Friday, March 07, 2008

Best time to deny BN two third Majority, Fact or Myth?

In less than 24 hours eligible Malaysian will become the “decision maker” of their own destiny – to vote their candidates and parties in the 12th General Election. This is the only chance to make things right after most of themscrewed up big time four years ago when the slogan of empty promises were drummed into their ears. Strangely this time around the posters war wasn’t that fierce although oppositions managed to make fools out of Gerakan’s sloganeering, one of the component parties within the ruling Barisan Nasional (National Front) coalition.

Huge crowds numbering to a staggering 50,000 were seen braving rain and traffic for the sake of listening to oppositions’ speeches in Penang, Malaysia. But the billion-dollar question is will these people who enjoyed the spectacular speeches are brave enough to put the cross (for opposition) onto the voting paper tomorrow? Opposition party DAP should still remember how despite the same huge crowds back in 1999 the Penangites sent the party packing. It was disastrous and DAP was speechless after the Penang Chinese chickened out.

Despite being complex, Penang Chinese are as kiasu and kiasi as Singaporean and are definitely not risk-takers despite being fooled by the National Front again and again without fail. Oppositions are claiming this is the best time to deny the arrogant National Front their two-third majority and could even form the new government but let’s get real. It’s easier to strike RM20 million lottery than to capture 75 parliamentary seats necessary to deny Abdullah Badawi’s team. The stars are not aligned in favor of oppositions.

And please don’t forget the bonus or reserve votes specifically tailored made for National Front to the tune of over 200,000 army votes. The bias Election Commission can deploy this huge votes anywhere required to cheat help National Front again. Need I say about the phantom votes again? So, the time for National Front or BN to be toppled has not yet arrived. Maybe if the Penangites are ready (and brave enough) to come forward by voting for oppositions tomorrow, it couldprovides the first step towards the chance of denying National Front its two-third majority in the next coming 13th General Election.

Enjoy the campaign (ceramah) video by Raja Petra Kamarudin in SS2 below. Can you imagine what could happen if there’s no YouTube? Oppositions will be slaughtered by the government-controlled print and electronic media. Perhaps Abdullah Badawi should consider buy over YouTube instead of the stupid “Corridors” projects.

Other Articles That May Interest You …

How to win a Nintendo Wii

What did you do when the local stock market was plunging into the toilet since the last couple of days? It staged a technical rebound today but that doesn’t mean the light is at the end of the tunnel. I normally play my PS2 when the stock market does not present opportunity to trade. Nowadays gamers are crazy about Wii instead of PS2 or PS3 from Sony and in the blogosphere you can read competition whereby Nintendo Wii was given away. Now you can win Wii by entering a couple of information.

Charter is giving away Nintendo Wii for readers in four steps. Just enter your e-mail together with some other personal information such as your name, address, telephone number etc and you’re on your way to win the Wii. You need to be 18 years of age or older though. The winner will receive Nintendo Wii Console, Wii Stand, 1 remote control, 5 games, 1 remote control and other standard accessories.

Besides, readers could bid for Charter High-Speed Internet for Life. The registration is for visitors who are staying within the serviceable area only. In another words if you’re not living within the coverage area, you can forget about it. Bids start at $10 and the auction begins on Mar 12, 2008. A random drawing will be done to select the winner by the sponsor and the winner will be notified by telephone, e-mail or snail mail by April 7, 2008. Click Here for a Chance to Win a Nintendo® Wii™!

*sponsored*

Thursday, March 06, 2008

Interested in trading currency? Wish to try it FREE?

In case you’ve not recovered from the shock of my previous article that the global oil prices might be heading for the $130 a barrel mark here’s another record reading. Briefly after Nymex closed Wednesday, the oil prices hit anew trading record - $104.95, just 5 cents short of touching the $105 level. If you didn’t know, the inflation-adjusted oil price record of $103.76 based on Iran hostage crisis back in 1980 has already been broken. In another words, we’re seeing theall-time high prices of the black-gold.

The reason for yesterday’s record was mainly due to the small wave in supplies drop that hit the already sensitive volatility in the futures market. The small wave turns out to be a rogue wave when U.S. Energy Department's Energy Information Administration (EIA) reported a surprise drop in crude oil stockpiles when most analysts expect it otherwise. The decision by OPEC to do nothing to the production didn’t help either but who can blame them when more profits are flowing into their coffers.

With Saxo Bank you can trade over 160 currencies, 24 hours and 7 days a week. As far as the

There’s another factor that you should consider when evaluating FX trading platform and that’s protection guarantee. Some other providers call it insurance coverage. Whatever it is, you should feel secured knowing that Saxo Bank is a regulated European investment bank covered by Guarantee Fund – meaning you’re covered up to the amount of DKK 300,000 (Danish Krone) in the event of institution’s suspension or bankruptcy.

Before you jump in, you can download your free trial of the SaxoTrader software, with No Risk and No Obligation. Try it out and see for yourself the speed as per claimed. Click on the banner within this site for the FREE download (can you find it?) or click here to download.

Tuesday, March 04, 2008

Oil prices going for the $130 jackpot, are you ready?

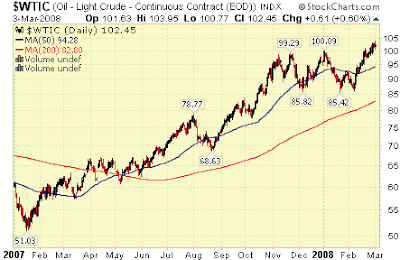

In Sept 2007 I wrote the reasons why oil prices might spikes to $90 and beyond. But if you were reading that piece of article back then you might screamed StockTube has gone crazy. With current oil prices above $102 a barrel (in fact it traded close to record $104 on Tuesday trading) you might laugh at how cheap the black gold was at $90 a barrel six months ago. Was there any magic lamp that I’ve rubbed and told by genie that oil prices would skyrocket?

Nope, it was based purely on the basic of how global markets will react to Federal Reserve’s interest rate cut. You cut interest rate, the dollar plunges and everyone runs for shelters under the name of oil, gold, copper, wheat and even palm oil. Central bank happily left the OPR (overnight policy rate) unchanged at 3.5 percent. Riding on the weak dollar, the Central Bank achieved two things – Ringgit strengthens on itself and the lower external loan repayment.

Oil prices to go $120 or even $130

But what if I were to say the oil prices might rise to $120 or even $130 a barrel? I bet you wanna knock my head off *grin*, don’t you? Well, the reality is nobody dares to bet their souls and fortunes that oil prices will not go to $120 or $130 level. Not after the oil prices went from as low as $51 a barrel in early 2007 to the mind-boggling $100 at the end of 2007. That’s almost 100 percent appreciation within a year, mind you. And what could possibly stop it from appreciates another 30 percent within 2008? Aren’t I’m over-generous with the estimated $130 a barrel (30 percent upside)?

So, AirAsia Berhad (KLSE: AIRASIA, stock-code 5099) Tony Fernandes might be right (and smart) after all when he revealed that the company had actuallyhedge the oil prices with $130 call options within the duration of six months. With the current election fever rising, somehow the high oil prices will bring you back to the campaign promises by oppositions. On one hand you’ve ruling coalitionbrainwashing brainstorming people that fuel prices hike is inevitable. On the other hand oppositions are justifying that it’s possible to reduce the fuel prices by taking RM10 billion of the RM80 billion annual net-profits from Petronas to subsidize it, without causing the nation to go bust.

Oil-Stocks to Monitor

- EOG Resources, Inc. (NYSE: EOG, stock) - explores, develops, produces and markets natural gas and crude oil primarily in major producing basins in the United States of America (United States), Canada, offshore Trinidad, the United Kingdom North Sea and other international areas.

- Transocean Inc. (NYSE: RIG, stock) - primary business is to contract these drilling rigs, related equipment and work crews primarily on a day-rate basis to drill oil and gas wells - specializes in sectors of the offshore drilling business with a focus on deepwater and harsh environment drilling services. Transocean, the world’s largest offshore drilling contractor merged with smaller competitor GlobalSantaFe Corporation (formerly NYSE: GSF), an offshore oil and gas drilling contractor, owning or operating a fleet of 61 marine drilling rigs, charges on a daily rate basis, on July 2007.

- Schlumberger (NYSE: SLB, stock) - an oilfield services company, supplying technology, project management and information solutions.

- EnCana Corporation (NYSE: ECA, stock) - is a holder of natural gas and oil resource lands onshore North America.

- Halliburton Company (NYSE: HAL, stock) - an oilfield services company and a provider variety of services, products, maintenance, engineering and construction to energy, industrial and governmental customers.

- Valero Energy Corporation (NYSE : VLO, quote) - owns and operates 18 refineries located in the United States, Canada and Aruba that produce refined products, such as reformulated gasoline (RFG), gasoline meeting the specifications of the California Air Resources Board (CARB), CARB diesel fuel, low-sulfur diesel fuel and oxygenates (liquid hydrocarbon compounds containing oxygen).

Other Articles That May Interest You …

- Contamination - Dead votes & soldiers’ Double votes?

- Tony’s AirAsia, to Privatise or Not to Privatise

- Oil prices at $100 a barrel on third day of New Year 2008

- What to do during US Economy Slowdown?

- Fuel Price Hike of 90 cents to RM2.82 a liter next year?

- Oil prices establishing $90 as the new base

- Reasons Why Oil Price might spikes to $90 and beyond

- Rate Cut’s effect – high Oil Prices and weaker Dollar

Monday, March 03, 2008

Dow up, KLCI down; Dow down, KLCI down even more?

In the past whenever the Prime Minister announced the dissolution of Parliament, the stocks would experience sudden spike as if it were given Viagra. Political-linked stocks would be thumping their chests as the stocks became hot-commodities. This time around the 12th general election fails to show the fireworks though the stock market saw the pre-election rally. In fact the reverse was what happened and this had some investors (not all) jaw dropped.

If you look at the technical chart, the KLCI (Kuala Lumpur Composite Index) appears to be having fun with the bungee-jump. Well, sort of free fall instead of bungee-jump. One may point the finger at U.S. stock exchange. Now, where are those people who screamed the local market is immune from Wall Street? What I can hear now is people who joked that when Dow Jones goes up, KLCI drops but when Dow drops, KLCI drops even more. After breached the 1,425 level, KLCI is heading towards the dangerous 1,335 level. Interestingly as of writing the KLCI is licking the 1,335 after tumbled more than 20 points.

The coalition party candidates are said to be selling like mad their stocks after the recent rally in order to cash-out. Contrary to public’s perception that every coalition party candidates are allocated unlimited funds, the fact is these individuals need tosource huge amount of money (this time around) to cushion their respective constituency. There’s difference between voluntary workers for both coalition party and oppositions. While coalition party’s voluntary workers generally expect some sort of payments, the oppositions’ are not paid a single cent. Hence mountain of money are needed to maintain these workers and to buy fish votes.

There’re also speculations that investors are selling off their stocks looking at the high possibility that Badawi’s team might lose enormous amount of seats, although it’s near to impossible to unseat the coalition party. Just how serious could be the risk that the oppositions might maintain Kelantan, recapture Trengganu and possibly deny Badawi’s coalition party two-third majority in states like Penang or Kedah, not to mention the possibility of giving the sleepy PM a run for their money in Perak, Federal Territory and Selangor?

The history of 1999 election could repeat itself if only Malay voters who voted Badawi in 2004 chose to stay back at home watching their favorite TV programs as sign of protest due to escalating high cost of living. The only stocks worth monitoring are palm-oil related counters after the benchmark May CPO futures contract rose to a record RM4,173 a tonne today. I guess Syed Mokhtar’s previous offer of RM3.79 a share for Tradewinds Plantation Berhad (KLSE: TWSPLNT, stock-code 6327) is way below attractive level considering the stock is trading at RM4.00 a share now.

Other Articles That May Interest You …

Friday, February 29, 2008

Contamination - Dead votes & soldiers’ Double votes?

The over 90 percent seats won by previous ruling government (I mentioned previous because there’s no government as the Parliament has been dissolved) was in fact could be explained in layman term. It was basically a protest vote against former premier Mahathir Mohamad’s racial discrimination and dictatorship rule. There was a strong reason why Abdullah Badawi was chosen instead of Najib Razak – to leverage on Badawi’s image as “Mr. Clean” in order to bring back supporters. Add some slogans and the voters blindly threw their support and within hours Badawi scored the highest win ever recorded. It was an easy win.

Whether there’s a gentlemen agreement between Mahathir and Badawi that the latter should enjoy the power for only one term is open to speculation. The fact is it’s hard for anybody who has tasted the power (of dictatorship) to willingly give it up. Despite unlimited control of the air time on TV and radio, as well as the mainstream print media, not to mention cash (that’s your money, mind you) one cannot rule out the obvious fact that this time around Badawi’s team could lose some seats though he will surely wins. Not only people on the ground were fed-up with Badawi’s empty promises made in 2004, they also do not see him as a capable leader that could bring the country to the right direction.

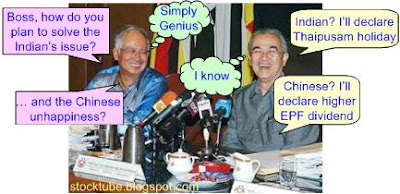

You just have to listen to the grumblings on the ground to gain tips on how the coming 12th Malaysia General Election will end up. The Chinese are not happy with the racial statement and economy while the Indian awaken by Hindraf of how they were marginalized, so much so that their basic needs such as temples were demolished without a blink. But all the Chinese, Indian and Malay have common dissatisfaction – the rising cost of living. The oppositions can smile this time as all these issues fall onto their laps without much effort. The former Deputy Prime Minister Anwar Ibrahim has been going around telling how the oppositions would lower the fuel price if elected and form the next government. Is this for real?

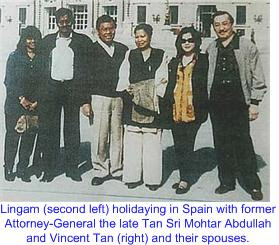

Badawi and Najib (his deputy) called it a bluff as the country will goes bankrupt if fuel price was to be lowered. But Anwar justified that it can be done by taking RM10 or RM20 billion off Petronas’s (state-owned oil and gas company) RM80 billion annual net profit to reduce the fuel price; it’s laughable to even think the nation could go bust. Whether you like Anwar or not he’s definitely a very charismatic politician, not to mention a very eloquent person compared to Abdullah Badawi. Corruption scandal such as the 114 million euros (RM530 million) “commission” received from submarine deal that somehow lead to the murder of Mongolian Altantuya Sharribuu was trumpeted into the ears of people who gathered during his campaign.

Meanwhile Malaysian netizens are watching anxiously if Jeff Ooi could become the“first blogger” to enter the election (under opposition DAP) and win a ticket to the Parliament. Jeff however is fighting an uphill battle considering his is an ageing constituency with only 15 percent people below the age of 35 and thus majority might not access his blog. Nevertheless oppositions are relying on technology such as blog and YouTube to carry their messages across, although the effect is yet to be seen. Is Abdullah Badawi’s coalition party shivering nervously at their prospect this time around? Yes and No.

Yes, judging from the high frequency of propaganda advertised on local media (they have spent over RM1 million within 3 days of campaign) and how their candidates were booed and jeered during their campaigns. For example one Donald Duck Lim got what he deserved when he used Malaysia and Burma (Myammar) as a comparison as to why voters should vote Badawi’s coalition party.

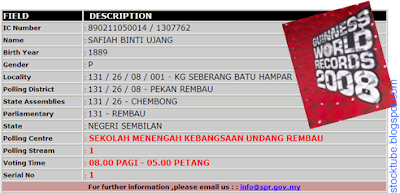

For gamblers who wish to strike big in 4-D, 3D or lottery, you can try the following numbers. These are the people who are over 100 years old but still alive and kicking. Enter them into here and tell me if the whole electoral roll is not contaminated.

For gamblers who wish to strike big in 4-D, 3D or lottery, you can try the following numbers. These are the people who are over 100 years old but still alive and kicking. Enter them into here and tell me if the whole electoral roll is not contaminated.

- 890211-05-0014 ( born: 1889 )

- 961022-50-5236 ( born: 1896 )

- 971219-75-0079 ( born: 1897 )

- 991230-71-0156 ( born: 1899 )

- 991025-74-0081 ( born: 1899 )

Other Articles That May Interest You …

- Malaysia 12th Election – Dynasties & internal Cleansing?

- How you’re being taken for a ride by the Suckers

- Land of Paradise with Great Leader and Mathematicians

- Mirror mirror on the wall who’s the biggest liar of all?

- Broom Award for the Information Minister please

- Malaysia’s Biggest Scandal – Business as Usual

Thursday, February 28, 2008

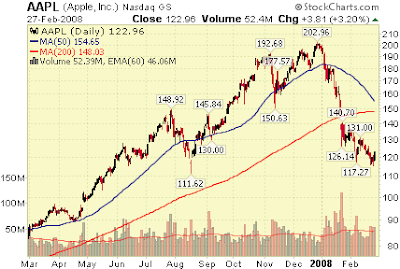

Apple Stock - 6 Reasons you should pay attention now

Once I was betting that Apple Inc. could climb above $200 a share without much difficulty considering the marvelous people, products and innovation this company has in its pocket. It did breaches above $200 a share but for a very short period before lost about 40 percent of its market capitalization (it’s market caps is $108 billion) in only two months thereafter. Long story short the Murphy Law came to take its toll. People who short the stock applause but could the rhythm is about to change?

It’s definitely very tempting and investors or traders who have been following Apple Inc.’s (Nasdaq: AAPL, stock) stock are drooling now. From P/E (price earning ratio) of almost 50 times its earning the stock is currently trading at 26.20 it’s multiple. And we’re talking about a company with no “debts” but over $25 billion in annual sales and earning per share of $4.55, not to mention annual sales growth of 35 percent (against industry’s 25.7 percent) and annual income growth of 57.5 percent (versus industry’s 46.5 percent). What more could you ask for? It’s rather sad that Warren Buffett doesn’t understand the business of technology else he could be drooling as well.

- It’s cheap at P/E of only 26.20 for such a (do I need to promote Apple Inc. again?) well managed and established company. In another words, it’s on 40 percent “discount” from its peak of $202 a share.

- The technology, innovation and development, leadership, people, products & quality and branding have not change for the worse. Unless Steve Jobs makes an abrupt exit the same way like Gamuda Berhad’s founder, the company should continue to shine.

Technically, the $120 should provide adequate support. Every Tom, Dick and you know that U.S. economy is in screw-up shape and things could only get better after 2008. Uncle Ben is going to cut the interest rate again regardless whether he likes it or not. Unless some idiots go and blow off themselves in the name of holy way, how worse could the Wall Street becomes?

- After Wednesday’s trading hour, Apple Inc. COO Timothy Cook reiterated the firm's 10 million iPhone sales forecast for 2008. He further noted that while year-over-year iPod unit shipment growth was 5% in the December quarter, year-over-year revenue growth was at a whopping 17% - the fastest in a year. So far Apple Inc. has shipped over 4 million units of iPhone.

Apple boss Steve Jobs is flying more spending $550,000 (three times the average) on airplane expenses. Analysts read it as a bullish sign, hinting that Jobs is trying to push up distribution deals for the iPhone and deals with Apple's suppliers. Furthermore Apple Inc.’s research and development spending was up 34% in the December quarter although that amount is only a fraction (2.56 percent) of the sales figure.

- Possible of share buy-back since this giant is sitting on a mind-boggling $18.5 billion pile of cash which translates into $21 for every Apple’s stock. Investors would love it if the cash could be returned back to shareholders in terms of dividend. But with Apple Inc. stock at such a discount, the time couldn’t be better to buy back the shares outstanding (currently at 879 million shares) and instantly boost the EPS (earnings per share). An estimated $10 billion could boost EPS by 10 percent, enough to send its 2008 financial years EPS estimate of $5.14 to $5.65.

# TIP: If the $120 support level is breached, prepare to make money by shorting the stock or load up your Put Options because it will goes down to $90 a share level. And $30 a share difference could make you tons of money.

Other Articles That May Interest You …

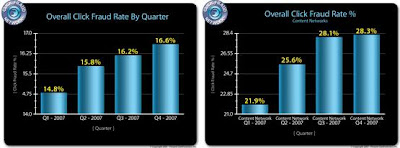

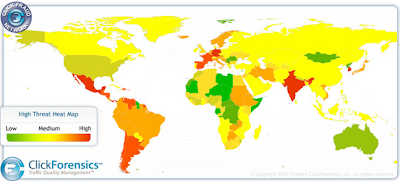

Click frauds rising, could Adsense and YPN act on time?

Looking at how Google Inc.’s stock price performed after I closed my position yesterday, I was relieved. Not that I can always close my position(s) when the trade(s) was in the money as naturally the greed somehow will always whisper to me to stay on for better profit percentage. Boy! I was glad I locked the profit by taking the money off the table. As a trader sometime you need to be realistic of your trade’s position. You got to be sensitive to the market news, both macro and micro. The main reason why I hit the button yesterday was due to the poor click-through rate's report. And logically after such a huge sell-off the technical rebound would follow, which happens today.

Anyway that trade was history but as a trader or investor one needs to remember the lesson learnt throughout the journey. You learn both when you made money as well as when you lose money. You gradually mature along the way and that’s how you go up to the next level. Now, talk about poor click-through rate do you know that one of the reasons Google Inc. implemented such a disastrous measure was to prevent accidental clicks? However it won’t be able to eliminate “intentional or fraud clicks”. And talking about fraud clicks do you know which country registers the highest fraud clicks and gave Google’s Adsense the biggest headache? It’s none other than India, the country that produce the most number of Information Technology (IT) intellectuals.

The high click fraud from India could be explained in a simple way. India has been mass producing IT-literate graduates and the gap between the rich and poor is jaw-dropping. Basically it’s a lucrative market to pull in some articles, get Adsense approval and start making U.S. dollars. Convert it back into local currency and you potentially could live comfortably, if you don’t get caught by Google’s click fraud detection system. Hence, don’t be surprise if you heard of networks of people who perform “you click my ads and I click your ads” strategy in order to make good money. What better way to work from home, don’t you think?

The high click fraud from India could be explained in a simple way. India has been mass producing IT-literate graduates and the gap between the rich and poor is jaw-dropping. Basically it’s a lucrative market to pull in some articles, get Adsense approval and start making U.S. dollars. Convert it back into local currency and you potentially could live comfortably, if you don’t get caught by Google’s click fraud detection system. Hence, don’t be surprise if you heard of networks of people who perform “you click my ads and I click your ads” strategy in order to make good money. What better way to work from home, don’t you think?

If the trend continues (click fraud), both Google Adsense and Yahoo Publisher Network might need to find a better alternative to ensure online advertising is worthwhile. The next quarter of earning announcement from Google Inc. could shed some lights into the severity of existing advertising system.

Other Articles That May Interest You …

Wednesday, February 27, 2008

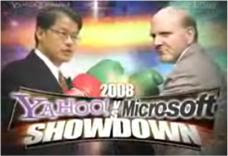

Take Money & Run, Google crumbled nearing 1-year low

Regardless of Microsoft Corp.’s (Nasdaq: MSFT, stock) strategy to tame internet giant Yahoo Inc. (Nasdaq: YHOO, stock) into submission, there’s no money to be made from both stocks. Such acquisition news depends solely on your luck – if you somehow bought into Yahoo’s shares before the announcement, you made money else don’t bother. Regular StockTube readers should know I never touch both stocks, for obvious reason. But that doesn’t stop me (and you) to make money leveraging on such acquisition news.

If you’re first time reader of StockTube I hope you’ve read into such news as opportunity to make money by shorting Google stock or its Put Options. Back then StockTube wrote reasons why Yahoo should accept Microsoft’s $44.6B offerand for this simple reason why you should short the stock. Everybody knows the market pulse is not bullish. If it’s not bullish then it’s bearish – no brainer huh? Seriously who would dare to long the stocks at such moment when U.S. economy wouldn’t be any much better till the end of 2008, well, that’s what analysts said and the perception on the trading floor just aren’t any better.

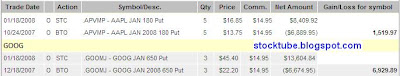

Since Google Inc.’s (Nasdaq: GOOG, stock) disappointed result which saw its stock plunged from the height of almost $750 a share, all the stars were almost aligned for you to be bearish and short the stock or buy the Put Options.StockTube opened the position, GOOG MAR 2008 500 Put Option on 1st Feb 2008, the same day the article was published and has been hanging on ever since. The stock dropped the next day (and made money instantly) but I chose to hold and the sight of your position going the other way thereafter wasn’t a pleasant one. If you’ve been monitoring Google Inc. you knew this monster can’t crawl very far.

Anyhow, it’s not wise to take any chances and such weakness (Google Inc.’s stock) should be seen as the best time to take money off the table and run. Furthermore I still have some position on GOOG APR 530 Put Options that I entered together with Baidu.com, Inc. (Nasdaq: BIDU, stock) of which I’ve closed earlier on.

Other Articles That May Interest You …

Tuesday, February 26, 2008

Maybank and TMI new chiefs, dare to ignore Rumors?

Rumors and speculations are part and parcel of investing life especially in the stocks markets. Sometimes rumors and speculations could be considered the crystal ball that could tell you the future, no matter how you hate it. In fact without rumors and speculations investing life could be so boring that it’s not much fun even if you made the money. Investing life is suppose to be excited and who said rumors are confined to people who like to gossips and hold no water?

There’ve been multiple times when rumors turned up to become realities. After months of speculation, today Malaysia biggest lender Malayan Banking Berhad (KLSE: MAYBANK, stock-code 1155) announced the appointment of Telekom Malaysia Berhad’s group CEO Abdul Wahid Omar as its new chief executiveeffective 1st July 2008. Maybank’s existing chief executive, Amirsham Aziz, 57, in a somber mood in turn announced he will retire on 30th June after serving as the CEO for 14 years. The rumors started when market talks had it that the political pressure was mounting to replace Amirsham who has been conservative in expanding the banking institution.

The jigsaw puzzles seemed to become clearer when former Maxis Communications Bhd group CEO, Datuk Jamaludin Ibrahim, announced his decision to call it a day on July 2007. People refused to believe Jamaludin retired for good considering he was just 48 years of age. The bet then was Jamaludin would most probably serve under a new and more powerful master – the government (instead of Maxis’ Ananda Krishnan). In order for Jamaludin to become the new boss of Telekom Malaysia Berhad (KLSE: TM, stock-code 4863) Abdul Wahid needs to be relocated and what better place than Maybank.

What could be the impact on Telekom and Maybank’s stocks? While it will take some time to see if Abdul Wahid could pass with flying color since he has no experience in banking business, the same cannot be say about Jamaludin. With his wide experience gained during his tenure in Maxis, Jamaludin is definitely an asset to TMI but this monster has its own challenges. Unlike Maxis, TMI is a government organization that has a huge pool of staffs enjoying their life complacently. It’s not easy to move these people the same way you direct Maxis’ staff to give their best in terms of productivity.

Don’t get me wrong as I’m not saying Telekom consists of bunches of lazy staffs, although it used to be not many moons ago. And don’t forget that within Telekom there’re basically tons of group of “teams” that have their “own territories” to take care of. To synergize all these islands of teams might take ages and could backfire if not handled with care. Therefore Jamaludin is expected to produce results set within Khazanah Nasional Berhad’s, which hold strategic 40 percent stake, scope of contract. As long as the profit can be increased annually with some expansion routes, Jamal’s mission is consider accomplished.

Other Articles That May Interest You …

Monday, February 25, 2008

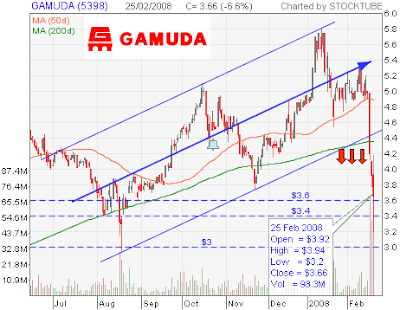

Gamuda’s Game-Over reveals Dark Side of Economy?

Besides the hot topic on Malaysia’s 12th General Election which probably will be the most exciting election ever in the history of the country, the stock market is equivalent electrifying especially in the construction sector. If you think what I wrote about Gamuda and the chain of thought of foreign funds in selling without blinking twice was a joke, today’s stock reaction speaks for itself. That’s the reality you have to consider if your stocks are within foreign portfolio, and Gamuda is the second largest builder mind you. You got to play by the rule of the game, like it or not.

If you missed my previous article on how foreign funds or investors “behave”, you can click here to read it. How do I know the reaction of foreign investors? Simple - through experience in stocks investing and option trading, no crystal ball. It’s just like Steve Jobs selling off his major stakes in Apple Inc (Nasdaq: AAPL, stock) but maintain his position in the company. Put yourself in the investors’ shoes. What would you do? Can you think of a compelling reason why investors should buy or hold when Steve Jobs sold off?

This disposal by founder and Managing Director Lin Yun Ling to some degrees also revealed the dark side of Malaysia’s economy, or rather the government’s economy policies. The theory is quite simple. If the MD is very confident that the so-called “Coridors” projects launched by previous (there’s no government now as the Parliament has been dissolved) Prime Minister Abdullah Badawi namely IDR, NCER, ECER and SCORE are real, the MD is definately mad and crazy to dispose of his stake now. Take SCORE for example. Just 1 percent of it will translate to a whopping RM5 billion. So why exit now? Being the person who has first-hand information he knows “very well” these projects, whether it’s for real or hoax.

Other Articles That May Interest You …

Saturday, February 23, 2008

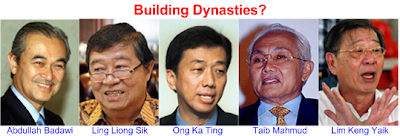

Malaysia 12th Election – Dynasties & internal Cleansing?

Hope of election rally didn’t materialize, if the performance of Kuala Lumpur Stock Exchange since the dissolution of Parliament is any yardstick to goes by. Stocks were plunging inline with the bleeding KLCI. Stock traders, speculators or gamblers were not bored though since two other venues to make money sprang due to this 12th General Election. I’ve wrote the first one, the 4-D or 3-D number forecast and there could be more “numbers” to come. For example if somehow Koh Tsu Koon who is more indecisive than the PM himself lose his Parliament seat, then you can bet gamblers will come out with some lucky 4D numbers to bet.

The second chance of making money is definitely the illegal betting of who will become the new Penang Chief Minister. In fact the betting could span wider scope such as would Malaysia Prime Minister’s son-in-law becomes the Negeri Sembilan new Chief Minister? Yes, that’s the most talk-about gossips. Khairi Jamaluddin, the 32-year-old son-in-law of PM Abdullah Badawi, has been given the go-ahead from the PM himself to contest the Rembau parliamentary constituency, confirming the rumors. Speculations and rumors are blowing like Hurricane Katrina that Khairi whose dream is to become the youngest Malaysian Prime Minister before the age of 40 is surely to win the Rembau seat. But it would be too obvious if he was to be given the easy ride to the Chief Minister post right after he wins the Rembau seat.

However one trend is obvious with this round of 12th General Election – lots of new faces and last minute changes to the candidates list. The ruling government especially the UMNO is obviously banking on many new faces to ensure voters are given choices and not sick and tired of same old guards who thought they’re still welcomed despite their grandfather’s age. At the same time it’s perfectly alright to argue that it was a pre-planned action to wipe off all pro-Mahathir (former premier) supporters. It’s a perfect double-edged sword to help revitalize UMNO’s support as well as to kill off all Mahathir’s leftover.

The same thing can be said of MCA, another component party of ruling government. People are inclined to speculate that the Deputy President of MCA Chan Kong Choy stepped down to hide from the PKFZ, Malaysia’s biggest scandal. But it definitely holds water that the MCA President, Ong Ka Ting, was out to clear all Team-B leftover as well – part of internal cleansing. Chan Kong Choy was part of the Team-B while Ong Ka Ting belongs to Team-A before Ling Ling Sik and Lim Ah Lek came to an agreement to pass the baton to Ong and Chan.

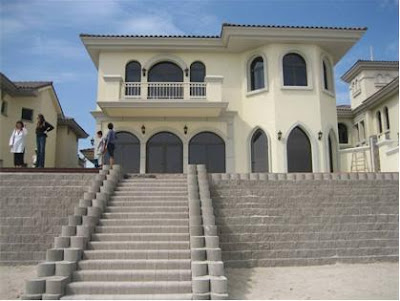

On the same mission to continue their dynasty is Sarawak Chief Minister Taib Mahmud who control Cahya Mata Sarawak Berhad (KLSE: CMSB, stock-code 2852) which in turn controls Utama Banking Group (KLSE: UBG, stock-code 6831). The good father is making way for his son Sulaiman to take over the family dynasty. On the other hand the man who owns the palace comparable to Sultan of Selangor has been dropped to minimize damages. The man behind Zakaria Palace however has ensures that his daughter-in-law, Roselinda, could at least continue the family’s dynasty, temporarily.

What about the infamous MIC President Samy Vellu? There were talks earlier that Samy tried to push his favorite son, Vell Paari, to the frontline as part of his dynasty building effort but the mention of Maika (Vell Paari is the CEO of Maika Holding) might just waste a seat. Samy was trying to step down honorably when he announce this could be his last term but every Tom, Dick and Malaysian Indians know he was beating around the bush. Given chance, he preferred to die as MIC President than to retire peacefully.

Other Articles That May Interest You …

- PM lied, Parliament dissolved, Elections on, Rumors won

- Mirror mirror on the wall who’s the biggest liar of all?

- Why you should become a politician in Malaysia

- Chua Soi Lek’s Sex DVDs, Cuckoo ends his Career

- No fees but shareholders fuming Ling Chicken Out

- Poor’s Hope in MAIKA – the Last Robbery

- Malaysia’s Biggest Scandal – Business as Usual

- Will There Be A Long Tussle For RHB?

Friday, February 22, 2008

Gamuda tumbled, opportunity to Buy or reason to Sell?

One of the main differences between foreign funds and local funds is the way they react to major movement of shareholders especially top guns who are driving the company. This is also the main reason why foreign funds could cut their losses to the minimum. Right, you can call them kiasu, kiasior whatever you wish but the fact remains that professional investors hate uncertainties. Ever wonder why the professional investors seem to be able to play the games many times more than you?

A good example is Gamuda Berhad’s (KLSE: GAMUDA, stock-code 5398) latest stock plunge that erased more than RM2 billion off its market capitalization in merely two-trading days, its biggest tumble is 10 years. Reason – the Malaysia second-largest builder’s Managing Director, Lin Yun Ling, who is also one of the founders cashed-out from the construction business. JPMorgan Chase & Co. (NYSE: JPM, stock) immediately cut its price estimate to RM3.30 from RM4.40 a share after the Gamuda MD reduced his stake from 5.23 percent (104.7 million shares) to 1.73 percent (34.7 million shares), pocketing a cool RM350 million.

Although Lin will remains as managing director it doesn’t change the perception amongst the investors (well, at least JPMorgan thinks so) that the risk of Gamuda not getting more gigantic contracts increases. Furthermore in Malaysia it’s who you know rather than what you know that would land you with government contracts. Of course you have local analysts such as TA Securities who did not see any reason for alarm and in fact the firm upgraded Gamuda to “Buy” with a target price of RM5 a share.

The chain of thought from foreign funds were that if the founder and captain of the ship decided to cash out, he might not see any more “interesting project(s)” in the pipeline else he could wait for the fruits to ripe. Other traders might think this is bargain hunting opportunity, reading from technical chart. Nonetheless the trading rule from foreign professionals is to cut or sell when such major event happens. Hence depending on which school of thought you’re comfortable with, you have the option to either buy or sell the stock at this junction.

Thursday, February 21, 2008

Microsoft-Yahoo Showdown – Bill Gates’ first salvo

Stop haggling over the price like some housewives at wet-markets, says Bill Gates. It’s a logical statement to make when you’re talking about coughing extra billions if the bid price of $31 a share were to be raised. But the richest man on earth did not say the first bid price was final and not a take-it-or-leave-it offer. All he said was the offer price was very fair. While Yahoo Inc.’s (Nasdaq: YHOO, stock) supporters are running amok that they could see the last of Yahoo very soon, Bill Gates could be right about the offer price being fair. Yahoo is dying slowly but surely unless a genius miraculously could multiply its bottom-line instantly.

Gates also said Microsoft Corp. (Nasdaq: MSFT, stock) will invest more into search and competing against Google Inc. (Nasdaq: GOOG, stock) – with or without Yahoo. The billionaire also hinted that he was actually after the pool of great engineers - the backbone of Yahoo’s business of which the engineering work could leapfrog Microsoft faster than its current pace. Strangely if Microsoft could do that why didn’t the giant do it earlier? To be number three in terms of market share goes to show Microsoft wasn’t serious in the search business in the first place, no?

It’s like a game of who blinks first at this stage, the same way option traders try to get the best “Ask” or “Bid” prices trading options. Analysts say Microsoft is using the proxy fight to circumvent a poison pill (and not to actually start a proxy war), a strategy used by companies to prevent unwanted takeovers by flooding the market with additional shares to dilute the holdings of hostile acquirers.

There’re at least two facts that point to a Microsoft-Yahoo merger ultimately.Firstly Yahoo shareholders seem to welcome and like the idea of Microsoft buying over Yahoo. Secondly there are reports that Yahoo is secretly giving away generous severance packages for employees to protect them in the event of layoffs. The ending of this merger episode is quite obvious – the writing on the wall says Microsoft will up its bid and Yahoo will gladly takes it.

Other Articles That May Interest You …

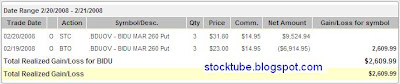

Have Profit Will Run, Make Money with Baidu in 1-Day

It’s not easy to make money trading option or investing stocks during such a bearish market. I hope you’re aware (or at least read about it either from analysts or StockTube) the bear is still roaming and perhaps will continue to do that for a couple of months to come. But when you’re trading in the stock markets that allow you to trade either way – up or down, long or short, buy Call Option or buy Put Option, then your chances of making money has just increased by 100 percent.

I have wrote and predicted why Baidu.com, Inc. (Nasdaq: BIDU, stock) might takes its pit-stop at $220 before going down to $200 level. Since then it has gone yo-yo up and down with great volatility testing investors / traders fear and greed but generally the stock was trading on downwards trend. It almost touched the pit-stop at $220 on 2nd Feb 2008 but staged a fast rebound to above $230 level thereafter. Looking at the chart it appears the $280 is the latest resistance level for Baidu.com.

Other Articles That May Interest You …

Tuesday, February 19, 2008

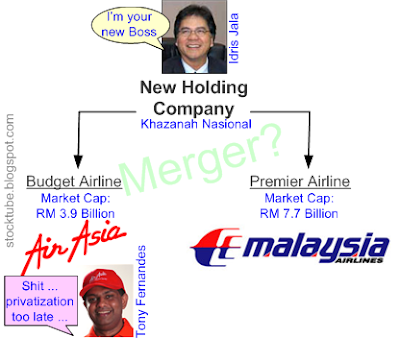

MAS to acquire AirAsia - Can’t Beat so Eat them Alive?

When the managing director of MAS, Idris Jala, said the company is interested in M&A (mergers and acquisitions) with other Asia Pacific carriers to grow the company, it didn’t raise my attention. The reason was quite easy – on its own, the Malaysia Airline System (KLSE: MAS, stock-code 3786) does not have the financial strength to flex its muscle beyond the soil of Malaysia. Of course the national carrier could suck up public fund (considering government is the major shareholders) to do it but what was the whole objective(s)? Unless it’s to show off that it’s capable of eating up (or rather swallow) other airlines within Asia Pacific, there’s simply no reason for it to do so. Furthermore the carrier has just made some profit after many quarters of red.

But then the real intention was revealed when Idris Jala said the airline actually does not discount the possibility of mergers and acquisitions with low-cost carriers, including AirAsia Berhad (KLSE: AIRASIA, stock-code 5099). Now, that really raised my eyebrows not because the carrier finally expressed what a normal government-linked company will do (to swallow other successful company instead of building it up itself) but the timing of such announcement. Everybody in the industry knew how Idris Jala hates Tony Fernandes (the boss of AirAsia) for obvious reason. And if not for “invincible hands”, AirAsia would not be allowed to fly to Singapore under a reciprocal arrangement (Tiger Airways allowed to fly to Kuala Lumpur).

The surprising word from Idris Jala was his admission that competition between MAS and AirAsia is good for improvement, something very rare when the stubborn national carrier chose to pull AirAsia to sink together by putting all kind of obstacles by means of political interference previously. There’re only two reasonswhy MAS suddenly talks sense. Firstly the managing director is mad and the second reason would be the protected national carrier plans to acquire AirAsia,in a not very distance future – if you can’t beat them, eat them alive.

Would Tony Fernandes sell? Nobody hates money and if the offer is good why not? Furthermore the whole purpose was to make good money out of his brain cells and sweat over the years in building the empire and branding of AirAsia. To ensure the AirAsia remains profitable under MAS’s stable and not just an empty vessel after the acquisition, Tony could be given the free hand to run AirAsia while MAS becomes the holding company. Who said it’s hard to become a parasite? As long as both parties happily living together, it’s a good marriage. MAS’s own budget airline, FireFly, could be easily absorbed by AirAsia through the deal.

The main question to minority shareholders is definitely the offer price of the deal.Would the minority shareholders taken for a wild ride again? If Tony is not interested in the deal due to reason(s) known to him, could this (M&A) the reason why the rumors that Tony Fernandes was thinking of privatization? Pressured to work with a bunch of clowns is bad but to be forced to sell cheaply is worse.

Other Articles That May Interest You …

Monday, February 18, 2008

Badawi attracted international attention, the wrong way

There’re many ways to skin a cat, so goes the saying. As far as a leader of a nation is concerned, there’re many ways to attract international attention as well. Former premier Mahathir chose to worship the Japan while blasted the Western during his dictatorship, so much so that he was labeled as anti-Semitic by United States, Australia, Canada, Britain, European Union and of course Israel. Those were the days when Mahathir was the outspoken Prime Minister of Malaysia.

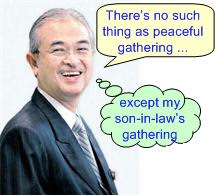

His successor, current Abdullah Badawi, hope to achieve the same feat – the wrong way. Internationally he hasn’t achieves much recognition until recently. Everything started from street demonstration. First there were thousands of lawyers marching for “Justice”. Then you had the peaceful BERSIH and Hindraf demonstrations, only to be greeted with water cannon, teargas and whatever chemical weapon in the name of public security. BERSIH peaceful demonstration was dominated by Malay although you can see Chinese and Indian participants that swelled to 40,000 people. Hindraf on the other hand was a demonstration staged by Indian. Five Hindraf leaders have since been “locked” at the pleasure of the Prime Minister in the name ISA, the dragonian detention without trial.

Abdullah has the cheek to condemn the protests, saying it was an attempt to disrupt the elections. Strangely when the Hindraf claimed the Indian were systematically marginalized, Abdullah Badawi denied it strongly and said the Indian are well taken care of. If what the PM claimed is true then he should just let the peaceful protesters go ahead and be there to receive the roses (roses are not cheap mind you). If he has indeed taken good care of the minority Indian, then logically these people have no reason to demonstrate, no?

If the government has taken care of Indian community, then PM should not have said that street protests and anger within the Indian community could have an impact on how the government fares in the general elections. The rest of the Indians will continue to give their votes to the ruling government (there’s no government as of today since the Parliament has been dissolved) just like the old time and the PM should have good night sleeps without worrying about the 300 or so demonstrators. But this is not the case. The PM, deputy PM, Samy Vellu (claimed to be the Indian community’s leader) and the rest of the leaders are dead concern about Indian votes, not to mention the Chinese votes that will surely swing to oppositions this time around.

He should start by opening up his monopoly in granting permits to demonstrators not associated with his own party (or allies). If his own son in law, Khairy, could have free hands in organizing demonstrators (against official guest US State Secretary Rice not so long ago) with guaranteed police permit (or was there one in the first place?), why can’t the others? And he should at least put his leadership level on par with other leaders by not insulting his own intelligence by saying:“There’s never been peaceful gathering”.

Other Articles That May Interest You …

- BBC News – Malaysian police break up protest

- Press TV, Iran – Malaysian police break up flower protest

- International Herald Tribune – Malaysian police break up ethnic Indian demonstration

- CNN – Detentions over Malaysian Hindu rally

- AlJazeera – Hindu protest broken up in Malaysia

- Channel NewsAsia – Malaysian police fire tear gas at protesters

- Kyodo News – Malaysia’s minority Indians rally for equality ahead of election

- PM lied, Parliament dissolved, Elections on, Rumors won

- Rally, Racial and the Race towards the Election

- Two Major Rallies within 1 month – great score for PM

- Malaysia’s Biggest Rallies since 1998 – KL under siege

- Lawyers Long March to Save the Judiciary – Photos Talk

Sunday, February 17, 2008

Astro trying to make money with Virgin

Astro which has a virtual monopoly on pay-TV services in Malaysia has almost nowhere to expand except internationally although its venture into Indonesia was met with losses. Reuters reported that Astro All Asia Network Plc (KLSE: ASTRO, stock-code 5076) is now trying to bid for United Kingdom-based SMG Plc.’s (LON: SMG) radio broadcaster Virgin Radio which operates as a commercial pop and rock music station. SMG put Virgin Radio for sale as part of the plan to dispose non-core assets.

Astro is competing with three other British bidders namely Global Radio, Absolute Radio and UTV Media (LON: UTV) with bidding prices ranging from 60

Through years of monopoly the pay-TV market in Malaysia has entered the saturation level, not that Malaysia is a country with huge population that Astro could leverage on. Ananda Krishnan’s investment in Indonesia’s Astro-venture screwed-up big time after it registered anet loss of RM54.18 million for the second quarter ended July 31 2007, dragging down Astro’s bottom line. Since then rumors after rumors that the tycoon plans to take the company private but none seems to materialize, so far.

In Apr 2007, Virgin Radio claimed its “first” when made its broadcasts available via Sony’s PlayStation 3 and Nintendo’s Wii. Instantly gamers could listen to streaming radio, buy tickets and CDs as well as download tracks through Virgin Radio Ticket store via their consoles. But the coolest of all was the option fromVirgin Radio to play iTunes online, the world’s best digital music jukebox from Apple Inc (Nasdaq: AAPL, stock). It appears Astro finally is catching up with thelatest technology and leverage on it to make money (besides those satellite dishes of course).

Other Articles That May Interest You …

Affordable and Magic of Air Travel with Silverjet

Donald Trump used to be a billionaire and lost everything with lots of debts, so much so that once he envied man on the street because those people have more money than him. But he learnt his lesson and diversification was the name of the game. He’s back to the status of a billionaire now of course. Now his businesses are so diversified that most of us might know him for his TV-show, Apprentice. You saw how he crafted his name with buildings, apartments and even his own helicopter. Owning a helicopter or jet could be the ultimate way to show your success.

If you have a fraction of the money to spend you can however book a jet, well literary, and pretend as if you own it. Silverjet for example could fly you between London and New York as well as London and Dubai. First thing first, what do you get by flying with Silverjet? How about dedicated security and check-in at the Silver Lounge just 30 minutes before departure, not to mention the complementary WiFi all parts of the private terminals facility? Maybe 6’3” flat beds, seats equipped with laptop-power, seat-back massager, in-flight entertainment and great food by Le Caprice could makes you drool.

Friday, February 15, 2008

Make Money TIPS for 4-D and 3-D Punters and Gamblers

The heat of 12th Malaysia General Election already started this year, 2008, although it has not reach the climax and boiling level yet. It’s not too much to say that most of the politicians are still warming up their belly since the final candidates list is not officially out yet. Majority of the “potential” candidates, except for the top leaders of the respective parties, are still in the dark whether they’ll be picked. For example there’re rumors that the controversial (or rather incapable) Works Minister, Samy Vellu, might be dropped after serving for 30-years. Prime Minister Abdullah Badawi neither acknowledged nor denied Samy be sent packing.

The most surprising news to all including oppositions is definitely the generous 13 days of campaigning period. But everyone was willing to bet their life & soul that it was more to do with PM Badawi’s lucky number rather than being nice guy and generous. His official car registration number is 13 and he decided to follow the advice of his feng-shui master to dissolve the Parliament on 13th Feb 2008. Born in the year of Rabbit his master said he would benefit from the number 13 and having his grandson born on 13th, it’s hard for Badawi not to be superstitious.

Now, for 4-D punters there’re more numbers to bet. There’re 222 parliamentary and 505 state seats up for grab. Nomination date is 24th Feb 2008. Depending on your creativity, the list of numbers that you could bet might be huge:

- 1313 – PM’s favorite number

- 2402 – Nomination date, 24th Feb

- 2139 – Last 4 digits being 10,922,139 registered voters.

- 1085 – Last 4 digits from 221,085 postal voters

- 8308 – Polling date of 8th Mar 2008

3-D numbers to bet:

- 222 – Parliamentary seats

- 505 – State seats

- 803 - Polling date of 8th Mar 2008

There you are some of the hot numbers which could strike big. You might want toconsider 0000 as the potential lucky number as well. Why 0000? Let’s give the PM Badawi the

Forget about stocks investing for the time being and ignore those analysts who said you should jump into stock market now the election is confirmed. With Bernanke’s confirmation of U.S. sluggish economy and the current KLCI at above 1,400 points, it doesn’t take a rocket scientist to tell you the election rally has already been discounted. The attention should be, at least temporarily, at the outcome of the coming 12th general election. **Please buy me some beers if the above numbers strikes**

Other Articles That May Interest You …

Sluggish Bernanke - Bear will roam till end of the year

The last thing you wish to see, or rather hear, is the pessimism from the most powerful person in charge of nation’s economy. This of course applies to person(s) who is transparent about the economy status and do not beat around the bush, never mind he was late in taking the necessary action to put the economy back on track. It’s much better than some leaders who lied blatantly right through his eyes without a blink.

The Dow Jones might fell 175 points but if you weight what Federal Reserve Chairman Ben Bernanke said against how much Dow suffered Wednesday, it’s actually not too bad. On Valentine Day, Ben predicted a “sluggish” economy until later in the year and more mortgage-related losses at banks – giving obvious hint that further interest cuts are on the horizon.

So which type of investors actually makes good and easy money out of current situation? Who else if not currency traders and speculators?

Other Articles That May Interest You …

Thursday, February 14, 2008

Tradewinds Boss raised the previous Pathetic Offer

Four months ago businessman Syed Mokhtar tried to purchase stocks he didn’t own from shareholders cheaply. The offer prices were ridiculously cheap as if he was trying to insult the shareholders’ intelligence, although his primary intention was to ensure he get hold of the RM597 million to repay debts totaling RM355 million. For example his offer price for Tradewinds Plantation Berhad (KLSE: TWSPLNT, stock-code 6327) was merely RM2.73 a share when the pre-suspension price was RM2.74. Nobody in their right mind would have accepted the offer for obvious reason.

Tradewinds Plantation has a fair-value of RM4.70, RM4.50, RM2.95 and RM2.40 a share estimated by Merrill Lynch, Aseambankers, AmResearch and Kenanga Investment Bank respectively. Although Tradewinds Plantation was trading at a high multiple, the company could easily be takeover target considering the bullishness of crude palm oil prices during that period. Shareholders of course threw the offer letter into the dustbin the moment it reached their mailbox - you didn’t accept the offer, did you?

Today Perspective Lane (M) Sdn Bhd, controlled by Syed Mokhtar raised the offer for all the shares it doesn’t already own in Tradewinds Plantations to RM3.79 a share (from RM2.73 previously) – RM1.06 a share more. The counter which stock price was RM3.66 pre-suspension today is expected to jump when it’s stock resume trading tomorrow. This is a classic example of how shareholders could get a better offer price if stay united in facing intimidation from major shareholder(s).

Other Articles That May Interest You …

Getting $600 Free Money, dream of a lifetime

If you’re a good American citizen who pay taxes or earn at least $3,000, you’re one of the 130 million lucky people selected by President Bush for the“Rebate Checks” scheduled to arrive at your doorstep around May 2008. Most taxpayers will receive a check of up to $600 for individuals and $1,200 for couples, with an additional $300 for each child. Bush’s $168 billion rescue package, Economy Rescue Bill, passed with lightning speed could easily become one of the envies to other parts of the world.

Just imagine what the same money could do to the drooling Malaysian voterswho are scheduled to cast their votes in early Mar 2008 after the PM Badawi dissolved the Parliament yesterday. The prime minister who was labeled to have done almost nothing throughout his four years against his 2004 election promises could easily repeat the same victory, no?

Anyway, the Economy Rescue plan by Bush was to force the money into American’s pocket so that they could spend and energize the U.S. economy to prevent it into recession, officially. But the plan might not work because according to a poll done, 45 percent people indicated they planned to pay off bills with 32 percent said they would save or invest the money. With only 19 percent said they would spend their rebates money, Bush could see the plan goes down the drain. The $168 billion hot money at best could push the recession timing into 2009instead of current 2008.

Other Articles That May Interest You …

Wednesday, February 13, 2008

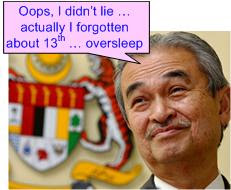

PM lied, Parliament dissolved, Elections on, Rumors won

One day after Malaysia Prime Minister Abdullah Badawi lied denied the Parliament will be dissolved (today) the guessing game came to an end when the PM announced today that he had met the Yang Di Pertuan Agong (King) in the morning and received His Majesty's consent to dissolve Parliament. The PM apparently made the announcement at a hastily convened press conference at his office Wednesday afternoon making people wonders if he indeed has overslept and thus forgotten today’s schedule. MalaysiaKinireported it earlier than theStar.

Abdullah Badawi however still deny to announce the date Malaysians would cast their ballots, passing the baton to the Election Commission (EC) to which EC said it would announce polling and nomination day on Thursday (tomorrow). Speculation on the street for the Nomination and Election Day are on 21st Feb and 2nd Mar 2008 respectively. Analysts expect Badawi to win this 12th snap general election again but with eroded majority (from his 2004’s 90 percent seats won).

Voting must be held 60 days after parliament is dissolved, but the government traditionally allows just a two-week campaign period (a strategy to prevent oppositions from gaining more votes via comprehensive campaigning), meaning the ballot in early March. This election will see 222 seats to be contested. Meanwhile DAP parliamentary opposition leader Lim Kit Siang condemned the election announcement which falls during celebrations for Chinese New Year as being insensitive to other cultures and religions in the country.

It’s time for the Malaysians to vote (wisely or foolishly?) again. If you’re a registered voter, you can recheck your area of voting to prevent from suddenly transferred hundreds of miles away in order for “phantom voters” to take your place. Check it here.

Other Articles That May Interest You …

Tuesday, February 12, 2008

Land of Paradise with Great Leader and Mathematicians

There’re not many investment heavens in this globe with Malaysia being one of the paradise. To justify Malaysia as one of the best managed countries you just got to look at some of the astounding announcements by the government. Heck, this could be the only nation that everyone should fight their heads off to become citizen or at least enroll in the “My Second Home Program”.

Malaysia Second Finance Minister Nor Yakcop claimed the country per capita income rose by 40% in 2007 compared with 2004 - RM22,345 (US$6,452) compared with RM15,819 (US$4,163) previously. Strangely the country’s GDP (gross domestic product) only grew by 5.0, 5.9 and 6.0 percent respectively in 2005, 2006 and 2007. One would wonder why U.S. didn’t snatch such a brilliant fellow to replace Ben Bernanke who did a pretty bad job. Maybe Uncle Ben’s mathematic sucks big time compare to Yakcop.

Again in the land of the retards, the idiot becomes the oracle and so Nor Yakcop’s outrages claim that the nation’s inflation was just over 2 percent caused everyone’s jaw dropped to the floor. Such an expert is needed badly during the current election fever. It’s all about how you play with the numbers. You don’t think the election is still a year away when after decades of uncertainty suddenly more than 900 farmers in Coldstream New Village, Bidor, were given a 30-year lease for the land they have been toiling on, do you?

Today the land of the paradise is presented with yet another set of amazing figures – total trade surpassed RM1 trillion mark, again. In actual fact the RM1 trillion was the value of export and import combined – RM605.1 billion and RM504.57 billion respectively. Knowing most of the people living in the nation would most likely jump off from their bed pounding their chest in pride with the “trillion” word, the International Trade and Industry Minister played the psychology game very well indeed. It’s like saying you earned a monthly salary of RM6,000 but spent RM5,000 yet declared your total money of RM11,000. This is another minister the developed countries such as U.S. or U.K. should snatch if they need great brain.

The ability of the Prime Minister Badawi with his great vision of multiple “Coridor projects” indeed had put his predecessor Mahathir to shame. The newly Sarawak Corridor of Renewable Energy (Score) that managed to attract RM500 billion worth of private investment made in 24 memorandum of understanding (MOUs) on the first day of the launching itself speaks volume. Where else could you find such a quality leader? He finally shared his great sorrow recently when he said he works very hard, taking great offence of people who said he didn’t work. If Malaysia is not a land of paradise I do not know what is.

Other Articles That May Interest You …

Sunday, February 10, 2008

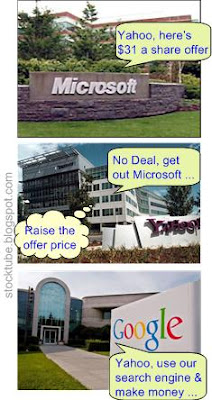

A game to get higher price, Yahoo rejects Microsoft

As expected Yahoo Inc.’s board is set to reject Microsoft Corp.’s $44.6 billion takeover bid with an official announcement on Monday’s morning. Yahoo’s board was merely doing their job with this decision as analysts expect the board members to at least do whatever in their capacity to force Microsoft to raise their offer price. The game is almost over for Yahoo but the company which was eating Google Inc.’s dust since is expected to buy more times to prolong the bid.

Microsoft Corp. (Nasdaq: MSFT, stock) could now take its $31 a share – half cash, half stock bid offer directly to the shareholders via tender offer, bypassing the 10-member board but such action would mean an open war with the board members. Alternatively Microsoft could sweeten its bid by raising the offer price to $35 a share - a move that analysts think could conclude the deal. UBS analysts think $34 a share is good enough. Nevertheless not all shareholders would take the $31 as a good deal especially those who bought into the stocks higher than that.

It really depends on the big picture. If Microsoft is very damn sure that Yahoo’s already upset shareholders are drooling with the $31 a share offer, a higher bid of $35 per share could just do the trick. Furthermore just because Microsoft had offered $40 per share to Yahoo a year ago doesn’t mean Yahoo’s current (struggling) condition is justifiable enough to ask for the same price tag again, not to mention there’re no other bidders interested in Yahoo.

To put pressure on the board members, Microsoft is expected to set a deadline for its offer. There’s a report that Microsoft could seek to oust Yahoo’s board at its next election should Microsoft sees the current stubborn board as the stumbling block. As much as the internet giant Yahoo’s board wishes to shoo off Microsoft, it better be ready to convince stockholders that it could give a better return on their shares investment than the 62 percent premium offered.

As for sentimental Jerry Yang who founded Yahoo Inc. (Nasdaq: YHOO, stock) with fellow David Filo in 1995, there’s only one alternative for him if he really wish to see his crumbling empire remains independent – to outsource its search advertising business to Google in exchange for hundreds of millions of profit, something that Yahoo hate to do and Google Inc. (Nasdaq: GOOG, stock) likes to have. The bigger question is whether Microsoft could leverage and maintain Yahoo’s large pool of loyal users and internal expertise to further grow the company, not to mention solution to the potential working culture clashes.

Other Articles That May Interest You …

Friday, February 08, 2008

Stocks Investing for Year of Rat – can feng shui tells?

Every year you can read without fail the stock markets forecast from feng shui experts, especially when you enter the yearly Chinese New Year (such as today which officially is the Year of Rat). StockTube received numerous emails asking which sector to watch out (more like what stocks I predict would move and could make money as a result of such movement) – I wish I know. Get real, if I know in advance I would not be blogging now because I’ll be too busy counting money and consulting tax consultant on how to pay the least tax to the authorities *grin*.

If these feng shui experts are so damn good they wouldn’t have to work, would they? However based on the survivability of feng shui for thousands of years, you simply can’t ignore this art altogether though you should take it as a guidance and not the Holy Grail. Furthermore with most Chinese businessmen from Hong Kong, Singapore, Malaysia, China, Taiwan and other parts of the world consulted feng shui experts in one way or another before how wrong could it be? Even Donald Trump consulted feng shui for his empire’s prosperity mind you.

While you can’t really dismiss feng shui as totally superstitious especially when you’re seeking harmony and balance flow of “qi” to improve health, relationship, education and wealth, I still haven’t read any person who built his / her fortunes from stock market solely on feng shui. Now back to the stocks that one can invest for the year of 2008. Assuming the U.S. economy will continue to be in the limbo stage, the safest stocks to invest are still the defensive stocks. I mean stocks that are recession proof or good dividend paying stocks should be your preferred stocks.

Nevertheless if the equity market that you’re trading allows you to profit from either way – up or down, then there’s nothing to worry about. In fact during bearish market one tends to make money much faster – heard of it takes days only if not hours for stocks to drop like a rock after it took weeks or months to build up?

Other Articles That May Interest You …

Tuesday, February 05, 2008

Google panicked, Yahoo to nag and Microsoft to borrow

Yahoo might hates Microsoft and Microsoft in turns hates Google but Google hates Microsoft even more. Looks like a love (or rather hate)triangle relationship, don’t you think? In theory if Microsoft were to leave Google alone without putting a stick between Google’s legs everything would be calm. Microsoft would continue dominating the personal computers’ operating system and Google will continue to make tons of money from its domination in the search engine. Yahoo, on the other hand will continue to rot the way it is rotting now.

But Microsoft couldn’t close its eyes and pretend Google will not overtake it as the next new Microsoft, only this time Google might makes multiple times of money from online advertising compared to what Microsoft did to personal computers in 1980s and 1990s. As with any other business it’s good to have a loser next to you, in this case Yahoo, as without a loser people will not know how great you are. And so Google continued to succeed while Yahoo continued to rot and each time Yahoo missed its earnings, investors rejoice by buying Google’s stock or Call Options (you did, didn’t you?) – until now.

Google’s Fear and Strategy

When Microsoft Corp. (Nasdaq: MSFT, stock) suddenly announced its $44.6 billion bid for Yahoo Inc. (Nasdaq: YHOO, stock), Google somehow panicked. Almost instantly, Google called Yahoo with offer of a partnership – Yahoo outsourcing its search to Google and split the profit. Right, suddenly Google becomes good friend of Yahoo. Some of you might think Google should still be able to smile as Google still commands 60 percent while a new Microsoft-Yahoo is still at a distance 30% of the market share. What really scare the shit out of Google is the potential of Microsoft-Yahoo’s in the vertical advertising network – a huge threat to Google’s Adsense.

From Google’s 2007 revenue of $16.6 billion, about 10 percent or $1.64 billion of Adsense revenue was generated by Google Network sites. Google missed its earnings forecast last week primarily due to weakness in its AdSense program – poor click-through from MySpace despite its guarantee of $900 million to News Corp. Microsoft and Yahoo’s financial portal, MSN Money and Yahoo! Finance respectively, are the two top financial sites. If Microsoft-Yahoo decides to sell ads to smaller publishers (ahem, such as StockTube) besides their vertical sites,most publishers would potentially switch to them instead of Adsense.

At the same time Google Inc. (Nasdaq: GOOG, stock) has begun to lay the groundwork to try to delay but definitely not to stop the Microsoft-Yahoo deal, not that Google can in the first place. It’s more of a payback for Google since Microsoft did almost the same thing when the former acquired DoubleClick for $3.1 billion in Apr 2007. Google cannot simply protest from the online advertising monopoly but it sure can argue about Microsoft-Yahoo! monopoly in the instant messaging (IM) and web-based email market share.

Yahoo is in Microsoft’s bag literally

However Microsoft has the upper hand in the sense that a combined Microsoft-Yahoo could create better competition (and stronger competitor) to Google’s current monopoly in internet advertising and search business. Antitrust experts say any review is likely to be lengthy, given the overlap in Microsoft's and Yahoo's businesses, but ultimately decided in Microsoft's favor. The only problem would be with the European Commission since Europe has a stricter scrutiny policy.

What could Yahoo do? Yahoo can’t take the company private because to do so would means 4,500 employees (31 percent of its workforce) need to be sent packing besides selling $12.5 billion worth of other investment such as Alibaba.com and Yahoo Japan. Already potential white knights such as News Corp., AT&T Inc. and Comcast Corp. have chickened out from the fight.

Yahoo however can nag for a higher offer price and some analysts already bet that Microsoft could end up paying as much as $35 a share. Microsoft is expected to borrow money to finance the acquisition, the first time the giant ever do so.

How to make money from their stocks

StockTube wrote that you should short Google Inc.’s stock the moment the news broke, and you should hold on to your profit as everything is pointing to a Google’s stock sell-off. Assuming Yahoo can’t do much except ask for a higher price ($35 a share?) you might want to long Yahoo stock.

Other Articles That May Interest You …

Monday, February 04, 2008

How much could Primus Pacific expand EON Capital?

Despite its highest offer to buy RHB (Rashid Hussain Bhd) at an offer price of RM1.97 a share and RM5.00 a share for RHB Capital Berhad (KLSE: RHBCAP, stock-code 1066), EON Capital Berhad lost the bid to a lower but government-linked entity EPF (Employess Provident Fund) which only offered RM1.80 and RM4.80 a share respectively for RHB and RHBCAP. Those happened about a year ago in Mar, 2007 and since then EON Capital was subjected to numerous rumors and speculation that its days were as good as game over.

The main factor why EON Capital Berhad (KLSE: EONCAP, stock-code 5266) would see its D-Day since the failure to acquire RHB was because one of its shareholders - DRB-HICOM Berhad (KLSE: DRBHCOM, stock-code: 1619). The controlling shareholder of DRB-Hicom, Tan Sri Syed Mokhtar Albukhary wasdesperately wanted to dispose the 20.2 percent equity in EON Capital for quite some time as he needs cash to reduce DRB Hicom debts which totaled RM1.9 billion.

EON Capital has total assets of RM39 billion and the price RM9.55 a share represents 2.16 times its book value. However Primus does not plan to make a general offer though. Malaysia's central bank has approved the transaction and the acquisition is expected to be completed in March at the earliest. After acquired the EON Capital, Primus plans to inject capital to expand its staff and management team.

It would be interesting to see if EON Capital could play a bigger role besides the current image as a lender in national automaker Proton. To do so Primus needs free hand to do what it believes would beneficial to its newly acquired baby. But would the rest of the shareholders especially the government-linked entities prove to be hindrance block?

Other Articles That May Interest You …

Yahoo hates Microsoft but Resistance is Futile

Almost every blog that I visited has the story about the Microsoft and Yahoo in the making – probably the deal of the year 2008. A mind-boggling $44.6 billion offer with half of it in cash that will indeed drains Microsoft’s cash reserve, some reports said this is perhaps the last thing Bill Gates’ empire could do to give Google some real punches. The fact is both Microsoft and Yahoo could not topple Google Inc. (Nasdaq: GOOG, stock) individually even since.

On one hand the world’s most valuable technology company was strategizing and pulling its own hair thinking on ways to bring Google down, or at least stop it from growing unstoppable. Just like a cat waiting patiently for the mouse, Microsoft Corp. (Nasdaq: MSFT, stock) was waiting for the right time to pounce on Yahoo Inc. (Nasdaq: YHOO, stock). On the other hand Yahoo was getting from bad to worse, earnings wise. Not sure if all the planets are aligned but Microsoft sure thought so with such a generous offer – 62 percent premium.

Rumors have it that Yahoo might try to find other white knight instead such as News Corp and InterActiveCorp. Others thought it would be a good idea for China’s search leader Baidu.com Inc. to join in the bid for Yahoo as well. Another possibility could be a takeover bid by Yahoo’s own 40% Alibaba.com. The extreme proposition was to invite Apple Inc.’s chief executive officer Steve Jobs to save Yahoo’s butt.

Other Articles That May Interest You …

Friday, February 01, 2008

Reasons Yahoo should accept Microsoft’s $44.6B offer

Let’s continue with internet search engine story and the consequences from their own screwed-up. One day after Yahoo screwed, Microsoft Corp. (Nasdaq: MSFT, stock) leaped in joy and pounced on the little pig which lost its way when the latter announced today an offer Yahoo shareholders may find hard to refuse. Microsoft Corp offered to buy search engine operator Yahoo Inc. (Nasdaq: YHOO, stock) Friday at a whopping $44.6 billion or $31 a share – half cash, half stock.

Based on Thursday’s closing price of Yahoo stock, the offer represents a 62 percent premium. This is probably the boldest move by Microsoft in declaring war against its number one enemy – Google Inc. (Nasdaq: GOOG, stock). Microsoft has been having sleepless nights since the naughty Google sneaked into its backyard and letting off firecrackers. The time couldn’t be better now for Microsoft to launch the takeover since Yahoo is basically crawling. Yahoo’s so-called Project Panama intended to fights Google’s Adsense heads-on is as good as dead.

- Yahoo might not be dead anytime soon but it’s dying slowly and painfully.

- There’s no way Yahoo could throw a single punch at Google, let alone to unseat it

- Yahoo lacks a great leader who can drive the company to start giving serious threat to Google

- Just like the political scenario in Malaysia, Google (Malaysian ruling government) is simply too strong with its huge cash-pile and the only way to compete is to have one-to-one fight - Microsoft + Yahoo against Google. In another words opposition parties should work together *grin*.

- Yahoo’s 500 million unique users and over 4 billion daily page views should be put to better use by competing “efficiently”. Yahoo has been wasting too much time and resources without any clear result. It’s time to let Microsoft (hopefully) to chips in their plan / tactic.