Wednesday, March 21, 2007

Why You Should Look At 200-day MA before investing

Even analysts and portfolio managers who only looked at fundamental research and didn't believe at all in technical analysis would look at this one indicator. These portfolio managers and analysts that work for big mutual funds, pension plans and hedge funds represent the institutional money in the market, and they are considered the "big players" in the market place. Regardless whether you like it or not, these "big players" feel comfortable putting money to work in a stock market when they are trading above their 200-day MA. So you better follow these market makers unless you plan to burn all your hard-earned money into the chimney.

Even analysts and portfolio managers who only looked at fundamental research and didn't believe at all in technical analysis would look at this one indicator. These portfolio managers and analysts that work for big mutual funds, pension plans and hedge funds represent the institutional money in the market, and they are considered the "big players" in the market place. Regardless whether you like it or not, these "big players" feel comfortable putting money to work in a stock market when they are trading above their 200-day MA. So you better follow these market makers unless you plan to burn all your hard-earned money into the chimney.When the stock or market falls below the 200-day MA, the big-boys are less likely to put new money to work in that particular stock or market or to defend their position if the stock or market drops. This behavior repeats itself without fail so knowing the pattern is one of the pre-requisities for traders or investors like you and me.

So, you have to remember that the 200-day MA is the cut-off in determining whether a stock or market is in a bull market or a bear market. You should take long trades after you get a buy signal ONLY if the stock or market is above its 200-day MA. Also, you should take short positions after you get a sell signal ONLY if the stock or market is below its 200-day MA. What is so special, you might ask, about this 200-day MA compare to other technical indicators, which will tell you whether we’re in bull or bear market? The main reason has already been stated above, that is majority follows the pattern. But most importantly it’s the perception and the psychological factors that will move the stock in an unstoppable big-wave. You simply can’t fight against the strength of the current.

And rest assured that this indicator was being tested over and over again by thousands of analysts before. It’s proven to be highly reliable. Of course you might want to mix 200-day MA with other technical indicators to give you a higher percentage of accuracy and comfort before you decided to dive into the stocks.

Tuesday, March 20, 2007

Scrapping Real Property Gains Tax – Tonic for Stocks?

S

ources say it is likely that an announcement on the matter will be made during theInvest Malaysia 2007 conference jointly organised by Bursa Malaysia (KLSE:BURSA, stock-code 1818), RHB Investment Bank and UBS (NYSE:UBS, stock) Securities.

ources say it is likely that an announcement on the matter will be made during theInvest Malaysia 2007 conference jointly organised by Bursa Malaysia (KLSE:BURSA, stock-code 1818), RHB Investment Bank and UBS (NYSE:UBS, stock) Securities.RPGT is a tax on profits from a sale of properties less than five years after they were bought. Only the profit arising from the disposal of a property is subject to RPGT. The tax will be assessed based on a percentage ranging between 5% and 30%, depending on how long the seller has held the property. For Malaysian individuals, there is no RPGT if the property is disposed of after five years. For foreigners, a flat rate of 30% is applicable within five years from the purchase of the property, and 5% on the sixth and subsequent years.

There’re even talks of stamp duty on property transactions being waived on top of the abolishment of RPGT. Stamp duty waiver would be the more significant factor given that it is based on the total purchase value. Example: a two-and-a-half-storey house worth about RM 628,000 will attract a stamp duty of RM 12,000 - a small figure percentage-wise, but a large sum in absolute terms.

With property prices in Malaysia being generally cheaper, and with the ringgit still considered a cheap currency, observers feel that any liberalisation in the property sector could see foreigners pumping money into the sector.

With property prices in Malaysia being generally cheaper, and with the ringgit still considered a cheap currency, observers feel that any liberalisation in the property sector could see foreigners pumping money into the sector.

Back to main justification that Malaysian government will most likely abolish RPGT is the fact that the rosy economic picture painted is not that promising after all. Historically, stocks bull-run will fill-over directly into property sector – people who made tons of profit from the stock market will have nowhere to park their money but to property, obviously. That was exactly what happened during the 1993 Super-Bull run. People were seen laughing their ways to the bank by buying and selling properties with minimal booking fees. The speculation caused the property prices skyrocketed in an alarming rate that the government introduced the RPGT.

But at current situation, the property market is not attracting the expected demand, if the so-called current bull-run is used as the gauge against the 1993’s bull. Needing a shot in the arm desperately, the government needs to see the property sector to take off in great strength if it wants to see the Iskandar Development Region (IDR) to even attract some excitement amongst the voters in preparing for the coming general election. Already the IDR project has all the doubts of success if you were to conduct an interview with person on the street. However, the abolishment of RPGT will definitely boost the property sector and hopefully it will create the wealth the same way before.

Amongst beneficiaries of property companies are players such as:

Other Articles That May Interest You ...

Saturday, March 17, 2007

Teh Hong Piow - Malaysian's Warren Buffett

Instead of confrontational tone set during question and answer

session which is a norm with most of the listed companies AGM in Malaysia, Public Bank’s was full of praise, applause and laughter amid a sprinkling of serious queries from shareholders who had scrutinised the accounts of the bank.

session which is a norm with most of the listed companies AGM in Malaysia, Public Bank’s was full of praise, applause and laughter amid a sprinkling of serious queries from shareholders who had scrutinised the accounts of the bank.The Minority Shareholders Watchdog Group CEO Abdul Wahab Jaafar Sidek, who was full of praise for Public Bank’s management and performance and described the way the AGM was conducted as professional, set the tone for the rest of the meeting. And you can’t blame them for being so tame if you haven’t seen the performance of Public Bank yourself.

After 40 years of uninterrupted profit growth, a shareholder of 1,000 Public Bank shares in 1967 would now be owner of 129,720 Public Bank shares worth a whopping RM1.16mil. Together with RM 391,000 paid out in gross dividends, Teh said the net worth of the 1,000 shares would be RM1.55mil, which represented a compounded annual return of 20% for each of the 39 years. Teh Hong Piow could be the only person who can matches Warren Buffett’s record as far as generating profit to shareholders in Malaysia.

Supposing you’re not so lucky and only able to own Public Bank stocks since the start of 2002 when the shares were worth RM5 each. That would have reaped a return of 122% over the five-year period to date, compared with a 58% rise in the KL Composite Index.

The country’s second largest bank by market capitalisation has ruled out further mergers and acquisitions, telling its shareholders at its AGM yesterday that Public Bank’s focus on expansion lies in tapping new markets, especially abroad where it has a presence. Public Bank said its international focus was to grow its business in Hong Kong and Indochina, as contribution from operations in China was still small.

The group’s Hong Kong operation now comprises 56 branches and it has two branches in Shenzhen, China. Public Bank aims to open between 10 and 15 new branches in Hong Kong and a minimum of five in Cambodia this year. The banking group’s international operations contributed 14% of pre-tax profit last year and that came mainly from Hong Kong and Indo-China.

The group’s Hong Kong operation now comprises 56 branches and it has two branches in Shenzhen, China. Public Bank aims to open between 10 and 15 new branches in Hong Kong and a minimum of five in Cambodia this year. The banking group’s international operations contributed 14% of pre-tax profit last year and that came mainly from Hong Kong and Indo-China.

In response to questions raised by the Minority Shareholders Watchdog Group, Public Bank Bhd said it is targeting to start an Islamic banking subsidiary by the end of the year or early next year (2008). Public Bank expects its Islamic banking and finance business to contribute a higher proportion of its income in future as it expands this business. If only Malaysian's public listed companies' captain takes care of all the shareholders' interest the way Teh Hong Piow did...

# TIP: Investing in Public Bank stock (on stages and on pullback) for long-term as part of your diversification strategy.

Friday, March 16, 2007

Smaller and Newcomers Won WiMAX Licenses

- Bizsurf (M) Sdn Bhd - 50%-associate of YTL e-Solutions

- MIB Comm Sdn Bhd - 55% subsidiary of Green Packet

- Redtone-CNX Broadband Sdn Bhd - subsidiary of REDtone International Bhd

- Asiaspace Dotcom Sdn Bhd - telecommunications and broadcast infrastructure company that was previously awarded the rights to build 50 cellular base stations in 2003

Malaysian Communications and Multimedia Commission (MCMC) said Bizsurf was awarded the 2330 to 2360 bandwidth, MIB 2360 to 2390, Asiaspace 2300 to 2330 and Redtone-CNX the 2375 to 2400 bandwidth. Except for Redtone-CNX, whose areas of operation are Sabah and Sarawak, the others will deploy their services in Peninsular Malaysia.

Malaysian Communications and Multimedia Commission (MCMC) said Bizsurf was awarded the 2330 to 2360 bandwidth, MIB 2360 to 2390, Asiaspace 2300 to 2330 and Redtone-CNX the 2375 to 2400 bandwidth. Except for Redtone-CNX, whose areas of operation are Sabah and Sarawak, the others will deploy their services in Peninsular Malaysia.

A total of 17 companies including Telekom Malaysia Berhad (KLSE: TM, stock-code 4863),Maxis Communications Berhad (KLSE: MAXIS, stock-code 5051) and DIGI.com Berhad(KLSE: DIGI, stock-code 6947) had submitted bids for the WiMAX license.

WiMAX - short for wireless interoperability for microwave access - allows super high-speed Internet access and file downloads from laptops, phones or other mobile devices over greater distances than previous technologies. WiMAX can blanket entire cities with high-speed wireless connections and is a longer-range version of the popular WiFi technology used to connect to the Internet in public spaces such as coffee shops. It is cheaper to set up and run than the high-speed 3G connection for mobile phones.

MCMC expects the companies to invest between RM250-RM300 million each during the first three years of operations. “We expect the winners to quickly roll out the service to 25% of the population in the area given to them by the end of this year, with a service provision of at least 1MBps at affordable rates. At the end of the third year, it is expected that they will be able to roll services to at least 40% of the population in the areas given to them,” MCMC said.

MCMC expects the companies to invest between RM250-RM300 million each during the first three years of operations. “We expect the winners to quickly roll out the service to 25% of the population in the area given to them by the end of this year, with a service provision of at least 1MBps at affordable rates. At the end of the third year, it is expected that they will be able to roll services to at least 40% of the population in the areas given to them,” MCMC said.

Analysts say the decision to award the licences for WiMAX - an emerging mobile broadband technology - to smaller companies is aimed at accelerating competition to meet its objective of wirelessly connecting more households. Malaysia badly lags more tech savvy nations such as Singapore and South Korea, despite a decade-long plan to become a high-tech nation.

Analysts say the decision to award the licences for WiMAX - an emerging mobile broadband technology - to smaller companies is aimed at accelerating competition to meet its objective of wirelessly connecting more households. Malaysia badly lags more tech savvy nations such as Singapore and South Korea, despite a decade-long plan to become a high-tech nation.

Of the four winners, Green Packet Berhad could probably be the only one who will lead the roll-out of services with the WiMAX licenses awarded. Green Packet’s SONmetro solution is also being conducted in Bahrain, Singapore, China, Hong Kong and Europe. SONmetro is Green Packet’s existing wireless broadband network solution. But rumors in the market was that something is fishy about MIB Comm Sdn Bhd as it was a 3-months-old company being registered early in Jan-2007 (could it be that "Men-In-Black" already knew it'll definitely get a license?). Redtone is the next one who probably could deliver the service to Sabah and Sarawak based on its’ good track record, experience, capabilities and leading edge in innovation.

Of the four winners, Green Packet Berhad could probably be the only one who will lead the roll-out of services with the WiMAX licenses awarded. Green Packet’s SONmetro solution is also being conducted in Bahrain, Singapore, China, Hong Kong and Europe. SONmetro is Green Packet’s existing wireless broadband network solution. But rumors in the market was that something is fishy about MIB Comm Sdn Bhd as it was a 3-months-old company being registered early in Jan-2007 (could it be that "Men-In-Black" already knew it'll definitely get a license?). Redtone is the next one who probably could deliver the service to Sabah and Sarawak based on its’ good track record, experience, capabilities and leading edge in innovation.

Without DIGI.com Berhad (KLSE: DIGI, stock-code 6947) in the picture, the game will not be as exciting as it should be. It’s just like a World Cup without the presence of Brazil – there won’t be samba to keep the spectators (consumers in this case) entertained.

Other Articles That May Interest You ...

Lost Again - What Should DIGI Do Next?

Already DIGI is required to sell-down to the allowed 49% limit for foreign companies. Telenor, the parent of DIGI seems to be losing more cards in growing the telecommunication business in Malaysia and decided to do what most of the foreign investors will do – to suck up the coffer as dry as possible. The strategy of the Malaysian government in saving the very-sick Time DotCom Berhad (this company was one of the listed companies which the shares were “Under-Subscribe” during the IPO) is to award the 3G license to it and deny DIGI of one. DIGI was then pressured to “work with” Time DotCom – a way to get DIGI to pour its’ money and expertise into Time DotCom.

Already DIGI is required to sell-down to the allowed 49% limit for foreign companies. Telenor, the parent of DIGI seems to be losing more cards in growing the telecommunication business in Malaysia and decided to do what most of the foreign investors will do – to suck up the coffer as dry as possible. The strategy of the Malaysian government in saving the very-sick Time DotCom Berhad (this company was one of the listed companies which the shares were “Under-Subscribe” during the IPO) is to award the 3G license to it and deny DIGI of one. DIGI was then pressured to “work with” Time DotCom – a way to get DIGI to pour its’ money and expertise into Time DotCom.Unfortunately DIGI didn’t take the bait and was willing to survive alone without any of the 3G. Time DotCom was then rumored to move into second gear of trying to acquire DIGI (which was denied by Time DotCom) but with the support and backup from the government, it’s a matter of time before DIGI needs to raise the white flag. An instruction is all it needs to buy over DIGI via share-swap (the cheapest way). So DIGI pushed up the stock price to the unbelievable RM 17.00 a share to prevent a possible hostile takeover. With Time DotCom stock price at RM 0.80, it’s a ratio of almost 21 Time DotCom’s share to 1 DIGI’s share.

Of course, money solves tons of problem and if Time DotCom or its’ backers really push all the ways, DIGI will be at the losing end ultimately. What Telenor wants is to get as much money as possible from DIGI in the event it’s being elbowed out of business. Furthermore, DIGI is not spending as much as before (practically) on any hardware or software which could be terms liabilities and could not be transferred out from Malaysia. To further sucks the coffer dry, DIGI proposed high dividend with the aim of slowly but surely reward the shareholders, in this case Telenor itself. So who do you think is the winner and smarter? Maybe DIGI should just wait and see if the new winners of WiMAX can deliver what the government was hoping for.

OPEC Maintain Production Level – Time to Make Money

Retail gasoline prices in the United States have been rising since the beginning of the year and reached about $2.60 a gallon on average last week, nearly 40 cents more than in January.Economists are pretty

sure the price will shoot up to $3.00 a gallon soon.

sure the price will shoot up to $3.00 a gallon soon.Oil prices have settled around $60 a barrel in recent months and members of the OPEC seem satisfied with that level. In 2006, OPEC which pumps about a third of the world’s crude oil cut its production levels twice to prevent prices from falling below $50 a barrel.

“We are watching developments on world stock markets to assess their possible impact on the global economy and, in particular, on energy demand,” said Mohamed bin Dhaen al-Hamli, OPEC’s president and the oil minister from the United Arab Emirates.

Consumers in developed countries can expect another summer of high gasoline prices and stiff energy bills with the solid demand for the black gold. On the other hand, consumers in “developing” countries such as Malaysia who created unsatisfaction amongst the people with the fuel-hike in 2006, any further hike will create dilemma to the government who is speculated to call for a snap election very soon.

Consumers in developed countries can expect another summer of high gasoline prices and stiff energy bills with the solid demand for the black gold. On the other hand, consumers in “developing” countries such as Malaysia who created unsatisfaction amongst the people with the fuel-hike in 2006, any further hike will create dilemma to the government who is speculated to call for a snap election very soon.Anyway, with such perception that the supply is tight, it’s only logical to look at the prospect of how to make money from energy-relaated stock counters.

Some of the oil-related stocks to be focused include:

- Transocean Inc. (NYSE: RIG, stock) - primary business is to contract these drilling rigs, related equipment and work crews primarily on a day-rate basis to drill oil and gas wells - specializes in sectors of the offshore drilling business with a focus on deepwater and harsh environment drilling services.

- Valero Energy Corporation (NYSE : VLO, quote) - owns and operates 18 refineries located in the United States, Canada and Aruba that produce refined products, such as reformulated gasoline (RFG), gasoline meeting the specifications of the California Air Resources Board (CARB), CARB diesel fuel, low-sulfur diesel fuel and oxygenates (liquid hydrocarbon compounds containing oxygen).

# TIP: If you decided to do option trading, remember to buy option with time-value of at least six-months expiration.

Thursday, March 15, 2007

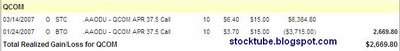

Ring Register & Run After QualComm Stock Heats Up

So, there I was on Jan-24-2007 right before the earning with my research that pointed to a good quarter. It gapped-up for a short-while before dived into territory lower than before the earning announcement. It took another three more trading weeks to settle at the peak but $44 seems to be a strong resistance for it to breach. I didn’t sell at this profitable area and I was punished dearly for this mistake. It went into consolidation phase just above $39 before rebound. The good news set to come in then.

On Mar-13-2007, Qualcomm shares climbed after the chip maker raised its sales and earnings forecast for the coming quarter - sees revenue of $2.1 billion to $2.2 billion during the second fiscal quarter ending in June, compared to the previously forecast $2.0 billion to $2.1 billion. Earnings per share will be between 41 cents and 42 cents, compared to the 35-37 cents range previously forecast. The company thinks it will ship around 60-61 million Mobile Station Modem chips during the June quarter, compared to a prior estimate of 55-57 million units.

On Mar-13-2007, Qualcomm shares climbed after the chip maker raised its sales and earnings forecast for the coming quarter - sees revenue of $2.1 billion to $2.2 billion during the second fiscal quarter ending in June, compared to the previously forecast $2.0 billion to $2.1 billion. Earnings per share will be between 41 cents and 42 cents, compared to the 35-37 cents range previously forecast. The company thinks it will ship around 60-61 million Mobile Station Modem chips during the June quarter, compared to a prior estimate of 55-57 million units.

Investors have been watching Qualcomm's sales closely as the company has been embroiled inlegal battles. Cell-phone giant Nokia Corporation (NYSE: NOK, stock), a client whose license agreement with Qualcomm expires in April, 2007, claims Qualcomm is using Nokia's 1,800 patents for wireless devices to extract outsize royalties on products. Meanwhile, Qualcomm's chipmaker rivals, led by BroadcomCorp. (Nasdaq: BRCM, stock), say they are being denied licenses to key technologies at reasonable rates.

"Despite our view of near-term customer and legal risks with with respect to Nokia and other firms, we would hold QCOM shares," said Standard & Poor's equity analyst Ken Leon in a research note. Qualcomm also announced that it will increase its dividend from 12 cents to 14 cents per share for quarterly dividends payable after Mar. 30, 2007.

I didn’t think twice and close the position since I think this is the only chance for me to flee after the China and U.S. stock’s volatility. Too bad I can’t make 100 percent profit on this stock. Human can never run away from greed, can they?

I didn’t think twice and close the position since I think this is the only chance for me to flee after the China and U.S. stock’s volatility. Too bad I can’t make 100 percent profit on this stock. Human can never run away from greed, can they?

Other Articles That May Interest You ...

Wednesday, March 14, 2007

MAS Firefly - Will It FLY or Catches FIRE Midway?

It will operate twice daily services out of Penang International Airport to Kota Bahru, Langkawi, Kuantan and

Kuala Terengganu. It will also have daily services to Phuket and Koh Samui. Firefly will be operated by MAS' wholly owned subsidiary, FlyFirefly Sdn. Bhd., which was formerly known as Kelas Services Sdn. Bhd. MAS said the Department of Civil Aviation Malaysia has issued the Air Services License and Air Operator's Certificate to Firefly effectuve from 17 March 2007.

Kuala Terengganu. It will also have daily services to Phuket and Koh Samui. Firefly will be operated by MAS' wholly owned subsidiary, FlyFirefly Sdn. Bhd., which was formerly known as Kelas Services Sdn. Bhd. MAS said the Department of Civil Aviation Malaysia has issued the Air Services License and Air Operator's Certificate to Firefly effectuve from 17 March 2007.Firefly will be the country's second low-cost carrier after the runaway success of AirAsia Berhad (KLSE: AIRASIA, stock-code 5099). "We expect between now and one year, it will be on a break-even keel and the following year we should be able to make money. There is no subsidy from the government," Malaysia Airlines Chief Executive Idris Jala told reporters.

It will be very interesting to see if this new baby (or rather experiment toy) of MAS can really FLY or catches FIRE in the sky. Remember what happen to the predecessor of AirAsia? Government-linked conglomerate DRB-Hicom's (KLSE: DRBHCOM, stock-code 1619) initially thought they can pull it through and make it big with the airline but ended up with two Boeing jets and $37 million in debt. Tony Fernandes bought the bankrupt airline for a token of 1 ringgit (26 cents) and assume $12 million of Air Asia debts. And the rest is history.

When asked about his phenomenal success during an interview by CNN, Tony stressed that it's the culture of the company to remain humble as it's crucial to remember the roots of their beginning. Air Asia operates in a family-like environment without hierarchy where marketing, finance, engineers, cabin crew and pilots are all in one office which guarantee effective communication.

When asked about his phenomenal success during an interview by CNN, Tony stressed that it's the culture of the company to remain humble as it's crucial to remember the roots of their beginning. Air Asia operates in a family-like environment without hierarchy where marketing, finance, engineers, cabin crew and pilots are all in one office which guarantee effective communication.

So, can Firefly emulate the same success as AirAsia? Maybe the most appropriate question is whether Firefly has the right captain who can run the low-cost airline professionally and profitably. Already there’re small groups of people who try to gain cheap mileage by applying political pressure even before it started to fly. You should read this funny news about “AirAsia must project our identity” which amongst others stressed the uniform of air stewardess which did not project a Malaysian image.

Do you think Firefly will FLY or catches FIRE midway in the sky? Will it fails the same way as how DRB-HICOM started it? The only difference between the DRB-HICOM project and this new pet project is the planes model - DRB started with two Boeing jets while MAS's Firefly starts with two Fokker. I think it’s time to start stocking sausages and burgers to start the barbeque.Anyone care to join me?

Other Articles That May Interest You ...

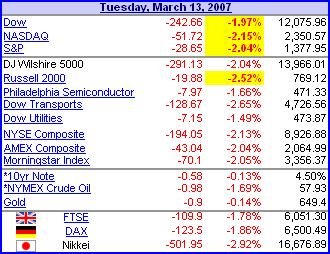

Investing Stocks, Option Trading - U.S. & China's factor

Subprime lenders provide mortgages to people with poor credit. Though they are a relatively small part of the U.S. economy, their difficulties raise larger concerns about the housing market. The Commerce Department said sales at U.S. retailers rose 0.1 percent in February as wintry weather in much of the country kept shoppers away from stores. Investors had expected an increase of 0.3 percent from January - spooking investors if Americans' buying power will withstand an economic slowdown.

Subprime lenders provide mortgages to people with poor credit. Though they are a relatively small part of the U.S. economy, their difficulties raise larger concerns about the housing market. The Commerce Department said sales at U.S. retailers rose 0.1 percent in February as wintry weather in much of the country kept shoppers away from stores. Investors had expected an increase of 0.3 percent from January - spooking investors if Americans' buying power will withstand an economic slowdown.Options expiration on this Friday and the high IV (Implied Volatility) registered since the market's big plunge on Feb. 27 only worsens the situation. The blue chip index is now down about 710 points, more than 5 percent, from its record close reached Feb. 20. Many market watchers suspect that the market's correction is not over.

The subprime worries have been mounting for weeks now, but came to a head when the New York Stock Exchange took steps to de-list shares of New Century, which said Tuesday that the Securities and Exchange Commission would be probing accounting errors that inflated its loan portfolio.

Late in the session, General Motors Acceptance Corp. - General Motors Corporation’s (NYSE :GM, stock) part-owned financing arm -- reported that its fourth-quarter profit rose, but struggles in its Residential Capital LLC unit were eating into earnings. That news gave investors extra motivation to sell.

Traders now await the producer and consumer price indexes, scheduled to be release Thursday and Friday, respectively. The two inflation gauges should give investors a better idea of whether costs are escalating too fast, and if the Federal Reserve might give consumers some relief by lowering interest rates later in the year.

Traders now await the producer and consumer price indexes, scheduled to be release Thursday and Friday, respectively. The two inflation gauges should give investors a better idea of whether costs are escalating too fast, and if the Federal Reserve might give consumers some relief by lowering interest rates later in the year.

As a result, stocks in Japan, Hong Kong and Australia all fell more than 2 percent, while shares in Singapore, India, Malaysia and the Philippines tumbled at least 3 percent. The Shanghai Composite index was down 1.28 percent while in India, Bombay Stock Exchange, down by 397 points, or 3 percent, to 12,585.70 points in midday trading.

It is obvious the bear still rules the street. Any slight negative data or news will send a wave of sellers into the queue unloading stocks to limit their losses. No one can guarantee that the one-day drop will not continue for the next subsequent days ahead. Prior to China becoming the new economic giant, everyone looks at how U.S. stock market performs. But know the whole world depends on both China and U.S. Either one sneezes, you'll catch the cold.

So what should you do with such situation? It depends, really. If you’re trading option orinvesting stocks in U.S. stock market, then you’re pampered with choices. With bearish sentiment - you can sell-short, buy “Put”, activate your “Bear Call” Spread strategy and so on. But if you’re residing in Malaysia or Singapore where you can only profit from stock in one direction, you have no other choice but to wait, pray and hope (if you’re already in the market and making losses) or you can take the risk of entering now (with high percentage of getting slaughtered).

Other Articles That May Interest You ...

Ford Selling-Off James Bond's Aston Martin

David Richards, a former British racing champion together with American banker John Sinders and two Kuwaiti investment firms, Investment Dar and the Adeem Investment Company will become the new owner. Mr. Richards, whose racing and automotive technology company, Prodrive,

helped develop Aston Martin’s racing program, became interested in buying the brand as soon as Ford put it up for sale.

helped develop Aston Martin’s racing program, became interested in buying the brand as soon as Ford put it up for sale.Mr. Richards will become Aston Martin’s chairman, while its current chief executive, Ulrich Bez, will continue to lead the company for at least five more years.

Officials at Ford, which is based in Dearborn, Mich., and is the second-largest American automaker behind General Motors Corporation (NYSE : GM, stock), insisted on Monday that they did not intend to sell other brands such as Jaguar or Land Rover, despite suggestions by many analysts to do so.

Ford closed out the worst year in its history two months ago, losing $12.7 billion amid slow sales of its biggest moneymakers, pickup trucks and sport utility vehicles. Ford stock price never traded above $10 a share in 2006. Ford should sign-up for a course to learn a thing or two from Toyota Motor Corporation (TYO: 7203) on how to produce quality cars without jeopardizing profit if it seriously want to turnaround the company which started by the father of automobile, Henry Ford.

Monday, March 12, 2007

AirAsia-X to Delay Long-Haul Flight to 2008

The reality was within reach when Jetstar, the budget

carrier of Australian carrier Qantas Airways Limited (ASX:QAN) said it plans to fly from Sydney to Kuala Lumpur from September 2007 onwards. In fact you still can check for seats availability and schedule here.

carrier of Australian carrier Qantas Airways Limited (ASX:QAN) said it plans to fly from Sydney to Kuala Lumpur from September 2007 onwards. In fact you still can check for seats availability and schedule here.Today, AFP reported a source from top company executive who said that AirAsia X, the long-haul budget airline set up by low-cost aviation pioneer Tony Fernandes, has delayed its takeoff, possibly until next year from the promised date of July 2007 (this year). The delay was said to be caused by higher leasing costs.

Besides, it was reported that AirAsia X has not decided on the type of aircraft and the firm does not want to get caught leasing planes at current high prices in a market with tight supply though Azmi, the CEO of Fly Asian Express (FAX), told AFP back in January 2007 that a decision will be made in Mar-2007.

Due to the delays in delivery of the Airbus super jumbo (the A380) to other carriers, it has led many airlines to acquire the A330 and caused excess demand. AirAsia X hopes to now start operations by year's end or at the latest, by August 2008. So if you’re still waiting and hoping to get a seat to fly to Britain for as low as 9.99 ringgit (2.97 dollars), then you’ve no other choice but to wait a little bit longer.

Other Articles That May Interest You ...

Sunday, March 11, 2007

Another Reason Why You Should Work With GOOGLE

As an employee of Google Inc. (Nasdaq: GOOG, stock) you’ll enjoy amongst others:

- unlimited amounts of free chef-prepared food at all times of day

- a climbing wall, a volleyball court and two-lap pools

- on-site car washes and oil changes

- haircuts and free doctor checkups

- stock-option

From the info gathered, this free ride is definitely a factor in attracting the best employees. Michael Gaiman, a 23-year-old Web applications engineer who lives in San Francisco and was recently hired, said he turned down an offer from Apple Inc (Nasdaq: AAPL, stock) before accepting the job at Google.

Inspired by Google, Yahoo Inc. (Nasdaq: YHOO,stock) also began a shuttle program in 2005 that could be described as the PepsiCo, Inc. (NYSE:PEP, stock) to Google’s Coke. eBay Inc. (Nasdaq:EBAY, stock) recently started began a pilot shuttle to five pickup spots in San Francisco and some high-tech employers are coming up with other approaches. Still, the top spot for Best Workplaces for Commuters went to Intel (Nasdaq: INTC, stock) which allows telecommuting, offers transit subsidies to employees and helps pay for shuttles that bring workers from transit stops, among other benefits. Microsoft Corp. (Nasdaq: MSFT, stock) came in second while Google and Oracle Corp (Nasdaq: ORCL, stock) both captured the third place.

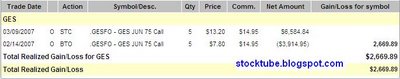

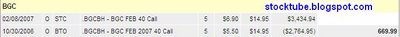

Picking the Fruits of Valentine Investing - GUESS

Guess?, Inc. (NYSE: GES) which I highlighted almost a month ago (on Valentine day itself, to be exact) in “Will GUESS Defy Gravity And Continue 45 Degrees Uptrend?” did not only report earning which beat consensus, it also announced goodies in the form of 2-for-1 stock-split and a quarterly cash dividend of $0.12 a share. Such announcement will only steams the stock price upwards and this is exactly what happened.

Guess?, Inc. reported fourth quarter earnings of $0.99 per share, $0.06 better than consensus, thanks to the globalization of the Guess? brand. Revenues rose 25.2% year over year to $346.4 mln versus consensus of $329.1 Million. It forecast earnings per share growth of up to 21% for the 2008 fiscal year. Operating margin in the fourth quarter improved 480 basis points to 20.5%, compared to the prior year's quarter. The company saw double-digit top line growth in each of its businesses, with Europe and licensing posting the largest increases.

Guess?, Inc. reported fourth quarter earnings of $0.99 per share, $0.06 better than consensus, thanks to the globalization of the Guess? brand. Revenues rose 25.2% year over year to $346.4 mln versus consensus of $329.1 Million. It forecast earnings per share growth of up to 21% for the 2008 fiscal year. Operating margin in the fourth quarter improved 480 basis points to 20.5%, compared to the prior year's quarter. The company saw double-digit top line growth in each of its businesses, with Europe and licensing posting the largest increases.

T he stock price peaked on Feb-20-2007 before consolidates – a period which I should have close my position but my greed-friend told me to hang-on as the overall market sentiment was still bullish. The China stock market crash on Feb-27-2007 added salt to my wounds and should serve as a reminder that a day of holding a stock/option is an extra day of risk exposure. Fortunately the stock price recovered quite fast on the same day itself and should you have monitored the stock movement, you’ll know what I meant. It was a good experience for traders to test their emotions for the next subsequent days when the stock just refused to goes up again.

he stock price peaked on Feb-20-2007 before consolidates – a period which I should have close my position but my greed-friend told me to hang-on as the overall market sentiment was still bullish. The China stock market crash on Feb-27-2007 added salt to my wounds and should serve as a reminder that a day of holding a stock/option is an extra day of risk exposure. Fortunately the stock price recovered quite fast on the same day itself and should you have monitored the stock movement, you’ll know what I meant. It was a good experience for traders to test their emotions for the next subsequent days when the stock just refused to goes up again.

It’s true that whatever goes up must comes down and vice versa. Guess?, Inc. reversed and recovered thereafter and I took the opportunity to lock-in profit last Friday, Mar-9-2007. I’ve to close the position anyway because the additional shares from the split will be distributed on Monday, Mar-12-2007. And the profit I made for being greedy is only at 69% compare to more than 100% should I sell it somewhere at the peak. But you’ll never know. However, as long as your trade is profitable, you should be grateful and continue the journey of trading and investing.

Other Articles That May Interest You ...

EON Capital to Become A Takeover Target Now?

Despite its’ highest offer, it lost (do you ever think EON Capital has any chance since the beginning anyway?) to not a better competitor but to a government-backed entity. Nowhere in the globe can you see a business company able to beat a government especially when politic and business exists within an area with such a grey area. You might not realize it but the money used by Malaysia’s state pension fund Employees Provident Fund (EPF) to force its’ body on the RHB belongs to the members who contributed to the fund. No doubt the clear winner is Utama Banking Group (KLSE:UBG, stock-code 6831) who walks away with billions of dollars to the bank.

Despite its’ highest offer, it lost (do you ever think EON Capital has any chance since the beginning anyway?) to not a better competitor but to a government-backed entity. Nowhere in the globe can you see a business company able to beat a government especially when politic and business exists within an area with such a grey area. You might not realize it but the money used by Malaysia’s state pension fund Employees Provident Fund (EPF) to force its’ body on the RHB belongs to the members who contributed to the fund. No doubt the clear winner is Utama Banking Group (KLSE:UBG, stock-code 6831) who walks away with billions of dollars to the bank.Now that EON Capital lost the bid, it better start thinking

and preparing of a defensive plan since it might be a target of a takeover. Business Times thinks so when it quoted some analysts who think the seventh largest bank might become a M&A target. EON Capital’s values are its’ 130 EON Bank branches nationwide and its’ monopoly in car loans section especially the national cars controlled by Proton Holdings Bhd (KLSE: PROTON, stock-code : 5304).

and preparing of a defensive plan since it might be a target of a takeover. Business Times thinks so when it quoted some analysts who think the seventh largest bank might become a M&A target. EON Capital’s values are its’ 130 EON Bank branches nationwide and its’ monopoly in car loans section especially the national cars controlled by Proton Holdings Bhd (KLSE: PROTON, stock-code : 5304).It’s major shareholder, DRB-HICOM Berhad (KLSE: DRBHCOM, stock-code : 1619) is said to be eager to cash out and received the approval from Malaysia’s central bank, Bank Negara, recently to do so. DRB-HICOM which holds about 20% of EON Capital is in talks with US private equity firm Newbridge Capital. EPF also has indicated its’ interest to sell its’ 8.4 percent stake in EON Capital.

There’s also a possibility that EPF might use RHB Capital as the vehicle to reverse takeover EON Capital. And when that happens, it will be interested to see if there’re any other challengers who is big and powerful enough to give EPF a lesson (which I doubt so for obvious reason). With its’ clean-bill, EON Capital’s consolation would probably be the option of asking a higher price for its stake.

# TIP: With new speculation of EON Capital becoming a potential takeover, its' stock price will surely be chase-up. Investing on the stock might - just might return some decent profit for you.

Other Articles That May Interest You ...

Thursday, March 08, 2007

UBG Aye to EPF despite Higher Offer from EON Capital

UBG, whose owners have political connections to the ruling coalition, announced today, Mar-8-2007, that it had accepted a revised EPF offer of RM2.25 billion or 1.80 ringgit a share compared with the earlier RM2.2 billion for its 32.6% stake in RHB. EPF’s offer for RHB Capital is 4.80 ringgit per share.

The other two bidders are Kuwait Finance House (KFH) and EON Capital Berhad (KLSE: EONCAP, stock-code 5266). EON Capital’s latest offer was higher at 1.97 ringgit a share for RHB and 5.00 ringgit a share for RHB Capital. RHB stock price was last traded at 1.90 ringgit while RHB Capital stock price was at 4.76 before the trade suspension.

Though the pension fund didn’t specify which of the two bidders will ultimately manage RHB, a statement from KFH in congratulating EPF’s latest victory might indicates that the pension fund entered the battle-ring to help wrestle the crown for KFH.

Overall, the pension fund's offers value RHB group at 12.73 billion ringgit ($3.63 billion), while EON Capital's bids put it at 13.38 billion ringgit. Kuwait Finance House has not made a bid for the whole group but says it could invest up to $4 billion to turn its plans for RHB into reality.

Does this means the minority shareholders are not protected when UBG accepted the offers from EPF despite a higher offer from EON Capital? You bet, but due to the large block of stake EPF owns and the political link amongst the main players (EPF, UBG, Minister of Finance and central bank) in this game, you can’t do much, can you? EPF already mentioned that the bid was to protect and maximize return on its investment in RHB group. Read again, it’s not to protect minority shareholders but itself and only itself. By buying at the lowest price possible to control RHB, it has the option to sell to KFH at a higher price or let KFH pumps, runs and grows RHB to maximize profit at a later stage.

Other Articles That May Interest You ...

Tuesday, March 06, 2007

Which Group of Investors Bleeds The Most?

You can see the same similar statements shouted by former Malaysian Prime Minister Mahathir, Thailand prime minister, South Korea, Indonesia and so on during the

1997 Asia Economic Crisis. When the sentiment or the perception of majority investors are bearish the “fear” emotion rules and that’s when a falling-knife is about to happen. And no one wants to catch a falling-knife, do you?

1997 Asia Economic Crisis. When the sentiment or the perception of majority investors are bearish the “fear” emotion rules and that’s when a falling-knife is about to happen. And no one wants to catch a falling-knife, do you?These investors are deaf or do not care about your fundamental data no matter how loud you echo it. In fact the fund managers and analysts were the one who sell first thing when things do not goes as expected. They’ll follow instruction to cut-loss, while retail investors are still standing still “hoping”for miracle to turn the table around – which most of the time will never happen.

Today’s rebound can be categorized as “short-term technical rebound” after two weeks of bleeding (remember what goes up must comes down and vice versa?). Dozens will take the opportunity to tell you that the worst is over and you should start flocking back to the stock market. But should you? I’m not a risk-taker and I prefer to ride with the wave, so I’ll wait and see (you can curse if you wish to).

Now, let’s goes back to the period when the Malaysia Prime Minister announced confidently said that Malaysia stock market will rally to 1,350 points – matching the 1993 Super Bull-Run. At that day, do you know that there’s a huge group of people who queues up signing up new stock-trading accounts? This group of people is the youngster, the teenagers who have no experience whatsoever in the world of stock-market.

Now, let’s goes back to the period when the Malaysia Prime Minister announced confidently said that Malaysia stock market will rally to 1,350 points – matching the 1993 Super Bull-Run. At that day, do you know that there’s a huge group of people who queues up signing up new stock-trading accounts? This group of people is the youngster, the teenagers who have no experience whatsoever in the world of stock-market.These young-chaps do not know what’s T+3 or the meaning of fundamental or technical analysis. And the rest is history. These beginners are the first and largest batch of investorswho fall prey to the cruelty of the stock market right after they entered into the fantasy world. And they didn’t know what hit them – they’ll still figuring out what happen to the huge losses and the reason they’re in the pool of blood, till now.

Back in 1993 Malaysia Super Bull-Run, the indicators or hints were when ordinary folks – the chicken sellers and vegetables resellers in bazaar were busy talking to their brokers via the brick-size cell-phone. This time it’s the youngsters. Will these people learn their lessons? Are you one of them? Share your comments or thoughts here.

# TIP: Remember when others are fear, you should be greed and while the crowds are greedy you should be very fearful.

Other Articles That May Interest You ...

Sunday, March 04, 2007

ASTRO Bullying Customers But Minister Is Helpless

At first I thought only high-rise residential viewers faced the problem

of “Missing Channels”from their subscription with the famous “Service Is Not Available” greeting them during Astro’s migration of channels to the Measat-3 satellite. At least those were the reports I received. But the latest news reported says otherwise because residents staying in low ground faced the same problem. Worst they were slapped with RM50 fees to get a technician climbed onto the roof and adjusted the satellite dish’s direction.

of “Missing Channels”from their subscription with the famous “Service Is Not Available” greeting them during Astro’s migration of channels to the Measat-3 satellite. At least those were the reports I received. But the latest news reported says otherwise because residents staying in low ground faced the same problem. Worst they were slapped with RM50 fees to get a technician climbed onto the roof and adjusted the satellite dish’s direction.The Malaysian minister in charge (who is well-known and feared amongst journalists for his saliva gushing out in high-pressure manner that you’ll be sorry for not bringing umbrella) commented thatAstro is wrong to charge its customers to rectify reception problems resulting from its migration to the Measat-3 satellite and advised customers who had been charged to write to the Malaysian Communications and Multimedia Commission (MCMC).

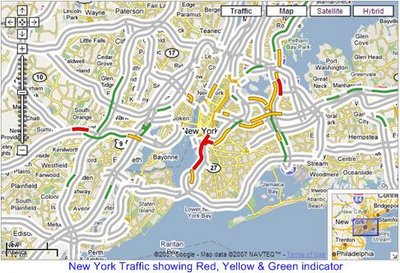

Check Traffic Before Start Your Journey

If you’re staying in U.S. Google offers the facility for more than 30 major cities. You can now see up-to-date traffic conditions to help you plan your schedule and route. For example if you're in San Francisco, New York, Chicago, Dallas, you just need to click on “Traffic” button to show current traffic speeds directly on the map. The map will shows some route with different color indicators:

- Red route means stop-and-go traffic

- Yellow route means expect a slight delay on your appointment

- Green route means you’re in luck because it’s a smooth sailing

# TIP: To view the traffic click link here to view San Francisco, New York, Chicago orDallas

Other Articles That May Interest You ...

Saturday, March 03, 2007

Genting Intl Lost Poker Game - Pull Out From Macau Deal

I

n a latest statement to Singapore Exchange,Genting International(SIN: G13) said it was divesting its stake in a Macau hotel casino to be run by Ho "as soon as practicable" because it was unlikely to meet the deal's regulatory deadline of March 19.

n a latest statement to Singapore Exchange,Genting International(SIN: G13) said it was divesting its stake in a Macau hotel casino to be run by Ho "as soon as practicable" because it was unlikely to meet the deal's regulatory deadline of March 19.Earlier, Singapore's casino regulator said that Genting International and Star Cruises along with their business associates would be subject to "suitability checks" before they would be awarded a casino license in the first salvo in punishing Genting for forming a partnership with Stanley Ho secretly without consulting Singapore authorities.

Genting's Macau investment is part of a deal announced in January that gave a group of investors including Ho a 5.99 percent stake in Star Cruises, which has a 25 percent stake in the Singapore project.

Genting Group should knows from the beginning its’ cards are such that it has to comply with the Singapore authorities since the government hold the five cards of a “Royal Flush” while Genting only managed to secure a “Straight Flush”. Stanley has to call it quit since he only managed a “Full House”. Logically one has to follows where the potential of making money is the highest – in this case Singapore, where the casino business is open for the first time in the history of the nation.

However the story might just begun as it is yet to be seen if the Singapore authorities are satisfy with Genting’s latest arrangement. Singapore might be able to smile at junior Lim only if both Genting International and Star Cruises hand-off from any Stanley-Macau deal as Stanley might still be entering Singapore project via its’ 5.99 percent stake in Star Cruises. But if Stanley is not allowed any stake then there’s no reason why Star Cruises will be allowed into Macau, which will translate the whole scenario back to square one. Genting stock price should be revised down minus it’s valuation of Macau’s project.

Other Articles That May Interest You ...

Friday, March 02, 2007

Insider Trading Exposed - What's The Big Deal?

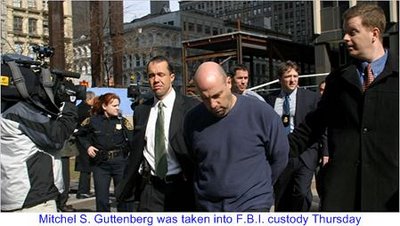

Linda C. Thomsen, chief of enforcement at the SEC, described the scheme as one of the most “pervasive Wall Street insider trading rings since the days of Ivan Boesky and Dennis Levine.”

Linda C. Thomsen, chief of enforcement at the SEC, described the scheme as one of the most “pervasive Wall Street insider trading rings since the days of Ivan Boesky and Dennis Levine.”

The Accused: 13 (thirteen) people including a former Morgan Stanley (NYSE: MS, stock) compliance official, a senior UBS AG (NYSE: UBS, stock) research executive, three employees of Bear Stearns Companies Inc. (NYSE: BSC, stock) and an employee from Bank of America Corp (NYSE: BAC, stock).

The Tactic: Wall Street executives tipping hedge fund traders about potential upgrades or downgrades of stocks, information which almost will move a stock’s price; leaking information about pending mergers and acquisitions, and taking kickbacks to get access to hot deals.

How it started: In 2001, Mitchel S. Guttenberg, a 41-year-old executive director in the stock research department of UBS, met a friend, Erik R. Franklin, then a hedge fund manager at Bear Stearns at the Oyster Bar. Mr. Guttenberg owed Mr. Franklin $25,000 and proposed paying that debt with information about stock upgrades and downgrades. He was a member of the firm’s investment review committee, which reviewed and approved analyst recommendations.

How much did some of them made:

- Mr. Franklin made $5 million over 5 years – pleaded guilty

- David Tavdy, a 38-year-old proprietary trader at Andover Brokerage made $6 million from Mr. Guttenberg’s tips – pleaded not guilty

- Two executives at Assent who got wind of the illegal UBS info & trading demanded bribes of $150,000 to stay quiet.

- Marc Jurman, Randi Collotta and Christopher Collotta netted $600,000. Jurman pleaded guilty but the Collotas pleaded not guilty.

Randi Collotta, a 30-year-old lawyer in the global compliance department at Morgan Stanley, teamed up with her husband, Christopher Collotta, to dispense information about Morgan Stanley’s coming mergers to Marc Jurman (a high school friend). Jurman traded on deals involving Adobe System Inc. (NASDAQ: ADBE, stock) acquisition ofMacromedia in 2005 and ProLogis’s (NYSE: PLD, stock) acquisition of Catellus Development.

Mr. Guttenberg provided hundreds of tips to Mr. Franklin about rating changes so that he could make quick trades in his hedge fund at Bear Stearns, Lyford Cay Capital. The two agreed to share the after-tax profits after the debt between them was settled. They exchanged cash at arranged meeting places. Lyford Cay was a small hedge fund overseen by Kurt W. Butenhoff, a senior managing director at Bear Stearns who is a top-producing broker and an equity derivatives specialist.

Mr. Franklin who used to report to Mr. Butenhoff left Lyford Cay in 2002 to return to Chelsey Capital and together with another portfolio manager traded on UBS tips. Mr. Guttenberg pleaded not guilty yesterday while Mr. Franklin pleaded guilty. For two counts of conspiracy to commit fraud and four counts of securities fraud, Mr. Franklin would face a maximum of 90 years in prison, but sentencing guidelines suggest he would more likely face about five years.

The fact is insider trading occurs almost in every country's financial market. Either these people are smart enough not to get caught or the law just couldn’t goes near them or the government doesn’t really care about this issue. Some of you may laugh your heart out reading the small figures involved in this insider trading. Some countries (need I say which it is?) consider this reported insider trading as a chicken-feed compare to the illegal “open” trading yet untouchable (to prosecution) that occurs almost on daily basis. So, what's the big deal?

Warren Buffet Is Hiring - Young CIO

Chinese proverb in relationship to how long a business empire built will lasts.

Chinese proverb in relationship to how long a business empire built will lasts.Westerners meanwhile learnt that there’s nothing wrong to pass on your business empire to people other than your immediate family members as capability of a person supersedes every factors if you wish to see your built-empire survives through decades or even centuries of challenges. That’s why you still can see Ford Motor (NYSE: F, stock), Coca-Cola Company (NYSE:KO, stock) and Alcoa Inc. (NYSE: AA, stock) around.

Legendary investor Warren Buffett is the greatest investor of all. Almost all investors investing in stocks would know who this great Oracle is. If you do not know who he is, you shouldn’t start investing your hard-earned money yet. He is so famous that his flagship, Berkshire Hathaway Inc. (NYSE: BRK-A) actually commands a huge premium on the stock price. Should he dies today, the stock of Berkshire Hathaway Inc. will tumble like a rock – most analysts believe. As he approached the age of 70 (Warren is 76 now), everyone was started to ask the billion-dollar question – who will be his successor? His sons neither have the magical touch nor half the investing talent he has.

Known as the Oracle of Omaha, Buffett has transformed Berkshire since 1965 from a failing textile company into a $164 billion conglomerate by buying out-of-favor companies with strong management and businesses, and investing in stocks.

Known as the Oracle of Omaha, Buffett has transformed Berkshire since 1965 from a failing textile company into a $164 billion conglomerate by buying out-of-favor companies with strong management and businesses, and investing in stocks.Yesterday, Mar-1-2007, in his annual shareholder letter Warren reveals his intention to hire a young investment manager to succeed him. Berkshire will create two top positions – chief executive officer (CEO) and chief investment officer (CIO). It was hope that the new candidate for the CIO position will be having some mandatory requirements besides being young.

Last year Buffett said Berkshire's board had three outstanding internal candidates for chief executive, and the board knows "who should take over if I should die tonight." Each of those candidates is significantly younger then the 76-year-old Buffett.

This year, the "Oracle of Omaha" said Berkshire is not well-prepared for a successor on the investment side of the business because those who might replace him on the investment side are too close to his own age. The best candidate so far for is Lou Simpson who manages Geico’s investment portfolio but Lou is already 70.

Some of the criteria the young CIO should possess include:

- have impressive investment records

- able to think independently

- recognize and avoid serious risks

- emotional stable

- keen understanding of human and institutional behavior

- able to put $38.3 billion cash to work

- as young as possible in relative to Warren’s age of 76

During the fourth quarter, which ended Dec. 31, Berkshire made $3.58 billion, or $2,323 per share. That is down 30.2 percent from the year-ago period when Berkshire made $5.13 billion, or $3,330 per share.Berkshire's Class A shares (BRK.A) arethe most expensive U.S. stock, and they have traded above $100,000 a share since last fall. Berkshire's Class A shares ended Thursday up $410 at $106,600 and its Class B shares (BRK.B) rose $31 to $3,554.

During the fourth quarter, which ended Dec. 31, Berkshire made $3.58 billion, or $2,323 per share. That is down 30.2 percent from the year-ago period when Berkshire made $5.13 billion, or $3,330 per share.Berkshire's Class A shares (BRK.A) arethe most expensive U.S. stock, and they have traded above $100,000 a share since last fall. Berkshire's Class A shares ended Thursday up $410 at $106,600 and its Class B shares (BRK.B) rose $31 to $3,554.

Buffett said Berkshire gained $16.9 billion in net worth during 2006, which represents an 18.4 percent jump in the per-share book value of the company. That's better than the S&P 500's 15.8 percent increase in value during 2006.

Berkshire owns more than 60 companies, including insurance, clothing, furniture, jewelry and candy companies, restaurants, natural gas and corporate jet firms and has major investments in such companies asCoca-Cola Co. (Warren’s favorite drink), Anheuser-Busch Companies Inc. (NYSE: BUD, stock), American Express Co (NYSE:AXP, stock), Dairy Queen ice cream, Fruit of the Loom underwear and Wells Fargo & Co(NYSE: WFC, stock).

Berkshire owns more than 60 companies, including insurance, clothing, furniture, jewelry and candy companies, restaurants, natural gas and corporate jet firms and has major investments in such companies asCoca-Cola Co. (Warren’s favorite drink), Anheuser-Busch Companies Inc. (NYSE: BUD, stock), American Express Co (NYSE:AXP, stock), Dairy Queen ice cream, Fruit of the Loom underwear and Wells Fargo & Co(NYSE: WFC, stock).

Other Articles That May Interest You ...

Thursday, March 01, 2007

Aladdin's Flying Into Malaysia - Helping MAS's debt problem

The MAS Hotels & Boutiques Sdn Bhd sale (MHB), which includes the Four Seasons Hotel in Malaysia, comes as

the state-controlled Malaysia Airlines unloads non-core assets to help turn around the once-ailing airline. The carrier said it stood to gain 62 million ringgit from the sale, which is expected to be completed by the end of the third quarter, will translate into an improved earnings per share (EPS) of five sen.

the state-controlled Malaysia Airlines unloads non-core assets to help turn around the once-ailing airline. The carrier said it stood to gain 62 million ringgit from the sale, which is expected to be completed by the end of the third quarter, will translate into an improved earnings per share (EPS) of five sen.Alwaleed, the nephew of King Fahd, is one of the largest single foreign investors in the United States. His major holdings include interests in U.S. tech heavyweight Apple Inc.’s (Nasdaq:AAPL, stock) and media giant Time Warner Inc. (NYSE: TWX,stock). He owns almost 5 percent of Citigroup (NYSE: C, stock), the largest U.S. bank, and more than 5 percent of the U.S.-based media conglomerate News Corporation (NYSE: NWS, stock).

Last year Alwaleed and Colony Capital agreed to pay $3.9 billion for Canada's Fairmont Hotels & Resorts Inc (FHR.TO), trumping an offer by billionaire investor Carl Icahn. It seems Middle-East tycoons are seriously flexing their muscles investing into Asian region. With their huge war-chest, this could be the beginning of the Aladdin's invasion to shield themselves should one day their oil-fields run-dry. What about Malaysia - are they still in complacent mood?

Wednesday, February 28, 2007

China Sneezes, U.S. Catches Cold and Others Panic

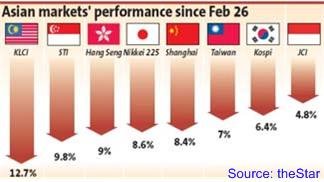

The global rout was triggered by the biggest sell-off in the Chinese stock market for 10 years. The main Shanghai exchange fell 8.8pc, its worst fall since the death of premier Deng Xiaoping in 1997. The trouble began Tuesday - just one day after Chinese stocks hit a record - as investors unloaded shares to lock in profits amid speculation about a fresh round of austerity measures from Beijing to slow the nation's sizzling economy.

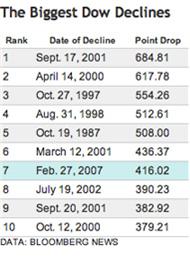

This followed by Wall Street when the Dow fell 546.20, or 4.3 percent, to 12,086.06 before recovering some ground in the last hour of trading to close down

416.02, or 3.29 percent, at 12,216.24. It was the Dow's worst point decline since Sept. 17, 2001, the first trading day after the terror attacks, when the blue chips fell 684.81, or 7.13 percent. The drop hit every sector across the market, and a total of $632 billion was lost in total in U.S. stocks on Tuesday.

416.02, or 3.29 percent, at 12,216.24. It was the Dow's worst point decline since Sept. 17, 2001, the first trading day after the terror attacks, when the blue chips fell 684.81, or 7.13 percent. The drop hit every sector across the market, and a total of $632 billion was lost in total in U.S. stocks on Tuesday.A Commerce Department report that orders for durable goods in January dropped by the largest amount in three months exacerbated jitters about the direction of the U.S. economy. Investors were also spooked by comments Monday from former U.S. Federal Reserve Chairman Alan Greenspan, who said a recession in the U.S. was "possible" later this year. In percentage terms however, the losses on Wall Street were nowhere near the record 24 percent loss in 1914 and the more recent 1987 collapse of 22.6 percent for the benchmark Dow index.

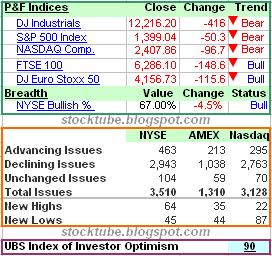

Investor optimism took a tumble in February falling back to

the level it reached in December 2006. The Index dropped 13 points to 90 (refer to chart), erasing all of its gains from January and bringing it back below 100, where it has generally been since December 2000. The Index is conducted monthly and had a baseline score of 124 when it was established in October 1996.

the level it reached in December 2006. The Index dropped 13 points to 90 (refer to chart), erasing all of its gains from January and bringing it back below 100, where it has generally been since December 2000. The Index is conducted monthly and had a baseline score of 124 when it was established in October 1996.So I guess it’s true that China is the emerging new economic power of the world. Previously when U.S. sneezes, the rest of the world catches the cold. Now it’s time the China sneezes and you can see the effect. But China factor is only part of the reason. The global stocks/equity markets have been on uptrend and this China stocks’ plunge was taken as an excuse for investors to take profit and run for shelter. How long will the bear play with the stock market is everyone’s guess. It could be days or weeks before the sky is clear for investors to decide the next direction.

# TIP: For those with lion-heart, a panic-selling day is an opportunity to scalp the stock for a minor but fast profit. Panic sellers will dump at any price because the FEAR rules the day.

Other Articles That May Interest You ...

Singapore Set To Punish - Will Genting Get Casino License?

Singapore said it has not yet awarded a casino license to Genting Berhad, even though the Malaysian gaming group won a tender in December. On Thursday, Genting is due to sign an agreement with Sentosa Development Corp., a government-owned body which runs the resort island where the casino will be built.

"The signing of the development agreement and the issuance of a casino license are two separate matters … The signing of the development agreement allow Genting International and Star Cruises to proceed with the construction of the integrated resort. However, it does not automatically qualify them for the casino license, which is needed before it can operate the future casino," Singapore's Ministry of Home Affairs casino regulator said in an emailed statement today, 27-Feb-2007.

Analysts said the deal between Genting and Stanley Ho has clearly upset the Singapore authorities, prompting the regulator to warn today that it may withhold the license for the casino, potentially the most lucrative component of the entire resort. The casino regulator said in a statement that Genting's eligibility for a casino license would depend on its suitability as specified in a key clause in Singapore's casino act. That clause states that operators must not have any business association with any partner who "is not of good repute having regard to character, honesty and integrity or has undesirable or unsatisfactory financial resources."

The statement is obviously targeting at Stanley Ho’s unproven but known connection to Macau’s reputation for massage parlours and triad gangs together with money laundering. I think Genting needs to sever the connection between Genting and Stanley Ho if it really treasures the Sentosa project that it won. With this negative news together with Dow Jones which shed 120 points at this moment, expect Genting related stocks to take a beating tomorrow when the market opens.

Other Articles That May Interest You ...

Tuesday, February 27, 2007

Malaysian Stock Market Crashing - More To Come?

Ignore the political calls and cries asking you as a retail investor to support by participating in Malaysian stock market. Ask Citigroup (NYSE: C, stock) Equity Research to

fly kite as well since this research firm always give contrarian suggestion to investors for obvious reason – they want to sell badly after accumulated stocks at lower price. To me, both the political figures and the market makers above belongs to the same group – they’re the fox guarding the chicken coop and asking the little chickens (that’s you and me dude) to queue up entering the slaughtering chambers.

fly kite as well since this research firm always give contrarian suggestion to investors for obvious reason – they want to sell badly after accumulated stocks at lower price. To me, both the political figures and the market makers above belongs to the same group – they’re the fox guarding the chicken coop and asking the little chickens (that’s you and me dude) to queue up entering the slaughtering chambers.And today what do you get with Malaysian stock market a.k.a. Bursa Malaysia (KLSE: BURSA, stock-code 1818)? A 50 points or almost 4% drop (minutes before closing just now) with arecord 1151 stocks down comprises 87% of the total stocks listed on the Kuala Lumpur Stock Exchange. Maybe the government should shout and front-page this record-breaking stock-crash the way they shouted how the good times were back not long ago.

Why am I so happy with the stocks-crash? I’m not, but I’ve to admit I’m glad I listened to my inner voice and my experience gained throughout the years of investing that something is not right about the sudden rush of the goodies. The simplest thing I learned is you have to take contrarian stand with a country’s equity market where the government does not practice transparency. So when the government officials say “you should buy”, you better take the opposite action and “sell instead”. Since when you make money because the government sincerely cares for you that they tipped you to enter the stock market in Malaysia?

Why am I so happy with the stocks-crash? I’m not, but I’ve to admit I’m glad I listened to my inner voice and my experience gained throughout the years of investing that something is not right about the sudden rush of the goodies. The simplest thing I learned is you have to take contrarian stand with a country’s equity market where the government does not practice transparency. So when the government officials say “you should buy”, you better take the opposite action and “sell instead”. Since when you make money because the government sincerely cares for you that they tipped you to enter the stock market in Malaysia?You have to remember that EPF (Employees Provident Fund) or PNB (Permodalan Nasional Berhad) or other government-linked agencies need to make money the way you want to in the stock-market. Need I tell you how much money the government needs to organize, conduct and vote-fishing in a general election? Where do you think those mountains of money came from?

Of course the analysts justify the bungee-jump stock performance on Dow-Jones consecutive days of down-trend, overdue correction, profit-taking, oil prices above $61 a barrel, geopolitical factors and other excuses which never fail to amuse me. But I bet they’ll never tell you if the foreign investors are pulling out in a big way. It’s possible the foreign investors who flooded into stock-market recently are short-term investors or speculators. Looking at the trend, it is impressive the retail investors nowadays are deploying a smarter strategy – investing in short-term by day-trading. If indeed the top-volume were played by retails, you can see them run helter-skelter today upon seeing the fox coming.

And did you notice how most of the 20 top-volumes stocks register double-digit percentage of drop? After the closing, the composite index was down 35 points – isn’t it fantastic how the “investors” push-up the index by 15 points within the few last minutes? Of course it's too early to tell if today's drop is an early indicator of the stock market crash. Ready for stock short-sell?

Other Articles That May Interest You ...

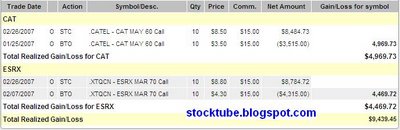

CAT & ESRX - Over 100% Profits In Option Trading

About a month ago on 26-Jan-2007 (yes, this trade is about a month old), Caterpillar reportshighest ever fourth quarter and full-year sales and profit of $41.517 billion in sales and profit of $3.537 billion, or $5.17 per share for financial year 2006. The company also reported a recordfourth quarter with sales and revenues of $11.003 billion and profit of $882 million, or $1.32 per share, up 10 percent from last year.

About a month ago on 26-Jan-2007 (yes, this trade is about a month old), Caterpillar reportshighest ever fourth quarter and full-year sales and profit of $41.517 billion in sales and profit of $3.537 billion, or $5.17 per share for financial year 2006. The company also reported a recordfourth quarter with sales and revenues of $11.003 billion and profit of $882 million, or $1.32 per share, up 10 percent from last year.

In 2007, the company expects anotherrecord yearwith sales and revenues in a range of $41.5 to $43.6 billion, which is flat to up 5 percent from 2006, and profit in a range of $5.20 to $5.70 per share. "I'm anticipating great things for Caterpillar in 2007. Despite a sharp decline in two key North American industries - on-highway truck engines and U.S. housing - and an expected reduction in dealer inventories, we are projecting another record year in 2007 … We expect to improve profit per share at a higher rate than sales and revenues, and that means a key focus in 2007 will be cost management." said Chairman and Chief Executive Officer Jim Owens.

In 2007, the company expects anotherrecord yearwith sales and revenues in a range of $41.5 to $43.6 billion, which is flat to up 5 percent from 2006, and profit in a range of $5.20 to $5.70 per share. "I'm anticipating great things for Caterpillar in 2007. Despite a sharp decline in two key North American industries - on-highway truck engines and U.S. housing - and an expected reduction in dealer inventories, we are projecting another record year in 2007 … We expect to improve profit per share at a higher rate than sales and revenues, and that means a key focus in 2007 will be cost management." said Chairman and Chief Executive Officer Jim Owens.

That’s all it needs to give Caterpillar the steroid to keep pushing the stock price up from the moment of the gap-up. From the chart, you can see it did paused for a while to establish a support level above $64 before continue its’ assault. Yesterday I sensed that Caterpillar could be trying to build another higher support level of $67 but I guess the sense of not wanting to be a pig (remember the phrase “Bull & Bear make money but Pig get slaughtered?") prompted me to erase this position from my monitoring screen and take money off the table altogether. Furthermore it’s over140% profits on my May 60 Call option position trading this lovely Caterpillar and I should be glad of it.

Express Scripts, Inc. (Nasdaq: ESRX, stock)  which launched the takeover bid forCaremark Rx, Inc. (NYSE: CMX,stock) in December 2006, posted earnings of $147.2 million, or $1.07 per share, compared with a profit of $111.1 million, 75 cents per share, during the same period a year earlier. Revenue however fell 1 percent to $4.53 billion from $4.58 billion. Express Scripts beat earning consensus of 97 cents per share on revenue of $4.6 billion polled by Thomson Financial.

which launched the takeover bid forCaremark Rx, Inc. (NYSE: CMX,stock) in December 2006, posted earnings of $147.2 million, or $1.07 per share, compared with a profit of $111.1 million, 75 cents per share, during the same period a year earlier. Revenue however fell 1 percent to $4.53 billion from $4.58 billion. Express Scripts beat earning consensus of 97 cents per share on revenue of $4.6 billion polled by Thomson Financial.

The main bullet was the upside profit guidance issued with new target between $4.08 and $4.20 per share from between $3.90 and $4.02 per share. Express Scripts said the guidance does not include any potential impact from a successful takeover of Caremark.

Upon earning announcement, the stock price of Express Scripts gapped-up but could not sustain the momentum thereafter and took a lazy rest. However the stock rises and performs what I hope for – an uptrend, more of 30 degrees. The uptrend somehow stopped last week below stock price of $78 but has since traded above this level. But it’s not moving upwards anymore, instead the stock try to build a support level at $78 but I’m not sure if this level can be maintained. My disadvantage on this Mar 70 Call option trade is I’m losing the time-value. So I decided to lock-in profit with over 100% profits. With both options, Caterpillar and Express Scripts, over 100% profits what else can I complaint?

# TIP: Depending on your risk management, holding on to stocks or option after a good earning announcement could sometime provide higher profits - require constant monitoring.

Other Articles That May Interest You ...

Monday, February 26, 2007

Factors From 1997 Asia Crisis Re-Appears - A Bad Sign?

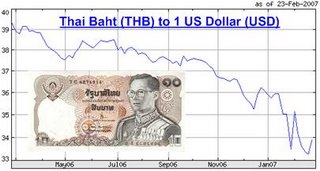

The region had seen a sharp rise in hedge fund activity and credit finance capital inflows into Asian equity and financial  products. Asian-Pacific equity markets rose 29 percent in 2006. In 2007, so far Malaysia is the best equity market performer. Speculative inflows and a weak U.S. dollar pushed most regional currencies higher last year prompting the Bank of Thailand imposed tough capital controls in December to control surging baht. The control however backfired and triggered massive stocks sell-off by frustrated foreign investors.

products. Asian-Pacific equity markets rose 29 percent in 2006. In 2007, so far Malaysia is the best equity market performer. Speculative inflows and a weak U.S. dollar pushed most regional currencies higher last year prompting the Bank of Thailand imposed tough capital controls in December to control surging baht. The control however backfired and triggered massive stocks sell-off by frustrated foreign investors.