Tuesday, April 22, 2008

TMI and TM stock Reference Price post spin-off

Ahead of its listing on Apr 28th 2008 Telekom Malaysia International(TMI), the mobile-phone arm of Telekom Malaysia Berhad (KLSE: TM, stock-code 4863) after a spin-off plan, Bursa Malaysia has given its’ indicative stock price of RM7.85 a share which translates into RM26 billion in market value. The boring fixed-line TM meanwhile is only worth RM3.05 per share, according to Bursa. The combined reference prices of TM and TMI should equal to the last traded price of TM on April 22th 2008 (today, closing price was RM10.90 a share).

However Kenanga Research house has pegged a fair value of only RM7.17 for TMIjustifying that despite cost improvements and higher productivity, the risk was equally high if one was to look at the regional expansion. Late last year (2007), TM has sweetened the demerger of its mobile and fixed-line business by proposing to return RM1.63 billion to its shareholders as special cash dividend – gross dividend of 65 sen a share. TM shareholders were entitled to receive one TMI share for every TM share they own.

It would be interesting to see how both TM and TMI will sails from here onwards. At one corner TM needs to prove it still has muscles to be flexed, depending on how successful it could rollout the high-speed broadband services secured late last year. On the other corner, TMI needs to show its’ old brother, TM, and all the investors that it could take the place of Maxis Communications (privatized now) as far as the cellular phone business is concerned. The money is there on the street and it is TMI’s duty to convince previous Maxis shareholders that they are as good, if not better, than Maxis stock.

Other Articles That May Interest You …

Monday, April 21, 2008

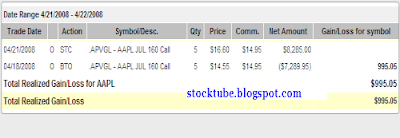

AAPL’s earning - the key is on the International Revenue

Apple Inc.’s (Nasdaq: AAPL, stock) coming earning announcement is on Wed, 23rd Apr 2008 – two days away. Since Google’s sudden quantum leap, Apple has been having free ride up the hill. I mentioned if Google were to drop, then it would drag Apple and most of the technology stocks with it and vice-versa. I was trying to scalp and hope to squeeze some money out of Apple last Friday but it didn’t get triggered until today. And so the money was off the table for AAPL Jul 160 Call Option.

In terms of iPods, JP Morgan estimates that Apple sold 9.68 million units in Q2 while Piper Jaffray is betting between 9.7-10.5 million units. While iPods sales are so-so, iPhone sales are sending both JP Morgan and Piper Jaffray scratching their heads as the gadget was affected by shortages and black market in developing countries. JP Morgan thinks Apple to report sales of 1.5 million iPhones but Piper Jaffray believes the number could reach 2 million.

Nevertheless there’s one intangible consideration that I think is worth to ponder upon. It’s the “expectation” - a magic variable that contributed to the Google Inc.’s (Nasdaq: GOOG, stock) huge gap-up last Friday. Generally people were not having high hope on Google, hence when it reported a “nice” number the stock was bid up. Putting Apple into the same context, what’s the expectation of Apple? I doubt Apple could stage another equivalent gap-up even if it presents a set of good numbers. Furthermore Google’s effect has push up Apple’s stock since then. All the eyeballs are staring at Apple’s sales figure for Q2, guidance for Q3 andother goodies in the bag.

Other Articles That May Interest You …

Unlimited international calls for $9.95 / month from Skype

There’s an obvious reason why the domestic land-lines phones are not and will not be upgraded into an IP-phone in the near future. It could potentially send the monopoly players such as Telekom Malaysia Berhad (KLSE: TM, stock-code 4863) packing simply because people will be busy making free calls from anywhere, provided you can load a small piece of software into the IP-phone. One of the softwares is Skype.

However, Skype which was acquired by eBay Inc. (Nasdaq: EBAY, stock) in 2002 is introducing its first plan for unlimited calls to overseas phones on Monday. The plan will allow unlimited calls to land-line phones in 34 countries for $9.95 per month which includes most of Europe, Canada,

Basically you can use Skype to call anyone in the world as long as both of you have software application (Skype) running on a computer equipped with a microphone and speakers or a headset. With most of you have smart phone which could load the Skype software nowadays, you can virtually call anyone as long as you’re connected to the internet.

Other Articles That May Interest You …

Sunday, April 20, 2008

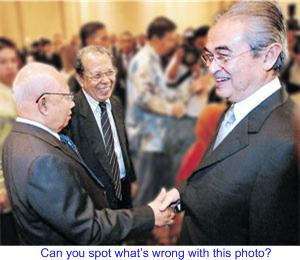

Can you spot how lousy this Photoshop work was?

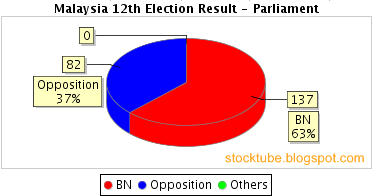

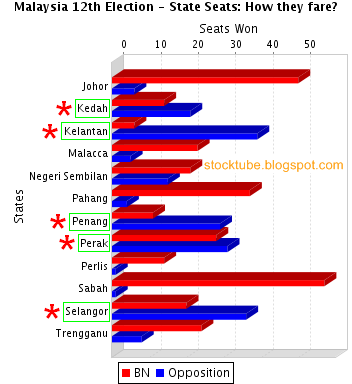

Four years ago Prime Minister Abdullah Badawi issued a “blank check”with promises of a paradise. People took the bait and gave him more than 90 percent passing mark. Four years later people found out they had voted a sleepy head instead and so swung 360 degrees, so much so that even a junior candidate such as Loh Gwo-Burne won easily for the Kelana Jaya parliamentary seat. Loh probably is still giggling until today since the 8th Mar 2008 general election of his unexpected windfall. He was tagging with his businessman father, Mr Loh Mui Fah, for legal advice from Lingam but the junior got bored, started playing with his phone and recorded the conversation involving Lingam brokering judicial appointments.

With such degree of people’s rejection Abdullah should thank God for still being able to become the Prime Minister although he single-handedly brought the National Front to its' worst defeat in the history. Short of apology to the wrongly sacked former judges in the 1988 Judicial Crisis, the PM chose to use money in the form of ex-gratia payment compensation instead. He was also pressured to setup a Judicial Commission specifically to appoint judges.

But of all the desperate efforts by the controlled-media to twist the facts to sabotage opposition Pakatan Rakyat (People’s Pact) and to create or fabricate goodies for PM Abdullah Badawi, nothing beats what Utusan did during the recent Malaysian Bar Council dinner. It was a lousy Photoshop work!!! Can you spot it(from source)?

Saturday, April 19, 2008

Iran President thinks oil prices are damn cheap at $115

Some of you might be screaming - He got to be kidding! America’s next immediate target, Iran President Mahmoud Ahmadinejad declared that crude oil prices, now above $115 a barrel, are just too low. He further added “The oil price of $115 a barrel in today's global markets is a deceiving figure. Oil is a strategic commodity that needs to discover its real value." Crude oil futures already surged to a new trading record of $117 a barrel Friday following an attack on a key pipeline in Nigeria.

Despite analysts suggestion that today's crude prices might have surpassed inflation-adjusted highs set in early 1980, the Iran President thinks otherwise. With heavy

Ahmadinejad, whose country Iran has switched U.S. dollar to Euro in its oil transactions, further declared thatU.S. currency is "a handful of paper" without any commodity support. This reminds me of the “Banana” money used as the currency issued by Imperial Japan during its’ occupation of Malaya, Sarawak, Singapore and Brunei. Regardless of the validity of the claim, in reality too many countries are holding the U.S. dollar as their reserves, so much so that it would be suicidal to replace the U.S. dollar in their daily business transaction.

Anyway I’m not surprise with President Mahmoud Ahmadinejad’s statement that the oil prices could goes up higher as I’ve wrote that it would be generous to have the black-gold even reaches the $130 a barrel.

Other Articles That May Interest You …

Friday, April 18, 2008

Google is still invincible, thanks to International Revenue

Google’s invincibility remains intact for now, not even a weakening U.S. economy could impact the search engine giant. Google earned $1.31 billion, or $4.12 per share, during the first three months of the year – a 30 percent increase from net income of $1 billion, or $3.18 per share, in the first quarter of 2007. Google said it would have made $4.84 per share if exclude one-time items and stock option expenses, therefore beat Thomson Financial projection of $4.52 per share.

So what was the surprise in the closet? It’s hard to predict that the international revenue rocketed and accounted for 51 percent of the total Google’s revenue this time around, surpassing U.S. revenue for the “first time” *Wow!*. Google’s stock staged a huge gap-up of about 17 percent or $76 to $525 a share after-hours trading, their highest since Feb 2008 *Ouch!*. And so StockTube goes down the drain together with ComScore Inc. (Nasdaq: SCOR, stock) which plunged more than 8 percent or $1.98 per share.

Google Inc. (Nasdaq: GOOG, stock) is smart to not provide any guidance as with other companies, thus eliminate another

It’s puzzling why the stock was beaten down after-hours trading despite a yet another excellent earning. ISRG’s first-quarter profit surged a whopping 88 percent to $44.8 million or $1.12 per share from $23.8 million (or 62 cents per share) in the same quarter a year earlier, mind you. Thomson Financial expected income of only 98 cents per share on $178.2 million in revenue. So what’s the problem here? People said it could be the bearish call spread on the stock but others said the guidance issued was not good enough.

The good thing about investing in U.S. stocks market is the fact that it’s a “two-way” street. You can long or short, buy Call or Put options. If you’re convinced the stock has a fantastic story then continues to hold it. On the other hand if you believe the stock’s trend has reversed due to the latest story then goes to the other flip of the coin. Just do something and stop moaning. What could you learn from the Google’s trade? Trading options and stocks based on earning is a risky business. But then high-risk high-gain and can you imagine the potential profits for those who were bullish on Google? Bottom line is if you can’t take the loss, then don’t trade such a volatile stock. Let’s see if Google can maintains the momentum after the opening bell.

Other Articles That May Interest You …

Thursday, April 17, 2008

Waiting for GOOG earning, any Giant Slayer out there?

As of writing time, I’m still monitoring the U.S. stock markets which saw a lower opening as far as Dow and Nasdaq index are concerned. So far, there’s no opportunity to enter new position yet. If you’re still longing Baidu.com, Inc. (Nasdaq: BIDU, stock), Congrats! I know I’ve mentioned yesterday that Baidu breached the $300 level and the stock looked very tasty indeed. Of course I scalped and made a fast exit yesterday despite the bullish look because I was too scared to be a pig. Okay, maybe it’s good to say that it’s better to become a chicken than a pig – so I chickened out too early, as what one of my readers emailed me (I believe this StockTube reader is making good money with AAPL Call Option now *grin*). Big deal!

If you’re still new in the world of stocks investing or option trading, you need to recognize the fact that you’re trading against your ownself and no one else. Forget about the top fund managers such as John Paulson, George Soros or James Simons who made a combined fortune of $9.4 billion in 2007 alone. I’m pretty sure these successful individuals had mastered the skills of a Jedi – they could make great money blindfolded as long as they can access the market news and happenings to gauge the pulses.

Hey! Respect the Mother Nature because everything is a cycle – whatever goes around comes around. Don’t be a greedy parasite who thinks of only sucking the last drop of the honey unless you do not wish the bees to come back. There’re always another trades next time and eventually you’ll know “yourself” very well that you could smell a trade opportunity miles away. I’ve mentioned in one of my articles that as long as your strategy makes you money, then your strategy is a good strategy.

Have you ever wonder why the strategies that you learnt after paid in thousands did not work despite the coach being the so called the best in the market? People who lost money claimed that

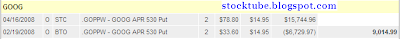

Okay, enough of philosophies and let’s get to business. In compliance with my article yesterday, I still think Google Inc. (Nasdaq:GOOG, stock) will disappoints after today’s closing (earning announcement) and thus I’ve opened new positions on GOOG May 450 Put Option in addition to the remaining I left yesterday (GOOG Apr 530 Put Option) for a trophy. With my gains on GOOG closed yesterday, I think I can afford a total loss should the giant proved to be impossible to be slayed *grin*.

Other Articles That May Interest You …

What a busy day - scalp BIDU, sell GOOG and AAPL

Trading stocks or options during earning season could be very tricky yet fun and possibly rewarding. At the beginning of this season you can be sure of ups and downs almost on daily basis. Hence your finger tips need to be inline with the market pulse else it could create havoc to your portfolio especially if you’re trading on short-term. For example today, Wednesday, the bull is showing its horn led by robust first-quarter earning results from Coca Cola Co. (NYSE: KO,stock) and Intel Corp (Nasdaq: INTC, stock), not to mention JPMorgan Chase & Co. (NYSE: JPM, stock) which beat analysts’ expectation despite report of $2.6 billion writedown.

The above three stocks are enough to lift both Dow and Nasdaq into positive territory. On my screen I can see Apple Inc. (Nasdaq: AAPL, stock) and Baidu.com, Inc. (Nasdaq: BIDU, stock) performing very well while Google Inc. (Nasdaq: GOOG, stock) is crawling (as of writing time) like a sick old-man *grin*. And did you notice how Intuitive Surgical Inc. (Nasdaq: ISRG, stock) stock is flexing its muscle *grin again*?

Analysts are looking for adjusted earnings of $4.52 a share on sales of $3.61 billion in the first quarter 2008 from Google. So could the company deliver the much needed upside surprises? You have to understand that analysts are notorious for their huge appetite when come to Google’s earning. Google needs to beat the street estimates by a huge margin or else risk getting slaughtered when the market opens Friday. Now assuming Google will disappoints tomorrow, then this stock could potentially pull-down Nasdaq and the rest of the technology stocks.

Other Articles That May Interest You …

Wednesday, April 16, 2008

What can you learn from the top Fund Managers?

Can you imagine yourself as a fund manager making $3.7 billion a year? That’s a lot of money and I couldn’t imagine the area needed to put the stacks of notes just for the pleasure of looking at it. But that’s exactly the money one of the fund managers in the Wall Street made in 2007, a whopping US3.7 billion for himself. John Paulson, the founder of Paulson & Company, even beat George Soros as the ultimate winner. His firm ended 2007 with $28 billion in assets, up from $6 billion at the start *Wow!*.

As comparison George Soros, the currency speculator whom Malaysia former prime minister despised and accused of wiping billions of dollars of wealth during 1997-1998 Asia Crisis, earned only $2.9 billion from his personal stake through his Soros Fund Management. Soros’ $17 billion flagship Quantum Endowment fund racked up a 31.7 percent return in 2007, its best annual showing since the high-tech implosion at the start of this decade.

According to Alpha Magazine, Paulson, 52, was shorting risky pools of collateralized debt obligations and buying credit default swaps on the cheap for the firm’s merger arbitrage and event-driven funds as early as 2005. Paulson was betting that the U.S.’s five-year housing bubble was ready to burst. Now, can you see the power of short-selling?

- It again proves that the higher the risk, the higher the gain you’ll reap. Risk management is one of your best weapons against annihilation.

- It’s easier and faster to make money, lots of it, from shorting financial instruments be it stocks, options, futures, commodities etc due to human’s emotion. People tend to fear and panic easily the moment they see some bloods on the floor. Do you know how much Soros made during the 1997-1998 Asia Currency Crisis?

- In the financial markets nothing is certain. Every investors, speculators, fund managers, analysts are actually betting – it’s a 50/50 chance of hitting the jackpot. You can argue that it’s the biggest casino in the world but the difference is – there’re more market makers who leveled the playing fields than only one-market-maker from a typical casino.

Other Articles That May Interest You …

Tuesday, April 15, 2008

Stocks to watch for the week, ISRG to gap-up again?

Since the earning season started, there are ups and downs. Unless all the companies report pathetic result, any big-boy who could give a breath of hope would potentially lift the overall market sentiment although for a very short period as can be seen by health products maker Johnson & Johnson today. I’m particularly excited this Thursday, 17th Apr 2008, because some of my favorites are going to announce their results such as Nucor Corp (NYSE: NUE,stock), Google Inc. (Nasdaq: GOOG, stock) and Intuitive Surgical Inc.(Nasdaq: ISRG, stock). Caterpilar and SanDisk Corp used to be my favorites not many moons ago but not anymore.

Let’s talk about Intuitive Surgical which is scheduled to announce its earnings after the closing b

The stock dips yesterday as an analyst from Cowen and Co. Eli Kammerman expects Intuitive Surgical to miss Wall Street's earning estimate by a penny due to hefty spending in Research and Development. According to Thomson Financial, analysts are looking at 98 cents per share on revenue of $178.2 million. However Wachovia's Michael Matson is bullish and expects ISRG to beat earnings. Overall analysts think the company will reaffirm its outlook figure for 2008 and this is what matter the most.

Rating Indicators for ISRG:

- Wall Street consensus : 0.98

- StockScouter rating : 8 / 10

- Whisper Number for this stock : 1.02

- Power Rating : 7 / 10

- Zacks Analysts Rating: Hold

- Option Trading: May 2008 330 Call

- Implied Volatility (IV) for Jul 2008 $330 Strike: 66.57%

The only problem trading this option is the high Implied Volatility making it very hard to make good money unless with huge gap. But this is a company that registers sales and income growth of 61.20 and 100.60 percent (compared to industry’s 22.50 and 2.00 percent) respectively with zero debts. Did you notice how the stock skyrocket starting from 10:45 trading hour today? Simply fabulous! I’m not sure if I should lock-in profit by taking half of it from the table (scalp it) while let the remaining runs for its’ earning this Thursday.

World’s biggest carrier from Delta and Northwest

Global oil prices are seeing its effect when U.S. Delta Air Lines Inc. and Northwest Airlines Corp. are combining in a stock-swap deal that would create the world's biggest carrier. Under the terms of the Delta transaction, Northwest shareholders will receive 1.25 Delta shares for each Northwest share they own - represents a premium to Northwest shareholders of 16.8 percent based on Monday's closing stock prices.

Delta said the combined airline, which will be called Delta, will have an enterprise value of $17.7 billion, which includes the combined market values of the two companies and combined net debt – reported AP. Delta Chairman Daniel Carp will become chairman of the new board of directors and Northwest Chairman Roy Bostock will become vice chairman.

As with any other merger or consolidation, head-cuts could be on the horizon but Delta said at the moment there will be an unspecified number of job cuts or transfers through the consolidation of overlapping corporate and administrative functions. Both airlines have more than 80,000 people on its’ payroll.

Delta also announced it will provides the Delta pilots a 3.5 percent equity stake in the new company and other enhancements to their current contract. However the agreement does not cover Northwest pilots. Northwest pilots and the union representing most of Northwest's ground workers immediately announced they would fight the combination. Delta and Northwest filed for bankruptcy protection in New York on Sept. 14, 2005 but both emerged from bankruptcy as leaner carriers last spring, after shedding billions in costs during their reorganizations.

Could this set the tone for more global merger in aviation sector in the future?

Web design is as important as SEO for blogs

I’m not sure if I should revamp the design of StockTube in case I decide to host it on my own, meaning to bid farewell to Google’s blogspot. Due to the reason that blogspot and wordpress (the most likely blogging platform I’ll choose) are very different in nature, it’s very hard to maintain StockTube’s existing design though it can be done. Anyway besides content I believe web or blog design plays a significant role in its success simple because the readers are human and human likes lovely and structured design.

Stylish Design is one of the web design and SEO related blog website that talks about the importance of design and SEO, that’s search engine optimization. The website started just recently, Feb 2008, and naturally it doesn’t have many articles but what caught my eyes was this article that you can never find out the true PageRank. Robert, the author, further argued that it was a myth that Google penalizes pages by giving them PageRanks of 0 to which I disagreed. If you’ve been in the blogosphere long enough you should have read how the notorious Google punished sites by reducing their PageRank to 0, some on stages over a period of time.

Overall I think Stylish Design has a good domain name plus a clean layout. I believe Robert worships Google and trust his soul solely on Adsense, which is not a very wise thing to do as he could potentially loose everything should Google tried to be nasty. Maybe the site should update more frequent to lock-in more readers. I’m currently looking for unique blog template but I couldn’t find it in Stylish Design. Hence probably Robert could give away some cool and free templates or themes.

*sponsored*

Monday, April 14, 2008

Astro Indonesia suspension – Sabotage or Exit Plan?

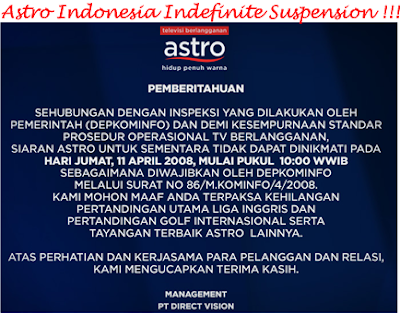

Astro Nusantara (PT Direct Vision), the Indonesian unit or branch of Astro All Asia Network Plc (KLSE: ASTRO, stock-code 5076) seems to be having some serious problems. It has been ordered by Indonesian Information and Communications Ministry to temporarily halt broadcast pending the fulfillment of several requirements and the transmission was off since 10 a.m. last Friday, 11 Apr 2008.

Thousands of subscribers are fuming for being left in the dark and are demanding refunds with some threatening to cancel their subscription, especially the soccer fans who missed the live EPL (English Premier League) match between Manchester United and Arsenal on Sunday. It was reported that PT Direct Vision which is under Lippo Group, the same company that owned KabelVision but rebranded as First Media received a whopping 18,000 complaints from its customers since the indefinite suspension.

In reality, doing business in Indonesia could be very tricky. Heck, any people who do not like Astro could charge that the company is against the Indonesian Satellite

However assuming the bad boy Astro didn’t abide Indonesian laws and broke all the laws mentioned. What was the intention then? Maybe Astro realizes that it’s high time to pull out from Indonesian soil altogether since the early dream to serve 3 million households, nearly 10% of all homes with TVs in Indonesia by 2010, is just a bad dream after all. If this is true then it’s definitely good news to Astro shareholders because the venture is dragging down Astro without clear sign when it’s going to end. It might be a total loss of RM200 million to end this expedition but to continue spending RM20 million a month to stay afloat, you don’t need a rocket scientist to make the decision.

Other Articles That May Interest You …

Sunday, April 13, 2008

Stocks do not go linear - Scalp your way to make money

There are many ways to skin a cat and in stocks investing or option trading, it applies perfectly. Even though it is said that the cat has nine lives I’ve pretty sure there’re more than nine ways to making money from stocks markets although by comparison I might only have 10 percent the intelligence of Albert Einstein. In stocks investing you can long or short the stocks (yeah, I know certain stone-age stock markets despise short-selling) while in option trading you can open “Call” or “Put” option positions. These are basic fundamentals 101 but there’re more methods out there.

So, you thought you can only buy stocks (or options), wait and hopefully it will goes up higher in order to reap the difference as profits. Or you thought you were wise enough to sell-short and hope for the stocks to be condemned so that you could buy back at lower price to cover your position and in the process make good money. Wrong! There’re so much more that you could do to make good pocket monies “during” the process.

Money can be made by “Scalp”

One such method is to “scalp” and make money, normally within the same trading day. The concept has been generalized. Some people believe “scalp” is associated with day-trading, made popular during U.S. dotcom glory days when highly-paid managers quit their day-jobs to day-trade at home. They made damn good money, mind you. It was easy meat during those days because the technology stocks just skyrocketed on daily basis, so much so that even a hot-dog seller could make money as day-trader.

Stocks do not go linear

But you should know that I’m no where near those big-time speculators. As such what I did was perfectly healthy and you can try this at home *grin*. It didn’t surprise me after I received queries why I scalped AAPL May 155 Put Option when in fact I was long on AAPL May 140 Call Option prior. Well, just because I long Apple Inc.’s (Nasdaq: AAPL, stock) doesn’t mean I’m prohibited from making some pocket monies by way of “scalp” whenever the opportunity arises.

In contrary, the stock could reverse its’ trend by huge quantum intradayplunges or skyrockets during its journey. You wouldn’t want to let go of such golden opportunity to scalp and make some pocket monies, would you? And that’s the reason I scalped Apple Inc.’s AAPL May 155 Put Option within the day last Friday itself. Need I tell you why Apple stock plunged last Friday? If you insist, blame it on General Electric which plunged about 13 percent dragging the Dow Jones with it by more than 250 points after its’ disappointing first-quarter earnings. General Electric which normally meets earnings target reported that profit fell 6 percent to $4.3 billion or 43 cents per share (against estimated 51 cents a share), enough to wipe out a whopping $47 billion off it’s market value *Wow!*.

Short benefits of scalping

However I agreed with some analysts that General Electric’s problems are both an isolated incident and a reflection of a break in the financial system. Hence I took the action to scalp Apple Inc. during this “hiccup” as the price, volume and other factors triggered my “Buy” (to scalp) signal. This is another way to maximize your investment while waiting for the stock to reach your target. It’s also a good way tominimize your losses should unforeseen factor kicks in, for example if suddenly Steve Jobs somehow joins the “LOST” groups in an abandoned island *grin*. By the way, there’s another way to make pocket money by writing check to yourself every month.

Other Articles That May Interest You …

Saturday, April 12, 2008

Pocket Money for the weekend but Bad Habits Never Die

Don’t you hate it when the stock tends to go higher right “after” you lock-in the profit on your long-position or go even lower right “after” you did the same on your short-position? It happened donkey of times and I believe there’s no reason why it won’t happens again in future. I was talking about Apple Inc (Nasdaq: AAPL, stock) which I scalped hours ago today. Couldn’t resists the temptation thus entered 3-contracts of AAPL May 155 Put Option with the intention of scalping.

Waited for two hours but the stock was moving (plunging) like a turtle. The profit was razor-thin and so decided to wait a little longer as my target was to gain at least 3-figure profit for the weekend. The stock reached my target and I mauled it like a tiger without food for 3-weeks. But guess what, right after I lock-in the profit, the stock drops further *smack myself*. You just can’t beat the market – can’t buy at the lowest and sell at the highest. That’s the fact and if you can’t get over it, chances are you’re not an inch away from the emotional trap which could affect your next decision-making on the remaining positions.

Well, get over it as there’ll be another trade another day. This is the basic investing or trading rule that you should prepare mentally no matter how hard it is to master. Hey, I’m still cursing myself every now and then. My God! Look at the huge sell-volume at 1:27pm trading hour *smack myself again*

Friday, April 11, 2008

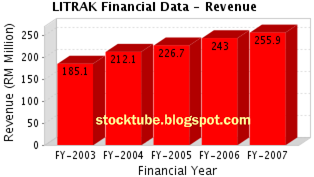

Litrak Capital Repayment, a nice way to suck money out

Mahathir Mohamad, the former Prime Minister of Malaysia admitted hisCabinet’s stupidity about a year ago when he said the government has erred in signing the toll concession agreements. Early 2007 he said “This is one of thing that we need to correct. What you have is a cabinet which is not very knowledgeable all the time because it is not made up of experts but politicians (and) some politicians like myself can sometimes be stupid!”

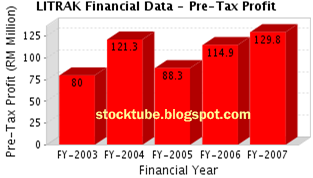

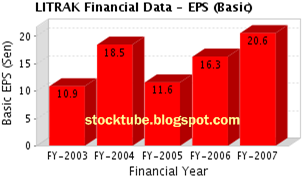

Hence miraculously the government and sadly the public were held ransom by these highway operators. One of them is Lingkaran Trans Kota Holdings Bhd (KLSE: LITRAK, stock-code 6645) which operates the 40 km Damansara-Puchong highway, where the toll rose by 60 percent early 2007. Shareholders or Litrak will be paid RM1 for every share they have, in the form of 93 sen cash under a capital repayment exercise and another seven sen in a single-tier interim dividend for the year ended March 2008.

Litrak has last Friday proposed the issuance of up to RM1.55 billion in Islamic debt papers under a sukuk programme or Islamic securities of which it received the approval from the Securities Commission (SC). The proceeds from the sukuk bond issue would fully retire Litrak’s existing debts (RM819 million as of Dec 2007) that were taken to fund the construction of the Damansara-Puchong Expressway (LDP). The tenure for the sukuk programme is 15 years.

People can argue until the cow comes home that the agreement between the government and Litrak is lopsided and not done in the best interest of the people but the fact remains that Litrak is a money-making machine. What do you expect from a UMNO-linked company such as Litrak? And what can the people do even though there’s a claim that the company had actually recovered its construction cost three years into operation and whatever they’re getting thereafter are pure profit? Heck, then why raise RM1.55 billion in the name of wiping the construction cost?

Other Articles That May Interest You …

Thursday, April 10, 2008

Oil prices at $112, another $18 to reach $130 a barrel

The global oil prices will be touching $130 a barrel pretty soon. Ouch! That hurts but *yawn* are you sure it’s not just another prediction or myth? I know Malaysian Prime Minister Abdullah Badawi doesn’t like what I’ve written. Petronas could hardly laugh because in spite of the new crude oil’s record that topped $112.21 a barrel the first time in the futures market Wednesday, the company knew it needs to subsidize the same amount that it’s profiting. Badawi’s balls are within your grip since he couldn’t raise the fuel price after the recent 12th general election no matter how desperate he wishes to, thanks to your votes. Anyway I’ll leave that discussion for another day.

Analysts believes crude imports fell in part because fog closed several shipping channels in Texas and Louisiana that serve as vital oil import conduits last week. However I believe the oil prices could just escalate as long as the U.S. economy is cracking and Uncle Ben needs to cut the interest rate. Furthermore elsewhere it is cheaper to buy oil now due to weaker dollar. With current $112 a barrel it’s only another $18 to go before the oil prices reach the $130 a barrel. Do you think it's achievable?

Other Articles That May Interest You …

Wednesday, April 09, 2008

Astro to buck-up? Wait till the Sun rises from the West

Although Astro monopolizes the paid-television market in Malaysia not many investors like the stock, at least not me especially after the company tried to put its foot onto Indonesian soil. Just ask any of the existing Astro All Asia Network Plc (KLSE: ASTRO, stock-code 5076) customers and chances are majority of them will give their thumbs-down for obvious reasons. Basically they (the customers) do not have other choice even though they knew the services sucks big time, not to mention the parasite-like monthly fees imposed.

Thanks to Malaysian Communications and Multimedia Commission (MCMC), Ministry of Energy, Water and Communications (makes you want to kick former Minister Lim Keng Yaik’s butt), unlisted pay-TV operator MITV Corporation Sdn Bhd (now known as U Telecom Media Holdings Sdn Bhd) and a whole bunch of other idiots, customers are still being screwed. But then with the untouchable billionaire Ananda Krishnan standing between Astro and the policy makers, it would be easier to blow up Mongolian model with C4 than to ask the company to buck-up *grin*.

Hence, when the newly appointed Energy, Water and Communications Minister Shaziman Abu Mansor said Astro will not be allowed to introduce new channels until the Malaysian Communications and Multimedia Commission (SKMM) is satisfied with its efforts to improve its services, I’ll take that with a pinch of salt. Shaziman’s statement was not new and it would be an uphill task for him to direct the bully Astro to address problems such as poor service, billing problems and charges that burden users.

Strangely most of the time it doesn’t work and if you care to call back, the customer support will tell you to engage

With 126 channels under its belt, Astro does not need to rush to comply with the Act since the offerings are more than the subscribers could take. In fact, some of the programs are so outdated that my grandma was complaining about it the other day. And they have the cheeks to call me up to subscribe to their Astro-On-Demand (hail the pirated DVDs *grin, I'm no fan of pirates*) because the take-up-rate was poor.

What this new Minister should do is to force Astro to sign the dotted-line and probably limit the mind-boggling excessive advertisements served (on Astro). It would be nice to invite other players elsewhere to create some competitionsalthough Astro is expected to maintain its domain in the Chinese-channels.

Other Articles That May Interest You …

Tuesday, April 08, 2008

Make Money from Apple, Early Birds get the Worms

If you’ve positions in Apple Inc., either stocks or "Call Option", you should be celebrating by now especially if you noticed now the stock performed yesterday, Monday 8th Apr 2008. Never mind that the stock reversed its’ uptrend afternoon as it has jumped more than $10 bucks over the last five days. So it only makes sense for profit taking to emerge after the rally. Most importantly iswhether you make any money out of it. I’ve mentioned how critical it was to pay attention to Apple Inc.’s (Nasdaq: AAPL, stock) last Friday and I hope StockTube readers who trade the U.S. stocks or options did put some time monitoring this stock.

Nevertheless analysts are calling “Buy” now although there’re equal numbers of them who think otherwise. You can’t blame the pessimism especially after the recent freefall from $200 to $115

That’s the strategy nowadays – to buy and sell on short-term basis since the U.S. economy is still in a mess. Did you notice that despite the so-called recession, thevolatility of stocks is still very much intact and you could squeeze some money out of it? Sometimes it helps to not read too much into what other analysts are saying as it could confuse your decision-making’s process. And if you’re still burning the midnight oils wondering why the local Malaysia stock market is not recovering, you better spend more time on U.S. stocks.

Other Articles That May Interest You …

Monday, April 07, 2008

Maths Genius Sufiah enjoys Sex career, no Regrets

She might not be close to Einstein but she could at least develop some sort of technical formulas for technical analysts to predict the direction of stock market, for example *grin*. Indeed it was a great loss that Maths genius Sufiah Yusof chose the field of prostitution as the way out to whatever reasons known only to her. Blame it on her monster father, the pressure, the high expectation or simply her wish to control her own life.

But the damage has been done and the fact is she’s enjoying working as a prostitute and she has no regret. Instead she even gave a short lecture that being an escort is not that terrible and sleazy as she revealed it. Photos and sexy videos about her made headlines.

In an interview with “News of the World”, 23-year-old Sufiah boasts “My clients love the fact that I can stimulate their minds AND their bodies … And I don't believe my education has been wasted - in fact I usually take problem sheets with me to solve before appointments … I've always had a high sex drive - and now I'm getting all the sex I want … and guys are much better in bed with an escort than a girlfriend.”

The fact that she got fascinated after read Belle De Jour's Diary of a London Call Girl, researched escort agencies on the internet and sent

Now that she has reveals all, let’s see if there’re still people who feel that she needs rescue and probably drag her back to Malaysia for treatment in rehabilitation center. Get real - this genius is enjoying every bit of his life now without any regrets whatsoever. "One man asked me how much I earned a year … I said £60,000 … He told me - I'll pay that amount straight into your bank and buy you a flat and you can be my mistress … But I don't want that because I'm happy doing what I do … I don't have any regrets … I've never felt more confident about my body and I've had some of the best sex of my life." – the genius Sufiah concluded.

Therefore it’s best to leave her alone. Maybe after a couple of years when she got tired of her “career”, she could make full use of her Maths knowledge in other area. Probably she could help the Malaysia government especially the Finance Ministry (recruit her Abdullah Badawi!!!) in crunching complex numbers such as inflation rate which strangely always settle at between 2 – 3 percent no matter how many times daily goods’ prices increase, not to mention the extraordinary economic growth despite people complaining of not getting the goodies.

Other Articles That May Interest You …

Sunday, April 06, 2008

Slow and Complacent Yahoo gets 3-week Deadline

Three weeks for Yahoo to accept its $41 billion buyout offer or else face the music of a hostile takeover at a less attractive price – that’s the deadlinegiven by Microsoft in its letter sent on 5th Apr 2008. The hostile takeover mentioned was referring to the proxy fight including nomination of a new slate of directors likely to approve the deal. Apparently Microsoft is getting impatient over Yahoo’s refusal to start the negotiations.

Chief Executive Steve Ballmer warned that should Microsoft Corporation (Nasdaq:MSFT, stock) forced to take an offer directly to Yahoo’s shareholders, that action will have an

In what seems to be the only solution for Yahoo Inc. (Nasdaq: YHOO, stock), Microsoft is adamant of not raising its’ own offer. Time is not on Yahoo’s side and it’s more than obvious that Yahoo co-founder and CEO Jerry Yang is check-mate. In fact nobody should feel sad about Yahoo being swollen by Microsoft and if you wish to put the blame on someone, that person has to be Jerry Yang. It’s not that Yahoo didn’t see where Google is going and Microsoft is coming in the internet advertising business.

So, blame it on Yahoo’s top management for being too slow, not to mention too complacent, in strategizing ways to improve itself from the competitor (Google Inc.). Yahoo’s management was so irritating that its’ own strong supporters were calling “Sell” on its stock long before Microsoft launched the hostile takeover.

Other Articles That May Interest You …

Friday, April 04, 2008

Time to make money trading Apple stock, are you ready?

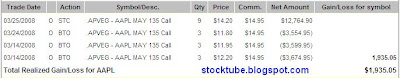

Apple Inc.’s (Nasdaq: AAPL, stock) next confirmed earning announcement is on 23rd Apr 2008, slightly less than three-weeks away. Assuming the Dow Jones could floats above 12,000, this stock that tumbled from it highest of $202 to lowest of $115 a share seems to be ready for the next wave. I blogged how I mauled at Apple Inc.’s AAPL May 135 Call Option on 25th Mar 2008 because it’s neck was sticking out of the 50-D Moving Average (read here). Of course I had closed the positions the next day but not before I opened new position on AAPL May 140 Call Option (read here) and have been holding it since.

Now Apple is trading above 50-D Moving Average and is moving towards the 200-D Moving Average. Chart-wise, I’m monitoring and keeping my finger-crossed that the stock could find a comfortable support level above $150 a share. Above $150 it should have a smooth sailing towards $190 *grin*. If you’ve not make any money during its previous rally or worst still lost some money (got hit at the top) but were too afraid to commit “Put Option” during its $80 dollars drop, a new opportunity could be smiling at you now. But please watch out for the $150 level.

It was reported that there are at least 7 million potential iPhone users in Nigeria, 9 Million in South Africa, 80 Million in India, 25 Million in Russia, 25 Million in Brazil, 8 Million in Indonesia and 100 Million

As the darling of the gadgets, such shortage also invited other rumors. One such is that Apple was actually gearing towards new model hence the tight supply. Many also said Apple underestimated its iPhone demand but there’re also reports that truckloads of iPhones were being hijacked or stolen. Whatever the reasons, the craze for iPhone is still puzzling. So, you know how to play this stock and make good money out of it, don’t you?

Other Articles That May Interest You …

Thursday, April 03, 2008

Stocks Investing - read more blogs than local media

Blogging in Malaysia seems to have scores another milestone - reported Utusan Malaysa, possibly the most bias government-controlled print media exist today. If not for the recent 12th general election which saw the National Front led by Prime Minister Abdullah Badawi crumbled with shameful defeat, I believe Malaysian bloggers will still be looked down upon, not to mention being called “monkeys”, “jobless women” and other funny names. I’m not sure how Utusan plucked the numbers but it’s definitely puzzling to know that Malaysia has about 500,000 active bloggers (Wow!) and 70 percent of the election results were influenced by such blogs’ information.

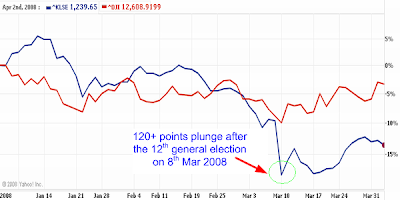

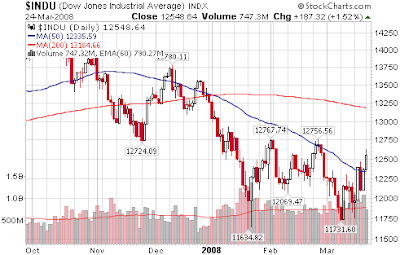

StockTube blogged about the general election’s effect on the local stock market on 10th Mar 2008, the same and first day the stock market open for trading after the election which saw a stunning 130+ points plunge. Also written was the simple reasons why foreign investors are still adopting a “wait and see”approach without committing huge funds into the local stock market. Without new foreign funds injection is bad and to have these same investors selling right after the election is worse but the worst of all is the fact that the politicians from the National Front themselves were selling like mad. And they are still selling into strength, mind you. Just look at the performance of KLCI against the Dow Jones in the chart below.

But really, you shouldn’t read too much into the latest

So you see, if you just rely on media such as theStar, New Straits Times, Utusan Malaysia and so on, you’re at least 3-weeks outdated. Not only are

You might want to ask if the time is ripe to enter the stock market now. The answer is a simple “No” especially if you’re aiming the blue-chips unless you’ve excessive bullets to waste. It’s a waste that short-selling cannot be performed the same and easy way as buying the stocks or else you could be smiling all the way to the bank now. That’s why trading alternative stock markets such as U.S. would keep you from falling asleep. And if you wish to try your skill trading currency, you can read here on how to try it for free.

Other Articles That May Interest You …

Wednesday, April 02, 2008

Hanky-Panky in Maybank-BII deal? How about MAS?

Everyone thought Malayan Banking Berhad (KLSE: MAYBANK, stock-code 1155) was a sucker for draining its coffer to the tune of US$2.7 billion to buy a financial-weak PT Bank Internasional Indonesia (JAK: BNII). Almost all analysts thought it was too pricey and were scrambling to cut Maybank’s rating. Investors who invest based on dividend cried foul as almost 25 percent from the Malaysia’s largest lender “cash-reserve” have just evaporated – they were hoping for special dividend from the huge US$11 billion cash on hand initially.

No matter how fishy the deal sounds, I thought the actual winner was Singapore’s Temasek which invested only $217 million for the stake and hence made fivefold profit from the sucker (Maybank). But I was wrong because someone has made more than that. It was interesting that Maybank’s “top management” made the decision (was it pre-planned?) right after it’s president and CEO, Amirsham, was about to serve the remaining months before hand-over to Telekom Malaysia Berhad’s group CEO Abdul Wahid Omar.

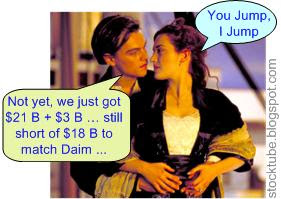

Everything can be traced back to the shameful defeat by Abdullah Badawi’s National Front coalition parties recently. By now everyone on the street knows UMNO is a sinking ship and most of its parasites sailors are waiting for the right signal to jump off just like the TITANIC, only this time there’s no icy ocean, no Leonardo DiCaprio, no Kate Winslet but loads of boats from opposition waiting to pick-up the leftovers.

According to Malaysia-Today, it was a simple equation oftransferring as much money as possible out of the countryassisted by the "broker" who advised that the Indonesian bank was a freaking good deal that Maybank should not let go. So the nation’s largest lender was made to over-pay RM3 billion for BII, a small token compared to over RM42 billion taken out by former Finance Minister Daim Zainuddin and the RM21 billion just before the recently 12th general election by some invincible hands. Well, that’s what the article said. I just say what Malaysia-Today said.

According to Malaysia-Today, it was a simple equation oftransferring as much money as possible out of the countryassisted by the "broker" who advised that the Indonesian bank was a freaking good deal that Maybank should not let go. So the nation’s largest lender was made to over-pay RM3 billion for BII, a small token compared to over RM42 billion taken out by former Finance Minister Daim Zainuddin and the RM21 billion just before the recently 12th general election by some invincible hands. Well, that’s what the article said. I just say what Malaysia-Today said.And assuming the claims were true, could the recent staggering purchase of 55 Boeing 737-800 aircraft for US$4.2 billion by the national flag carrier Malaysia Airline System (KLSE: MAS, stock-code 3786) tainted with irregularities as well? MAS is expected to take the delivery from Sept 2010 onwards. With weakness in the global economy to persist for sometimes, wouldn’t it be wise to purchase only when it hit the bottom, i.e. when MAS could bargain and buy at a lower price? Furthermore MAS is not short of planes the same way as AirAsia Berhad (KLSE:AIRASIA, stock-code 5099). Maybe the whole idea was to renovate and transform MAS into the “World's Five Star Value Carrier” but still, why the rush and the huge order and most importantly, why now? What was the actual discount rate for such a bulk purchase? Any hidden commissions paid to unknown "agent(s)"?

Now, it’s up the Maybank shareholders to approve or reject the over-price acquisition although I doubt Bank Indonesia regulatory will rejects it. Reject the acquisition and you might see a better chance of getting special dividend. At least bombard the top management and ask them to bargain for a lower price unless you wish to be the laughing stock of foreign investors and analysts.

Other Articles That May Interest You …

Tuesday, April 01, 2008

The Swiss Meltdown of another $12B, no April Fool

Just when you thought only U.S. financial institutions were in deep trouble, Switzerland’s largest bank UBS AG (NYSE: UBS, stock. VTX: UBSN) dropped another bombshell when it said it expected to post first-quarter net losses of a mind-boggling $12 billion and would seek $15 billion in new capital due to exposure in U.S. subprime mortgage. UBS AG is seeking writedowns of $19 billion putting its total writedowns since 9-month ago at a whopping $40 billion – the largest by a bank so far.

It was reported that more heads will be chopped by the bank as a result of the losses. The latest losses by the Zurich-based

Although UBS shares rose 1.82 francs to 30.68 francs by 10 a.m. in Zurich, thestock has fallen 41 percent this year, cutting the bank's market value to 63.7 billion francs and making UBS the second- worst performer on the 60-member Bloomberg Europe Banks and Financial Services Index. Analysts had expected the bank to write down an additional 10-20 billion francs in 2008. Earlier on the same day German’s largest lender, Deutsche Bank, said it expected a first-quarter loss of about €2.5 billion, or $3.9 billion, on write-downs of the same old U.S. real estate loans and assets crisis.

As of now the global banks have written down more than $200 billion of soured loans after the explosion of U.S. subprime mortgage crisis. This is the game for the big boys – high risk high gain. Therefore take it with pride Mr. UBS, as not every banks could incur such huge losses *grin*.

Monday, March 31, 2008

The entry of Franklin Templeton, the more the merrier

Franklin Templeton Investments is probably one of the best global investment management organizations with over $650 billion in assets management. In a nut shell the organization can be segregated into three main management groups – Franklin Funds, Templeton Funds and Mutual Series Funds. Its coverage includes 54 offices across 6 continents – North America, Europe, Asia, South America, Africa and Australia.

Heck, if you’ve been in the investing world for a while you should know who Sir John Templeton is. Just like Warren Buffett, Templeton rejected the teaching of technical analysis and worship fundamental analysis and he made great number of billions as a stock investor, not to mention he’s a great philanthropist. The company was listed under the name Franklin Resources, Inc. (NYSE: BEN,stock).

So, is this good news to the local stock market? Yes, if the company has already identified a substantial amount of money to be parked here immediately. No, if the company is just setting up the office while waiting for the right investment climate change for the better. There’s no commitment by these foreign fund managers to pour in “X” amount of dollars within “Y” time-frame. What they’re doing now is to secure a license and probably adopts a wait-and-see approach especially with the latest political landscape changes. Nevertheless it’s a recognition that there’re money to be made in Malaysia.

Getting the best web hosting is the most difficult

Since the blogosphere took off with a big bang, the traditional way of information flows has changed tremendously. Bloggers were mushrooming with great influence so much so it knocked out billions of dollars off Apple Inc.’s market capitalization, not to mention how it changed the political landscape such as in Malaysia and now Singapore is talking this trend very seriously.

Serious bloggers went a step further to monetize their blogs and due to obvious reason a new channel of making money from domain names buying and selling flourishes. While getting your own domain name is quite straight forward, the same cannot be said about web hosting. Besides having to pay for web hosting there’s no guarantee that it wouldn’t give you nightmare such as downtime, horrible customer support etc which could be better spent on blogging.

It’s more of a try it and see if you can get the best web hosting company. Generally, you would bump into names such as Host Monster, Host Gator, Yahoo Host, Blue Host, Dream Host and many more. Of course after you consider domain name and hosting company, it’s time to consider the design of your web or blog. So, what’s your experience and which web hosting would you recommend?

Sunday, March 30, 2008

Anwar, PM-in-waiting plans Sabahan for Prison Break

Former premier Mahathir had done many mistakes during his 22 yearswalking along the corridors of power. He could be forgiven if he didn’t realize it during his tenure as the Prime Minister since every single soul he met gave him the thumbs up. Even before he could finished farting, apple polishers would screamed at the top of their voice of how great the “smell” was – better than KFC. That’s how Mahathir lived throughout the 22 years – as a dictator who was afraid of no one, not even the President of the United States or the Prime Minister of Britain, let alone the nation’s highest person in the judiciary or the monarchy.

The hypocrite Mahathir

So, when Mahathir opened his mouth and suggested that the nomination quotato contest top posts in UMNO should be abolished as it is being abused to prevent members from nominating candidates I almost fell off my chair laughing. Not sure if he’s really senile or the denial syndrome still running thick inside his body but it was him who architected the quota system to prevent anyone from challenging him when he was still the PM. Funny how this old-fox still talks as if he’s still a virgin. He basically ripped off the Judicial Pillar and architected the inappropriate sacking of the then Lord President Tun Mohd Salleh Abbas.

Internet and blogs play vital roles

If there’s one thing that Mahathir had done well, it has to be his commitment in 1999 that there would be no censorship of the Internet in Malaysia as stated in the Communications and Multimedia Bill. Heck, I bet he was jumping up and down in joy when he could only found comfort in Internet whereas all the government print and electronic media blackout him after he left the office. And thanks to Internet and bloggers, the arrogant National Front coalition parties were given the shock of their lifetime during the recent 12th general election.

Anwar preferred as PM by business community?

While it’s true that Anwar Ibrahim and Tengku Razaleigh are running towards the finish-line, more and more money is on Anwar as Malaysia sixth Prime Minister. Mahathir who once wrote off Anwar’s chance to become the PM is now sulking, pushing and supporting Razaleigh to replace Badawi but not before hinting that Deputy PM Najib Razak could be the candidate as well. Of course every Tom and his dog know Najib is tainted with the Mongolian Altantuya trial but Mahathir wouldn’t care.

His first preference was Najib, not because the latter is a saint but more because Mahathir was grateful to Najib’s

Given a choice, the corporate world would choose Anwar instead of Razaleigh as the new Prime Minister considering Anwar’s past experience as the Finance Minister and his close relationship with the West. Rumors were spreading thatcorporate world has started to place their bets with most of it on Anwar.Even Berjaya tycoon Vincent Tan started to rub Anwar’s shoulders, not to mention hypocrite press editor such as theStar’s Wong Chun Wai started to slowly by surely play the neutral game. Heck, Chun Wai could be sent packing once the political landscape change again.

National Front still in denial, Sabah to “Prison Break”

MCA and MIC is still adopting denial syndrome while Gerakan was rumored to be considering bitter medicine to ensure their relevance, probably pull out from the National Front. UMNO is falling apart and the only thing that Badawi can do now it to delay the dying process but it depends very much on how he could convince the Eastern Malaysia (particularly Sabah) from crossing over to Anwar’s side. Nevertheless I think Badawi needs to do more than sweet-talk or to just give another one or two minister-ship to Sabahan.

Other Articles That May Interest You …

- Malaysia to have new PM – who is the faster runner?

- Second Tsunami - Anwar to form the next Government?

- Stocks still gloomy as tension runs and Lim slams PM

- Stocks to remain volatile, political landscape is instable

- General Election’s effect on local Stock Market

- The Rise, Fall and Re-emerge of Rashid Hussain Again?

Friday, March 28, 2008

Transmile’s sudden Spring to Life, what’s in the pot?

Frankly, I was planning to buy some Transmile Group Berhad (KLSE:TRANMIL, stock-code 7000) shares if the stock hit below RM1.00.Seriously there were not many reasons that could justify the purchase since the company was literally ripped off under the previous management. And to think the former chairman could just chicken out as if there’s nothing happen can easily send your blood boiling. But that’s Malaysia whereby politicians or former politician in this case are basically immune from any wrongdoings.

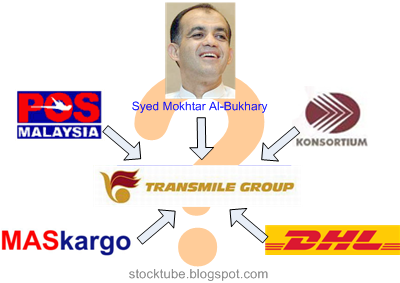

Since the cargo carrier Transmile office was raided by Securities Commission back on 25th May 2007, the stock was hammered to as low as RM1.50 from its high of RM13.00 a share. Malaysia's richest man Robert Kuok, JP Morgan, Goldman Sachs, the Singapore government and national postal company Pos Malaysia & Services Holdings (KLSE: POSHLDG, stock-code 4634) were speechless. The only reason why I would want to buy at below RM1.00 a share was because ofRobert Kuok and nothing else. With investment below RM1.00 a share I was ready for a total-loss.

However my hope to become one of the minority shareholders vanished when the stock suddenly jumped and hit the 52-week high with speculations that new substantial shareholder may emerge. Some of the possible shareholders who might be interested in Transmile included:

- DHL – while it denied the speculation, this company is the most probable candidate since Transmile and DHL business matches perfectly, not to mention close business relationship. If the price is right, the deal would make sense.

- Pos Malaysia – with 15 percent stake in Transmile, this company could not run away from speculated as the potential buyer. Analysts however think Pos Malaysia will not dig deep into its pocket for the company. Furthermore Transmile business model might not be Pos Malaysia’s the cup of tea. But Robert Kuok could be planning something here.

- Konsortium Logistik Berhad – Konsortium holds 20 percent while Pos Malaysia and Transmile holds 42.5% and 37.5% respectively in CEN Sdn Bhd which in turns own CEN Worldwide, the marketing arm of Transmile. What role could Konsortium plays by acquiring Transmile?

- Malaysia Airlines Cargo Sdn Bhd (MASkargo) – does MASkargo needs to buy Transmile since both has the same landing rights? There’s no compelling reason for MASkargo to buy into Transmile.

- Local tycoon Tan Sri Syed Mokhtar Al-Bukhary – with over US$2 billion he’s the seventh riches man in Malaysia. I won’t be surprise if this guy emerge as the new shareholder since he’s in the transportation industry as well.

Wong Yoke Meng who was appointed the new Managing Director of Transmile in Sept 2007 has resigned today. Hence, the rumors about a new substantial shareholder might be true after all. It doesn’t make sense for Wong to resign after his short tenure in Transmile unless there’s a major development.

Other Articles That May Interest You …

Thursday, March 27, 2008

Maybank’s stock punished after $2.7 billion BII purchase

Did Malaysia’s biggest lender, Malayan Banking Berhad (KLSE:MAYBANK, stock-code 1155), overpay when it bid billions of dollars in its quest to acquire 100 percent of Bank Internasional Indonesia (BII)? Maybank agreed to fork out a whopping $1.5 billion for 55.7 percent stake of the Indonesia’s sixth largest bank with another $1.2 billion for the remaining 44 percent stake from BII shareholders. It definitely raised many eyebrows with investors gave an early punishment when it sent Maybank’s stock price lower by more than 10 percent, it’s biggest drop since September 21, 2001 when market reopened this morning.

Maybank will acquire the 55.7 percent controlling stake from Sorak Financial Holdings, a

Temasek has been forced to sell the stake under a Bank Indonesia's rule of single presence policy banning an investor from having controlling stake in more than one bank in the country. Temasek also has a majority stake of 69.57% in the country's fifth-largest lender, Bank Danamon. Malaysia’s Khazanah Nasional Berhad also affected by such ruling but it planned to merge both Lippo Bank and Bank Niaga.

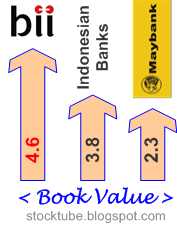

Too Pricey – Analysts downgrade Maybank

Analysts said a US$2.7 billion offer for PT Bank Internasional Indonesia (JAK: BNII) is overpriced and will undermine its ability to pay dividends. Furthermore the offer prices BII at 4.6 times book value, above Maybank’s 2.3, while the top five Indonesian banks now trade at around 3.8 to 3.9 times book only. Maybank naturally has created history as this is highest ever paid (book value) for a banking acquisition in Indonesia.

To add salt to the wound Citigroup Inc. and Morgan Stanley cut their ratings on the stock. Citigroup slashed Maybank's target price to RM8.38 a share from RM10.63 and downgrade it to “Sell”. Meanwhile Credit rating agency Fitch put Maybank's creditworthiness (current A- credit rating) on watch after the deal. While Maybank said it would fund the deal internally Fitch thought otherwise - the bank was likely to have to raise capital to reinforce its balance sheet. Credit Suisse analyst said the deal would empty the war-chest that Maybank has accumulated for acquisitions.

Maybank Dividend Yield at Risk

The cash-rich Maybank has about $11 billion (RM36 billion) cash on hand. Maybank last paid a special cash payment to shareholders in 2005. The company’s stock offers a gross dividend yield of 3.5 per cent, more than double that offered by Malaysia’s second-biggest bank, Bumiputra-Commerce Holdings Bhd, according to data compiled by Bloomberg. However with this latest acquisition, the hope of any special dividend vanishes – another reason why the stock was dumped.

Who’s the Winner?

The winner is definitely Singapore’s Temasek which paid only $217 million or 82 Rupiah a share for the BII (51 percent initially but increased to 56 percent later) in 2003 from BPPN,

So, could this be another classic example of a little too late and a little too pricey for Maybank to expand regionally? Hopefully it was not a decision (to purchase BII) based on emotion to emerge as the winner. Regardless of the arguments from Maybank’s top management to justify the acquisition, it’s up to the shareholders to reject or approve the acquisition.

Could there be any relationship between this pricey acquisition and the rumorsthat Bumiputra-Commerce Holdings Berhad’s (KLSE : COMMERZ, stock-code 1023) Bumiputra-Commerce Bank might be merged with Maybank?

Wednesday, March 26, 2008

Why you should use Limit Order when you’re undecided

Seriously, if you have this problem of falling in love with your portfolio, either stocks or options, you’ve better leverage on the limit order function to enter the price(s) you desire to sell or buy. It’s not too much to say that almost all the investors who trade on behalf of their own account are incapable of putting their emotions (greed and fear) aside. This is normal so don’t feel bad about it. Regardless of all the changes since the invention of stocks trading, one thing remains unchanged – human emotions.

My trades, AAPL May 135 Call Option, were triggered and hence all my options that expired on the month of May with strike price of $135 were closed automatically. In fact I lost more money (gained less) by constant monitoring than by leaving the STC (Sell To Close) to the system. Hey, all these brokerages invested millions of dollars for such functionalities so it would be very cruel if we didn’t use it. If you’ve been investing or trading long enough, you should realized that the major problem why traders lost money (or made less money for that matter) was because they do not know when and how to “SELL”.

As of writing, Apple Inc. Google Inc. and Baidu.com Inc. are all in the green territory even though the Dow and Nasdaq are in the red. I’ve mentioned in my previous article why I’ve chosen Apple Inc. instead of Google Inc. and Baidu.com Inc. for the Call Option. Open up your trading chart and watch how Apple Inc. skyrockets as of current moment – it’s a 30 degrees intraday uptrend. Wow! How I wish my Apple is still available (there I go again *grin*). Let’s see if there’s any more money to scalp from here – AAPL May 140 Call Option anyone?

Other Articles That May Interest You …

Cost-saving tip for PM, $200,000 instead of $30 million

Remember how the whopping $30 million tax-payers money evaporatedinto thin air by sending a Malaysian space tourist as part of the “controversial” $1 billion Russian arms deal back in Oct 2007? Some said the space tourist idea was never part of the original plan but since the enormous amount of $1 billion somehow contained hanky-panky elements (opposition Anwar Ibrahim claimed so during his campaign). Thus the bright idea of blasting a Malay tourist into the space hoping to divert the attention away, not to mention the potential of “feel-good” factor amongst the ethnic-Malay which could be translated into votes for the National Front coalition parties.

Fast-forward six months later the space tourist back-fire. Not only the National Front lost five states in addition to the prized two-third majority but its two states, Perlis and Trengganu were embroiled in government-palace crisis, so much so that Prime Minister Abdullah Badawi’s was humiliated when his preferred candidates for the Chief Minister’s position were rejected point-blank. Fortunately the country didn’t manage to buy (and waste another $100 million) the damn whole Russian Soyuz TMA-11 Space Rocket, courtesy of another freaking good idea from former Science, Innovation and Technology Minister Jamaluddin Jarjis.

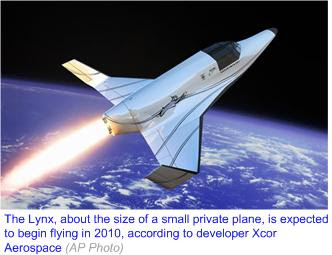

Just two months after aerospace designer Burt Rutan and billionaire Richard Branson unveiled a

There you are Mr. Prime Minister, the latest tip in cost-saving. Instead of spending another $30 million, of which you can send 150 persons instead of one, you now need to spend a fraction of $200,000 only.It’s good to hear that the Prime Minister has finally admitted his "biggest mistake" in disastrous elections was to ignore cyber-campaigning on the Internet which was seized by the opposition. Now he knows the power of the bloggers so start respecting them.

Other Articles That May Interest You …

Tuesday, March 25, 2008

Bursa Main and Second Boards Merger, a Marketing Ploy?

Speaking at the “Invest Malaysia 2008” conference here today (25th Mar 2008), the Prime Minister Abdullah Badawi announced that local stock market would merge its Main and Second boards to set up a single and unified board for more established companies with strong financial records (huh?). The third board, Mesdaq, which caters mainly to technology companies that are not qualified for listing on either the main or second board will be revamped to allow relatively smaller companies to access the equity market at an earlier stage of their life cycle.

Now, hold your horse as you should take this with a pinch of salt. Forget about the marketing talks that by combining both boards (Main and Second) it will miraculously create better established companies, let alone boosting stronger financial result or investment. The Main and Second board were created for obvious reason – to separate the “proven” and larger capitalized companies (Main board) from the “smaller-revenue” medium-sized companies. In short Second board companies that didn’t qualify for listing into Main board would need to “prove itself” financially before could be considered to be upgrade to Main board.

So it’s misleading to assume that by merging both boards, the listed companies will automatically become paradise with strong earnings and revenue. You wish to change the perception that all the stocks post-merger are of top-quality? Why not start from the respective agencies such as Bursa Malaysia Berhad (KLSE:BURSA, stock-code 1818), Securities Commission, Central Bank, Judiciary, Anti Corruption Agency (BPR) and others? There’re tons of companies that got listed without a sound business model, let alone a sustainable profit and revenue history. Underwriters were paid good money to drum up IPO in order to attract hot money from the public. Minority shareholders were taken as suckers.

Hmmm, what happen to the culprits who cooked up the accounting books? The recent 130 points plunge after the political tsunami should serve as a reminder of how fragile your investment is if most of the stocks are somehow tied to a “flawed framework” that related to politics. The only people who will suffer the most are the small investors and newbies who normally do not do their homework but assume blindly all the stocks are the same. At least with the separation of boards as of now, these idiots know the Second board stocks literally carry higher risks.

Other Articles That May Interest You …

- Meritocracy & Judicial Independence in doing business

- Malaysia to have new PM – who is the faster runner?

- Ling Liong Sik Resigned (or Fired?) from Transmile

- A case of Little Crime overshadows Big Crime

- Stock Market Criminals – NATO, No-Action-Talk-Only

- Listed Co Not Trustable – Book-Cooking from Day-1

- TRANSMILE in Loss since 2005, Lower 2004 Profit

- Widespread Accounting Crisis – Government Equally Responsible

- Privatization Gaining Momentum - Junk Stocks Left

Fishing for the bottom? Don’t bother, just trade short term

Looks like good news are aplenty right after the Easter – JPMorgan Chase & Co. (NYSE: JPM, stock) ups its bid for The Bear Stearns Companies, Inc. (NYSE: BSC, stock) and stronger than expected housing reportpleased the stock investors. Like it or not the Feds would have no choice but to allow the shareholders of Bear Stearns enjoy some more fruits from the higher offer from $2 to $10 a share. Although this is the first report sales of existing homes increased after six months of decline, it’s no-brainer that a full recovery could be many months away.

While many think so a handful of economists thought otherwise. I would like to hope so but I think the psychology of investors are pretty much have stabilize, which is important because it’s the perception that would influence the market’s direction. After the latest 0.75 percent interest rate cut to 3.00 percent, every Tom, Dick and your dog knows the Fed would probably cut the interest rate one more time, the most, before sit down and see how the situation will fare.

Other Articles That May Interest You …

Monday, March 24, 2008

Bear Stearns Bailout, should silly you blame Cramer?

Unless you’re living in Stone Age, you must have heard about one of the greatest mega-sale of the century – the $2 a share sale of The Bear Stearns Companies, Inc. (NYSE: BSC, stock) to JPMorgan Chase & Co. (NYSE: JPM, stock). Bear Stearns was facing collapse because of the U.S. mortgage crisis and the offer from JPMorgan, with the backing of the Federal Reserve Bank of New York, valued Bear Stearns at only $250 million – a whopping97.5 percent discount.

At $2 a share it’s as good as throwing your shares into the toilet. It’s little wonder that Bear shareholders are fuming at the outrages bid price. Who can blame them when suddenly their stocks investment shrunk by 97.5 percent in value? If you’re one of the investors or traders who have been following “Mad” Jim Cramer’s recommendations, you might want to strangle him for suggested (on 11 Mar 2008 on Mad Money) that “Bear Stearns is fine … Bear Stearns is not in trouble … Don’t move your money from Bear … Don’t be silly …” just before the collapse. Poor Cramer!!!

But before you actually reach for the gun and pull the trigger, you got to accept the fact that investments, regardless of instruments, carry certain degree of risk. To put the blame solely on Crazy-Jim is rather childish as sometimes you should follow your instinct and discipline. If your trade is already profitable (or the other way), there’s no harm to take it off the table. So it’s silly for Jim Cramer’s fans to follow blindly without doing one’s own homework.

In a twist to pacify angry Bear Stearns’ shareholders, JPMorgan today announced a sweetened offer, 400 percent or four times higher than the initial offer bid of $2 to $10 a share. However the Fed, which must approve any new deal, was balking at the new offer price on Sunday night. In the original deal, the Fed guaranteed to absorb $30 billion of Bear’s toxic assets while directed JPMorgan to pay no more than $2 a share for Bear to paint a picture as if it was not a bail-out plan. With this latest higher bid price, Fed is worry that critics would complain that tax-payers money are used to bail out Bear Stearns.

Interestingly Bear Stearn employees own more than a third of Bear’s stock and many longtime employees were reportedly could loose all the savings considering the stock was trading at $67 two weeks ago and as high as $170 a year ago. Anyway this is another classic example of why you should adopt a mixture strategy of long-term as well as short-term and middle-term investment instead of solely long-term. Most importantly do not forget the rule to lock in profit (if there’s any) or take some money off the table if you wish to put your trade to run.

Other Articles That May Interest You …

Sunday, March 23, 2008

Meritocracy & Judicial Independence in doing business

Just what are the factors foreign investors are looking at before they pour in millions or billions of dollars of investment money into a country? There’re many but certain mandatory or fundamental foundations must be in place before these foreign hot monies would find their new parking lots. Suffice to say some of these factors are, in no particular orders - political stability, transparency, investment protection, cost of doing business, good governance, financial rules & regulations and others.

I’ve wrote about one of the reasons why you should stay sideline since the political stability has changed with the recent 12th general election result which saw the government lost two-third majority and five developed states as well as the possibility of a new Prime Minister in not very far future. Although the states won by opposition parties would see a swing of transparency for the better, it’s still too early to jump into the local stock market because a desperate Federal government could resort to silly actions to rock the boat.

Penang, the state now controlled by DAP government (opposition), has trumpeted open tenders to start the ball-rolling to attract foreign investors in the name of transparency. This was lauded by businessmen because the “entity of corruption” and “abuse of power” would essentially be eliminated and hence the cost of doing business would be lower. But one of the most important issues that hindered foreign investors from pumping in their money was the lack of investment protection. Who could blame them if the country’s judiciary pillar was and still tainted since the 1988 judicial crisis?

I read with great interest today’s news that the newly-appointed de facto Law Minister Datuk Zaid Ibrahim declared that the Malaysia Federal Government must make an open apology to those victimised by the judicial crisis in 1988 that led to the inappropriate sacking of the then Lord President Tun Mohd Salleh Abbas. Zaid’s next step to strengthen judicial independence and the delivery of justice by revamping the appointment and promotion process of the country's judges and magistrates is something which everyone has been waiting for decades.

Thus, if the government has really repented of its past mistakes, it should, for example, let the national automaker Proton Holdings Bhd (KLSE: PROTON, stock-code 5304) runs its business

An excellent tip indeed but it would be of no use if the government still consider meritocracy as a stone-age beast that should be killed at first sight. In actual fact the whole government system in doing business is flawed. Take for example the pampered Proton dealers who were offered one-off VSS (voluntary separation scheme) fee of RM150,000 per dealer to close down their dealership in a downsize plan in the middle of 2007. Surprisingly only 36 out of 102 dealers accepted the offer while the rest of the dealers were asking as much as RM500,000 instead justifying that they have invested RM200,000 to setup their operations. Should there be VSS in such a scenario in the first place?

parasites dealers who were asking for compensation to recoup their initial investment. This is probably one of the most lucrative, no matter how silly, dealership you can ever have - almost risk-free, no? First of all there’s no business in this world that can guarantee 100 percent profitability, let alone compensation of up to RM500,000 which is more than double the investment cost.

If these dealers could not even face the reality of business risk, one could only pray when the full globalization takes effect. And if you weren’t aware, the “compensation” came from the RM500 million “Automotive Development Fund” allocated in the Ninth Malaysia Plan – that’s your (taxpayers) money dude.