Sunday, April 29, 2007

Stem Cells - Who Is Crazy? Public or Malaysian Government?

Maybe Dr Chua should do some studies (I hope he knows how to search for info from the internet) on what cord blood can do and the un-charted potential of it. Here are some sites for him to click if he’s too lazy to even move the mouse to search:

Since the potential and benefits of cord blood are not known to most of the public, discarding the cord blood at the time of birth is commonly done in 99 percent of all deliveries.

What are Cord Blood Stem Cells?

Blood can be collected from the umbilical cord of a newborn baby shortly after birth. This blood is rich in blood stem cells that can be used to generate red blood cells and cells of the immune system. Cord Blood stem cells can be used to treat a range of blood disorders and immune system conditions such as leukaemia, anaemia and autoimmune diseases. Once collected, cord blood can be stored in a cord blood bank and would be available for use by the donor and compatible siblings.

Ethical Issues

Although cord blood stem cells are less versatile than Embryonic Stem cells, their use in research is less controversial as it does not involve the destruction of embryos. Their potential use for cell-based therapies is also attractive as it would be possible to use a patient's own cord blood stem cells to generate tissue for transplantation, thus avoiding problems with immune rejection.

Saviour Siblings

Controversy has arisen over the practice of genetically selecting

The first 'saviour sibling' to be born in Australia was reported in March 2004. A Tasmanian couple used this technology to have a second child who was free of a genetic condition, Hyper IgM Syndrome. Cord blood from this child could be used to treat the affected sibling. As a result of this selection process carried out Sydney IVF Clinic, the woman started her pregnancy knowing that her baby was free of Hyper IgM Syndrome and would be a potential tissue donor for her existing son.

What are the potential uses of human stem cells?

Most of the body's specialised cells cannot be replaced by natural processes if they are seriously damaged or diseased. Stem cells can be used to generate healthy and functioning specialised cells, which can then replace diseased or dysfunctional cells.

For example, in Parkinson's disease, stem cells may be used to form a special kind of nerve cell, a kind that secretes dopamine. These nerve cells can theoretically be transplanted into a patient where they will re-wire the brain and restore function, thus treating the patient.

If Dr Chua is still not convince on the importance of

Dr Chua further claimed that if there’s indeed potential for the use of stem cells, his ministry will study it. The first question I would like to ask him is “Does his ministry has the EXPERTISE to even start producing a medical research on what is stem cells at the first place?” From his statement that the private Malaysian stem cells storage provider is charging RM 500 a year for the storage, somehow I can smell that he’s envy of such companies. Would he think the same if he holds some stake in these companies? Not that his ministry can provide a cheaper alternative by building public stem cells bank.

I’m sure if his ministry can provide the same service and charge half the price (since he’s complaining the high price the private providers) there would be long queues waiting to subscribe for the service. How much money can his ministry make? Based on StemLife Berhad (KLSE: STEMLFE, stock-code 0137) annual report ended 31-Dec-2006, StemLife stored over 5,000 units of stem cells taken from umbilical cord blood of newborn babies. Supposing Chua’s ministry is charging $200 per unit, he’s making over RM$1,000,000 – and mind you, this is repeat annual sales.

Also, StemLife Berhad (currently the largest stem cell bank in South East Asia in terms of units stored) announced (in the annual report) the type of diseases treated successfully retrieved from its’ bank. The following data proves some of the diseases which were successfully treated by Malaysia’s hospitals from stem-cells released (the quantity of treatments is not shown):

- 2004 : General Hospital Kuala Lumpur - Leukemia

- 2004 : Gleneagles Medical Center Penang (GMCP) – Lymphoma

- 2005 : GIMC – Diabetic foot ulcer

- 2005 : HSC – Heart disease

- 2005 : GMCP – Lymphoma

- 2006 : HSC – Heart disease

- 2006 : Subang Jaya Medical Center – Heart Disease

- 2006 : GIMC – Heart Disease and Diabetic foot ulcer

- 2006 : University Hospital – Thalassaemia major

- 2006 : GMCP – Leukemia and Lymphoma

- 2006 : HSC – Heart Disease

As you can see from the simple summary, the number of cases where diseases are cured from stem-cells over the years has been on uptrend. So, how could a Health Minister (himself a doctor) makes such irresponsible claims to confuse the people? If there’s no potential and all these stem-cells is purely “hype”, then the medical specialists in those developed countries who spends millions on it are mainly stupid and morons, aren’t they?

Perhaps the Malaysian government should start preparation to shutdown all these stem-cells storage providers since they’re making money (cheating) out of the public with the hype of it. But these listed companies were approved by the same Malaysian government via Bursa Malaysia (KLSE: BURSA, stock-code 1818) andSecurities Commission. Indirectly are we to say Malaysian government is cheating money out of public since the Health Ministry does not even recognize such a business at the first place?

To those who succeed in getting and still keeping some StemLife’s shares, congratulations as you’ve made over690% profit from the initial IPO of RM 0.33 per share.

Other Articles That May Interest You ...

Thursday, April 26, 2007

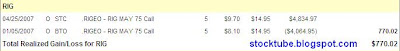

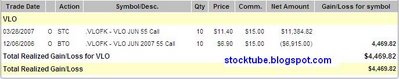

RIG - Locking Profits After Four Months of Waiting

I entered the position back on 5-Jan-2007 during the period when the oil price hit $55 per barrel. Right after the position I posted the reason why I chose to take the risk investing in this stock. You can read it at What's Your Bet Now Oil Is At $55?

It has since climbed above the resistance of $81 per share. It took almost three months to do that - the main reason why I always investing more than 120 days to option expiration for "oil stocks". You see, oil or energy stocks are cyclical - I can almost swear that the worldwide oil price is controlled by the cartel of the middle-east countries with influence from United States. Or else how can you explain the cyclical pattern? When the oil price drop to below $60 per barrel, you can bet it always and almost will rebounce within the next 6 months (usually within 3 months).

Though this means trading option or investing oil stocks are rather expensive, you can almost can be sure of making money out of it. It's a matter of how much money you want to make, which boils down to the question of how greedy you are. Somehow, as long as President Bush is sitting inside the Oval Office, you can pretty much know that oil price will never goes back to pre-historic period of below $50 per barrel (at least not for long).

APPLE Scores Big – Wait Till iPhone Comes to You

I would think the after-hours trading which saw the stock-price gained more than 7 percent is mainly due to the “double happiness” effect. The great quarterly profit merely started the engine but the vote of confidence by the board (which includes former Vice President Al Gore) in defending CEO Steve Jobs from new accusations of the company’s backdating of stock options is the turbo that propels the stock skyrocket above $100 a share. That’s the reason why the shares of Apple which closed at $95.35, up $2.11 (2 percent) on the Nasdaq Stock Market, leaped to$102.40 in after-hours trading.

For the first three months of the year, Apple said it earned $770 million, or 87 cents per share, up from $410 million, or 47 cents per share, in the year-ago period. Sales were $5.26 billion, up 21 percent from $4.36 billion last year. According to Thomson Financial, analysts, on average were looking for earnings of 64 cents per share on sales of $5.17 billion.

For the first three months of the year, Apple said it earned $770 million, or 87 cents per share, up from $410 million, or 47 cents per share, in the year-ago period. Sales were $5.26 billion, up 21 percent from $4.36 billion last year. According to Thomson Financial, analysts, on average were looking for earnings of 64 cents per share on sales of $5.17 billion. Apple said it shipped 1.5 million Macintosh computers and more than 10.5 million iPods during the quarter. Wait till you see the profit when iPhone comes and rule (well, not exactly eat-up in one shot but gradually) the market. While this is the good news to my investment portfolio, the same cannot be said on Akamai stock after earning announcement.

Apple said it shipped 1.5 million Macintosh computers and more than 10.5 million iPods during the quarter. Wait till you see the profit when iPhone comes and rule (well, not exactly eat-up in one shot but gradually) the market. While this is the good news to my investment portfolio, the same cannot be said on Akamai stock after earning announcement.Akamai Technologies Inc. (Nasdaq: AKAM, stock) announced first-quarter profit that surged 67 percent on solid revenue growth. But investors were unimpressed, and sent the company's shares sharply lower in the final minutes of trading on the Nasdaq Stock Market. So now you know why it’s so damn hard to satisfy these market makers who usually are the market mover.

Net income for the quarter was $19.2 million, or 11 cents per share, up from $11.5 million, or 7 cents per share, for the first quarter of 2006. Excluding certain expenses, income in the latest quarter was $50.7 million, or 28 cents per share.

Revenue for the quarter was $139.3 million, up 53 percent from $90.8 million in the year-ago period. Analysts expected earnings of 28 cents per share on $138.8 million in revenue, according to a Thomson Financial survey. Akamai shares mostly held steady throughout the day, but after the company released its earnings in late afternoon, they dived $5.62, or 10.3 percent, to finish at $48.97. Depending on the chart behavior during the first 45-minutes of trading, I might decide to reverse my position or convert it into spread. The stock could goes into worse territory since those investors who bid-up the Call options might decide to cover their position.

The same story goes to F5 Networks, Inc. (Nasdaq: FFIV, stock). My position is in Put option (when it was bid-up the same way like Akamai) mainly due to the technical analysis that shows a stagnant rally since early of the year (2007). $80 bucks per share seems to be the strong resistance with $70 as the next resistance – the 1-year chart shows a very tired bull losing steam to the bear.

Malaysian Government So Rich It Rejects Tax-Payer's Declaration

Wednesday, April 25, 2007

AKAM and The Gang of Four – AAPL, CTXS, FFIV & FRK

After Waters Corporation (NYSE: WAT, stock), Brinker International Inc. (NYSE: EAT, stock) and Coach Inc. (NYSE: COH, stock) disappointed me, I hope (hey, sometime I can only predict whether it’ll beats earning but not the bottom line etc) my luck (who said you don’t need lucks to maximize your profit?) will change for the better. Anyhow, as an investor, you should still do your research on stocks’ fundamental and technical analysis.

Rating Indicators for AKAM:

- StockScouter rating : 9 / 10

- Whisper Number for this stock : 0.31

- Schaeffer rating for this stock : 6 / 10

- Power Rating : 5 / 10

- Insider Trading (last 52 weeks) : ($38.65 M)

- Zacks Analysts Rating: Hold

- Option Trading: June 2007 55.00 Call

- Implied Volatility (IV) for June 2007 $55.00 Strike : 40.91%

Sales, Income & Growth - For the past 12-months, Akamai registered $428.67 Million in sales versus the industry’s $4.32 Billion. Income amounted to $57.40 Million against the industry’s $475.64 Million. While Akamai’s 12-months sales growth is at 51.4%, the income growth is in negative 82.50% (the same industry sector sales growth is at 25.80% and income growth of 119.30%).

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 13.4%. Akamai has a debt/equity ratio of 0.21 compare to industry’s ratio of 0.50.

Stock Resistance & Support Level – The resistance is at 59.69 (52-week high)while the first level support is at 52.44 (50-day moving average)

Risks – The ratio of AKAM's price-to-earnings multiple (160.20) to its five-year growth rate is above the average of all stocks.

Cramer believes both Apple Inc.’s (Nasdaq: AAPL, stock) and Akamai will be worth getting into ahead of their quarters - Apple as a play on its new iPhone and Akamai as a way to play streaming video.

Cramer believes both Apple Inc.’s (Nasdaq: AAPL, stock) and Akamai will be worth getting into ahead of their quarters - Apple as a play on its new iPhone and Akamai as a way to play streaming video.Akamai says that traffic generated by its SaaS (Software-as-a-service model) customers increased fivefold in the year ending January 2007. Let’s face the fact, SaaS can't work without a secure and reliable Web infrastructure to undergird it. SaaS up and coming Google (Nasdaq:GOOG, stock) could unleash a market that researcher Gartner says will triple to $19.3 billion by 2011 – which would put Akamai in the center of attention.

Furthermore demand for software-as-a-service is increasing as small and large businesses alike have become more and more frustrated by the lengthy deployment cycles and the costly maintenance of traditional software. By using the Akamai Web Application Acceleration solution for secure and reliable application acceleration, SaaS providers can confidently approach any enterprise regardless of their size and geographic distribution while reducing the operating costs associated with IT.

"We expect that Google's deal for Doubleclick will benefit public assets such as aQuantive, ValueClick, and possibly even Akamai, as there is a scarcity of high-quality assets combined with an aggressively consolidating sector," Scott Devitt, an analyst with Stifel Nicolaus, said in a research note.

Other Stocks Under My Radar (for today’s after market closing target stocks):

- Florida Rock Industries, Inc. (NYSE: FRK) – can you believe I still keep this baby from my positions of the previous quarter pre-announcement? The volume is rather low for this stock.

There’re just too many potential and great companies going to announce their earning announcement this week. I just can’t cover all of them, so I’ll just choose based on stocks which I made money from it before – simply because I’m comfortable with it’s fundamental.

Tuesday, April 24, 2007

PayPerPost Acquires Zookoda Instead

Zookoda is said to command a 10,000 blog customers sending emails to 2.3 millions people.PayPerPost might hopes to leverage on Zookoda which allows active bloggers to attract readers to return to their blogs regularly with the email newsletter concept. But provider such as feedburner is already providing such offering and is the leader in email-notifications for readers who subscribe for such feeds.

Why PPP is looking for something such as Zookoda which might not add much-value

to it's current blogger's database is beyond my imagination. EarlierStockTube wander too far away by suggesting that PPP might be courting something more imaginative such as Shozu in PayPerPost Acquired A Company - Who, Why & What? which I think makes more sense. Anyway, PPP might not have too deep a pocket for new acquisition. It seems PPP's management direction is to continue add blogger's size by acquiring companies with database of bloggers.

to it's current blogger's database is beyond my imagination. EarlierStockTube wander too far away by suggesting that PPP might be courting something more imaginative such as Shozu in PayPerPost Acquired A Company - Who, Why & What? which I think makes more sense. Anyway, PPP might not have too deep a pocket for new acquisition. It seems PPP's management direction is to continue add blogger's size by acquiring companies with database of bloggers.Other Articles That May Interest You ...

Monday, April 23, 2007

Take A COACH of Luxury Accessories and Money Away

Rating Indicators for COH:

- StockScouter rating : 9 / 10

- Whisper Number for this stock : 0.38

- Schaeffer rating for this stock : 6 / 10

- Power Rating : 5 / 10

- Insider Trading (last 52 weeks) : ($82.08 M)

- Zacks Analysts Rating: Moderate Buy

- Option Trading: June 2007 52.50 Call

- Implied Volatility (IV) for May 2007 $52.50 Strike : 31.39%

Sales, Income & Growth - For the past 12-months, Coach registered $2.40 Billion in sales versus the industry’s

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 24.1%. Coach has a debt/equity ratio of 0.01 compare to industry’s ratio of 0.06.

Stock Resistance & Support Level – The resistance is at 53.81 (52-week high) while the first level support is at 49.86 (50-day moving average).

Risks – The price-to-earnings multiple, 35.20 is higher than the average industry level.

Stifel Nicolaus & Co. analyst David A. Schick expects "solid" results for the New York-based company. "We believe strong momentum from the holiday season continued through the third quarter, highlighted by the introduction of the Carly handbag group, new styles in the Hamptons and Soho collections and the introduction of fragrance (store checks indicate strong initial reception)," wrote Schick in an April 20 earnings preview. He affirmed his "Buy" rating, and raised his price target to $55 from $50.

Oppenheimer & Co. analyst Christopher Jones reiterated his "Buy" rating as well. He believed the company will "continue to create innovative products and distribute them through new and existing channels." Buckingham Research Group analyst David J. Glick predicted Coach will raise 2007 guidance during its earnings conference call on Tuesday.

Checks indicate Coach’s management is focusing on the high-end market and have introduced several items with higher prices than usually found in Coach stores. With it’s almost perfect 45-degrees chart, I couldn’t find a reason not to invest or trade the option of this luxury maker. What more, this stock has been beating earning estimate since 2002 (that’s 5 years in a row).Not many stock can do it, don’t you agree?

Can I EAT and Make Money At The Same Time?

Rating Indicators for EAT:

- StockScouter rating : 5 / 10

- Whisper Number for this stock : N/A

- Schaeffer rating for this stock : 5 / 10

- Power Rating : 6 / 10

- Insider Trading (last 52 weeks) : ($12.16 B)

- Zacks Analysts Rating: Hold

- Option Trading: July 2007 30 Call

- Implied Volatility (IV) for July 2007 $30.0 Strike : 26.41%

Sales, Income & Growth - For the past 12-months, Brinker registered $4.28 Billion in sales versus the industry’s

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 5.3%. Brinker has a debt/equity ratio of 0.45 compare to industry’s ratio of 0.51.

Stock Resistance & Support Level – The resistance is at 33.29 (50-day moving average) while the first level support is at 29.11 (200-day moving average).

Risks – The ratio of EAT's price-to-earnings multiple (18.7) to its five-year growth rate is above the average of all stocks. Shares are being heavily sold by financial institutions

Earlier in mid-Apr, competitor restaurant chain Ruby Tuesday Inc. reported on Wednesday a 5 percent drop in third-quarter net profit and lowered its profit and sales outlook for the year in part because sales this quarter have lagged expectations. The company, which operates a chain of bar-and-grill restaurants, said aggressive discounting by rivals (including Brinker) and frigid temperatures have kept customers away in recent weeks.

Just like Waters Corporation, Brinker has been consistently beat earning estimate from analysts since 2005. I believe this stock will beat earning again – simply because its’ competitors are losing out. My reason for trading option for Brinker is the same as YAHOO's Loss is GOOGLE's Gain -Time to Make Money plus for the simple reason people just can’t stop eating.

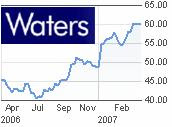

Waters Equal Money – Will This Stock Make Me Money?

Waters Corporation (NYSE: WAT, stock) will announce its’ earning tomorrow, Apr-24-2007 (before market open). Waters Corporation (Waters) is an analytical instrument manufacturer. The Company operates in two business segments: Waters Division and TA Division (TA). Through its Waters Division, Waters designs, manufactures, sells and services high-performance liquid chromatography (HPLC), ultra performance liquid chromatography (UPLC), referred to as liquid chromatography (LC), and mass spectrometry (MS) instrument systems and support products, including chromatography columns and other consumable products.

Rating Indicators for WAT:

- StockScouter rating : 8 / 10

- Whisper Number for this stock : 0.55

- Schaeffer rating for this stock : 6 / 10

- Power Rating : 5 / 10

- Insider Trading (last 52 weeks) : ($11.78 M)

- Zacks Analysts Rating: Moderate Buy

- Option Trading: Aug 2007 60 Call

- Implied Volatility (IV) for Aug 2007 $60.0 Strike : 22.48%

Sales, Income & Growth - For the past 12-months, Waters registered $1.28

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 17.4%. Water has a debt/equity ratio of 2.49 compare to industry’s ratio of 0.39.

Stock Resistance & Support Level – The resistance is at 60.59 (52-week high) while the first level support is at 57.38 (50-day moving average).

Risks – The price-to-earnings multiple, 28.00 is higher than the average industry level.

Waters has seen revenues increase by more than 10% each year, and earnings per share by more than 15% a year. Much of its growth over the last three years can be attributed to its breakthrough Acquity UPLC (ultra performance liquid chromatography) machine. The product, which can cost from $150,000 to $600,000, enables drug companies to cut the analysis of a new chemical sample from some 60 minutes to 5.

Waters depends on demands from pharmaceutical company for its specialized lab equipment. Waters has been consistenly beats earning estimate since 2005. And based on its record, it should not have problem getting business from the companies.

Sunday, April 22, 2007

PayPerPost Acquired A Company – Who, Why & What?

In my previous blog which I wrote PayPerPost - Another Way to Make Pocket Money, I mentioned how PayPerPost bought over Performancing two important tools to further enhance its’ offerings. Leveraging on the tools, PayPerPost’s publishers and advertisers will have better report on visitors’ statistic. The acquisition will also drive traffic from the strong28,000 quality bloggers which will attracts more in terms of quality and quantity advertisers to PayPerPost’s market-place.

Now, PayPerPost has announced to its’ publishers or bloggers that it has acquired a companybut it wouldn’t tell which is it. To make things more interesting, PayPerPost opens up the guessing game to all it’s bloggers. OK, PayPerPost is not a giant like Google Inc.’s (Nasdaq: GOOG, stock) who has a deep pocket for basically any acquisition the money-making money likes. While Google has billions, PayPerPost might have only millions in its’ war-chest for acquisition.

I wish I know but it can’t be a listed company on the stock exchange. PayPerPost has the business model which leverage on both advertisers and publishers. An all three parties make profit in this win-win-win situation. PayPerPost basically has the mini Google’s Adsense or Yahoo Inc.’s (Nasdaq: YHOO, stock) Panama advertising model in place by now. The company acquired should be able to deliver the missing piece(s) that can bring further value to PayPerPost. My guess isPayPerPost has acquired ShoZu.

Why PayPerPost Acquired Shozu?

ShoZu provides the free service for anyone who has a phone to send and receive photos, videos and music anywhere anytime. With the acquisition, PayPerPost’s bloggers can do another thing –Video Blogging, a method of blogging which is gaining popularity. ShoZu allows you to capture videos or photos with your phone and upload it to the web instantly. You can add description and tags either before or after uploading the videos and photos. Your destination can be an email, a blog (such as Blogger and WordPress), a photo website (such as Flickr) or a video website (such as YouTube). The cool thing is whenever your friends comment on your online video or photo, ShoZu automatically forwards their comments to your phone of which you can reply direct from your phone. What more, ShoZu is FREE to download and use.

What does this mean for the Posties?

Posties will definitely benefits from such acquisition as he/she doesn’t need to hook-up to internet to do postings. Instead posties now can posts anywhere anytime from the phone. The volume of postings will definitely shoots-up many-fold and this could rival Google’s Bloggger (which also has the function to enable mobile-blogging). With such convenience, PayPerPost should not have problem getting more venture funding to expand and get ready their infrastructure for the flooding-volumes of postings.

PayPerPost - Another Way to Make Pocket Money

What attracted PayPerPost to purchase the selective assets of Performancing.com were two main tools namely Performancing Metrics and Performancing Exchange.

Performancing Metrics enable bloggers to track visitors statistic including blog comments, ads clickthrough and how Google Inc.’s (Nasdaq: GOOG, stock) money-making Adsense. On the other hand, Performancing Exchange is a brilliant tool which brings internet communities together enabling companies and other people who wish to employ professional bloggers to offer their service. The acquisition gave PayPerPost instant access to a pool of 28,000 quality bloggers who became PayPerPost customers.

PayPerPost which has recently raised $ 3 Million in venture funding is a company which business model depends on advertisers and bloggers who are also their members. Once a blogger registered as a member of PayPerPost, he/she will get paid for blogging. You can write about web sites, products, services, and companies and earn cash for providing your opinion and valuable feedback to advertisers.

Now, how can you make money online? If you’re a loyal (if you’re not, I hope you will become one) readers of StockTube, then logically you’re either have deep interest in stocks investing or option trading. This means you’re already an investor or a trader in the equity markets. If you’ve not started trading option or stocks, then you’re a newbies trying to understand more about the world of investing. You’ve to congratulate yourself for being able to trade online via internet at the current age, talk about the investment opportunity availale during your parent time.

But if you’re still not sure about investing in stocks or option, thinking the risks are too high, maybe you might want to make some little pocket-money from the internet by trying thePayPerPost program. What’s the risk? You might lose some of the time blogging if your posts are not accepted by PayPerPost. There're wide varieties of topics to choose from, ranging from technology, health, entertainment, business, free stuff, education etc. That’s your risk. What’s the requirement?

Your blog has to be at least 90 days old (that’s roughly 3 months)

- Your blog must be in English language

- Your blog must have at least 20 pre-existing posts

- Your blog must have no more than 30-day gap between posts in the past 90-days

- Your blog must not have violence or racial intolerance, pornography or adult content.

Once you have registered as PayPerPost member, what you need to do is wait (normally within 48 to 72 hours) for the approval. Once approve, you can start choose the opportunity from a list of advertisers. Some of them specifically require you to write positively about their program, product or services but some of them are neutral. If you’re evil enough you can write positive follows by negative things about them. But most of the advertisers want you to write sincere review. Some of them also want bloggers from specific geographical location only such as from United Kingdom or Australia. The minimum pay for each posts is USD$ 5.00 (RM 17) and you can take up a maximum of three posts per day.

So, if you’re interested, then sign-up here at PayPerPost or click on banner image below to register:

Do you notice a small bar at the bottom of each post within StockTube blog? It looks something like:

To take immediate advantage of a special opportunity, what you need to do is to write aboutStockTube’s post and earn USD$ 7.50. How else can it be any easier to make money than this? Yeah, I know it sounds like chicken-feed compare to your profit investing stocks or trading option. But as I said above, if it’s too early to start your investing or trading’s journey, why not earn some pocket-money blogging StockTube’s post while at the same time read and enjoy what I’ve blogged (almost on daily basis)?

Saturday, April 21, 2007

MoneyMaking Machine GOOGLE – Did You Make the Money

I actually checked the earnings calendar earlier (on Friday of the second week of Apr) but whenever you do that you’ll realize most of the earning dates are not

CONFIRMED. If you’ve been trading option, you’ll know what I mean. The stock which caught my eyes then was Citrix System Inc(Nasdaq: CTXS, stock) but somehow the earnings date has been changed to Apr-25-2007 (after market close) instead of earlier published Apr-18-2007.It’s a good practice therefore to develop a discipline of checking and re-checking the actual date of earning announcement.

CONFIRMED. If you’ve been trading option, you’ll know what I mean. The stock which caught my eyes then was Citrix System Inc(Nasdaq: CTXS, stock) but somehow the earnings date has been changed to Apr-25-2007 (after market close) instead of earlier published Apr-18-2007.It’s a good practice therefore to develop a discipline of checking and re-checking the actual date of earning announcement.Google Inc. keeps giving Wall Street what it wants - scintillating earnings growth that eclipses analyst estimates quarter after quarter when it announced a 69 percent increase in first-quarter profit to surpass analyst projections by 38 cents per share. If not for expenses incurred for employee stock compensation, Google would have earned $3.68 per share, beating Thomson Financial estimate of $3.30 oer share.

Quarterly revenue reached a new company high of $3.66 billion, a 63 percent increase from $2.25 billion a year earlier. After subtracting advertising commissions and other payments to its partners, Google's revenue totaled $2.53 billion. That amount was about $40 million above analyst estimates.

Goldman Sachs analyst Anthony Noto restated his "Buy" rating and $620 price target for Google, saying he expects healthy growth for the year. The analyst raised his fiscal 2007 and 2008 earnings per share estimates to $15.10 and $19.50, respectively.

Looking at the chart, I’m hoping the support level of $482 will be formed as a strong basesoon. But with all the potential legal suits and complaints about Google being too big might create volatility to the Google’s stock. Already Microsoft Corp. (Nasdaq: MSFT, stock) and AT&T Inc.(NYSE: T, stock) are urging government regulators to block the DoubleClick deal as both are worried sick that Google will gain too much control over the online advertising market.

Looking at the chart, I’m hoping the support level of $482 will be formed as a strong basesoon. But with all the potential legal suits and complaints about Google being too big might create volatility to the Google’s stock. Already Microsoft Corp. (Nasdaq: MSFT, stock) and AT&T Inc.(NYSE: T, stock) are urging government regulators to block the DoubleClick deal as both are worried sick that Google will gain too much control over the online advertising market.And in case you’re wondering, nope, I’ve not close my position yet on Google June 2007 470 Call. I would like to see if it can re-test the $ 500 per-share level again (yeah, you can call me a greedy pig). Furthermore with more than 2 months to go, the time-decay has not kick-in yet, not in huge momentum yet. But as I blogged earlier in YAHOO's Loss is GOOGLE's Gain -Time to Make Money, this giant is a very risky stock to invest either in stock of option trading. In terms of gap-up value, this is the highest gap-up (a whopping $19 from Thursday’s closing to Friday’s opening) in the history of my blogging in StockTube. How can I not love this stock?

Other Articles That May Interest You ...

Thursday, April 19, 2007

YAHOO's Loss Is GOOGLE's Gain - Time to Make Money

In August 2006, it acquired Neven Vision, an online photo-search company. On October 10, 2006, it acquired the online video company, YouTube. In October 2006, it also acquired JotSpot. And the most recent is the acquisition of DoubleClick for a whopping $3.1 Billion

Google’s stock price has been trading in the tight range of between $ 461 and $ 475. As of current stock trading price, Google’s share price will either jumps above $ 475 or dive below $ 461 depending on it’s earning today (after closing bell). Yahoo Inc. (Nasdaq: YHOO, stock) traditionally provides the yardstick of how Google will performs. Yahoo’s loss will be Google’s gain and vice-versa, let’s look at some fundamental data on Google.

Rating Indicators for GOOG:

- StockScouter rating : 7 / 10

- Whisper Number for this stock : 3.20

- Schaeffer rating for this stock : 5 / 10

- Power Rating : 5 / 10

- Insider Trading (last 52 weeks) : ($2.32 B)

- Zacks Analysts Rating: Moderate Buy

- Option Trading: June 2007 470 Call

- Implied Volatility (IV) for June 2007 $470.0 Strike : 28.18%

Sales, Income & Growth - For the past 12-months, Google registered

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 29.0%. Google has a debt/equity ratio of zero compare to industry’s ratio of 0.03.

Stock Resistance & Support Level – The resistance is at 513.00 (52-week high) while the first level support is at 460.81 (50-day moving average).

Risks – The price-to-earnings multiple, 48.00 is higher than the average industry level. Previous day's closing price for GOOG was close to its 50-day moving average. Heavy insider selling especially by Schmidt Eric could put some concern on the stock price to some analysts.

Shares of search engine operator Yahoo Inc. sunk in heavy trading Wednesday, as several analysts restated ratings while showing concern over the company's Tuesday announcement that first-quarter earnings declined 11 percent. On Tuesday, Yahoo announced its first-quarter profit fell 11 percent to $142.2 million, or 10 cents per share, from $159.9 million, or 11 cents per share, in the year-ago period.

It’s always the competition between Yahoo and Google in the online advertising business. Yahoo’s Panama which is suppose to rival Google’s Adsense has been a failure so far in giving Google a run for its’ money. As long as Yahoo disappoints, Google should shines with the market automatically in its’ portfolio. Furthermore, out of 10 times, Google beats Whisper Number 8 times in the earning estimation. Please take note that investing Google's stock is always a risky business.

Other Articles That May Interest You ...

Internet Investment's Get-Rich-Scheme You Should Avoid

“The public is advised not to make any investment with companies that are not licensed or approved by the SC,” the SC’s website said. The SC warned investors against the fraudulent investment scheme operated by Cambridge Capital Trading, which has thus far targeted Australian and Singaporean investors.

In February, the SC froze two Malaysian bank accounts amounting to RM1.6mil, closed two websites and questioned several individuals believed to be connected to a global Internet investment scam run by Cambridge Capital Trading.

In February, the SC froze two Malaysian bank accounts amounting to RM1.6mil, closed two websites and questioned several individuals believed to be connected to a global Internet investment scam run by Cambridge Capital Trading.As for Gold Quest International or GoldQuest, it had its offices in Kuala Lumpur raided in 2000 by the Domestic Trade and Consumer Affairs Ministry for allegedly operating an illegal scheme. News reports on the Internet said that GoldQuest was a company which lured investors into pyramid-style schemes where gold was the main commodity.

However if you are one of the many people who has been approached before by one of the above internet investment scheme, you might know that one of the high-profile scheme is Swiss Mutual Fund a.k.a. SwissCash. You might have heard that some of the people who actually believe and pump in money into this SwissCash consist of politicians or those with “Datuk” title who are crazy about get-rich-scheme.

But the Malaysia Securities Commission’s website which lists the 50 companies comprises out-dated info as the links are not accurate. For example SC alert web-site at this link said SwissCash’s website is www.swisscash.com or www.swisscash.biz but none of it works. Instead the real link should be www.swisscash.net. It simply shows how irresponsible and careless SC in their basic task in the effort to alert the people at large. A simple validation by SC’s staff to ensure all the links are the actual and working site should do the trick. But none of this is being carried-out.

SwissCash is perhaps one of the most attractive in their plan whereby you will earn USD 5,000 every 30 days with initial investment of USD 20,000. Their website claims the average return is25% to 45% per month, probably beating all the investment out there and putting Warren Buffett in shame.

A simple test will shows how legitimate SwissCash is by an email. I’ve sent an email just to ask how I can check if they have the license to operate by any of the countries or if they can provide some sort of financial reports. After numerous email and not a single response concludes that the company is not sincere in explaining to any queries posed to them.

5 Reasons Why You Shouldn’t Investing Proton Stocks

After the Crisis, economic was in a mess – property, banking, retails, automobiles and basically all sectors were in downtrend. People lost

almost all their savings investing in Malaysian stocks – or at least in paper-lost. People were holding from spending, simply because retrenchment which wasn’t heard before becomes the buzzword on the street. Needless to say, sales of automobiles took the nosedive.

almost all their savings investing in Malaysian stocks – or at least in paper-lost. People were holding from spending, simply because retrenchment which wasn’t heard before becomes the buzzword on the street. Needless to say, sales of automobiles took the nosedive.Then the former premier Mahathir decided to handover the baton to current Badawi. Instead of continueing his predecessor’s policies (which very much bending towards cronyism and nepotism), Badawi reverse and steer the country’s policies towards the other way. Not that the new direction becomes better but Malaysian had the choice of choosing new cars which at least better-equiped with basic security features such as air-bag and ABS (anti-braking-system). Most of the accidents happened on Malaysia road result in fatality due to the lack of safety features.

When Honda launched their new generation of 1.5-liter Honda City and Toyota their 1.5-liter Vios 4 years ago, it was selling like hot-cakes despite its’ higher price ranging from RM 78,888 to RM 85,000. Though the price is slightly higher than Proton’s model, many Malaysian consumers who were sick and tired of low quality and after-sales maintenance of Proton’s cars chose Honda and Toyota.

Having said that, should you as an investor consider investing in Proton’s stocks? I would conclude the following reasons as the justification to stay clear of Proton’s share, at least in short to medium term.

- Sales have been decreasing and will continue to slides. For the three months ended Dec-2006, Proton continues to register quarterly losses of RM 281.45 million (USD 82 million). In fact if you refer to the five-year financial highlight, the EPS (earning per share) demonstrates an excellent reverse-healthy trend – dropping consistently from 216 cents per share in 2002 to 8.5 cents in 2006. You can see the figures here. And we’ve not even open up 100% of the automobile’s market to the world. As an investor, would you invest in such a company?

- One of the basic fundamental rules in investing a company is to investigate their management prior to pump in your hard-earned money. Former premier Mahathir’s personal agenda aside, current Proton has indeed a very weak management team who couldn’t drive the organization to a better direction. Quality asides (not that they can do anything in improving it after more than 20-years in the automobile industry), Proton simply does not have a capable team to even produce attractive models. To survive in global automobile industry, you have to constantly produce new models for ever-demanding consumers. The most recent Proton Savvy and Gen2 were not successful in turning around the already sick company

- Proton does not have the innovative and know-how in designing an appealing models. Let’s face it, if the huge and expensive Proton team has half the creativity and design ability of Honda, Nissan or Toyota, Malaysian won’t be driving the still-in-production model launched more than 10-years ago. Hence the need to find a foreign partner such as Germany's Volkswagen (FRA: VOW) or U.S. car giant General Motors Corp. (NYSE: GM,stock), of which the talk with Volkswagen already failed attributing to government reluctance to cede control to foreign hands.

- Political pressure will prevent premier

Badawi from giving up control of Protonfor as long as the ruling party relies on the Malay-votes (mostly work under Proton or its’ supply-chains payroll) to retains their power. You can argue until the cows come home that the operational costs will continue to soar but sales drops like there’s no tomorrow and such a justification is strong enough for a re-structuring in cost-cutting. In order to stay in power, nothing can be done to heal the wounds as the pride of retaining the Proton’s logo surpasses the conscious to re-vitalize the company.

- Perodua, the second homegrown manufacturer of which Daihatsu Motor, a subsidiary of Toyota, owns a 51 percent stake, will continues to eat-up Proton’s cake in the affordable yet attractive models range. It’s Myvi model was a great success and top the best-selling model overtaking Proton.

Today, former premier Mahathir drop a bombshell stressing Malaysia must choose a domestic partner over a foreign company for ailing carmaker Proton to preserve its status as a national company. "If you sell to a foreign company, it will no longer be a national car. They have to sell to a local company," Mahathir, who is Proton advisor told reporters. Mahathir who oversaw the creation of the ailing carmaker in 1983 under his tenure as premier has singled out Prime Minister Abdullah Ahmad Badawi and his administration for badly managing the company.

Its’ obvious Badawi is directionless on how to manage this national bleeding giant. The only way out and decision to make is obvious but it’s highly unlikey to be executed for political survival. This could be the only time Badawi and Mahathir share the same common interest.

Other Articles That May Interest You ...

Tuesday, April 17, 2007

Crazy Promotion Starts – 500,000 Free Seat

Earlier, sources from top company executive said that AirAsia X, the long-haul budget airline set up by low-cost aviation pioneer Tony Fernandes, has delayed its takeoff, possibly until next year from the promised date of July 2007 (this year). The delay was said to be caused by higher leasing costs.

Tony launched Tune Hotels.Com recently which allows you to stay in a five-star hotel but pay as low as RM 9.99++ to RM 59.99++ per night. Just like Tony Fernandes successful low-cost carrier, AirAsia Berhad, Tune Hotels.Com will offers basic amenities such as a deluxe five-star bed by King Koil, 250-thread count white duvets, an ensuite "Power Shower" and a ceiling fan. For extra comfort, guests have the option to purchase items like towels and air-conditioning cards.

Whenever such promotion starts, people are just grumbling because they either can’t login to book due to heavy traffic or they are only able to login during peak hour. So, please follow the following tips to get your free seats:

- Best time to log on is between 1 - 7am (Malaysia Time)

- Tell your friends to rotate on shifts to log on to airasia.com

- Aoidd weekends and public holidays and try for mid week and mid day flights.

# TIP: Check Availability of Free Seats here

Other Articles That May Interest You ...

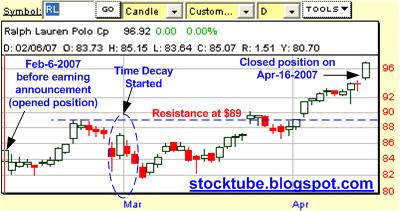

Rushing Against Time-Decay - Take Profit on Ralph Lauren

Looking at the chart, Ralph Lauren didn't gap-up after earning announcement on Feb-1-2007 before-market-open as what I hoped for even though it beats earning. It registered earning of $1.03 versus estimated $0.92 cents per share. It could be due to the fact that once a stock (from the same sector) beaten and gapped-up (Estee Lauder announced earning earlier than Ralph Lauren and gapped up real nice), the rest of the stocks from the same sector could have experienced the effect of stock-uptrend. Thereafter the gap-up could be limited unless the earnings announcements are exceptionally fantastic.

Anyway, I'm not complaining based on the 100% profit I'm making from the two and a half months trading the option of this stock. Noticed that I deviate from the rule of buying option with minimum of more than 120 days to expiration? Well, sometimes the market sentiment of a particular stock would made you real confident of the fundamental of the stock. Hence I bought with less than the best-of-practice time-value. And needless to say, the time-decay kicked-in soon after (as you can see from the chart).

It took more than two months from the date of my entered position for the stock to breach higher over it's resistance level of $89. Based on Apr-16-2007 stock's performance and the way the Dow Jones behaved, I concluded that this is my last chance to take profit before time-decay eats further into my profit. Please note that the April-2007 expiration is days away.

Other Articles That May Interest You ...

Sunday, April 15, 2007

Apple iPhone’s June Launching to Be Delayed?

Apple had never specified when in June the device would ship, but its wireless partner,

Apple has hinted that making iPhone is no cake-making as it contains the most sophisticated software ever shipped on a mobile device. With two months or less to go before market release, a device such as iPhone would ordinarily be going through a heavy round of testing in preparation for volume manufacturing. The apparently sudden shift of personnel away from Leopard suggests that a late wrinkle has emerged – at least that’s what most analysts believe.

Richard Doherty, director and co-founder of the Envisioneering Group, says he's tested the phone and didn't uncover problems with it. So, the rumors were that Apple is actually working on fixing security holes as that’s the last thing Apple would like to have – a hacker attacks.

Since Apple hopes customers will use iPhone for online purchases, it wants to ensure iPhone operating system is more secure and powerful than existing mobile phone such as Microsoft Corp.’s (Nasdaq: MSFT, stock) Windows Mobile or Nokia Corporation’s (NYSE: NOK, stock) Symbian.

Another potential problem facing Apple’s team is the challenge to give iPhone sufficient battery life. The battery will have to be powerful enough to handle a variety of functions, but it must also be compact. There's a lot of skepticism about the iPhone's battery life especially when it is expected to have two batteries, one for the phone and the other for the music player. The phone battery, which is very small, would have to power a huge screen, Wi-Fi network connections, and many other power-hungry features.

Analysts are generally okay with a slight delay in Leopard and should the delay in launching of iPhone be announced, they are still bullish on Apple’s stock. It’s better to be late but delivers a well-tested iPhone rather than meet the deadline but giving customers a bug-riddled iPhone, which could be a disastrous. And knowing Steve Jobs, he would not want to tarnish the image of Apple and most importantly his name with an inferior product. Furthermore Microsoft Vista was late by 2-years.

Other Articles That May Interest You ...

Saturday, April 14, 2007

Giant Google Flashes $3.1 Billion for DoubleClick

The sale of DoubleClick involved weeks of negotiation that included at one point Yahoo Inc.(Nasdaq: YHOO, stock), AOL and most importantly Microsoft Corp. (Nasdaq: MSFT, stock). Microsoft which has more cash than Google and trying to position itself as an advertising rival to Google was however outbid.

Google made most of the money from basic online advertisement and the stock price has skyrocket to the $500 per share level not too long ago. But it lacks the strength which DoubleClick has, that is the flashy banner ads and video ads that are more like high-end magazine or television ads. DoubleClick on the other hand lacks the vast network of advertisers that Google has.

One attraction for Google was DoubleClick’s new exchange that brings Web publishers and advertising buyers together on a Web site where they can participate in auctions for ad space.

The sale raises questions about how Google will manage its existing business and that of the new DoubleClick unit while avoiding conflicts of interest. If DoubleClick’s existing clients start to feel that Google is using DoubleClick’s relationships to further its own ad network, some Web publishers or advertisers might jump ship.

Most of DoubleClick’s clients are locked into long-term contracts to keep using DoubleClick. And DoubleClick’s chief executive, David Rosenblatt, said in an interview last night that the company would protect its ability to remain neutral with its clients. “We are exquisitely sensitive to our role as Switzerland,” Mr. Rosenblatt said. “In the simplest sense, they bought customer relationships, and they’re primarily focused on making sure not only are those relationships preserved but that they are enhanced and made better.”

DoubleClick generated about $300 million in revenue and $50 million in earnings before interest, depreciation and taxes last year, mostly from providing ads on Web sites. While some suggested that $3.1 billion was a high price for DoubleClick others said Google was buying far more than DoubleClick’s cash flow. And, Google has plenty of cash to spare. At the end of last year it had $11.24 billion in cash and marketable securities.

Other Articles That May Interest You ...

Friday, April 13, 2007

New World’s Second Richest Person - SLIM

In the two months since Forbes calculated its 2007 wealth rankings, the 67-year-old Slim's fortunerose $4 billion to

$53.1 billion, while Buffett's holdings slipped to $52.4 billion as of March 29. In the 2007 rankings released March 8 - but prepared almost a month earlier - Forbes had listed Slim as the world's third-richest man and estimated Gates' fortune at $56 billion.

$53.1 billion, while Buffett's holdings slipped to $52.4 billion as of March 29. In the 2007 rankings released March 8 - but prepared almost a month earlier - Forbes had listed Slim as the world's third-richest man and estimated Gates' fortune at $56 billion.Slim said shortly afterward that he wasn't concerned about his ranking or taking over the top spot, but he expressed differences with Buffett, the chairman of Berkshire Hathaway Inc. (NYSE:BRK.A, stock), and Gates. "It's not about having who knows how many bonds, to spend them on whatever one wants or live it up all year," said Slim, an engineer who wears modest suits and whose main indulgence appears to be expensive cigars. "I don't have apartments abroad. I don't have a house abroad."

Slim, who owns Mexico's dominant phone company and has holdings throughout Latin America, said his vision of a businessman's role in the world is at odds with that of Buffett, who announced last year he would donate $1.5 billion every year to the Bill & Melinda Gates Foundation. "It's very interesting, because he leaves those who are running his affairs the responsibility of being very profitable," Slim said of Buffett. "If they're inefficient or don't get real-term returns, they're not going to be running anything."

It’s kind of philosophical opinion, isn’t it? Without generous donations, other not-so-lucky people will not have the opportunity to change their life for the better (a donation to a bright but poor student might makes a difference). We might not have a healthier life or longer life expectancy if not for some philanthropists who donated into R&D (research and development) in health sector.

But on the other hand if the donations are not properly handled and channeled for continuous mankind benefits, it could be mis-used or worst still, generate a false impression that the money donated would lasts forever – creating a lazy and un-creative society.

Other Articles That May Interest You ...

Wednesday, April 11, 2007

Why You Should Investing Genting Stock - Perception Game

Genting’s share price rose as high as RM9.95 in early trade, which was RM1.10 or 12.4% above the reference price of RM8.85. It closed at RM9.25, up 40 sen with 11.55 million shares traded. Resorts rose to a high of RM4.06, up 12.15% or 44 sen from its reference price of RM3.62. It ended the day at RM3.80, up 18 sen with 17.99 million

The call warrants of Genting and Resorts also closed higher. Genting-CA closed four sen higher to 41 sen, Genting-CB 4.5 sen to 24.5 sen, Genting-CC five sen to 21 sen and Genting-CD six sen to 13.5 sen. Resorts-CA gained seven sen to 40.5 sen while Resorts-CB increased five sen to 19 sen

The share split of one 50-sen share into five 10-sen shares had made the counters more accessible to retail investors. In the past, its share price of around RM40 made it difficult for retail investors to buy into as a lot of 100 shares would cost RM 4,000. The surge in share prices was also liquidity driven as there were more shares in the market. The number of Genting shares became 3.69 billion while Resorts has 5.61 billion shares after the exercise.

In terms of valuation, Resorts, which is a pure play in gaming and casino operations, is still trading at a lower price to earnings ratio (PER) of 21.7 times compared with other casino operators at other bourses at PER ranging from 25 times to 30 times. Genting is also cheaper as it was trading at 21 times, even though its current PE is above its historic 15 times. Singapore-listed while Genting International (SIN:G13) was trading at 87 times, Las Vegas Sands (NYSE: LVS, stock) 71.4 times, MGM Mirage (NYSE: MGM, stock) 33.3 times and Harrah Entertainment Inc. (NYSE: HET, stock) 30.48 times.

Since the perception of the majority is that Genting and Resort stock is more “affordable”, the stocks are expected to see continue buying. Accept the fact that there’re not many good fundamental stocks with good business with excellent management plus a proven model which can generate good return for investors in Malaysia. So for those who’re looking for stocks as their investment tool, both stocks especially Genting will be their ultimate choice.

# TIP: Investing Genting in stages for a better average price if you’re looking for long-term investment of which the stock has global exposure.

Other Articles That May Interest You ...

Forever U-Turn Policies – Affecting Foreign Investors

In a statement on April 11, PPBOP said according to BNM, the resident, individual or corporation with or without domestic ringgit borrowing was free to reinvest foreign currency dividends, profits and proceeds from the sale of

overseas investments.

overseas investments.Earlier Bank Negara tried to play smart by imposing rule that says Malaysian resident shareholders ofPPB Oil Palms Bhd (KLSE : PPB, stock-code : 6823), PGEO Sdn Bhd and Kuok Oils & Grains Pte Ltd (KOG), which would be acquired by Wilmar International Ltd via a share swap, must repatriate all dividends, profits and proceedsfrom the disposal of the Wilmar shares.

BNM's condition raised eyebrows as it was seen to be inconsistent with its broad policy that has seen quite deliberate liberalisation moves recently of the foreign exchange administrative policies. Pursuant to the easing of capital controls, effective April 1, 2005, Malaysians were allowed to invest abroad any amount if they do not have any domestic credit facilities. Previously, anyone who wanted to take out more than RM 10,000 needed BNM's approval.

This U-Turn is seen as an approval for Malaysian shareholders to keep their money in Singapore. Obviously the relationship between current Malaysian and Singapore government is the main glue that changes the ridiculous policy imposed earlier. Should former premier Mahathir were still in power, he’ll do anything within his iron-fist rule to punish the shareholders. But why would the Malaysian government made the earlier decision to impose only to reverse at a later stage? Does this means the whole government machineries do not work in one direction as far as major decision-making is concern? You can’t say one thing now and say another thing later. This is not the way business is conduct – what more with foreign investors who are holding billions of dollars to invest in this region (stocks investing or conventional businesses) wish to make decision fast without much time to waste with a country flooded with kid’s rules and regulations.

Who is the main person or department within Malaysia that can make such similar vital decision? Bank Negara (Central Bank), Deputy Minister of Finance, Minister of Finance (Prime Minister himself) or third person with invinsible hand giving instruction? It can’t be the Prime Minister himself who imposed the rule earlier as he was, well, busy with problems related to Proton Holdings Bhd(KLSE: PROTON, stock-code, 5304). Could it be the highest political-person from Singapore who actually expressed his dissatisfaction that pressure Malaysian premier to reverse Bank Negara’s earlier decision? How could foreign investors invest confidently in Malaysia without having to worry what the government will impose the next day? Can’t the Malaysia government ever grows-up and stand tall together with other countries who have been behaving professionally?

Other Articles That May Interest You ...

Tuesday, April 10, 2007

Does Volkswagen Chief Wants to Meet Badawi?

"I have not seen him yet," Abdullah told reporters in reply to a question on whether he had met the chairman of the German carmaker. "He has not made his appearance here. I don't think I can wait too long ... I can't be waiting

Industry sources said talks between Volkswagen and the Malaysian government had been bogged down over several issues, including Volkswagen's reluctance to assume Proton's debts.Could this be the main obstable with Peugeot earlier on? I bet it is one of the factors. I mentioned one of the factors here because I’m pretty sure the Proton management would set some other ridiculous conditions which could not be thought of by developed countries such as German or France (whether you like it or not they are superior to Malaysia mentality).

Proton Chief Executive Syed Zainal Abidin Syed Mohamad Tahir said at the weekend that a decision on Proton's

French car maker France's PSA Peugeot-Citroen (EPA : UG) had also explored a tie-up with Proton before calling off the talks last month, saying it was not economically viable to co-produce cars with the Malaysian company. Chances are the conditions set by Proton are being re-used and presented on the table for both Peugeot and Volkswagen. Proton stock price closed down 1.5 percent at 6.55 ringgit.

Other Articles That May Interest You ...

Monday, April 09, 2007

Warren Buffett’s New Taste in Railroad Stocks

Berkshire’s 39,027,430 shares in BNI are worth $3.23 billion based on the stock’s closing price on Apr-5-2007. The stock price of BNI jumped $3.03 before market open today, Apr-9-2007, after the disclosure – creating a clean profit of $118 million. Isn’t it easy to make money with money? BNI is the second largest railroad after Union Pacific

Corporation (NYSE: UNP, stock). Shares of companies often get a boost when Berkshire discloses investment stakes.

Corporation (NYSE: UNP, stock). Shares of companies often get a boost when Berkshire discloses investment stakes.It was not known why Berkshire purchased the stake, Reuters reported. Mr. Buffett, in his Feb. 28 letter to Berkshire shareholders, named 17 companies in which Berkshire, based in Omaha, owned at least $700 million of common stock. He declined at the time to itemize two other companies in which Berkshire owned $1.9 billion of stock “because we continue to buy them. I could, of course, tell you their names. But then I would have to kill you.”

Burlington Northern said on Thursday that first-quarter profit would be cut to about 96 cents a share because of $80 million of charges for environmental costs and the write-off of a technology system. Berkshire’s total common stock investments totaled $61.5 billion at year end 2006.

Earlier this year, the Korean steelmaker Posco rose 3.1 percent, the British retailer (LON: TSCO) gained 2.1 percent and the health insurer UnitedHealth Group Inc (NYSE: UNH, stock) advanced 3.8 percent on their first respective trading days after Berkshire revealed sizable stakes.

CNBC reporter notes that besides Burlington Northern Santa Fe Corp., Warren Buffett has invested in another North American railroad yet to be disclosed. The reporter mentionsCSX Corp. (NYSE: CSX, stock), Norfolk Southern Corp. (NYSE: NSC, stock), Union Pacific Corp. (NYSE: UNP, stock) and Canadian National Railway Company (NYSE: CNI, stock) as possibilities. All the stocks mentioned jumped in pre-market and expected to be in volatile mode pending Warren’s announcement. As long as Buffett keep mum on the company, all these stocks will be heavily speculated.

Last week, Canadian National Railway Co. said its first-quarter earnings per share would decline 5 to 10 percent because of weather and a conductors strike earlier in the period. Investors also absorbed Norfolk Southern Corp. profit warning from after the bell Wednesday blaming declining automotive and housing-related freight. It makes sense for Warren to buy during current railroad recession in tandem with buy low sell high rule.

Sunday, April 08, 2007

Looking For a New Job? Take a Look at GOOGLE

Depending on what you’re looking for in your new job, you can’t miss the fact that finding a job which is both satisfying and well-paid is getting difficult nowadays. Sometime you simply do not know if the new job is what you’re looking for – you just need to join the company and over a period of time only will you be able to judge if you’ve found what you’re looking for.

However most of us will not think twice about high-profile MNC (multi-national-company) as the perception is that if the company is so big and has presence in multi-countries, it has to be good – well, at least the perks should be good. And one of these high-profile companies which still received thousands of applications per-day is non other than Google Inc. (Nasdaq:GOOG, stock).

Once you’re part of the Google’s payroll, you’re known asGoogler. Google hire great people and encourage them to make their dreams a reality – there’s something call 20% policy whereby Googlers are encourage to spend 20% of their time to do their own personal project(s).

Some of the “Life at Google” that you might want to read are:

- Benefits of working at Google

You can browse what are the jobs opening at Google by searching it here. The lists of opening range from human resources to product management. The jobs opening cover other global sites from Asia Pacific to Europe, Middle East and Africa.

# TIP: to get a feel of an inside look at Google, you can watch a 7-minute-video.

ther Articles That May Interest You ...

Investing Technology Stock - Turn Green Packet to Greenbacks

RSI has climbed to about 66% and Stochastic shows a good sign of cross-over. It closed at RM 5.25 which is also the day’s high with good volume. This is one of the stocks in Malaysia whichtraded along the uptrend line with great “discipline”. A 1-year chart shows theresistance is strong at RM 5.80. The ratio of bulls againsts bears is 850 Bulls : zero Bears.

Green Packet is one of the quality companies which successfully put Malaysia map on the globe with its’ R&D in networking spanning in locations such as Cupertino, Kuala Lumpur and Shanghai. Probably one of its’ most success stories is the recognition of the clients such as China Telecommunications Corporation, Intel China, Lenovo Group (HKG: 0992), Panasonic and Maxis Communications Berhad (KLSE: MAXIS , stock-code 5051).

Green Packet is one of the quality companies which successfully put Malaysia map on the globe with its’ R&D in networking spanning in locations such as Cupertino, Kuala Lumpur and Shanghai. Probably one of its’ most success stories is the recognition of the clients such as China Telecommunications Corporation, Intel China, Lenovo Group (HKG: 0992), Panasonic and Maxis Communications Berhad (KLSE: MAXIS , stock-code 5051).It attracted the former CEO of TMNet Sdn Bhd, Michael Lai to join Green Packet as the new CEO of its global marketing arm Green Packet International Sdn Bhd effective Jan 15 2007. Being one of the most successful Mesdaq-listed companies, Jeddah-based Saudi Economic and Development Co (SEDCO) agreed to buy 10% stake for about RM 91 million at RM 2.47 per-share. The entry of SEDCO is said to create the springboard for Green Packet to penetrate Middle East wireless networking and telecommunications market.

Green Packet solutions such as SONaccess, SONbuddy, and SONmetro are said to be well-received by ICT-hungry countries such as Saudi Arabia and beyond. Middle East on average are paying RM430 and RM550 a month for only 256 kilobytes per second of broadband connectivity compare to RM40 in Malaysia.

Green Packet solutions such as SONaccess, SONbuddy, and SONmetro are said to be well-received by ICT-hungry countries such as Saudi Arabia and beyond. Middle East on average are paying RM430 and RM550 a month for only 256 kilobytes per second of broadband connectivity compare to RM40 in Malaysia.With good management and leader such as Chan Cheong Puan it’s not surprising that Green Packet Berhad become the most profitableand has the largest market capitalisation of more than RM 1.6 billion amongst companies listed on Malaysia’s technology market. Convinced of the opportunities of wireless networking technology convergence, Mr Puan founded Green Packet in the Silicon Valley of California in 1999 to boldly forge ahead in the wireless world to develop products to provide a seamless and universal platform for the delivery of user-centric multimedia communication and services regardless of the nature and availability of the backbone infrastructure.

Green Packet Berhad, has posted a pre-tax profit of RM17.92 million on the back of a revenue of RM43.13 million for the fourth quarter ended 31 December 2006. Net profit after tax and minority interest was 43.61% higher at RM15.33 million, translating into an EPS (earnings per share) of 3.67 sen per 10 sen share. For the full year ended 31 December 2006, pre-tax profit surged 84.92% to RM58.73 million. This came on the back of a 151.23% jump in revenue to RM98.93 million. The full year earnings are the highest recorded to date. Together with the 10.53 sen EPS (earnings per share) posted in the first nine months of the year, the latest 3.67 sen in Q4 adds up to 14.20 sen per 10 sen share for the financial year ended 31 December 2006.

According to data compiled by Bloomberg, analysts expect Green Packet's net profit to rise to about RM79 million and RM159 million in 2007 and 2008 respectively. The firm had some RM300 million cash in hand as of the end of 2006. Foreign investors particularly like Green Packet due to its’ extensive R&D, global presence and excellent management.

According to data compiled by Bloomberg, analysts expect Green Packet's net profit to rise to about RM79 million and RM159 million in 2007 and 2008 respectively. The firm had some RM300 million cash in hand as of the end of 2006. Foreign investors particularly like Green Packet due to its’ extensive R&D, global presence and excellent management.Of the four companies awarded the much awaited WiMAX licenses, perhaps only Green Packet can delivers and deploy the technology although I still miss DIGI.com Berhad (KLSE: DIGI , stock-code 6947) who lost twice in its’ bid for 3G and WiMax in Malaysia. You can’t find another listed company in Mesdaq which can rival this stock.

# TIP: If you’ve appetite for technology stock in Malaysia, consider investing in Green Packet stock. Wait till it fell just above the uptrend-line. This Green Packet might turns your Ringgit into Greenbacks.

Other Articles That May Interest You ...

Friday, April 06, 2007

Should You Concern with Googlezon?

Google is still the number one search engine drawing more clicks, cash and users from the advertisement’s revenue leaving Yahoo Inc. (Nasdaq: YHOO, stock) and Microsoft Corp.(Nasdaq: MSFT, stock) behind eating its’ dust.

Consumers love Google's simplicity and results, which is why it draws 56% of all searches. And advertisers willingly hand-over some $10.6 billion into Google’s coffer in 2006, a mind-boggling increment of 73% from 2005. Already Google has market capitalization of $144 billion, bypassing the combination value of Time Warner Inc. (NYSE: TWX, stock), Viacom, Inc. (NYSE:VIA, stock), CBS Corporation (NYSE: CBS, stock) and The New York Times Company (NYSE:NYT, stock).

From the monopoly in internet advertisement, Google switch direction and attacks the traditional markets of newspapers, magazines, radio and television. Google is so rich (it has $11 billion of cash ready to be fired) that it gave Bill Gates’ Microsoft Corp. (Nasdaq: MSFT, stock) a run for its’ money by offering a suite of online office software for a small fraction of the price of Microsoft Office. It also provides free wireless internet access giving telecom players endless sleepless nights.

The nine-year-old company was publicly traded only less than three years ago in Aug-19-2004 but it’s the most talked about company in the current age. A year ago, Google was rumored to be jumping into personal computer business. Then you heard about Google’s cell phone and more to come.

Google has the financial and the attraction to pull most of the top brains into it’s payroll – this includes pinching some of the top mathematicians from Microsoft. Till today Google still receives thousands of resume daily from applicants hoping to join the powerhouse. While it doesn’t show any sign of slowing down in eating up market share, it’s fierce and awesome capability worries some people.

"That much money and power concentrated in one place can be dangerous … Google's vast network, now a substantial piece of the Internet itself, is very quickly becoming vital national security infrastructure" says Dyson, who sometimes advises the Defense Dept. on potential threats.

So, is Google too powerful? That’s the question everyone is asking but is equally divided on the answer itself. For investors who make a living trading option or investing shares, Google is their darling stock which made them tons of money. One thing for sure, I can’t live without Google myself even today. Can you?

Other Articles That May Interest You ...

Malaysia's Policy - Now You See It, Now You Don't

Thursday, April 05, 2007

Malaysian Government Trying to Silent Bloggers

Bloggers in Malaysia will soon be required to register with the authorities in a move that the government hope to curb the spread of malicious content on the net. The news from the local newspaper, theStar, immediately sparks outcries from web writers.

Using national security as the excuse, a deputy minister told parliament that the ruling might be imposed on bloggers using locally hosted Web sites. Malaysia has promised it would not censor the Internet but has said bloggers were not above the law if they "disrupt peace and harmony".

"Do they even understand how blogs work … Any time today, any number of the 11 million Internet users in Malaysia can register with Google's (Nasdaq: GOOG,stock) Blogger or Wordpress or any of the blogging Web sites and there is nothing they can do about it … None of them need to ask permission to blog of anyone. This is why blogs are popular” Marina Mahathir, an active blogger and outspoken daughter of former Prime Minister Mahathir Mohamad wrote on her blog.

Earlier, the New Straits Times, the country's oldest and pro-government newspaper, filed suits in January against two bloggers, one of them a former employee, over numerous postings in their blogs attacking top company officials. The suit is the first case of bloggers being sued for libel in Malaysia.

Internet has created the bourderless world with information travels at lightning speed. Malaysian government who are used to work under excessive bureaucracy with great inefficiency is caught pants-down with the new world of cyber-generation. The new rule (if implemented) will only chase away all the bloggers to switch their platform to overseas while the local hosting provider will be the next group of people who’ll have to close-shop.

After text blogging, the video-blogging is gaining popularity now. The technology for a blogger to shoot a video and upload it immediately to his/her blog is already here. The blogging platform can be thousands miles away but the blogger could be anyone walking along the streets of Malaysia. With more and more sophisticated method of blogging appearing, the Malaysian government’s new rule is merely wasting time and resources.

Other Articles That May Interest You ...

Will RHB Falls to Foreigners or Sleeps With CIMB?

After opening a new Scotiabank branch outside of Kuala Lumpur, one of four new outlets recently approved by Malaysia's central bank, its’ senior vice-president for Asia Pacific Michelle Kwok said“We are always interested in opportunities to expand our presence, especially in a market like Malaysia. If it aligns with our bank's strategy, we are open to discussion."

Today, Reuters reported that EPF might see CIMB Bank, an investment bank of Bumiputra-Commerce Holdings Berhad (KLSE: COMMERZ, stock-code 1023) as a new partner to merge both RHB Bank and CIMB Bank to rival Malaysian largest bank Malayan Banking Berhad (KLSE:MAYBANK, stock-code 1155). RHB Bank with its’ 200 branches nationwide would be a good fit to CIMB as its’ strong presence in retail banking will add weight to CIMB’s investment and wholesale banking.

The merger of CIMB Bank and RHB Bank will create a new giant with combined assets of $ 70 billion. An announcement of such merger within short-time period might be out of question as RHB Bank has yet to be re-structured to solve its’ huge debts. But then with the brother of deputy Prime Minister Najib at the helm of CIMB, such a possibility cannot be rule-out in a country like Malaysia where politic and business are like twin brothers.

Besides the above two potential marriage partner, EPF is said to be flirting with other partners such as Kuwait Finance House ( KFH ), British banks Barclays (LON: BARC) and Royal Bank of Scotland (LON: RBS).

Who do you think EPF will sleep with? Please do not forget CIMB managed to launch the successful hostile take over of Southern Bank (one of the remaining and most profitable Chinese-based banks in Malaysia) recently despite rejection from its founder. But the rumor in the market is that thedeputy Prime Minister is not getting along well with premier Badawi. So strong was the rumor that the deputy Prime Minister has to call a press-conference to deny it. In Malaysia’s politic, you’ll never know the ultimate winner till the last minute as the stories and the games could easily beat Hollywood’s box-office should it be made a film.

Other Articles That May Interest You ...

Wednesday, April 04, 2007

Survival Series - Proton Downsize While PM Waiting

Today, the Prime Minister confirmed that he’s waiting to meet German giant Volkswagen AG’s (FRA: VOW) chief. Just like what one of StockTube's readers commented, it’s rather strange for a head of a country to meet a top official from a company over the fate of Proton. It shows how critical the Proton has reached in terms of its’ illness. Though it has been played down by

certain politician (the deputy Prime Minister, Najib brushed off the dead-line as something which is not so vital), the anxiety shown by Badawi points to a different story altogether.

certain politician (the deputy Prime Minister, Najib brushed off the dead-line as something which is not so vital), the anxiety shown by Badawi points to a different story altogether.If only Badawi is not the Prime Minister, he could be flying all the way to Germany just to meet and beg Volkswagen to re-consider its’ decision to call-off the talk (though it has been denied that the talk was over). Due to protocol, the Volkswagen chief has no choice but to fly-in instead – thoughhe’s taking his own sweet time to meet the premier.