Thursday, December 06, 2007

Breakfast in KL and lunch in Singapore

The Channel Tunnel was perhaps the most ambitious, controversial and complex project ever taken by mankind as far as rail transportation is concern. The challenge was in linking two nations separated by sea – beneath English Channel. The Channel Tunnel which is also known as Eurotunnel is the second-longest rail tunnel in the world, with the Seikan Tunnel in Japan being longer, but the undersea section of the Channel Tunnel, at 37.9 km (23.55 miles), is the longest undersea tunnel in the world.

It was reported that the tunnel cost nearly 6 times more than expected to build and debts were around £6.2billion and after several false starts it was finally completed in 1994, linking London with Paris and Brussels. A journey through the tunnel lasts about 20 minutes with the Eurostar trains travel at 160 km/h even although their maximum speed was 300 km/h. The same technology in tunnelling the undersea was used by Malaysian’s SMART project.

Taking the cue from the London-Paris Eurostar which had increased the land and properties’ value in the cities, Francis Yeoh is betting (or justifying) that the same proposal could create the same impact. He further mentioned that the 700 percent difference in property value between Singapore and Kuala Lumpur could be reduced to 260 percent of which will translate to RM5 billion in property values.

Property appreciation aside, it would be wonderful to think of the prospect of able to travel by bullet train from KL to Singapore within a short time-span. Shopping at Singapore anyone?

The Stock Market wants 50 basis points cut

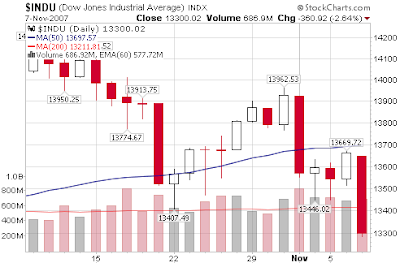

Wall Street rally Wednesday with Dow Jones jumped almost 200 points after new data showed the overall economy is holding up but isn't too strong to prevent the Federal Reserve from cutting interest rates. ADP Employer Services said 189,000 jobs were added during the month - an increase that bodes well for consumer spending. The report raised hopes for a strong November jobs report from the Labor Department on Friday.

Some investors are even bold enough in betting the Fed will go beyond the generally anticipated quarter percentage point cut and lower rates by a half point. The market is currently pricing in a rate cut next week. Supporting the case for a cut is that central banks globally seem to be open to the idea, a trend that would give the Fed even more room to move - reported AP.

Meanwhile the Bush administration has hammered out an agreement to freeze interest rates for certain subprime mortgages for five years to combat a soaring tide of foreclosures. The plan would apply to borrowers with loans made at the start of 2005 through July 30 of this year with rates that are scheduled to rise between Jan. 1, 2008, and July 31, 2010. It is aimed at homeowners who are making payments on time at lower introductory mortgage rates but cannot afford a higher adjusted rate.

The administration plan is designed to deal with the crisis by letting subprime borrowers who are living in their homes and are current on their payments to avoid a costly reset for five years. The hope is that by that time the housing downturn will have stabilized. Under the typical subprime loan those offered to borrowers with spotty credit histories - the rates for the first two years were at levels around 7 percent to 8 percent. But after two years, those rates were scheduled to reset to levels around 9 percent to 11 percent. Let's hope all ends well.

Wednesday, December 05, 2007

A creative jail sentence for Insider Traders

You’ve heard how insider traders were punished in U.S. but this news israther amusing. A former financial analyst at Morgan Stanley (NYSE:MS, stock) and her husband were each sentenced yesterday to a year and half in prison for insider trading. The husband, Ruben Chen was a former hedge analyst at ING. Ruben and his wife, Jennifer Wang, would have to serve the combination three years in prison but it appears the Judge Colleen McMahon of United States District Court in Manhattan has other idea.

Judge Colleen decided that the husband and wife should serve their sentences one after the other so their infant son would have one parent with him for the three years. Jennifer’s plea not to serve the jail sentence justifying she needs to be with her son was rejected as the judge said she would not let Ruben “take the fall for both.”

“Ms. Wang, you are not less culpable. You are more culpable. You are the thief …You have done this to your son” Judge McMahon said. Federal prosecutors accused them of trading based on nonpublic information material that Jennifer obtained from Morgan Stanley, gaining more than $600,000.

However the judge sentenced them so that Jennifer would report to prison after Ruben was released and their son had turned 2. A nice and flexible proposition isn’t it?

Other Articles That May Interest You …

Tuesday, December 04, 2007

Tong Herr Stock, hidden Gems within bolts & nuts?

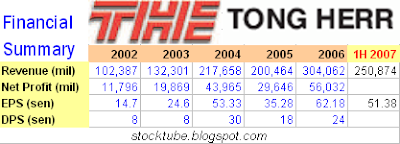

One of StockTube’s readers was curious as to why low-PE stock such as Tong Herr Resources Berhad was bleeding profusely, stock price wise. Is Tong Herr a fundamental stock? Based on its past financial statements Tong Herr is definitely a sound company with sustainable profits, not to mention great EPS (earnings per share) and DPS (dividend per share). The company is the largest manufacturer and exporter of stainless steel fasteners and almost 95 percent of its products are exported overseas.

The Penang-based Tong Herr operates via its subsidiaries - Tong Heer Fasteners Co. Sdn. Bhd. (100% owned) and Tong Heer Fasteners (Thailand) Co., Ltd. (50.01% owned) are engaged in the manufacture and sale of stainless steel fasteners, including nuts, bolts, screws and all other threaded items. As with any company in the manufacturing field the cost of raw materials and the selling prices determines the profit or loss of the business - hence the setting up of the plant in Thailand.

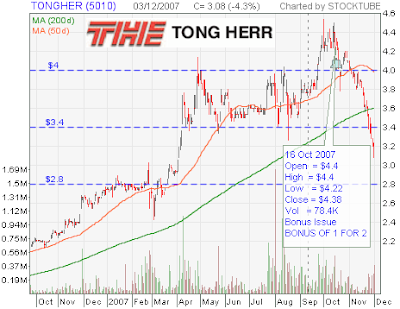

The fall of Tong Herr

Tong Herr Resources Bhd’s (KLSE: stock-code 5010) net profit for the third quarter ended Sept 30, 2007 fell 26.5% to RM15.23 million from RM20.71 million in 2006. Although the company announced its revenue surged 57.7% to RM139.11 million from RM88.22 million in 3QFY06, the stock was punished the moment it said theearnings per share (eps) fell to 11.95 sen from 16.26 sen in 2006.

- lower demand of its product

- higher cost of raw materials purchased

- lower selling price of goods during the quarter

Investors do not like weaker expectation in terms of earning and will not hesitate to sell upon the sight of such weaknesses, the same way U.S. stocks are being assessed.

FTA the answer to better earnings

Tong Herr has definitely taken the wise step in shifting part of its manufacturing into Thailand (in May) due to import duty issue. All the manufacturing companies have (or plan to) no other choice but to find alternative countries that have preferential tariffs with the U.S. This is one of the reasons why Malaysian government is favoring FTA with U.S. albeit other issues such as NEP which is preventing a speedier execution.

Consider this – Tong Herr has to pay import duty of 8.6% in the U.S. for stainless steel screws and bolts exported from Malaysia since the country lacks the FTA with U.S. However there’s no duty for exports from Thailand to U.S. for the same products.

Should you consider Tong Herr in your portfolio?

The stock has been on the plunge since the bonus issue of 2 for 1 on 16th Oct 2007. Interestingly there were insider sellings by the Tsai shareholders. If you’re trading U.S. stocks or option such selling could weaken the investors’ sentiments and the same reason applied here. The target price lowered by some investment banks or research institution did not help either.

Nevertheless the low P/E ratio is definitely the main bullet that you should consider for this stock. Assuming the full financial year 2007 will bring in the same earnings per share as of 2006 (62.18 sen) which should be achievable since the first half of 2007 already saw it registered 51.38 sen, the stock could be a steal at a P/E of 5.3 multiple only based on today’s closing price of RM3.30 a share.

Nevertheless the low P/E ratio is definitely the main bullet that you should consider for this stock. Assuming the full financial year 2007 will bring in the same earnings per share as of 2006 (62.18 sen) which should be achievable since the first half of 2007 already saw it registered 51.38 sen, the stock could be a steal at a P/E of 5.3 multiple only based on today’s closing price of RM3.30 a share.Is Tong Herr stock price expensive? If you take its competitors Chin Well Holdings Berhad and Techfast Holding Berhad (KLSE: TECFAST, stock-code 0084) which are trading at multiple of 21 and 10 respectively into consideration, Tong Herr could be one of the hidden gems available. However the timing of entry is of paramount important and you should buy in stages with lots of patience.

The World of MergeCraft games in the making

Computer gamers out there should know who’s Blizzard Entertainment. No? Then games such as “World of Warcraft” and “Diablo” might ring the bell. Of all the games I’d played my favorite was easily Diablo II - thereafter you saw some other games built within the same story-line or concept as Diablo. It appears the corporate M&A has hit the gaming sector with the latest announcement that Vivendi SA is set to acquire a controlling stake in Activision Inc. and combine the company with Vivendi Games in a deal that would create arival to Electronic Arts Inc. as the world's largest video game publisher.

French conglomerate Vivendi would pay $27.50 a share and make cash infusion of $1.7 billion to acquire a 52 percent stake in Activision Inc. (Nasdaq: ATVI,stock), valuing the combined company at $18.9 billion. Vivendi will then fold its game operations into those of Activision in the new company. Vivendi's Irvine, California-based Blizzard Entertainment is behind the top multiplayer online role-playing game franchise, "World of Warcraft." which the company says more than 9.3 million subscribers worldwide. Activision Blizzard will continue to operate as a public company traded on the Nasdaq Stock Market under the ticker ATVI.

Sales at Activision rose to $1.5 billion in 2007, a 74 percent jump from 2003. In the same period, Electronic Arts’ revenue rose 25 percent, to $3.1 billion. Vivendi and Activision estimated their combined revenue for 2007 at $3.8 billion.

Robert A. Kotick, the chief executive of Activision will retain his position atop the combined company while Bruce Hack, chief executive of Vivendi Games, will become vice chairman and chief corporate officer.

Sunday, December 02, 2007

Billionaire Li’s latest $60M bet on Facebook

To Hong Kong billionaire Li Ka-shing 60 million dollars are just loose change. Considering his fortune was estimated to be worth 23 billions and the ninth richest person in the world by Forbes, 60 million dollars toy would not looks excessive. The tycoon could probably talk days and nights when come to topic of property investing but unlike Warren Buffett who walked away from technology stocks during dot com boom, billionaire Li’s latest bet could turns out to become the future jackpot.

Following Microsoft Corp.’s (Nasdaq: MSFT, stock) step in recognizing the potential in social networking websites in Facebook, it appears Li has somehow saw the potential in pouring 60 million dollars with a right to acquire another 60 million dollars stake in the US-based company which has about 5 million members around the world and is registering 250,000 new users daily. Microsoft had bought 240 million dollars stake in a deal that instantly valuing Facebook at 15 billion dollars back in Oct 2007.

Facebook, according to sources, is still planning on raising more investment dollars, although some once-hot prospects, such as Providence Equity Partners, have dropped out due to the onerous terms Facebook has demanded from investors. Providence was put off by the lack of downside protection and also the fact that a major investment in Facebook would not get them a seat on the board of the start-up. Neither Microsoft nor Li will get a Facebook board seat though.

Other Articles That May Interest You …

Where to search for Web Hosting Choices

Your personal web hosting normally comes into mind whenever you’ve decided to host your own domain name. Most bloggers would not jump into real blogosphere by having their own domain name plus the hosting server as they won’t know if blogging is what they’re looking for. Hence free blogging via free platform such as blogspot and wordpress would be their test-bed, until they could see some successes.

Assuming somehow you wish to host your own domain. Which hosting companies would you choose? There’re tons of web hosting companies out there on the net. WebHostingChoice is a web hosting directory that contains a list of such web hosting companies that provides information such as disk space, bandwidth, monthly hosting cost and the setup fee. You can also choose specific features preferred such as Unix, PHP, MySQL, Phython, type of support and others.

Besides provide useful information on web hosting choice, please remember to read the part about the web hosting scam. For people who wish to customize their specific requirement, the advanced web hosting search allows you to pick the plan details and features to fit your bill. This advanced search which is brought to youby Web Hosting Choice is a handy tool for people who’s looking for hosting their domain.

Suddenly PM Badawi and Samy are super awake

Someone who tried to please Malaysian PM Abdullah Badawi said recently that the PM was perhaps the nicest and bestest premier as he has not used the draconian Internal Security Act (ISA) and the people should appreciate it. Not many months later the PM threaten to use the ISA in the wake of the rally organized by Hindraf which gained fame when it filed the $4 trillion lawsuit against the British Government in London.

Already on the brink of receiving the award for being the “Father of Rallies” in the history of Malaysia since Independence, Badawi who was labeled as sleepy-head due to the claims that he almost goes into auto-sleeping-mode during most of the official meetings is actually at the center of crisis. Maybe the word crisis is a bit exaggerated because the current ruling government could never be replaced with the bias delineation exercise that almost give the ruling parties 4 seats vs oppositions’ 1 seat for the same number of voters. But at least the PM is awake – temporarily. Abdullah Badawi said yesterday that he was aware of complaints about “what is happening to the economy”. He tried to crack a joke that he actually has “big ears” but maybe you should take that with a pinch of salt as whatever entered his left ear could be leaving the other end of the ear as fast as you can blink your eyes. Does this simply mean the local businessmen are unhappy with the way he administer the country’s economy?

Abdullah Badawi said yesterday that he was aware of complaints about “what is happening to the economy”. He tried to crack a joke that he actually has “big ears” but maybe you should take that with a pinch of salt as whatever entered his left ear could be leaving the other end of the ear as fast as you can blink your eyes. Does this simply mean the local businessmen are unhappy with the way he administer the country’s economy?

Strangely while the government officials immediately jump into denial syndrome again saying it was not true that the Malaysian Indian has been marginalized, the same government via MIC (Malaysian Indian Congress) will setup a hotline to “entertain” all problems faced by the Indian community. Wow! Since when a “hotline” is a magic bullet that can solve a community’s poverty, not to mention oppression and suppression, problem? Maybe the country could earn foreign currencies by exporting such know-how to African countries.

To add to the stupidity, Samy Vellu (president of MIC) proudly said that the PM had also asked MIC to set up a special committee to analyse and address socio-economic problems faced by the Indian community. Wait a minute; didn’t the government deny there was any problem with the Malaysian Indian earlier? So why set up a special committee if it was true that Hindraf’s claims were false in the first place? Having fun watching and reading the government shooting their own foots huh?

While the Malaysian Indian make up 8 per cent of the population, their share of the economy is just 1.5 per cent today and little changed from the 1 per cent in the 1970s, thanks to the MIC under the leadership of Samy Vellu. No wonder MIC as a party was not longer relevant since ages ago as can be seen when the ruling party UMNO didn’t give the Indian community the respect when it scheduled its’ AGM right in the middle of Deepavali’s festival recently.

The Hindraf ‘s rally has even courted the attention of India when Tamil Nadu Chief Minister M. Karunanidhi had written to Indian Prime Minister Manmohan Singh urging him to take immediate and appropriate action to end the “sufferings and bad treatment” of Tamils in Malaysia. Spotting the opportunity to become hero, Minister in the Prime Minister’s Department Nazri Aziz immediately issued a stern warning to Karunanidhi to stay out of the controversy and said he won’t apologize for calling those who participated in the Hindraf rally on Sunday “penyangak” (thugs).Assuming India shouldn’t even whisper the issue in the name of “no interference in other countries” then maybe Malaysia should back off from championing Palestine’s problem after all.

It won’t do any good if the PM Badawi keep on trumpeting that he has big ears and listening but never take any concreate action(s) to work around the issue. You can only push people to certain degree and when they hit the wall of no return, they’ll“let you know”. The worst thing is you’ve a PM who has no idea what to do in such scenario except to give some marketing talks hoping the issue will disappears when he wakes up the next morning.

Other Articles That May Interest You …

Friday, November 30, 2007

Stocks Investing - don’t run naked with the crowds

StockTube had said previously that investors shouldn’t run naked but take their own sweet time to put on their clothes so that nobody could call you cuckoo. Speculators or gamblers on the other side ran helter skelter and unfortunately investors whose emotion were put to test decided to join in the crowd, most of them ultimately. For decades, the same emotion runs wild and didn’t change; perhaps it will never change as long as human is trading the stock markets.

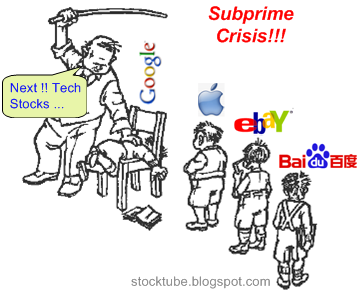

Yeah, easier said than done – who would know what will happen next? A bird in hand is worth two in the bush and so instead of normal selling it became panic selling when the Dow Jones decided to take the bungee-jump recently. The reason for selling was quite silly though – because of the old sub-prime old problem but if this known reason was used to even infect technology-stocks, then something must be terribly wrong. Investors couldn’t invest rationally but emotional instead and that’s something you should be able to read.

The big boy’s plan works and Federal Reserve Chairman Ben Bernanke on Thursday hinted that another interest rate cut may be needed to bolster the economy. Fed policymakers will need to be "exceptionally alert and flexible," Bernanke said. Analysts said the Fed's next move on interest rates depends on the outcome of next week's employment report. If the report shows a weaker employment climate, that could seal a rate cut, economists said.

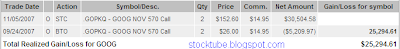

So, if you had taken some positions when the Dow hits just below the 13,000 points you might be smiling now. If you had believed in the business model of Google Inc. and thought it would be silly for the stock to plunge below $600 a share, you could be smiling as well. And if you had believed Apple Inc. would not simply collapse because of the over-trumpeted sub-prime issue, you’re part of the smiling crowds. But most importantly if you believed your stocks’ fundamental were simply awesome and decided to hold on instead of running naked, give yourself a pat on the back.

# TIP: Don’t always run naked with the crowds investing stocks or trading option. Think rationally of your own portfolio. The crowds are not always right and you’re not always wrong.

Other Articles That May Interest You ...

Thursday, November 29, 2007

Delayed Toll Hike – bait for voters before election

One of the most spectacular things you can find amongst the politicians in Malaysia is the way they talk faster (output) than what their brain machines could process (input). Most of the government controlled-media reported news that the Cabinet has agreed not to raise the toll charges at four main highways, including the North-South Expressway (PLUS), Prolintas for the Ampang-Hulu Klang Elevated Highway, Skim Penyuraian Trafik KL Barat (Sprint) and the Penang Bridge next year.

As a result, the government (or rather tax payers) will be paying RM242 million in compensation to the above four concessionaires. However, the toll charges for six other highways/expressways would be raised in accordance with the concession agreements; which include Seremban-Port Dickson, North-South Expressway Central Link, Kulim-Butterworth, Malaysia-Singapore Second Link, North Klang Valley, Johor Causeway and Bukit Kayu Hitam.

Analysts were quick to conclude (it wasn’t so hard to guess, was it?) that the“delayed” hike in toll charges was aimed at pleasing voters ahead of early elections especially after the PM Abdullah Badawi had tasted the medicine of inflation since his last unpopular 30 cents per liter petrol hike in Feb-2006. As usual the Works Minister who has been making fun and fool of the voters for the last 30 years was happily denied the link between the delayed toll hikes with the coming general election.

Many ignorant voters who voted blindly for the current administration might have no clue as to why the agreements were so biased towards the concessionaires that it was as good as presenting a blank check/cheque. Could you imagine concessionaires were allowed to increase the toll rates indefinitely – at least that’s what happens to PLUS expressway. But you can’t blame the politicians since you allowed them to milk you for the next 40 years. So continue taking the bait and let the government have a good laugh again. At least Reuters was smarter and knew that this is one of the election goodies.

Other Articles That May Interest You ..

Wednesday, November 28, 2007

Second attempt to delist E&O Property by the parent

One of my property stocks, Eastern and Oriental, has requested suspension on the shares trade of both the parent and its subsidiaries.Eastern & Oriental Berhad (KLSE: E&O, stock-code 3417) has signaled a major corporate transaction involving itself (parent) and its property arm,E & O Property Development Berhad (KLSE: E&OPROP, stock-code 3468).

It was reported that an announcement will be released later in the day on a a major corporate exercise, igniting speculation that Eastern & Oriental could be launching a buy-out bid for the property unit, which has a market value of around US$482 million. The last stock prices traded for Eastern & Oriental was RM2.40 while E & O Property was at RM2.45 a share.

Reuters reported that a spokeswoman for the parent company said it’s a “big corporate” announcement, without giving more details. Could the parent company, Eastern & Oriental trying to wrest and take the profitable property arm private again after failed to do so previously? For those who’re not aware of thepower of minority shareholders, let’s do a flashback.

On 5th May 2005 Eastern & Oriental served a notice of conditional voluntary offer to while E & O Property's board of directors when the KLCI was hovering at 900 points. The reason for the privatization - E & O Property’s shares traded was not reflective of its true value. But minority shareholders believed the management didn’t work hard enough to bring in values to the property arm. Furthermore the offer price of 65 sen a share was well below attractive level. Of course the picture of holding unlisted shares scared the shit out of many shareholders and lots of them accepted the offer.

In a twist to give the majority shareholders a taste of their own medicine, a group of 134 shareholders with 19.90 million shares voted against 20 other shareholders with 741.86 million shares for the Company’s delisting at E & O Property’s EGM on 12th Oct 2005. It was a victory for the minority shareholders, until today.

- swap 1,000 shares for 1,100 new Eastern & Oriental shares OR

- exchange 1,000 E&O Property shares for 715 new Eastern and Oriental shares plus RM875 cash.

For the first option, shareholders will ended up owning Eastern & Oriental shares worth RM2,640 based on closing price of $2.40 a share. The second option will give shareholders total values amounting to RM2,591. However assuming the stock prices of E&O Property goes up upon relisting from suspension, the offer might not be that attractive. Eastern & Oriental owned 63.8 percent of E&O Property Development as of July 2007 and it appears this round the parent company has a higher chance of delisting the property arm.

Other Articles That May Interest You ...

Tuesday, November 27, 2007

Compare prices for best deal this Christmas

Electronic Games such as Nintendo Wii, Xbox or Playstation are the favorites and hot-selling items during the year-end holiday Christmas. These are just a small portion of other holiday gifts which could sell-off before you can blink your eyes. Thanks to internet grabbing a piece of the items online proved to be a valuable alternative way. Best still you can do a price comparison to get the bargain you ever dreamt of.

Now, getting lower price has even reach a new level. You can tell SaveBuckets that the prices offered are not low enough and suggest your budget. Whenever the product(s) is available at your suggested price, they’ll email to alert you. However if the price has not fallen to your budget price after two weeks, you’ll be notified of the current lowest price. Hence the site actually does not sell products but act as a price comparison site to assists online shoppers.

Monday, November 26, 2007

Two Major Rallies within 1 month – great score for PM

Boy! You should see the face of the Malaysian Prime Minister Abdullah Badawi when he was giving his opinion about Sunday’s rally by thousands of minority Indians. After Hindraf (Hindu Rights Action Force) filed a $4 trillion lawsuit against the British Government in London, August 2007, it raised eyebrows because of the huge amount of money involved. Let’s face it, $4 trillion is a lot of money – not even the world’s richest man has that amount of money, yet. The amount was arrived when Hindraf was demanding $2 million in compensation for each Indian in Malaysia.

Besides the money Hindraf was also demanding a grant of British citizenship as an"opportunity to escape any future discrimination, marginalization, oppression and suppression by the Government of Malaysia" – reported KyodoNews. Hindraf claimed that the British government h

The Indian, like the Chinese, have begun challenging the continued implementation of an affirmative action policy that grants special privileges to Malays, including a greater admission quota to public universities and special access to government contracts. Over the 50 years since independence the three major races have been living in harmony – until now. There’re many reasons speculated as to why the Indian suddenly got “excited” and joined the rally.

Some said it was the underlying issues represent longstanding grievances among Malaysian Indians who possess neither the political clout of the majority Malays nor the economic strength of the Chinese who are the second largest ethnic group in Malaysia. There has also been deep anger generated among the Indians by the recent demolitions of dozens of Hindu temples. The Indians, who were mostly Tamils, are also unhappy over the dilapidated state of Tamil vernacular schools in the country.

Deputy Prime Minister Najib Abdul Razak on Saturday accused Hindraf of trying to incite racial hatred although the real intention was to press for a better treatment by the government. Badawi could easily be the weakest PM in the history as far as economy administration is concerned. People who are oppressed, suppressed and depressed are the people who will take to the street as can be seen in other parts of the world – regardless of how developed the nation is. MalaysiaKinireported about 30,000 protesters demonstrated under the shadows of Kuala Lumpur’s iconic Twin Towers after their efforts to petition the British High Commission was thwarted by the police with tear gas and chemical-laced water cannon.

If Samy Vellu couldn’t deliver given the 30-years in power, one cannot expect any more miracles from him, not that he has done any before. Of course if one intends to trace the root of the problem, one cannot run too far away from the former premier Mahathir’s policy of “Divide and Rule”. The NEP (New Economic Policy) has proven to be successful only in enriching cronies in power instead of broad-base wealth distribution amongst the Malay-ethnic. It’ll be interesting to see how Badawi will score for the coming general election.

Other Articles That May Interest You ...

Saturday, November 24, 2007

After MAGNUM’s privatization will BJTOTO follows?

The recent privatization announcement involving yet another sector, number forecast operator (NFO), has created some excitements since the stock market took the plunge taking the cue from U.S. continuous sub-prime worries. Magnum Corp Berhad, the oldest NFO in Malaysia is set to be taken private by its largest shareholder Multi-Purpose Holdings Berhad (KLSE: MPHB, stock-code 3859) which holds about 55.54 percent in Magnum.

Under the proposed deal, MPHB together with private equity firm CVC Asia Pacific Ltd will form a special purpose vehicle (SPV) to take Magnum private at RM3.45 per share or RM4.9

While there’re three main 4D players or NFOs in the Malaysian market, Berjaya Sports Toto Berhad (KLSE: BJTOTO, stock-code 1562) has the most lotto games and outlets in the country while the other two players, Magnum Corp Bhd and Tanjong plc.only offer 4D games. Magnum which started operation in 1969 has followers since then and it was said that gamblers who bet their luck with Magnum has higher chances of striking, though it’s not proven. But old timers are mostly Magnum’s loyalist.

With Magnum set to be delisted from Kuala Lumpur Stock Exchange, logically the attention from investors would be diverted to BJTOTO. It would be interesting to see if Vincent Tan plans to adopt similar approach in taking his cash-cow private.

Other Articles That May Interest You ...

Friday, November 23, 2007

Asia’s downsizing waves from CA, finally

Mention CA (Computer Associates) and the next thing that comes to your mind is the co-founder Charles Wang. He was born in Shanghai, China, and moved to New York when he was eight years old. At the age of 31, Charles Wang started Computer Associates. But those were not what made him famous. What he was well-known for is the way he built the empire of CA. Those in the IT (information technology) field would know that the method Wang (as he’s often addressed) used was quite simple yet fast in building an empire – via takeovers.

Known as a heartless and ferocious person who applied draconian practices, Wang had over 50 (fifty) takeovers under his belt during his time as CEO of Computer Associates. He was notorious for forcing the employees of an acquired company to sign new employment contracts on-the-spot at a company meeting without prior warning – he/she who refused or wished to review the contracts were immediately fired. If you think Donald Trump was cruel during the Apprentice series, wait till you meet this monster.

In the sub-area of data protection, CA’s ARCserve Backup software competes directly with Veritas Backup software (now known as Symantec after it bought over Veritas). Although CA’s backup software is very much cheaper than the BMW-priced Veritas, CA somehow couldn’t kick Veritas out from the market. Today, Computer Associates has decided to downsize its operations in Asia, including Malaysia, but has spared Singapore for the time being as one of its regional centres.

Indonesian office has been closed while offices in the Philippines and Malaysia would be downsized. Rumors said CA, Inc. (NYSE: CA) offices in Taiwan, Thailand, Hong Kong and China would be the next target of downsizing. Meanwhile with more than 60 employees in Malaysia on the chopping board, you can’t blame the rumor that CA will eventually close down its office in the country. CA’s abruptly measure could be due to its changing business model from direct to partner-centric. The name mentioned to continue representing CA is Patimas Computers Berhad (KLSE: PATIMAS, stock-code 7042).

It’s time for American companies to accept the fact that you can’t simply replicate the direct-to-customer business model in U.S. to Asia’s countries. They need the local partners in order to bring in the sales. So many MNCs had tried and failed. Unless your products are retail-based and require minimum support such as Dell Inc.’s (Nasdaq: DELL, stock) model in selling PCs via internet, you can’t expect businesses to rely solely on the MNC’s support as 24x7 uptime would squeeze the MNC’s bandwidth.

Thursday, November 22, 2007

Stock Market has become extra emotional

Holiday mood is gaining momentum and judging by how the investors sold their equities, Thanksgiving will be another excuse for stock market to head south. In time of uncertainties coupled with long holiday it’s just too hard to convince investors to long. The 13,000 Dow’s mark is still a crucial point to note and as long as it couldn’t stabilize, you just can’t long, at least temporarily.

The stock market has been thrashing about recently as investors attempt to gauge how companies will fare amid a further slowdown in the U.S. housing market, a deterioration of credit and record oil prices that crested above $99 a barrel ahead of Wednesday's session. Stocks have fallen in eight of the 11 last sessions including Wednesday’s 200 points slide.

The Conference Board suggested an economic slowdown could accelerate in the coming months amid rising costs and further weakness in the housing market. On the other hand the Reuters / University of Michigan consumer sentiment survey showed its lowest reading in two years - an unwelcome development for retailers entering what is for many the most important period of the year. The Commerce Department said jobless claims fell by 11,000 last week, a positive sign for U.S. employment.

There’s only one word to describe the current stock market – it is so emotional.

Tuesday, November 20, 2007

VW-Proton talks ended, sensitive issue during Election

Just when everyone thought struggling Malaysian carmaker would ink the deal with foreign partner Volkswagen, the bleeding Proton Holdings Bhd (KLSE: PROTON, stock-code 5304) suddenly call off the negotiation.Although this was the second time in two years that VW-Proton talks over cooperation have ended without a deal, VW said it still planned to build up a production base in Southeast Asia.

According to Reuters, Malaysia announced on Tuesday that it would no longer look for a foreign partner for the ailing Proton for now and added that state investment firm Khazanah Nasional had stopped its talks with both Volkswagen and U.S. rival General Motors Corp. (NYSE: GM, stock).

Reuters further reported that the loss-making Proton, set up in 1983 by then Prime Minister Mahathir Mohamad, was for a long time state-protected due to policies aimed at giving extra business and employment opportunities to the country's majority ethnic Malays. At one point, it sold more than half of all new cars in Malaysia. But since barriers to competition started coming down, it has lost market share to international rivals and even to domestic carmaker Perodua.

In a statement VW said "Volkswagen will now independently examine other possibilities to enter the ASEAN market and further strengthen its sales operations in the region including Malaysia." Actually besides Malaysia, the nearest location that Germany's Volkswagen (FRA: VOW) could try its luck isThailand.

Malaysian Second Finance Minister Mohamed Yakcop said rising domestic sales and exports should help tide Proton over its current difficulties. An industry source said the government's sudden change of heart could be due to factors such as a fear of ceding management control of Proton to Volkswagen and intense lobbying by Proton rivals who fear VW could flood the market with VW cars.

So, just wait for the general election to past and you’ll get the official announcement before you can even blink your eyes. But isn’t VW wasting too much time playing to the tune of Malaysian government? Probably they could just setup their own plant in Thailand and start the production lines.

Other Articles That May Interest You ...

Bear is leading but Bull is trying very hard indeed

When one of the top 10 stocks that moves the index of Dow Jones was being downgraded or kept being flushed into toilet with not-so-good news, you can expect the overall stock markets to be volatile. Coupled with bearish sentiments, you just can’t beat the bear no matter how slow it moves around. This is not the time to play Call Options especially the stocks which are due to announce its earnings. Yous stocks might announce flying color results but it won’t last.

Instead if you’re damn sure a particular stock’s earning is doomed your chances of making money playing Put Option could have multiply by now. Chances are great that the stocks which you do not have much confidence in the first place could potentially make you tons of money since it’s swimming along the course. Goldman Sachs downgrade Citigroup Inc. by betting the bank would have to write down $15 billion due to its exposure to risky debt over the next two quarters.

Stocks have fallen in six of the last eight sessions and it appears the trend will continue. At one point, Dow plunges to minus 200 points, well below the psychological 13,000 points. Hence it’s important to watch this level as bull and bear are at the opposite sites waving at you. No matter what, the Asian stocks will definitely say hello to the bear when stocks markets open its trading on Tuesday tomorrow. At time such as this, sometimes you just got to stay neutral and wait for a clearer signal, or try to scalp some Put positions if your favorite stocks demonstrate such opportunities.

Sunday, November 18, 2007

The King’s Consent Untold Story – watch 24 series

One week after the largest rallies since 1998 all the print-media reported that Malaysian King (Yang di-Pertuan Agong Tuanku Mizan Zainal Abidin) has expressed displeasure over claims that he and the Palace approved and supported Saturday’s illegal rally in the city. Tuanku Mizan also stressed that he and Istana Negara (Palace) had at no time approved or given any support – directly or indirectly – to any quarters which organised or were involved in the illegal assembly or any other activities that contravened the law.

Due to protocol, the statement was issued by Datuk Pengelola Bijaya Diraja of Istana Negara (Royal Household) Datuk Wan Mohd Safiain Wan Hasan on behalf of Agong and not directly from the King himself. Since all the print-media are government-controlled, the front-paged news indeed gave a slap to the participants who gathered and rallied all the way braving the rains to the Palace to handle the memorandum to the King. It was claimed that The Agong did not say no to 100,000 citizens who wish to seek for an audience with His Majesty – the King wanted to know how many people will be representing the 100,000 rakyat and the names of the representatives.

So if the article was correct, does that mean the King being the Commander-in-Chief actually save the day with the police who received earlier endorsement from PM actually backed-off? But why the statement from the Palace (seven days later) denied the King actually gave the consent to the rallies? According to Malaysia-today the answer could be more interesting than you thought. It seems Wan Mohd Safiain is not the official spokesman of the King – the rightful person should be the Keeper of the Royal Seal. Malaysia-today’s theory was that it was actually a plan to send the Prime Minister and the King into conflict.

Malaysia-today even went to the extent of exposing that Malaysia’s intelligence agency miraculously reported the participants from the previous rally amounted to138,000 people. The number was exaggerated in hoping the Prime Minister will panic and start making silly decisions which could accelerate his own downfall. Deputy Prime Minister Najib already said the government hopes to avoid using ISA, although such action will be the most unpopular but could only issued by the Prime Minister who holds the powerful portfolio as Minister of Internal Security.

As usual Malaysian politic never fails to amuse me. The plots and story-lines are far much better than watching the highly explosive Emmy and Golden Globe award-winning American television series 24, except that you can’t find hero Jack Bauer in Malaysia. So far I believe the best season would be 24 Season 5 – how do you bring down the evil President of the United States?

As usual Malaysian politic never fails to amuse me. The plots and story-lines are far much better than watching the highly explosive Emmy and Golden Globe award-winning American television series 24, except that you can’t find hero Jack Bauer in Malaysia. So far I believe the best season would be 24 Season 5 – how do you bring down the evil President of the United States?The story (24 Season 5) might makes sense in the country that practices transparency and separation of powers, well maybe not 100% but at least there’re clear and written procedures on how to force the President to step down. Also in U.S. it’s rather difficult to have 90% of the House of Representatives (lower house) and Senate (upper house) members corrupted to the stage of rubber-stamping all the President’s wishes. If Malaysian Politic’s plots could be incorporated into the series it would definitely wins more awards. Malaysia needs Jack Bauer.

Other Articles That May Interest You ..

Saturday, November 17, 2007

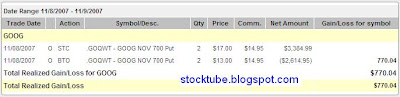

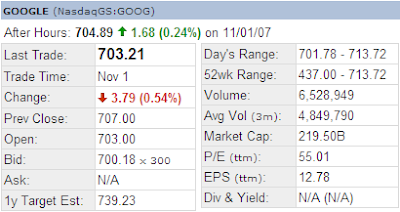

Take remaining profit from GOOG on expiration Friday

Today is the Friday expiration and options for the month of November will expire after the trading bell. My plan to breach my earlier 486 percent profit record evaporated into this air. Hence I’ve no other choice but totake whatever remaining profit left. And guess what, just after I’ve locked the profit, the trend reversed. Yeah, I know I’ve lost thousands of profit because of my plan but seriously I believed Google Inc. could touch the $800 level and I still believe it can. Maybe the Nasdaq Composite needs some rest or rather the technology stocks need to take a coffee break, so much so the moment it spotted an excuse to do so, it dropped like a rock.

Any regret? Well, the potential profit was good but if I didn’t challenge myself I wouldn’t know if I could make it. Trading is all about pushing yourself to the limit, at least that’s what I believe. This round is also a good exercise to test my emotion. Of course along the way, I made some tiny profits scalping Google with Put Option. So in a way there were consolation prizes. But it's part of the journey.

Other Articles That May Interest You ...

Friday, November 16, 2007

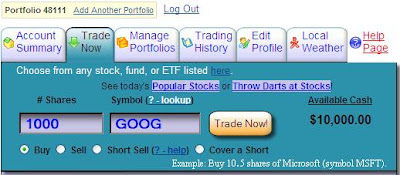

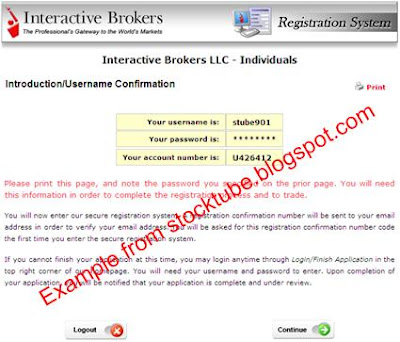

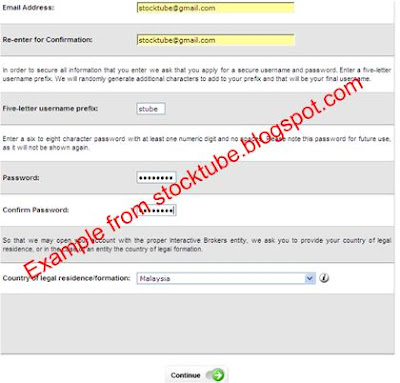

Paper trade virtually before you trade real money

The closest you can go to gauge whether you’re ready to take the plunge into the pool of real stocks investing or trading is through virtual trading. Call it virtual trade, paper trading, virtual compete or whatever you want but the basic reason is still the same – to prepare yourself what the stocks investing is all about. However one thing that paper trading cannot equip you is the fact that the actual emotion of “fear and greed” are not there. You’re trading virtual money (the same way you’re playing monopoly) and hence the decision to buy or sell stocks might differ from the real stocks trading.

Nevertheless it’s still a good tool especially if this is the first time you’re trying to trade the largest stocks exchange in the global equity markets – the Wall Street.HowTheMarketWorks – the subject of this paid request – is one of the websites that provide the free Virtual Stock Exchange platform for newbies. It only requires your first-name, email and password to sign-up. You can setup up to 3 portfolios to trade virtually. Starting with $10,000 as your initial investment fund, you can increase your wealth (virtually) to $500,000. To make it easier and fun to learn, the website provide the basic ingredients required such as stock quotes, stock charts, symbol lookup, popular stocks (long and short-sell) and even “Throw Stock Darts”.

Having said so, the website provides the basic functionalities which can benefits lots of first-timers who would like to get their hands dirty in trading U.S. stocks but are not willing to put their hard-earned money into the trading floor yet. Not much complaint from me since it’s simple, easy, fun and free.

Take money off the table after 1-day of GOOG’s trade

Iwasn’t sure if I did the right thing yesterday when I opened a position with the intention to scalp Google Inc. The stock was floating within the range of $660 and $654 for more than 3 hours. Once it breached below $651, I knew the stock was heading south for the rest of the day and so I was relieved. Theinstability of Dow and Nasdaq as if they were constipating helped in my decision after the technical rebound on Tuesday, 13th Nov.

Today, I closed the position, GOOG Dec 660 Put Option after I sensed it was trying to breach the $648 level although at the time of writing it appears to be too weak a creature to push above that. It’s been on zig-zag trend almost the whole trading day – not a good sign to scalp again. Anyway tomorrow is expiration Friday and the volatility is going to be more fun.

Thursday, November 15, 2007

Bored with railroads, Warren found his new toy

Months after playing with his trains, world’s second riches man Warren Buffett somehow got bored with the toys. The Oracle of Omaha continues to sell Norfolk Southern Corp. (NYSE: NSC, stock), Union Pacific Corp. (NYSE: UNP, stock). His empire Berkshire Hathaway announced it has only 4.5 million shares of Union Pacific as of Sept. 30, down from the 7.4 million shares held on June 30. Berkshire also trimmed its shares in Norfolk Southern to 1.9 million shares as of Sept. 30 from the 3.8 million it owned as of June 30.

However one of his railroad toys, Burlington Northern Santa Fe Corporation (NYSE:BNI, stock) remains his favorite with his stake at 60.8 million shares, controlling 17.2 percent of the nation's second-largest railroad. Warren has found a new interest though, his new toy in used-car retailers. According to regulatory filing, Berkshire Hathaway (NYSE: BRK.A, stock) has bought nearly 14 million shares (6.4 percent stake) of Carmax Inc. (NYSE: KMX, stock), the nation's largest specialty used-car retailer.

Other Articles That May Interest You ...

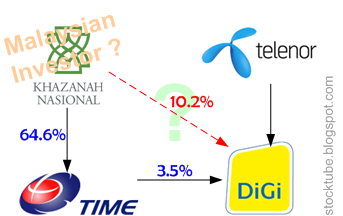

Telenor reduced stake to 49% in compliance

After announced it would give away RM700 million (in exchange for 10-year period of right for 3G license) to loss-making Time DotCom so that Time can nurse its wound, DIGI.com’s parent company, Norway's Telenor ASA (OSL: TEL) said it has made a gain of 2.6 bln nkr on the sale of a 10.2 percent stake in Malaysia's DiGi.com, which was carried out in order to comply with the maximum 49 pct equity ownership requirement of the Malaysian government applied to foreign investors.

Telenor sold 76.5 million shares in Malaysian operator DiGi in a book building exercise, representing the remaining shares to meet the 49 percent threshold, atRM 21.5 per share to Malaysian investors for a total of RM 1.61 billion – 8.9 percent discount over DIGI’s pre-suspension price of RM23.60 a share. Together with the the issuance of 27.5 million new ordinary DiGi shares for Time's 3G spectrum, Telenor will have a 49 percent ownership in DiGi.

If Telenor could sell the 10.2 percent stake (76.5 million shares) at the same price as per-suspension stock price, it could pocketed the cool RM200 million but guess you “need” to give discount for such a large block of shares.

Other Articles That May Interest You ...

Wednesday, November 14, 2007

Bail-Out with a piece of paper worth RM700 million

Malaysia never fails to amuse me when comes to corporate bail out. Not so long ago you have PKFZ scandal but the magic word “soft-loan”solved the controversy. And now, you’ve the white-knight DIGI.com saves the day by bailing out Time DotCom in disguise of an “alliance”. So now you know the “real reason” why Time DotCom Berhad (TIMECOM: stock-code 5031) was awarded the 3G license by the government despite bleeding profusely. You don’t really think Time DotCom has the capability to roll-out anything under the 3G, do you? If you still think so, please go back and research what happened to Time DotCom’s initial public offering (IPO) years ago.

It’s obvious that the auhorities knew the only way to bail-out Time and its major shareholders was to give it an Ace, not ordinary Ace but the Ace of Spades (which is 3G license). The authorities also knew in order to force the bailer to take the bait the sucker’s application for further extension for stake sell-down in compliance with the rules had to be rejected. Furthermore authorities knew the bailer will not throw in the towel and sell-off its 61 percent and start packing heading back to Norway – there’s still money to be made.

Bail-out becomes creative with “Alliance”

The sucker or bailer on the same time knew the autorities are pushing it against the wall. So what it needs to do is ensure it won’t be eaten up alive, at least put up some fights. Pushing the stock price to as high as possible would be the immediate weapon. With its sound management and quarter-on-quarter profits plus great dividend declaration, the task wasn’t that difficult. The bailer also knew sooner or later they’ve to take the Ace of Spades by the throat, at a hefty price (of RM700 million). Tell DIGI that it can wave the whopping $700 million and the unlisted pay-TV operator MITV Corp would have snap the offer even before Telenor can say “Any 3G license for sale?”

Time DotCom the clear winner

Beyond that DIGI might needs to apply for renewal, the same way you renew your road-tax. Short of daylight robbery, this is indeed one of the creative and ingenious ways to make money out of one’s own incapability to do so. The summary of benefits that Time DotCom will enjoy:

- DiGi issuing (giving away free) 27.5 million shares, equivalent

to 3.5% stake in the company, valued at RM654milor RM23.80 a share, to Time DotCom.

- DIGI would issue a guarantee to the Malaysian Communications and Multimedia Commission in place of Time DotCom unit TT dotCom’sguarantee of RM50mil.

- DIGI to share telecommunications towers with Time DotCom for the purpose of Time DotCom’s broadband service in the 2.5G spectrum band or WiMAX.

- DIGI will utilize (or lease?) Time DotCom’s idling fibre-option network at a contract value of between RM10 million to $15 million per annum

- DIGI will provides training to key Time DotCom personnels (so that the idiots can become smarter and able to understand the world of telephony services)

- Invitation to Time DotCom to take part in the placement of DiGi shares to comply with the equity stake sell-down; although it’s highly unlikey that Time DotCom as a company has the financial strength to do so.

Does DIGI have a choice?

Now, most of the analysts said it’s a win-win “partnership” justifying that the 3G is required if DIGI.com needs to achieve higher ARPU (average revenue per user). But DIGI’s Chief Executive Morten Lundal once said the company still has other options or alternatives besides 3G to further grow the company. Without 3G, DIGI might crawls but it will still be able to deliver the values to the shareholders, better still if it has the 3G license.

Nevertheless this still has not solves the deadline problem where DIGI is required to sell down from the current 61 percent (59 percent after the dilution) to 49 percent stake. Khazanah Nasional Berhad which has a 64.6% stake in Time DotCom is perhaps the only entity that has the financial resources to acquire the remaining shares from DIGI. It would be interesting to see if Khazanah is willing to pay in cash or push more bones into DIGI’s throat.

Maybe by giving the $700 million free coupon, it could prolong the life of DIGI.com and Telenor as a whole. Yes, DIGI.com sets to gain from the license but still to pay $700 million for the 10-year license is over-kill don’t you think? Morten Lundal most likely has done some cost-benefit justifications and could conclude that this is his only choice.

More cheap sales from DIGI’s placement?

To comply with rules and regulations, Telenor will sell its DiGi shares under a placement exercise to investors, in which Time DotCom is invited to bid. While Time DotCom obviously doesn’t have money to do so, its largest shareholder Khazanah has the capability. Not sure how transparent the auction will be butplease do not get too excited or flabbergasted if a lower bidder wins the deal at the end of the day. There’re still more developments to be announced from both parties, so stay tune.

Other Articles That May Interest You ...

Limit Order Triggered Scalp position on PCLN

This is not the first time but just get prepare for it because I’m going to curse myself again. Yeah, everyone did it because the stock market has the tendency to make a fool out of you when you least expect it. So please don’t try this at home because it’s not something healthy to do. Now here we go –If only I knew PCLN would goes up by a whopping $8.00 a share Tuesday, I would limit my selling price at higher level.

Sounds familiar huh? Well, get used to it as every traders will never be able to control their fear and greed. When you realized that you’ve sold at a lower price you scream. When you realized that you’ve bought at a higher price you scream again. Yes, I realized that I’ve sold my position in Priceline.com Incorporated(Nasdaq: PCLN, stock) which I scalped Tuesday a little bit too low. My only complaint was that I paid too much attention to Google Inc. simply because the trading pattern didn’t look good. I was afraid Google’s instability might pull down the Nasdaq Composite and the rest of its members.

Other Articles That May Interest You ...

Tuesday, November 13, 2007

Google is giving away US10 million to developers

All right, the technical rebound is finally here but it’s still too early to see if it can last but at least the 13,000 mark (DJIA) is putting some fights with the bear instead of letting it ripping off the skin of it. This week is the expiration week and as usual the volatility is building again. I like to wait till Friday to see if Google Inc. can erupts again. It appears Apple Inc. is taking the lead by jumping a whopping 7 percent as of 10:15 trading hour. Google meanwhile is crawling the same way like its founder, Sergey Brin.

Yeah, Sergey Brin could be so bored with his billions of U.S. dollar notes now that he doesn’t seem to have the fire or passion to work anymore. He even looks very sleepy when he announced that Google is giving away a whopping US$10 million to the developers who can come out with the best and coolest application for his new toy – the Android. I bet he just woke up.

US$10 million might be a lot to developers out there but it’s just loose change to Sergey Brin. Dropped US$10 million? Forget it, might as well get some sleep, says Brin.

Other Articles That May Interest You ...

Broom Award for the Information Minister please

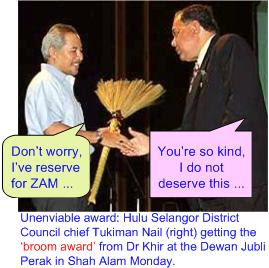

Do you know which news hit the “Most Viewed” of the day from theStar? It’s the “Broom Award” presented by Selangor Khir Toyo to two government agencies for failing to collect assessment above the 50% mark required for 2006. It might sound insulting but in fact it could probably be the most creative (or insulting) method in getting those fat-arse moving away from the comfort chair to become more productive.

The broom might only costs RM3.80 a piece but the values associated with it was high, so much so that certain agencies magically hit 97% in terms of revenue collection just to prevent from the embarrassment of getting it. Maybe the Malaysian government could take this newly found

If you think Foreign Minister Syed Albar was pathetic enough for the award, wait till you hear the quality shown by ZAM during the phone interview with Al-Jazeera on the day when Malaysia’s Biggest Rallies since 1998 – KL under siege. Apart from the denial syndrome, ZAM went a level ahead of everyone by single-handedly brought Al-Jazeera to “shame” and"speechless" when he lectured the Doha, Qatar-based television network about the real meaning of democracy.

Not only that, he probably surprised every Tom, Dick and Abdullah Badawi when he shown to the world how the highest level of English should be spoken. ZAM was a former journalist himself so he can’t be wrong, can he? Furthermore as the top man sitting on the important Information Ministryship, he is the most (and bestest) informed person of the nation and whenever he speaks, the country and even Al-Jazeera should listens.

Of course the Information Minister was right that whenever the country held the election without fail, that tantamount to fair and clean election, never mind that voters as old as 100+ years and as young as 8 years can cast their vote. Tell me which country in the world can be more democratic than this. Also the gathering was illegal because the organizer doesn’t have the police permit. In the true, virgin, first-version and highest level of democracy, any gathering of 5 or more persons is as good as illegal.

So, Al-Jazeera, CNN, BBC, Reuters, KyodoNews, ChinaDaily and all the foreign news providers out there better get the definition of democracy right or elseMalaysian

So, Al-Jazeera, CNN, BBC, Reuters, KyodoNews, ChinaDaily and all the foreign news providers out there better get the definition of democracy right or elseMalaysian Other Articles That May Interest You ...

Next on Middle East’s shopping list - MAHSING

After invading the territory of Putrajaya Perdana (KLSE: PPEDANA, stock-code 5117) and Loh & Loh Corp Berhad (KLSE: LOH&LOH, stock-code 7706), it appears the appetite from Middle Eastern is getting bigger and it was reported that a consortium from the oil-rich states is eyeing a strategic stake in property developer Mah Sing Group Berhad.

The shopping spree by Abu Dhabi and Kuwait investors is part of their quest to build the Middle East-Southeast Asia property value chain. Only this time their strategy might change in the sense of buying only strategic but not controllingstake as Mah Sing Group Berhad’s (KLSE: MAHSING, stock-code 8583) current boss, Datuk Seri Leong Hoy Kam, is unlikely to let go of his empire of which he owns the 40 per cent stake. The Middle Easten investors might have learnt (their lessons) from their earlier acquisitions into Putrajaya Perdana and Loh & Loh that buying major stakes to take control and triggering mandatory general offer (MGO) might not be the best approach. They still need someone who is well-versed with the business and the operation to drive the newly acquired company. It’s better not to rock the boat and maintain the status quo of the ability of the management in generating strong cash balances, low gearing, great earnings and continue to deliver values to shareholders.

The Middle Easten investors might have learnt (their lessons) from their earlier acquisitions into Putrajaya Perdana and Loh & Loh that buying major stakes to take control and triggering mandatory general offer (MGO) might not be the best approach. They still need someone who is well-versed with the business and the operation to drive the newly acquired company. It’s better not to rock the boat and maintain the status quo of the ability of the management in generating strong cash balances, low gearing, great earnings and continue to deliver values to shareholders.

Mah Sing which is trading at 9 times and 7 times multiple of its 2008 and 2009’s financial earnings is reported to be trading at 40 percent discount to its revised net asset value of RM2.86 as estimated by Macquarie Research. The company which has declared 40 percent of its net profit will be given back to shareholders in terms of dividends for financial year 2007 has also attracted other investment bankers.

Besides a “Buy” call, all the investment banks have almost the same target price - Deutsche Bank (target price of RM3.02), CIMB (target price of RM3.00), Aseambankers (target price of RM3.00) and SJ Securities (target price of RM3.15).

Other Articles That May Interest You ...

Monday, November 12, 2007

DIGI to Bail-Out Time DotCom via Share-Swap?

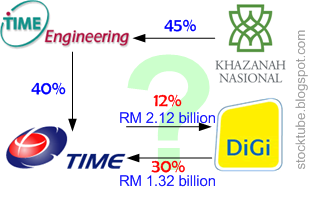

Both Telenor’s DIGI.com Berhad (DIGI : stock-code 6947) and loss-making Time DotCom Berhad (TIMECOM : stock-code 5031) were suspended from trading today, Monday, and rumors quickly spread again thatDIGI.com is buying into Time DotCom on a share-swap. The last trading price of DIGI.com was RM23.60 a share while Time DotCom’s stock price was RM0.87 per share before the suspension.

Based on the last stock prices, 1 share of DIGI.com would fetch about 27 shares of Time DotCom. Telenor which was given a year extension earlier must now cut its holdings to 49 per cent from 61 per cent currently by end of 2007. With floating shares of 750 million in the stock market, a 12 percent stake from the selldown to swap shares with Time DotCom would worth RM2.124 billion.

Time DotCom on the other hand has 2,530,775,000 floating shares worth a total RM2.201 billion. Hypothetically, let’s say Khazanah Nasional Bhd is willing to dig into its own deep pocket for RM2.124 billion for the 12 percent stake and inject it into Time DotCom. Assuming Khazanah is forcing its own direct 30% in Time DotCom to DIGI.com with a 50% premium of the last trading price. That would means DIGi.com needs to cough up RM991 million. Khazanah still owns 45% in Time Engineering which in turns own 40% in Time DotCom (not the latest figure).

Assuming again that somehow DIGI.com is required to pay 100% premium for Time DotCom, a 30% stake in the latter will cost RM1.32 billion and Khazanah needs to pay only RM804 million.

Other Articles That May Interest You ...

- Who’s the New Buyer for 12% stake in DIGI.com?

- What if Telenor refuse to sell-down DIGI.com?

- DIGI - If You Can't Beat Them, Suck the Coffer Dry

# Update (Tuesday 13th Nov 2007 15:02pm): Reuters reported that DiGi has agreed to form strategic and equity tie-ups with broadband telecommunications firm Time dotCom Bhd, allowing DiGi access to Time’s prized 3G spectrum. Time DotCom said it also received an offer from DiGi’s parent, Telenor, to buy a stake in DiGi via a share placement to help DiGi comply with Malaysian equity rules. Both companies have announced the alliance in statements to Bursa Malaysia today.

Bursa should get more mature, take the Quantum Leap

Nobody knows when the current temporary bearish sentiment will last. What we know is the U.S. sub-prime or housing bubble has burst and now is the time for financial companies to report the extent of the damages caused by it. Gauging from the initial reports, it seems the damage is quite serious but does not warrant the 1929 Great Depression. It’s already announced that the sub-prime problem might needs up to 2-years to recover. Fortunately China and India markets are still running at full speed and able toabsorb some damages – from America to South-East Asia’s countries.

And please remember that Federal Reserves Chairman still has the aces of the interest rate of which he can cut anytime if the situation requires him to. In fact he has too much room to move around that investors are whining with the intention to force Ben Bernanke to use it. Hence logically investors should not worry and instead should let Ben’s team do their work. It’s not like the economy is on the brink of collapse with the interest rate remaining at 0.5%.

If you ever noticed the Kuala Lumpur Composite

It’s true that if you’re speculating or trading with penny stocks, you don’t really need to worry about having sleepless nights because your shares will not drop any much further down the drain even with today’s plunge (KLCI was down 20.71 as of writing). Trading volume drops significantly with less than a billion shares traded, which is normal considering few people will try to catch a falling knife. It’s a boring trading day and the Bursa Malaysia should accept the fact that most of the volume traded prior was from the penny stocks.

Needless to say, stocks above RM3.00 to $4.00 affected the most everytime KLCI drops. On the interesting note, the foreign Call-Warrants are being pulled down together simply because their main shares on the foreign soils took the beating more severely.

Other Articles That May Interest You ...

Sunday, November 11, 2007

Payday Loan is getting easier and even free

Remember those days when the parents would be extra proud that their daughters found their other half working under the bank’s payroll? It was the moment to cherish simply because the job was said to be one of the safest of all. It was like striking a gold-mine and you can be sure your daughter will not die of starvation. Such was the power of job security. Today if you think you can find job security anywhere, you must have living under the coconut shell for a very long time.

People tend to stuck in financial difficulties more often than ever. While Asian’s been saving, American’s been spending. And it’s a wonderful to know despite continuous spending to the current deficit level, U.S. is still the biggest economy power-house that everyone needs to rely on. However, unless you command great pay and have good credit rating, chances are you belong to the majority middle to low level income citizens who might face cash shortage, every now and then.

It’s normal to face short-term cash problem and who do you approach urgently for help? Maybe your immediate family members or friends but not everyone can start the conversation of money borrowing with ease. There’s another way though which is cash advance loans. No, this is not something like those underground loan-sharks that can loan you hundreds of thousands of dollars but will not hesitate to harass you in 1001 ways to get back double or probably triple what you borrowed in the first place.

Just because you need money by tomorrow but somehow your payday isn’t available until next week does not mean you shouldn’t have the flexibility or option to get small loans amounting to $100, $200 or $300 fast and easy. Although the competition is tough, some providers such as National Payday is providing free payday loan or cash advance as long as you pay the full balance due on your due date. It’s fair to conclude that unless you’re really desperate and are sure you can pay back the loan amount within the time-frame, you should reconsider taking such loan unless you’re willing to pay 25% loan fee on the balance after the due date.

Dow and Nasdaq ready for technical rebound?

Almost every single human being on the trading floor at Wall Street ran helter skelter searching for shelter from the stocks plunge. This time (last Friday) it was Wachovia Corp. and Qualcomm Inc. with their loan losses and weak quarter respectively that continued the previous day’s panic selling started by Cisco System Inc. The selling accelerated in the final minutes of Friday and subsequently Dow Jones sank 223.55 points to 13,042.74 while the Nasdaq Composite dropped by 68.06 points to 2,627.94.

As usual, it doesn’t matter if the stock (in this case Qualcomm) beats Wall Street’s estimate earnings. It’s all about guidance. And when Qualcomm guides financial year-2008 EPS (earnings per share) below consensus - $2.03-2.09 vs. $2.19 consensus, it was punished. Great! If only these investors could maintain the momentum with the current continuous selling program, I believe some of us should start laughing all the way to the bank. Making money would be much easier with such trend by buying Put Option and for investors who’re holding stocks / shares you can sell option contracts which is out of money, wait for the option to expire worthless with Friday expiration around the corner.

By the way, I had opened new positions on both Tiffany and Co. and Priceline.com Inc. which I short (Put Option) and long (Call Option) respectively last Friday. When market open for Monday trading regional stocks markets such as Hong Kong, Japan and Asia can expect another round of selloff. Going by the current trend 1,400 could perhaps be the most interesting level to watch out for Malaysia stock exchange.

Other Articles That May Interest You ...

Saturday, November 10, 2007

Malaysia’s Biggest Rallies since 1998 – KL under siege

There’s a strong reason why Malaysian PM Abdullah Badawi didn’t looks relax when he should be when closing the 58th UMNO General Assembly on Friday. Obviously he was disturbed with what was going to happen on the very next day, Saturday 10th Nov 2007. A mass gathering organized by a non-governmental organisation called The Coalition for Clean and Fair Election (BERSIH) which consists of a group of 60 non-governmental organisations supported by five Opposition parties was scheduled to happen on that day. The rally is to call for free and fair elections.

According to the New York-based Human Rights Watch, Malaysia's parliamentary elections have been characterized by vote buying, the use of public resources by the ruling parties, and gerrymandering. The Election Commission has been accused of bias. – reported Kyodo News. Bersih is demanding the use of indelible ink to prevent voters from casting more than one vote, the removal of alleged phantom voters from electoral rolls, and access to state-controlled media by all political parties. New York-based Human Rights Watch slammed the government's stance on the mass rally, which Prime Minister Abdullah Badawi had vowed to suppress, and police had threatened to arrest protesters.

While the Malaysian government put the number of demonstrators at less than 10,000 BERSIH claimed over 40,000 people involved while CNN/AFP put the numbers at between 30,000 and 40,000. Opposition group leader and former deputy Prime Minister Anwar Ibrahim put the number much higher, claiming more than 100,000 people had gathered in the streets. Witnesses said police fired tear gas and jets of "chemically-laced water" at hundreds of demonstrators who sought refuge in the city's Jamek mosque and in commercial buildings. MalaysiaKiniwhich provide live reports on the rally experienced servers overload – you can take a look at the map here.

While the Malaysian government put the number of demonstrators at less than 10,000 BERSIH claimed over 40,000 people involved while CNN/AFP put the numbers at between 30,000 and 40,000. Opposition group leader and former deputy Prime Minister Anwar Ibrahim put the number much higher, claiming more than 100,000 people had gathered in the streets. Witnesses said police fired tear gas and jets of "chemically-laced water" at hundreds of demonstrators who sought refuge in the city's Jamek mosque and in commercial buildings. MalaysiaKiniwhich provide live reports on the rally experienced servers overload – you can take a look at the map here.The delegation, led by opposition leader Anwar Ibrahim, successfully handed the memorandum to the King's secretary at the gate of the Istana Negara at 4 pm, accompanied by PAS' Hadi Awang and Nasharuddin Mat Isa and DAP's Lim Kit Siang and Lim Guan Eng. The organisers then asked the crowd to disperse. Foreign media carries out the rallies’s coverage in a big wave and thanks to internet, the local Government-contolled media that normally black-out such rallies failed to close the people’s access to such information.

So, can you blame the poor PM Badawi to be in such panic in the first place? The PM has said no gathering is a peaceful gathering even before it takes place. Does this mean the PM somehow knew in advance the gathering will not be a peaceful one? The gathering turned out to be the biggest anti-government protest in nearly a decade with the organizer, BERSIH, claimed over 40,000 people took part, although it wasn’t able to be held at the pre-planned Independence Square as the police had taken over the area.

I still can’t understand why the government and police can’t just allow the“peaceful” gathering to take place. The fact that BERSIH chose Saturday, just two days after the Deepavali festival to hold the gathering showed it tried to minimize the impact to the motorists as much as possible. Of course the argument that the gathering was illegal since it did not receive police permit is simply insulting people’s intelligence as it was known that besides the government itself, no other parties are allowed any permits to gather.

For God sake just let those people voice their rights and if anyone becomes violent, arrest him/her. People will not simply sacrifice their sweet weekend time to demonstrate if the whole election process is clean. And to even think of the basic fundamental rights enshrined under Constitution - freedom of speech my foot!

# Note: more photos from Malaysia-Today

# Note: Coverage by AlJazeera that made one of the Malaysian Ministers furious?

Other Articles That May Interest You ...

Friday, November 09, 2007

Technology Stocks’ Tumble Exaggerated

So, the whole world thinks the technology stocks are next in line to get the spanking from the subprime crisis. That’s just silly. If you didn’t know, Nasdaq was punished on Thursday because Cisco System Inc. (Nasdaq:CSCO, stock) indicated his company has been having trouble selling products to its 25 largest customers particularly financial institution. Without identifying them, Cisco whined that the reluctant buyers include eight banks.

Logically when a company is hit by financial difficulties, one will tend to temporarily evaluate and might stop the purchasing of luxury items and this does not only confined to I.T. hardware(s) or software(s). It could affect other expenditures such as office upgrades or renovations, salary raises, retrenchments, staffs’ benefits and even stationaries. But has the banking sector reaches such a depression stage? There’s no more bailout in a very big-scale, is there? Cisco might thought it would be a good idea to sound the alarm early as not to disappoint the ever-hungry wolves’s (investors) high expectation. Little did it realize it actually had caused the panic and blood-shed all over the trading floor.

The fact is the banking companies still need to buy the necessary technology equipments or programs in order to compete or to enhance their existing operation problems. They might just stretch the project into multiple phases but to scrap in totality might be too exaggerated. History has shown that the fastest and efficient way to bring up the bottomline is to chop the staffs’ strength. So for the technology stocks to plunge (to continue?) as if it’s the technology bubble instead of housing bubble that was actually burst is tantamount to present good opportunity to investors to scoop at a very attractive stock prices.

Other Articles That May Interest You ...

Scalping GOOGLE for fast money, thanks to option

Unless you’re Angkasawan (not astrounaut mind you), you should respect the Newtons’ Law of Gravity which says whatever goes up must come down. The physic law or formula applies mostly to engineering - remember those days when your physic teacher always relates your classmates who excel in physic as potential engineers but not doctor? I might wanna give my physic teacher a lecture if I have the opportunity to meet him.

My physic teacher could have forgotten or didn’t have a clue that Newton’s Law of Gravity can be used profitably in trading options or stocks. I’m referring toGoogle Inc. (Nasdaq: GOOG, stock) of course. Today is the day the physic law takes its effect on Google’s stock. So what’s the problem with Google that it plunges more than 5 percent or $37 a share as of writing? Traders blame it on Cisco System Inc. which drops more than 7 percent and pull the rest of the Nasdaq’s stocks into negative territory.

Other Articles That May Interest You ...

Thursday, November 08, 2007

Pamper yourself with high-speed wireless broadband

Days ago, I’ve blogged about how you can trade U.S. stocks or options basically anywhere you are located within the globe as long as you’ve internet access. The world of investing has somehow becomes smaller geographically. Gone are the days when small investors need to drive all the way to the brokerage firms to monitor their stocks. Of course you can subscribe to the real-time stock prices but it would costs you an arm and a leg back then.

Now, if you have internet access you can basically trade from home and trade most of the major equity markets from major stocks exchanges. Current internet access does not confined to wired-access anymore but wireless has become the de facto. In fact wireless equipments have become so affordable that if you’re trading from U.K. you are pampered with wireless broadband which bundled with the wireless BT Home Hub and BT Hub Phone and unlimited download, not to mention the download speed of up to 8Mb.

Add in 24x7 customer support, 5GB of free online storage, built-in firewall and the ability to leverage your existing touchtone home phone to make inclusive UK evening and weekend calls – it’s a great offer. For a more cost-effective option, you can choose another package specifically for wifi broadband with optional BT Hub Phone.