Sunday, May 31, 2009

PKFZ’s RM12 Billion Scandal - Where’re the Sharks?

PKFZ (Port Klang Free Zone) scandal is perhaps the biggest scandal the country ever had so far from the legacy of former premier Mahathir Mohamad since the BMF scandal, that’s if you ignore the Central Bank’s losses from the foreign exchange speculation. BMF (Bumiputra Malaysia Finance Ltd) scandal involved losses of about RM2.5 billion (that’s huge amount of money back in early 80s mind you) thanks to dubious loans to Hong Kong Carrian Group which collapsed in 1983 after the property crash. Carrian Group chairman George Tan (a Malaysian/Singaporean businessman), BMF chairman Lorraine Esme Osman (a longtime Tengku Razaleigh Hamzah associate) and BBMB (Bank Bumiputra Malaysia Berhad) executive director Mohd Mashim Shamsuddin were figures linked to the scandal.

Like it or not PKFZ is yet another shameful scandal although government-controlled news tried to play down the issue by using “weak project management” by PKA (Port Klang Authority) instead. Of course if the word “scandal” is used then many heads need to roll but a “weak project management” means people who were responsible for multi-billion of dollars of losses can be forgiven. Just like BMF scandal the Malaysian government was trying to cover-up the PKFZ scandal but the losses just got too huge to be swept under the carpet. And if not for the huge losses in peoples’ confidence in the current BN government as can be witnessed from the Mar 2008 general election, you must be mad to think that Najib’s administration would reveal the findings of PKFZ scandal by PricewaterhouseCoopers to the public.

Prolonging PKFZ Report to Cover-Up Politicians?

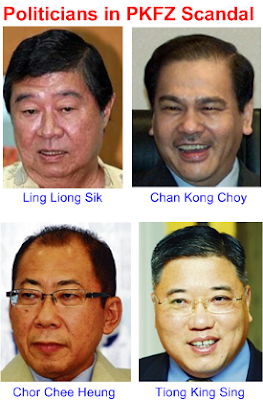

Although the report has been delayed for many months with countless of modifications made to ensure it is “in order and presentable” to the public *ahem*, a round of applause should be given to Najib’s administration although at the early stage the Transport Minister Ong Tee Kiat tried very hard to divert the attention from the scandal. Unfortunately the PKFZ scandal was simply too huge and the potential of losses is unlimited hence it’s too difficult not to scream the name of former Transport Ministers Chan Kong Choy and Ling Liong Sik. If the contents of this final report (to the public) which has been amended is shocking enough, can you imagine what would be the original report be? The good news is: the big sharks involved will get away while some small fishes may be charged but eventually their case will be thrown out due to insufficient evidence, as usual lor.

Politicians Who Made Billions

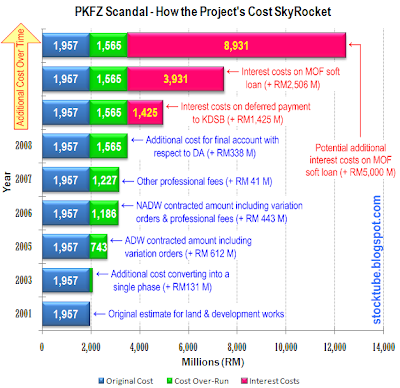

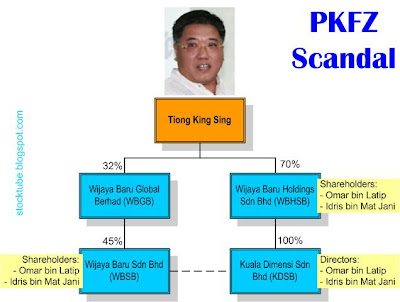

Initially PKA (or rather “Puk Kai” Authority?) entered into several agreements with KDSB (Kuala Dimensi Sdn Bhd), a wholly-owned subsidiary of Wijaya Baru Holdings Sdn Bhd (WBHSB). Ironically WBHSB is heavily owned by several politicians from the ruling government inclusive BN backbenchers chief Tiong King Sing who owns 70% stake. KDSB made handsome gains when it bought the land for RM3 per square foot (psf) and sold it for RM25 psf to the government although the government’s valuation was only RM10 psf. With this purchase the project cost was at RM1.957 billion but subsequently escalated to RM3.522 billion as at 31 Dec 2008. Interest cost due to deferred payments to KDSB increased to RM1.425 billion resulting in a total project cost of RM4.947 billion.

PKA was having problem since the beginning - it had to get a 20-year soft loan of RM4.632 billion from Ministry of Finance (MOF) when it could not even pay the first scheduled payment in 2007 to KDSB. The soft loan alone would squeeze RM2.506 billion of interest cost from PKA and this would push the total project to a staggering RM7.453 billion. It was reported that PKA would have no more money left between 2012 and 2041 after paying two installments to MOF and when this happen additional interest cost of approximately RM5 billion would send the PKFZ project to RM12.453 billion *WoW*. And you wonder why Jebel Ali Free Zone Authority pulled out from a pact to manage PKFZ.

- Ting Chew Peh – Pengerusi (2001 - 2003)

- Abdul Rahman bin Mohd Noor – Wakil Ketua Setiausaha, Transport Ministry

- Zubir bin Abdul Aziz – Wakil Ketua Pengarah, Unit Perancang Ekonomi, PM Office

- Yap Pian Hon – Pengerusi (2004 - 2006)

- Chor Chee Heong – Pengerusi (2007)

- And many more politicians and little Napoleans

PKFZ’s 20 Major Problems

PricewaterhouseCoopers has basically outlined 20 issues with PKFZ:

Issue-1: The proposal to purchase the land was approved by the Cabinet but subsequent development proposals (2004 - 2006) which involved additional RM1.84 billion were not tabled to Cabinet for approval but were awarded to KDSB after recommendations from Minister of Transport to the Prime Minister.

Issue-2: Even though PKA knew it was not able to meet the Cabinet’s condition on self-financing, it not only did not alert the Cabinet but miraculously had the gut to sign other development agreements and thereafter the cost balloon indefinitely. Without support from somebody as powerful as a minister, you won't dare to do so, do you?

Issue-3: PKA board did not exercise adequate governance over the project implementation, another nice way to say the board did not know or simply clueless on was happening on the ground. Lots of things happened without the board’s approval or maybe the board didn’t care at all (close one eye?).

Issue-4: Advice of the Attornet General was not sought to safeguard the interests of PKA and the Government (I think it should be the taxpayers’ interests instead). Worst still, compliance such as defect liability was deliberately taken out from the agreements entered with KDSB.

Issue-5: Involvement of politicians and individuals who obviously created conflicts of interest. Chor Chee Heung, for example, was non-executive Deputy Chairman of Wijaya Baru Global Berhad (Apr’2004 – Jul’2007) and at the same time acted as Chairman of PKA (Apr’2007 – Mar’2008). In fact WBGB, KDSB, WBHSB and WBSB are all related under the umbrella of a common shareholder – Tiong King Sing.

Issue-6: Interest on the MOF soft loan will increase the project cost from RM4.947 billion to RM7.453 billion and it seemed like PKA would be almost bankrupt thereafter unless the MOF soft loan is restructured otherwise the project expenditure will balloon to RM12.453 billion. MOF soft loan of 4% per-annum over a period of 20-year will slowly but surely kill PKA of which was already being squeeze by KDSB.

Issue-7: PKA and Ministry of Transport somehow chose not to comply with MOF’s recommendation to issue government-guaranteed bonds to reduce funding cost. Obviously leakages happened when the illiterate PKA was willing to pay 7.5% per-annum charged by KDSB on deferred payments for the land purchase compared to government-guaranteed bonds coupon rates of 3.80% to 4.27%.

Issue-8: The land was purchased at value above market value. Apparently KDSB managed to convince (or rather con?) PKA that the land was worth RM25 psf because it has “special value” as if there were huge deposit of gold or oil hidden underground. Earlier JPPH valued the land at RM17 psf in Nov 1998 and RM18 psf in May 2000.

Issue-9: KDSB may have taken advantage of PKA, which didn’t really care about the project, by overcharged the latter for interest by between RM51 million to RM309 million in regards to the land purchase. The interest has been calculated using 6-monthly compounded basis instead of non-compounded yearly basis.

Issue-10: DA3, which did not contain detailed specifications and scope of work, was not a “fixed sum” contract. As a result the original estimate of RM1 billion surprisingly ballooned by 21% to RM1.216 billion. KDSB later claimed additional RM121.592 million as professional fees being 10% of the final amount of RM1.216 billion – was this figure (10%) plucked from the sky since it was not mentioned in the DA3 and PKA didn’t even question it? Thus the final development cost increased by 33% from the original estimated amount of RM1 billion to RM1.337 billion. Now, who says making money from the Malaysian Government is difficult?

Issue-11: PKA again showed its “generousity” when it allowed additional claim of RM95.256 million for general preliminaries although this cost was not specified in the DA. This was not due to stupidity on PKA but a very obvious case of leakages in broad daylight.

Issue-12: Although KDSB did not deliver three infrastructure components (monsoon drain system, water supply system and two bridges) as specified in the land purchase agreement, the final account did not include any deduction for value of work not done.

Issue-13: KDSB was awarded the RM1 billion development contract nine months before a project masterplan was finalized. Obviously someone very powerful whose status is nothing less than a minister had a hand on such decision. Your guess is as good as mine.

Issue-14: PKA may not have received value for money because it depends solely on KDSB as the turnkey developer raising the question what role is PKA playing in this project.

Issue-15: There was almost no project management and control over the project although this is a multi-billion project. It seemed the main objective was to suck up as much money as possible from the project without concern for the project deliverables.

Issue-16: Project status as at 31 Dec 2008 – except for LIU with CF, defect liability period has expired and certain defects remain to be rectified.

Issue-17: PKA has projected that it will be in cumulative cash deficit position in 2012 and will not be able to repay MOF soft loan installments thereafter. Potentially the PKFZ total project cost could skyrocket to more than RM12 billion.

Issue-18: Ministry of Transport has breached Treasury regulations because it has issued four letters of support to PKA which could be construed as a guarantee that PKA would meet its obligations on a full and timely basis. Ministry of Transport needs Ministry of Finance’s approval before issue such letters.

Issue-19: To date, PKFZ only managed to attract occupancy of only 14% which is insufficient in generating revenue to cover its operating expenses, let alone in servicing the interest costs.

Issue-20: PKFZSB is as good as bankrupt because it has incurred losses since its incorporation and has negative shareholder’s funds as at 30 Sept 2008.

So, what’s next Najib?

Sure, Ong Tee Keat (current Transport Minister) can now blow his trumpet and bull his way that the decision on PKFZ will be in people’s interest and all those craps but the fact that he tried to delay the release of the earlier version of PricewaterhouseCoopers report on PKFZ means his predecessors are involved and he’s trying to cover up for them. However this PKA is actually a one big happy family consists of politicians from the current government BN trying to scoop their “ice creams” from the taxpayer’s money. When there’s no sincerity in ensuring the project succeed but merely to suck up the leakages as much as possible, it’s a matter of time before the project get too hot and burst.

If Najib’s administration thinks that by releasing the report to the public without “fair prosecution” of those involved in the scandal the people will start sing the song of praises of him, he may as well cover this scandal. To blame the whole scandal on poor and weak management on the part of PKA is simply insulting our intelligence. You can’t screwed up and pretended nothing happens and nobody will know and keep screwing up until there’s no turning back as can be seen with the current potential RM12.453 billion of cost overrun. That’s more than six times of original cost for the project. And RM10 billion is a huge sum that can help thousands of poor citizens but I’m sure many pockets of those involved would get away free, as usual.

Other Articles That May Interest You ...

- Transportation – Silly PR Stunt and PKFZ Scandal Revisit

- Malaysia 12th Election – Dynasties & internal Cleansing?

- No fees but shareholders fuming Ling Chicken Out

- Learn from Mistakes - better days ahead for Transmile

- Ling Liong Sik Resigned (or Fired?) from Transmile

- Malaysia’s Biggest Scandal – Business as Usual

Thursday, May 28, 2009

Foreign Funds My Foot! Learn from Genting Singapore

CIMB Investment Bank Berhad claimed that foreign investors returned in droves bringing in their hot money as if they have no where else to park their money. The funny part is CIMB can only target the KLCI to reach 1,060 points by year-end, another 20 points from today’s index of 1,040. Why not 1,200 or 1,300 or even 1,600 points by year-end? What’s wrong with a higher target if CIMB and other researchers or analysts for that matter are freaking sure Malaysia stock market is a honey-pot that it would be stupid for foreign funds to ignore? Furthermore when the Dow Jones jumped the KLCI happily jumped with the same quantum but when the Dow Jones plunged miraculously the KLCI staged a very high resistance in following suit.

Can you tell me the level of KLCI if the DJIA were to jump to 9,000-points by year-end, since the Americans are very optimistic of their economy based on the latest U.S. consumer confidence barometer? I would be very surprise if KLCI couldn’t even breach 1,200 by then judging from the current overall bullish sentiment on the local trading floor. Unless the market-maker decided to push the “game over” button, the speculators or punters can still happily punting and dancing to the tune of the music. As long as the volume is high and the composite index is above 1,000-points you can bet your last dollar that the top-20 active counters are all penny stocks. And you don’t think foreign funds, if they indeed have returned, are scooping from the same penny-stocks pool, do you?

There’s no doubt that the current bear rally or suckers rally is one hell of a good rally, if you believe the current trend is a suckers rally in the first place. It’s hard to justify that the current rally is a bull rally because corporates’ quarter earnings are still plunging. But why the bullish trend when the earnings are going south? Sure, you may argue that people are buying in advance because the bull will report to work end of the year and you don’t start buying only when that happen. You buy in advance because traditionally that’s how it works. You do not want to miss the boat because you believe you should maximize your profit by being “kiasu” – buy at the lowest. That’s the basic mentality of most of the punters and to a certain degree analysts of the day. But do you have a plan to lock in your profit now since analysts are getting nervous that the market is getting too hot and a major healthy consolidation should kicks in anytime soon?

What if the current bullish sentiment in the local KLSE was deliberately pushed up to attract local punters such as you? Every Tom, Dick and his cat knew the quarter earnings were going to be bad so to see the local stock market defying the gravity is simply breathtaking. But Najib’s administration needs to show that he’s a better PM than Abdullah Badawi. It’s strange that Abdullah didn’t think of using stimulus package stunt to push up the stocks. Indeed Abdullah Badawi was the weakest and lousiest prime minister so far. If the current bullish sentiment was the result of government-link-funds leveraging on the stimulus packages, can you imagine what it could do to the local stock market if foreign investors were genuinely pouring their hot money into the country? Of course that will take time and Najib’s administration needs to do more than lips service to ensure the blatant day-light robbery of NEP is history.

The other day we were having discussion with another Singaporean who had just arrived. We agreed that despite the big hoo-haa about the global recession, it seems Singaporeans and Malaysians do not see this recession as bad as the previous 1997-98 Crisis. Surprisingly we even suspected that many employers were actually using the recession as an excuse to retrench their staffs hence exaggerated the situation. Except for manufacturing sector, people are still shopping like there’s no tomorrow and Friday and Saturday’s happy hours are still as bustling as before. However there’re some key differentiators between now and 1997. Now we have China to cushion most of the impact and most of the people who got burnt in the stock market during 1997 are still licking their wounds.

What we’re seeing now are “new-birds” eager to try their luck on the gambling table, at least majority of them. At the same time the “old-birds” are getting smarter and place their bets in phases. Can you see the report that the country’s first quarter contraction of 6.2% has relatively no effect on the stock market? You may argue that investors had taken that into consideration since the report is outdated because we’re now into second quarter. But the Central Bank Governor also said the second quarter will have little difference from what was revealed so what gives? Meantime watch out for Vincent Tan’s Berjaya Corp because it has been more than a year since the stock was fried *brings back sweet memory of 100% profit*. Happy Dumpling Festival !!

Other Articles That May Interest You …

Wednesday, May 27, 2009

Even if the Worst is Over, So What?

General Motors Corp. (NYSE: GM, stock) announced that only a small fraction of the holders of its $27 billion in bonds agreed to swap their debt for a 10 percent equity share of a recapitalized GM. Without at least 90% of GM’s unsecured debt bondholders agreeable to the swap-plan, GM has no other choice but to file for bankruptcy. The U.S. government is expected to become the largest stakeholder in a restructured GM – as high as 70%. Fortunately there was other good news that overshadowed the gloomy GM’s problem.

It seems the Americans are more optimistic about their economy with the U.S. consumer confidence barometer jumped in May to its highest level since September thus sending the Dow Jones up almost 200-points yesterday. Also more than 90% of economists predict the U.S. recession will end this year, according to a study done by National Association for Business Economics (NABE) but nobody dares to say anything positive about unemployment. In fact NABE said unemployment rate would average 9.1% - highest level since 9.6% registered in 1983. Some even predicted unemployment could skyrocket to 10.7% in the second quarter 2010.

Nevertheless even after the recession ended, U.S. economy growth is expected to be weak for at least two years. The good news is the outlook for Asia was more positive than for U.S., Europe and Japan. Malaysian Central Bank Governor released the GDP report that the country’s economy contracted by a whopping 6.2% in the first quarter thanks to weak external demand for manufacturing goods. The Governor also expects the second quarter performance to be little change and mirror the first quarter. However the question is whether the country will emerge a stronger nation to combat the next recession after the dust is over. Najib’s administration doesn’t seems to be interested in moving the country to a higher value-chain judging from the excessive politiking, not to mention his education minister is still clueless on what to do with the “brains” at schools.

Other Articles That May Interest You …

- Now is the best time to overhaul – GM to the Bankruptcy

- Chopping Board for Stubborn Punters and Gamblers

- Stress Test a Hoax? Another Wave of Banking Tsunami?

- Beats Earnings - Blinded by Excessive Low Expectation

- Fishing for the bottom – 140 Years of Bull & Bear Hints

- Interest Rate Hike on Non-National Cars – Why?

- Dow Jones Rally – is the Worst Really Over?

- Britain, a Ticking Depression Time-Bomb?

- Citi Stock at $1 a share – Cool; Right Issues - Boo

No comments:

Post a Comment