Sunday, November 09, 2008

It Ain’t Over Yet – China and Unemployment are Next

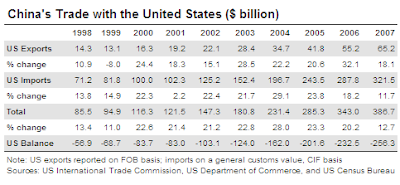

Once I read that we shouldn’t jump as we would not be affected by the U.S. sub-prime crisis because the engines from China and India were running at full steam. I almost fell off my chair because such article could mislead novice investors in snapping up stocks without knowing what they were doing. I’ve written about it and again I would like to emphasis that nowhere in the world can we find the replacement market huge enough to take over the vacuum from U.S. Not European Union, not Russia, not Brazil and definitely not India or China. No doubt China registered mind-boggling annual economic growth but that’s because U.S. allows it. The United States and China symbiosis relationship was a unique one really.

Already many China factories are closing putting tens of thousands of workers speechless and out of job. In fact every sector of the Chinese economy is slowing and credit is tightening. From annual economic growth of 11 percent in 2007 the Chinese economic muscle is expected to shrink to 5.8 percent – a level that worries Beijing because anything less than 8 percent means many more will lose their jobs. Speculators, punters and gamblers whose job were to bet on the stock market and nothing else to make a living were watching with horror their invincible Shanghai composite index fall more than 60 percent this year alone.

Other Articles That May Interest You …

Thursday, November 06, 2008

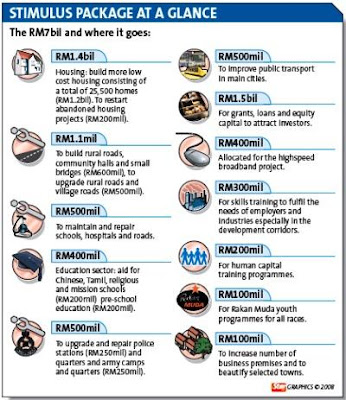

Stimulus Plans, to be spent Wisely or ended up Elsewhere?

Outgoing PM Abdullah Badawi said “Anyone can be PM” after reporters asked the sleeping beauty if it were possible for a person from a minority group to become Prime Minister in Malaysia, apparently referred to President-elect Barack Obama. That would be a bold and positive statement that would raise millions of eyebrows and earn applause if it was made four-years ago. Sadly Badawi still has another four months to go before hand-over his comfy bed to his deputy PM Najib. So it doesn’t matter what Badawi said as it does not carry any more weight. The focus is on Najib, advisor Mahathir, Deputy-PM-in-waiting Muhyddin and of course CIMB Group chief executive Nazir Razak (Najib’s brother).

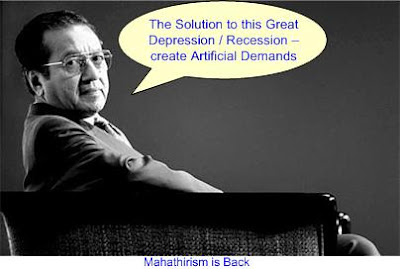

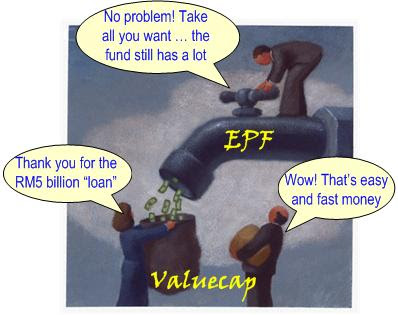

However critics are questioning the source of the money, the huge RM7 billion after the earlier RM5 billion capital injection to boast stock market was tainted with claims that the money was actually needed to pay the debts-due from Valuecap. Furthermore it will be an uphill task to track the money spent on the so-called projects identified. Every Tom, Dick and his dog knows “leakages” are bound to happen within the current administration but little activities are still better than no activities in the attempt to boast domestic economy. Najib (and his advisor Mahathir) knew they can’t depend on foreign investor but to rely solely on the domestic supply and demand to create excitement. Execution is important and Najib’s boys need to ensure whatever projects trumpeted would be properly carried out.

If Nazir speaks on behalf of his brother Najib, expect more similar multi-billion stimulus packages to supplement the current RM7 billion based on the statements released by the National Economic Council to which Nazir is the member. And he actually recommended former premier and dictator Mahathir for Nobel economic prize? Absolutely amazing!

Other Articles That May Interest You …

- It’s President Obama, learn from this Great Nation please

- Will Malaysians wake up to face the Economic Challenge?

- In time of Cheap Lobster, Peoples Money are Robbed

- The RM5 billion, shouldn’t the Government seek approval?

- The Richest Malaysians, Robert Kuok scored the perfect 10

- Dow up, KLCI down; Dow down, KLCI down even more?

- Does CIMB Plans to acquire more Banks?

Wednesday, November 05, 2008

It’s President Obama, learn from this Great Nation please

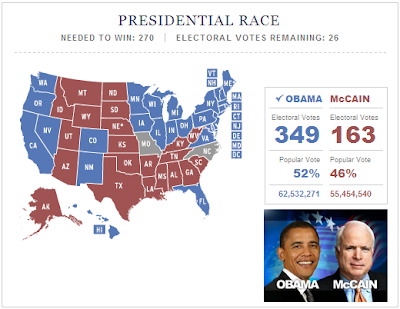

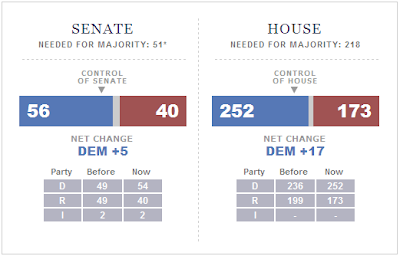

Barack Obama, 47, the son of a father from Kenya and a mother from Kansas was elected as the 44th President of the United States on Tuesday. America has again show why the country is the greatest nation ever. America is a place where all things are possible. Who would have thought that a black man, whose fate is destined to be a slave if today is 400 years ago, could become the president of the most powerful country in the world? Instead of congratulating President Obama, there are actually many things that we can learn from this latest historic moment. In fact there’re some similarities when you compared the latest U.S. election with Malaysian’s election in Mar.

Now that the election is over all eyes will re-focus back to the economic mess, not to mention the “buy on rumor, sell on news” profit taking activities that are set to starts after the recent gains. On the local front, the RM7 billion stimulus package announced by Finance Minister and de-facto Prime Minister next Mar should be applauded. Already there’re speculations whether the RM7 billion is really derived from the money saved from the reduced fuel subsidy. Let’s hope the government is not working behind the scene to borrow the money from EPF again after Najib’s earlier plan to inject RM5 billion borrowed money from EPF to stock market drew criticism as it was claimed the money (RM5 billion) was actually meant to pay Valuecap “debt-call”. Let’s give Najib the benefit of doubts for the moment, shall we?

Other Articles That May Interest You …

Tuesday, November 04, 2008

Obama or McCain, place your bets and Make Pocket Money

Ever wonder why those casinos, lottery and 3-D, 4-D & 5-D businesses were almost recession-proof? Besides opportunity to make money if you strike, people tends to feel great when their bets hit the bull-eye. The feeling was just unbelievable as if it was better than sex. And it’s not funny at all to read the husband-wife team was slapping each other to confirm they actually won the multi-million dollar jackpot recently. Today, Tuesday Nov 4, is the day the de-facto Malaysian PM Najib is due to announce his grand economic plan while the Americans will decide if the country will see the first black as their next President of the United States.

Dow Jones closed the trading session with little change Monday ahead of the election. But at one corner punters (can you call them investors?) are monitoring to see if their bets will make cool monies for them – the Election Futures Market.You can virtually open an account for as little as $5 to as much as $500 bucks (real money, mind you) and use it to buy and sell contracts. However you’ve to take this trading system with a pinch of salt because a simple huge order could tilt the result in your favor. The risks are high but so do the gains.

Platforms such as Iowa Electronic Markets or Intrade are some of the election futures market providers. It was reported that people who bet on Barack Obama a year ago are making great money today. Back then Obama was given a pathetic 14% if he can win the Democratic presidential nomination but now traders are betting this guy has a staggering 90% chance of being elected to the White House. If you’re a high risk taker then place your bet on Arizona Senator John McCainbecause as of now a contract will cost you only $9.20 but if this guy can pull the stunt, you can pocket $100 from the bet.

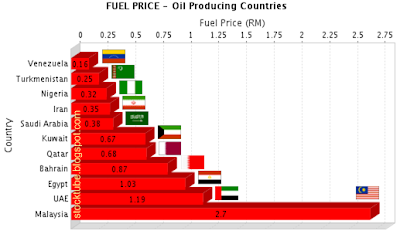

Unlike Malaysia whereby only 191 voters will vote for the President of UMNO and indirectly the Prime Minister of Malaysia, there will be more than 100 million people who will vote for the President of the United States. No wonder money can easily buy the Prime Minister seat in Malaysia. Can you imagine doing the same in the United States? But then we shouldn’t do such comparison because Malaysia is such a darling country with the cleanest Prime Minister, heaven-like investment climate, fairest wealth distribution of all, recession-proof, highest concentration of great-brains from all over the world and basically there’s not a single poor citizen at all *grin*. We’ve even explored the space and self-sufficient with abundance of oil, palm oil, agriculture products, clean water, free electricity, cheapest fuel price, great foods and you name it we have it.

And no, we didn’t blow up that Mongolian beauty Altantuya, most probably she tripped and blown up herself while playing with that piece of hamburger-like C4. I still wonder how do Chief Inspector Azilah Hadri and Corporal Sirul Azhar Umar, both from Special Action Unit, look like since until today nobody can ascertain if the persons behind the masks are indeed them at all.

Other Articles That May Interest You …

Time is Tough but don’t be Silly and Commit Suicide

Technical recession may already hits the economy in about 15 European Union countries and the EU forecast unemployment to climb to 8.4 percent in 2009 which literally means another 2 million people will be out of job. Even Hong Kong’s oldest stockbroker David Tung said he has not seen a financial crisis as serious as the current one throughout his 65 years of stocks trading. One thing that never fails to happen when economy crisis exploded is the increasing number of suicide cases. It doesn’t matter if you’re a seasoned stock traders or a young chap who have not even graduate from high school. The stock trading game does not discriminate and most of the suicidal lost not only their savings but also their jobs, homes, marriage and probably their kids’ piggybanks *grin*.

It’s sad to note that despite past suicide cases reported people still tends to treat stock market as a casino gambling their money away. The rule of the game is pretty simple – if you can’t afford to lose then don’t ever step your foot on the trading floor (inclusive of internet trading nowadays, mind you). There’re big time gamblers and there’re small time traders. Either way if you can’t afford to lose the shirt you’re wearing or the few thousands of dollars of savings then don’t spell stocks. This is not the game for you. You may do well in the game of fixed-deposit saving, provided the bank you trusted do not go bust. However if you still stubbornly wish to play the stock market then allocate the amount of money that you can afford to lose without thinking even once of committing suicide. If you’ve heart problem by all means go and do some knitting will you?

Other Articles That May Interest You …

Monday, November 03, 2008

Will Malaysians wake up to face the Economic Challenge?

One of my favorite cakes is indeed the tiramisu cake from Secret Recipe. My only complaint is its price because I normally will buy the whole cake instead of a slice or two. I’m not sure if the cake has shrunk since the price increases but I suppose if you like it so much you’ll still pay for it. The tiramisu cake will be super nice if you “chill” it in the fridge. At least the tiramisu has not shrunk (assuming they did not add extra baking powder) compared to other foods whereby the portion was ridiculously small even after they raised the price in tandem with the fuel hike.

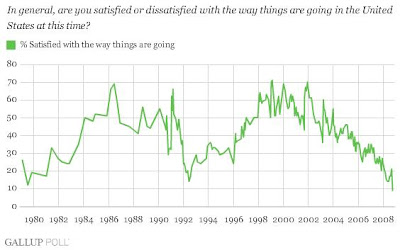

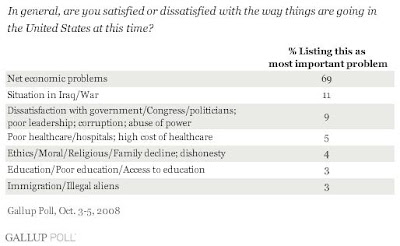

Lately the politicians are fighting nail and tooth to justify their candidacy as the most powerful person in their respective country. Sadly while the Americans may see Barack Obama as their first black President of the United States, Malaysians are still very much a racial country. No doubt the cake of wealth is shrinking as we speak because there’re too many people talking while too few people are building the wealth pie. In fact the country is reaching the tipping point whereby the cake is not enough to be distributed to the lazy and greedy cronies of politicians that the same pool of cronies might end up cannibalizing each other.

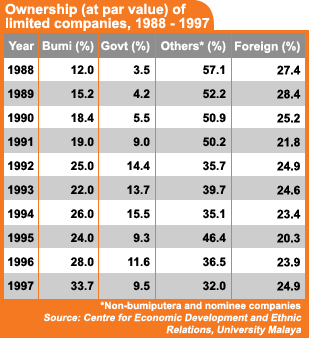

But NEP’s objective was the eradication of poverty irrespective of race so why the need to constantly find a bumiputra and beg him / her to take your 30 percent stake away? Strangely despite the equity given out, the bumiputra’s stake was claimed to be still at 19 percent since 1970. Of course professional thieves are always creative in their justification that the loots are never enough. And what better way then to use the companies’ shares par value, a stagnant and nonsense method, to ask for the 30 percent freebies forever? Best still, exclude the ownership of GLCs (government linked companies), EPF (employee provident fund) and other state-owned companies. In this way the non-bumiputra would work for generations like cows to generate the wealth so that these bumiputras can enjoy the fruits of hard labour. However even the most hardworking cow can work for so long before give up and “migrate” or “transfer” their wealth overseas. Hey, don’t under-estimate the cows because with the current internet technology, anything is possible.

We’re already living in a borderless world and with each recession every 10-year, you don’t need to be a heart surgeon to realize the impact on the economy if the country is not prepared. If the politicians and the UMNO-bumiputras still think they are invincible, can demand 30% free stakes and more whenever they like and the tiramisu cake will continue to grow itself, this country is a very risky place for foreign investors to pour their money in. Get real! While the local non-bumiputras have no choice, the foreign investors are pampered with many alternatives.

Other Articles That May Interest You …

Thursday, October 30, 2008

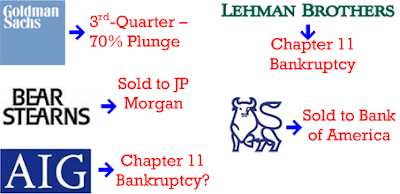

Forget about rate cut, AIG may Crash the Stock Markets again

Boy! I’m glad that I took the little profit I made scalping Apple before the Feds announcement. As expected the Federal Reserves lowered its interest rate by 50-basis points to 1 percent now, the same rate last seen five years ago in 2003 and 2004 after the Internet bubble burst. However unlike the bubble five years ago that only affected the technology stocks, this time the problem is more severe simply because the financial institutions were in the center of the problem. Going by current situation Bernanke’s boys may go even further and the interest rate could go down to “zero” percent – virtually means the bank loans are free of interest *Yippee!*.

But I suppose the Feds has to do what it has to do. If the interest rate was the medicine to cure the current havoc, it would have worked much earlier. I’m sure the Feds and Bush administration know that the main problem is the consumers and businesses lost in confidence, so much so that they are holding back in spending. The fact that the banks and financial institutions are still fearful in lending money despite being disbursed of $600 billion by Feds is not helping the situation. It makes one wonder what could be the problem with these greedy banks hugging the monies that were supposed to be lent out. They should be grateful that taxpayers’ money was used to bail them out after they thrown the risk-management guidebook out of the windows just because these top executives need to please the boards with cool-figures in order to secure fat bonuses.

Other Articles That May Interest You …

Wednesday, October 29, 2008

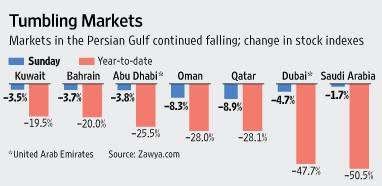

Experience the Real Panic in Persian Gulf Slowdown

Prince of Persia was one of my favorites and I was so addicted to the DOS-game that I used to sleep four to five hours daily in order to complete the adventure. It was many years ago and the game which was developed by a teenager was superb. The fact that the game did not allow you to save meant I’ve to literally switch on the personal computer for God know how many days. The first personal computer that I owned was a 386 (although 286 was still available) that comes with 240MB of hard-disk, if my old memory still serves me right, and if I press the turbo button the clock will speed up to 66 Megahertz. It was the top range back then and most of my friends envy my machine *grin*. Of course there’s also this simple stock market game that randomly flashed on the screen if you’ve made great fortune or went bankrupt the next trading morning.

Needless to say nowadays I seldom have the time to play computer games and I still have many PS2 games bought but never have the time to enjoy it. Surprisingly I don’t find many stock market games today. I suppose with the internet technology it would be silly to play such games when you can trade with real money on actual stock markets. Dow Jones is rather boring today as everyone is waiting for the afternoon announcement from Ben Bernanke on the interest rate cut. Feds do not really have much choice but to cut it further lest it wants to see another huge plunge. Furthermore the almost 900 points jump Tuesday was mainly due to anticipation that Feds will cut the rate by either 50 or 100 basis points. China had just cut its interest rate to 6.66% from 6.93% while Norway’s cut was 50 basis points to 4.75%. The European Central Bank (ECB), Bank of England and Bank of Japan may follow soon.

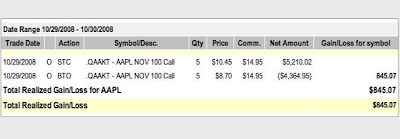

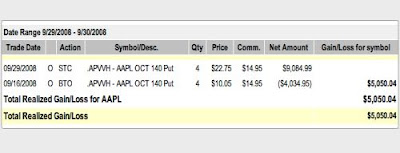

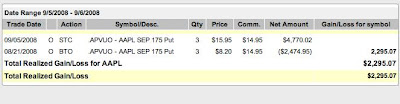

Middle East is a self-sufficient territory although you (if you’re a foreigner) would cry for home if you were to stay in Dubai for more than a month. Even if you can cook finding the raw materials such as veggies and eggs known to you would be a big problem. Egypt receives $3 billion in annual remittance from its 2-million citizens working in the Persian Gulf while Jordan receives $2 billion annually. It would be interesting to see if Dubai’s overheated real estate market will have a soft landing instead of a crash. Anyway, I’m not going to wait for the Feds announcement on the interest rate cut because it would be very volatile thereafter. Instead I decided to take small profit scalping Apple Inc.’s AAPL Nov 100 Call Option during the morning trading session today.

Middle East is a self-sufficient territory although you (if you’re a foreigner) would cry for home if you were to stay in Dubai for more than a month. Even if you can cook finding the raw materials such as veggies and eggs known to you would be a big problem. Egypt receives $3 billion in annual remittance from its 2-million citizens working in the Persian Gulf while Jordan receives $2 billion annually. It would be interesting to see if Dubai’s overheated real estate market will have a soft landing instead of a crash. Anyway, I’m not going to wait for the Feds announcement on the interest rate cut because it would be very volatile thereafter. Instead I decided to take small profit scalping Apple Inc.’s AAPL Nov 100 Call Option during the morning trading session today.

Other Articles That May Interest You …

Tuesday, October 28, 2008

The Junk US Dollar Skyrockets but whose fault is it?

Another slaughter day (Monday) in the global stock markets *yawn* and the yoyo is expected on Tuesday as well. I wonder if all the governments worldwide instructed their print and electronic media to announce fictitious news such as Dow Jones jumped 1,000 points or 1 million tons of gold suddenly found hidden in some caves or every citizen will be given free cash of 1 million to buy stocks, will the confidence suddenly reverse for the better. After all it was all about peoples’ sentiment when come to stocks. As much as I would like to day-dream *smack me* we’ve to accept the fact that the global economy is in total chaos. Unlike 1997 Crisis this time it would be more serious because the U.S. is in the center of the problem. And guess what, the Bush administration is not super-worry about it because they know someone will definitely offer the seat for the super-power in this musical chair game.

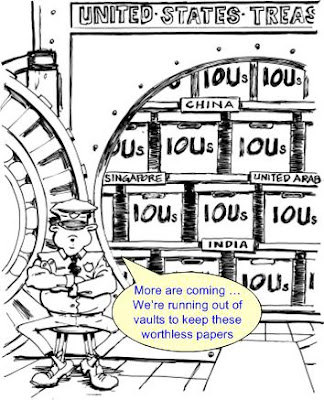

Nobody dares to quit the musical chair game simply because the stake is too high. Imagine the Japanese and Chinese suddenly decided to quit the game and demanded US$600 and $500 billion in gold respectively from U.S. in exchange for the worthless papers to which the U.S. do not have. It will create panic selling on the U.S. dollar and the domino effects are beyond imagination although it would be fun to see an exchange rate of US$100 to RM1 (Malaysian Ringgit) or US$300 to 1 Chinese Yuans for that matter. It would be super-cheap to buy Boeing jumbo planes or their AH-64 Apache helicopters, so much so the Malaysian de-facto PM Najib Razak can get his personal Apache parked on his helipad. But then the U.S. will not be able to buy from the rest of the countries because the manufacturing goods from these countries will costs a leg and an arm.

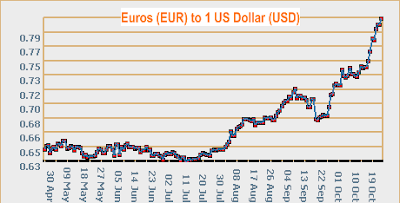

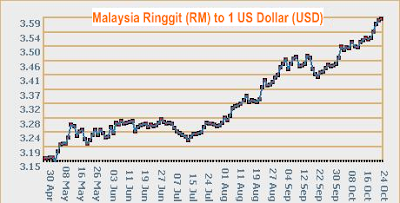

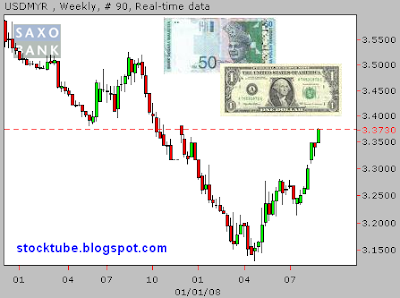

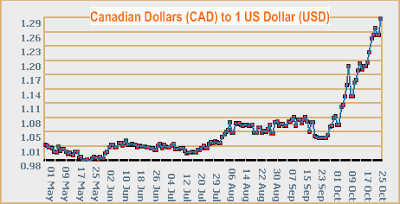

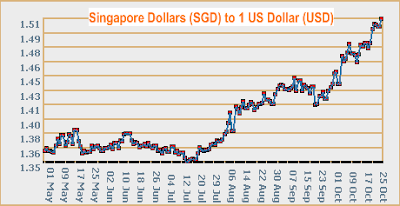

Hence, don’t expect Malaysian Ringgit to strengthen anytime soon because it won’t. The central bank (Bank Negara) has been intervening for many weeks to stabilize the Ringgit else it should have nose-dived to RM3.80 to a dollar long time ago. Even if it drops to RM4.00 to a dollar I’m not complaining because inflation will continue to rise regardless of RM3.50 or RM4.00 to a dollar as long as the incompetency, cronyism, corruption and nepotism are still very much alive. Short the ringgit as much as you like because it’s going down the toilet anyway.The next move from the Feds is to cut the interest rate again but I doubt it will help much. And the reasons why Malaysian Central Bank stubbornly maintained the interest rate were to attract foreign hot monies (hopefully) and the so-called inflation (what inflation?) but again I doubt they can hold on to it for long.

Other Articles That May Interest You …

- The New Great Depression is a Different Animal, Stupid

- The RM5 billion, shouldn’t the Government seek approval?

- Hooray! Another Fuel Reduction but it’s a Little Too Late

- Black Friday almost Rock&Roll, it’s not the bottom yet

- Arrogance, Greed & Corruption – Will We Ever Learn?

- Currency Traders prepare to dump Malaysia Ringgit

- External and internal factors point to gloomy economy

Monday, October 27, 2008

The New Great Depression is a Different Animal, Stupid

Just because some so-called smart analysts who may not know how it felt during the 1998-1998 Asia Economic Recession screamed that “our shares are oversold”, “they no longer reflect their values” and “plenty of cheap quality undervalued stocks”, you should refrain yourself from being influenced by them as the fruits are not ripe yet for the picking. And please stop believing those buy “calls” from irresponsible analysts or fund managers whose main intention was to unload their sour stocks, unless you wish to become the suckers.

Kuala Lumpur Composite Index finally closed below 900 points (Yippee!) after it shed 32 points to 859.11 on Friday. I bet many beginners were mouth watering and may have entered as the stocks were relatively cheap (than yesterday). But if you’re a season player the past memory of the KLCI’s plunged from 1,300 to 262 points 10-year ago should serve as guidance for this round of the game. If you think 800 points is attractive then 700-level is very cheap, 600-level is absurd and 500-level is unbelievable. That’s right! don’t blink with your jaw dropped to the floor when that happen. Prepare yourself mentally and you would reap a bountiful harvest soon. Forget about the parasites’ plan to rob peoples saving (EPF) to boast their cronies’ stocks because the RM5 billion is practically useless against the onslaught of the stocks-tsunami.

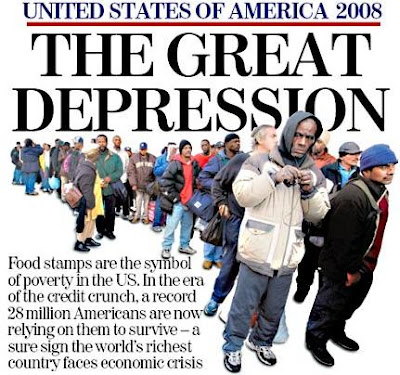

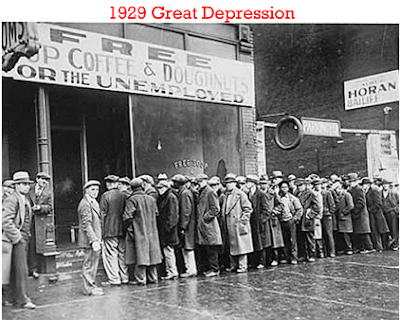

More than 110,000 have lost their jobs so far this year and some industry experts forecast Americans could see close to 200,000 will face the same fate before the year is over. Already branded companies such as Yahoo Inc. (Nasdaq: YHOO,stock), Goldman Sachs Group Inc. (NYSE: GS, stock), Coca Cola Co. (NYSE:KO, stock) and Electric Company (NYSE: GE, stock) has announced the job-cut plan. In September alone, 2,269 employers each laid off 50 people or more and most likely the current job losses are only the tip of an ugly iceberg. It is pity that there’re still people who are in the denial state and think recession is centuries away. Interestingly there’re people who chose to argue that the current recession will not reach the level of 1929’s Great Depression. So, we should applause and pretend things are all right?

Great Depression of today’s standard is a different animal altogether. Unlike 80 years ago, U.S. has become smarter with the ability to print almost unlimited monies if required. Furthermore U.S. problem is not confined to U.S. alone but rather shared amongst the entire richest nations. You have watched how European and Japanese were more anxious than Bush’s administration in preparing trillions of dollars whenever the superpower needs it. It is no-brainer that everyone cannot afford to have U.S. stop playing this musical chair game. American’s purchasing engine cannot stop else it’s Armageddon.

Other Articles That May Interest You …

- In time of Cheap Lobster, Peoples Money are Robbed

- Black Friday almost Rock&Roll, it’s not the bottom yet

- Tsunami Politic Tsunami Stocks, waiting for Perfect Storm

- External and internal factors point to gloomy economy

- Why you shouldn’t invest on Brokers’ Stocks for now

- What to do during US Economy Slowdown?

- Speculators & Fund Managers Art of Making Money

Thursday, October 23, 2008

In time of Cheap Lobster, Peoples Money are Robbed

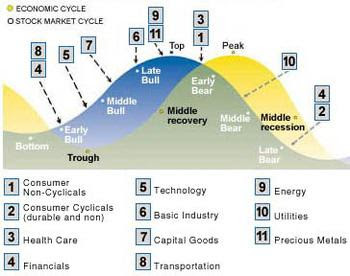

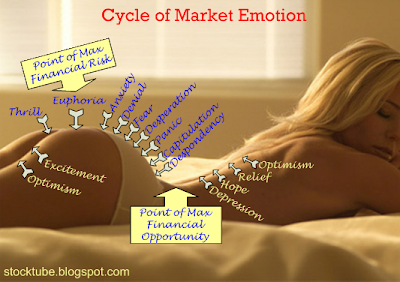

From the initial result of the “Poll” conducted by StockTube it appears majority of the readers are ready with tons of money to pounce on cheap stocks. I’m both surprise and happy that the readers are so financial-savvy – Bravo! This is once in a 10-year chance and might be once in your lifetime opportunity to make your money grows exponentially. Of course many of you were screaming like a hungry wolves that have not seen a moving creature for months –when is the best time to move in for the kill? Well, if I know the exact date Warren Buffett, Charlie Munger, Peter Lynch, Jim Cramer, George Soros, Carl Icahn, Jesse Livermore, John Templeton, Prince Alwaleed or even President Bush will need to bid with the highest bidder get to have an hour lunch appointment with me *grin*.

The fact is nobody knows when the perfect time to buy low (or rather lowest) but fortunately neither the technical analysts nor the fundamentalists can tell. It won’t be fun if you know that Michael Schumacher will emerge again as the F1 champion for the X-time, would it? So that’s the excitement of the current stock market. Everyone was looking at each other and wondering if it’s the right time to scoop the stocks. In fact the big boys with deep pocket are currently buying in stages. Only time will tell if they’re actually averaging down or averaging up – either way they’ll have the portfolios if the bull comes. Small investors would not have such luxury and most of them will have to wait for the right wave and ride on it. Unless of course your strategy is as simple as buy the stocks and keep it until the bull comes regardless of the “when”. I’m not suggesting that the bottom is here and you should buy now because I still think the worst is yet to come – I might be wrong, mind you *grin*. At the stock trading hall when the KLCI was at 1,300 back in 1997, who would have thought that the index would plunge to 262 in another 18-months?

Now, this story about Argentina somehow reflects exactly what the Malaysian government was trying to do – access to EPF’s (Employee Provident Fund) RM5 billion in the name of boasting and helping undervalued stocks. Blind patriotism aside, I still couldn’t figure out why the ruling government has such an easy access to the vault. What you need to do is announce it (access to RM5 billion) without providing a detail plan and you get it? One of the comments I received from the reader suggested that there could be insider trading and the repeat of the 1997-1998 bailout of politicians’ stock at sky-high price actually hold water, mind you. The cronyism, corruption and nepotism are still very much alive and you can bet your last dollar that many politicians’ wealth had evaporated over the weeks. Strangely if Valuecap could make great profit by investing undervalued stocks then why should EPF loan the $5 billion? Won’t it better for EPF to invest the money itself and reap all the profits (and hopefully redistribute the profit in terms of dividends to us)? Declare how much profit can EPF enjoys from such silly arrangement and StockTube increases it by 1 percent. Just give me the RM5 billion and let me invest the so-called undervalued stocks *grin*.

Using such silly excuses only go to prove that it was true that the country actually has huge excess of electricity after all. Therefore why the plan to proceed with thisstupid and wasteful mega project called Bakun Dam, not to mention the newly proposed RM3 billion dam in Murun, Sarawak? Maybe the brilliant boys from Khazanah Nasional Berhad could shed some lights with its forecast that the nation will face energy shortage in 2012. Or maybe the newly appointed deputy Chairman was smarter than Abdullah Badawi in such tariff usage forecast calculation. Still, I want to know why give away RM5 billion to Valuecap knowing that we couldn’t trace its whereabouts. The chances are high that a huge portion of it will ended up in unknown’s pocket so might as well divide it equally to the 27 million population –each will get roughly RM185, enough for a month groceries to some of the poors.

Other Articles That May Interest You …

- The RM5 billion, shouldn’t the Government seek approval?

- Hooray! Another Fuel Reduction but it’s a Little Too Late

- Cash is King but do you have the bullets?

- Nuclear Plant – Tenaga’s new Toy worth RM10 billion?

- Windfall Tax - Punishment or Desperation for Money?

- SIME aborts cable, no more cheese or the Rats move it?

Wednesday, October 22, 2008

The RM5 billion, shouldn’t the Government seek approval?

Warren Buffett has blew the trumpet to buy stocks now and don’t keep cash. So if you’re a die-hard fan of this Oracle of Omaha, then you should just follow him. After all nobody knows when the bottom is to fish for stocks so you might as well take his advice. Furthermore how could the greatest investor be wrong when his fortune was built based on the simple concept of “be fearful when others are greedy and be greedy when others are fearful”. It’s true that fear is now widespread but the multi-billion-dollar question is will we ever see the desperation, panic or capitulation along the way from now onwards? Bad news is indeed our best friend and I wish there would be more of such friends coming to town *cruel me*.

When the chief executive of Berkshire Hathaway's (NYSE: BRK.A, stock) screamed “Cash is Trash” you better think twice before you unload all those money stacked under the mattress ready to buy any stocks tomorrow. What he really meant was if your only intention was to keep your money inside piggy bank or stash it under the pillow, then you’re fighting a losing game against the inflation. But if you believe “Cash is King” and the reason why you keep so much of it was to wait for the right time to pounce on dirt-cheap stocks, then you don’t really have to come visit StockTube *grin*.

However you’ve to take note that Warren Buffett’s strategy is always a long-term investment simply because he’s a novice when come to short-term prediction. Also he’s not always right so you got to do your homework as well. Make no mistake about the current U.S. stock market. Don’t ever dream that it will make a V-recovery because you would be lucky to have a U-recovery and the last thing we want is a L-recovery. One of my buddies was right when he said we shouldn’t rush into stocks now because you’ll have at least six-months to do your window shopping. Even at this moment investors are buying stocks to average their holding.

It is believed Valuecap has about RM4.9 billion worth of investment in 70 listed companies and the company which has assets of well over RM7.5 billion had paid out a total of RM135 million in dividends since Sept 2007. Nevertheless the returns of such borrowing to EPF from Valuecap is still unknown, not to mention the EPF account holders were being paid pathetic dividends every year. Just like Bush administration’s request for $700 billion rescue plan that requires Congress approval, the Malaysian Government cannot simply give a call to EPF and the RM5 billion is ready to be transported. The Malaysian Government should seek the approval from the “Congress” since the money belongs to the shareholders – the peoples’ monies.

Other Articles That May Interest You …

Monday, October 20, 2008

The Return of Sex Actor and Mahathirism

Who would have thought that the former health minister, Chua Soi Lek, would make a comeback after his sex scandal exposed early this year? He was written off from the political scene simply because none of the politicians who involved in sex scandal could come back in a big way. But now it appears this guy has not only come back after a mere 10-month since his cuckoo was revealed to public, he also came back as the deputy President of MCA, the second biggest party in the BN coalition government. As strange as it may look, the return of the sex actor spells more uncertainty to the party.

The newly elected President of MCA, Ong Tee Kiat, has been on cyber-war with the newly elected deputy President, Chua Soi Lek, via their personal blogs ever since the race for the power (and money?) begins. And now both have been put on the bed as newly wed husband-and-wife, it would be interesting to watch how they could sleep and live happily together. The result of the election also shows that the “just awaken” MCA delegates do not mind having a sex actor as their deputy President as long as he dares to speak up, lest they wish the party to become totally irrelevant. It’s always better to have such candidate than to have someone whose task is to submit to the bully UMNO, not to mention the continuity of “Ong-Dynasty”. You don’t need a heart-surgeon to conclude that the Ong-Brothers expired right after the Mar 2008 general election.

Until now, it’s hard to say whether his capital control was successful as compared to the IMF-pills swallowed by countries such as South Korea and Indonesia. However one thing is for sure – over the period of 10-year since 1998 crisis, Malaysia could not match the prosperity enjoyed pre-1998. Sure, it appears that the country is not “affected” by the current global economic crisis as per various statements by the government ministers. The joke was that the local stock market did not fall as badly as 1997-1998 Crisis because almost all the foreign investors have exited and is enjoying pop-corn and Coke while watching how the country would perform. Furthermore compared to pre-1997 Crisis, the presence of foreign hot-money post-1997 was laughable. Theoretically the stock market should jump as a sign of approval of the three musketeers – Mahathir-Najib-Muhyddin, right after Badawi thrown in his towel. But it didn’t happen, so go figure.

Other Articles That May Interest You …

Friday, October 17, 2008

Cycle and the desire for Power, Money, Sex and Glamour

Did you realize that the climate has change dramatically this year? It might have transformed earlier but the slow and sleepy me only realized it days ago. Besides the consistent rainy evening (or afternoon on certain days) that pours “money” almost daily onto us, it appears the sunset and sunrise have shifted about an hour earlier. Not that I’m complaining but a few weeks of snow would be great, not that I’m tired of past skiing experience from the mountain of South Korea. I’ve not try (can’t afford it anyway *sigh*) pamper myself at Ski Resort in Switzerland though. Therefore I cursed my sister who has just return from her ski trip in Switzerland simply because she kept singing the songs of praise on her adventure which was mouth-watering. Heck, if only I can afford it *grin*.

Anyway, the Dow’s 733-point tumble should not surprise you by now. Didn’t you read that such problem requires time to recover? Hence the 733-point plunge only goes to prove that the recent 932-point single-day-gain was heavily subsidized by over-due technical-rebound after a week of onslaught. By now you should be able to read the market’s pulse and you surely do not need the government to tell you that a recession is bound to happen, if not already happened. Go back to the basic fundamental of demand and supply. Get to know the employment report and move your lazy bum to survey the retails sales. Yeah, the greedy bankers should be punished and let to rot and not be given the taxpayer money to bail them out else the same problem will happen again. But the problem is this bunch of greedy top executives also happened to be smart-arses as well. They created fear that if their financial institution goes down, they will pull the rest down the lake unless of course the government rushes as much money as possible to their coffer.

Other Articles That May Interest You …

- Easy money everywhere, we are safe – for now

- Let’s Close the Global Stock Markets, shall we?

- Black Friday almost Rock&Roll, it’s not the bottom yet

- Cash is King but do you have the bullets?

- A week full of Tensions, Rumors, Sex and Lies

- Maths Genius Sufiah enjoys Sex career, no Regrets

- Chua Soi Lek’s Sex DVDs, Cuckoo ends his Career

Thursday, October 16, 2008

Hooray! Another Fuel Reduction but it’s a Little Too Late

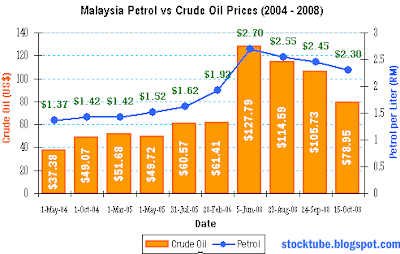

Sometimes it’s fun to see how the half-past-six government struggling to find ways to twist the facts again after they shot their own foot. Everyone knows that Malaysia is perhaps the only oil-producing country that charges the highest fuel price on her citizen. Sure, the country’s oil reserve will dry soon and in another 10-year or so, we’ll be begging other oil producer countries to sell their oil to us, so goes the propaganda. Hence, we got to become “prudent” and one way to preserve the wealth is to pay more. Was it our fault that the stupid government spent like there’s no tomorrow in the first place and when the nation’s coffer is running dry, they instilled this fear in order to justify the fuel hike? It was amusing that suddenly the government awakens from their nightmare and realized thesubsidy mentality that they had deployed decades ago has grown so strong that it robbed them of five-states and two-third majority in the Parliament.

The country has too many artificial parts. The NEP thing has only enriches a small group of cronies while the rest of the people were left to rot although strangely these same people continue to vote the same corrupt officers to power. The subsidy scheme was drafted in order to jump-start the poor so that they could stand tall on their own feet one fine day. But it didn’t take off as planned and this“category” of people still demands subsidies from gasoline to education. Essentially it has created an artificial demand and supply value chain of which if interrupted could explode like volcano. Ask anyone old enough and they will tell you an engineer 20 years ago has more disposable money than now – with salary package hardly change within the time-span.

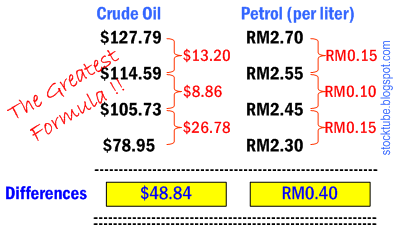

Climax was reached when the sleepy, clueless and confused PM thought the people would understand him when he decided on the 78 sen (41%) a liter hike on 5th June 2008. All hell breaks loose when the inflation skyrockets. The crude oil prices were at $128 a barrel then. The fact that Petronas, a wholly government owned entity, was reaping easy money during the black oil’s appreciation was swept under the carpet and instead the government launched the No-Holds-Bar campaign focusing on how much the government was subsidizing the fuel. So, instead of performing the simple arithmetic of minus the “extra gains” from Petronas sudden windfall and “add” to the government’s so-called fuel subsidy in order to “neutralize” the situation during such trying time, Badawi’s administration believed it was better to take money away from the struggling citizen than to offend the Petronas major shareholders (which in turns is the government themselves).

Other Articles That May Interest You …

- Flip-flop Badawi to the Exit Corridor – from Hero to Zero

- Currency Traders prepare to dump Malaysia Ringgit

- Forget about oil prices, it’s the Inflation you should worry

- External and internal factors point to gloomy economy

- No further fuel hike for 2008 yet nobody rejoicing?

- Oil price hike – Badawi’s greatest Economic Challenge

Tuesday, October 14, 2008

Easy money everywhere, we are safe – for now

It was nice to hear the Malaysia’s Central Bank (Bank Negara) is ready to provide liquidity to financial institutions should they need the money although the Central Bank did not commit on the dollars and cents that it could cough up to “rescue” them. I’m sure the central bank should have tens of billions ready in the vault for such purpose. It was also nice to read that British PM Gordon Brown’s administration injected ₤37 billion ($63 billion) into Royal Bank of Scotland Group PLC (RBS), Lloyds TSB Group PLC and HBOS PLC (Lloyds & HBOS are to be merged) in exchange for 60 and 43.5 percent stake respectively.

Spain also help by buying the rest of the three-quarters stake it doesn’t already in Philadelphia-based thrift Sovereign Bancorp Inc. for $1.9 billion. The much awaited and greatest news came from Japan and EU nevertheless. The cash-rich Japan says it is ready to offer money to any crumbling financial institutions around the world (Hello! Anybody interested?) This is what I called “Cash is King” and what could be the better time to scoop stakes in such banks if not now? Europe (Britain, France, Germany, Netherlands, Portugal, Spain & Austria) has committed a whopping $2.3 trillion to protect their banks.

Meanwhile Treasury Secretary Henry Paulson has summoned nine banking chief executives to Washington, basically to tell them how much the Treasury is buying into their companies. Some of the big banks were not happy to be told to swallow the money despite the fact that many didn’t want the money. But like it or not the Treasury will buy $25 billion in preferred stock in Bank of America, Merrill Lynch, J.P. Morgan and Citigroup; between $20 billion and $25 billion in Wells Fargo (fight it Warren Buffett!); $10 billion in Goldman and Morgan Stanley; $3 billion in Bank of New York Mellon; and about $2 billion in State Street. Preferred shares mean such paper carries a coupon of 5% annual dividend that rises to 9% after five years although the holders do not enjoy voting rights.

Other Articles That May Interest You …

Monday, October 13, 2008

Let’s Close the Global Stock Markets, shall we?

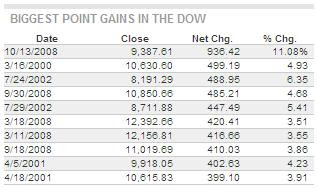

On Black Monday in 1929 the stocks dropped 24 percent and at the lowest point the U.S. stocks had lost more than 80 percent compared to their highest point (recorded in Sept 1929). But it wasn’t until 1932 when it hit the bottom and it took 29 years (1958) for the stock market to climb back to pre-Depression level. It was better during 1974’s Great Bear Market when the U.S. stocks erased more than 50 percent off their peak but compared to 1932 Great Depression, the stocks this time fell gradually. Still with Black Monday, the 1987 crash sent the U.S. stock market down 20 percent but it recovered fairly quickly.

As for the 2008 bear, the stock market has fallen more steeply during the first year than it did during the 1932 Great Depression and so far the stocks are more than 40 percent lower. The U.S. has done her part when the law was passed for the $700-plus billion rescue plan although the Congress felt somewhat foolish when the Bush administration suddenly wanted to buy part ownership in American banks and now it’s Group of Seven (G7) and Group of 20 nations’ (G20) turn. Whether such talks will remain talks and more meeting to be attended without concrete actions shall remains to be seen.

That was exactly what the G7 finance ministers were mooting when the Italian Prime Minister leaked the story. Strangely these smart ministers thought it was a freaking good idea to suspend the world’s exchanges in order to buy some time to rewrite some rules and enable U.S. Treasury and Federal Reserves to implement the $700 billion bailout plan. Furthermore stock markets around the world such as Iceland, Russia, Indonesia, Romania, Austria, Thailand and Brazil were either forced to halt trading or frozen indefinitely. It would be laughing stock to implement such stock market closure across the boards, no? These geniuses must have thought that once the global stock markets closed and reopen, people will forget about the sub-prime and the financial crisis as if they were being brain-washed. What a joke!

U.S. companies are set to announce their corporate earnings for the season starting this week. All the eyes are set to grill financial institutions such as Citigroup and JPMorgan Chase & Co. Investors are watching and will find tiny excuses to punish any stocks that do not exceed earnings estimate. The emotion is running high and people can be very unreasonable. Next week should be another interesting and great week with lots of surprises.

Other Articles That May Interest You …

Sunday, October 12, 2008

Black Friday almost Rock&Roll, it’s not the bottom yet

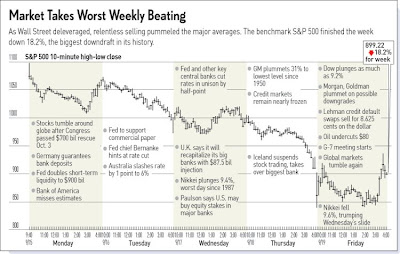

Black Friday – well, almost, when the Dow opened with breathtaking plunge of nearly 700 points during the first 5-minutes into trading hour. The much monitored index was whacked to as low as 7,884 before recovered to above 8,000. Somehow I believe the authorities had their hands in this sudden recovery, not that it’s anything puzzling considering Friday’s closing was the seventh day of straight triple-digit loss. The Dow was bashed again at from 1:50 pm to 2:50 pm when the index tried to dive below 8,000-level after Moody’s warning that Morgan Stanley’s (NYSE: MS, stock) and Goldman Sachs Group Inc.’s (NYSE: GS, stock) long-term debt ratings might be cut. At the closing the Dow was down 128-point only with a huge swung of about 1,000 points from its low to its high *applause*.

Another reason why I believe the bottom is still quite far below is the fact that such crisis will not infect financial sector alone. We’ll soon see the chain-reaction and it seems the next immediate sector is auto industry with 100-year-old General Motors Corp and 83-year-old Chrysler LLC talking about merger possibility. All this while we were being fed with the mortgages problem but nobody talks about the hidden time-bomb – credit-card debt, which amounted to a whopping US$950 billion outstanding. Prepare for another round of financial crisis when this credit-card melts and should this happens, banks such as Citigroup Inc, Bank of America and JPMorgan Chase will not be spared.

With Jakarta Stock Exchange frozen in the fridge, Japan’s insurer Yamato Life Co Insurance and Co in bankruptcy and Iceland financial system collapsed to the extent that the country may go bankrupt herself prompting the Iceland’s premier to tells the nation to go fishing instead, there could be more fireworks from countries such as:

With Jakarta Stock Exchange frozen in the fridge, Japan’s insurer Yamato Life Co Insurance and Co in bankruptcy and Iceland financial system collapsed to the extent that the country may go bankrupt herself prompting the Iceland’s premier to tells the nation to go fishing instead, there could be more fireworks from countries such as:

- Indonesia - stock fell by 21 percent in three days,

- Vietnam - inflation of 21% and currency depreciation),

- South Korea - currency (Korea won) lost 30% value against dollar since early of the year)

- Pakistan - central bank’s foreign currency reserves fell to US$5 billion only),

- Argentina - inflation of 28%),

- Turkey - huge foreign debt),

- New Zealand – currency (Kiwi dollar) lost 28% value against dollar and is in recession

- Hungary - huge foreign debt exceeding 80% of GDP)

And to think that the dreadful "Mahathirism" will be back haunting us again with his shadow dictating Najib in the daily administration and policies, the old dictator might just play with his favorite toy again – repeg the ringgit against dollar again, not to mention more bloggers would be dump into the toxic site. So far we’ve witness the stock market tsunami. Will we be able to see the political tsunami this year? Life during weekend is definitely boring without Anwar’s stories, never mind he flip-flop imitating Badawi’s dance.

Other Articles That May Interest You …

Friday, October 10, 2008

Panic Selling Continues, first Stock Exchange to be Frozen

The “Taikor” Dow Jones has erased a whopping 2,300 points since six days ago and all were in triple-digit loss. I hope none of StockTube readers bought any Call Options when all the gamblers and traders were shorting the market using Put Options since the ban on short-selling. After the 777-point plunge now we saw 678-point plunge to 8,579.19 Thursday. The scary part is not about the triple-point tumble although the 7 percent drop would normally saw many jaws dropped onto the floor before the $700 billion rescue plan; but rather the fact that the 9,000 level was breached with such an ease. This is bad news, mind you, and it’s no brainer that you can increase your bet on Put Options. Wait! Hang on there!

And if you believe the curse of Friday, you just have added another reason to be extremely bearish when the market open later. People do not think logically and any attempt(s) or initiative(s) announced by the federal government to save or calm the situation will be seen from the negative perspective / angle. So when the federal government said they wish to stabilize U.S. banks in exchange for equity stakes, investors generally thought that more banks are crumbling down and this started another round of panic-selling. Since six days ago, the selling volume is still high and there’s no sign to show otherwise. I pity the next President of the United States, whoever he is because this is not a toy for small boy.

Other Articles That May Interest You …

Thursday, October 09, 2008

Flip-flop Badawi to the Exit Corridor – from Hero to Zero

Like it or not the outgoing Malaysian Prime Minister Abdullah Badawi would be remember as the weakest, laziest, useless and the most indecisivePM this country ever had. From the start he doesn’t have the minimum quality, both academic and leadership, to become the PM. He was put on throne because the former dictator, Mahathir, who had ruled Malaysia with iron-fist for 22-years “thought” Badawi was the tamest breed of hamster pet he could ever afford to warm the seat temporarily before hand-over the premiership to the current deputy PM Najib Razak.

Little did Mahathir realize that his hand-picked hamster would bit his hand and ate his “cheese” while refused to stay temporarily as promised. What frustrated Mahathir more was when Badawi decided to play marbles with the Father of Singapore, Lee Kuan Yew, a person Mahathir hates the most even to this day. Things got extremely ugly when Mahathir found out that Badawi was actually sleeping on the job and left the daily management of the country to a bunch ofhippies led by his own son-in-law, Khairi Jamaluddin. Without grassroots support but yet was ambitious to become youngest Prime Minister before he reaches the age of 40, Khairi and his “4th Floor” boys were said to control almost every decision made by Badawi.

Abdullah Badawi - Rise of a Hero

Of course Abdullah Badawi had his glory moment when in 2004 he led the Barisan Nasional (National Front) to a landslide and historic victory with 90 percent of seats in the bag. It was the greatest victory ever. Four years later on Mar 2008 general election Abdullah again led the BN coalition party of 14 political parties. Only this time it was a spectacular disaster because not only the National Front lost five states inclusive of the most developed state of Penang and Selangor, the arrogant coalition also lost its treasured two-third majority in the Parliament. It was the greatest defeat ever. I guess not many world leader could claim such trophy. To be fair the 2004 victory was a direct result of people’s 22-year of unhappiness under Mahathir’s racists divide-and-rule scheme and the threat of fear using the draconian ISA on whoever that could threaten Mahathir’s iron-fist grip on power.

Abdullah Badawi’s journey to Zero

Hidden by the shadow of arrogance Abdullah Badawi thought he was invincible with the grand victory and he started to sleep on the job thinking he could fool the people all the time. Instead of surrounding himself with good advisors, Badawi chose to get close to shoe polishers. He thought his slogan should work forever and people won’t mind if he "sleeps a little". In fact he was an empty vessel who happened to be there at the right time at the right place. Furthermore if he managed to fool the old-fox Mahathir, chances are he can fool almost everybody. Who cares if all he got was only Islamic Studies under his belt and can’t even articulate any idea, let alone vision, to the audience. Obviously he has zero knowledge in Economic 101. He was the King of Sloganeering after all and that’s enough to stay in power - at least that was what he thought.

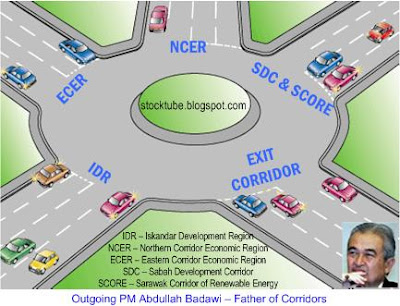

Badawi, the Father of Empty Corridors

Badawi should stop beating around the bush that he’ll not defend his UMNO presidency in March 2009 because he loves the party and wish to put the nation’s interest above all. Accept the fact that he’s no longer welcome not only by the people at large but also by his own comrades within UMNO. Sure, somebody who is “next-in-line” could have plotted the Supreme Council Warlords to kick him out but if he can at least produce a non-blank report-card since he took over the premiership, the attempt would not have been so easy. He tried to imitate his successor in promoting mega project and started the silly “Corridors” initiatives. Of course it didn’t take off handsomely because the scale was simply unbelievable – between RM800 billion to RM1.3 trillion (I was flabbergasted). He’s now shown the “Exit Corridor” instead.

Other Articles That May Interest You …

- Arrogance, Greed & Corruption – Will We Ever Learn?

- Lame Duck PM to quit? Or another Mother of All Lies?

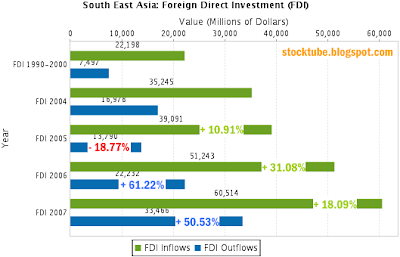

- FDI Out-Flows began rushing the day Badawi becomes PM

- RPK sent to detention without trial, FCUK you Big Bully

- Badawi to Quit but not before Anwar is put under ISA?

- Operasi ISA Started? Climate of Fear for the Country

- The Myth of 916 and One Last Racist Drama from BN

- Crackdown on bloggers’ websites? Stop the Stupidity

- Oil price hike – Badawi’s greatest Economic Challenge

Wednesday, October 08, 2008

Cash is King but do you have the bullets?

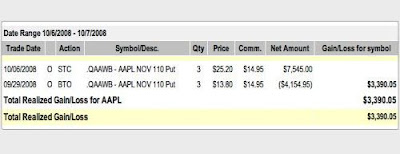

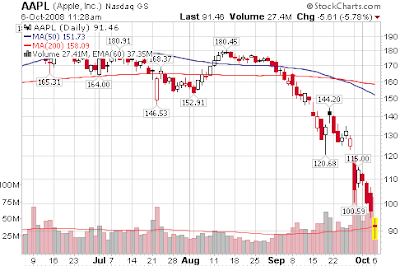

When the Dow was flushed to below 10,000 and as low as 9,560 at one point but recovered nearing the 10,000 before the closing bell on Monday, I was relieved. Firstly I was glad because I closed my position on AAPL Put Option before the last hour jump and secondly I was relieved that the Dow looked to bounce back, technically, and was fighting for the important 10,000-level. It’s no fun to see the Dow bleeds to death because it means the macro and micro economy will be affected. The last thing we want to see is high unemployment and increase in crimes, not that it’s any better now.

The Dow rebound on Tuesday but unfortunately managed to stay for a very short period of time before the freefall and erase more than 500 points from its index. In fact the writing was already in the wall when the VIX spiked on Monday. Although this extreme fear-factor indicator was not accurate due to the ban on short-selling forcing hedge-funds to re-strategize their betting on “put options”, it nevertheless showed the general sentiment. When time is bad people gets blamed as human feels good to have someone takes the bullet. Congress was blamed for the 777-point drop and Europe blamed the bankrupt U.S. for letting the shits flowed into their garden. And it’s Ben Bernanke’s turn to get the blame for Tuesday’s 500-point plunge for saying “The outlook for economic growth has worsened and that the downside risks to growth have increased”.

It’s not mission impossible or some fantasy Vision-2020 dreamed by some politicians. Assuming you’ve no debts (credit card, house-loan or mortgage, car loan etc) and you need $48,000 per annum to stay alive you will need $240,000 in savings to fit into this category. It’s better if you have the extra pounds to buy cheap stocks when the time comes. Annually, a Google Software Engineer earns about $96,000, an Accenture Analyst earns $58,000 and a Deloitte Tax Consultant earns roughly $60,000. Unless you graduated yesterday, chances are high that you would have some sort of savings and if you do not have, it’s wake-up time for you. You can’t skin the fat cat no matter how cheap the stocks are if you do not have the money.

Other Articles That May Interest You …

- Dow below 10,000; $700B bailout plan was the poison?

- Arrogance, Greed & Corruption – Will We Ever Learn?

- Short-Selling Crackdown on Naked Shorties but will it help?

- Soros, Buffett and Trichet said It Ain’t Over Yet

- Microsoft chickened out, Berkshire shareholders partying

- Pritzkers’ feud offers $4.5 billion opportunity to Buffett

AirAsia Privatization, a Pathetic Offer of RM1.35 a share?

Rumors about AirAsia Berhad’s (KLSE: AIRASIA, stock-code 5099) privatization have been circulating many months ago and today the Southeast Asia’s largest discount carrier confirmed that its major shareholder Tune Air Berhad is considering the initiative to buy back the shares from the public in an attempt to take the company private. The magic word here is“considering” and based on the airline’s feedback to Bursa Malaysia it appears this option will only be viable if the public agreed to surrender their shares in exchange for RM1.35 per share *stingy rat*.

As much as Tony Fernandes and his partner, Kamarudin Meranun, would like investors to appreciate the listed company more than the current stock value, the fact remains that its aggressive expansion has somehow sent shivers into investors’ bones. It (the expansion) also came at a bad time when the global oil prices jumped from as low as $85 early Jan 2008 to as high as $147 a barrel mid July 2008. So you can’t blame investors for having cold feet over the stock as the black gold has direct impact on the cost of running the airline business. Tony has earlier hinted that his baby (AirAsia) will not be de-listed despite the poor stock performance but instead might float his long-haul budget airline, AirAsia X, via a reverse takeover or backdoor listing *could this happen now?*.

Based on the strengthening of U.S. dollar against major currencies and the London inter-bank offered rate (LIBOR) of 4.5 percent for US dollar-denominated borrowings, it would be suicidal to seek borrowing in U.S. currency.Assuming Tune Air Sdn Bhd and EPF which own 30.7% and 7.7% respectively in AirAsia work hand-in-hand to get the plan works, it will need to dig about RM1.974 billion to buy back the remaining public shares. EPF is cash-rich so funding shouldn’t be a problem. A better plan is to allocate certain percentage to interested parties such as Middle-East financier and of course Tony buddy’s Virgin Group.

Global oil prices which have fallen to $90 a barrel should take away the pressure on AirAsia’s bottom-line and the current stock price seems juicy for private investors to take up stakes for sale. Heck, since most of the research houses are still reluctant to give a higher value on its stock AirAsia might as well take it off from the Kuala Lumpur Stock Exchange. Nevertheless the privatization plan could fail if the minority shareholders think the RM1.35 a share is too pathetic an offer to accept. OSK Research thought a 20 percent premium should be an attractive price but I want more. You should know by now how greedy I am, don’t you *grin*? By the way, it appears Dow Jones and Apple Inc. (Nasdaq: AAPL, stock) are still bleeding.

Other Articles That May Interest You …

Monday, October 06, 2008

Dow below 10,000; $700B bailout plan was the poison?

Lame-duck and flip-flop PM Abdullah Badawi said he will announce the decision on whether he would defend the UMNO presidency either tomorrow or by Wednesday. Although he would most probably quit, the Malaysian PM might just show his infamous indecisive leadership again – he might announce he still has many things to do and people are still supporting him so he’ll only decide when he crosses the bridge next Mar 2009. Bet his anxious deputy, Najib, would be fuming with anger because his wife could be waiting at home and ready to slap him for not pushing the sleepy-head enough. She had made the necessary arrangement for the big day – to be the country’s First Lady (although hierarchy-wise the wife of PM is not the First Lady but who cares).

Already the American consumers are cutting on their spending and this Christmas could be a boring one even if the current global oil prices were to plunge to below $90 a barrel. Bernanke and his boys could not afford to stand and watch the consumers do window-shopping only so the Feds might be force to cut the interest rate again. Now if you were to ask 100 people, I bet 99 percent of them will tell you the recession is inevitable. Only last week investors were brainwashed that without the $700 billion rescue plan and if the lawmakers do nothing, the U.S. economy will collapse. But today people (including me) are wondering if the law signed by President Bush was the right medicine or was it the catalyst (or poison) that is accelerating the recession. Average Joes are thinking that since the governments were so damn anxious to save the banks, the problems with these institutions must be really huge. Period. And so they’re selling the shares on their hand because their friends are doing the same thing. It’s the contagion of fear that is sweeping the trading floors.

Other Articles That May Interest You …

Sunday, October 05, 2008

Arrogance, Greed & Corruption – Will We Ever Learn?

Germany is a great nation. The country also saw the emergence of a great hero, or devil depending on how you look at it – Adolf Hitler. He participated in both worlds’ greatest war, World War I and II. I can’t imagine what would happen to Germany if Hitler never invaded Soviet Union and spared the three million elite German troops and the much feared and greatest tanks of all time, Panzer, to guard his newly acquired territory of Poland, Austria, Czechoslovakia, Denmark, Norway, France, Luxembourg, Netherlands, Belgium, Hungary, Northern African Countries, Romania and Bulgaria. Arrogance and greed were the main reasons that soon sent Germany to her defeat and Hitler his death. If only he listened to his advisors.

Amazingly both countries that were defeated in the World War II, Japan and Germany, rebound and becomes world’s third and fifth largest economy respectively. However the Germans are not so happy lately. As expected the U.S. Congress finally passed (263 – 171 in favor) and President Bush signed the $700 billion rescue plan. So I guess everything is settled as if we’ve traveled t

Unfortunately an economic downturn is happening. You can choose to argue until the cows come back whether U.S.’s economy is technically in recession (Warren Buffett believed so months ago) but in reality the times are getting tougher. Despite Germany’s surplus of $185 billion compared to United States’ deficit of $731 billion in 2007 and the fact that the Germans save on average 11 percent of their incomes into savings accounts, the country that once ruled most of the European countries is mumbling about having to bailout their financial institutions as a result of United States’ own problem. Not even the mighty “Terminator” Governor Arnold Schwarzenegger is immune from current crisis that the California state isscreaming for $7 billion emergency loan from federal government because it is running out of cash.

All the eyeballs are now monitoring on how the $700 billion will be disburse effectively to meet the objectives. But if the Dow’s performance is any indicator to goes by, it appears that majority of the investors, analysts and economists do not think the $700 billion bailout plus the $150 billion tax breaks will do any good and the monies are as good as flushed down the toilet. Sure, now that the U.S. economy is in a huge mess it quickly becomes the laughing stock. Countries (such as Malaysia) that was criticized (and laughed at) because it didn’t subscribe to the IMF medicine during the 1997-1998 Asia Crisis are now giggling and laughing back at the military power-house United States. No doubt that U.S. is literally bankrupt and relies on printed monies without the backing of gold reserve (go check the Fort Knox) as claimed by such parties but like it or not all the economic super-powers are holding huge amount of U.S. Treasury bills. Japan owns $593 billion and China has $519 billion while Asian countries hold more than $1 trillion of these IOUs. Why?

I read that the blogger, Kickdefella, was toying with the prospect of being kicked into the detention center without trial (ISA) when he claimed that the outgoing PM Abdullah Badawi actually received RM200 million from the total of half a billion ringgit commission gotten from the submarine deal. He claimed the money was paid by deputy PM and PM-in-waiting Najib Razak’s wife, Rosmah. This is absolutely ridiculous because Malaysian politicians are the cleanest and can never be so corrupt, can they? RM200 million is a lot of money and I can tell you a dozen of good companies to buy over after their share prices took the beating lately. Do we really have that US$119 international reserves as claimed by the new Finance Minister Najib recently? It would be interesting to get an independent auditor to perform such check else all our jaws will drop to the floor one fine day when we open the vault only to find a couple of pussy meowing inside.

Other Articles That May Interest You …

Friday, October 03, 2008

Waiting for Congress’s “Aye” but the Problem is Gigantic

When you read from the government-controlled media that Malaysia’s economy has the capacity to weather the destabilizing consequences of developments in the US economy and international financial markets, that’s when you need to start worrying about the economy. It’s better for newly appointed Finance Minister Najib Razak to shut his mouth and do what his boss didn’t do for the last four years – listen to foreign (and domestic) investors what they want in order to attract them into the country and carry out those reforms. Stop bragging about the US$119 billion international reserves because going by the rate FDI outflows are pulling out, the chicken feed of US$119 billion will not help in the long run.

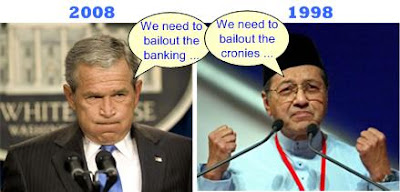

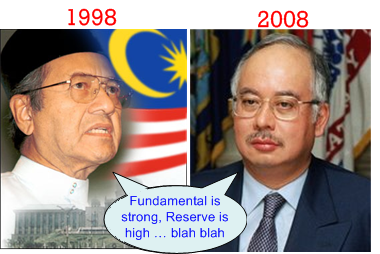

The fact is many countries are still depended on U.S.’s economy and if this super-power is not doing well chances are high that countries such as Malaysia will be affected. Like it or not diversification can only do so much and you still need foreign investors to bring in their hot money to excite the domestic activities. It would be foolish and disastrous to underestimate the current problem of U.S. financial crisis. Former premier Mahathir had tasted the medicine before during 1997-1998 Asia Crisis and the old man screamed the exact same wordings – country’s international reserves were strong, economic fundamental was strong, banking sector was strong, export was healthy and heck, everything were strong. The dictator almost ran a one-man show with total control over Malaysia’s economy and he spent lavishly to build the biggest and the tallest, apparently in his obsession to search respect from the West.

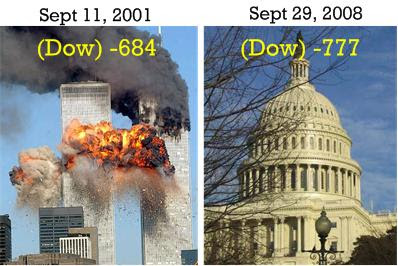

On Wednesday, U.S. Senate strongly (74 to 25 in favour) endorsed the $700 billion economic bailout plan and the ball has been passed back to Congress which had earlier rejected the plan causing the Dow Jones to tumble 777 points. Congress will decide again on Friday whether to approve the rescue plan after sweetener of $150 billion in tax breaks for individuals and businesses was included. Analysts expect the latest modified $700 billion plan to get the backing from Congress this time.Really, after the 777 points drop and many fingers pointed at Congress it would be interesting to see if Congress dares to screw up again. Frustrated, some investors were asking whether Nancy Pelocy, a hippie from San Francisco, is more qualified to make critical economic decisions than Secretary Paulson, the former CEO of Goldman Sachs.

Billionaire investor Warren Buffett said the nation has been hit with an "economic Pearl Harbor" and predicts that the rest of the "Main Street" economy will start to have problems if the government's financial bailout plan doesn't pass Congress soon. Buffett who has always tries to be greedy when others are fearful is still shopping for good deals, the latest being $3 billion of preferred shares of Electric Company (NYSE: GE, stock), which carry a 10 percent dividend – that’s $300 million a year dude. Last week, the Sage of Omaha invested $5 billion in preferred Goldman Sachs Group Inc. (NYSE: GS, stock) shares which comes with a 10 percent dividend string attached – that’s another $500 million a year, mind you. But the icing is the warrants to buy $5 billion in Goldman Sachs common shares at a strike price of $115 that can be exercised at any time over the next five years in addition to the right to buy $3 billion in GE common shares at a price of $22.25.

Other Articles That May Interest You …

- Economic 9/11 after $700 billion Bailout Plan Rejected

- Panic again, $700 billion is insufficient to treat disease

- FDI Out-Flows began rushing the day Badawi becomes PM

- Short-Selling Crackdown on Naked Shorties but will it help?

- Soros, Buffett and Trichet said It Ain’t Over Yet

- Warren to face tribes protest at Berkshire annual meeting

Wednesday, October 01, 2008

Should we rejoice or mourn on Maybank-BII deal?

Let’s rejoice and celebrate because Malaysia’s largest lender, Malayan Banking Berhad (KLSE: MAYBANK, stock-code 1155), has just managed to beg PT Bank Internasional Indonesia’s (JAK: BNII) major shareholder Fullerton Financial Holdings, a unit of Singapore's Temasek, for more sweets. Maybank agreed to a rebate of S$315.2 million (RM758.9 million) after rejected the initial rebate of S$236.4 million (RM569.2 million) – an improvement of a whopping 33.33 percent, mind you. At last, the state-owned bank knows how to negotiate, big deal. I bet Maybank’s board of directors was popping the Champaign as if it was the greatest victory on earth.

With the current weak market sentiment it’s only logical for Singapore’s Temasek to back down and compromise on a lower offer. Seriously it was a pathetic offer and what is an extra of S$78.8 million to Temasek compared to the still-overprice deal pushed into Maybank’s throat? The joke here is that while the latest rebate is welcome, it only reduces the offer price to 433 Indonesian Rupiah from the initial 511 Indonesian Rupiah per BII share for the first 55.6 percent stake. Maybank willstill have to pay 511 Indonesian Rupiah per BII share for the remaining 44.4 percent stake. Therefore Maybank will pay a total of RM4.26 billion ($1.24 billion) for 55.6 percent and RM3.8 billion ($1.11 billion) for the remaining 44.4 percent stake.

This is perhaps another classic example of how incompetent the decision-makers (or politicians) at the negotiation table. It is still unbelievable how generous Maybank was in its offer of 4.6 times book value for BII. Rumors were flying that former Finance Minister, Daim Zainuddin, had his hand on the deal and is set to make handsome profit from Maybank’s coffer. As the new deputy Chairman of Khazanah the newly Finance Minister cum deputy PM, Najib could probably shed some lights on this acquisition since Maybank is part of Khazanah’s Transformation Program for Government-linked Companies (GLCs). One of the intentions of the program it to continue Maybank’s Economic Profit, lest the special “friendship” with Temasek has blinded the objective and reverse it to Economic Loss *grin*.

Admit the mistake that the BII’s acquisition is indeed pricey and stop making a fool of yourself with announcement that you’re happy with the agreement (better rebate offer) when in reality it was a bad deal. The only party that can afford a celebration is Temasek Holdings which is making roughly fivefold profit from the sale. And they are still giggling all their way to the bank, thinking of Maybank’s stupidity. With BII’s last traded stock price at 310 Indonesian Rupiah a share, it will take more than a rebate coupon to convince investors that the deal was a freaking good one.

Other Articles That May Interest You …

Tuesday, September 30, 2008

Economic 9/11 after $700 billion Bailout Plan Rejected

Boeing is a trademark synonym with domination in aerospace and by far the largest global aircraft manufacturer. Mentioned 777 and chances are the awesome “Triple Seven” world’s largest twinjet jumbo plane appear in front of you. It’s jumbo alright and when you’re talking about something this huge and heavy, it would be disastrous should there be a crash. After I closed my Apple Inc.’s AAPL position yesterday to lock in the profit, I didn’t look back. Little did I realize the huge crash following thereafter on the U.S. stock markets – a jaw-dropping historic 777 points decline on Dow Jones. Guess that should be the expected result from the $700 billion failed bailout plan by Bush administration when the vote in the House showed 228-205.

It was the biggest one-day fall ever beating even the 684 (721 at one point) points plunge on the first day of trading after the Sept 11, 2001’s terrorist attacks on U.S. soils. There’s only one work to describe

Rates on three-month Treasury bills declined 55 basis points to 0.29%, nearing the levels hit on Sept. 17 when they hit their lowest level since World War II. The TED Spread - the difference between what banks and the Treasury pay to borrow for three months, widened to 3.59% when it was 1.10 percent a month ago. The three-month London interbank offered rate (LIBOR), a key measure of lending rates between banks climbed to 3.88%. In short, banks are extremely reluctant to lend money to people on the street as well as businesses. Americans do not save but spend more than they earned instead (to some extent) hence the Feds is playing the role of a father trying to distribute money into financial institutions so that people can go to these banks for cash, literally. This brings back the good memory of 1997-1998 Asia Financial Crisis *grin*.

Of course not all the lawmakers who participated in the voting session voted with good knowledge about the current financial problems. Some of them voted according to the wishes of the people’s sentiment on the street lest they wish torisk their political seats with five weeks before the elections. You can’t blame the people when the fact remains the plan was designed to bailout the problematic financial companies, not the average Joe. It was reported that more than two-thirds (133 votes) of Republicans and 40 percent (95 votes) of Democrats opposed the bill. Now the ball has been passed to the Federal Reserve’s court.

Other Articles That May Interest You …

Monday, September 29, 2008

Panic again, $700 billion is insufficient to treat disease

Wachovia Corp., just like Washington Mutual Inc., is probably one of the classic examples of investing at the wrong time. It suffers huge losses after it acquired mortgage lender Golden West Financial Corp in 2006 for a whopping $24 billion. The acquisition was done at the peak of housing boom – talk about bad timing huh? Days after CEO Robert Steel assured Wachovia employees that the company was doing fine and remained strong, Citigroup Inc. today announced it will acquire the company and will absorb about $42 billion of losses from Wachovia’s $312 billion loan portfolio. As a result Citigroup it will sell $10 billion in common stock and cut its quarterly dividend in half to 16 cents.

Wachovia stock price tumbled 91 percent *Ouch!* to 94 cents. I’ve wrote earlier that despite the $700 billion (let’s put it at $1 trillion, shall we?) injection into the financial market the fear factor will remains and it’s not the right time to become a hero and long the stocks. Seriously your chances of making money is better off shorting the stocks (not naked, mind you) or playing the Put Options – if you do not mind the volatility. Hey! This is the greatest time to put your psychology into this greed and fear into the testing chamber. At one time the Dow Jones plunged to more than 300 points in the morning trading session – everyone is waiting for the bailout vote. I’m not taking any chances and my AAPL trade got triggered so I’m taking my money and run further up the hill to get a clearer picture of the fight between bull and bear on the trading floor. If you think this could be the bottom now that a solution was found for Wachovia maybe the statement from FDIC that there’re roughly 117 banks still in trouble could change your thought. You’re really a brave soul if this news is not enough to hold you back to at least stay at the sideline should your intention was to long the stocks. It would be interesting to see if KLSE could take the punches after the opening bell tomorrow morning.

If you think this could be the bottom now that a solution was found for Wachovia maybe the statement from FDIC that there’re roughly 117 banks still in trouble could change your thought. You’re really a brave soul if this news is not enough to hold you back to at least stay at the sideline should your intention was to long the stocks. It would be interesting to see if KLSE could take the punches after the opening bell tomorrow morning.

Other Articles That May Interest You …

Maybank-BII deal goes wrong? Taste your own medicine

Only after heavy criticisms and sell-off of Malayan Banking Berhad’s (KLSE: MAYBANK, stock-code 1155) shares as a sign of protest, the Malaysia’s Central Bank woke up (from sleep) and told Maybank to behave and re-negotiate for a better pricing in its acquisition for PT Bank Internasional Indonesia (BII) (JAK: BNII). The Minority Shareholder Watchdog Group (MSWG) did bark against the silly deal but as expected the authorities did not give it much thought since the group is toothless. The proposed deal was the laughing stock within Abdullah Badawi’s administration simply because the 4.6 times book value was more than twice the book value of state-owned Maybank itself and the highest amongst Indonesian banks. Indonesian leading lender, Bank Mandiri’s own book value is only 1.98 times. Instantly speculation was floating that the deal was filled with hanky-panky hands.