into the low margin grocery business certainly won’t help matters. Added expense of promoting new business areas (recently auto parts business) is another bottleneck to its profit.Amazon moved too quickly in unveiling its video downloading service dubbed Unbox. Negative reviews and numerous glitches only invites Apple (Nasdaq : AAPL) to smilingly taking it to Amazon.

Trading at 48 times estimated 2007 earnings of 70 cents per share makes Amazon not attractive at all. As comparison, Google (Nasdaq : GOOG) trades at a modest 35 times year-ahead projections only.

Trading at 48 times estimated 2007 earnings of 70 cents per share makes Amazon not attractive at all. As comparison, Google (Nasdaq : GOOG) trades at a modest 35 times year-ahead projections only.Kuwait Finance House Buying RHB?

Kuwait Finance House ( KFH ) has expressed interest in buying a stake in Malaysian financial house Rashid Hussain Bhd (RHB : stock-code 1309) which controls Malaysia's fourth-largest banking group, RHB Capital (RHBCAP : stock-code 1066).

Kuwait Finance House ( KFH ) has expressed interest in buying a stake in Malaysian financial house Rashid Hussain Bhd (RHB : stock-code 1309) which controls Malaysia's fourth-largest banking group, RHB Capital (RHBCAP : stock-code 1066).According to Edge, RHB's other major shareholders include state pension manager, the Employees Provident Fund (EPF), which has a stake of 31.7 %, and another pension fund, Kumpulan Wang Amanah Pencen (with a 10.8 % interest).

Utama has earlier rejected an unspecified offer from the EPF for its 32.9 percent stake in RHB as it could not agree on the price. However EPF was expected to raise its bid for RHB.

Saturday, November 25, 2006

Google To Conquer Brick Media After CyberSpace?

I think Google (Nasdaq : GOOG) is lucky, very lucky indeed to be born after Internet Version 1. After the burst of Internet first generation, only a handful can claim victory to be able to surf passed the giant tsunami. The rest of the dotcom startups are either folded or still licking their wounds, till today. Employees who became instant multi-millionaires due to stock options are either happily counting their cash or still hanging to their normal office hour job - simply because they didn't exercise their options.

I think Google (Nasdaq : GOOG) is lucky, very lucky indeed to be born after Internet Version 1. After the burst of Internet first generation, only a handful can claim victory to be able to surf passed the giant tsunami. The rest of the dotcom startups are either folded or still licking their wounds, till today. Employees who became instant multi-millionaires due to stock options are either happily counting their cash or still hanging to their normal office hour job - simply because they didn't exercise their options. While Google is getting "Bigger" and richer with market capitalization of a whopping $ 155 billion, it is learning from mistakes committed by earlier Internet first generation companies such as Yahoo (Nasdaq : YHOO).Paper wealth will evaporates if not turned into hard-cash or used to purchase brick and mortar business which will never "fold their tents" and disappear overnight (such as virtual store).

While Google is getting "Bigger" and richer with market capitalization of a whopping $ 155 billion, it is learning from mistakes committed by earlier Internet first generation companies such as Yahoo (Nasdaq : YHOO).Paper wealth will evaporates if not turned into hard-cash or used to purchase brick and mortar business which will never "fold their tents" and disappear overnight (such as virtual store).Yahoo used to be the proud owner of $ 150 billion in paper wealth during the peak time of dotcom boom. It could be naive (can't blame them as the wealth came just too fast and easy) for the founders to think the wealth is permanent. As fast as it came, it disappears with the same speed with current wealth worth only at about $ 40 billion.

Hence any serious investors can tell how all the C-level officers from Google including Larry Page, Sergery Brin and Eric Schmidt have been consistently selling their shares to realize their profit.

As much as online advertising is generating the bulk of the main profit for Google, the latest move by Google in putting its' feet into brick & mortarmedia should give hints of where it will spend it's huge war-chest in the next acquisition (YouTube being the latest purchase).

As much as online advertising is generating the bulk of the main profit for Google, the latest move by Google in putting its' feet into brick & mortarmedia should give hints of where it will spend it's huge war-chest in the next acquisition (YouTube being the latest purchase).Google has started selling advertising space in 50 top newspapers, making it easier for companies advertising online to also show off their products in print. A group of more than 100 Google advertisers will be placing bids for space in newspapers owned by The New York Times Company (NYSE : NYT), Gannett (NYSE : GCI), the Tribune Company (NYSE :TRB), the Washington Post Company and Hearst during a three-month test period.

Executives downplayed any risks of letting Google handle their relationships with advertisers, instead welcome it as a way to increase their struggling sales.

While its' team is experimenting with the media advertising, are the top management quietly drafting the plan to buy over any of these media companies? According to BusinessWeek, New York Times only worth less than $ 4 billion while Times management is having problem with its' shareholder to buck-up or else - the asking price for a new buyer could be worth less than $ 7 billion. The treasure of Times however is the invaluable 155 years of content archives.

It looks like Google has the same characteristic of Warren Buffett in the sense that both have too much wealth and need to do some spending. The only difference is - Warren is cracking his head in finding good and potential companies to buy but Google has too many choices to choose from.

Friday, November 24, 2006

Who's Behind Synergy Drive ?

But what everyone is waiting for is to know who the real "BOSS" who's behind this merger. Definitely can't be the top executive of any of the three companies itself as they are just the persons entrusted to run the daily operation. So the next couple of days when the new formed "Synergy Drive" Sdn Bhd makes official announcement will be the the day everyone knows who's the man pulling the strings.

It was reported investment bank CIMB Bhd has sent letters to the three companies about a "change in business direction".

The Malaysian government (UMNO being the major party) which owns stakes in all three companies through state-run asset manager Permodalan Nasional Bhd (a.k.a PNB) is creating the world's biggest oil palm company. The three companies didn't identify Synergy Drive, or elaborate about the expected proposal. It seems CIMB Chief Executive Officer Nazir Razak is the man who met the heads of the three companies.

Malaysia Deputy Prime Minister Najib Razak, a trustee at Permodalan Nasional and brother of CIMB Chief Executive Nazir, said he supports a merger.

Synergy Drive was registered on Nov. 7, according to a filing at the Companies Commission of Malaysia, which named Rossaya Mohd Nashir and Wan Razly Abdullah Wan Ali as directors. Rossaya is an assistant general manager at CIMB Investment Bank and Wan Razly is adirector of investment banking at CIMB, according to source from Bloomberg.

Hence it looks obvious there're political influences in this merger. Question remains if the merger will indeed synergize the new entity or will it create more unforeseen issues such as management and operation integration. Will there be any assets disposal due to duplication and over-lapping of the combined three ginat companies ? The puzzle will be answered in the next couple of days, so stay tune.

Other Articles That May Interest You ...

Know The Difference - Warrants & Call-Warrants

Warrants give the holders the right, but not an obligation, to subscribe for new ordinary stock shares at a specified price during a specified period of time. The warrants are issued by the company. Warrants have a maturity date (up to 10 years) after which they expire worthless unless the holder had exercised to subscribe for the new shares before the maturity date. Warrants used to have expire date of 5 (five) years but after the 1997 Asia Economic Crisis, most of these out-of-money warrants were granted extension of a longer expiry-date.

Warrants give the holders the right, but not an obligation, to subscribe for new ordinary stock shares at a specified price during a specified period of time. The warrants are issued by the company. Warrants have a maturity date (up to 10 years) after which they expire worthless unless the holder had exercised to subscribe for the new shares before the maturity date. Warrants used to have expire date of 5 (five) years but after the 1997 Asia Economic Crisis, most of these out-of-money warrants were granted extension of a longer expiry-date.Call Warrants also give a right, but not an obligation, to buy a fixed number of stock shares at a specified price within a limited period of time. But unlike warrants, call warrants are issued by third parties based on existing stock shares. Therefore, they do not increase the issued capital or dilute the earnings of the company as a warrant do. Call warrants have maturity dates of not more than two (2) years.

Thursday, November 23, 2006

After The Super-Merger Will Others Follow ?

Three of Malaysia's largest palm oil producers - Kumpulan Guthrie Berhad(GUTHRIE : stock-code 3131), Sime Darby Berhad (SIME : stock-code 4197) andGolden Hope Plantations Berhad (GHOPE : stock-code 1953) are to merge, potentially create the world's biggest bio-fuels company and its largest publicly-traded palm oil entity.

Three of Malaysia's largest palm oil producers - Kumpulan Guthrie Berhad(GUTHRIE : stock-code 3131), Sime Darby Berhad (SIME : stock-code 4197) andGolden Hope Plantations Berhad (GHOPE : stock-code 1953) are to merge, potentially create the world's biggest bio-fuels company and its largest publicly-traded palm oil entity. The merger is expected to go through smooth as all three of them are under the government fund manager Permodalan Nasional Berhad (PNB)umbrella.

The merger is expected to go through smooth as all three of them are under the government fund manager Permodalan Nasional Berhad (PNB)umbrella.- IOI Corporation Berhad - RM 23.0 billion

- Kuala Lumpur Kepong Berhad - RM 9.8 billion

- PPB Oil Palms Berhad - RM 4.2 billion

- Batu Kawan Berhad - RM 3.2 billion

- Asiatic Development Berhad - RM 3.0 billion

- United Plantations Berhad - RM 1.8 billion

- Kulim (M) Berhad - RM 1.47 billion

- Tradewinds Plantation Berhad - RM 1.0 billion

- Kwantas Corporation Berhad - RM 636 million

- United Malacca Berhad - RM 621 million

- Far East Holdings Berhad - RM 542 million

- Sarawak Oil Palms Berhad - RM 370 million

- Tanah Emas Corporation Berhad - RM 137 million

So, can anyone guess which of the above plantation companies have the potential of another round of merger ? There might be money to be made if your guess is right by investing in that stock. I think the potentials are probably on the smallest companies being acquired unless the history of "small fish" eating up "bigger fish" repeats again. What do you think ?

Wednesday, November 22, 2006

2007 Daily Volume 1.2B - Is This Guy Serious ?

I read with great interest the comment by Bursa Malaysia CEO, Yusli today who expect the average daily trading volume for 2007 to hit 1.2 billion units - about 50% more than the current figure.

I read with great interest the comment by Bursa Malaysia CEO, Yusli today who expect the average daily trading volume for 2007 to hit 1.2 billion units - about 50% more than the current figure. Without foreign investors, the only players are retail against the market-maker. Maybe his intention is to instil confidence within retail players - which is good in a way. But after so many false starts, will the small retail investors be caught pants-down again ? Or could this be another trick from the ruling party to accumulate some monies for the comingGeneral Election (come on, every Tom, Dick & Harry know about this strategy which was being used every-time pre-election).

Without foreign investors, the only players are retail against the market-maker. Maybe his intention is to instil confidence within retail players - which is good in a way. But after so many false starts, will the small retail investors be caught pants-down again ? Or could this be another trick from the ruling party to accumulate some monies for the comingGeneral Election (come on, every Tom, Dick & Harry know about this strategy which was being used every-time pre-election).Investing The Right Stocks Or Options - Sales Growth

- increased in number of new customers

- increased in purchase volume from existing customers

- expansion into new markets territory

- introduction of new products

- improvement to existing products

- special limited promotions via bundling programs

Top-performing companies normally show consistent double or triple-digit sales growth, in fact such companies perform so well that the expectation from investors are so high that if they miss a single quarter earning estimate, their stock price might subject to severe punishment.

However pay attention to companies which have great sales growth but :

- depends heavily on certain number of customers only

- depends heavily on overseas market (bad economies & political factor)

- high exposure in foreign-exchange rates (1997 Asian crisis is a good example)

- recorded sales which have not actually taken place

Example of companies with good sales growth :

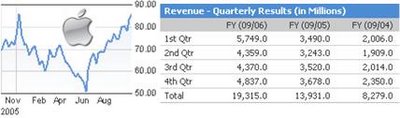

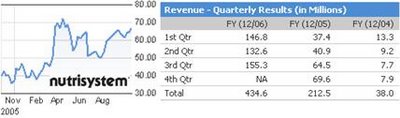

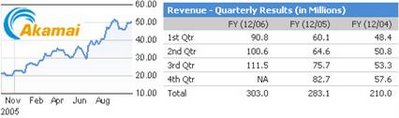

- Apple (Nasdaq : AAPL)

- Nutrisystem Inc. (Nasdaq : NTRI)

- Akamai Technologies (Nasdaq : AKAM)

- Google (Nasdaq : GOOG)

Other Articles That May Interest You ...

Stocks & Options Depend On Moon

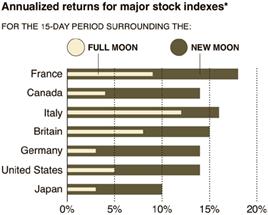

The studies, "Lunar Cycle Effects in Stock Returns” and "Are Investors Moonstruck?Lunar Phases and Stock Returns”, done by Ilia D. Dichev, Troy D. Janes and Lu Zheng agreed that during the 15 days of the lunar month closest to the new moon - starting seven days before it and ending seven days after — the stock market’s average

returns are much higher(as much as 10 percent a year) than those of the other half of the month.

returns are much higher(as much as 10 percent a year) than those of the other half of the month. Meanwhile, both my favorites, Google(Nasdaq : GOOG) and Apple (Nasdaq :AAPL) shares surge to new all-time high after the bell Tuesday. While Google closing price passed the $500 mark at $509.65 (up $14.60 or 2.95%), Apple's stock price closed at $88.60 (up $2.13 or 2.46%). But hey, wasn't full-moon yet, so shall I start accumulating and wait for the full-moon knowing it'll peak then (Google to $600 and Apple to $100) ?

Meanwhile, both my favorites, Google(Nasdaq : GOOG) and Apple (Nasdaq :AAPL) shares surge to new all-time high after the bell Tuesday. While Google closing price passed the $500 mark at $509.65 (up $14.60 or 2.95%), Apple's stock price closed at $88.60 (up $2.13 or 2.46%). But hey, wasn't full-moon yet, so shall I start accumulating and wait for the full-moon knowing it'll peak then (Google to $600 and Apple to $100) ?

Bursa Malaysia (KLSE) To Ease Further ?

"The market is going to be soft. Any rise will be marginal," said Wong Chee Seng, head of research at Alliance Research. He further pegged support for the main index at1,033-1,032 and resistance at 1,045.

"The market is going to be soft. Any rise will be marginal," said Wong Chee Seng, head of research at Alliance Research. He further pegged support for the main index at1,033-1,032 and resistance at 1,045.Another research chief said investors were likely to focus on plantation stocks and shares of firms due to report quarterly earnings this month. Planters such as IOI Corp and PPB Oil Palms climbed two and five percent respectively on Tuesday. Tentatively Genting, MISC, PLUS and MAS will report their respective earning this month.

StockTube think the above statement is about right taking into consideration Bursa Malaysia (KLSE) Composite Index has been on steep uptrend within a short span of time - any consolidation is healthy for the overall market. Malaysian shares could ease on Wednesday, weighed down by further profit-taking and a spike in crude oil prices.

Oil prices jumped more than 2 percent to $60 a barrel on Tuesday after bad weather disrupted loadings at Alaska's main export terminal and analysts forecast a drawdown in U.S. fuel stocks ahead of winter. Furthermore today, Wednesday is the day where U.S will release its' data on oil consumption. Any shortage in inventories will further escalate oil price.

U.S. stocks ended Tuesday slightly higher, as fresh record highs in shares of aircraft makerBoeing Co. (NYSE : BA) and Web search leader Google Inc. (Nasdaq : GOOG) outweighed rising oil prices.

Tuesday, November 21, 2006

The Internet Giant Is Too Big & Bloated

Yahoo Senior Vice President Brad Garlinghouse commented the lack of focus and decisiveness at the company and a lack of accountability for executives. He further called for headcount reductions of 15% to 20% to the company's 10,000-strong staff, divestiture of underperforming units and cancellations of redundant products.

Meanwhile at Google (Nasdaq : GOOG), Chris Sacca, who joined Google in 2003 and the head of special initiatives expressed his greatest fear is that Google could become a big company (not just in terms of headcount). He fears Google's increased bureaucracy and unnecessary layers of management might backfire sooner or later. He proclaimed "These are the enemies of innovation".

He has seen a few mid-level bosses evoke the traditions of Japanese management and schedule “pre-meetings” to plan, discuss, and approve what will be planned, discussed and approved at the actual meeting itself.

But Google’s culture of letting engineers and product specialists' freedom in building great & cool stuff that user's want might be the differentiator between Google and Yahoo. Yahoo has over 9,800 staffs while Google has over 5,600 staffs.

From iPhone To iChat Mobile

Latest investing news from a Wall Street analyst indicated Apple Computer (Nasdaq :AAPL), which recently released its first mobile handset to manufacturing, is working on a second model that will incorporate messaging capabilities (here to read about the new Apple iPhone).

Latest investing news from a Wall Street analyst indicated Apple Computer (Nasdaq :AAPL), which recently released its first mobile handset to manufacturing, is working on a second model that will incorporate messaging capabilities (here to read about the new Apple iPhone).American Technology Research analyst said Apple will leverage on existing Mac's iChat software to focus on mobile IM instead of e-mail.

Though Apple is mum on "When" the iPhone will be on the street, analysts are very optimistic the company's first cell phone will be released in 2007.

Though Apple is mum on "When" the iPhone will be on the street, analysts are very optimistic the company's first cell phone will be released in 2007. Back in early November-2006, Apple has quietly introduced a 8GB version of its iPod nano (PRODUCT) RED digital music player retailed at $ 249 (features 24 hours of battery life). These iPods are sold through Apple direct channels, have a unique red color, and are for a charitable cause where Apple donates $10 for each sold to the Global Fund (a fund to Fight AIDS, Tuberculosis and Malaria which was established in 2002).

Back in early November-2006, Apple has quietly introduced a 8GB version of its iPod nano (PRODUCT) RED digital music player retailed at $ 249 (features 24 hours of battery life). These iPods are sold through Apple direct channels, have a unique red color, and are for a charitable cause where Apple donates $10 for each sold to the Global Fund (a fund to Fight AIDS, Tuberculosis and Malaria which was established in 2002).This provide investing opportunity in Apple and its' related partner such as Broadcom Corp (Nasdaq : BRCM) which is expected to supply chips for iPhone. Broadcom stock rose almost six percent on Nasdaq yesterday (at the time of writing StockTube has opened a position on Broadcom - May 2007 35 Call option).

Other Articles That May Interest You ...

Monday, November 20, 2006

Timber Giant WTK

It seems Lingui's excellent profit announcement (posting here) has started the chain-reaction to other timber player as well which earlier on triggered StockTube "Buy" signal (earlier posting here).

It seems Lingui's excellent profit announcement (posting here) has started the chain-reaction to other timber player as well which earlier on triggered StockTube "Buy" signal (earlier posting here).WTK Holdings Berhad (WTK : stockcode 4243) today triggered StockTube & MACD "Buy" signal with 1,404 Bulls : zero Bears. Stochastic has crossed and RSI is bullish.

WTK posted a net profit jump of 235.62% to RM46.35 million for its third quarter ended Sept 30, 2006, from RM13.81 million a year earlier boosted by its timber division. Revenue rose 23.71% to RM194.95 million from RM157.59 million. It declared an interim dividend of 9% less tax. For the nine-month period, net profit jumped 69.94% to RM79.65 million from RM46.87 million, while revenue climbed 6.46% to RM491.26 million from RM461.47 million.

WTK posted a net profit jump of 235.62% to RM46.35 million for its third quarter ended Sept 30, 2006, from RM13.81 million a year earlier boosted by its timber division. Revenue rose 23.71% to RM194.95 million from RM157.59 million. It declared an interim dividend of 9% less tax. For the nine-month period, net profit jumped 69.94% to RM79.65 million from RM46.87 million, while revenue climbed 6.46% to RM491.26 million from RM461.47 million. Fundamentally, WTK is a well-managed company with sustainable sales & profit due to the great demand in timber especially from Japan. Its' long-term debt also is within manageable level. WTK stock pricehas been on uptrend since August.

Fundamentally, WTK is a well-managed company with sustainable sales & profit due to the great demand in timber especially from Japan. Its' long-term debt also is within manageable level. WTK stock pricehas been on uptrend since August.The Company, through its subsidiaries, operates business in three segments: timber, the extraction and sale of timber, manufacture and sale of plywood, veneer and sawn timber; trading, the trading of tapes, foil, papers and electrostatic discharge products, and manufacturing, conversion of aluminum foils, flexible packaging, metallized and electrostatic discharge products, manufacture and sale of adhesive and gummed tapes. Other business segments include investment holding, property investment, property rental, plant and equipment rental, and plantation. On 29 December 2005, the Company acquired 100% interest in Biogreen Success Sdn. Bhd.

Investing Opportunity In Cables LEADER

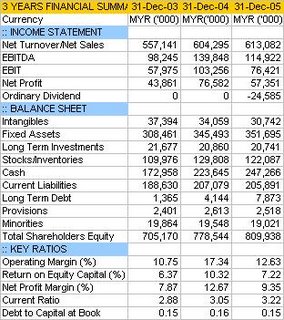

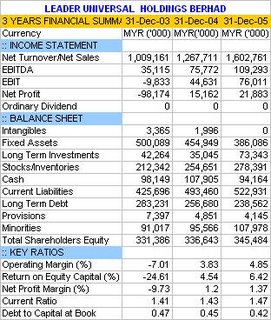

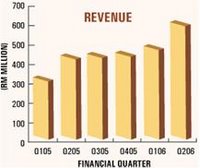

After Bursa Malaysia (KLSE) closing today, Leader Universal Holdings Berhad (LEADER : stockcode 4529) triggered StockTube and MACD "Buy" signal.Technically, the stock's RSI & Stochastic have been in bullish mode since 2-Oct-2006. The Bull:Bear ratio peaked on 26-Oct-2006 and started to weaken since then, till today when it registered 509 Bulls : zero Bears. Volumes increased to more than 7 times compare to yesterday with Stochstic about to cross.

After Bursa Malaysia (KLSE) closing today, Leader Universal Holdings Berhad (LEADER : stockcode 4529) triggered StockTube and MACD "Buy" signal.Technically, the stock's RSI & Stochastic have been in bullish mode since 2-Oct-2006. The Bull:Bear ratio peaked on 26-Oct-2006 and started to weaken since then, till today when it registered 509 Bulls : zero Bears. Volumes increased to more than 7 times compare to yesterday with Stochstic about to cross. Fundamentally, Leader has improved it's net profit from red since 2004, mainly due to worldwide demand in copper and aluminium. Annual Sales, Operating Margin, ROE & Long-Term-Debt has shown improvement. However Inventories and Liabilities's figure doesn't quite looks promising though.

Fundamentally, Leader has improved it's net profit from red since 2004, mainly due to worldwide demand in copper and aluminium. Annual Sales, Operating Margin, ROE & Long-Term-Debt has shown improvement. However Inventories and Liabilities's figure doesn't quite looks promising though.Latest corporate update (dated 17-Nov-2006) indicated Leader is bidding for 200 MW Coal-Fired power project inCambodia partnering MKCSS on a 50:50 basis joint-venture.

Leader is an investment holding company of Leader Group established in 1988 after the merger of Leader Cable Industry Berhad and Universal Cable (M) Berhad, two of the largest cable companies in Malaysia.

Its' subsidiaries are mainly engaged in the manufacture and sale of telecommunication and power cables, single and double-coated copper enameled wires, copper rods and optical fiber cables; investment holding and property development; letting of properties; trading of cables, and power generation. Its associate companies include Universal Cable (Sarawak) Sdn. Bhd., La-Bayan Development Sdn. Bhd., Gift Visions Sdn. Bhd., Lite Kabel Sdn. Bhd., SL Philippines Holdings Corporation, Leader Realty Corporation Ltd. and Hebei Xinhua Leader Cable Co. Ltd.

Its' subsidiaries are mainly engaged in the manufacture and sale of telecommunication and power cables, single and double-coated copper enameled wires, copper rods and optical fiber cables; investment holding and property development; letting of properties; trading of cables, and power generation. Its associate companies include Universal Cable (Sarawak) Sdn. Bhd., La-Bayan Development Sdn. Bhd., Gift Visions Sdn. Bhd., Lite Kabel Sdn. Bhd., SL Philippines Holdings Corporation, Leader Realty Corporation Ltd. and Hebei Xinhua Leader Cable Co. Ltd.Malaysia Says Only Talking To VW, Peugeot on Proton

Latest financial news from Reuters indicated Malaysia is talking only to France's PSA Peugeot Citroen and Germany's Volkswagen on a possible collaboration with state automaker Proton Holdings, a government minister said on Monday.

Latest financial news from Reuters indicated Malaysia is talking only to France's PSA Peugeot Citroen and Germany's Volkswagen on a possible collaboration with state automaker Proton Holdings, a government minister said on Monday.Apple's iPhone With 2MP Camera

According to news from AppleInsider : Apple Computer's (Nasdaq : AAPL) much anticipated iPod cell phone will include a 2.0-megapixel digital camera when it arrives late first quarter or early second quarter of next year 2007, according to a new report out of Taiwan.

According to news from AppleInsider : Apple Computer's (Nasdaq : AAPL) much anticipated iPod cell phone will include a 2.0-megapixel digital camera when it arrives late first quarter or early second quarter of next year 2007, according to a new report out of Taiwan.The China Times said Thursday the device, which will merge traditional cellular capabilities with Apple's legendary iPod digital music player technology, has been finalized and released to manufacturing.

According to the report, Foxconn (registered trade name for Hon Hai Precision Industry Co in Taiwan) will begin delivering the phones to Apple out of its Fushikang manufacturing facility at run rate of 500,000 to 600,000 per month beginning in February.

According to the report, Foxconn (registered trade name for Hon Hai Precision Industry Co in Taiwan) will begin delivering the phones to Apple out of its Fushikang manufacturing facility at run rate of 500,000 to 600,000 per month beginning in February.

Intel (Nasdaq : INTC), Sharp, Tripod Technology, Broadcom (nasdaq :BRCM) and Sunrex are also said to be part of the mix, supplying the memory, LCM display, circuit board, baseband chip and keypad, respectively.

The reported Apple-branded cell phone will initially be available in only a single model. Pricing information was not disclosed.

Apple stock price has been on uptrend since its' earning report. It closed at $ 85.85 last Friday after the bell. It will be interesting to see if the current cameras with default 2.0-megapixel will be affected since logically everyone will be waiting for this new product.

Apple stock price has been on uptrend since its' earning report. It closed at $ 85.85 last Friday after the bell. It will be interesting to see if the current cameras with default 2.0-megapixel will be affected since logically everyone will be waiting for this new product.

Other Articles That May Interest You ...

Sunday, November 19, 2006

Take A Vote On Bursa Malaysia (KLSE) Stock Exchange

Since Bursa Malaysia (KLSE) Composite Index breached 1,000 marks recently, alot have been said about the sustainability of it especially amongst the analysts. Some said the bull is real, some said it's too soon to conclude the bull is here to stay and adopt a neutral stand. Others are still skeptical since there were too many instances of false start prior.

Since Bursa Malaysia (KLSE) Composite Index breached 1,000 marks recently, alot have been said about the sustainability of it especially amongst the analysts. Some said the bull is real, some said it's too soon to conclude the bull is here to stay and adopt a neutral stand. Others are still skeptical since there were too many instances of false start prior.  Numerous reasons were suggested for the over 1,000 points recorded. Could it due to the recently UMNO assembly ? Could it be an early year-end window dressing ? Could it be the foreign investors are silently accumulating ? Could it be an artificial pushed-up by certain Government bodies to paint a good-feel of the overall market ? Could it be the stock market finally plays the catch-up since the regional markets have performed excellently ? Or could it be the next general election is around the corner ?

Numerous reasons were suggested for the over 1,000 points recorded. Could it due to the recently UMNO assembly ? Could it be an early year-end window dressing ? Could it be the foreign investors are silently accumulating ? Could it be an artificial pushed-up by certain Government bodies to paint a good-feel of the overall market ? Could it be the stock market finally plays the catch-up since the regional markets have performed excellently ? Or could it be the next general election is around the corner ? Hence StockTube would like to gauge the public opinions on what they think about the bull this time. The polls for the votes are ready on this web-page for everyone to cast.

Hence StockTube would like to gauge the public opinions on what they think about the bull this time. The polls for the votes are ready on this web-page for everyone to cast.Porsche To Take Over Volkswagen ?

Porsche said it had increased its stake in Volkswagen to 27.7 percent and that its supervisory board had given the green light to increase its stake to 29.9 percent. Under German law, once it gains a 30-percent holding it must launch a takeover bid.

Porsche made its move as European competition authorities prepared to begin examining a German law that in theory bars hostile takeovers for Volkswagen. The law is likely to be changed next year. Porsche insists that no takeover is likely for now.

Porsche made its move as European competition authorities prepared to begin examining a German law that in theory bars hostile takeovers for Volkswagen. The law is likely to be changed next year. Porsche insists that no takeover is likely for now.Peugeot's Turn To Bid Proton

According to business news from Reuters which picked-up a report from Business Times, France's PSA Peugeot Citroen is expected to present its bid for Malaysian carmaker Proton Holdings next week.

According to business news from Reuters which picked-up a report from Business Times, France's PSA Peugeot Citroen is expected to present its bid for Malaysian carmaker Proton Holdings next week. PSA is believed to have brought forward the briefing, after news broke out that Volkswagen AG, Europe's biggest carmaker, was interested in taking a 51 per cent stake in Proton's manufacturing arm, in a deal valued at about RM2 billion.

PSA is believed to have brought forward the briefing, after news broke out that Volkswagen AG, Europe's biggest carmaker, was interested in taking a 51 per cent stake in Proton's manufacturing arm, in a deal valued at about RM2 billion.In September, Proton and PSA signed a letter of intent to study possible cooperation between the two auto manufacturers.

The pact, which expires on Jan. 1, 2007, will focus on areas including product development, manufacturing, quality initiatives, vendor development, contract assembly and distribution.

The government has been reluctant to relinquish a majority share in Proton, which was launched in 1985 by then Prime Minister Mahathir Mohamad to help boost the wealth of ethnic Malays by finding them a niche in the auto sector.

Friday, November 17, 2006

Casino Royale - SANDS, WYNN, MGM's Bet

We have Daniel Craig, the new 007 agent in the latest James Bond movie. Somehow our immortal agent can't escape from casino scenes in most of the past movies. Together with hot-babes, the new James Bond is set to save the world again. Guess the image of casino represent status and wealth.

We have Daniel Craig, the new 007 agent in the latest James Bond movie. Somehow our immortal agent can't escape from casino scenes in most of the past movies. Together with hot-babes, the new James Bond is set to save the world again. Guess the image of casino represent status and wealth. Casino stocks have soared amid hopes for lucrative paydays from expansion into the Asian gambling hot spot. Mega-resort operators Las Vegas Sands ( NYSE : LVS ) and Wynn Resorts ( Nasdaq : WYNN ) hit 52-week highs in mid-November amid optimism about the potential for growth in Macao, the gambling center near Hong Kong.MGM Mirage ( NYSE : MGM ) also has a stake in a Macao venture scheduled to open in 2007.

Casino stocks have soared amid hopes for lucrative paydays from expansion into the Asian gambling hot spot. Mega-resort operators Las Vegas Sands ( NYSE : LVS ) and Wynn Resorts ( Nasdaq : WYNN ) hit 52-week highs in mid-November amid optimism about the potential for growth in Macao, the gambling center near Hong Kong.MGM Mirage ( NYSE : MGM ) also has a stake in a Macao venture scheduled to open in 2007.Both have the fundamentals which attracted analysts but since the stock price rally, it could be expensive to own. On Nov. 16, Sands hit a 52-week high of $92.90, up from $38.07 last December. Meanwhile, Wynn reached its own peak of $96.50 on Nov. 16, up from $51.57 a year ago. MGMalso hit a 52-week high on Nov. 16, touching $48.60 after trading below $35 per share in September.

Wynn's shares benefited from an announcement on Nov. 13 that the company would pay out a per-share cash dividend of $6—and news a few days later that it would double down and expand Wynn Macau, which opened in September in the new gaming Mecca.

Wynn's shares benefited from an announcement on Nov. 13 that the company would pay out a per-share cash dividend of $6—and news a few days later that it would double down and expand Wynn Macau, which opened in September in the new gaming Mecca. Wynn, the smaller company, had a P/E ratio of15.30 with 12-months sales of $ 1.1 Billion (59.25% net-profit margin) while Sands' was an incredible PE of 72.10 with 12-month sales of $ 2.1 Billion (20.86% net profit margin). MGM P/E is at 24.6 with 12-months sales of $ 7.4 Billion (however it's net profit margin is only at 7.36%).

Wynn, the smaller company, had a P/E ratio of15.30 with 12-months sales of $ 1.1 Billion (59.25% net-profit margin) while Sands' was an incredible PE of 72.10 with 12-month sales of $ 2.1 Billion (20.86% net profit margin). MGM P/E is at 24.6 with 12-months sales of $ 7.4 Billion (however it's net profit margin is only at 7.36%). Looking beyond Macao, Sands plans to open a casino in Singapore and wants to build another in eastern Pennsylvania. Next year it is slated to open The Palazzo in Las Vegas, yet another ultra-luxury resort and casino. Not to be outdone, Wynn is building Encore, an expansion to its luxury Wynn Las Vegas property.

Looking beyond Macao, Sands plans to open a casino in Singapore and wants to build another in eastern Pennsylvania. Next year it is slated to open The Palazzo in Las Vegas, yet another ultra-luxury resort and casino. Not to be outdone, Wynn is building Encore, an expansion to its luxury Wynn Las Vegas property. Thursday, November 16, 2006

Lingui 1Q Profit Jumps To RM 86 Million

Latest financial news from EdgeDaily indicated Lingui Developments Bhd(stockcode 2011) has posted a massive jump in its net profit to RM 86.14 million for the first quarter ended Sept 30, 2006 from the RM4.56 million a year ago, mainly due to the strong improvement in timber prices and conducive weather conditions during timber harvesting.

Latest financial news from EdgeDaily indicated Lingui Developments Bhd(stockcode 2011) has posted a massive jump in its net profit to RM 86.14 million for the first quarter ended Sept 30, 2006 from the RM4.56 million a year ago, mainly due to the strong improvement in timber prices and conducive weather conditions during timber harvesting.Revenue rose 41% to RM435.51 million from RM308.93 million while basic earnings per shareimproved to 13.06 cents from 0.69 cents.

In a statement, Lingui said selling prices for timber products were on an upward trend thanks to a contraction in Indonesian log supplies. Coupled with strong demand from China, Japan and India, it expects the current price trend to continue in the coming months.

In a statement, Lingui said selling prices for timber products were on an upward trend thanks to a contraction in Indonesian log supplies. Coupled with strong demand from China, Japan and India, it expects the current price trend to continue in the coming months.Infrastructure and development programmes in China, it said, together with furniture manufacturing in India and the construction boom in the Middle East, also augur well for timber product prices.

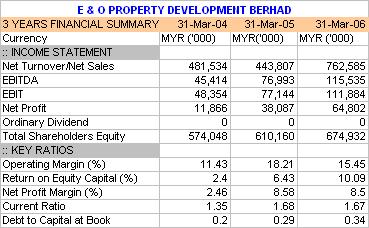

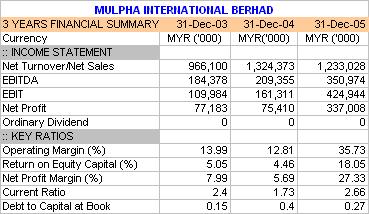

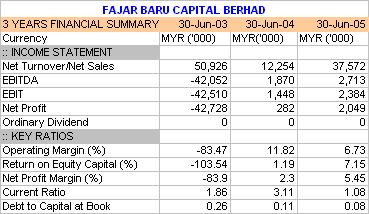

Coincidently, StockTube highlighted this stock at E&O-PROP, LINGUI, MULPHA, FAJAR, MBFCORP & RHB-CA previously when it triggered StockTube and MACD "Buy" signal. It will be interesting to see how this stock will react tomorrow morning.

Interest Rate Remains Until 2008 ?

That was the third consecutive meeting that the Fed left rates unchanged after seventeen consecutive hikes from June 2004 through June of this year.

That was the third consecutive meeting that the Fed left rates unchanged after seventeen consecutive hikes from June 2004 through June of this year.Banks Allowed To Talk To Multiple Parties

According to latest news from Business Times, banks can now negotiate potential mergers and acquisitions with multiple parties at the same time. Bank Negara said parties intending to enter into negotiation for the acquisition or disposal of 5 per cent or more of financial institutions can submit their intention with more than one party simultaneously.

According to latest news from Business Times, banks can now negotiate potential mergers and acquisitions with multiple parties at the same time. Bank Negara said parties intending to enter into negotiation for the acquisition or disposal of 5 per cent or more of financial institutions can submit their intention with more than one party simultaneously.The central bank said the move was in line with the transition of the financial system into a more deregulated environment. Utama Banking group director Datuk Vaseehar Hassan Abdul Razack told Business Times that doing away with the existing rule of negotiating with only one party at a time, augured well for the Malaysian capital market.