Friday, January 18, 2008

Great time to make money on Baidu Stock

Blood was running thick at Wall Street Thursday when the Dow Jones plunged 306 points, the lowest level since Mar 2007 and the worst three-day percentage decline since October 2002. Investors were seen selling in big wave after Federal Reserve report showed a sharp and unexpected decline in manufacturing activity – a negative reading of 20.9 from negative 1.6 in Dec. Moody's Investors Service placed bond insurer Ambac Assurance Corp. on review for a possible downgrade instantly raised the concern that bond insurers would be unable to absorb a spike in claims.

The Dow which is now at 12,159.21 has only about 150 points above 12,000 – a dangerous level of which if breached could see more panic sellers emerge. The Chicago Board Options Exchange's volatility index (known as the VIX) and often referred to as the "fear index," jumped nearly 17 percent Thursday. With this it’s very obvious that Ben Bernanke’s job has been made easier – no other choice but to cut rates. So if you’re currency trader, you should know which currency to short.

Early of this week, somehow I fell in love with Baidu.com as it seems to begging and asking me to short the stock or trade the Put Option. To be fair, the overall market pulse wasn’t on Baidu.com’s advantage. The stock drops like a rock and I concluded that Baidu.com probably loves Scottish actor, Gerard Butler, a lot – so much so that the stock not only didn’t rest at $300 as I anticipated but digged its grave-hole deeper than that. So where is Baidu.com heading? Probably the stock might makes a pit-stop at $220 before going down to $200 level. Anyhow I’m not closing my Put Option positions yet. At this moment I hope Baidu.com could help me to break my own record of 486 percent profit in Google.

So what’s my strategy for Friday? Close all my profitable Put Options of course, since it’s the expiration Friday.

Other Articles That May Interest You …

Thursday, January 17, 2008

How you’re being taken for a ride by the Suckers

By now everybody in the urban area knows about the general election’s heat that is gaining momentum. Left are the rural people who rely only on electronic and print media, both are controlled by ruling government, for news and happenings. As much as the government has trumpetted the feel-good factors just short of brainwashed them physically, the inflation is getting out of hand. Forget about the government’s inflation figure that seems forever stagnant at 3 percent or so. Yeah right and the price of a plate of chicken rice costs only RM2.00.

Recently there was this argument between the opposition party and the deputy Prime Minister of Malaysia. With the ruling government’s election machinery at full speed the opposition told potential voters that if the opposition comes into power, they will utilize the gigantic profits from national oil firm Petroliam Nasional Bhd (Petronas) to subsidize the current high fuel prices by reduce instead of hike it. The deputy Prime Minister counter-attacked that should the opposition did what it said, the country will go bust - bankrupt.

You don’t really need to be a rocket scientist to conclude how the deputy Prime Minister misled the public with his statement. Is Malaysia that fragile? Thank God Malaysia is not ruled by absolute monarchy like Brunei but that didn’t stop the ruling government from milking the revenues from Petronas to the last drop. Isn’t it puzzling that despite tons of natural resources such as tin, rubber, palm oil and crude oil the country continues to have foreign debts and now even on the brink of bankruptcy if you reduce the fuel prices (meaning increase the subsidy). Where has all the nation’s wealth gone to all these years? Perhaps the conversation below which I picked up days ago could summarize the “effectiveness” or rather the “corruptness” of the current government.

Other Articles That May Interest You …

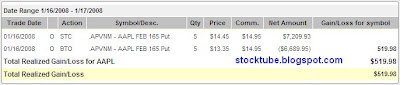

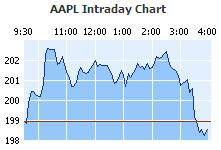

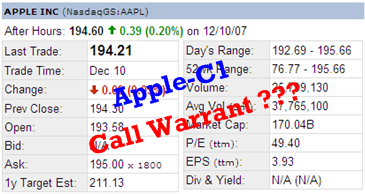

Make Money scalping AAPL, not enough for MacBook Air

Don’t you love it when you can make money both ways – stock market up or down? The stock market will be more efficient if only the rest of the regional markets such as Malaysia and Singapore allow full-blown “long” and “short” to be implemented. The talks or rather excuses that short-selling would collapse their respective market faster than ever is only myth. When the market is efficient, the direction of the stock markets will be depends solely on supply and demand.

Decided to scalp Apple Inc.’s (Nasdaq: AAPL, stock) this morning (and closed the position just now) after I was satisfied with the fast bucks but the main reason was the rebound in the technology stocks and the Dow (scare a little out of me). Again I’m not sure what will happen to the final scores for both Dow and Nasdaq after the closing later today but as long as your position is profitable, there’s no harm in locking the profit (I know I’ve making the same point over and over again). Heck, the profit is not enough to get me the MacBook Air *sigh*.

Other Articles That May Interest You …

Wednesday, January 16, 2008

Forget about stocks plunge, I want the MacBook Air

With such pessimism over the US economy, never mind if it’s exaggerated, Apple Inc.’s (Nasdaq: AAPL, stock) needed a stronger steroid than last year’s iPhone announcement to push up its stock price. The fact that the stock price plunged during and after Steve Jobs presentation should be expected. News that Citigroup Inc. had lost nearly $10 billion in the fourth quarter as it wrote down mountains of bad mortgage assets couldn’t come at the better time.

The Wall Street is set for another day of selloff today, Wednesday, after technology leader Intel Corp.’s failure to meet earnings and revenue forecasts for the fourth quarter – worsen by first quarter lower guidance. JPMorgan Chase & Co. might offered a relatively light-weight first-quarter earnings as it took a writedown of $1.3 billion but the bank warned of difficult conditions ahead in 2008. Stocks slide aside let’s see what Apple Inc. offered at its Macworld.

[ 1 ] MacBook Air – I can swear that Steve Jobs stole the idea of “Air” from Nike Inc.’s Air range of shoes to denotes feather-light products. I thought my existing Fujitsu S7000 series notebook was one of the lightest in its range until I saw how “Thinovation” Apple Inc. can be. It’s now officially the world’s thinnest notebook – as thin as your index finger (is yours at 0.8 inches thick?) but packed with:

13.3 inch widescreen LED display,

- 1280x800 resolution,

- 2GB RAM, 80GB hard drive,

- 1.6GHz or 1.8GHz Intel Core 2 Duo processor,

- built-in iSight camera, only single USB,

- 5-hours battery, 802.11n Wi-Fi and Bluetooth 2.1 + EDR

However Steve’s imagination might have cost the notebook its DVD drive and a removeable battery. But he argued the new notebook is designed specifically for wireless world (you heard that Streamyx) and if you insists on software installation via DVD or CD (else you’ll throw a grenade at Steve), you can “borrow” the optical drive of a Mac or PC wirelessly via new feature called Remote Disc (hmm, can I borrow money wirelessly?). The notebook is gorgeously priced at $1799 for the above specification. If that’s not enough to blow you off your chair, wait till you hear how you can backup wirelessly.

[ 4 ] iPhone Update – still no GPS yet? Hey I thought since you’re talking to Japan’s DoCoMo, you should have it ready, no?

[ 6 ] iTunes Movie Rentals - launched a

Although the stock price suffered, longtime Apple watchers say thedisappointment won't last. They justified that ultimately the new lineup will help Apple take fuller advantage of the demand it's already created among both Mac fans and the swelling ranks of consumers weighing a jump from PCs to the Mac. Furthermore just like music, movies are part of people’s live. Piper Jaffray’s analyst think thinks the MacBook Air could become Apple's best-selling portable, resulting in a 10% increase in the number of Macs sold this year. Time to continue accumulating Apple Inc.'s stock?

Other Articles That May Interest You …

Solution and comparison for bad credit loans

It’s not easy to suddenly find yourself stuck with thousands other consumers categorized as “bad credit” customers. And it’s definitely no fun at all to accept the fact that you’re trapped in the current housing crisis. However life goes on and you should find the best bad credit loans available to slowly take care of your problems. By making prompt payments, you can actually rebuild your credit.

There’re bad credit for home loans, credit cards, auto loans and other information out there which you should compare to optimize your current situation (if you’re one of the unfortunate persons). The business of company offering such services are mushrooming and the competition amongst these businesses means you’re spoilt for options.

*sponsored*

Tuesday, January 15, 2008

Tony’s AirAsia, to Privatise or Not to Privatise

As an organization AirAsia Berhad (KLSE: AIRASIA, stock-code 5099) could easily be a role model or case study for many top executives on how a bankrupt company could be revived to become a profitable and most successful low-cost carrier in Asia. With the correct management and right business model the dead could rise from the grave. And Tony Fernandes is perhaps one of the most recognizable figures in the corporate world especially in the aviation field.

As much as he would like it, there’s something that Tony couldn’t do regardless of how excellent he is in managing and marketing AirAsia. He couldn’t control the stock prices of his flagship AirAsia, unless he enlists himself together with people like Vincent Tan to fry his own stocks. Unlike national carrier, Malaysia Airline System (KLSE: MAS, stock-code 3786), Tony knew the government will not bails his company should something happens. To ensure sustainability, AirAsia has its’ own fuel-hedging policy to ensure its’ profitability (and survival) which in turns depends very much on global oil prices; also to ensure the company is not wiped out due to the black gold’s volatility.

As such theoretically AirAsia had actually bought call options up to $130 a barrel to hedge against oil prices within six months. In other words, is Tony somehow awares that the oil prices could shoot up above $100 and even $130 in the next six months? If not could the call options bought rather excessive and speculative in nature? Maybe Tony is a buddy of President George Bush and knew that the US is going to rains Iran with Tomahawk missiles by then.

Other Articles That May Interest You …

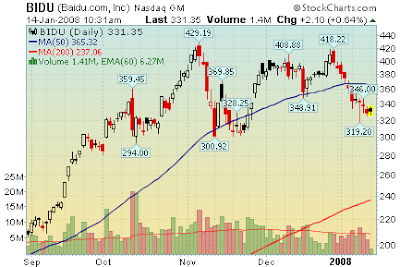

BAIDU Stock’s resting target might be at $300

China is the largest market that every Tom, Dick and Yahoo trying to get into but the reality is the country with more than 5,000 years of civilization is not a country that offers you the golden key to instant riches just because you’ve the money to invest. It’s a complicated nation that could dry your money before you could blink your eyes. The nation has become the specialist in manufacturing that if you’re trying to shift your factory there hoping to leverage on its low costs of production, chances are you might fail miserably if you didn’t do your homework. And this applies to other sectors as well.

So when Yahoo Inc. (Nasdaq: YHOO, stock) and even Google Inc. (Nasdaq:GOOG, stock) tried their luck there, they were met with stiff competition from local rivals such as Baidu.com, Inc. (Nasdaq: BIDU, stock). China’s almost 100 million broadband users and 20 million bloggers is nevertheless a huge market by itself. And if a survey reported that Chinese web young users of between 16 and 25 years of age depend heavily on internet than anybody else is anything to goes by, one will tends to rush stockpiling Baidu’s stocks.

Did you watch the movie “300”? I think Baidu.com is heading to that level and if you care to read my previous article, you should know how I played this stock. There’s something funny about stocks investing. When something goes wrong and there’re not much catalysts that could jump-start the dying battery, the stock would eventually heading south. Most importantly the $300 support is stronger than the $330 and hence, don’t bet your last penny on $330 as the bottom. Meanwhile did you noticed how Apple Inc.’s (Nasdaq: AAPL, stock) take off before Steve Jobs takes the stage tomorrow, 15th Jan at the 2008 Macworld Conference and Expo?

Other Articles That May Interest You …

Monday, January 14, 2008

With KLCI above 1,500, what’s your plan now?

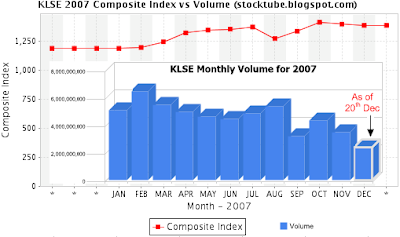

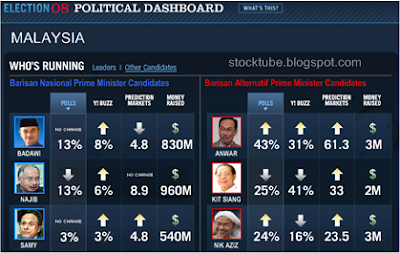

It’s not easy for Malaysian Stock Exchange’s Composite Index to reach 1,500 level, let alone 1,600 but it appears reaching 1,600 is not something that is impossible now. And if you believe in simple technical reading, since middle of Aug 2007’s correction, the bull didn’t look back judging from the linear regression lines. Simply puts, the lines are drawn by technical analysts to see if the trend goes according to the pattern – within the range. And if you believe in the trend, then it seems the KLCI is due for correction but looking at the volumes, the Composite Index needs to go higher before it can comes down for a rest.

Dow Jones plunged over 246 points last Friday but heck, who cares, most of you might ask. Malaysia does not need the pointers from U.S., what more with the writing on the wall that Ben Bernanke is almost definitely will cut the interest rate again. So logically foreign funds could be scrambling (or already rushed in?) to park their money elsewhere such as Asia in general and Malaysia in particular. At least that’s what the PM, Abdullah Badawi believed when he was asked if the current sudden bull was due to pre-election rally.

Badawi believed the foreign funds are begging to have their money into local stocks because he succeeded in promoting the country as an investment haven. Remember what happened when he opened his big mouth in early 2007 and subsequently the stock market plunged more than 100 points in only days? And he did it again in 2008. Let’s hope his mouth is not cursed this time around. It probably won’t simply because the general election is here for real – at least the perception is such. This time it won’t take long to test the rumor that the election would probably be held three to four weeks after the Chinese New Year festival (falls on Feb 7th) and during the school holiday (Mar 7th to 16th). So March 2008 is the month to watch out.

In fact if your previous fundamental stocks that went through the distribution phase have bottom down, there’s no law to prevent you from accumulating in stages. How risky could it be if these fundamental stocks didn’t move when since the KLCI jumped more than 100 points? Let’s face the reality. The government couldn’t jack-up the stocks market up by 20 points on daily basis. They can’t afford to have the stocks plunge by 100 points back to below 1,400 either. Hence most probably the KLCI would find a temporarily resting place somewhere above 1,450 at the worst case scenario – unless of course U.S. suddenly attack Iran.

In short, it’s time to liquidate your portfolio to have a healthy balance of cash against stocks on hand. Only with sufficient cash you could bargain hunt should there be some innocent sheeps wandering around. Bull and Bear makes money, Pig gets slaughtered! So readers, what’s your strategy now that the KLCI is above 1,500? Do you have an exit plan?

Other Articles That May Interest You …

Friday, January 11, 2008

Earnings season started, Ben to be nicer this time?

December data (payroll, unemployment, ISM) were clearly disappointing as job deterioration raises the risk to consumer spending – a sign that many thinks will force Uncle Ben to act again when the Fed meet next Jan 29th – 30th. And on Thursday the Federal Reserve Chairman pledged to slash interest rates as needed to prevent housing and credit problems from plunging the country into a recession.

Economists now believe the Fed will slice its key interest rate by a bold one-half of a percentage point instead of one-quarter point reduction. Remember when the Fed (Dec 11th 2007) cut the

Anyway, the earning season started with stock picking becomes more difficult with the gloomy U.S. economy and the hanging post-subprime problem especially with financial institutions still bleeding profusely. The market’s pulse does not show a healthy status and any great earning reports from stocks not related to financial could join the blood-pool if the overall market sentiment for that particular day (heck, or even a trading session) is not good. Next week we’ll see how the sub-prime crisis affect Citigroup Inc.’s (NYSE: C, stock) bottom line. Also we’ll have Intel Corp (Nasdaq: INTC, stock) reporting its earnings on the same day as Citigroup on Tuesday, Jan 15th. Both reports could set the direction for the financial and technology stocks, temporarily.

And don’t forget the much anticipated MacWorld Conference and Exposcheduled on 14th – 18th Jan 2008, that’s next week dude. For all you know, Apple Inc. (Nasdaq: AAPL, stock) could be the saviour of the day.

Other Articles That May Interest You …

Thursday, January 10, 2008

Move aside iPod Nano, here come Tata Nano

What does Steve Jobs have in common with Ratan N. Tata? Both have the vision to build the smallest version of their products, well, sort of. While Steve is known for introducing iPod and instantly uplifts the Apple Inc. brand to almost every corner of the globe, Mr. Tata owns India’s largest automobile company with reported revenues of US$7.2 billion in 2006. You might not know it but chances are the heavy trucks and buses plying the road carry the Tata brand.

To bring their products to another level, Steve has introduced the infamous iPod Nano and today Mr. Ratan introduced the Tata Nano at the 9th Auto Expo in New Delhi. Not sure if the chairman of the Tata Group actually owns iPod Nano and gotten the inspiration from there but the two-cylinder 623-cc capable of generating 33bhp care is surely the “People’s Car”. The cheapest car in the world which is selling for only $2,500 is bundled with 4-speed manual gearshift, air-conditioning, front disk and rear drum brakes, four doors, multi point fuel injection petrol engine, basic suspension and seat belts.

Tata Nano is expected to be available on the road in the second half of 2008 and the company hopes to sell 500,000 units. Just wondering if Malaysia should consider importing the car to provide alternative to lower-income group since it’s so economical.and cheap.

Other Articles That May Interest You …

Spectacular last 90 minutes cheers to Tech-Stocks

Lately Wall Street has been trading on a trend whereby the morning session’s pattern could be different from the afternoon. It appears the investors are trying to find reason(s) or rather excuse(s) creating volatility on both trading sessions of the day. I remember those days when you could roughly know the trading trend of the day sometimes into the opening bell till the closing session. And you could pretty much know when to scalp for a small profit and run. However nowadays it is as if there are two different trading days altogether squeezed into one day.

Wednesday trading was a good example whereby the Dow was down 90 points but staged a rebound in the final one and a half hour towards closing bell to register a gain of 146 points. Most investors are waiting for hints about the U.S. central bank’s stance on the economy from the scheduled Thursday speech by Ben Bernanke. You should see how Google Inc. spectacularly climbed over twenty bucks a share within the last 90 minutes. The day’s trading range for Google Inc.(Nasdaq: GOOG, stock) was between $622 and $653 a share.

Meanwhile Baidu.com, Inc.’s (Nasdaq: BIDU, stock) which plunged about $20 a share in the morning session performed the same rebound but not enough to lift it into the green territory. However the stock was traded higher above the $350 level at $351.50 or 2.15% during after hours trading. The year 2007 was the year of Google Inc. when the stock breached the $700 and was just inches away from the $800 mark. Baidu.com did even better by more than doubled its stock pricesince the beginning of Jan 2007. The rally was set to continue if not for the unfortunate loss of its CFO and since then the stock price of Baidu.com appears to be eyeing the $300 mark for new direction.

Other Articles That May Interest You …

Wednesday, January 09, 2008

Have the Chinese New Year and Election Rally started?

Once every for or five years, Malaysian stock market would stage a rally in anticipation of the general election. The rally could be a mini one or a huge one just like what’s happening now. The daily transaction volume was on plunging mode towards the end of last year, 2007, but suddenly the daily volume sprang to life with the year of rat (2008). The KLCI (Kuala Lumpur Composite Index) is currently inches away from the 1,500 – a level that would put 1993 Super Bull Run to shame.

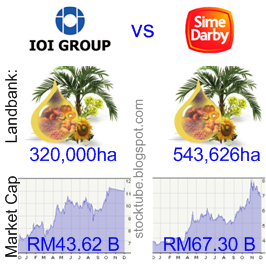

Traditionally every New Year would start with a bang and if the Chinese New Year is about one or two months away, chances are the pre-Chinese New Year rallycould be smiling at stocks investors (though there were minor exceptions). This year could spells double bonus as the pre-Election rally may add more sweet mandarin oranges to you, never mind the Prime Minister still has yet to get his inspiration. Another mini bonus is the rally in crude palm oil (CPO) prices.

Now you have Sime Darby Berhad (SIME: stock-code 4197) and IOI Corp Berhad (KLSE: IOI, stock-code 1961) as the new plantation heroes with a combine 12.9 percent weighting to KLCI – the task could not be easier. To add cheers to the crowd, Public Bank Berhad (KLSE: PBBANK, stock-code 1295) and Genting Berhad (KLSE: GENTING, stock-code 3182) could add spices to the celebration. So you shouldn’t be surprise when the talks of KLCI reaching even above 1,600 within 2008. But the above heavyweights are not everyone’s cup of tea.

Most season investors are looking for this signature (already started?) before start pinching the politically-linked stocks such as MRCB (KLSE: MRCB, stock-code 1651), Time DotCom Berhad (TIMECOM: stock-code 5031), UEM World Berhad (KLSE: UEMWRLD, stock-code 1775) and others. With the current KLCI defying Wall Street’s movement, any one-eye remisiers, dealers or analysts will have a common agreement – the Chinese New Year rally just started. The Election rally and the strong ringgit are the icing to the current rally. I’ve yet to see more than 80% of the stocks in the green contrary to what I’d seen during the 1993 Super Bull Run though.

Other Articles That May Interest You …

Tuesday, January 08, 2008

Microsoft’s FAST bid will not improve its search position

It’s a known fact that to be successful you need to focus and once you achieved it you got to continue focusing in doing what you do best. Most of the successful company tried to diversify but somehow they never succeed, at least in a big way. That’s why despite owning mountains of cash Microsoft could not simply send Google Inc. (Nasdaq: GOOG, stock) packing in the search engine section. Microsoft tried to unseat Apple Inc. (Nasdaq: AAPL, stock) iPod’s success with its Zune but met the same fate as MSN search engine.

Today it was reported that Microsoft Corporation (Nasdaq: MSFT, stock) has bid$1.2 billion for a Norwegian search engine company, Fast Search and Transfer ASA (OSL: FAST), which specializes in high-end Internet search and business intelligence systems. The bid price for the company which was founded in 1997 and currently employs about 500 people is $2.97 a share or about 42% premium over the Norwegian company's recent average share price. The stock has risen by nearly the same amount in early trading on the Oslo stock exchange.

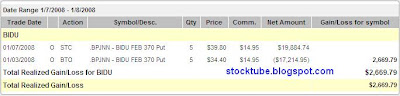

Take Money off the table on Baidu, watchout for Apple

Did you notice the volatility displayed by the technology stocks on Nasdaq today? This is what a trader would love to see. A huge plunge follows by a reverse trend to the green, just like how the Dow and Nasdaq composite swung. StockTube had blogged that Baidu.com, Inc.’s (Nasdaq:BIDU, stock) support was at $350 which was breached during today’s trading, 7th Jan 2008. If only you had monitored how the stock was sold off within 10:15 to 10:35 trading hour today – all the red spikes could easily test your emotion.

At the time of writing, I’m not sure if $350 would be the new resistance or remains as the support for Baidu.com but I decided not to wait to find out. Instead I had closed the position and take the money off the table gauging from the volatility of the Dow and Nasdaq. It was a mere 15 percent profit for my BIDU Feb 2008 370 Put Option – how I wish I could sell when the stock was at $338 but then you just can’t, can you? Baidu.com is trying to climb back to above $350 but it depends very much on the overall market sentiment.

Other Articles That May Interest You …

Monday, January 07, 2008

MAS offers low fares but Tiger Airways is giving Free

As their competitor you got to hate them but as their customer you simply got to love them, although you might have thousand and one reason to criticize them because you were comparing an apple and an orange. Before the creation of this creature called AirAsia Berhad (KLSE: AIRASIA, stock-code 5099), not many people can afford to fly domestically, let alone to another country. Of course if you’ve been the frequent flyer of Malaysian Airline System Berhad (KLSE: MAS, stock-code 3786) then nobody can blames you for screaming at the top of your voice that “AirAsia service sucks!”

Like it or not AirAsia is the most successful low-cost airline in this region and they are about to dominate this for some time. They’ve also set the standard as far as competitiveness is concerned. When you thought they’re already too cheap to do anything innovative to capture new customer base, they threw in the infamous popular marketing plan – Free Seats. Despite decades in business when was the last time you heard of MAS giving away free seats – even during their anniversaries celebration sake? Yet here you can not only fly around cheaply (no free meals provided of course) but also able to enjoy free seats periodically.

Tiger Airways which was awarded the rights to operate a daily service on the Singapore-Kuala Lumpur route last month will operate from the Low Cost Carrier Terminal at the KLIA (Kuala Lumpur International Airport). The 55-min Singapore-Kuala Lumpur daily flight will depart Changi Airport for KLIA LCCT at 10.50am and return from KLIA LCCT at 12.15pm from Feb 1 to March 29. Now everyone is wondering if MAS would be generous enough to offer free seats in the not too distance future- I’m sure you won't mind if MAS was to take off the menu from the 55-min journey, would you?

Other Articles That May Interest You …

Sunday, January 06, 2008

Tale of a Producer that runs out of Stock

Just what could be the problem with Malaysia’s fifth Prime Minister Abdullah Badawi’s administration? He got the highest votes from the public during his first election since taken over from former premier Mahathir but it appears he’s screwing it up pretty fast. Hold on! It was not only the votes that Badawi gotten the highest score. Let’s be fair and analyze both his achievements (if you can call it) and his failures.

He ended the ringgit's peg to the U.S. currency which was implemented by his predecessor. The ringgit is now proudly at the highest traded at about 3.28 to a dollar, never mind that public might not enjoy benefit(s) out of it. Then during his regime the oil prices hit the $100 a barrel on third day of New Year but of course we can’t blame him for something that he can’t control, can we? Instead he was kind enough not to raise the fuel hike when all of you were happily celebrating the 2008 New Year as the PM only promised not to do so till 11:59pm on 31st Dec 2007. Rumor has it that the next fuel hike could be as low as 40 cents per liter although nobody can blame him if he decided to raise it to 90 cents a liter or evenRM1.20 a liter.

The greatest achievement of all could probably be that the local stock market is at its highest, much to the envy of Mahathir. The country also saw the creation of the the biggest listed palm oil producer in the world in terms of output. Surprisingly the country is facing shortage of cooking oil based on the same commodity that the country was proud of in the first place. It’s like sayingSwitzerland is facing shortage of Rolex watches, Japan is facing shortage of Toyota cars and Saudi Arabia is facing the shortage of fuel. Interestingly this is not the first time the nation is facing shortage of such basic fundamental needs.

The solution by Malaysian government – rationing which limit customers to two 5kg bottles of palm oil based cooking oil each. As usual the respective ministry and even the deputy PM put the blames on middle man, consumers who panic easily and thus contribute to the shortage, smuggling and all sorts of excuses that could only insult your intelligence. Heck, if only the country is so vulnerable that a simple trick of creating a shortage would pull the nation to her knees, could you imagine the reaction of current administration if the same old George Soros was to attack the currency again as in 1997 Crisis?

Other Articles That May Interest You …

- Chua Soi Lek’s Sex DVDs, Cuckoo ends his Career

- Oil prices at $100 a barrel on third day of New Year 2008

- Fuel Price Hike of 90 cents to RM2.82 a liter next year?

- Why Can’t Public Enjoy the Benefits of Strong Ringgit?

- Oil price hike – Badawi’s greatest Economic Challenge

- Malaysia’s Biggest Scandal – Business as Usual

Saturday, January 05, 2008

Red all over Wall Street due to Unemployment Data

Weaker job growth and a rise in the unemployment rate enabled Wall Street to take the 3-digit plunge again Friday. The Dow fell 256.54(1.96 percent) to 12,800.18, below the psychological 13,000 points while the Standard & Poor's 500 index declined 35.53 (2.46 percent) to 1,411.63. Meanwhile The Nasdaq composite index dropped 3.77 percent or 98.03 points to 2,504.65, thanks to the downgrade of Intel Corp.

United States Labor Department reported that employers raised payrolls by only 18,000 and that the nation's unemployment rate rose to its highest level since November 2005. A weakening job market will hurt consumer spending and this got investors worried. Previously when the sub-prime crisis hit the stocks market, investors were using the growing employment to argue that as long as people were getting jobs consumption would continue to spur the economy. Employment was the last fort and now with the weakness report, investors are not too sure.

While I do not know if the technology stocks will continue to take the beating, I do know it’s time to accumulate in stages. Remember that you can never buy at the lowest and sell at the highest. If you’re mouth-watering looking at Apple and Google’s prices, why not take some actions. On the side note, next Monday’s opening bell will not be a nice view to the other regional stocks markets including KLSE.

Other Articles That May Interest You …

Friday, January 04, 2008

The Composite Index, Plantation Stocks and the Wolf

Who would have thought that the traditional boring plantation stocks will be the sector that jump-starts the New Year 2008 with a bang? People would most likely put their bet on financial, property or even oil and gas companies to be the hero entering the new calendar. But the crude palm oil (CPO) prices appears to defy the gravity and continue to comfortably floating above 3,000 mark with the Mar 2008 contract touched a new high of RM3,159 per tonne – thanks to global high prices of palm oil and soya-oil.

Sime Darby Berhad (SIME: stock-code 4197), IOI Corporation Berhad (KLSE:IOICORP, stock-code 1961) and even Tradewinds Plantation Berhad (KLSE:TWSPLNT, stock-code 6327) are happily enjoying the “bountiful harvest” today. Most of the telecommunication companies such as Telekom Malaysia Berhad (KLSE: TM, stock-code 4863) and DIGI.com Berhad (KLSE: DIGI, stock-code 6947) joined in the bull-party, pushing the Kuala Lumpur Composite Index to more than 30 points higher at one point.

To the fans of Vincent Tan (and StockTube readers), today could be a decision making day. Readers who invested in the Berjaya Corporation Berhad (KLSE:BJCORP, stock-code 3395) Irredeemable Convertible Loan Stocks, ICULS (2005/2015) BJCORP-LC (stock-code 3395LC), had either been taking some profit or decided to wait (brave-heart and greedy) for Vincent Tan to give hint(s) of his actual “exit-plan”. However if you care to look at both BJCORP and BJCORP-LC stocks movement today, surprisingly the BJCORP-LC registered losses while the BJCORP was in green. In normal days since Vincent started heating the “wok”, both will goes hand-in-hand – green or red together.

Maybe this could help you to decide. Vincent Tan continued to accumulate BJCORP right to the last month of 2007 via married-deal – a whopping 42,500,000 shares at RM1.25 a share. He is holding a direct 28.78% and indirect 28.45% with total shares amounted to 1,684,360,506 in BJCORP. You also have some recent acquisitions from UBS AG London and Goldman Sachs. If you know Vincent well, chances are he might not have devoured the whole bull yet – talk about the old wolf.

Other Articles That May Interest You …

Baidu mourning while Google and Apple near support

While Baidu.com, Inc. (Nasdaq: BIDU, stock), the Chinese search engine that often said to be Chinese version of Google, lost their Chief Financial Officer, Shawn Wang, who died in an accident in China, its stock is still mourning. With the next support at $350 the stock could see further downtrend – another $20 to go down the drain based on current stock price of about $370 a share.

Meanwhile, both Google Inc. (Nasdaq: GOOG, stock) and Apple Inc.’s (Nasdaq:AAPL, stock) are toying around their support level of $680 and $196 level respectively. At the same time the Nasdaq Composite is trying very hard to stay in the positive territory – it has been zig-zagging in the red and green area throughout most of the morning

I think Google Inc. at its $680 would be a steal while I hope to buy Apple Inc. at the next support - $192 (or lower *grin*) before the next earning announcement. The Dow is currently at 13,095.01, very near to its strong support of 13,000. Keep watching the stock chart for the above mentioned stocks.

Thursday, January 03, 2008

Oil prices at $100 a barrel on third day of New Year 2008

Fuel prices touched the frightening level of $100 a barrel before eased Thursday. Light, sweet crude for February delivery fell 38 cents to $99.24 a barrel in Asian electronic trading but not before rose $4.02 to $100 a barrel Wednesday, only to slipped back below $100 to a record $99.62 – up $3.64. The $100 a barrel was done for one contract (1,000 barrels) only on the Nymex floor.

The continuous demand from two new giant, China and India, have keep the oil prices volatile and any crisis or instability related to oil would spark the acceleration of the black gold. As usual the violence in Nigeria resumes with the invasion of a band of armed men at Port Harcourt, the center of Nigeria's oil industry. Two police stations and lobby of a major hotel were reportedly raided.

Although many investors are confident the oil prices will breach the $100 a barrel eventually, they also believed the fuel prices will stay below $100 region for some time before going for the $100 kill. If 2006 was the year the oil prices were targeting $90 level, 2008 could be the year $100 becomes the new defacto level.

Other Articles That May Interest You …

Wednesday, January 02, 2008

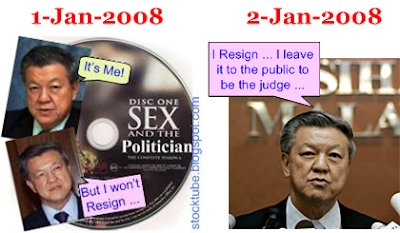

Chua Soi Lek’s Sex DVDs, Cuckoo ends his Career

The first political casualty from the ruling government starts the second day of the New Year 2008 today when Malaysian Health Minister cum MCA vice president, Dr Chua Soi Lek, announced his resignation (or sacked by his own boss?) one day after he refused to do so. Chua Soi Lek’s sex DVDs scandal proves too hot to be handled by the Malaysian government, so much so that the 60-year old senior politician could not be saved even by the Prime Minister himself. MalaysiaKini and theStar reported the news.

Stock market opened for trading for the first day of the year 2008 but it appears the sex DVDs stole the limelight of the day. Investors are still in the holiday mood judging from the low volume after the closing bell. I bet even remisiers, dealers or brokers themselves were busy searching or finding where to download Chua Soi Lek’s sex DVDs. The year 2008 is perhaps the worst year in his political career. The MCA big gun might have thought of adopting the infamous former President Bill Clinton and Monica Lewinsky’s strategy in denying the scandal but the difference is Chua was caught with his pants totally down with the sex DVDs while Clinton-Lewinsky was not.

There were numerous other sex scandals involving politicians. The hottest rumor was a very top leader who was caught with an actress in Port Dickson but his power saved the day, not to mention there were no CCTVs that manage to record the hot-scenes. Chua Soi Lek and his supporters were crying that they were setup by some sort of political parties but when your cuckoo was captured running wild with other women except your own wife, you’re dead meat. That’s the reality in politics. As much as the PM would like to save Chua’s butt, the stake is too high to take considering the general election is around the corner.

Maybe it’s time the politicians learn the 101 Dos-and-Don’ts of “don’t eat and shit at the same place” – obviously Chua didn’t know about it. But then the post is indeed CURSED!!!

Other Articles That May Interest You …

Tuesday, January 01, 2008

What a day to start the New Year – Sex DVDs anyone?

What a day to start the first day of the New Year 2008. And if you’re living in the land of a nation called Malaysia, you should be proud of the great abundant of stories that never fail to amuse you. While everyone was celebrating the New Year with great fireworks, you have groups of Mat Rempit (illegal racers) pulling all kinds of stunts who might endangered other users. It’s amazing how this group of people still exists till today, thanks to the son-in-law of the Malaysian Prime Minister who endorsed and even called them Mat Cemerlang (bright and excellent racers?) not many moons ago.

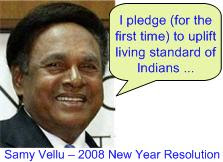

Then you have the Works Minister Samy Vellu who said his resolution for the New Year is to uplift the standard of living in the Indian community, something he had never said before in his

Not to lose out, you have the MCA (Malaysia Chinese Association, a component party of ruling government) president Ong Ka Ting who trumpeted and sing the song of praises to his own boss about the allocation of RM6.02 million for 32 Chinese schools. That’s a mere $188,000 for each school, mind you. Isn’t it the responsibility of the government to provide the basic education facilities to the citizen in the first place? So why the marketing talk?

But the most amazing story on the first day of the New Year is the “Sex DVDs” of a high-ranking politician in Johor who is related to MCA, the component party of the ruling government. The first and second DVD each lasted 56 minutes and 44 minutes respectively are believed to be closed-circuit television (CCTV) recordings in a hotel suite. Both DVDs showing a man resembling a prominent senior politician and a woman engaging in various sexual antics was first reported in the Chinese dailies on Sunday.

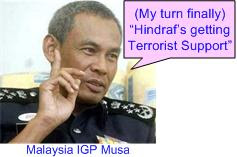

Now here’s the fun part. Instead of investigating the DVDs’ actor and actress, Malaysian Inspector-General of Police (IGP), Musa Hassan, hinted the police might start grilling the reporter who broke the story. Police also warned that anyone found in possession of the DVDs or caught distributing copies of them could be charged under Section 292 of the Penal Code and sentenced to three years' jail or fined, or both. Is this another classic case of punishing the whistle-blower instead of the culprit?

And who’s this politician? It’s none other than the Health Minister Dr Chua Soi Lek, the Vice President of MCA, who

The portfolio of Health Minister is traditionally reserved for MCA probably due to the rumors that the seat is cursed. Except for Chong Hon Nyan, past ministers didn’t have “good ending” in their political career. And with the current Sex-DVDs, it would take lots of encouragement (or thick skin?) to pretend as if the DVDs didn’t exist for Chua Soi Lek. Nevertheless ignoring the public embarrassment is one thing, facing his family members is another different thing. I'm not sure if there're brave souls out there who dare to sell the DVDs since the issue is already sizzling hot but I'm pretty sure people will start googling to download the sex DVDs. Maybe it will make its way to YouTube sooner or later *evil grin*.

The next upcoming hot topic would be the fuel hike. Already rumors were spreading that the government is ready to increase petrol by 40 sen to RM2.32 a liter from current RM1.92 a liter. But I guess there’re enough amazing stories on the first day of the New Year itself.

Other Articles That May Interest You …

- Video: Member of Parliament assaulted and humiliated

- Rally, Racial and the Race towards the Election

- Bail-Out with a piece of paper worth RM700 million

- Two Major Rallies within 1 month – great score for PM

- Malaysia’s Biggest Rallies since 1998 – KL under siege

- Fuel Price Hike of 90 cents to RM2.82 a liter next year?

- Malaysia Judiciary Scandal? Don’t bet on it

- Malaysia’s Biggest Scandal – Business as Usual

- No fees but shareholders fuming Ling Chicken Out

- Poor’s Hope in MAIKA – the Last Robbery

Monday, December 31, 2007

Mission Accomplished – 100% Profit with Vincent Tan?

StockTube first blogged about Vincent Tan’s stocks in Oct 2006 when Berjaya Capital Berhad was still a listed company. Then Berjaya Corporation Berhad (KLSE: BJCORP, stock-code 3395), formerly known as Berjaya Group Berhad together with its Irredeemable Convertible Loan Stocks, ICULS (2005/2015) BJCORP-LC (stock-code 3395LC) triggered StockTube and MACD "Buy" signal.

It wasn’t about a year later that Berjaya Corp finally made its move in Oct 2007. The attraction was not the Berjaya Corp shares but its ICULS which was traded about $0.20 a share most of 2007. It was traded below $0.08 a share before 2007 mind you. Why is this fella difference from other warrants? It’s because itsexpiration is at mind-boggling 2015 - huge time-value at your advantage. Essentially nobody would believe Vincent Tan will keep quiet and do nothing to push up his own shares.

Other Articles That May Interest You …

Sunday, December 30, 2007

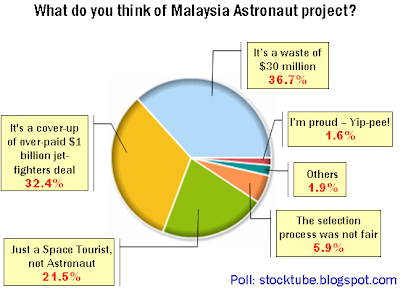

Malaysian Astronaut Project Poll Result

Not many hours left before we welcome yet another new year and bid farewell to the year 2007. The holiday mood should have started since the middle of Dec 2007 when most of you are clearing your annual leaves and probably will see your colleagues again in 2008. Kuala Lumpur Stock Exchange is set to do some last minute window-dressing on Monday, being the last trading day in the calendar 2007. StockTube would like to publish the result from the poll “What do you think of Malaysia Astronaut project?” before the curtain comes down.

I bet you, being tipical Malaysian, would have forgotten the above issue as in synonym with what the former premier Mahathir said – Malaysian has short memory. Anyhow, here’s a summary to refresh your memory. On 10th Oct 2007, Malaysia became the first country in Asean (can you take that Singapore?) to send an “Angkasawan” to space on board the Russian Soyuz TMA-11 spacecraft. What caused the controversy was how the plan was bundled within a billion-dollar deal for Malaysia to buy 18 Russian-made Sukhoi 30-MKM jet fighters.

There’re people who applauded the mission as well as people who criticized it. For those who still think there’s actually free lunch attached with the billion-dollar arm deal, you must have been staying under the coconut shell for God knows how long. The fact that USD30 million can be used to build lots of school, send many capable students to further their studies, help tons of families affected by the recent flood or even to help very poor families who couldn’t send any of their kids to primary school simply shows how the government chose to “brag” about the trip being the first step by Malaysia to prove its capability in the field of aerospace.

Anyway, let’s take a look at how the readers of StockTube have voted. Here’s the result:

- 36.7% of readers voted “It’s a waste of $30 million”

- 32.4% of readers voted “It’s a cover-up of over-paid $1 billion jet-fighters deal”

- 21.5% of readers voted the astronaut was “Just a Space Tourist, not Astronaut”

- 5.9% of readers voted “The selection process was not fair”

- 1.9% of readers voted “Others”

- 1.6% of readers voted they’re proud of the project

There’re 5 votes who voted for “Others”, so let’s see what were their opinions, shall we?

There’re 5 votes who voted for “Others”, so let’s see what were their opinions, shall we?- one reader said fortunately the government didn’t proceed with the shameful idea of sending roti canai or teh tarik to the space.

- one reader mentioned the project was truly a leader’s visionary quality

- one reader said it was a load of bull cooked up by BN (ruling government) to project a false sense of Malay Supremacy.

- another reader still couldn’t figure out how Malaysia is gonna benefit from the project

- one reader thought it was “idiotic”

So there you are; the result of the previous poll and the other feedback from the readers. But if you think the project has ended you better think again. The government has committed to send the second angkasawan to the space by end of 2010 as it would be cruel to leave the other guy high and dry after all the training. That’s not all. Miraculously Malaysia’s Science, Innovation and Technology Minister Jamaluddin Jarjis said in early Nov 2007 that it was “a freaking good idea” to buy the whole Russian Soyuz TMA-11 Space Rocket. Assuming the sending of the second angakasawan will costs another $30 million and the space rocket costs $100 million, you’re looking at $130 million being taken out from the nation’s coffer – that’s your money dude.

And be prepared to see the space rocket being painted “Made in Malaysia” in due course should the decision to purchase it approved. Meanwhile I’ve started another poll concerning hikes. Every Tom, Dick and Dog knows hike(s) is imminent under current Abdullah Badawi’s administration. If not for the general election of which he needs to push the feel-good factors out to public, the government would have announced multiple hikes by now. So in 2008 what hikes do you think is the most disastrous, at least to you? You can choose “Others” and enter your opinion. So, vote and have fun – it’s on the right side of this blog. Happy New Year to all StockTube's readers!!!

Other Articles That May Interest You …

Saturday, December 29, 2007

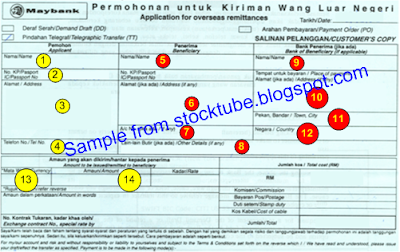

How to TT, Wire or Fund your US Trading Account?

Globalization seems to be the magic bullet which is slowly but surely taking its effect on everyone including the world of stocks investing. When I first started StockTube about slightly more than a year ago, I wasn’t too sure if I should write about the hidden opportunity in investing not only stocks but also option from the world’s largest equity markets – the United States. Since then I’ve received great response (surprisingly most of the readers decided to send me private email instead of using the comment section) particularly the mechanism of option trading.

One thing leads to another and due to overwhelming requests (I was bombarded with emails for related articles for quite some time) I’ve written the article on which broker to choose and how to open a trading account. Surprisingly I continue to receive emails from readers (who can blame them *grin*) asking me how to fund their accounts. Hey! I thought funding the account should be a straight-forward process that the local banking institutions have no problem executing. Isn’t it strange that Malaysian local banks such as Maybank and Public Bank do not know how to do simple TT (Telegraphic Transfer) to USA? But then maybe it only affects certain branch(s) of which their officers have not done such a high-tech procedure before *evil grin*.

As such, I’m publishing this short article on steps to fill in the “Application for overseas remittances” form or most of you would refer it as “TT form”(applicable to Malaysian investors only). The example below is based on Malayan Banking Berhad’s (KLSE: MAYBANK, stock-code 1155) form. Take note that this form might have changed. Other financial institutions that offer such facility should have different form but the basic fundamental of the contents should be almost the same. Here’s the extract of the form (I’ve ignored the rest of the no-brainer particulars within the actual form).

Particulars of Applicant:

- [Step-1] - Your Name: you shouldn’t have problem with this else I do not know what to say.

- [Step-2] - IC / Passport No: your identification number or passport number for non-citizen

- [Step-3] – Address: your residential or mailing address

- [Step-4] - Telephone No: your contact number which is reachable

Particulars of Beneficiary (the most important):

- [Step-5] – Name: the Bank Account Name of the broker that you’re applying, i.e. Interactive Brokers LLC. You should be able to get this information when you sign-up with your preferred broker.

- [Step-6] – Address (if any): this is the address of the broker’s banking, i.e. Citibank, N.A. (New York Branch), 111 Wall Street, New York, NY 10043, United States of America. Again this info should be supplied to you by your preferred broker when you sign-up.

- [Step-7] – Account No: this broker’s bank account number should be available during your preferred broker’s sign-up

- [Step-8] – Other Details (if any): you should enter the information provided by your broker with reference (benefit to) to you.

Particulars of Bank Beneficiary (important):

- [Step-9] – Name: the name of the broker’s bank, i.e. Citibank, New York

- [Step-10] – Place of payment / Address (if any): this should be the “Bank Codes” provided by your broker, i.e. ABA Number and the SWIFT BIC Code.

- [Step-11] – Town, City: the city of your broker’s bank location, i.e. New York

- [Step-12] – Country: you should enter United States of America.

Amout to be remitted to beneficiary:

- [Step-13] – Currency: USD

- [Step-14] – Amount: 3,000,000.00 (if you wish to fund such amount *grin*)

That’s almost all you need to fill with the remaining to be taken care by the bank’s officer. If your local bank officer still scratching his/her head while giving you a clueless look, it’s time to kick his/her butt. Let me know if this article is useful to you, will ya?

Other Articles That May Interest You …

Friday, December 28, 2007

Bhutto’s assassination a minor hiccup for Consolidation

Dow Jones plunged over 190 points after the assassination of Pakistani opposition leader Benazir Bhutto together with Commerce Department's durable goods orders raised concerns about the U.S. economy. Bhutto's assassination in Rawalpindi raised the possibility of increasing political unrest in Pakistan, a nation which is an ally of U.S. in the fight against terrorism. What makes the situation worse is the fact that Pakistan possesses an arsenal of nuclear weapons and if the post-assassination situations spin out of control, it could spells catastrophic.

For Apple Inc.’s (Nasdaq: AAPL, stock) fans, it was a short cheers when the stock price charged

Benazir Bhutto’s assassination could well present the excuse for investors to sell and stocks to consolidate before the next rally (for certain stocks). Someone mentioned about two major occasions for Apple Inc. in Jan 2008 – MacWorld and Earnings. Do some research and you should be able to scoop some pocket money.

Other Articles That May Interest You …

Thursday, December 27, 2007

Shorter stocks trading hours will create higher Volatility

This seems to be a good idea – the suggestion to shorten the Malaysia Stock Exchange’s trading hours from the current 9 a.m. - 5 p.m. to 10 a.m. – 4 p.m. It was suggested by Malaysian Investors’ Association (MIA) today. Frankly I’ve no objection to such a proposal simply because I do not see the co-relation between longer trading hours with the transaction volume.

I agreed that if a busier stock market such as Hong Kong Stock Exchange could coup with their daily transaction within market period of 10 a.m. to 4 p.m., a smaller market such as Malaysia’s shouldn’t have much issue about doing so. Wall Street’s trading hour is from 9:30 a.m. to 4 p.m. EST. although New York Stock Exchange (NYSE) had mooted the idea of extending its trading hours in the past.

Will it affect the daily volume? Not really since serious investors or traders would adapt to the new trading hours and their buying or selling would eventually find its way. In fact with more and more investors or traders trading online, you could experience a higher volatility or stocks movement per hour with such shorter trading hours. Will it create healthier investors? Definitely considering the lesser time in tracking the stock market, not to mention ample time for them to enjoy their breakfast before starting their job *grin*. What do you think?

Wednesday, December 26, 2007

Early Online Holiday Sales up 19% from previous year

Early study done by comScore, Inc. (Nasdaq: SCOR, stock), a leader in measuring the digital world, showed U.S. online retail sales hit a record$26.29 billion from Nov. 1 through Dec. 21, up 19% from the year-ago($22.04 billion in 2006). Target Corp. (NYSE: TGT, stock) warned late Monday that its same-store sales might decline for December, while a broad gauge of consumer spending released by Mastercard Inc. (NYSE: MA, stock), which includes estimates for spending by check and cash, reported on Tuesday an increase of 3.6 percent from Thanksgiving to Christmas, compared with a 6.6 percent gain in the year-ago period.

Thanks to free shipping, product discounts and retailers that opened earlier than normal hour the online spending could be higher pre and post Christmas. Toys "R" Us Inc. which opened its door two hours earlier at 8 a.m. on Wed is offering 40 percent price cuts on all MP3 and iPod accessories. Macy's Inc.

Amazon.com Inc (Nasdaq: AMZN,stock) said five of the top 10 itemson its electronics best-seller list are Apple Inc. (Nasdaq: AAPL, stock)iPod players. Meanwhile Buy.com reports strong sales of Microsoft Corp. (Nasdaq: MSFT, stock) Zune and SanDisk Corp.’s (Nasdaq: SNDK, stock) Sansa players. It’s great to see the online commerce could generate additional $4 billion in sales despite the shadow of economy slowdown in US. So if you intend to invest some retailers stock, you’ve the above companies to choose from. Watch out for their earning announcements. And as usual you should know which my favorite amongst them is.

Pritzkers’ feud offers $4.5 billion opportunity to Buffett

Silently, Warren Buffett could be one of the investors hoping for the much talked about recession to happen sooner rather than later to the US economy. It might sounds cruel but the fact is this legendary Oracle of Omaha has been waiting for opportunities – prices fall to rock-bottom levels. He might just have found one, though it's a public listed company, before the end of 2007. His flagship Berkshire Hathaway (NYSE: BRK.A, stock) is buying 60% of Marmon Holdings Inc., which has about $7 billion in annual revenue.

On one side of the ring you’ve the second richest man in the world, Warren Buffett, who has $47 billion war-chest looking for acquisitions. On the other side of the ring you’ve the Pritzker Empire which is facing the 11-way split, due in 2011. The 11 siblings and cousins who were involved in the previous internal feuds would stand to get their shares should there be any more holdings not liquidated by 2011. The deal will help Pritzker family, which still controls the Hyatt hotel chain, to advance a plan to liquidate its holdings, which are estimated to be worth about $15 billion.

It was reported that the $4.5 billion deal for a 60 percent stake in Marmon Holdings was sealed within two-weeks of negotiations. Berkshire will acquire the remaining 40 percent of Marmon over the next five or six years at a price that will be based on the future earnings of the company. Marmon posted revenue of $7 billion and profit of $1 billion in financial year 2006 from operations like wire and cable, railroad tank cars (something related to Warren’s existing railroad business) and water treatment systems.

Buffett said he likes "the kind of fundamental businesses" Marmon is in, and its position in those businesses. He said he plans to keep Marmon's chief executive, Frank S. Ptak, in place, and hopes to add some "bolt-on acquisitions." Hence with the uncertainty in the stock markets particularly in relation to the possibility of a US economy slowdown, it’s wise to allocate a good ratio of stocks against cash in hand.

Other Articles That May Interest You …

Tuesday, December 25, 2007

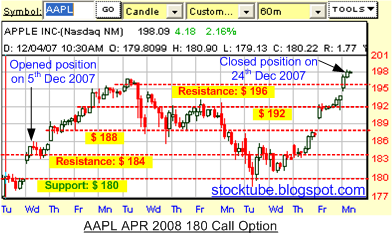

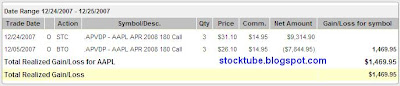

Silly Mistakes, Making Money and Christmas Eve’s Joy

Christmas has been kind to Apple Inc. but definitely no Santa’s visit to Googleplex on the last remaining couple of trading hours before the happiest day of the year – Christmas 2007. Yeap, the stock markets will be close early on 24th Dec, Christmas Eve – three hours early for people to celebrate the holiday. Depending on your geographical location (longitude and latitude) the Xmas bells might have already rang.

As much as the joy of holiday (believe it or not I’ve been listening to Christmas songs non-stop since this morning) was on the air, I made the mistake of closing the wrong position. So, instead of Apple Inc.’s (Nasdaq: AAPL, stock) AAPL Jan2008 165 Call Option, I accidently clicked on AAPL Apr 2008 180 Call Optionwithout realizing it until it was filled, although both were in the profitable position *kick myself*. Yeah, you can laugh at me. Go on and laugh it loud “HO HO HO!”

There’s another thing that you might wanna laugh. See the chart down here? How many option traders out there would have bought at $184 level, watched it skyrocket to $196 level only to see the position plunged back to $180 level “without” taking any action? Was my timing right when I opened the position on 5th Dec 2007? Going by the chart – definitely! In fact it was good money but I screwed it, well, temporarily.

One of the reasons why I love trading Apple’s option again and again is the fact that once it was trading at the normal pace (not like the tumble’s mentioned), you tend to be able to understand its cycle well. If you look at the chart, you’ll notice how the minor support and resistance levels help you in making good money. The date 11th Dec was the day the mini pull-back occurred again, though this time itwasn’t as severe as the first round. My reason for holding back might sounds silly but I believed the $200 level should be within reach.

But this time I’m not going to wait and see it plunges again, the same way it did previously, without taking some money off the table. Only this time I closed the wrong expiration Call option. Heck, I’ll just wait for it to make its traditional pullback before open new position again. Don’t you just love cyclic stocks that are predictable? Okay you can call me names again on the above’s silliness; I won’t curse you no matter what because it’s Christmas and to be able to make money on Christmas Eve is a double happiness. So Merry Christmas to all the traders out there. Cheers!!!

Other Articles That May Interest You …

Monday, December 24, 2007

Former PM Thaksin to returns home with PPP’s victory

Unofficial results (with 96% of the vote counted) from Sunday's general election gave pro-Thaksin People Power Party (PPP) 232 of the 480 seats in parliament, just short of the absolute majority needed to govern Thailand alone. The party, which has promised to bring former premier Thaksin Shinawatra back from his self-imposed exile in Britain, claimed victory on Sunday and immediately began courting potential partners.

While Surapong Suebwonglee, secretary general of the PPP, claimed they had received enough support from other parties to form a coalition government he however declined to name which parties had agreed to join PPP. The Democrat Party, which came in second with 165 seats, has already refused to join a PPP-led government. So PPP depends on the remaining five minority parties which captured the other 83 seats, with Chart Thai seen as the potential partner.

If PPP could form a coalition and dominate the government, PPP leader Samak Sundaravej would become Thailand's new prime minister. Samak told CNN Sunday that February 14 - Valentine's Day - would be a good day for Thaksin to return from exile in London, but that he would have to face corruption charges filed against him. He said a new parliament controlled by the PPP would pass an amnesty law to allow Thaksin's return and amend the constitution to allow his return to politics.

Other Articles That May Interest You …

Sunday, December 23, 2007

Why you shouldn’t invest on Brokers’ Stocks for now

Obviously you should refrain yourself from thinking, let alone committing more money investing stocks related to stock-broking i.e. the stock-brokers or investment banks that are listed in the KLSE (Kuala Lumpur Stock Exchange) – at least temporarily. Stock-brokers business is primarily depend on daily transaction volume. The more the merrier so when the daily volume exceeded the 1 billion mark these listed companies rejoiced. When the stock exchange recorded less than the mentioned figure, almost all the stock-brokers’ stock prices plunged. And the cycle continues.

Unless the stock-brokers are diversifed such as TA Enterprises Berhad which was forced to venture into property development and investment during the bearish market in order to survive, they who rely solely on stockbroking business as their bread and butter would see the immediate pinch of any slowdown. Others such as OSK Holdings Berhad (KLSE: OSK, stock-code 5053), K & N Kenanga Holdings Berhad (KLSE: KENANGA, stock-code 6483) and Hwang-DBS (M) Berhad (KLSE:HDBS, stock-code 6688) have shown weakness in their stock prices since the first quarter run-up.

Nevertheless stockbroking is still the main revenue generator to TA, with total revenue combined from property investment, property development and hotel operations couldn’t even breach (though the figure comes pretty close) the revenue from stockbroking alone, judging from the consolidated income for the fiancial quarter ended 31 Oct 2007. Brokerage fees which constitute the bulk of the income from daily transaction volume still play the vital part. Hence can you imagine the direct impact to broker house(s) that survives mainly from such fees?

Could the current bull (if you insist on calling it so) signal a new trend in, well, bull in Malaysia stock market such that people are smart and mature enough not to chase non-bluechips? Or could the new trend simply means the previous 1993’s way of pushing stock prices 10 or 20 times higher is already history? Maybe there’s a co-relation between US equity markets with Malaysia’s bull – so much so that the local and foreign hands are as quick as US traders in dumping the stocks the moment crisis such as sub-prime exploded.

Malaysia’s Bank Negara (Central Bank) might have taken the easy route by maintaining the interest rate, despite US Feds’ multiple cuts, hoping the wide-gap would force foreign fund managers to park their hot money in Malaysia. However that doesn’t means the foreign money can’t find other alternatives. Without external hot money, the government can only depends on retail investors. Unless the current administration knows how to bring back the economy from its feet, retailers might think twice about committing more resources which in turn will depress the stock-brokers even further.

Saturday, December 22, 2007

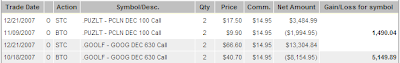

Google and Priceline’s Profits on Expiration Friday

Decided (not that I’ve other choice) to take profit today as it’s the Friday Expiration for options for the month of Dec 2007. Overall the stock markets were more positive and broad-based with Dow up by 3-digits and Nasdaq jumped more than 30-points. What a day to lock in profit. Please note that I let my option positions to run as it was deep in the money and the only thing I was looking for was the stock prices movement. There’s no more time-value. Only intrinsic value was my buddy and the timing couldn’t be better to take whatever profit left.

First it was Google’s GOOG Dec 630 Call that got triggered. Then it’s the Priceline’s PCLN Dec 100 Call’s turn to make some pocket monies. It was almost two months wait to lock in the profit, not that there wasn’t any opportunity before but I decided to hold on despite the recent major pullback. Remember when I said it was silly that the technology-stocks were punished for the mistakes done by the financial institutions? I didn’t run naked with the rest of the panicky but my profit surely was eroded by those events.

So, let’s see if Dow and Nasdaq could go even higher to which the rest of the regional stock markets depend very much on it when Monday’s trading starts.

Other Articles That May Interest You …

Friday, December 21, 2007

Oracle and Google brought cheers to Tech-Stocks

Thursday was the trading day that saw investors / traders primarily concentrated on technology stocks. The Dow didn’t perform and only managed to up by 0.29% or 38.37 points – still it was well above the support and psychological 13,000 level. However Nasdaq was up by 1.53% or 39.85 points to 2,640.86 points. That was enough to bring cheers to technology stocks such as Apple Inc., Google Inc., Priceline.com Inc. and Oracle Corp., of course.

Basically, there were two news that contributed well into the otherwise another boring trading session. Firstly the strong profits by Oracle Corp. brought back optimism to investors, at least temporarily, after days of economic slowdown haunting. Oracle's results indicate that some companies will still be able to show growth even as tight credit markets make it harder for some companies to raise capital – reported AP.

With Google’s financial strength, it could either build its own display advertisement network or buy a similar DoubleClick company but of a smaller size to prevent opposition from the EC. On the other hand, Friday will be the expiration Friday for options traders. Hence expect the usual unusual high volatility for the day.

Wednesday, December 19, 2007

Operation Normandy II – Apple’s 3G-iPhone Invasion

Japan’s NTT DoCoMo seems to be the latest partner that Steve Jobs is trying to court. Rumours were spreading that NTT and Apple Inc.’s(Nasdaq: AAPL, stock) were cooking something before the former confirmed on Wed 19th Dec that its president, Masao Nakamura, had met with Apple’s Steve Jobs. The odd is getting higher that Apple’s iPhone would reach the soil of Japan.

Kyodo News reported that DoCoMo is Apple’s top choice in a plan to penetrate Japan’s market with its iPhone. However the biggest stumbling block would be the formula on subscriber revenue sharing. Apple Inc. has multiple distribution partners in other countries including US AT&T’s (NYSE: T, stock). Amongst them are Deutsche Telekom in Germany, Orange in France and O2 in United Kingdom.

Nevertheless features wise the Japanese consumers might be yawning at iPhone since most Japanese phones are functionality-riched; but their interest could be in the slick touch-screen interface and elegant design. Consumers in Japan are looking at nothing less than a good camera with video capability (obviously) ability in ringtones selection and texting input similar to current Japanese phones (so that they don’t have to re-learn again).

Japan currently has over 73 million 3G subscribers, over a third of whom are on flat-rate data plans – meaning fast downloads of full-track music and video without having to pay extra packet charges for the data. While it was speculated that Apple Inc. is asking for 10% in terms of revenue sharing, DoCoMo was arm-folded with the message “Go fly Kite, Steve!!!” (Apple Inc.'s stock price to fly instead?)

Know About Your Money – Finding The Best Credit Card Deal

Gone were the days when you need to satisfy the tight requirements before you can walk away as the proud owner of a credit card. Recently I received a credit card issued by Citibank that comes specifically with goodies if you're a frequent traveller of AirAsia. Credit card marketing is gettingcreative, what more with other corporate partnerships. It's rather difficult to live without a credit card, at least not me. But I still believe that unless you can control your spending habit and able to pay your outstanding, don't try walking around with one.

If your financial situation is a little precarious coming up to the New Year then your resolution should be to sort it out. After Christmas there is no better time to sort out your finances and credit card debt because you can accurately gage what you can afford to pay out in order to get it clear. There will also be more and morecredit card offers available to you so you can make the most of them and choose the best one for you if you compare credit cards effectively.

But how can you do that? It can be a lot of time and hassle, unless you use one of the better credit card comparison websites available. One of those that you should consider using is About Your Money. This is one of the newer ones but it is just as good as the larger ones and is not peppered with advertising! There arecompare credit cards tables, interest rates, offers and anything else you may want to know all laid out in a handy package that is extremely easy to use.

To be honest, there are that many credit cards available at the moment that you would be forgiven for getting confused when you try to compare them. That may be why they have provided a guide as well to help you to figure out what you want and need. Check it out because you'll find it much better than taking a stab in the dark and choosing the wrong one!

However as usual, credit card is a tool to facilitate whenever you're short of cash. So treat it as a tool of convenience and not a tool to be abused.

Tuesday, December 18, 2007

Can Proton just make up its mind on the partnership?

Less than a month since ailing Malaysian carmaker Proton Holdings Bhd(KLSE: PROTON, stock-code 5304) abruptly called off any negotiation with both Germany's Volkswagen (FRA: VOW) and US-based General Motors Corp. (NYSE: GM, stock), the reason begun to appears although it’s still hard to determine if this could be the actual reason - NAZA Group was given preferential option to become the strategic partner for Proton Holdings Berhad.

While StockTube still thinks the initial talk ended due to its sensitivity with general election around the corner, Volkswagen should not waste any more time playing to the tune of the national carmaker. Just after Proton announced the call-off, the same party announced it didn’t close the door entirely and the talk could resume. And now you have this NAZA Group trying to play the white-knight role. The lame reason given for the initial call-off was that Proton registered a net profit of RM3.5 million on revenue of RM1.3 billion, the first quarterly profit after six continuous quarterly losses.

However it doesn’t takes a rocket scientist to undertand the profit was purely due to the model launched, Proton Persona with over 20,000 bookings, of which if you look closer it was a minor facelift from the older version of Gen-2. Furthermore the RM3.5 million net profits were too tiny to be celebrated, let alone declaring the carmaker was out of wood. Surely Proton’s management and Malaysian government aren’t stupid to acknowledge this (are they?). The government also repeatedly announced that Proton would not get a local partner (NAZA or DRB-Hicom) as both parties didn’t have distinct value-propositions that could push Proton to the next level of survival.

If Proton decided to sleep with local partner, then it’s time to define the framework of its business model. Do what the local boys are good at – distribution. Don’t even try to do assembly unless they can improve on the quality. You might think how hard it could be to achieve top-quality in assembly-lines. Well, if they can do it, you won’t have the same decades-long complaints about problems (amazingly each Proton model has its own trademark of problems) till now.

However the magic bullet for Proton to prolong its life depends on its luck in China’s market. If Proton could just put more resources in ensuring high quality for its Europestar model with competitive pricing, it might just be able to float temporarily – until it falls into quarterly losses again (that would be another story for another time).

Other Articles That May Interest You …

Monday, December 17, 2007

Jim is still the Mad Cramer, make no mistake about it

There’re not many crazy stock investors or traders around, at least not that StockTube is aware of. However when you have someone as crazy and mad as Jim Cramer you just got to be both flabbergasted and thrilled. If you’ve been trading for a while in the US stock markets chances are you should know this crazy fella who didn’t give a damn when he got mad or irritated at somebody or something. He’s easily one of the best stock entertainers around and you can’t miss him if you glued yourself to CNBC.

Mad Cramer might be, well, crazy but he did help lots of people in the basic fundamental of stocks investing. He dares to make a call on stocks that he think are fabulous and he won’t think twice about telling his audience to flush stocks down the toilet if he hates them. Yes, he runs radio shows that attracted great number of followers and he’s influence all right judging by how certain stocks jumped the moment he recommended it. While he was proud and enjoyed every moment of his influence, he was responsible enough to advise his fanatic fans not to chase the stocks that were bid-up ridiculously high as a result of it – something known as “Cramer Spike”.

Jim Cramer, the flamboyant host of CNBC’s Mad Money is seen as the hyperactive stock-picker. But nobody gets past his screening, not even the most powerful man in the global stocks markets – the Feds Chairman Ben Bernanke.His proudest moment of the year (2007) is an on-air tantrum in the middle of the summer's financial crisis, a plea to the Federal Reserve Chairman Ben Bernanke to take action. "He has no idea how bad it is out there. He has no idea!" he told CNBC's Erin Burnett. Watch the video below and judge for yourself how mad, or rather brave he was. Try to do that to Malaysian Prime Minister and you could end up in detention without trial under Internal Security Act (ISA).

people actually won't get rich by buying individual stocks, Cramer says. Unless you do your homework, namely spending an hour a week researching for each stock you own, "You won't beat the market, and you'll probably lose money," he writes.

people actually won't get rich by buying individual stocks, Cramer says. Unless you do your homework, namely spending an hour a week researching for each stock you own, "You won't beat the market, and you'll probably lose money," he writes. Jim may come to his sense that investing long term is probably the bullet to riches after all, compare to short-term traders. One of his critics (reported in BusinessWeek) said Cramer is a "chair-throwing, self-aggrandizing clown who gives terrible advice”; but at the same time couldn’t help but to admit “he's obviously a smart man who knows better”. No matter what, he’s still the Mad Cramer in the Mad Money who helped lots of people making money investing stocks. And I believe he’ll continue to be mad for a very long time. You can search other books written by Jim Cramer here.

Other Articles That May Interest You …

RHB Bank to be Sold Again, EPF to make good money

Money from Middle East is basically screaming to be flushed elsewhere. While the US dollar is flushing down the toilet, Middle East’s fortune is looking into, well, Islamic countries to be flushed. One of the countries that attracted these hot monies is Malaysia, not a hard thing to understand since Malaysia premier PM has been on the roadshow marketing his version of Islam Hadhari. According to Wikipedia however, the theory of Islam Hadhari was originally founded by the first Prime Minister of Malaysia, Tunku Abdul Rahman in 1957 but was under different name. So the current PM Abdullah Badawi hijacked the theory, renamed it as Islam Hadhari and claimed it’s his own creation?

Well, we’re not going to debate on this issue but rather how the Middle Eastern countries slowly but surely invading Malaysia’s corporate scenes. Let’s face it – with oil prices at current level, the Aladdins are basically speechless with their newly found treasures. They’re on the shopping spree as their own kingdoms are nothing but sands. Besides being the center of oil reserves there’s nothing interesting to invest. So they bought marbles from Italy, Ferraris, private jets, hotels around the world, financial institution from foreign soils and they even tried to buy the port from US but was met with furious controversy over port security and pressure from Congress that they backed-off.