Wednesday, February 07, 2007

AKAM, RAIL & ESRX - My Next Option Trading Target

Analysts polled by Thomson Financial expect the Cambridge, Mass.-based company to post a profit of 26 cents per share on $121.5 million in revenue for the fourth quarter.

In a Jan. 24 note to investors, Deutsche Bank analyst Todd Raker wrote that the surge of online shopping during the holiday quarter and an overall rise in movie downloads over the Web could push Akamai's fourth-quarter results higher than expected. The analyst also cited Apple Inc. comments from last month's Macworld conference that iTunes users downloaded 1.3 million movies in three months.

Akamai provides content delivery services to 13 of the top 20 most visited Web sites on the Internet. Increased traffic to these sites is likely to add to top line growth as the company charges a fee based on bandwidth usage in addition to a fixed cost for its services.

Rating Indicators for AKAM:

- StockScouter rating : 10 / 10

- Whisper Number for this stock : 0.27

- Schaeffer rating for this stock : 7 / 10

- Power Rating : 5 / 10

- Insider Trading (last 52 weeks) : ($55.54M)

- Zacks Analysts Rating: Moderate Buy

- Option Trading: May 2007 55 Call

- Implied Volatility (IV) for Mar 2007 $55 Strike : 42.08%

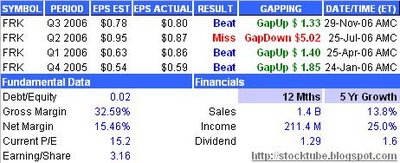

FreightCar America, Inc. (Nasdaq: RAIL, stock) will announce its’ earning on Thursday, Feb-8-2007, before market open. RAIL is a manufacturer of aluminum-bodied railcars in North America, based on the number of railcars delivered. The Company specializes in the production of coal-carrying railcars, which represented 93% of its deliveries of railcars during the year ended December 31, 2005. It also refurbishes and rebuilds railcars and sells forged, cast and fabricated parts for all of the railcars it produces, as well as those manufactured by others.

Rating Indicators for RAIL:

- StockScouter rating : 9 / 10

- Whisper Number for this stock : N/A

- Schaeffer rating for this stock : 8 / 10

- Power Rating : 6 / 10

- Insider Trading (last 52 weeks) : ($9.36M)

- Zacks Analysts Rating: Hold

- Option Trading: June 2007 55 Call

Besides above stocks alert for option trading, I’m researchingExpress Scripts, Inc. (Nasdaq: ESRX, stock) which will announce its’ earning on the same date as FreightCar America, Inc. ESRX is quite a risky stock to invest as the price-to-earnings multiple is close to the average for the industry level.

Other Articles That May Interest You ...

New Call Warrants For Feb2007 – PBBANK & MAYBANK

- PBBANK-CA (stock-code: 1295CA)

- MAYBANK-CC (stock-code: 1155CC)

The expiry-date for both call-warrants is Aug-30-2007. All these call-warrants are exercisable at any time from and including the issue date. The issue prices are:

- PBBANK-CA: 36 cents

- MAYBANK-CC: 38.5 cents

# TIP: For more detail-data related to Bursa Malaysia (KLSE) call-warrants, you can visit OSK188 at Warrants Pricing Table or CIMB Warrant Portal at Warrants Analytics.

Other Articles That May Interest You ...

Why Luxury Stocks Will Performs And You Should Invest

W

ith only 60 prestigious brands, LV commands 14 billion euros in total revenue for financial year 2005. It has over 59,000 employees worldwide and a retail network of more than 1,700 stores. Louis Vuitton recently paid dividend of 0.30 Euro back in Dec-2006.

ith only 60 prestigious brands, LV commands 14 billion euros in total revenue for financial year 2005. It has over 59,000 employees worldwide and a retail network of more than 1,700 stores. Louis Vuitton recently paid dividend of 0.30 Euro back in Dec-2006.Okay, back to the boutique story. When you first step into LV boutique in Paris, you’ll be surprised to notice the number of tourists who swarm the shop buying like there’s no tomorrow. It was such a good business as if it’s on 90% sales when in fact LV never had any discount-sales before. People just buy it for the sake of the brand, and the quality of course (it’s water-proof but unfortunately not fire-proof, sigh). But there’re other reasons why people rush to Paris to buy Louis Vuitton’s products.

LV products, just like your dreamt Rolex watches and Mont Blanc pens, will appreciate in value over time. So when you’re in bad time, you can rely on your LV to convert some hard-cash for you at second-hand shops (ever visited one in Hong Kong?), not sure if pawnshop will accept it though.

Another reason why you should buy LV

from Paris (en route your travel path) is because you can get it cheaper in Paris than in other countries. As comparison, a Monogram Canvas (Toile Monogram) Speedy 30 in Paris will costs 415 Euro which will translate into RM 1,884 based on 1 Euro to 4.54 Ringgit. If you go to YTL Corporation Berhad’s (KLSE: YTL, stock-code 4677) Starhill Louis Vuitton boutique(the only one LV boutique in Malaysia), the price is RM 2,400. It’s a saving of more than RM 500. And if you buy more imagine the total savings you can gain.

from Paris (en route your travel path) is because you can get it cheaper in Paris than in other countries. As comparison, a Monogram Canvas (Toile Monogram) Speedy 30 in Paris will costs 415 Euro which will translate into RM 1,884 based on 1 Euro to 4.54 Ringgit. If you go to YTL Corporation Berhad’s (KLSE: YTL, stock-code 4677) Starhill Louis Vuitton boutique(the only one LV boutique in Malaysia), the price is RM 2,400. It’s a saving of more than RM 500. And if you buy more imagine the total savings you can gain.Let’s go back to LV Paris. Don’t be surprise if you noticed majority of the tourists who crazily grab LV products are from China. Louis Vuitton seems to have recognized this group of new wealthy customer-base judging from the fact that the boutique actually recruited a couple of Chinese-speaking sales reps specifically to take care of these tourists.

According to China Embassy Website, China has 236,000 millionaires (at least US$ 1 million in financial assets) based on 2004 World Wealth Report issued by Merrill Lynch (NYSE: MER, stock). With a 12 percent year-on-year growth, the number would be very much higher by today. With the ever-growing rich society, the hunger for luxury items would definitely benefits not only Louis Vuitton but other players such as Polo Ralph Lauren Corp. (NYSE: RL, stock), Estee Lauder Companies Inc. (NYSE: EL, stock) and others. And this is one of the many reasons why you should invest in their stocks (alternatively option trading, of course).

Other Articles That May Interest You ...

Tuesday, February 06, 2007

Cash-Rich KFH Won Bid For RHB After Late-Night Meeting

convertible unsecured loan stocks (ICULS) and warrants. Instead of leaving RHB, UBG had been offered, and had agreed to take up, a 20% stake in the consortium.

convertible unsecured loan stocks (ICULS) and warrants. Instead of leaving RHB, UBG had been offered, and had agreed to take up, a 20% stake in the consortium. Upon conversion of the ICULS and warrants, UBG's equity interest in RHB would rise to about 60%from 32.8% now. Following this, the consortium will have to undertake a mandatory general offer in RHB. The consortium would be supportive of the Employees Provident Fund's (EPF) proposed plan for a restricted offer for sale (ROS) of RHB Capital shares as long as it would serve to benefit all shareholders.

Upon conversion of the ICULS and warrants, UBG's equity interest in RHB would rise to about 60%from 32.8% now. Following this, the consortium will have to undertake a mandatory general offer in RHB. The consortium would be supportive of the Employees Provident Fund's (EPF) proposed plan for a restricted offer for sale (ROS) of RHB Capital shares as long as it would serve to benefit all shareholders.Would Ralph Lauren Performs Equally Well Like Estee Lauder?

On Feb-1-2007, Department-store operator J.C. Penney Co (NYSE: JCP, stock) started offering a new brand called American Living (created by Polo Ralph Lauren's Global Brand Concepts) that includes merchandise, intimate apparel, accessories and home products exclusively.

Thomas Weisel Partners LLC analyst, Liz Dunn has a target of $90 on Ralph Lauren saying there’s room for significant growth ahead. “Mad” Jim Cramer has a strong take on Ralph Lauren stating consumer is strong with tax-cuts benefits which will translate to spending.

Rating Indicators for RL:

- StockScouter rating : 7 / 10

- Whisper Number for this stock : N/A

- Schaeffer rating for this stock : 6 / 10

- Power Rating : 5 / 10

- Insider Trading (last 52 weeks) : ($60.10M)

- Zacks Analysts Rating: Moderate Buy

- Option Trading: Apr 2007 80 Call

- Implied Volatility (IV) for Mar 2007 $80 Strike : 30.75%

Sales, Income & Growth - For the past 12-months, Ralph Lauren registered $4.09 Billion sales versus the industry’s $2.97 Billion. Income amounted to $370.30 Million against the industry’s $211.55 Million. While Ralph Lauren 12-months sales growth is at 19.20%, the income growth is in the region of 40.20% (the same industry sector sales growth is at 12.60% and income growth of 28.80%).

Sales, Income & Growth - For the past 12-months, Ralph Lauren registered $4.09 Billion sales versus the industry’s $2.97 Billion. Income amounted to $370.30 Million against the industry’s $211.55 Million. While Ralph Lauren 12-months sales growth is at 19.20%, the income growth is in the region of 40.20% (the same industry sector sales growth is at 12.60% and income growth of 28.80%).

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 9.1%. Ralph Lauren has a debt/equity ratio of 0.13 compare to industry’s ratio of 1.85.

Stock Resistance & Support Level – The resistance is at 85.00 (52-week high) while the first level support is at 79.87 (50-day moving average).

Risks – The ratio of Ralph Lauren's price-to-earnings multiple to its five-year growth rate is above the average level.

Estee Lauder Companies Inc. (NYSE: EL, stock) beats earning and make me money when it said fiscal second-quarter profit more than doubled on higher sales recently. Gauging from earning performance of Estee Lauder, I would think Ralph Lauren would performs equally well – at least both are in the same industry.

Other Articles That May Interest You ...

Trading CTSH Option - 67% Profit In 1-Day

Again I can hear people say - if only you hold on a little but longer you might be able to gain higher profit. Hey, I'm not sure what'll happen next and I'm definitely not David Copperfield. I might say to myself I should hold on another day to see what'll happen. But another minute wait is another minute risk - I've my risk management to follow. Be discipline or you might be punished. Furthermore 67% profit in one-day trading option is satisfying enough - at least for me.

Again I can hear people say - if only you hold on a little but longer you might be able to gain higher profit. Hey, I'm not sure what'll happen next and I'm definitely not David Copperfield. I might say to myself I should hold on another day to see what'll happen. But another minute wait is another minute risk - I've my risk management to follow. Be discipline or you might be punished. Furthermore 67% profit in one-day trading option is satisfying enough - at least for me.

CTSH earned $69.5 million, or 46 cents per  share, up 21 percent from $57.7 million, or 39 cents per share, during the same period in the previous year. Sales rose 65 percent to $424.4 million from $256.9 million. Analysts, on average, were looking for earnings of 43 cents per share on sales of $405.5 million, according to a poll by Thomson Financial. So CTSH beats earning estimate again and the stock price was rewarded generously.

share, up 21 percent from $57.7 million, or 39 cents per share, during the same period in the previous year. Sales rose 65 percent to $424.4 million from $256.9 million. Analysts, on average, were looking for earnings of 43 cents per share on sales of $405.5 million, according to a poll by Thomson Financial. So CTSH beats earning estimate again and the stock price was rewarded generously.

Francisco D’Souza, president and chief executive officer of Cognizant, said a good portion of company’s growth came from Europe, where revenue doubled last year. In totality, U.S. contributes 86% while Europe the remaining 13% of the revenues.

Cognizant, which recently opened its eighth center in India saw strong demand from healthcare, media and entertainment. Cognizant's competitors such as Infosys Technologies (Nasdaq: INFY,stock) and Wipro Limited (NYSE: WIT, stock) also reported strong growth due to increased outsourcing demand.

Other Articles That May Interest You ...

Yusli Switch Direction To Blame Remisiers & StockBrokers

According to the Star titled “Hire more young remisiers” today, Yusli noted that the number of remisiers had been stagnant since the financial crisis in 1997/98 despite increase in stock-broking branches. He blamed the lack of retail interest on remisiers, who acted as a market intermediary, and the stockbrokers, who seemed to have stopped hiring remisiers. He further urged stockbrokers to recruit young remisiers (20 to 30 of age) to cater to the new generation of investors.

First thing first, do you think by recruiting more young sexy remisiers the retail participation in the Malaysian local bourse will increase? If the existing “experienced remisiers” do not even have the latest knowledge to advice investors on listed companies’ prospect (both technically and fundamental), do you really think the young chaps will make any difference? Do not trust what I wrote? Go and ask your remisier the earning per share (EPS) or price-earning-ratio (P/E) of any stock that came to your mind. I bet he/she couldn’t answer you such basic question. Where’s the flaw? Could it be in the lack of quality of education/training that each remisiers undergo in order to pass before granted the trading license?

First thing first, do you think by recruiting more young sexy remisiers the retail participation in the Malaysian local bourse will increase? If the existing “experienced remisiers” do not even have the latest knowledge to advice investors on listed companies’ prospect (both technically and fundamental), do you really think the young chaps will make any difference? Do not trust what I wrote? Go and ask your remisier the earning per share (EPS) or price-earning-ratio (P/E) of any stock that came to your mind. I bet he/she couldn’t answer you such basic question. Where’s the flaw? Could it be in the lack of quality of education/training that each remisiers undergo in order to pass before granted the trading license?Supposing all the remisiers are competent enough, do you think majority of retail investors are convince of the current bullish market? If you do not agree with me, you’ve the right to think otherwise. At least Remisiers Association of Malaysia president, Sam Eng agreed with me when he said “Retail investors are still not convinced with the current rally. This is perhaps something that Bursa Malaysia needs to look into.” Eng said the bullish trend was not across the board. “Only the blue chips have gone up, not the second and third liners, which are the retailers’ preferred choice,” he added.

Couple with lower commission, you need to have really huge volume with retail investors’ participation in order to attract younger people to join the profession of remisiers. Remisiers depends heavily on retail investors – they don’t really care even if composite index reach 2,000 points tomorrow but only blue-chips were the gainers. Most of the blue-chips were transacted via stock-brokers’ dealers (instead of remisiers) who deal directly with foreign investors.

So, during such blue-chip-centric bullish market, dealers are the one who benefits the most with guaranteed fat yearly bonus. Either retail investors are super-smart nowadays not to get burnt again or they’re really out of money for further investment. Have you thought of the possibility that the nation’s economy is not in good shape that there’re no surplus in the retail investors’ pocket to invest in stocks?

Other Articles That May Interest You ...

Monday, February 05, 2007

Hope VFC Stock Performs Again With Blessing From Cramer

Anyway, VF Corporation (NYSE: VFC, stock) will announce its’ earning tomorrow, Tuesday 6-Feb-2007 before market open. VFC is a leader in branded lifestyle apparel including jeanswear, outdoor products, image apparel and sportswear. Its principal brands include Wrangler(R), Lee(R), Riders(R), Rustler(R), The North Face(R), Vans(R), Reef(R), Napapijri(R), Kipling(R), Nautica(R), John Varvatos(R), JanSport(R), Eastpak(R), Lee Sport(R) and Red Kap(R).

Recently VFC (Nasdaq:) was reported to be selling its intimate apparel lines to Warren Buffett Berkshire Hathaway's (NYSE: BRK.A, stock) Fruit of the Loom for $350 million – a figure said to be low (the stock price was punished) but analysts said the move has long-term benefits due to weak store sales. UBS Equities analyst Jeffrey B. Edelman points out that intimate apparel represented only 12 percent of VF's sales and wasn't an integral part of its growth strategy.

The company just completed its’ acquisition of Eagle Creek which will give it one more name in its growing stable of outdoor brands, including Vans, the North Face, JanSport, and Eastpak. VF says Eagle Creek will add $30 million to 2007 sales and sustain high single-digit sales growth over the next couple of years.

- StockScouter rating : 8 / 10

- Whisper Number for this stock : 1.25

- Schaeffer rating for this stock : 4.5 / 10

- Power Rating : 5 / 10

- Insider Trading (last 52 weeks) : ($58.18M)

- Zacks Analysts Rating: Hold

- Option Trading: May 2007 80 Call

- Implied Volatility (IV) for Mar 2007 $80 Strike : 22.40%

Sales, Income & Growth - For the past 12-months, VFC registered $6.08 Billion sales versus the industry’s $2.96 Billion. Income amounted to $519.37 Million against the industry’s $210.30 Million. While VFC 12-months sales growth is at 10.10%, the income growth is in the region of 10.30% (the same industry sector sales growth at 12.60% with income of 29.00%).

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 8.5%. VFC has a debt/equity ratio of 0.32 compare to industry’s ratio of 1.86.

Stock Resistance & Support Level – The resistance is at 79.47 (50-day moving average) while the first level support is at 71.53 (200-day moving average).

Risks – Shares are heavily sold by financial institution.

After the announcement of its sale to Berkshire Hathaway, the stock price took a beating and current stock price should have taken that into consideration. This stock is one of the favorites ofJim Cramer. He named VF Corp. as his first fallen angel because he considers the $350 million sale of intimate apparel business as a great move due to the “razor-thin margins”. And since it’s gone now, VFC is free to "let its other higher margin businesses shine."

I have invested VFC before via option trading during the previous earning. It gapped-up but for a short-while which I hope will not happen again this time around.

Other Articles That May Interest You ...

New Tool For Warrants Stock Investors But It Crawls

Being an adventurer, I further tried to enter a random Call Warrant code; I chose RHBCAP-CA simply because it is listed as top-10 volume today and I hit [ Draw Chart ] button. The processing took ages and somehow you need to count your luck to get a result. Chief  executive officer Datuk Nazir Razak should make sure the infrastructure is ready before announcing such a service, don’t tell me the brother of deputy prime minister can’t afford to purchase better performance hardware.

executive officer Datuk Nazir Razak should make sure the infrastructure is ready before announcing such a service, don’t tell me the brother of deputy prime minister can’t afford to purchase better performance hardware.

Somehow RHB Capital Berhad Call Warrant (KLSE: RHBCAP-CA, stock-code 1066CA) would not returns any result but other warrants or call-warrants are able to. Strange isn’t it? Probably there’re bugs within the application. Anyway, it’s still a good tool to check volatility and expiry-date, amongst the others.

PANTECH - Another Cheap IPO Stock Worth Investing

Pantech provides pipes, fittings and flow control solutions to the oil and gas industry as well as those in the energy, refinery, petrochemical and chemical sectors, including palm oil and biodiesel. Pantech posted a net profit of RM21.6 million for the year ended Feb 28,

2006 on the back of revenue totalling RM169.77 million, with about 26% of its business arising from exports.

2006 on the back of revenue totalling RM169.77 million, with about 26% of its business arising from exports.Pantech expects strong demand from foreign and local clients to boost revenue to RM216.06mil for the financial year ending Feb 28, 2007, representing a 27% growth from 2006. It also projects pre-tax profit rising 18.5% to RM34.77mil and a dividend payout of 3 cents for the year to Feb 28. According to Executive Director, Adrian Tan, 70% of Pantech's customers were local companies and the rest were from the United States, Singapore, Indonesia, Australia, Japan and Thailand.

Based on the prospectus, the enlarged issued and fully paid-up upon listing totals 150,000,000 ordinary shares. Net EPS (earning per share) for financial year ended Feb-2007 is 16.34 cents yielding a net P/E (price to earnings ratio) multiple of 7.22. The forecast for financial year ended Feb-2008 meanwhile is giving a return of 18.37 cents net EPS translating into net P/E multiple of 6.42.

I would think this is rather cheap if I use Kencana Petroleum Bhd (KLSE: KENCANA, stock-code 5122) as a comparison (the closest I can find). Kencana is trading at RM 1.44 today which is 28 multiple of it’s earnings of 5.14 cents per share. Using the same multiple of 28 times, Pantech stock price should trade at RM 5.14. By the way, do you see some similarities between Kencana and Pantech?

Listing Schedule :

- Prospectus Date : 29-Jan-2007

- Closing of Applications : 5-Feb-2007 (today)

- Issue Price : RM 1.18 (Main Board)

- Listing Date : 15-Feb-2007

# TIP: I think Pantech is rather cheap looking at its’ earning per share projected for the financial year 2008. I would think it’s worth investing in its’ IPO stock. Subscribe it.

# TIP: Analysts have a fair-value of RM 2.26 on Pantech.

Other Article That May Interest You ...

Yahoo OurCity Is Learning Your Local Culture And Info

- Share photos, videos, trip plans or events of the cities with other communities

- Invite other people to share and contribute to the city communities.

- Related news about the city which was syndicated from international news

- Weather, blogs and a summary of the cities for newcomers such as travellers.

You can submit your comments on what you think about the city – your comment might be able to help the local authorities improve the city as a tourist destination. Personally I think the project is a great start for countries earning foreign currencies in the tourism industry. Imagine the huge latest information that tourists can get from the internet thousands of miles away. No matter how much you spend on attracting foreign tourists to your country, the campaign might not reach some individuals. But with OurCity, a foreigner might just be able to find your city from the cyberspace and plan his/her next visit.

You can submit your comments on what you think about the city – your comment might be able to help the local authorities improve the city as a tourist destination. Personally I think the project is a great start for countries earning foreign currencies in the tourism industry. Imagine the huge latest information that tourists can get from the internet thousands of miles away. No matter how much you spend on attracting foreign tourists to your country, the campaign might not reach some individuals. But with OurCity, a foreigner might just be able to find your city from the cyberspace and plan his/her next visit.

Yahoo said more cities and several more features will follow soon – an indication that cities within U.S. soil would be next within the roadmap. Isn’t it funny Yahoo didn’t starts it with a U.S. city? In the meantime, start shooting photos to share it on the net to attract other communities - if photography is your hobby.

Sunday, February 04, 2007

No Entry For Stanley BUT Will Genting Still Into Macau?

Genting International (SIN: G13), part of Malaysian gaming

conglomerate Genting Group(KLSE: GENTING, stock-code 3182), and its sister firm Star Cruise Ltd (SIN: S21) won a licence in December to build an "integrated resort" including a casino on Sentosa.

conglomerate Genting Group(KLSE: GENTING, stock-code 3182), and its sister firm Star Cruise Ltd (SIN: S21) won a licence in December to build an "integrated resort" including a casino on Sentosa.However the Ministry of Home Affairs' Casino Regulation Division declined to comment directly on the report but told AFP last month that "suitability checks will be conducted as and when necessary".

Now, we only heard one side of the story, which is from Genting. But Jackson did not elaborate on the Genting’s stake in a new proposed boutique hotel and casino to be operated by Ho's Sociedad de Jorgos de Macau. If the deal for Stanley Ho is off, can the same be said on the deal offered to Genting in Macau? So if both Stanley and Genting will not gain entry into Singapore and Macau respectively, does that mean Genting stock price should pull-back to the level where it was right before the news broke? So far, Singapore has kept a silent mode in this matter but I don’t blame them as I still do not see what values Stanley can bring into the Sentosa project if given the 6.99 percent stake.

Other Articles That May Interest You ...

Malaysia KLCI Hits 10-Year High – So What?

The Star reported that overseas investors now own nearly a third of exchange operator Bursa Malaysia Berhad, a quarter of Tenaga Nasional Berhad (KLSE: TENAGA, stock-code 5347) and over 40% of Bumiputra-Commerce Holdings Berhad (KLSE: COMMERZ, stock-code 1023). They also own substantial shares in top companies like IJM Corp Berhad (KLSE: IJM, stock-code 3336) and IOI Corp Berhad (KLSE: IOI, stock-code 1961).

If you look at Friday’s top gainers, you’ll notice the main contributor to the index was Genting Berhad (KLSE:GENTING, stock-code 3182), Bursa Malaysia (KLSE:BURSA, stock-code 1818), Kuala Lumpur Kepong (KLSE:KLK, stock-code 2445), Malayan Banking Berhad (KLSE: MAYBANK, stock-code 1155) and Telekom Malaysia Berhad (KLSE: TM, stock-code 4863). But if you re-look at the top volume, you still cannot escape the view of the penny stocks (second or third liner stocks) struggling to register more gains over the months. This is so different from the period of pre-1997 Economic Crisis when it’s rare to have penny stocks appeared on top 20 volume counters. I’ve covered this issue on my previous website at Why Malaysia Yusli Blames Local Investors?

If you look at Friday’s top gainers, you’ll notice the main contributor to the index was Genting Berhad (KLSE:GENTING, stock-code 3182), Bursa Malaysia (KLSE:BURSA, stock-code 1818), Kuala Lumpur Kepong (KLSE:KLK, stock-code 2445), Malayan Banking Berhad (KLSE: MAYBANK, stock-code 1155) and Telekom Malaysia Berhad (KLSE: TM, stock-code 4863). But if you re-look at the top volume, you still cannot escape the view of the penny stocks (second or third liner stocks) struggling to register more gains over the months. This is so different from the period of pre-1997 Economic Crisis when it’s rare to have penny stocks appeared on top 20 volume counters. I’ve covered this issue on my previous website at Why Malaysia Yusli Blames Local Investors?According to stock exchange data, the daily average value of stocks traded on Bursa in January was RM2.1bil compared with RM1.28bil in the final quarter of 2006. Brokers attributed the sharp increase in trading value in recent months to the huge inflow of funds from overseas. So with these indicators, KLSE is indeed in the bull-run phase and it’s only about 100 pointsaway from the 1993-1994 Super-Bull which registered the highest composite index of 1,332 (Jan-5-1994) before the bear took over. In fact, looking at the chart, since the resistance level of 1,018 was breached on fourth quarter last year, 2006; the composite index was on 45 degrees uptrend.

It’s not difficult to breach the 1,332 level – you need another 7 trading days of continuously register 20 points gain to breach it or 14 trading days of 10 points gain to achieve the desire result.

But the question remains – are you making any money from this so-called bull-run? If not, why not? Most probably your portfolio does not include blue-chips or index-linked stocks. But if you can only make money from blue-chips and not other stocks, then can you call this round a super-bull even if the composite index breaches the 1,332 level? So what if KLCI close at1,500 level; but only a handful of expensive blue-chips were the gainers? Foreign investors no doubt will not touch second and third-liners stocks. These stocks were traditionally chased by retail investors, speculators, syndicate who prey on first-comers or whatever you wish to call it. The reality is local retail investors are not putting their hands on the chopping board, at least not yet, after losing several fingers already.

Everyone is waiting for somebody to start the ball-rolling on the second or third liners stocks. Maybe EPF (Employees Provident Fund) or PNB (Permodalan Nasional Berhad) should start by showing retail investors their confidence on some good performers stocks categorized as second or third liners companies. Then the chain reaction will sparks the desire participation from retails dreamt by Yusli, chief executive officer of Bursa Malaysia.

# TIP: Looking forward, the 1,271 level registered on Feb-25-1997 at the height of pre-1997 Economic Crisis would be the important yardstick on how far more KLSE can goes.

Other Articles That May Interest You ...

Friday, February 02, 2007

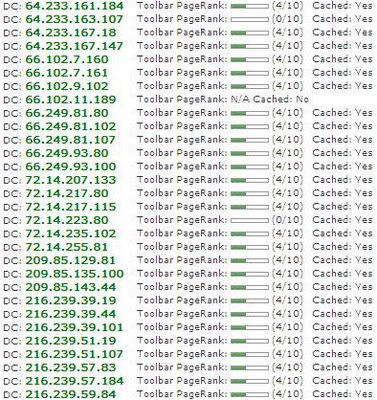

Finally StockTube Has Been Assigned A PageRank

University by Larry Page and Sergey Brin as part of a research project about a new kind of search engine. The project started in 1995 and led to a functional prototype, named Google, in 1998 and the rest is history. The name PageRank is a trademark of Google Inc. (Nasdaq: GOOG, stock) but the patent is not assigned to Google but to Stanford University.

University by Larry Page and Sergey Brin as part of a research project about a new kind of search engine. The project started in 1995 and led to a functional prototype, named Google, in 1998 and the rest is history. The name PageRank is a trademark of Google Inc. (Nasdaq: GOOG, stock) but the patent is not assigned to Google but to Stanford University.

Ready To Take Money Off The Table - CAT, ILMN, EL & MAT

I mentioned I was still researching Caterpillar Inc. (NYSE: CAT, stock) when I published the “Will Illumina Continues Its' 45 Degrees Uptrend?” which was expected to announce its’ earning the same day as Illumina, Inc. (Nasdaq: ILMN, stock). During the

announcement Caterpillar said higher operating costs trimmed fourth-quarter profit growth to 4 percent, but predicted strong results for 2007 despite an expected slowdown in U.S. machine and engine sales. This forecast is enough to send the stock price up despite earnings fell short of Wall Street's expectations as higher production costs offset strong sales. However, net income for the fourth quarter grew to $882 million, or $1.32 per share, up from $846 million, or $1.20 per share, a year ago.

announcement Caterpillar said higher operating costs trimmed fourth-quarter profit growth to 4 percent, but predicted strong results for 2007 despite an expected slowdown in U.S. machine and engine sales. This forecast is enough to send the stock price up despite earnings fell short of Wall Street's expectations as higher production costs offset strong sales. However, net income for the fourth quarter grew to $882 million, or $1.32 per share, up from $846 million, or $1.20 per share, a year ago.Next, Illumina, Inc. (Nasdaq: ILMN, stock) said yesterday its fourth-quarter profit skyrocketed, but shares fell in after-

hours trading on guidance that included a sharp rise in expenses. Quarterly earnings soared to $17.1 million, or 34 cents per share, from $326,000, or 1 cent per share, during the same period last year. Revenue on the other hand more than doubled to $60.4 million from $23 million in the year-ago quarter. Shares of Illumina sank $1.49, or 3.6 percent, to $40.07 in after-hours electronic trading – just what are analysts thinking? They’re not happy with the expenses increase expectation – what a hard-to-please bunch of clowns.

hours trading on guidance that included a sharp rise in expenses. Quarterly earnings soared to $17.1 million, or 34 cents per share, from $326,000, or 1 cent per share, during the same period last year. Revenue on the other hand more than doubled to $60.4 million from $23 million in the year-ago quarter. Shares of Illumina sank $1.49, or 3.6 percent, to $40.07 in after-hours electronic trading – just what are analysts thinking? They’re not happy with the expenses increase expectation – what a hard-to-please bunch of clowns.Probably the best stock which deserves my praise is Estee Lauder Companies Inc. (NYSE: EL,stock), first h

ighlighted at my website during my Gamble On SanDisk Stocks Option – simply because it makes me lots of money this round (what other reason do you expect?). Estee Lauder on Wednesday said fiscal second-quarter profit more than doubled on higher sales and lower costs, prompting it to lift its full-year outlook – and the analysts just love it. Quarterly earnings rose to $208.4 million, or 99 cents per share, trouncing analyst expectations for earnings of 76 cents per share and sending the stock up all the way. But I expect some profit takings to start today.

ighlighted at my website during my Gamble On SanDisk Stocks Option – simply because it makes me lots of money this round (what other reason do you expect?). Estee Lauder on Wednesday said fiscal second-quarter profit more than doubled on higher sales and lower costs, prompting it to lift its full-year outlook – and the analysts just love it. Quarterly earnings rose to $208.4 million, or 99 cents per share, trouncing analyst expectations for earnings of 76 cents per share and sending the stock up all the way. But I expect some profit takings to start today.T

oy maker Mattel Inc. (NYSE: MAT, stock)reported net income of $286.4 million, or 75 cents per share, for the three months ended Dec. 31, compared to $279.2 million, or 69 cents per share, a year ago - easily beat estimates from analysts surveyed by Thomson Financial, who had expected earnings of 67 cents per share. But surprisingly the stock didn’t shoot up as what I expect. It instead chose to crawl like a turtle. Since I’ve tons of time-value (expiry on April), I’ll leave it do whatever it wish to do.

oy maker Mattel Inc. (NYSE: MAT, stock)reported net income of $286.4 million, or 75 cents per share, for the three months ended Dec. 31, compared to $279.2 million, or 69 cents per share, a year ago - easily beat estimates from analysts surveyed by Thomson Financial, who had expected earnings of 67 cents per share. But surprisingly the stock didn’t shoot up as what I expect. It instead chose to crawl like a turtle. Since I’ve tons of time-value (expiry on April), I’ll leave it do whatever it wish to do.Other Articles That May Interest You ...

Fastest Growing Tech To Sustain 45 Degrees Uptrend?

Cognizant is one of the America’s 25 fastest-growing public technology companies (in terms of annual sales gains), according to Forbes 25 Fast Tech, outperformed the Nasdaq Composite over the past year. In early November 2006, Cognizant announced plans to invest over $200 million through the end of 2008, expanding its facilities in India

Rating Indicators for CTSH:

- StockScouter rating : 10 / 10

- Whisper Number for this stock : 0.45

- Schaeffer rating for this stock : 7 / 10

- Power Rating : 5 / 10

- Insider Trading (last 52 weeks) : ($26.77M)

- Zacks Analysts Rating: Moderate Buy

- Option Trading: Apr 2007 85 Call

- Implied Volatility (IV) for Mar 2007 $85 Strike : 29.05%

Sales, Income & Growth - For the past 12-months, Cognizant registered $1.26 Billion sales versus the industry’s $10.71 Billion. Income amounted to $220.94 Million against the industry’s $458.53 Million. While Cognizant 12-months sales growth is at 59.0%, the income growth is in the healthy region of 50.30% (the same industry sector sales growth at 31.90% with income of 33.10%).

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 17.6%. Cognizant has a debt/equity ratio of 0 (zero) compare to industry’s ratio of 0.25

Stock Resistance & Support Level – The resistance is at 85.54 (52-week high) while the first level support is at 80.20 (50-day moving average).

Risks – At 57.72, the price-to-earnings multiple is higher than the average of the stocks of the same sector.

I like this stock because its’ earnings growth in the past year is holding steady compared to earnings growth in the past three years. This is probably one of the performing technology stocks which consistently beat the earning estimate for the past 8 (eight) quarters. Did you notice the almost 45 degrees 1-year chart of this guy?

Do you know that of all stocks on the public markets, Cognizant Technology (Nasdaq: CTSH, stock), Google (Nasdaq: GOOG, stock), Coldwater Creek (Nasdaq: CWTR, stock), and First Marblehead (NYSE: FMD,stock) are four of the most aggressive growers and for the next five years, analysts are expecting each to grow at least 25% per annum?

Your Option Trading At A Loss - How To Reverse The Plan

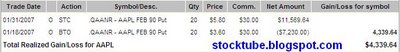

Anyway, remember when the Apple Inc

(Nasdaq: AAPL, stock) announced earning which beats estimates but gave a lower (conservative) guidance on Jan-17-2007 after the market closed? In case you missed it, the website is here. In order to close the gap of my loss, I re-open another position, AAPL Feb 90 Put, on Jan-18-2007 just when it crossed the lower of the lowest within 45 minutes. And it drifted lower thereafter as what I hoped for. I put a stop-limit to lock-in profit at about $84 plus (the three months chart gives you a support at about $84

(Nasdaq: AAPL, stock) announced earning which beats estimates but gave a lower (conservative) guidance on Jan-17-2007 after the market closed? In case you missed it, the website is here. In order to close the gap of my loss, I re-open another position, AAPL Feb 90 Put, on Jan-18-2007 just when it crossed the lower of the lowest within 45 minutes. And it drifted lower thereafter as what I hoped for. I put a stop-limit to lock-in profit at about $84 plus (the three months chart gives you a support at about $84  level). It got triggered on Jan-31-2007 – the period of which I couldn’t monitored due to the disruption to my internet line.

level). It got triggered on Jan-31-2007 – the period of which I couldn’t monitored due to the disruption to my internet line.Just imagine if there’s no option for me to execute a limit-order and “Good Until Cancelled” just like in Malaysia stock market. My previous option position on Apple which is Apr 95 Call (before Apple earning) is still in the redbut after minus the profits just pocketed, I’m still making some money. And should Apple shares decided to reverse its’ down-trend (assuming $84 is the support), my Call option positions will start to make me money. Furthermore the Call option expires on Apr-2007 - time-value is on my side.

Other Articles That May Interest You ...

My Internet Link Is Down But I'll Still Try To Trade

The last entry before this very post was actually posted under Starbucks (Nasdaq: SBUX, stock) wireless internet connection. And I'm currently blogging from cyber-cafes / internet-cafes (I can't take any more coffee latte) - I can't live without the internet.

However I managed to enter some trades before I was off-line two days ago. Trading U.S. options online provide you the flexibility of opening a position before market open if you choose the option of "Good Until Cancelled" under your broker's trading platform - meaning your trade(s) order will stays till your limit order is met or you cancel it manually.

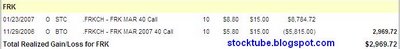

I didn't post any research on my previous trades due to obvious reason stated above. Anyway below were my positions which were triggered:

Obviously, my bet on both didn't produce the result I desire - but with the fundamental in place, I hope both will behave for the coming days.

Wednesday, January 31, 2007

Will There Be A Long Tussle For RHB?

There’s a saying “Don't bite off more than you can chew” – the worst is to mix politics with business which historically has been proven not to work. What more if you put your second son who is without REALcorporate experience in managing one of the largest bank in Malaysia. What will you get as a result? An almost guaranteed of failure from the highest level of corporate decision making to the lowest level of daily operations. Some of Malaysian corporate entities seems to not understand that its’ better to leave the running of a company to the professionals.

There’s a saying “Don't bite off more than you can chew” – the worst is to mix politics with business which historically has been proven not to work. What more if you put your second son who is without REALcorporate experience in managing one of the largest bank in Malaysia. What will you get as a result? An almost guaranteed of failure from the highest level of corporate decision making to the lowest level of daily operations. Some of Malaysian corporate entities seems to not understand that its’ better to leave the running of a company to the professionals.On Tuesday, the Star reported Employees Provident Fund (EPF), which owns about 31 percent of RHB Capital's controlling shareholder, RHB, has put the plan to other owners of the parent holding company to sell RHB Capital shares to RHB at a discounted price of 3 ringgit per share in order to clean up its books and pave the way for a takeover by Kuwait Finance House ( KFH ).

However, today, Business Times was told that UBG is not in favor of the plan, as the timeframe to undertake it could weaken Utama's hand at the negotiation table should there be hiccups midway.

However, today, Business Times was told that UBG is not in favor of the plan, as the timeframe to undertake it could weaken Utama's hand at the negotiation table should there be hiccups midway.EPF wanted its’ proposal to be concluded before June 2007, when some of RHB's paper issue debts are due, and possibly affect the standing of RHB Capital (KLSE: RHBCAP : stock-code 1066). RHB has RM1.58 billion of debt due between June 30 and December 31 this year. Utama Banking owns 32.5 percent of Rashid Hussain and the fund owns about 31 percent.

It would be fun to see if this will translate into a long-battle between the two giants – which I doubt so. Money talks and it all boils down to dollars and cents. Will they learn the true meaning of business? Will these folks grow-up and mature enough to not repeat the same mistake of mixing political and business the way western countries practices? What about the case of RHB founder Tan Sri Abdul Rashid Hussain and five other individuals who are being sued by RHB Capital? Will the case disappears over the time?

Other Articles That May Interest You ...

Loss On Charges But Sales Up 55% - SanDisk

The company's loss includes $186 million charge to acquire in-process technology, $31 million for stock-based

compensation, $20 million in other acquisition charges, and $10 million in income taxes related to those charges. Revenue for the quarter surged 55 percent to $1.16 billion from $750.6 million in 2005. The company's sales included results from its M-Systems acquisition, which SanDisk closed in November 2006.

compensation, $20 million in other acquisition charges, and $10 million in income taxes related to those charges. Revenue for the quarter surged 55 percent to $1.16 billion from $750.6 million in 2005. The company's sales included results from its M-Systems acquisition, which SanDisk closed in November 2006.If SanDisk exclude the above charges, it would have earned 87 cents a share, better than Wall Street's expectation of 72 cents. So, the decline stock price over the last 3 months should have taken the acquisition costs into consideration. SanDisk also said average price per megabyte of its NAND flash fell 17% is within its’ projected forecast. But I think when the company cautioned that there is an oversupply of NAND flash, the investors decided to dump the shares causing the stock to slide by 10% to $38.30 from closing of $42.83.

So what’s the next step to salvage my trade? Depending on the chart pattern for the first 45 minutes trading when the stock market open today, I’ll decide whether to reverse my earlier trade or convert it into spread or give SanDisk some space to breathe and investors to digest the figures. Furthermore it’s very close to the 52-week support level at $ 37.34.

A Gamble On SANDISK Stock Options

The company said in December it received approval from the Chinese government to build a test manufacturing and captive assembly facility near Shanghai, in Zizhu Science Park.

Analysts polled by Thomson Financial expect SanDisk to earn, on average, 75 cents per share on $984.4 million in revenue. The company warned in October that flash memory prices could drop 15 to 20 percent sequentially during the fourth quarter.

Despite pricing declines during the quarter, Pacific Growth Equities' Satya Chillara thinks SanDisk may meet or beat Wall Street expectations. Chillara has a "Buy" rating on the stock. Citigroup (NYSE: C, stock) analyst Craig Ellis, who has a "Hold" rating, said he expects SanDisk to post a "solid" fourth quarter "fueled by robust handset card demand" but could cut 2007 guidance due to soft prices, royalty payments, and competitive pressure from Micron Technology Inc. However, Bear Stearns analyst Gurinder Kalra thinks bearish future expectations are priced in the stock.

Rating Indicators for SNDK:

- StockScouter rating : 10 / 10

- Whisper Number for this stock : 0.82

- Schaeffer rating for this stock : 3 / 10

- Power Rating : 4 / 10

- Insider Trading (last 52 weeks) : ($97.91M)

- Zacks Analysts Rating: Hold

- Option Trading: Apr 2007 40 Call

- Implied Volatility (IV) for Mar 2007 $40 Strike : 50.77%

Sales, Income & Growth - For the past 12-months, SanDisk registered $2.84 Billion sales from the industry’s $3.29 Billion. Income amounted to $367.95 Million from the industry’s $282.25 Million. While SanDisk 12-months sales growth is at 34.6%, the income growth is in the red of -7.30%.

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 12.9%. SanDisk has a debt/equity ratio of 0.35 compare to industry’s ratio of 0.25

Stock Resistance & Support Level – The resistance is at 44.03 (50-day moving average) while the first level support is at 37.34 (52-week low).

Risks – The price-to-earnings multiple is close to the average for all stocks within the same sector. The IV is rather high for Mar 2007 $40 Strike which is at 50.77%.

Shares of SanDisk, which have traded between $37.34 and $72.36 over the last year, fell roughly 20 percent during the quarter to a Dec. 29 close of $43.03 on the Nasdaq. The stock took the biggest one-day hit during the quarter on Oct. 20, when it fell from $61.73 to $49.15 after the company posted third-quarter results. The risk of investing this stock is quite high even though the shares are under heavy accumulation by financial institutions. The high IV compounded the risk. SanDisk stock needs an excellent result and upside guidance for a huge-gap-up in order to make money. But I’ll play on contrarian – I’ll bet on Option Call instead of Put due to the fact this stock was being punished for the last 3 months since its’ earning announcement. With its’ current price of $42.20 not too far away from its’ 52-week support at $37.34, I figure the stock price have absorbed all the negative considerations listed above.

The risk of investing this stock is quite high even though the shares are under heavy accumulation by financial institutions. The high IV compounded the risk. SanDisk stock needs an excellent result and upside guidance for a huge-gap-up in order to make money. But I’ll play on contrarian – I’ll bet on Option Call instead of Put due to the fact this stock was being punished for the last 3 months since its’ earning announcement. With its’ current price of $42.20 not too far away from its’ 52-week support at $37.34, I figure the stock price have absorbed all the negative considerations listed above.

In the meantime, I’m still researching Websense Inc. (Nasdaq: WBSN, stock) of which its’ Feb 2007 $22.50 Strike have been bid-up today. The Estee Lauder Companies Inc. (NYSE: EL,stock), manufacturer and marketer of skincare, makeup, fragrance and hair care products looks quite promising as well - will research further on this stock which is expected to announce its' earning tomorrow, Wednesday, Jan-31-2007 before opening bell.

Tuesday, January 30, 2007

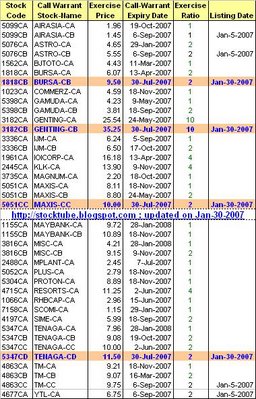

New Call Warrants - Bursa, Genting, Maxis & Tenaga

- BURSA-CB (stock-code: 1818CB)

- GENTING-CB (stock-code: 3182CB)

- MAXIS-CC (stock-code: 5051CC)

- TENAGA-CD (stock-code: 5347CD)

The expiry-date for all the four new call-warrants is 6 months from and including the issue-date. All these call-warrants are exercisable at any time for a period of 6 months from and including the issue date.

The issue prices are:

- BURSA-CB: 77 cents

- GENTING-CB: 46 cents

- MAXIS-CC: 65 cents

- TENAGA-CD: 55 cents

# TIP: For more detail-data related to Bursa Malaysia (KLSE) call-warrants, you can visit OSK188 at Warrants Pricing Table.

Other Articles That May Interest You ...

Tiong Hiew King In A Hurry To Control Nanyang?

Stock price of Ming Pao which closed at HK$1.73 on Monday opened at HK$2.35 today and jumped as much as 49

percent to HK$2.58 on the merger news. Sin Chew’s stock price ended the day almost unchanged while Nanyang’s stock price closed 20 cents lower today.

percent to HK$2.58 on the merger news. Sin Chew’s stock price ended the day almost unchanged while Nanyang’s stock price closed 20 cents lower today.Sin Chew publishes Malaysia's largest circulated Chinese newspaper, the Sin Chew Daily, while Nanyang produces the country's oldest Chinese-language daily, Nanyang Siang Pau. Ming Pao Group's major publications include the Ming Pao Daily News, which is published in Hong Kong, Toronto, Vancouver, New York and San Francisco.

Sin Chew said the enlarged entity would "leverage on its extensive global footprint to expand into the media market in China as well as globally" while Tiong said "The merger is a strategic move to transform Sin Chew Media into an international media group to compete with global media corporations." Forbes in 2006 said Tiong’s net worth was about one billion dollars, listing him as number 746 of 793 billionaires worldwide.

T

he merger will see the enlarged group operating through a publishing merger of Chinese-language newspapers and magazines in Malaysia, Hong Kong, the United States, Canada and China. Under the deal which must be signed by April 30, Sin Chew and Nanyang will be de-listed from Malaysia's bourse and become wholly-owned subsidiaries of Ming Pao. Ming Pao will assume Sin Chew's publicly traded status and have a dual listing on the main board of stock exchange Bursa Malaysia (KLSE: BURSA, stock-code 1818) and the Stock Exchange of Hong Kong Ltd., investment bank CIMB said in a stock exchange statement.

he merger will see the enlarged group operating through a publishing merger of Chinese-language newspapers and magazines in Malaysia, Hong Kong, the United States, Canada and China. Under the deal which must be signed by April 30, Sin Chew and Nanyang will be de-listed from Malaysia's bourse and become wholly-owned subsidiaries of Ming Pao. Ming Pao will assume Sin Chew's publicly traded status and have a dual listing on the main board of stock exchange Bursa Malaysia (KLSE: BURSA, stock-code 1818) and the Stock Exchange of Hong Kong Ltd., investment bank CIMB said in a stock exchange statement.Sin Chew’s Executive Director Rita Chin said the exercise was targeted to be completed by February 2008, with Sin Chew and Nanyang shareholders expected to vote on the merger in the fourth quarter of this year. Shareholders of SinChew will exchange their stock at 4 ringgit per share for new Ming Pao shares to be issued and credited at HK$2.70 while Nanyang shareholders will exchange their stock at 4.20 ringgit per share for new Ming Pao shares to be issued and credited at the same price of HK$2.70.

The Nanyang Press had created sagas previously when Huaren (investment arm of MCA) bought it and later sold it to Ezywood Options Sdn Berhad which is controlled by timber and media tycoon Tan Sri Tiong Hiew King for a lost estimated at RM100 Million in 2006. Chinese community worried about monopoly of Chinese newspaper industry cried that MCA (Malaysia Chinese Association) should have sold its controlling stake in Nanyang Press Holdings Bhd to other parties instead of Tan Sri Tiong Hiew King who already controls Sin Chew Media Corporation Bhd.

The Nanyang Press had created sagas previously when Huaren (investment arm of MCA) bought it and later sold it to Ezywood Options Sdn Berhad which is controlled by timber and media tycoon Tan Sri Tiong Hiew King for a lost estimated at RM100 Million in 2006. Chinese community worried about monopoly of Chinese newspaper industry cried that MCA (Malaysia Chinese Association) should have sold its controlling stake in Nanyang Press Holdings Bhd to other parties instead of Tan Sri Tiong Hiew King who already controls Sin Chew Media Corporation Bhd.Oops I Did It Again - Malaysian Prime Minister

was confirmed last year," the source said. "It will join an existing VVIP fleet."

was confirmed last year," the source said. "It will join an existing VVIP fleet."Other Articles That May Interest You ...

- If you can't view it above, click here to enter the Luxury of AIRBUS A319

Monday, January 29, 2007

Is Samling Really Interested In Buying LINGUI?

T

he group posted a net profit of RM22.6 Million on revenue of RM1.24 Billion for the financial year ended June-30-2006. Its’ export of logs for the financial year 2006 amounted to 294,606 cu m, 28.6% lower than previous year in 2005.

he group posted a net profit of RM22.6 Million on revenue of RM1.24 Billion for the financial year ended June-30-2006. Its’ export of logs for the financial year 2006 amounted to 294,606 cu m, 28.6% lower than previous year in 2005.Earlier in July-2006, Lingui announced the acquisition of 24,000,000 ordinary shares of RM1.00 each in Samling Plywood (Miri) Sdn Bhd (SPM), representing 60% of the entire issued and paid-up ordinary share capital of SPM, for a purchase consideration of RM 89,554,589 satisfied by issuance of 74,628,824 new ordinary shares of RM 0.50 each in the Company at an issue price of RM1.20 per new ordinary share. The acquisition expanded the company's timber concession to about 800,000ha from previous 650,000ha.

Samling Global Ltd (SGL) – which owns a 40.75% stake in Lingui – made a mandatory general offer for the rest of the shares it did not own in Lingui at RM1.01 cash each on Apr-2006. The offer valued the stock at about 21 and 23 times its projected earnings for the years ending June 30, 2006 and 2007 respectively. SGL's offer for the balance 390.81 Lingui million shares is worth RM395mil. SGL stated its intention to maintain Lingui's listed status, but said it would take steps to de-list the company if its stake in Lingui increased to above 90% following the takeover offer. But the shareholders didn’t like the proposal when it only managed to secure about 20% of the shares it did not own, bringing its shareholding up to 60.6%.

According to BizWeek, Samling is said to have upped the price to RM4.00 per share – a sign that Yaw family is ready to dig deep into their pocket for RM1 Billion to buy the remaining 259.5 million shares it does not own(Lingui had a net asset per share of RM2.20 per share). Yaw Teck Seng who control Samling Group acquired about 130.7 million shares or 20% in Lingui at RM1.01 a share mid last year, 2006, forking out only some RM132mil for the equity.

Lingui stock was trading as high as RM3.12 per share today, Jan-29-2007, an increase of over 17% to the closing last Friday. However minutes ago, Lingui said it had received a letter from Samling on Saturday saying that neither it nor its subsidiaries planned to take Lingui private, in responding to a stock exchange query. The most important question is why would Samling offer to buy Lingui at P/E (price to earning ratio) of more than 80 times? So, was it a purely rumor spread by interested parties to benefits from the stock run-up or another chapter of buying-over is in place?

Sunday, January 28, 2007

Do You Wish To Make Money With YouTube?

revenue-sharing system in a couple of months. You will get the pie of the revenue provided you own the full copyright of the videos that you uploaded onto YouTube website.

revenue-sharing system in a couple of months. You will get the pie of the revenue provided you own the full copyright of the videos that you uploaded onto YouTube website.Saturday, January 27, 2007

What Will Next Generation iPhone Offers You?

You heard about how Paul O'Brian posted a link on an xda-developer forum about how to create the skin which looks similar to the iPhone user interface and upload it into your Windows Mobile Phone. Of course Apple Inc (Nasdaq: AAPL, stock) wasn’t amused and issued him acease and desist letter from Apple's lawyers.

Since then, nothing much has happened – people are still waiting anxiously for the iPhone to be released this June. Meanwhile on the other side of the creative world, designers have start talking about the next release of iPhone which will come with more “functionalities”. So sit tight and enjoy the video below (it's weekend and you should relax) on the next innovative capabilities of iPhone (some of you might have watched this, I believe).

Apple's next generation iPhone's new capabilities:

Okay, let's get serious and listen to what Steve Jobs has to say during an interview with CNBC at 5th Avenue Apple Store recently.

Other Articles That May Interest You ...

How To Turn Your House Into Smart-Home?

If you’re staying in U.S. you might want to check out this facility with AT&T’s (NYSE: T,

stock)remote home-monitoring service which allow you tocontrol home lighting and appliances via live video, viewable on Cingular Wireless phones or their PCs. Talk about Cingular, I know what you’re thinking – that’s the famous name mentioned repeatedly by all the Apple Inc.’s (Nasdaq: AAPL,stock) fanatics over the iPhone gadget.

stock)remote home-monitoring service which allow you tocontrol home lighting and appliances via live video, viewable on Cingular Wireless phones or their PCs. Talk about Cingular, I know what you’re thinking – that’s the famous name mentioned repeatedly by all the Apple Inc.’s (Nasdaq: AAPL,stock) fanatics over the iPhone gadget.According to research firm Frost & Sullivan (reported by CNNMoney), smart home market is valued at a staggering $1.3 Billion and expected to increase to $10 Billion worldwide by 2010.

Some companies such as Control4, Cortexa Technology, and Exceptional Innovation are already targeting real-estate developers to automate new homes with set-top box, central touch-screen, wireless cameras, and sensors.

Elsewhere, Motorola (NYSE: MOT, stock) partnered with New York City-based Xanboo on a product called Homesite, which cost $220 and let users monitor their homes on cell phones back in 2005. Palo Alto-based iControl Networks raised $5 million fromIntel Corp (Nasdaq: INTC, stock) Capital and VC firm Charles River Ventures in April 2006 and launched its first product - a $400 starter kit and a $15 monthly service that provides PC and cell-phone access to a home-monitoring system.

If you’re living outside of U.S. then you are at the mercy of your local mobile operators. The next region to be implemented could be Europe but I’m not discount the possibility of some Asia countries such as China, Korea and Singapore being ahead with this cool service. So, if Singapore Telecommunications Limited (SIN: Z74), Maxis Communications Berhad (KLSE: MAXIS, stock-code 5051), DIGI.com Berhad (KLSE: DIGI), China Mobile Ltd. (HKG: 0941) or China United Telecommunications Corporation (SHA: 600050) is listening, you know what your customers want, so start preparing the necessary infrastructure, will you?

What Should You Do In Globalization World?

So, what shall you do to adapt to the new era of doing business?

- On your traveling journey, get ready to experience and learn the other cultures – not just travel purely on business purpose. Go to cultural events, sporting events, try their local foods and understand their business-mind.

- Instead of thinking of retirement at the age of 55 and spend the remaining old age at your cozy home, think about traveling overseas to gain experience. Force your kids to spend some years working overseas if he/she works for you.

- If you’re blue-collar workers, keep on re-training your own skill-sets to keep yourself abreast with the latest demand on know-how to continue your survival.

- If you’re fearful of radical change in China, that’s because it’s the risk premium you’ve to pay for such an important economy powerhouse. You just can’t ignore this coming giant which was said to be able to unseat U.S. as the next biggest economy nation in the world.

- Some countries in the Middle East such as United Arab Emirates which has good visionfor the future is a starting point for you to venture into. You know such quality country when they put great effort in their local education and think about nanotechnology and bio-fuels, compare to country such as Saudi Arabia who still think their oil fields will self-regenerate once it dry-up one day. Countries which refuse to change in the name of society contract will not move along globalization.

- If you’re the government who make policies you better start reduce red-tape, improve competitiveness, improve the country’s market attractiveness and retrain segments of the population.

Just because your country is the biggest economy in the world doesn’t mean that status will remain forever. Just because a country is blessed with abundance of natural resources such as tin, rubber, palm-oil, timber and oil doesn’t make you eligible to be “self preservation”. Just because you’ve been holding a top management position in a company doesn’t mean the company will not axe you comes job-cuts. So, the key to survival is to continue learning and be open to global changes.

Friday, January 26, 2007

Can ELMO Make MATTEL's Stock Laugh Next Monday?

Toy maker Mattel Inc. (NYSE: MAT,  stock) reports earnings for the fiscal fourth quarter on Monday, Jan-29-2007 (confirmed). Mattel, the maker of Barbie, Fisher-Price and Hot Wheels toys, has, along with other toy makers, faced pressure as the popularity of electronics and video games have displaced demand for traditional toys. But Mattel has fought back with big sellers such asTMX Elmo.

stock) reports earnings for the fiscal fourth quarter on Monday, Jan-29-2007 (confirmed). Mattel, the maker of Barbie, Fisher-Price and Hot Wheels toys, has, along with other toy makers, faced pressure as the popularity of electronics and video games have displaced demand for traditional toys. But Mattel has fought back with big sellers such asTMX Elmo.

In December, Mattel said sales of Barbie, which have slumped in recent years, were up for the year, and a survey by the National Retail Federation found that Barbie was the top toy for girls during the holiday season. Mattel's TMX ELMO was the top toy for boys.

Thompson Financial estimate Mattel to post net income of 67 cents per share on revenue of $1.99 billion. Analysts generally expects Mattel do deliver the best fourth-quarter results of all the toy makers, with TMX ELMO, Dora the Explorer, and "Cars" toys performing well.

Rating Indicators for MAT:

- StockScouter rating : 9 / 10

- Whisper Number for this stock : 0.68

- Schaeffer rating for this stock : 7 / 10

- Power Rating : 5 / 10

- Insider Trading (last 52 weeks) : ($9.80M)

- Zacks Analysts Rating: Hold

- Option Trading: Apr 2007 25 Call

- Implied Volatility (IV) for Mar 2007 $25 Strike : 24.83%

Sales, Income & Growth - For the past 12-months, Mattel registered $5.38 Billion sales from the industry’s $3.9 Billion. Income amounted to $585.73 Million from the industry’s $381.33 Million.

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 10.9% against industry’s 7.9%. Mattel has a debt/equity ratio of 0.41 compare to industry’s ratio of 0.40.

Stock Resistance & Support Level – The resistance is at $24.08 (52-week high) while the first level support is at $22.91 (50-day moving average).

Risks – For a large company like Mattel, its’ stocks are neither being accumulated heavily nor sold heavily by financial institutions.

This stock has beaten earning estimates most of the time and  December generally is the peak season for toys. Mattel stock also made me some money during the last quarter’s earning. I believe the ELMO sold-out during the 2006 Christmas period would help the earning figure when Mattel announce next Monday. However this round I plan to join the crowd of out-of-money Apr 2007 25 Call. If you noticed the $25 Strike for Feb, Mar and April, you’ll noticed this 25.00 Call were being bid-up with such a high volume. Interesting isn’t it? Maybe the crowds already knew something about Mattel.

December generally is the peak season for toys. Mattel stock also made me some money during the last quarter’s earning. I believe the ELMO sold-out during the 2006 Christmas period would help the earning figure when Mattel announce next Monday. However this round I plan to join the crowd of out-of-money Apr 2007 25 Call. If you noticed the $25 Strike for Feb, Mar and April, you’ll noticed this 25.00 Call were being bid-up with such a high volume. Interesting isn’t it? Maybe the crowds already knew something about Mattel.

Elmo was so popular that it was being offered for sale on eBay (Nasdaq : EBAY. stock) for as much as $93.99, more than twice the toy's $39.99 list price. Perhaps the new T.M.X. Elmo will laughs, slaps its knee, and rolls around on the floor next Monday with a set of good result.

Other Articles That May Interest You ...

NYSE Teaming With TSE - BURSA Try To Follow?

"Over time it makes sense to have linkages with the Tokyo Stock Exchange...We are working at it," Thain told reporters on the fringes of the World Economic Forum annual meeting in Davos. He also said that fullintegration of NYSE and Euronext would take a year, and that the combined exchange was open to include other European bourses.

"Over time it makes sense to have linkages with the Tokyo Stock Exchange...We are working at it," Thain told reporters on the fringes of the World Economic Forum annual meeting in Davos. He also said that fullintegration of NYSE and Euronext would take a year, and that the combined exchange was open to include other European bourses.On the other hand, Bursa Malaysia (KLSE: BURSA, stock-code 1818) stock price jumped to above RM10.00 earlier this week when the speculation on Bursa taking up minority stakes in regional stock exchanges was on the air. Bursa chief executive officer, Yusli Mohamed Yusoff later confirmed the rumor but admitted the difficulty in doing so. Well, at least he understands that stock exchanges are regarded as national infrastructure and without strong justification, you can’t simply propose and hope the other parties will hand-over the stake to you. That's the mentality within Asia region at this moment, with the exception of Japan?

It’s the same way the government of Malaysia over-protect its’ own pets in terms of GLC (government-link-companies) such as Malaysian Airline System Berhad (KLSE: MAS, stock-code 3786) and Proton Holdings Berhad (KLSE: PROTON, stock-code 5304), Telekom Malaysia Berhad (KLSE: TM, stock-code 4863) and Tenaga Nasional Berhad (KLSE: TENAGA, stock-code 5347). Of course now that Proton is in deep trouble the government starts to open up the door for foreign acquisition. Khazanah Nasional Bhd is also reviewing the prescribed limit on foreign shareholding in GLCs in view of rising interest in Malaysian equities by foreign investors, echoed by TENAGA president and chief executive officer Datuk Seri Che Khalib Mohamad Noh during TENAGA’s earning announcement.

While the western countries (and certain Asia country such as Japan) have recognized the benefits of open market, most of ASEAN countries are still struggling trying to learn the basic-101 of open-market. It’s time to give these countries a wake-up call before they’re left in their own dinosaur-age thinking. I’ll not be surprise if Singapore be the next (the best candidate) to liberalize its’ equity market.

The Day Bear Rules The Stock Market

Investors were basicallynervous about corporate earnings growth, which is expected to slow in the fourth quarter, after more than four years of double-digit gains. For example,Microsoft Corp. (Nasdaq:MSFT, stock) fell 2.1 percent as investors sold the software maker's stock even before its quarterly earnings report. But the stock turned around (rose 1.8 percent to $31.00) after the close as the software maker posted quarterly earnings that topped Wall Street's estimates, driven by sales of database software and its Xbox 360 game console. Microsoft also raised its full-year profit target.

Investors were basicallynervous about corporate earnings growth, which is expected to slow in the fourth quarter, after more than four years of double-digit gains. For example,Microsoft Corp. (Nasdaq:MSFT, stock) fell 2.1 percent as investors sold the software maker's stock even before its quarterly earnings report. But the stock turned around (rose 1.8 percent to $31.00) after the close as the software maker posted quarterly earnings that topped Wall Street's estimates, driven by sales of database software and its Xbox 360 game console. Microsoft also raised its full-year profit target.I guess there’re too many bad news on one day. A report showed sales of existing homes took their biggest tumble in 17 years in 2006, and bond yields jumped to their highest level since August after a five-year Treasury note auction attracted only lukewarm interest. Higher bond yields can signal higher borrowing costs for companies - a trend that worries stock investors because higher rates can dampen corporate profits.

The blue-chip Dow average and the S&P 500 suffered their steepest one-day percentage declines since late November 2006. If you can’t remember that particular sell-off day, you can read it againhere which affect other stock markets the next day, including Malaysia stock market.

Bear Rules the Day - The Dow Jones industrial average dropped 119.21 points, or 0.94 percent, to end at 12,502.56. The Standard & Poor's 500 Index slid 16.23 points, or 1.13 percent, to finish at 1,423.90. The Nasdaq Composite Index fell 32.04 points, or 1.30 percent, to close at 2,434.24. If you look at the data-chart, Russell 2000, Semiconductor and Dow Transport also drop by one percentage. This is a sign of bear creating havoc to the market with sentiments changed over-night.

The point and figure data which map out the relationship between supply (created by sellers) and demand (created by buyers) at different price levels shows market is entering the“High Risk Area” of 70% level. At current level of 68%, index fund managers would start tightening stop loss points on all holdings and sell all laggards stocks (weak relative strength). Index fund investors’ strategy at this moment will be the switching from stock to call options to limit equity exposure.

The point and figure data which map out the relationship between supply (created by sellers) and demand (created by buyers) at different price levels shows market is entering the“High Risk Area” of 70% level. At current level of 68%, index fund managers would start tightening stop loss points on all holdings and sell all laggards stocks (weak relative strength). Index fund investors’ strategy at this moment will be the switching from stock to call options to limit equity exposure.Investor optimism soared to its highest level since 2004, reaching 103 for the month of January 2007. This is a jump of 13 points from last month’s level of 90 and only the fifth time the Index has been above 100 since December 2000. Generally investors began the New Year 2007 with a bullish outlook for the stock market. On the other hand investor sentiment continues to suggest that residential real estate market conditions continue to deteriorate with two in three investors believe so. With such a high optimism, there’s only one way to go when other market data shows bearish trend and that is – downwards.

The stock market needs good news to continue the bull-run – maybe an interest rate cut by our dear Ben Bernanke will do the trick.

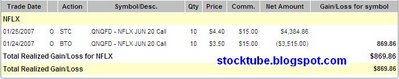

NFLX - Locked-In Profit After 1 Day Option Trading

is good with only 1 day trading, at least I’m happy.

is good with only 1 day trading, at least I’m happy.The whole bearish day could be due to Dow Jones and Nasdaq trading in the red-territory. I’m not sure yet but I might re-enter this stock again at a later stage during the day depending on the trend.

In the meantime, did you noticed how strong F5 Networks, Inc. (Nasdaq: FFIV, stock) made a U-turn from a loss of almost 3 points from yesterday closing to positive territory now. That’s what I called a good fundamental  stock – just because it gave a lower guidance, investors should not panic and dump it.

stock – just because it gave a lower guidance, investors should not panic and dump it.

QUALCOMM Inc. (Nasdaq:QCOM, stock) is still stubbornly refuse to run – it’s crawling instead but I have confidence with this stock.

Other Articles That May Interest You ...

Thursday, January 25, 2007

Will Illumina Continues Its' 45 Degree Uptrend?

Rating Indicators for ILMN:

- StockScouter rating : 7 / 10

- Whisper Number for this stock : NA S

- Schaeffer Rating for this stock : 7 / 10

- Power Rating : 4 / 10

- Insider Trading (last 52 weeks) : ($16.35M)

- Zacks Analysts Rating: Hold

- Option Trading: Jun 2007 40 Call

- Implied Volatility (IV) for Mar 2007 $40 Strike : 50.83%

Sales, Income & Growth - For the past 12-months, Illumina registered $147 million sales from the industry’s $6.2 billion. Income amounted to $23.15 million from the industry’s $1.29 billion. The company’s one-year sales growth is at 145.90% against industry’s 91.70%.

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 15.7% against industry’s -1273%. Illumina does not have and debt compare to industry’s debt/equity ratio of 0.32.

Resistance & Support Level – The resistance for this stock is at $45.87 (52-week high) while the first level support is at $39.70 (50-day moving average).

Risks – Current P/E (price to earnings multiple) of 87.50 is rather high compare to industry. The relative strength is rather weak at 24 for the last 3 months.

However this stock has beaten earning estimates for the last three quarters and should it do the same this time, it should gap-up again just like the previous quarter when I made some decent money from it. In the meantime I'm still researching Caterpillar Inc. (NYSE: CAT, stock) which will announce its' earning the same today as Illumina - tomorrow before market open.

Other Articles That May Interest You ...

Could Property Stocks Take Off In A Bigger Wave?

Focusing on the property sector, stocks with exposure to retail such as KLCC Property,KrisAssets Holdings Berhad (KLSE: KASSETS, stock-code 6653),Starhill REIT (KLSE: STAREIT, stock-code 5109) and Hektar REIT (KLSE:HEKTAR, stock-code 5121) will definitely see improvement in its’ earning. On the other hand Genting Berhad (KLSE: GENTING, stock-code 3182), Resorts World (KLSE:RESORTS, stock-code 4715),Sunway City (KLSE: SUNCITY, stock-code 6289) and Pulai Springs (KLSE: PSPRING, stock-code 5059) would likely enjoy better earnings from higher hotel occupancy rates.

(KLSE: KASSETS, stock-code 6653),Starhill REIT (KLSE: STAREIT, stock-code 5109) and Hektar REIT (KLSE:HEKTAR, stock-code 5121) will definitely see improvement in its’ earning. On the other hand Genting Berhad (KLSE: GENTING, stock-code 3182), Resorts World (KLSE:RESORTS, stock-code 4715),Sunway City (KLSE: SUNCITY, stock-code 6289) and Pulai Springs (KLSE: PSPRING, stock-code 5059) would likely enjoy better earnings from higher hotel occupancy rates.

Earlier, UBS (NYSE: UBS, stock) Investment Research has raised its target price for IGB Corp Bhd (KLSE: IGB, stock-code 1597) a nd KLCC Property Holdings Bhd (KLSE: KLCCP, stock-code 5089) on expectation that the developers will benefit from robust office rents and strong tourist arrivals this year. IGB, operator of Mid Valley City which comprises office, retail and hotel offerings, had its target price lifted to RM2.50 from RM1.96.

nd KLCC Property Holdings Bhd (KLSE: KLCCP, stock-code 5089) on expectation that the developers will benefit from robust office rents and strong tourist arrivals this year. IGB, operator of Mid Valley City which comprises office, retail and hotel offerings, had its target price lifted to RM2.50 from RM1.96.