Tuesday, December 26, 2006

Brokers Are Equally Confuse With Short-Selling Procedures

(1) What are Approved Securities for RSS?

- The Approved Securities for the re-introduction of RSS consists of 70 stocks on the main board based on the criteria set. Goto here to refer the 70 stocks identified: Stocks You Need To Know For Short-Selling

(2) Will this list of Approved Securities change?

- Yes, the list of Approved Securities will be reviewed approximately every six months i.e. June and December.

(3) What are the criteria for the selection of RSS Approved Securities?

- Securities which must satisfy all the following criteria:

** Average daily market capitalization of more than RM500 million for the past three months;

** At least 50 million shares in public float;

** Average monthly volume traded of more than 1 million units for the past 12 calendar months.

** However, Bursa may not declare a securities as Approved Securities notwithstanding that it fulfills the criteria above.

- Feature-1: The Up-tick Rule whereby RSS orders can only be keyed in at a price greater than the last traded price

- Feature-2: RSS orders must be executed through designated RSS Trading Accounts

- Feature-3: Gross short transactions are limited to 10 per cent of the total number of listed shares of a particular Approved Securities.

- Why set the 10 percent limit? I understand the reason behind this but it should be un-limited if the exchange is serious about making this short-selling a mature instrument in the market.

- RSS activities for a particular Approved Security for RSS will be suspended for four market days from the day the limit is reached. Normal trades for the particular security will continue.

- It must be joking on this - do you think the market will collapse with the limited 10% shares being shorted at the first place? If the speculators indeed have intention to pull their investment out, a combination of selling their portfolio and consistently short the index-linked counters one after another will do the trick. Let's get real.

(6) What happens to orders already entered prior to the above suspension?

- Orders already entered will be matched in full unless withdrawn by the broker. The 10 per cent limit is a trigger point to commence action to suspend RSS activities.

(7) What do investors need to do if they are interested to short-sell any of the RSS Approved Securities?

- Investors interested to short-sell any of the RSS Approved Securities would need to open a designated RSS trading account with their brokers.

- All trades have to be executed via this designated RSS trading account.

Before any short-selling orders can be executed, investors must provide a confirmation to the broker:

Before any short-selling orders can be executed, investors must provide a confirmation to the broker:

(i) that they are not an associate pursuant to section 3 of the Securities Industry act 1983, and

(ii) that they have borrowed the RSS Approved Securities or have procured confirmation from an Authorized SBL Participant that RSS Approved Securities are available for borrowing.- How do you go about borrow these shares for short? Do I have to pay any fees to borrow this shares? How much do I have to pay then? My broker is confuse and not sure himself about this part, to him there's only one word - TROUBLESOME.

(8) Participating Organizations (POs) have the obligation to obtain confirmation from the client as stated under the previous question. Would a verbal confirmation be sufficient?

- Yes, verbal confirmation is permitted provided that the verbal confirmation is taped. Therefore, if a Participating Organization allows verbal confirmation, it must put in place phone taping system to record such verbal confirmation.

(9) Can an investor borrow securities and do RSS at different POs?

- No

(10) Will the RSS screen accept a sell order using a non-RSS trading account?

- No

(11) Are purchases allowed in an RSS Trading Account?

- Yes, purchases are allowed in an RSS trading account provided it is executed after the execution of any RSS of an approved securities for the following purposes:

(i) For a contra either in full or partially, the RSS trade provided such a contra is executed on the same market day of the RSS of an approved security;

(ii) For the return of the borrowed securities - Purchases shall not exceed the total amount of net short positions of the approved securities on a market day

(12) Can a client sell overbought securities in the RSS account?

- Yes, provided the overbought position of the securities arose from a mistake and the sale is subsequently reported by the Executive Director Dealing to the Exchange with explanation on how the mistake arose.

# TIP: If you understand the complete procedure of the short-selling, I would appreciate very much if you can share/comment your knowledge here.

# TIP: I would rather wait to see how the authorities will solve problem(s) which might arise from this new short-selling instrument. I just hope more information can be published for investors' digestion - talk about getting Malaysia Stock Exchange on the global presence.

Other Articles That May Interest You ...

Why Options Trading Is A Great Leveraging Tool?

But we never being taught that to buy stock, there's only 1 (one) way you can make money - that's the stock has to go UP. We seldom being taught we can make money shorting the stock as well (human being like being optimistic and bullish somehow gives a good-feel compare to bearish). Furthermore you need to have quite a sum of cash in order to buy stocks. So, stocks were planted into our sub-conscious mind as the first financial instrument to make money. Of course you have other investment means such as properties, unit-trust, currency trading, insurance so on and so forth - but stocks are the preferred one.

But we never being taught that to buy stock, there's only 1 (one) way you can make money - that's the stock has to go UP. We seldom being taught we can make money shorting the stock as well (human being like being optimistic and bullish somehow gives a good-feel compare to bearish). Furthermore you need to have quite a sum of cash in order to buy stocks. So, stocks were planted into our sub-conscious mind as the first financial instrument to make money. Of course you have other investment means such as properties, unit-trust, currency trading, insurance so on and so forth - but stocks are the preferred one.- Stock Price --- Stock Profit (Loss) --- Option Profit (Loss)

- $ 20 ----------------> ($10,000) ------------> ($7,000)

- $ 30 ----------------> ($ 5,000) -------------> ($7,000)

- $ 40 ----------------> $ 0 ---------------------> ($7,000)

- $ 50 ----------------> $ 5,000 ---------------> $3,000

- $ 60 ----------------> $10,000 --------------> $13,000

- $ 70 ----------------> $15,000 --------------> $23,000

That's the power of LEVERAGING in options trading.

Hong Kong Beats New York For Second Place

- Hong Kong is next door to mainland China's booming economy

- Tough new U.S. accounting rules discouraged companies from listing in America.

Frederick Ma, secretary for financial services and the treasury said Hong Kong was already benefiting from a new clustering of businesses drawn to the city because of its success in finance. The world's top 70 banks are operating there, he said. In 1995, the city only had 200 chartered financial analysts, but now it has 3,000 - ranking it No. 4 in the world behind the U.S., Canada and Britain.

Frederick Ma, secretary for financial services and the treasury said Hong Kong was already benefiting from a new clustering of businesses drawn to the city because of its success in finance. The world's top 70 banks are operating there, he said. In 1995, the city only had 200 chartered financial analysts, but now it has 3,000 - ranking it No. 4 in the world behind the U.S., Canada and Britain.

However, Hong Kong is heavily dependent on listings by mainland Chinese companies which make up nearly 50 percent of the total market capitalization of $1.59 trillion, according to Hong Kong Exchanges & Clearing.

Shanghai is still a minnow compared to Hong Kong, which has average daily turnover of $4.21 billion - 12 times the volume of Shanghai but many believe Hong Kong will lose some of this investment as Chinese firms might decide to float more shares on the Shanghai Stock Exchange in the coming years.

Shanghai is still a minnow compared to Hong Kong, which has average daily turnover of $4.21 billion - 12 times the volume of Shanghai but many believe Hong Kong will lose some of this investment as Chinese firms might decide to float more shares on the Shanghai Stock Exchange in the coming years.

One thing Hong Kong needs to be more aggressive about doing is attracting IPOs by companies that have operations in China but are owned by firms in the U.S., Canada, Germany and other places, said Ronald Arculli, chairman of Hong Kong Exchanges & Clearing.

Sunday, December 24, 2006

Miss Nevada Ask For Second Chance As Christmas Present

Late Thursday,21-Dec-2006, Rees was dethroned. “Katie Rees has been relieved of her duties as Miss Nevada USA

2007,” said Paula M. Shugart, president of the Miss Universe Organization, which owns the Miss USA pageant, according to the Associated Press.

2007,” said Paula M. Shugart, president of the Miss Universe Organization, which owns the Miss USA pageant, according to the Associated Press."The pictures were disgusting," Miss USA co-owner Donald Trump told Larry King on CNN Thursday night. "These pictures were pretty far out there and that is not representative of Miss USA. We had no choice but to terminate her."

It seems Katie was doing the same underage partying Miss USA Tara Conner did which almost costs her the crown. And now, Katie Rees wants a special Christmas present from Donald Trump: a second chance. I guess Donald Trump does not have much choice but to grant Katie the second chance since the billionaire granted the same wish to Tara Conner or else Donald will be known as the guy who practiced double standard when it comes to beauty queens.

Earlier, Donald Trump announced Miss USA Tara Conner, who had come under criticism amid

rumors she had been frequenting bars while underage, will be allowed to keep her title. "I've always been a believer in second chances,"Trump, who owns the Miss Universe Organization with NBC said. Trump later said Conner would be entering rehab.

rumors she had been frequenting bars while underage, will be allowed to keep her title. "I've always been a believer in second chances,"Trump, who owns the Miss Universe Organization with NBC said. Trump later said Conner would be entering rehab.Conner won the title in April and has been living in New York. Recent media accounts of heavy drinking brought a storm of criticism since she was underage at the time. In a tear-choked voice, Conner said, "In no way did I think it would be possible for a second chance to be given to me." Turning to Trump, she said, "You'll never know what this means to me, and I swear I will not let you down."

Is Malaysia Ready For A Bigger Magnitude Of Disaster?

Malaysia's worst floods in 37 years have displaced nearly 100,000 people amid food shortages, looting and criticism of the government's handling of the crisis.Eight people, all in the worst-hit state of Johor, have now died in the floods, which the government described as the worst since 1969.

criticism of the government's handling of the crisis.Eight people, all in the worst-hit state of Johor, have now died in the floods, which the government described as the worst since 1969.

Malaysian weathermen warned the floods, which hit the southern states, could spread to thecentral and northeastern parts of the country if the unusually heavy monsoon rains persisted.

Lootinghappened in the towns of Kota Tinggi and Segamat of Johor and reportedly has spread to the states of Malacca, Negeri Sembilan and Pahang. There were also cases of rescuers demanding money (the going rate was between 50 and 100 ringgit - $14 and $28) from flood victims before rescuing them.

Lootinghappened in the towns of Kota Tinggi and Segamat of Johor and reportedly has spread to the states of Malacca, Negeri Sembilan and Pahang. There were also cases of rescuers demanding money (the going rate was between 50 and 100 ringgit - $14 and $28) from flood victims before rescuing them.

Flood victim Abu Rashid Maidin said he had to pay a boatman who came around with a  boat to rescue his family who had beenstranded for two days. “I told the boatman that my family needed help and my wallet was missing. The boatman even told me that he was giving me a discount as others were willing to pay more,” he said. He had to borrow the money from his neighbor to pay for the 10-minute ride.

boat to rescue his family who had beenstranded for two days. “I told the boatman that my family needed help and my wallet was missing. The boatman even told me that he was giving me a discount as others were willing to pay more,” he said. He had to borrow the money from his neighbor to pay for the 10-minute ride.

Housewife Sandy Lim, 42, claimed that soldiers had asked her neighbor to pay RM  4,000 to rescue her two-year-oldgranddaughter who was trapped along with her babysitter in the attic of a single-storey house in Kampung Abdullah. “How is she to raise RM 4,000 when all the banks are closed?” asked Lim.

4,000 to rescue her two-year-oldgranddaughter who was trapped along with her babysitter in the attic of a single-storey house in Kampung Abdullah. “How is she to raise RM 4,000 when all the banks are closed?” asked Lim.

Flood victims also complained of lack of food, clothing, blankets and water at many of the relief shelters.

Opposition leaders criticized the government's handling of the crisis, saying relief operations were in complete disarray.

Deputy Prime Ministrer Najib, who is also National Disaster Management and Relief Committee chairman, said so far, assistance had been given in the form of food and equipment when victims were evacuated to relief centers. Earlier Najib said Malaysia does not need international help as the country can manage the situation on its' own.

Deputy Prime Ministrer Najib, who is also National Disaster Management and Relief Committee chairman, said so far, assistance had been given in the form of food and equipment when victims were evacuated to relief centers. Earlier Najib said Malaysia does not need international help as the country can manage the situation on its' own.But with the multiple stories and incidents of victims being left on the roof of their  houses for days without help and uniformed government officers demanding money for evacuation, was it the pride that prompted Najib to refuse to ask for help from other countries? Is it true the National Disaster team is in disarray as claimed by opposition? Why only a handful of rescue boats were sent to help out victims?

houses for days without help and uniformed government officers demanding money for evacuation, was it the pride that prompted Najib to refuse to ask for help from other countries? Is it true the National Disaster team is in disarray as claimed by opposition? Why only a handful of rescue boats were sent to help out victims?

When there're major disaster erupts in other countries such as Indonesia and Philippine or elsewhere, Malaysia was acting in lighting speed in declaring to the world Malaysia is ready to send rescue team. There were numerous frontline with ministers sending off rescue teams who are so proud with their assignment holding Malaysia flag as if it was getting ready for the Oscar Academy award. Could it be more "glamour" to help others internationally but not so within Malaysia itself?

Could these lives be saved if the National Disaster Management has a proper procedure in execution? Why the military resources are not being used in full-swing (Najib himself is the Defence Minister)? Why does Malaysia need to setup some sort of funds every-time a disaster occurs? Doesn't the government have a ready fund for such disaster?

I 'm not against charity or funds to help out victims but there're too many cases where the money contributed by public didn't reach the victims directly - for sure there're money disappeared somewhere, somehow. It was even discussed at Dewan Rakyat on funds misused for the 2004 tsunami and reported in the media. If you wish to donate, I would strongly advice to do sodirectly to hte victims themselves.

'm not against charity or funds to help out victims but there're too many cases where the money contributed by public didn't reach the victims directly - for sure there're money disappeared somewhere, somehow. It was even discussed at Dewan Rakyat on funds misused for the 2004 tsunami and reported in the media. If you wish to donate, I would strongly advice to do sodirectly to hte victims themselves.

In time of disaster, politicians should set aside any agendas and pride but instead move ALL the machineries or resources available (inclusive from external) to save lives as nothing is more previous than the life of a human being regardless of races and ethnics. Nevertheless the question remains - is Malaysia government ready for a bigger nation-wide disaster in future?

# TIP: Get yourselves a list of DO(s) and DON'T(s) in preparation for such disaster or even bigger magnitude of crisis should it happen in future.

Saturday, December 23, 2006

Stocks You Need To Know For Short-Selling

- Affin Holdings Berhad (KLSE : AFFIN, stock-code 5185)

- AirAsia Berhad (KLSE : AIRASIA, stock-code 5099)

- AmInvestment Group Berhad (KLSE : AIGB, stock-code 2288)

- AMMB Holdings Berhad (KLSE : AMMB, stock-code 1015)

- Asiatic Development Berhad (KLSE : ASIATIC, stock-code 2291)

- Astro All Asia Network PLC (KLSE : ASTRO, stock-code 5076)

- Berjaya Sports Toto Berhad (KLSE : BJTOTO, stock-code 1562)

- Bumiputra-Commerce Holding Berhad (KLSE : COMMERZ, stock-code 1023)

- Bursa Malaysia Berhad (KLSE : BURSA, stock-code 1818)

- Dialog Group Berhad (KLSE : DIALOG, stock-code 7277)

- DIGI.com Berhad (KLSE : DIGI, stock-code 6947)

- DRB-HICOM Berhad (KLSE : DRBHCOM, stock-code 1619)

- ECM Libra Avenue Berhad (KLSE : ECM, stock-code 2143)

- EON Capital Berhad (KLSE : EONCAP, stock-code 5266)

- Gamuda Berhad (KLSE : GAMUDA, stock-code 5398)

- Genting Berhad (KLSE : GENTING, stock-code 3182)

- GuocoLand Berhad (KLSE : GUOCO, stock-code 1503)

- HongLeong Bank Berhad (KLSE : HLBANK, stock-code 5819)

- IGB Corporation Berhad (KLSE : IGB, stock-code 1597)

- IJM Corporation Berhad (KLSE : IJM, stock-code 3336)

- IJM Plantations Berhad (KLSE : IJMPLNT, stock-code 2216)

- IOI Corporation Berhad (KLSE : IOICORP, stock-code 1961)

- KLCC Property Holdingd Berhad (KLSE : KLCCP, stock-code 5089)

- Kuala Lumpur Kepong Berhad (KLSE : KLK, stock-code 2445)

- Kurnia Asia Berhad (KLSE : KURNIA, stock-code 5193)

- Lafarge Malayan Cement Berhad (KLSE : LMCEMNT, stock-code 3794)

- Landmarks Berhad (KLSE : LANDMRK, stock-code 1643)

- Lion Corporation Berhad (KLSE : LIONCOR, stock-code 3581)

- Lion Diversified Holdings Berhad (KLSE : LIONDIV, stock-code 2887)

- Lion Industries Corporation Berhad (KLSE : LIONIND, stock-code 4235)

- Magnum Corporation Berhad (KLSE : MAGNUM, stock-code 3735)

- Malayan Banking Berhad (KLSE : MAYBANK, stock-code 1155)

- Malaysian Bulk Carriers Berhad (KLSE : MAYBULK, stock-code 5077)

- Malaysian Plantations Berhad (KLSE : MPLANT, stock-code 2488)

- Malaysian Resources Corporation Berhad (KLSE : MRCB, stock-code 1651)

- Maxis Communications Berhad (KLSE : MAXIS, stock-code 5051)

- Media Prima Berhad (KLSE : MEDIA, stock-code 4502)

- MISC & MISC-F Berhad (KLSE : MISC, stock-code 3816)

- MKLand Holdings Berhad (KLSE : MKLAND, stock-code 8893)

- Mulpha International Berhad (KLSE : MULPHA, stock-code 3905)

- OSK Holdings Berhad (KLSE : OSK, stock-code 5053)

- PadiBeras Nasional Berhad (KLSE : BERNAS, stock-code 6866)

- PLUS Expressway Berhad (KLSE : PLUS, stock-code 5052)

- POS Malaysia & Services Holdings Berhad (KLSE : POSHLDG, stock-code 4634)

- PPB Group Berhad (KLSE : PPB, stock-code 4065)

- Proton Holdings Berhad (KLSE : PROTON, stock-code 5304)

- Public Bank Berhad (KLSE : PBBANK, stock-code 1295)

- Puncak Niaga Holdings Berhad (KLSE : PUNCAK, stock-code 6807)

- Ranhill Berhad (KLSE : RANHILL, stock-code 5030)

- Rashid Hussain Berhad (KLSE : RHB, stock-code 1309)

- Resorts World Berhad (KLSE : RESORTS, stock-code 4715)

- RHB Capital Berhad (KLSE : RHBCAP, stock-code 1066)

- SapuraCrest Petroleum Berhad (KLSE : SAPCRES, stock-code 8575)

- Scomi Marine Berhad (KLSE : SCOMIMR, stock-code 7045)

- Shell Refining Co Berhad (KLSE : SHELL, stock-code 4324)

- SPSetia Berhad (KLSE : SPSETIA, stock-code 8664)

- Sunrise Berhad (KLSE : SUNRISE, stock-code 6165)

- TA Enterprise Berhad (KLSE : TA, stock-code 4898)

- Telekom Malaysia Berhad (KLSE : TM, stock-code 4863)

- Tenaga Nasional Berhad (KLSE : TENAGA, stock-code 5347)

- Time DotCom Berhad (KLSE : TIMECOM, stock-code 5031)

- Titan Chemicals Corporation Berhad (KLSE : TITAN, stock-code 5103)

- UEM Builders Berhad (KLSE : UEMBLDR, stock-code 4855)

- UEM World Berhad (KLSE : UEMWRLD, stock-code 1775)

- UMW Holdings Berhad (KLSE : UMW, stock-code 4588)

- Unisem (M) Berhad (KLSE : UNISEM, stock-code 5005)

- Utama Banking Group Berhad (KLSE : UTAMA, stock-code 6831)

- Wah Seong Corporation Berhad (KLSE : WASEONG, stock-code 5142)

- YTL Corporation Berhad (KLSE : YTL, stock-code 4677)

- YTL Power International Berhad (KLSE : YTLPOWR, stock-code 6742

# TIP: Even after the short-selling started, do not rush in as it is "regulated" but the rules pertaining to this mechanism are still un-clear. The authorities still have much to fine-tune to make it a smooth instrument.

Other Articles That May Interest You ...

Friday, December 22, 2006

2006 Tech's TOP-5 You Should Know

- Cisco Systems (CSCO) - $ 165.72 Billion

- Google (GOOG) - $ 139.67 Billion

- Verizon Communications (VZ) - $ 107.09 Billion

- Kulicke & Soffa Industries (KLIC) - 97.1

- VeriFone Holdings (PAY) - 60.3

- ImClone Systems (IMCL) - 48.3

- Amkor Technology (AMKR) - 47.6

Top-5 : Change in Profit

- ImClone Systems (IMCL) - 347%

- ARRIS Group (ARRS) - 235%

- Google (GOOG) - 86%

Top-5 : 12-Months Sales

- AT&T (T) - $ 60.13 Billion

- Microsoft (MSFT) - $ 45.35 Billion

- Sprint Nextel (S) - $ 41.88 Billion

- Motorola (MOT) - $ 41.52 Billion

Top-5 : 12-Months Profit

- AT&T (T) - $ 7.07 Billion

- Verizon Communications (VZ) - $ 6.48 Billion

- Cisco Systems (CSCO) -$ 5.93 Billion

- Motorola (MOT) - $ 3.94 Billion

# TIP: If you're really crazy about investing tech-stocks you can be sure the above stocks will deliver the financial result - at least these stocks will not go BUST.

Will Currency Speculators Attack Malaysia Next?

Despite rising in recent weeks, second Finance Minister Nor Mohamed Yakcop maintained that the authorities were not worried it was too strong against the dollar. I hope this minister knows and serious about what he said because according to dealers the currency was likely to head higher towards 3.5 per dollar in coming weeks.

Despite rising in recent weeks, second Finance Minister Nor Mohamed Yakcop maintained that the authorities were not worried it was too strong against the dollar. I hope this minister knows and serious about what he said because according to dealers the currency was likely to head higher towards 3.5 per dollar in coming weeks.How ELMO Help You Make Profit Investing Mattel?

to open an hour earlier than usual. The store sold out of its initial stock in two and a half hours, as cashiers in red Elmo T-shirts busily rang up sales. This year, Mattel refused to reveal Elmo's latest trick until the day the doll went on sale. To build buzz for the toy's 10th anniversary, boxes of the T.M.X. Elmo were shippedthe night before to retailers—most of which had agreed to buy it sight unseen.

to open an hour earlier than usual. The store sold out of its initial stock in two and a half hours, as cashiers in red Elmo T-shirts busily rang up sales. This year, Mattel refused to reveal Elmo's latest trick until the day the doll went on sale. To build buzz for the toy's 10th anniversary, boxes of the T.M.X. Elmo were shippedthe night before to retailers—most of which had agreed to buy it sight unseen.Mattel hopes to change that with the latest version of its ten-year-old Elmo. The company is helping fuel a new Elmo frenzy by manufacturing fewer than it normally would, says Jim Silver, co-publisher of Toy Wishes, an industry trade publication. He estimates that the company is making about one-third fewer than its usual run of about 1.5 million Elmos. That has retailers champing at the bit. "I have never seen the item," says Robert Weinberg, senior vice-president for merchandizing at retailer KB Toys. "We really want a lot more." Here's a look at some other toy crazes over the years, from Hula-Hoops to Pokémon.

Everyone is looking for this Elmo but the trick of lower production and secrecy about the toy's ability makes it a success for this holiday. This will definitely bring superb revenue to Mattel for the coming quarter. Mattel is one of my favorite stocks which made good money for me during the last quarter pre-earning announcement. Mattel will be announcing its next quarter earning on Jan-29-2007 (BMC) and I'm pretty sure this stock will not disappoint me.

# TIP: Consider the Call Option with sufficient time-value to make some descent profit on this guy and have a good laugh on the way to the bank like the Elmo.

Other Articles That May Interest You ...

Thursday, December 21, 2006

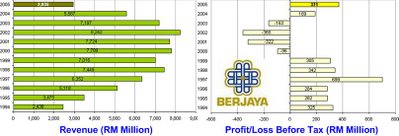

Will Vincent Tan Finally Moves His Stocks?

Berjaya-Corp closing price is the highest since almost a year ago with very high-volume. Stochastic just crossed and RSI moved into the bullish level of 74.5 while the ratio of bullishness is 2,449 Bulls: zero Bears. The ICULS meanwhile breached the all-time high of RM 0.13 since the listing in 2005 (after a complex restructuring involving Berjaya Capital Bhd (KLSE : BJCAP, stock-code 4499) and Berjaya Land Bhd) was trading with equally high-volume, Stochastic cross-over, bullish RSI and a ratio of 809 Bulls : zero Bears.

During the fiscal year ended April 30, 2006, the principal activities of Berjaya-Corp include financial services; manufacturing; property investment and development; hotel, resort and recreation; restaurants and cafes; marketing of consumer products and services, and investment holding. It's been a long time since Vincent Tan started to "move" his stocks which he normally did in the 1990s.

During the fiscal year ended April 30, 2006, the principal activities of Berjaya-Corp include financial services; manufacturing; property investment and development; hotel, resort and recreation; restaurants and cafes; marketing of consumer products and services, and investment holding. It's been a long time since Vincent Tan started to "move" his stocks which he normally did in the 1990s.Quek Buying Kencana But Should You Follow?

Kencana is one of seven companies licensed by state oil firm Petroliam Nasional Bhd to build offshore production platforms and reportedly has a 21ha fabrication yard in Lumut, Perak. The company, 53.5 per cent controlled by

Datuk Mokhzani Mahathir, is bidding for some RM3 billion worth of deals with probability win of 30 percent.

Datuk Mokhzani Mahathir, is bidding for some RM3 billion worth of deals with probability win of 30 percent.Stock price of Kencana Petroleum which is trading at a high of RM 1.17 today, 21-Dec-2006, - nearly triple compare to their initial offer price of 41 cents. The Kencana official said the group may raise more funds for expansion from a new placement or rights issue late next year.

Quek who recently sold his shares in OYL Industries Bhd to Japan's Daikin Industries Ltd for RM7.61 billion is cash-rich and need to invest the huge-pile of money. The companies controlled by Quek include:

- BIL International Ltd (SIN, BIL), which recently announced a major venture into casino operations in the UK

- Camerlin Group Bhd (KLSE : CAMERLN, stock-code 3751)

But just because Quek venture into oil & gas industries doesn't mean investors should blindly jump into the pool. Kencana is currently trading at 22.17 times (based on price at RM 1.14 as of writing time) its forecast earnings of 5.14 cents per share (ended 31 July 2007). As comparison to its' competitor such as Ramunia Holdings Berhad (KLSE : RAMUNIA, stock-code 7206) which is trading at 14.72 times and OilCorp Berhad (KLSE : OILCORP, stock-code 3697) trading at 13.85 times, it looks like Kencana is quite expensive.

Kencana is trading at current stock-price due to Quek's factor - it's fair enough to pay some premium but at 22 times, I would rather invest in either Ramunia or OilCorp which have lesser shares-floated which means the stock price will move faster should it decide to. But in Malaysia, anything can happen as investors are more emotional-driven rather than financial-conscious-driven.

# TIP: Wait for a pullback before you invest Kencana. DO NOT chase-up the stock price (unless you've reliable insider information, of course - which you can alert me by sending email to StockTube)

Other Articles That May Interest You ...

Which Industry Should You Get A Job From?

- Employees at Morgan Stanley earned $264,715 per person in bonus

- Lehman Brothers paid $334,000 per employee in bonus

- Goldman Sachs rewarded an average $622,000 per employee in bonus

Goldman Sachs's (NYSE : GS, quote)chairman and chief executive, Lloyd C. Blankfein was paid a bonus of $53.4 million this year, 2006, the highest ever for a Wall Street chief executive. Together with his $600,000 salary, his income for the year totaled $ 54 million (from $ 38 million in 2005).

Goldman Sachs's (NYSE : GS, quote)chairman and chief executive, Lloyd C. Blankfein was paid a bonus of $53.4 million this year, 2006, the highest ever for a Wall Street chief executive. Together with his $600,000 salary, his income for the year totaled $ 54 million (from $ 38 million in 2005).

Earlier, Morgan Stanley(NYSE : MS, quote) paid its' chief executive, John J. Mack, $41.1 million bonus last week - a record that lasted less than a week. Lehman Brothers (NYSE : LEH, quote), on the other hand paid it's chairman and chief executive, Richard S. Fuld Jr., $11 millionin restricted stock.

Earlier, Morgan Stanley(NYSE : MS, quote) paid its' chief executive, John J. Mack, $41.1 million bonus last week - a record that lasted less than a week. Lehman Brothers (NYSE : LEH, quote), on the other hand paid it's chairman and chief executive, Richard S. Fuld Jr., $11 millionin restricted stock.

Goldman Sachs stock price is up almost 60 percent for the year 2006 creating a $90 billion market capitalization, more than triple when it went public in May-1999. Thompson Financial today announced Goldman Sachs as the overall champion amongst the global M&A advisers, with combined value deals of more than $1 trillion, or about 29 percent of the value of all the year’s deals. Citigroup (NYSE : C, quote), which ranked No. 5 last year is in second place this year with total deal value of $987 billion, or a 27.3 percent market share. Morgan Stanley, J.P. Morgan Chase (NYSE : JPM, quote) and Merrill Lynch (NYSE : MER, quote) are in third, fourth and fifth places respectively.

Wall Street bonuses are expected to hit a record$23.9 billion in 2006 - a staggering amount which according to Associated Press will boost New York economy with bankers having no problem in spending $15,000 bottles of champagne, $40,000 BMWs and multimillion-dollar apartments.

Wall Street bonuses are expected to hit a record$23.9 billion in 2006 - a staggering amount which according to Associated Press will boost New York economy with bankers having no problem in spending $15,000 bottles of champagne, $40,000 BMWs and multimillion-dollar apartments.

With soaring revenues, profits and per-share earnings investment banks which generally pay about 45 to 50 percent of net revenue in bonus to its' employee is indeed the goose which lays golden eggs and should be your preferred industry if you're looking for a career-change now.

# TIP: Get a job with investment banks regardless of your field as you won't be able to get the amount of bonus or compensation elsewhere.

# TIP: Invest in investment banks stocks or consider option trading with sufficient time-value (at least 6 months expiry) as the year-end mergers will ensure good profit in the next quarter earning announcement.

Other Articles That May Interest You ...

Wednesday, December 20, 2006

How Much Did Thailand Lose In 24 Hours?

But just how much did Thailand lose with such an announcement? Bangkok's The Nation newspaper headlined an estimated 820 Billion Baht or US$22.9 billion (euro17.3 billion) being wiped out from the SET plunge.

But just how much did Thailand lose with such an announcement? Bangkok's The Nation newspaper headlined an estimated 820 Billion Baht or US$22.9 billion (euro17.3 billion) being wiped out from the SET plunge.Does Malaysia PM Owns RM30 Million Yacht?

According to the report, the boat is made of Akuju,

Maun, Sipo and Brimanya tree which is imported from South Africa and expected to be completed in 16 months. "I was in Turkey but did not see the boat," he said in reference to his transit in Turkey from Kuala Lumpur before coming here for a three-day official which ended Tuesday. Badawi denied again the allegation via TV3 1:30pm news.

Maun, Sipo and Brimanya tree which is imported from South Africa and expected to be completed in 16 months. "I was in Turkey but did not see the boat," he said in reference to his transit in Turkey from Kuala Lumpur before coming here for a three-day official which ended Tuesday. Badawi denied again the allegation via TV3 1:30pm news.Hurriyet however claimed that the yacht belongs to Malaysia Prime Minister as the Prime Minister ordered the boat himself 4 months ago as per translated by Rocky's Bru blog. Badawi was also reported to be enjoying himself very much fishing together with Ananda Krishnan, owner of Maxis Communications Bhd (KLSE : MAXIS, stock-code 5051) onboard a 40-meter-long luxury yacht "Obsessions".

Maxis Second Attempt To Buy India's Hutchison Essar

The Financial Express of India reported that Maxis had engaged Standard Chartered as its adviser for the bid. It also said Reliance had tied up with four US private equity firms for its bid. The addition of Hutchison Essar to Maxis, which already owns 75% of Aircel Ltd, would make the company the third largest mobile operator in India with over 26 million subscribers.

The Financial Express of India reported that Maxis had engaged Standard Chartered as its adviser for the bid. It also said Reliance had tied up with four US private equity firms for its bid. The addition of Hutchison Essar to Maxis, which already owns 75% of Aircel Ltd, would make the company the third largest mobile operator in India with over 26 million subscribers. Panic Sell-Off Forced Thailand To Lifts Investment Controls

investment in stocks after the market plunged nearly 15 percent, sending panic throughout regional bourses of worries about a repeat of 1997 Asian Economic Crisis. Investors dumped stocks in Hong Kong, India, Indonesia, Malaysia, South Korea and the Philippines amid contagion concerns today.

investment in stocks after the market plunged nearly 15 percent, sending panic throughout regional bourses of worries about a repeat of 1997 Asian Economic Crisis. Investors dumped stocks in Hong Kong, India, Indonesia, Malaysia, South Korea and the Philippines amid contagion concerns today. 14.8 percent at 622.14, after plunging as much as 19.5 percent earlier with the hardest hit sectors being banking, energy and telecommunications. The SET has reacted by calling for the central bank to review its decision to impose new rules aimed at weakening the baht, saying the move prompted foreign investors to dump Thai shares.

14.8 percent at 622.14, after plunging as much as 19.5 percent earlier with the hardest hit sectors being banking, energy and telecommunications. The SET has reacted by calling for the central bank to review its decision to impose new rules aimed at weakening the baht, saying the move prompted foreign investors to dump Thai shares.Tuesday, December 19, 2006

Would You Like Short-Selling By Now?

Earlier blog reported how The Bank of Thailand surprisingly announced a new measure to curb speculators with plans to

force speculators to keep their money in the country for at least one year or face stiff financial penalties, starting today, 19-Dec-2006. It was reported that as much as 950 million dollars of foreign capital flew into Thailand in the first week of December

force speculators to keep their money in the country for at least one year or face stiff financial penalties, starting today, 19-Dec-2006. It was reported that as much as 950 million dollars of foreign capital flew into Thailand in the first week of DecemberKuala Lumpur Kepong Follows The Smart Move

This round it's Kuala Lumpur Kepong Bhd (KLSE : KLK, stock-code 2445) turn when it announced it is acquiring Swiss-based Dr W Kolb Holdings AG, a specialty oleochemical holdings company, for 135 million Swiss francs

(RM393.39 million). KL Kepong said on Dec-18-2006 that the purchase price included a net working capital of 30.9 million Swiss francs - reported Reuters & The Edge.

(RM393.39 million). KL Kepong said on Dec-18-2006 that the purchase price included a net working capital of 30.9 million Swiss francs - reported Reuters & The Edge.The company said it would supply fatty alcohol and fatty acids to Kolb, adding that the acquisition would enable KL Kepong to develop immediate market penetration in Europe.

Other Articles That May Interest You ...

Thai Currency Under Attack Again After 1997 Crisis?

The new rules, the central bank's third attempt since early November to block speculation in the baht, affect transactions worth more than $20,000. "Should any customers wish to repatriate their funds earlier than one year, they would be refunded only two-thirds of the amount," Bank of Thailand Governor Tarisa Watanagase said in a statement.

The new rules, the central bank's third attempt since early November to block speculation in the baht, affect transactions worth more than $20,000. "Should any customers wish to repatriate their funds earlier than one year, they would be refunded only two-thirds of the amount," Bank of Thailand Governor Tarisa Watanagase said in a statement.Monday, December 18, 2006

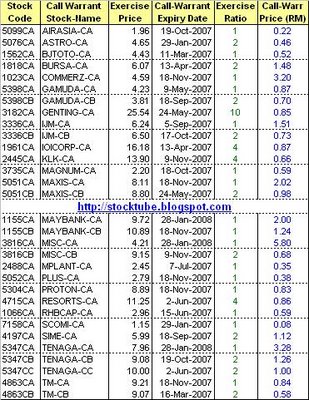

Call Warants Expiry Date, Strike Price & Exercise Ratio

Investors, including myself (how about you?) are quite frustrated when it's so difficult to find information pertaining to stocks information such as call-warrants strike/exercise price or its' expiry-date. The information actually exists but you need to dig deep inside their database - I suspect the webmasters are not doing their job or the head of I.T. doesn't really bother to go the extra miles to collect feedback from customers / visitors on how poor their information are for public viewing.

Investors, including myself (how about you?) are quite frustrated when it's so difficult to find information pertaining to stocks information such as call-warrants strike/exercise price or its' expiry-date. The information actually exists but you need to dig deep inside their database - I suspect the webmasters are not doing their job or the head of I.T. doesn't really bother to go the extra miles to collect feedback from customers / visitors on how poor their information are for public viewing.Anyway, the attachment is the summary of all the call-warrants for the stocks listed in the KLSE of which I think is useful for your consumption before you decide to invest your hard-earned money. I'm attaching the companies name together with its' website should you need to investigate more on the respective company.

- AirAsia Berhad - http://www.airasia.com/site/en/home.jsp

- Astro All Asia Networks plc - http://www.astroplc.com

- Berjaya Sports Toto Berhad - http://www.sportstoto.com.my

- Bursa Malaysia Berhad - http://www.ijm.com

- IOI Corporation Berhad - http://www.ioigroup.com

- Kuala Lumpur Kepong Berhad - http://www.klk.com.my/

- Magnum Corporation Berhad - http://www.magnum.com.my

- Maxis Communications Berhad - http://www.maxis.com.my/

- Malayan Banking Berhad - http://www.maybank2u.com.my/

- MISC Berhad - http://www.misc.com.my.

- Malaysian Plantations Berhad - http://www.mplant.com.my

- Plus Expressways Berhad - http://www.plus.com.my/

- Proton Holdings Berhad - http://www.proton.com

- Resorts World Berhad - http://www.resortsworld.com/

- RHB Capital Berhad - http://www.rhb.com.my

- Scomi Group Berhad - http://www.scomigroup.com.my

- Sime Darby Berhad - http://www.simedarby.com

- Tenaga Nasional Berhad - http://www.tnb.com.my

- Telekom Malaysia Berhad - http://www.telekom.com.my

Based on information above, you can calculate other financial data, example, Gearing = Underlying Security Price / (Call-Warrant Price x Exercise Ratio) - you can get the underlying security price and the call-warrant stock price quite easily from other medias.

Other Articles That May Interest You ...

Sunday, December 17, 2006

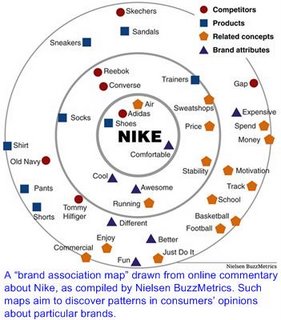

What's The New Component In Branding?

involved indirectly in decision-making in producing quality goods at the right price for the targeted customers and then only repeatedly publish the products/services at media (television or print). The customer service or post-sales department together with marketing will then be responsible to evaluate and fine-tune it through letters, phone-calls, and surveys and so on to gauge the sustainability of the products.

involved indirectly in decision-making in producing quality goods at the right price for the targeted customers and then only repeatedly publish the products/services at media (television or print). The customer service or post-sales department together with marketing will then be responsible to evaluate and fine-tune it through letters, phone-calls, and surveys and so on to gauge the sustainability of the products. An influential blogger can undermine a brand pretty fast in the current age of internet. For example, complaints by bloggers about the poor level of service and quality of Dell Inc. (Nasdaq : DELL, quote) recently gained wide exposure. Toyota's (NYSE : TM, quote) hybrid Prius sedan on the other hand received positive comments which proved to be a plus to its' sales.

An influential blogger can undermine a brand pretty fast in the current age of internet. For example, complaints by bloggers about the poor level of service and quality of Dell Inc. (Nasdaq : DELL, quote) recently gained wide exposure. Toyota's (NYSE : TM, quote) hybrid Prius sedan on the other hand received positive comments which proved to be a plus to its' sales.Saturday, December 16, 2006

Does Malaysia Needs Bakun Project?

Sime Darby Bhd (KLSE :SIME, stock-code 4197) take ownership of the2,400-MW Bakun hydroelectric project on the island of Borneo, reported The Edge financial news on 16-Dec-2006.

Sime Darby Bhd (KLSE :SIME, stock-code 4197) take ownership of the2,400-MW Bakun hydroelectric project on the island of Borneo, reported The Edge financial news on 16-Dec-2006.Sime was leading the consortium which built the half-finished dam, which is one of Asia's largest hydro-electric projects outside China and has suffered problems such as construction falling behind schedule and hefty cost overruns.

Sources also mentioned that the government has also agreed for a 650 kilometers RM 9.0 billionundersea cable project, with Sime leading the consortium undertaking the project. The Bakun dam will flood an area the size of Singapore when it is completed about four years from now, but its owner, the federal government, has yet to find a major buyer for its power.

Among the justifications the government had considered for the construction were:

- a possible aluminium smelter in Sarawak.

- redirect the power to the country's more industrialized peninsular via submarine cables.

It was reported the foreign partner for the cable project was likely to be Asea Brown Boveri (a Swiss power and automation firm), which was involved with the Bakun project in the mid-1990s initially.

It was reported the foreign partner for the cable project was likely to be Asea Brown Boveri (a Swiss power and automation firm), which was involved with the Bakun project in the mid-1990s initially.

Besides main power supplier Tenaga Nasional Bhd (KLSE : TENAGA, stock-code 5347) who will act as the sole customer for the supply, other companies that could be roped in for this project are expected to have relationship with UMNO, the key party in Malaysia's ruling coalition which include:

- Realmild Sdn Bhd (the investment arm of UMNO, the key party in Malaysia's ruling coalition)

Previously, foreign companies which have expressed interest in setting up a smelter in Sarawak include Rio Tinto (NYSE : RTP, quote), Alcoa (NYSE : AA, quote), BHP Billiton (NYSE, ASX :BHP, quote), Smelter Asia-China Aluminium International Engineering and Cahya Mata Sarawak Berhad (KLSE : CMS, stock-code 2852) and Press Metal.

Smelter Asia is owned by tycoon Syed Mokhtar Al-Bukhary, who has warm ties with former premier Mahathir while CMS, on the other hand, is a well-connected group with diversified interests in Sarawak led by Sulaiman Abdul Taib, the son of powerfulSarawak Chief Minister Taib Mahmud.

Smelter Asia is owned by tycoon Syed Mokhtar Al-Bukhary, who has warm ties with former premier Mahathir while CMS, on the other hand, is a well-connected group with diversified interests in Sarawak led by Sulaiman Abdul Taib, the son of powerfulSarawak Chief Minister Taib Mahmud.

The dam was criticized due to theenvironmental impact of building such a massive project in Sarawak's rainforest. More than 10,000 people have already been resettled to make way for the construction. Smelters emit perfluorocarbon (PFC), which is detrimental to humans, animals and vegetation and has global-warming potential. The government is estimated to have already sunk RM 1 billion into the project, of which RM 500 million went to Ting Pek Khing's Ekran Berhad (KLSE : EKRAN, stock-code 3085) as compensation for it being scrapped.

"It's utterly unnecessary," said one Sarawak-based political analyst of the dam, declining to be identified for fear of repercussions. "The only people who need the dam are the Sarawak politicians and their cronies." Moreover, he added, Sarawak has a wealth of alternative energy resources such as natural gas. So, does the government really practice the prudent spending as promised before the last election? Or will this government put the previous government led by Mahathir to shame in terms of mega-projects that this country is so obsessed?

"It's utterly unnecessary," said one Sarawak-based political analyst of the dam, declining to be identified for fear of repercussions. "The only people who need the dam are the Sarawak politicians and their cronies." Moreover, he added, Sarawak has a wealth of alternative energy resources such as natural gas. So, does the government really practice the prudent spending as promised before the last election? Or will this government put the previous government led by Mahathir to shame in terms of mega-projects that this country is so obsessed?

Friday, December 15, 2006

Biggest-Ever Foreign Acquisition In Britain

The Nihon Keizai business daily reported Japan Tobacco Inc. (TYO :JTI, 2914) announced on Friday it would buy Britain's Gallaher Group Plc (LON : GLH) for $14.7 billion in the biggest-ever foreign acquisition by a Japanese company. Japan Tobacco (50 percent owned by the Japanese government) agreed to pay 11.40 pounds per share for Gallaher, the maker of Benson & Hedges and Silk Cut cigarettes.

The Nihon Keizai business daily reported Japan Tobacco Inc. (TYO :JTI, 2914) announced on Friday it would buy Britain's Gallaher Group Plc (LON : GLH) for $14.7 billion in the biggest-ever foreign acquisition by a Japanese company. Japan Tobacco (50 percent owned by the Japanese government) agreed to pay 11.40 pounds per share for Gallaher, the maker of Benson & Hedges and Silk Cut cigarettes. The takeover could help Japan Tobacco offset declining cigarette sales in Japan and reinforce its position as the world's third-largest tobacco firm behind Marlboro maker Altria Group Inc. (NYSE : MO, quote) and British American Tobacco Plc(LON : BATS). In Japan, where Japan Tobacco has a two-thirds market share, cigarette sales fell 1.3 percent in the six months to September from a year earlier to 2.02 trillion yen. Sales volume fell 4.7 percent to 140 billion cigarettes.

The takeover could help Japan Tobacco offset declining cigarette sales in Japan and reinforce its position as the world's third-largest tobacco firm behind Marlboro maker Altria Group Inc. (NYSE : MO, quote) and British American Tobacco Plc(LON : BATS). In Japan, where Japan Tobacco has a two-thirds market share, cigarette sales fell 1.3 percent in the six months to September from a year earlier to 2.02 trillion yen. Sales volume fell 4.7 percent to 140 billion cigarettes.  Overseas cigarette sales have been Japan Tobacco's main source of profit growth. It bought RJR Nabisco's non-U.S. tobacco business for $7.8 billion in 1999, and in 2005 international sales volume overtook Japanese volume for the first time.

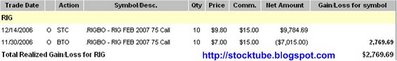

Overseas cigarette sales have been Japan Tobacco's main source of profit growth. It bought RJR Nabisco's non-U.S. tobacco business for $7.8 billion in 1999, and in 2005 international sales volume overtook Japanese volume for the first time.Take Profit On VFC And RIG

The reason I like Transocean is the volatility of this share  which can be very rewarding if you leverage your investment with option. In this case, my entry was Feb-2007 75.0 Call Option, giving me 3 months of time-value of which I'm comfortable with in-line with the facts that traditionally energy stocks are bullish during winter-period.

which can be very rewarding if you leverage your investment with option. In this case, my entry was Feb-2007 75.0 Call Option, giving me 3 months of time-value of which I'm comfortable with in-line with the facts that traditionally energy stocks are bullish during winter-period.

I still have positions is other energy-related stocks which have not yield the profits to my satisfaction yet. Hopefully I can cash it out before the coming Christmas.

V.F. Corporation (NYSE : VFC, quote) position was the pre-earning announcement position deployed with details here. I still can remember the day when VFC beat earning estimate and Nollenberger raises their target on VFC to $83 from $76. It was the same day where Google (Nasdaq : GOOG, quote) beat its' earning and earned the multiple upgrade from analysts of which made me some good money as well.

But you'll never know how the market will behaves. VFCgapped-up as expected on the morning, 20-Oct-2006, after the earning result but it was for a very short-period before turns to red.

But you'll never know how the market will behaves. VFCgapped-up as expected on the morning, 20-Oct-2006, after the earning result but it was for a very short-period before turns to red.

And for the next couple of days, my position of Feb-2007 75.0 Call Option was in red. It's very important that you do your research and invest only in fundamental stock as the fair value of a good stock will always be reflected given the time. As such, I rang the register on 12-Dec-2006 as the profit met my target. Based on the chart on the left, can you see what will happen if only I hang-on for another 2 more days? I would have gain more profits - but I always smile and tell myself "Bull and Bear make profit, Pig gets slaughtered".

Other Articles That May Interest You ...

Thursday, December 14, 2006

Kuok Group Consolidates To Defend Palm Oil Business

agribusiness group and enable Wilmar to be the world's leading merchandiser and processor of palm oil. According to The Edge financial news, Wilmar via CIMB Investment Bank Bhd on Dec 14 made a conditional voluntary takeover offer (VGO) for PPB Oil Palms via the issue of 2.3 Wilmar shares for each PPB Oil Palms share, valuing the deal at S$1.8 billion based on PPB Oil Palms' paid-up capital of 445.42 million shares, or RM9.046 per PPB Oil Palms share. PPB Oil Palms' pre-suspension price was RM8.95.

agribusiness group and enable Wilmar to be the world's leading merchandiser and processor of palm oil. According to The Edge financial news, Wilmar via CIMB Investment Bank Bhd on Dec 14 made a conditional voluntary takeover offer (VGO) for PPB Oil Palms via the issue of 2.3 Wilmar shares for each PPB Oil Palms share, valuing the deal at S$1.8 billion based on PPB Oil Palms' paid-up capital of 445.42 million shares, or RM9.046 per PPB Oil Palms share. PPB Oil Palms' pre-suspension price was RM8.95.  KOG is the Kuok Group's flagship company involved in processing and international trading of oil and grain products. As part of the exercise, Wilmar made an offer to FFM to acquire its 65.8% stake in PGEO for S$491 million via the issue of 287.12 million Wilmar shares.

KOG is the Kuok Group's flagship company involved in processing and international trading of oil and grain products. As part of the exercise, Wilmar made an offer to FFM to acquire its 65.8% stake in PGEO for S$491 million via the issue of 287.12 million Wilmar shares.Are Your Trades Being Sold By Your Own Broker?

Let's continue and see why some brokers didn't get you the NBBO. When you place an order to buy or sell stocks/option, you normally do not care how the transaction is being routed and executed. You just need to know that it's "filled" or "done" or "successfully executed" or whatever name you want to call it right? Well, I'm sorry to say "Wrong" - how and where your order is executed can impact the overall costs of the transaction, including the price you pay for the stock/option.

Many online traders thought / assume they have a direct connection to the securities markets when in fact they don't. When you press the "ENTER" key, your order is sent over the Internet to your broker - who in turn decides which market to send it to for execution. During this period the price of the stock/option might change especially in a fast-moving or high-volume market.

Your broker generally has options on how and where to execute your trade:

- For a stock listed in NYSE (New York Stock Exchange), your broker can direct the order to that exchange. Alternatively, he/she can direct it to a "third market maker" - which agreed to pay your broker attractive fees for doing so. Obviously this broker who sell your trade to a certain market-maker will not get you national best bid and offer because the third market maker need to cover their costs (to the broker) which is known as "Order Flow Payment".

- For OTC (over the counter) stock, your broker may once again route it to Nasdaq market-maker which adopt the same principle in paying the broker for the order flow.

- If you send a "limit-order" (an order to buy or sell a stock at a specific price), your broker may route it to ECN (Electronic Communications Network) that automatically matches your buy or sell orders at specified prices.

- In order for your broker's firm to make money on the "spread" (difference between the purchase price and the sale price), your broker might decide to send your order internally (internalization) to the firm's own division to be filled.

Two years ago when the situation worsen, the US Securities and Exchange Commission (SEC) investigated a dozen brokerage firms, including Morgan Stanley (NYSE :MS, quote), Merrill Lynch (NYSE : MER, quote),Ameritrade (Nasdaq : AMTD, quote), Charles Schwab, Knight Trading Group and E*Trade Financial (NYSE : ET,quote), on suspicion they failed to secure the best available price for stocks for their customers.

Two years ago when the situation worsen, the US Securities and Exchange Commission (SEC) investigated a dozen brokerage firms, including Morgan Stanley (NYSE :MS, quote), Merrill Lynch (NYSE : MER, quote),Ameritrade (Nasdaq : AMTD, quote), Charles Schwab, Knight Trading Group and E*Trade Financial (NYSE : ET,quote), on suspicion they failed to secure the best available price for stocks for their customers.

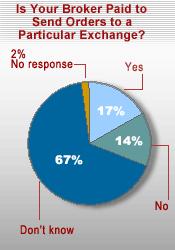

In an Online Broker Survey previously done in TheStreet.com's, it was found that a wide majority of participants said they don't know whether their broker has anything to do with this practice. And nearly half say they don't know whether their broker is getting them the best possible price.

To find out if you're getting national best bid and offer:

- Ask your broker about his firm's order routing practices or look for that information in your account agreement.

- Ask your broker how his firm gets price improvement – that is, a better price than the currently displayed quote.

- Ask if the order-flow, if exists, is provided free-of charge.

- Ask more and more question as if you're investigating them.

TIP: To avoid buying or selling a stock at a price higher or lower than you wanted, ALWAYS place a limit order rather than a market order. A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. When you place a market order, you can't control the price at which your order will be filled and this is when the market maker will ensure you do not get the best price

Other Articles That May Interest You ...

Are You Getting National Best Bid And Offer?

Regardless of whether you're an existing or new player in this game, you need to know more than just fill-up a paper or electronic form for submission. Now, let's talk about NBBO - short for National Best Bid and Offer. If you already knew about this, then you may skip the remaining info otherwise please understand what is these little 4 characters.

Regardless of whether you're an existing or new player in this game, you need to know more than just fill-up a paper or electronic form for submission. Now, let's talk about NBBO - short for National Best Bid and Offer. If you already knew about this, then you may skip the remaining info otherwise please understand what is these little 4 characters.In short, National Best Bid and Offer (NBBO) is a SEC regulation requiring brokers to guaranteecustomers the best available ask price when buying securities, and the best available bid pricewhen selling securities.

The NBBO is updated throughout the day to show the highest and lowest offers for a security in all exchanges and market makers.

Why is this NBBO thingy important? Before online trading exists, there used to be wide difference between bid price and ask price - the difference between these two is known as spread. Who do you think set this spread at the first place? The "Market-Makers", of course, and the intention is obviously to make money out of the difference. By offering you the highest possible ask price when you buy and offering another person the lowest possible bid pricewhen he/she sell, the market-makers created a huge gap and made the handsome gain of the difference.

Why is this NBBO thingy important? Before online trading exists, there used to be wide difference between bid price and ask price - the difference between these two is known as spread. Who do you think set this spread at the first place? The "Market-Makers", of course, and the intention is obviously to make money out of the difference. By offering you the highest possible ask price when you buy and offering another person the lowest possible bid pricewhen he/she sell, the market-makers created a huge gap and made the handsome gain of the difference.Investing Stocks Or Options - Consider Brokerage Fees

Brokerages such as Merrill Lynch (NYSE: MER), UBS (NYSE: UBS), Morgan Stanley (NYSE:MS), and Citigroup's Smith Barney charge quite a sum for stock trades compare to their low-cost competitors which offer many of the same services.

For example, according to a Bloomberg article, buying

1,000 shares of a stock via telephone with Merrill Lynch can cost at least$120. Compare that with discount brokerages such asAmeritrade (Nasdaq:AMTD), which charges $10for most trades, orOptionsXpress (Nasdaq:OXPS), which charges around $13 to $15, or Fidelity or E*Trade (NYSE: ET), which charge as little as $8 or $6, respectively.

1,000 shares of a stock via telephone with Merrill Lynch can cost at least$120. Compare that with discount brokerages such asAmeritrade (Nasdaq:AMTD), which charges $10for most trades, orOptionsXpress (Nasdaq:OXPS), which charges around $13 to $15, or Fidelity or E*Trade (NYSE: ET), which charge as little as $8 or $6, respectively.- Are you getting personalized service from this high-fees brokerage which justifies the cost?

- Are they providing you with excellent support whenever you get yourself into trading problem?

- For online-trading, how fast is the execution of your trade once submitted ? It does not serve any purpose if it takes ages for the transaction to be completed / filled.

- Are you protected from the broker's Financial Failures?

- Do you prefer web-based trading or client-based or the flexibility to have both?

Above are just a handful of considerations that an investor / trader should look at from a high-level view. Brokerage fees is the main determine factor which will decide whether your trades is a profitable or loss-trade - especially if your frequency of trade is high. There're more factors to be considered which StockTube will highlight in the coming articles.

Wednesday, December 13, 2006

Singapore's Wilmar To Bid PPB

Both companies are linked to the family of Malaysian billionaire Robert Kuok. The family is the major shareholder of PPB Group and Kuok's nephew, Kuok Khoon Hong, is chairman and a major shareholder of Wilmar. Wilmar Holdings, which owns 82 percent of Wilmar International, was co-founded in 1991 by Kuok Khoon Hong. Wilmar Holdings' other major shareholders include U.S.-listedArcher Daniels Midland (NYSE : ADM, quote).

The source told Reuters Wilmar was expected to offer cash and shares for the Kuok family's stake in PPB, which would trigger a mandatory bid for the rest of the company. The family owned 39.58 percent of PPB Group and Kuok-controlled firm Kerry Group another 5.94 percent as of March 2006, according to Reuters data.

The source told Reuters Wilmar was expected to offer cash and shares for the Kuok family's stake in PPB, which would trigger a mandatory bid for the rest of the company. The family owned 39.58 percent of PPB Group and Kuok-controlled firm Kerry Group another 5.94 percent as of March 2006, according to Reuters data."It will likely be a cash and stock offer," the source said. No other details were available. Shares in Wilmar, PPB Group and PPB's listed subsidiary, PPB Oil Palms Bhd (KLSE : PPB, stock-code : 6823), were all suspended from trading on Wednesday, pending an announcement.

Road Tolls To Rise By 60 Percent

Under toll concession agreements that critics say favor operators, the government has to reimburse operators if traffic volumes and revenues fall short of pre-agreed projections. Most of the highways were approved in the 1990s by the administration of then Prime Minister Mahathir Mohamad, which made privatization and mega-projects one of its hallmarks.

Under toll concession agreements that critics say favor operators, the government has to reimburse operators if traffic volumes and revenues fall short of pre-agreed projections. Most of the highways were approved in the 1990s by the administration of then Prime Minister Mahathir Mohamad, which made privatization and mega-projects one of its hallmarks. Some 418,000 vehicles used the highway daily on average, reflecting a 14.5 percent compounded annual growth rate for the past seven years, rating firm RAM said in a review of Litrak.

Some 418,000 vehicles used the highway daily on average, reflecting a 14.5 percent compounded annual growth rate for the past seven years, rating firm RAM said in a review of Litrak.Have you ever come across any other countries of which the government is being held ransomby the road operators? This is better than the goose which lay golden eggs as the operators will definitely win with the "guarantee" huge profits from periodically toll-hike. It will definitely spark another round of inflation as the prices of goods will go up again with this hike. Previously the hike in fuel was being used as justification for numerous hikes started from transportation sector. Nevertheless, expect the stocks of these two companies to generate some interest tomorrow.

Aging Mahathir To Meet Soros Since 1997 Crisis

Dr Mahathir’s aide confirmed that the meeting with Soros, who is scheduled to make his first visit to Malaysia to deliver a talk on Challenges to Promoting a Global Open Society is on.

George Soros, the billionaire financier and philanthropist has been invited to address the London School of Economics and Political Science Alumni Society of Malaysia at a fund raising dinner in The Ritz Carlton Kuala Lumpur on Friday, Dec-15-2006. Soros himself was a graduate from the London School of Economics.

Soros said that he and Dr Mahathir had exchanged letters and a personal meeting was planned, depending on the former premier’s health who suffered a mild heart attack on Nov-9. In 1997, Dr Mahathir blamed the Asian financial crisis on Soros, whom he called a “moron” and later refused to meet him when the latter had indicated an interest to talk to the former premier.

Soros said that he and Dr Mahathir had exchanged letters and a personal meeting was planned, depending on the former premier’s health who suffered a mild heart attack on Nov-9. In 1997, Dr Mahathir blamed the Asian financial crisis on Soros, whom he called a “moron” and later refused to meet him when the latter had indicated an interest to talk to the former premier.

During the crisis, Mahathir urged a ban on currency trading while Soros replies that intervening with convertibility of capital is a recipe for disaster and calls Mahathir a menace to his own country.

At a launch of fully computerized Kuala Lumpur Stock Exchange in 1997 and before some 1,000 guests, Mahathir declared that the currency crisis was the handiwork of "powerful predators" from abroad. A few days later, he banned the couple-of-months-old "short-selling" as he claimed it was being manipulated but didn't goes well with international investors and the Malaysia stock market was being punished further with continuous dumping of stocks by the investors.

At a launch of fully computerized Kuala Lumpur Stock Exchange in 1997 and before some 1,000 guests, Mahathir declared that the currency crisis was the handiwork of "powerful predators" from abroad. A few days later, he banned the couple-of-months-old "short-selling" as he claimed it was being manipulated but didn't goes well with international investors and the Malaysia stock market was being punished further with continuous dumping of stocks by the investors.Finally The Correction Started

Bull & Bear makes money, Pig gets slaughtered!!!

Other Articles That May Interest You ...

Tuesday, December 12, 2006

Bursa Short-Selling Re-Schedule In Jan-2007

To start the ball-rolling, it was reported that Bursa Malaysia would only allow short selling for 70 large companies stocks selected based on their size and liquidity. To make things complicated, the process of borrowing and lending of stocks can only be conducted through Bursa Malaysia that will then charge borrowers or lenders a 2.2% interest on the total value of stocks involved.

To start the ball-rolling, it was reported that Bursa Malaysia would only allow short selling for 70 large companies stocks selected based on their size and liquidity. To make things complicated, the process of borrowing and lending of stocks can only be conducted through Bursa Malaysia that will then charge borrowers or lenders a 2.2% interest on the total value of stocks involved.Yusli admitted this new ruling will not see immediate increase in the stock exchange trading volume.

I find this amusing as if the Stock Exchange is serious about this easy but made to look-difficult short-selling mechanism to increase the trading volume, it should be made not only easier to execute but should be given more incentive to be successful. Short-selling is a common instrument within mature market such as NYSE, Nasdaq, LSE and others as a complement to the traditional stock-buying.

Yusli should understand that the perception of short-sellers as the potential bad-guys who will cause the stock-market to goes down is an immature thinking. In fact it is quite reverse - if the stocks are bullish, short-sellers will ultimately need to cover their positions by buying stocks and this will push up the stocks price.

Yusli should understand that the perception of short-sellers as the potential bad-guys who will cause the stock-market to goes down is an immature thinking. In fact it is quite reverse - if the stocks are bullish, short-sellers will ultimately need to cover their positions by buying stocks and this will push up the stocks price. On the other hand if the global market is on downtrend, short-selling will not only allow investors (local and foreigner) to cover their long position but potentially make tons of profit which can in return be channel back to the equity market to potentially support the falling market. Imagine if all the investors are trapped in a bearish market because they can only long the stocks - without any mechanism to liquidate their portfolio, it's as good as losing these investors as continuous customers (who contribute in terms of brokerage fees) simply because they do not have any more money to invest. Sounds familiar?

That's what happened to Malaysia Stock Exchange for a couple of years since the 1997 Asia Economic Crisis. The question is will Bursa finally wake up and serious about promoting Malaysia stock-market globally as a destination for foreign investors?

Other Articles That May Interest You ...

Have You Invested In Oil-Related Stocks Yet?

Today Reuters reported that most OPEC members are in favor of a cut in oil output to combat excess supplies and to ensure prices stay above $60 a barrel. "Iran, like most OPEC members, does not consider an oil price of less than $60 a barrel as appropriate," said the Oil Ministry's news Web site.

U.S. heating demand is expected to be nearly 27 percent below normal this week, with warmer temperatures in most regions east of the Rockies, the National Weather Service said on Monday, which means fuel inventories are likely to remain ample.

U.S. heating demand is expected to be nearly 27 percent below normal this week, with warmer temperatures in most regions east of the Rockies, the National Weather Service said on Monday, which means fuel inventories are likely to remain ample. track much farther north than usual, which will keep any snow in Canada, while sweeping mild air throughout the northern Plains on gusty, westerly winds. The air will turn a little bit colder across the region, but still not as cold as what you typically see across this area during the month of December.

track much farther north than usual, which will keep any snow in Canada, while sweeping mild air throughout the northern Plains on gusty, westerly winds. The air will turn a little bit colder across the region, but still not as cold as what you typically see across this area during the month of December.So, besides the considerable supply surplus over demand and warmer temperature, theweakening dollar which reduces OPEC's purchasing power from dollar-denominated oil is another factor that could push OPEC to take further action to stem a 22 percent price slide since a record of over $78 in July.

Other Articles That May Interest You ...

Volkswagen Close To Acquire 51% Proton?

According to a source reported by Asia Pulse, the German carmaker could sign a preliminary agreement to enable it to do a full fledged due diligence audit on Proton just before Christmas.

Volkswagen was reported earlier that it's desperate in finding a new assembling partner and Proton has the advantage of Malaysia's free trade agreement (FTA) with Japan to exportMade-in-Malaysia Volkswagen cars to Japan by 2010. Under the FTA, Made-in-Malaysia cars above the 2000cc can be brought into Japan on a commercial basis without duty.

Volkswagen was reported earlier that it's desperate in finding a new assembling partner and Proton has the advantage of Malaysia's free trade agreement (FTA) with Japan to exportMade-in-Malaysia Volkswagen cars to Japan by 2010. Under the FTA, Made-in-Malaysia cars above the 2000cc can be brought into Japan on a commercial basis without duty.Volkswagen, which has come up with 20 new models this year, is said to be the preferred choice as it was the only party willing to pump in money, which should help the cash flow at Proton. Volkswagen is believed to be willing to commit as much as RM2 billion (US$563.7 million) to acquire a 51 per cent stake in Proton's manufacturing arm.

Other parties that have expressed the same interest are PSA Peugeot-Citroen (EPA : UG),Mofaz Sdn Bhd, Naza Group and DRB-HICOM Berhad (KLSE : DRBHCOM, stock-code : 1619). While PSA Peugeot-Citroen is only interested in forming a loose alliance, the other three local companies were said to have a slim chance on the tie-up possibility as they're heavily involved in the local assembly - creating a conflict of interest scenario.

Yusli Should Ensure Bursa Malaysia Play Its Role As Well

“It is not our job to promote the companies or the exchange. If companies which make millions a year cannot allocate a few hundred thousands for IR, they should remain a private company. Don’t take up space in our system,” he said, citing CLSA's regional conference, which some invited Malaysian companies did not want to attend and meet investors.

“It is not our job to promote the companies or the exchange. If companies which make millions a year cannot allocate a few hundred thousands for IR, they should remain a private company. Don’t take up space in our system,” he said, citing CLSA's regional conference, which some invited Malaysian companies did not want to attend and meet investors.- Enhance Transparency - how many times have the minority investors got misguided (I guess the word cheated might not sounds polite) when a specific stock was manipulated by syndicate (regardless of insider-linked or not) which drove the share sky-high only to be so-called asked by Bursa Malaysia on the reason for the abnormal price movement. As usual the standard answer from this listed companies are "We're not aware of any new development which contributes to the price movement". And what will happen after that? Nothing at all, the cases just vaporize into thin air.

- Allow only companies with Qualities to be listed - Malaysia stock-market were bombarded with too many companies without quality trying to get listed with the main intention of converting their shares into instant cash. Get real, how many of these companies have the long-term plan to benefit all the shareholders (biggest to smallest)? After the first year, the subsequent year seems to deviate (lower) too much from the projected revenue/profit as stated within IPO brochures.

- Heavier punishment - not only should the listed-company which mislead the public be punish, the CEO, CFO, COO and all the C-level officers should be investigated and held responsible for any of their misdeed. Entrusted with the role of good management but used it as a way to enrich themselves above minority shareholders' interest is equivalent to crime of day-light robbery which entitled to severe punishment. How many minority shareholders lost the only shirt on their body when these companies were declared PN (Practice Notes) and de-listed thereafter?

- Track and Report Insider-Trading - setup a special body to specifically monitor and report any insider-trading which might jeopardize the value of normal shareholders. Learn from U.S. on how they did this efficiently to protect the interest of the public generally and minority shareholders specifically. If the same Enron case were to happen in Malaysia, rest assures the whole Malaysia Stock Exchange will collapse faster than you can blink your eyes.

- Reduce Brokerage Fees for online-trading - why should investors pay the same rate regardless of whether the transaction is being done through brokers or electronically via internet? It doesn't make sense at all when the brokers are doing nothing but to collect brokerage-fees just because the investors happened to open an account with him. The worst thing is most brokers are not research-oriented - it happens many times that retail investors are more knowledgeable than the brokers themselves about the fundamental and technicality of a specific stock. Don't trust me? Pick-up the phone and ask your brokers about it now.

There're many other measures which can be adopted to ensure long-lasting and healthy environment for investors (both locally and foreign) if Malaysia Stock Exchange is serious about long-term investment into the market.

Other Articles That May Interest You ...

Monday, December 11, 2006

Top Reasons Genting Is A Winner