Thursday, November 12, 2009

Didn’t get Maxis IPO Shares? Stop Sulking, Be Happy

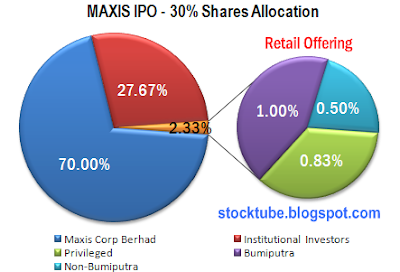

Much has been written about how unfair it was in the Maxis relisting IPO shares allocation. To recap the horror story, existing Maxis shareholders (that’s Ananda Krishnan and his geng) agreed to give up 30% of their share for the purpose of the IPO of which a whopping 27.67% was to be allocated to institutional investors while Average-Joes were allocated a merely 2.33%. After the book-building exercise Maxis Berhad has set the price of the IPO at RM4.75 per share while institutional at RM5.00 a share – raising RM11.2 billion from the 2.25 billions shares to be floated in the local stock market this coming 19 Nov 2009.

Now, many are crying over the small retail portion allocated from this IPO, something which is understandable considering that it’s not everyday you have the opportunity to be part of the minority shareholders of such an established company. Many former Maxis shareholders still remember the huge profit they made (RM15.60 a share during Maxis privatization in June 2007) from their initial investment in Maxis’s first IPO hence they expect the same may happen from this second round of Maxis IPO.

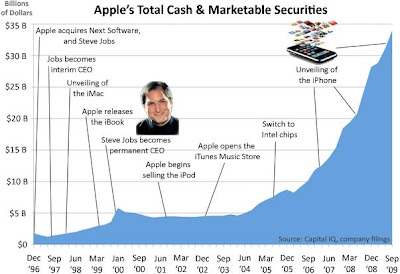

Anyway if you didn’t’ get any Maxis IPO shares due to the limited retail portion, do not get too sad and start crying like a baby who losses his / her pacifier. As have mentioned many times, Maxis today is a different animal and the upside is not the same as when it was listed the first time. Do I really have to re-mention the word “saturated” again? Sure, non of Maxis top management will tell you this and they will keep telling you there’re more spaces of growth (otherwise who in their right mind would buy their shares?). Underwriters told you the same story as if Maxis is another Apple Inc. (Nasdaq: AAPL, stock) and Ananda Krishnan is Steve Jobs. If the underwriters didn’t tell you such fairy tales then they need to take up the remaining unsubscribe shares so it was their job to tell you so.

Of course there’re still some upsides to the initial IPO price of RM4.75 upon listing because people who didn’t manage to get a single share would be chasing the stock because they’re buying for its dividend. The stock price may go up to RM6.00 a share easily because institutional investors are not about to sell on the first day of listing, at least not the so-called cornerstone investors who had promised not to sell within 6-months from the listing date. Funds such as EPF (Employees Provident Fund) and PNB (Permodalan Nasinal Berhad) who relies heavily on dividend stocks as their return to the members will not sell and this will contribute to price surge should retailers decide to chase the stock further. Maxis IPO price of RM4.75 also means it was priced at 15.83 multiple times of the company financial year 2009’s 30 sen EPS. At RM6.00 a share the stock will be trading at an EPS of 20 times and this is expensive considering the saturation in the mobile telecommunication sector. The local and global stock markets are currently at the junction whereby the economy recovery is still questionable. Hence if you were to chase the stock you may be buying at the highest. Don’t try to buy for the sake of buying or out of revenge just to show that you’re also belong to the Maxis shareholders group. Take your time and wait for the right time to buy at a later stage (price consolidation). Hey, it could be blessing in disguise because you didn’t get a single share out of Maxis IPO. Who knows, maybe Maxis share price will not venture too far away from its’ RM4.75 a share. If you’re too loaded with cash why not go and invest in stocks such as Apple Inc.? Stop sulking and invest your hard-earned money another day.

Maxis IPO price of RM4.75 also means it was priced at 15.83 multiple times of the company financial year 2009’s 30 sen EPS. At RM6.00 a share the stock will be trading at an EPS of 20 times and this is expensive considering the saturation in the mobile telecommunication sector. The local and global stock markets are currently at the junction whereby the economy recovery is still questionable. Hence if you were to chase the stock you may be buying at the highest. Don’t try to buy for the sake of buying or out of revenge just to show that you’re also belong to the Maxis shareholders group. Take your time and wait for the right time to buy at a later stage (price consolidation). Hey, it could be blessing in disguise because you didn’t get a single share out of Maxis IPO. Who knows, maybe Maxis share price will not venture too far away from its’ RM4.75 a share. If you’re too loaded with cash why not go and invest in stocks such as Apple Inc.? Stop sulking and invest your hard-earned money another day.

Other Articles That May Interest You …

- Maxis Relisting – The Race for the Pathetic Limited Shares

- Maxis is Coming (back) to Town but are Investors Excited?

- The Rise of CELCOM Empire, Tales You Should Know

- It's RM15.60 for Your MAXIS Shares - Would You Sell?

- MAXIS Delisting – Good News for DIGI and TELEKOM Stocks

- Maxis Second Attempt To Buy India's Hutchison Essar

Monday, November 09, 2009

Why Stocks didn’t take cue from Jobless Rate?

Recession may be over, at least for now, but the same cannot be said about U.S. unemployment market. The jobless rate surprisingly surpassed analysts’ estimate (of 9.9%) to a staggering 10.2% in Oct, higher than Sep’s 9.8% jobless rate. Strangely enough the stock markets, both Dow Jones and Nasdaq, didn’t take much cue from the double-digit jobless rate which is the highest since early 1983. United States recorded jobless rate of 10.8% during the period of September 1982 to July 1983 while during World War II the country experienced 11% of unemployment. The latest data may send U.S. economists at MFR Inc. back to the drawing board since their prediction of hitting jobless rate of 11% by mid-2010 may come sooner than expected.So what does this means? It only means that while we may not have the opportunity to witness yet again another 1929 depression, the recovery is definitely moving at a snail pace. Make no mistake about it – the U.S. economy didn’t dive to the like of 1929 Depression because of government’s stimulus package and it appears that Obama’s administration may has no other option but to get ready it’s second stimulus bill, in case of more surprises such as credit card burst. But there’s something more worrying about the economy model that is sending many economists cracking their heads.

The global recession sparked by U.S. subprime mortgages problem may be the turning point that will shape a new way of how business cycle operates. We may not be able to claim back the jobs destroyed during the recession because if the latest jobless rate is anything to go by – jobs will not necessary be replenished after the recession dust is over. Recession which ended in 1991 took a year before re-hiring resumed and the recession ended 2001 took two years before the jobless could find their job. So if we’re lucky the current jobless rate may take at least three years to recover, provided the old way of business cycle is still intact.

However we’re no longer living in the age of manufacturing, at least not United States, a country which inherited such business model when one-third of their workforce were in the manufacturing. Of course the new manufacturing hub now is China but in the meantime what shall the U.S. men and women who lost their jobs do? With automation, technology and the shift in the services sector as the new way of doing business, employers may just have found the excuses of not hiring as many as they did before the recession. Hence it's interesting to watch the next month's jobless rate data.

However we’re no longer living in the age of manufacturing, at least not United States, a country which inherited such business model when one-third of their workforce were in the manufacturing. Of course the new manufacturing hub now is China but in the meantime what shall the U.S. men and women who lost their jobs do? With automation, technology and the shift in the services sector as the new way of doing business, employers may just have found the excuses of not hiring as many as they did before the recession. Hence it's interesting to watch the next month's jobless rate data.Back to the stocks, one of the reasons why the market didn’t tumble after the jobless rate data was release could be due to the bet that Federal Reserve has no reason to hike the banking lending rate so the record low rate or zero to 0.25% may stay for some time. Lower interest rate makes dollar unattractive and this would pump more liquidity into the stock market. So where will be new interests? Definitely you can short the dollar in currency trading; gold is still skyrocketing as if there’s no tomorrow and the Hurricane Ida may just create enough havoc in the Gulf Coast to push up oil prices.

Another reason why the stocks are still relatively bullish is due to the fact that holiday season is around the corner. Analysts are still waiting for the retailers’ earnings reports for clues if the consumers are willing to spend. Christmas may be used as an excuse to spend but otherwise the Dow Jones may drop to below 10,000 once the retailers’ earnings reports are not favorable.

No comments:

Post a Comment