Thursday, December 17, 2009

Economy is Crawling - Scrap the 4% GST, Idiot

Allright, here are more signals that the global economy will neither skyrockets nor drops like a stone into the ocean. Basically people are convince that the U.S. economy will most likely crawling for years instead of months before the worst enemy – unemployment – is over. We, and to a large extent the Americans, may be lucky that this round of recession did not suffer the same fate as the 1929 Great Depression. But this recession may have created a new economy landscape that we have to live on for decades to come – the scale-of-employment model pre-recession is history and a new employment model may have emerged.

It’s true that layoffs have slowed, at least for now, and (hopefully) the housing problems have bottom. However jobs remain scarce and the economy will not stage a V-shape recovery anytime soon. The fact that the Federal Reserve holds the bank lending rate at zero to 0.25% speaks volume of the U.S. economy’s health. But who can blame Ben Bernanke and his boys when the figures still show consumer spending remains sluggish, hiring remains weak, wage growth is almost stagnant and the banking sector is not lending as much as Obama’s administration hoped they would.

Low inflation also means companies couldn’t raise prices of their products simply because the once fearless American consumers are not spending as they used to be pre-recession. Of course you shouldn’t blame some of the analysts who predict that 2010 will be an explosive year for the U.S. economy when everything will be back to normal, though I would take that as a new-year wishlist instead *grin*. In actual fact you don’t really have to go very far to ascertain the health of the U.S. economy. The financial sector will tell you whether what those good-for-nothing analysts’ “wishlist” that you should be buying stocks is a good advice.

The banking stocks are literally still in disarray as if they’re headless chickens moving without clear directions. Otherwise you wouldn’t see Citigroup Inc. (NYSE: C, stock) shares still trading at three bucks a share and the attempt to unload 5.4 million Citigroup shares at $3.15 share (8.7% discount). Heck, why sell at a discount (and at the current low price) if indeed everything is so rosy – get the picture? I would hold the shares if I know I can make many times the profit in another year or two, unless of course I’m not sure if the bright sky is in the horizon.

Well, maybe Rosmah was right after all considering she has chosen the right man to marry; the highly intelligent Prime Minister Najib Razak who thinks the time is right to push for the GST (Goods and Services Tax) - scheduled to be implemented by the middle of 2011, never mind that the average-Joes are having difficulties putting food on the table. Thanks to former PM Mahathir’s cheap labor economic model which is obsolete by now, the fact remains that the proposed 4% GST will bring hardship to the poors due to inflation.

Supposingly the economy fully recovers by 2011, do we have the same buying power like the Singaporeans whose government also implemented the GST?

Other Articles That May Interest You …

Tuesday, December 08, 2009

Ong to Exit – 1Corruption, Together We Prosper

It’s easier to move a mountain than to change a person’s character – goes a Chinese saying. By the same logic, it is definitely many times harder to change the Malaysian ruling government’s policy of worshipping corruption. Whatever the result from the PKFZ multi-billion scandal, you can kiss your money (yes, part of the billions of dollars belong to you) goodbye simply because you won’t be able to see it again. And you can bet your last dollar that MCA Pesident Ong Tee Kiat would see his political career ends very soon.If the government-control’s print and electronic coverage on three fighting factions is anything to goes by, you can actually smell that Ong Tee Kiat will be history while “sex actor” Chua Soi Lek and betrayal Liow Tiong Lai would most likely win this battle. Liow and Chua were given wide media coverage even before Ong’s sudden illness. From the beginning Ong Tee Kiat’s fate was written on the wall after his disclosure of PKFZ scandal. To pick a fight with politicians, new and veterans, who are flush with monies (from the scandal) is tantamount to poking Mike Tyson’s butt while laughing like Phua Chu Kang.

The ball is at Chua Soi Lek’s court now that he still commands huge supporters which in turns made him the kingmaker in this political comedy, sex scandal or not. Given a choice, Najib’s administration would prefer Chua than Ong to lead the ailing party simply because Chua is flexible to be nose pulled anywhere UMNO likes. But can a person who was caught with his pant down in sex-scandal become MCA President? If a person who was allegedly murdered a pregnant lady can become the Prime Minister, Chua’s sex scandal can be equate to a 2-year-old kid caught putting his hand in the jar stealing cookies so it’s perfectly fine.

The ball is at Chua Soi Lek’s court now that he still commands huge supporters which in turns made him the kingmaker in this political comedy, sex scandal or not. Given a choice, Najib’s administration would prefer Chua than Ong to lead the ailing party simply because Chua is flexible to be nose pulled anywhere UMNO likes. But can a person who was caught with his pant down in sex-scandal become MCA President? If a person who was allegedly murdered a pregnant lady can become the Prime Minister, Chua’s sex scandal can be equate to a 2-year-old kid caught putting his hand in the jar stealing cookies so it’s perfectly fine.Would it be better to have Liow as the new President with Chua as his running mate? Possible, but it would be too obvious on how the ruling government, present and the past tainted leaders, brokered and endorsed the plan in bringing Ong’s presidency down due to PKFZ scandal exposure. Either Liow or Chua becomes the new MCA president is fine with UMNO but definitely not the loose cannon Ong. On paper, Chua as President warming up the seat for Liow to take over looks like a good plan. Najib may wish to project himself as independent and to tell the Chinese that UMNO does not interfere in MCA’s internal affair but he did so through his deputy, Muhyddin, who openly support a new party poll, something which Liow has been fighting for.

Of course Ong’s sudden illness was insurance, just in case he officially instructed to pack his things. The standard way of telling someone you’re fired in Malaysian politics is to tell him to pretend he has health problem. But what does this tell of Najib’s administration about the corruption which always breaks the world corruption index record? Who cares? If former PM Mahathir who was allegedly squandered RM100 billion away during his 22-year-old iron-fist rule is still treated as a statesman, to hell with those criticisms about escalating corruption. Corruption is here to stay and has been part of the culture. If you’re not happy with it then you can migrate to other countries because the country only cares about losing brains of those who do not corrupt, otherwise voters won’t vote them in *grin*.

If everything goes according to the plan, UMNO together with MCA may set a new direction for the future leaders. Besides endorsing corruption, you would see more and more leaders such as Youth Chief Wee Ka Siong and Wanita Chief Chew Mei Fun who openly cried like a baby without shame the moment they were removed from MCA Presidential Council. Can you imagine what these two persons would do the moment they loose their current deputy ministry-ship? Guess the sight of losing all the perks and potential huge incomes are too much to bear for the politicians manufactured from Mahathirism’s built- factory.

Other Articles That May Interest You …

Well, it’s hard to imagine Maxis were to re-privatise again in the near future but anything is possible considering political climate in Malaysia. If it’s alright to broker top judges’ appointment, kill innocent people before pushing them out of the building, plunder the nation of billions of dollars in project such as PKFZ and whatnot, you can’t blame investors when even local business owners lost confidence and relocated their monies elsewhere, what more with foreign investors. Hence it was hope that Maxis relisting will bring back the foreign investors’ confidence (and their hot money) into the country.

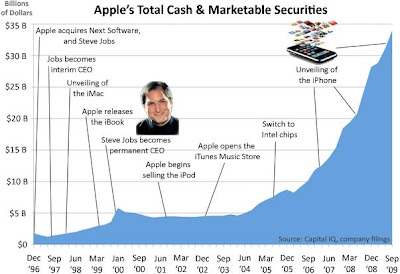

Well, it’s hard to imagine Maxis were to re-privatise again in the near future but anything is possible considering political climate in Malaysia. If it’s alright to broker top judges’ appointment, kill innocent people before pushing them out of the building, plunder the nation of billions of dollars in project such as PKFZ and whatnot, you can’t blame investors when even local business owners lost confidence and relocated their monies elsewhere, what more with foreign investors. Hence it was hope that Maxis relisting will bring back the foreign investors’ confidence (and their hot money) into the country. Maxis IPO price of RM4.75 also means it was priced at 15.83 multiple times of the company financial year 2009’s 30 sen EPS. At RM6.00 a share the stock will be trading at an EPS of 20 times and this is expensive considering the saturation in the mobile telecommunication sector. The local and global stock markets are currently at the junction whereby the economy recovery is still questionable. Hence if you were to chase the stock you may be buying at the highest. Don’t try to buy for the sake of buying or out of revenge just to show that you’re also belong to the Maxis shareholders group. Take your time and wait for the right time to buy at a later stage (price consolidation). Hey, it could be blessing in disguise because you didn’t get a single share out of Maxis IPO. Who knows, maybe Maxis share price will not venture too far away from its’ RM4.75 a share. If you’re too loaded with cash why not go and invest in stocks such as Apple Inc.? Stop sulking and invest your hard-earned money another day.

Maxis IPO price of RM4.75 also means it was priced at 15.83 multiple times of the company financial year 2009’s 30 sen EPS. At RM6.00 a share the stock will be trading at an EPS of 20 times and this is expensive considering the saturation in the mobile telecommunication sector. The local and global stock markets are currently at the junction whereby the economy recovery is still questionable. Hence if you were to chase the stock you may be buying at the highest. Don’t try to buy for the sake of buying or out of revenge just to show that you’re also belong to the Maxis shareholders group. Take your time and wait for the right time to buy at a later stage (price consolidation). Hey, it could be blessing in disguise because you didn’t get a single share out of Maxis IPO. Who knows, maybe Maxis share price will not venture too far away from its’ RM4.75 a share. If you’re too loaded with cash why not go and invest in stocks such as Apple Inc.? Stop sulking and invest your hard-earned money another day. However we’re no longer living in the age of manufacturing, at least not United States, a country which inherited such business model when one-third of their workforce were in the manufacturing. Of course the new manufacturing hub now is China but in the meantime what shall the U.S. men and women who lost their jobs do? With automation, technology and the shift in the services sector as the new way of doing business, employers may just have found the excuses of not hiring as many as they did before the recession. Hence it's interesting to watch the next month's jobless rate data.

However we’re no longer living in the age of manufacturing, at least not United States, a country which inherited such business model when one-third of their workforce were in the manufacturing. Of course the new manufacturing hub now is China but in the meantime what shall the U.S. men and women who lost their jobs do? With automation, technology and the shift in the services sector as the new way of doing business, employers may just have found the excuses of not hiring as many as they did before the recession. Hence it's interesting to watch the next month's jobless rate data. There’s no doubt that the newly appointed deputy MCA president Liow Tiong Lai belongs to the

There’s no doubt that the newly appointed deputy MCA president Liow Tiong Lai belongs to the  It’s not easy to find someone like Ong Tee Kiat who was willing to expose such scandal, regardless of whatever reason he did that in the first place. On the other hand there’re thousands of MCA politicians who are willing to become puppets as long as there’re millions to make. It’ll be interesting to see if Ong can still bark about PKFZ issue now that the scandal is slowly swept under the carpet after taken over by Najib’s other boys. The next episode should see how Chua Soi Lek tries to wrest back his deputy President post from the traitor Liow Tiong Lai. But with Registrar of Societies (ROS) adopting “hear no evil, see no evil” over Chua’s status, Chua and Ong needs to work together to get rid of traitors from the third force team.

It’s not easy to find someone like Ong Tee Kiat who was willing to expose such scandal, regardless of whatever reason he did that in the first place. On the other hand there’re thousands of MCA politicians who are willing to become puppets as long as there’re millions to make. It’ll be interesting to see if Ong can still bark about PKFZ issue now that the scandal is slowly swept under the carpet after taken over by Najib’s other boys. The next episode should see how Chua Soi Lek tries to wrest back his deputy President post from the traitor Liow Tiong Lai. But with Registrar of Societies (ROS) adopting “hear no evil, see no evil” over Chua’s status, Chua and Ong needs to work together to get rid of traitors from the third force team.

It’s no secret that the 78-year-old Teh Hong Piow has a “close model friend” from East Malaysia who was crying over a business deal gone sour but finally managed to get the sole Malaysian franchisee rights to the prestigious Ford Supermodel contest. Hmm, wonder who will be her sponsor for the contest *grin*. It’s also a well known fact that billionaire Teh Hong Piow was hospitalised for so-called minor operation recently. But not many know

It’s no secret that the 78-year-old Teh Hong Piow has a “close model friend” from East Malaysia who was crying over a business deal gone sour but finally managed to get the sole Malaysian franchisee rights to the prestigious Ford Supermodel contest. Hmm, wonder who will be her sponsor for the contest *grin*. It’s also a well known fact that billionaire Teh Hong Piow was hospitalised for so-called minor operation recently. But not many know From a mere S$130 a month working as a clerk in Oversea Chinese Banking Corp (OCBC) in 1950 to becming Malaysia’s third richest person with an estimated RM8.2 billion in wealth, it is sad to note that none of Teh Hong Piow’s four children (three daughters and a son) will continue to build or at least maintain the empire built more than four decades ago. Although Teh Hong Piow has his most-trusted man, Managing Director Tay Ah Lek, in position to continue the banking business after he’s no longer around, the most likely scenario is a

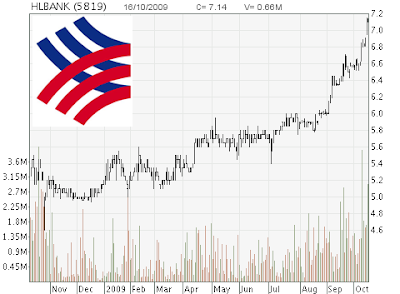

From a mere S$130 a month working as a clerk in Oversea Chinese Banking Corp (OCBC) in 1950 to becming Malaysia’s third richest person with an estimated RM8.2 billion in wealth, it is sad to note that none of Teh Hong Piow’s four children (three daughters and a son) will continue to build or at least maintain the empire built more than four decades ago. Although Teh Hong Piow has his most-trusted man, Managing Director Tay Ah Lek, in position to continue the banking business after he’s no longer around, the most likely scenario is a  With the current political landscape it’s easy to point the finger at none other than tycoon Quek Leng Chan, the founder of Hong Leong Group Malaysia which owns Hong Leong Bank. Prime Minister Najib’s fourth brother, Mohamed Nazim Razak, is the non-executive director of Hong Leong Bank Berhad (KLSE:

With the current political landscape it’s easy to point the finger at none other than tycoon Quek Leng Chan, the founder of Hong Leong Group Malaysia which owns Hong Leong Bank. Prime Minister Najib’s fourth brother, Mohamed Nazim Razak, is the non-executive director of Hong Leong Bank Berhad (KLSE:  Nevertheless Quek is no ordinary businessman so expect him to put in all his efforts in acquiring the best managed bank with cheapest possible offer-price. Furthermore political advantage is on Quek’s side hence there should not be any hindrance from the Central Bank. The biggest question is whether the current Najib’s administration would allow Hong Leong Bank to become such a giant (if merged with Public Bank) that it would undermine government-linked-banks such as largest lender Malayan Banking Berhad’s (KLSE:

Nevertheless Quek is no ordinary businessman so expect him to put in all his efforts in acquiring the best managed bank with cheapest possible offer-price. Furthermore political advantage is on Quek’s side hence there should not be any hindrance from the Central Bank. The biggest question is whether the current Najib’s administration would allow Hong Leong Bank to become such a giant (if merged with Public Bank) that it would undermine government-linked-banks such as largest lender Malayan Banking Berhad’s (KLSE:  It would be interesting to see if other companies could follow the same sentiment because it would certainly help Dow Jones’s journey into the 10,000-level territory. In any case if there are negative signals from big-boys’ earnings it could easily reverse the current bullish trend. During current stage it’s always a wise move to take some money off the table if your portfolios are in profit because it’s a fact nobody can say for certain the U.S. housing market and unemployment has bottomed.

It would be interesting to see if other companies could follow the same sentiment because it would certainly help Dow Jones’s journey into the 10,000-level territory. In any case if there are negative signals from big-boys’ earnings it could easily reverse the current bullish trend. During current stage it’s always a wise move to take some money off the table if your portfolios are in profit because it’s a fact nobody can say for certain the U.S. housing market and unemployment has bottomed. Unlike seven years ago (2002) when the company needs the money to expand the busines Maxis’s re-entry this time is due to different reason(s).

Unlike seven years ago (2002) when the company needs the money to expand the busines Maxis’s re-entry this time is due to different reason(s).

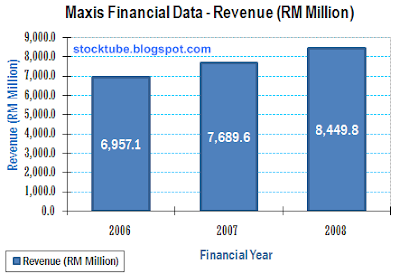

While the company only disclosed its domestic financial figures to the Securities Commission pre-listing hence hinting the operations and growth prospect in India (via Aircel) and Indonesia (PT Natrindo) are excluded, at least for the time being, you’ll be facing another grey area should Maxis decided to inject these overseas operation into Maxis Communications Berhad later. Who can forget the

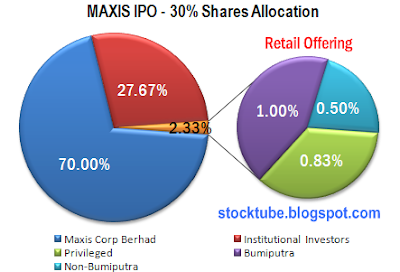

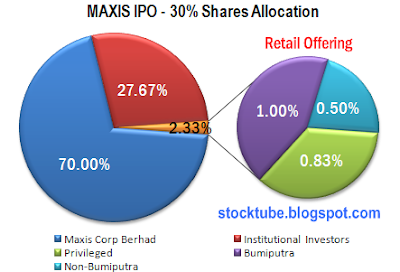

While the company only disclosed its domestic financial figures to the Securities Commission pre-listing hence hinting the operations and growth prospect in India (via Aircel) and Indonesia (PT Natrindo) are excluded, at least for the time being, you’ll be facing another grey area should Maxis decided to inject these overseas operation into Maxis Communications Berhad later. Who can forget the  The argument that associates retail investors with “dumping risk” group actually does not hold water. They don’t cry and jump from 18th floor because they got burnt for no apparent reason. The fact is retail investors are more emotional attached to their stocks than anybody so it was the institutional investors who will never think twice about dumping their stocks the moment the technical indicators said so. In the contrary retailers will keep their stocks (they never learn, do they?) under their pillow even during market crashes. Most of the retailers are expert in buying but not in selling *grin*.

The argument that associates retail investors with “dumping risk” group actually does not hold water. They don’t cry and jump from 18th floor because they got burnt for no apparent reason. The fact is retail investors are more emotional attached to their stocks than anybody so it was the institutional investors who will never think twice about dumping their stocks the moment the technical indicators said so. In the contrary retailers will keep their stocks (they never learn, do they?) under their pillow even during market crashes. Most of the retailers are expert in buying but not in selling *grin*. We’re still not sure the main reason tycoon Ananda Krishnan decided to re-list his crown jewel. Maybe he was asked to perform national service in exchange for some attractive propositions. Maybe he needs to unload and the RM40.5 bilion (based on IPO price of RM5.40) is a lot of money for him to re-allocate elsewhere. Maybe he couldn’t find any other oversea markets attractive enough to unlock his Maxis due to current economy climate. Maybe the counter-offer from Najib’s administration was too attractive to reject. Maybe he’s more confident with Najib’s administration since his close buddy former PM Mahathir is behind the scene advising Najib. Heck, for all you know maybe he knows something about Maxis potential that it would be stupid not to unload now *grin*.

We’re still not sure the main reason tycoon Ananda Krishnan decided to re-list his crown jewel. Maybe he was asked to perform national service in exchange for some attractive propositions. Maybe he needs to unload and the RM40.5 bilion (based on IPO price of RM5.40) is a lot of money for him to re-allocate elsewhere. Maybe he couldn’t find any other oversea markets attractive enough to unlock his Maxis due to current economy climate. Maybe the counter-offer from Najib’s administration was too attractive to reject. Maybe he’s more confident with Najib’s administration since his close buddy former PM Mahathir is behind the scene advising Najib. Heck, for all you know maybe he knows something about Maxis potential that it would be stupid not to unload now *grin*. Now that the ruling government’s most hated blogger RPK has exposed copies of 18-page memorandum submitted by Finance Ministry to the cabinet seeking endorsement for RM4.6 billion government loan to cover the cost over-run of the PKFZ project, Najib’s administration cannot deny anymore that it didn’t know anything about the scandal and hope to sacrifice former Transport Minister Chan Kong Choy and a few more small fishes – if that was the intention in the first place. The immediate reaction from Najib to punish those who leaked the Cabinet documents (under the name of Official Secreat Act, OSA) was sufficient to confirm that the government knew about the scandal since day one. Unlike Janet Jackson’s NippleGate, there’s

Now that the ruling government’s most hated blogger RPK has exposed copies of 18-page memorandum submitted by Finance Ministry to the cabinet seeking endorsement for RM4.6 billion government loan to cover the cost over-run of the PKFZ project, Najib’s administration cannot deny anymore that it didn’t know anything about the scandal and hope to sacrifice former Transport Minister Chan Kong Choy and a few more small fishes – if that was the intention in the first place. The immediate reaction from Najib to punish those who leaked the Cabinet documents (under the name of Official Secreat Act, OSA) was sufficient to confirm that the government knew about the scandal since day one. Unlike Janet Jackson’s NippleGate, there’s  Of course the joke of the town was that it would do peoples’ favor if Proton or Lotus could at least fix the legendary window-problem first before try to take on the Formula-1. Many also sarcastically hope the 1Malaysia F1 team drivers (whoever that is) could drive faster that Formula 1’s safety car *grin*. But was Najib’s plan a wise move since even giants like Honda and BMW have decided to quit due to extraordinary high cost? Honda and BMW’s F1-teams were spending US$398 million and US$367 million respectively in 2008 alone. The team that spent the least, Force India, was spending US$122 million in 2008 and you don’t have to be a rocket scientist to calculate how much the 1Malaysia F1 team would be spending.

Of course the joke of the town was that it would do peoples’ favor if Proton or Lotus could at least fix the legendary window-problem first before try to take on the Formula-1. Many also sarcastically hope the 1Malaysia F1 team drivers (whoever that is) could drive faster that Formula 1’s safety car *grin*. But was Najib’s plan a wise move since even giants like Honda and BMW have decided to quit due to extraordinary high cost? Honda and BMW’s F1-teams were spending US$398 million and US$367 million respectively in 2008 alone. The team that spent the least, Force India, was spending US$122 million in 2008 and you don’t have to be a rocket scientist to calculate how much the 1Malaysia F1 team would be spending. Sure, Alex Yoong was the wrong candidate to drive in Formula-1 (is he coming back again?). He was there because of this father’s close connection with the then Mahathir’s administration. But since then do we have the local quality to drive such a powerful racing car? Will we try the same path as Alex Yoong again and in the process send Malaysia’s team to the bottom of the chart? Maybe they’ve shortlisted daredevil “Mat Rempits” as the future heroes. Otherwise it is misleading to declare that the F-1 car will be

Sure, Alex Yoong was the wrong candidate to drive in Formula-1 (is he coming back again?). He was there because of this father’s close connection with the then Mahathir’s administration. But since then do we have the local quality to drive such a powerful racing car? Will we try the same path as Alex Yoong again and in the process send Malaysia’s team to the bottom of the chart? Maybe they’ve shortlisted daredevil “Mat Rempits” as the future heroes. Otherwise it is misleading to declare that the F-1 car will be

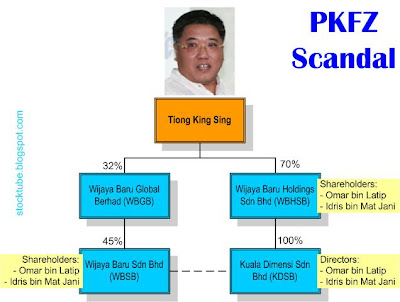

Along the years there were many scandals but nothing beats the controversial PKFZ (Port Klang Free Zone) scandal which looks to

Along the years there were many scandals but nothing beats the controversial PKFZ (Port Klang Free Zone) scandal which looks to  However the tycoon who is also the BN backbenchers’ chief received a rude shock when MCA newly elected president, Ong Tee Kiat, made public the audit findings by PricewaterhouseCoopers about irregularities on PKFZ project. The delay in the release of the findings initially however suggested that Ong Tee Kiat was under political pressure from his master, UMNO, to sweep the scandal under the carpet. But since the Mar 2008 general election, the ruling government cannot ignore peoples’ voice in totality whatmore with Ong’s promise to reveal all about the project, just before he becomes the president of MCA. Ong Tee Kiat also may think that it would be wise for him not to cover the scandal, not that he could in the first place, considering he’s still relatively “clean” compared to his predecessors Chan Kong Choy and Ling Liong Sik.

However the tycoon who is also the BN backbenchers’ chief received a rude shock when MCA newly elected president, Ong Tee Kiat, made public the audit findings by PricewaterhouseCoopers about irregularities on PKFZ project. The delay in the release of the findings initially however suggested that Ong Tee Kiat was under political pressure from his master, UMNO, to sweep the scandal under the carpet. But since the Mar 2008 general election, the ruling government cannot ignore peoples’ voice in totality whatmore with Ong’s promise to reveal all about the project, just before he becomes the president of MCA. Ong Tee Kiat also may think that it would be wise for him not to cover the scandal, not that he could in the first place, considering he’s still relatively “clean” compared to his predecessors Chan Kong Choy and Ling Liong Sik. Politically, Ong Tee Kiat’s base is still quite weak compared to his rival Chua Soi Lek thus naturally he made the right move to project himself as the least tainted MCA president. But in the process he has

Politically, Ong Tee Kiat’s base is still quite weak compared to his rival Chua Soi Lek thus naturally he made the right move to project himself as the least tainted MCA president. But in the process he has  What better option than to have young and obedient chaps such as Health Minister Liow Tiong Lai and Deputy Education Minister Wee Ka Siong to become the new president and deputy president of MCA knowing well that both are guaranteed to “kow-tow” to their political master UMNO? The fact that Ong Tee Kiat was grilled twice by the Anti-Corruption Agency on allegation by Tiong King Sing that the former took free ride using his private jet and accepted RM10 million in donation clearly shows that Ong Tee Kiat’s tenure in MCA may not last long. Heck, which political parties within the ruling BN government never accept donations before? Short of freezing RM140 million of Kuala Dimensi funds which is chicken-feed to Tiong King Sing, the tycoon is still untouchable. The battle here is about who has the deepest pocket and there’s no prize for guessing who will win ultimately. It was hope that once Ong Tee Kiat is out of MCA the PKFZ scandal may be forgotten - forever.

What better option than to have young and obedient chaps such as Health Minister Liow Tiong Lai and Deputy Education Minister Wee Ka Siong to become the new president and deputy president of MCA knowing well that both are guaranteed to “kow-tow” to their political master UMNO? The fact that Ong Tee Kiat was grilled twice by the Anti-Corruption Agency on allegation by Tiong King Sing that the former took free ride using his private jet and accepted RM10 million in donation clearly shows that Ong Tee Kiat’s tenure in MCA may not last long. Heck, which political parties within the ruling BN government never accept donations before? Short of freezing RM140 million of Kuala Dimensi funds which is chicken-feed to Tiong King Sing, the tycoon is still untouchable. The battle here is about who has the deepest pocket and there’s no prize for guessing who will win ultimately. It was hope that once Ong Tee Kiat is out of MCA the PKFZ scandal may be forgotten - forever. There’s of course speculation that after Ong and Chua’s episode is over,

There’s of course speculation that after Ong and Chua’s episode is over,  The month of September started with a bang – Dow Jones and Nasdaq went down the drain plunging 185.68 and 40.17 points respectively or 2 percent each. In fact, since 1929’s Great Depression

The month of September started with a bang – Dow Jones and Nasdaq went down the drain plunging 185.68 and 40.17 points respectively or 2 percent each. In fact, since 1929’s Great Depression  But let’s not panic after the Dow’s overnight 25% plunge because the DJIA is still above 9,000-level. Maybe we can press the panic button only if it tumbles below this level. Furthermore recent investor sentiment survey showed 51.6% bulls, 19.8% bears and most importantly 28.6% actually expecting a correction after the recent rally. However I suppose in a market where the bull is taking its rest, rumors of more bank failures can easily send stocks players run helter-skelter. It seems investors have pulled a staggering $4.77 billion from two Cerberus hedge funds. That amounts to almost 20% of Cerberus’s total $24.3 billion in assets and although the managing director of Cerberus Capital Management LP has promptly denies the rumor that the fund has made huge losses on private equity investments in Chrysler and GMAC, the damage has been done.

But let’s not panic after the Dow’s overnight 25% plunge because the DJIA is still above 9,000-level. Maybe we can press the panic button only if it tumbles below this level. Furthermore recent investor sentiment survey showed 51.6% bulls, 19.8% bears and most importantly 28.6% actually expecting a correction after the recent rally. However I suppose in a market where the bull is taking its rest, rumors of more bank failures can easily send stocks players run helter-skelter. It seems investors have pulled a staggering $4.77 billion from two Cerberus hedge funds. That amounts to almost 20% of Cerberus’s total $24.3 billion in assets and although the managing director of Cerberus Capital Management LP has promptly denies the rumor that the fund has made huge losses on private equity investments in Chrysler and GMAC, the damage has been done.