Thursday, November 01, 2007

Judiciary Rot - Let’s do what each Individual should Do

Guess it’s true what a MP (member of parliament) said today. The MP, Zaid Ibrahim, who is a member of the ruling party, UMNO, is perhaps the only one from the government who dare to go against the odds on the ridiculous happenings to the nation’s judiciary. He can choose to sit and watch quietly from the sideline but being a senior lawyer, I guess the mess is too much to bear so much so that he couldn’t take it anymore and need to express his opinion.

Instead of firing salvos at the government to which I believe he knew would not make any difference considering more than 90 percent of the MP are hopeless, he fired at the people. He said he’s depressed as the people had become too comfortable due to the country’s prosperity and don’t seem to care too much about the independence of the judiciary and separation of powers. What really pissed him off could be the fact that despite almost 2,000 lawyers’ recent marching which should be seen as a sign of threat to national security, people on the street and even the bench does not seem worried.

Sharing the same sentiment on Malaysian continuous gloomy state of Judicial is the senior constitutional lawyer Raja Aziz Addruse who said the checks and balances that were in the 1957 constitution did not exist anymore. He cited the reasons for this change as a failure of the courts to uphold fundamental liberties, executive interference and the amendment to Article 121 which meant that the courts' jurisdiction was now as that determined by Parliament.

“Fundamental liberties no longer exist; this is a harsh thing to say but the courts don’t seem to think that fundamental rights are important … To me, the constitution now means nothing because it can be changed at any time” he said yesterday at a coffee table session on “What the Constitution means to me” on the last day of the 14th Malaysian Law Conference.

One of the most successful tactics adopted by ruling government is the creation offear, divide and rule. Most of the Malay-ethnic are being fed with subsidies, goodies such as NEP (New Economic Policy) and brain-washed with

As long as the economy doesn’t end up like in Myanmar (Burma), the Chinese wouldn’t care. That’s the problem with most of the Chinese people. They’re too scared to rock the boat even though the boat is actually rocking hard now and it’s a matter of time before capsize. Probably the Chinese learnt the art of denial syndrome from some of the MPs and prefer to live in the denial world – everthing is still OK.

Today also marks the “expiry date” of Chief Justice Tun Ahmad Fairuz Sheikh Abdul Rahim – his tenure

Ahmad Fairuz, who turns 66 (compulsory retirement age for judges) today, reportedly had his statement recorded by the Anti-Corruption Agency investigating the video clip controversy of which a lawyer was filmed talking to supposedly a senior judge on his handphone, purportedly trying to broker the appointment of judges. Let’s assume Ahmad Fairuz is history and his desire for extension will never come true. Then what? Who’ll be the next in line to take over?

Going by the Courts of Judicature Act 1964, the second judiciary man, the President of the Court of Appeal, Justice Abdul Hamid, will assume the role of the Chief Justice. However the rumors are circulating that someone dear to the ruling party might be given the helicopter ride. UMNO lawyer Zaki Azmi became the first lawyer in the history of Malaysian Judiciary to be appointed straight to the Federal Court, bypassing the convention of first serving in the High Court and the Court of Appeal back in early Sept 2007. Zaki could be the person in PM Abduallah Badawi’s backup plan to have someone pro-UMNO becoming the Chief Justice in case Ahmad Fairuz couldn’t make it.

So everything back to square one? The judiary continue to rot with the Executive squeezing Judicial’s ball to rubber stamp ruling government’s wishes. After the recent 2,000 lawyers’ recent marching now there’re talks to boycott the courts. Lawyer Haris Ibrahim had recently submitted a petition to the King containing 5,036 signatures from the public for a Royal Commission of Inquiry into the video clip. What else can be done to bring back the judiciary’s shine?

Other Articles That May Interest You ...

# Update: Court of Appeal president Datuk Abdul Hamid Mohamad has been made the acting Chief Justice while waiting for the post to be filled officially. Ahmad Fairuz's application for extension was NOT renewed.

From stocks to holiday cheer, enjoy it

Halloween is over but there’re still Thanksgiving and Santa Clause to greet you before the curtain is pull down for the year. This period is also the happiest for the kids as they’re looking forward to the long holidays, gifts and whatever their wish-lists drafted. Traditionally stocks investors, speculators, analysts and fund managers will be rushing to submit their leave applications (if they’re required to). Of course you still have some unlucky people staying put to monitor their portfolio because they need to perform window-dressing in order to show the customers their stocks are performing (hmmm, are they?).

Naturally sales will pick up during the last quarter of the year. Consumers need to do shopping and the shops need to clear their old stocks. That’s why year-end sales never fail to attract the customers, although sometimes the sales might be gimmick. The word “Sales” is enough to send high-voltage shock into shoppers’ mind to buy as if there’s no tomorrow. You might thought of just do a round of window-shopping and vowed not to buy anything (better save for the rainy day) but amazingly without you realizing it you’re inside the shop joining the crowds.

Despite the sales, it would be wonderful if you can get more from coupon codesand promotional deals in online shopping. With categories spanning from art, automotive, books & magazine, food, flowers, jewelry to office supply and others, you can find almost anything you like within your wish-list. The coupons available changes almost on daily basis whenever Coupon Chief able to scout for new deals.

The latest added into the list on the main site is 50% off at SpiritHalloween.com coupons clearance sale. I found the $13.46 offer for a wireless optical mouse with rechargeable batteries from Shop4Tech deals interesting and a bargain – it expires on Thursday.

Last 25 basis points cut for 2007 amid soaring oil price

As expected the Federal Reserve executed the second rate reduction by one-quarter percentage point or 25 basis points to 4.50 percent on Wednesday. Ben Bernanke has cut 50 basis points from 5.25% to 4.75% earlier in September. The 9-1 decision to cut rates on Wednesday was opposed by Thomas Hoenig, president of the Federal Reserve Bank of Kansas City. He preferred no change in the funds rate.

"The pace of economic expansion will likely slow in the near term, partly reflecting the intensification of the housing correction," the Fed acknowledged in a statement explaining its action. In response to the latest cut, commercial banks including Bank of America, Wells Fargo and KeyCorp. announced that they were cutting their prime lending rate - for certain credit cards, home equity lines of credit and other loans - by a corresponding amount, to 7.50 percent.

Fed policymakers indicated the two rate cuts ordered so far may be sufficient to help the economy make its way safely through the trouble spots. They said the risks to the economy from inflation "roughly balance," or are equal to, the risks of a serious downturn in economic growth. Previously, the risks of a recession were seen as more of a threat to the country's economic health.

Fed policymakers indicated the two rate cuts ordered so far may be sufficient to help the economy make its way safely through the trouble spots. They said the risks to the economy from inflation "roughly balance," or are equal to, the risks of a serious downturn in economic growth. Previously, the risks of a recession were seen as more of a threat to the country's economic health.Lynn Reaser, chief economist at Bank of America's Investment Strategies Group and other economists think the Fed probably will leave the funds rate alone when its meets next on Dec. 11, the last session of the year. While the stocks cheer the announcement, the oil prices soared to a record $95 a barrel. This put pressure on Bernanke as increases in energy and commodity prices have put renewed upward pressure on inflation.

The Dow, which had dipped briefly into negative territory after the decision, rose 137.54, or 1 percent, to 13,930.01. The Standard & Poor's 500 index rose 18.36, or 1.20 percent, to 1,549.38, and the Nasdaq composite index rose 42.41, or 1.51 percent, to 2,859.12. The Russell 2000 index of smaller companies rose 11.87, or 1.45 percent, to 828.02.

The Dow, which had dipped briefly into negative territory after the decision, rose 137.54, or 1 percent, to 13,930.01. The Standard & Poor's 500 index rose 18.36, or 1.20 percent, to 1,549.38, and the Nasdaq composite index rose 42.41, or 1.51 percent, to 2,859.12. The Russell 2000 index of smaller companies rose 11.87, or 1.45 percent, to 828.02.Now that the interest rate has been reduced the gap has widen between U.S. and Malaysian. It would be interesting to see if the Malaysian Central Bank will be under pressure to cut the rate as well. If it plans to have stronger ringgit, then the governor does not have to do anything – just sit tight. However this would invite speculators and to intervene means the central bank have to buy dollars. Would it be more efficient to reduce rate then? Furthermore the inflation is going up regardless of the rate due to poor economic management.

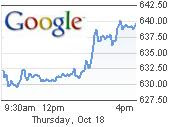

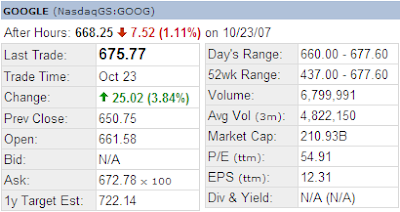

On the side note, I blogger earlier how the Google amazingly leaps to $700 from $600 within 20-days of trading and I can assure you that this might not happen again anytime soon within your lifetime. The stock is just spectacular. It’s fabulous. For readers who have been following my journey to the Googleplex, my position has breached the 400 percent profit. However it weren’t with fear and greed along the way especially when you saw how the stock was trying very very hard to stay above the $700 level but slipped on various occasions.

Frankly there was a period on Wednesday trading when I thought of just sell and close the position as the heat was too much. But then the expectation was high that the Feds was going to cut the rate and this will send the stocks higher. So what I did to control my emotion? I closed all my trading session and did some other stuff. And when I checked the Google Inc. (as well as Apple Inc.) after the closing bell, I was smiling from left to right. Now I’ve told you how I did it, you might want to tell me how you control your emotion when you’re trading volatile stocks.

Frankly there was a period on Wednesday trading when I thought of just sell and close the position as the heat was too much. But then the expectation was high that the Feds was going to cut the rate and this will send the stocks higher. So what I did to control my emotion? I closed all my trading session and did some other stuff. And when I checked the Google Inc. (as well as Apple Inc.) after the closing bell, I was smiling from left to right. Now I’ve told you how I did it, you might want to tell me how you control your emotion when you’re trading volatile stocks.Other Articles That May Interest You ...

Google leaps to $700 from $600 within 20-days trading

Investors or traders who believe in Google have every reason not only to smile but laughing all the way to the bank. Since the Mountain View-based company reported a set of good earnings less than 2 weeks ago, it breached the $650 level and never looks back. And to think that the internet search engine breached the $600 level less than 20 days ago can easily put other internet and technology stocks to shame. Can you imagine that this guy could jumps more than $100 a share within a period of 20 days?

Today, Wed 31st Oct 2007, Google Inc. (Nasdaq: GOOG, stock) created history when its stock price past through the $700 a share barrier for the first time. At one time the shares traded as high as $704.79 in morning trading before falling back to the current $700 a share. In fact as time past, the stock seems to trade within a very tight range trying to put its foot above the $700 foundation.

With the latest stock price Google’s market capitalization reaches $220 billion mark, more than the second richest man on earth, Warren Buffett. However Warren’s refusal to split his Berkshire Hathaway's (NYSE: BRK.A, stock) means Warren still hold the trophy for owning the most expensive stock on earth - $130,000 a share. Larry Page and Sergey Brin, both 34, have been the biggest winners by far, with estimated fortunes exceeding $20 billion apiece.

The latest surge came after Google confirmed plans to become a bigger force in the Internet's social networking scene and amid reports that the company is about to unveil a long-rumored operating system designed for mobile phones so it can make more money by distributing ads to people on the go – reported AP. Pending the announcement from Ben Bernanke, it appears the market is in silent mode at this moment

Other Articles That May Interest You ...

- Stock Jumps, Google Phone on the Analyst Day?

- Bad News for You and Good News for Me

- Change in plan for Google, going for “Top Greed”

- Little Secret in Making Money trading GOOGLE

- Google and Apple stocks, my money making machine

- GOOGLE ready to blast off into the space of $700

- GOOGLE's stock price zoomed above $600 finally

Wednesday, October 31, 2007

Trading Options can generate 10% monthly returns

Whenever the Fed speaks, everyone stop trading and listen. Stocks markets will normally go to silent from busy mode, at least relatively. After the announcement, everybody will either scramble to buy or sell. That’s where the excitement is and it’ll be more exciting if the people freak out to the direction of your prediction. Today, Wednesday 31st Oct 2007, we’ll see if Bernanke is obedient enough to follow the crowds’ urge to cut the rate again. Most people think it’s likely. And what’s the quantum? It’s going to be a quarter or 25 basis points, so goes the speculators.

The Iron Condor

It’s easy because you only trade once per month with the objective of achieving10% returns every month using iron condors. Iron Condors what? Iron condors is the strategy adopted by Condor Options designed to help lazy *grin* investors generate consistent 10% monthly returns with just 10 minutes a week of your time.

Condor Options Performance

Before we proceed, let’s take a peek at iron condors performance. If you visit their site, the iron condor strategy actually generates an average return of 23.94 percent (based on the disclosed positions since June 2007). That’s not bad considering the fixed-deposit from the bank next to your house is only giving out a pathetic single digit return.

Iron Condor’s strategy in making money

It’s easy, convenient and profitable all right but what is this options tradingstrategy? After reading it I think its equivalent to the spread strategy. Everything boils down to the time-value of options. Just like warrants, options expire within certain period of time. Instead of beating (or control) the stocks price which you do not have the capability to, you instead concentrate on the time-value. The basic fundamental is quite simple. Instead of a buyer, you become a seller.

Assuming stocks or indexes normally trade within a range, you sell options at the top and bottom of the range with the hope that it will expire worthless (same expiration month) – and you keep the credit (the money). Multiply that with more contracts and you can make more money. A simple method but it does come with some risk. The risk is when the stocks or indexes make some huge movement up or down and infiltrate into the range predicted of which you might get assigned or exercised. To tackle this risk, the strategy is to buy options a bit further (out of money) above and below the predicted range.

Since I’ve deploy the same strategy before I know it works. But if you’re thinking of making 100, 200, 300 or higher percent profit trading options, this strategy might not be your choice. Furthermore I like the excitement of very volatile movement as demonstrated by Apple Inc. and Google Inc. because I can put my fear and greed to test (crazy me).

Forget about TMT stocks, here come the Replacements

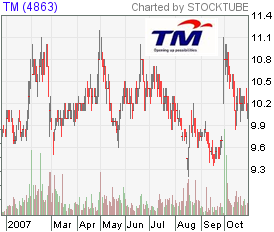

For a very long time, foreign investors were fed with the limited choice of TMT whenever stocks investing are concerned in Malaysia. The abbreviation of TMT means Telekom, Maybank and Tenaga. The best of practice for foreign fund managers then was you must invest in these three heavyweight stocks since they constituted the biggest percentage in terms of Kuala Lumpur Composite Index (KLCI). And when these three musketeers move; the KLCI move. TMT was like the Great Wall of China and you can’t and shouldn’t claim to have been to China if you haven’t visited the Great Wall.

In layman term, it’s quite easy to justify TMT as the leader in the stock exchange. Telekom Malaysia Berhad (KLSE: TM, stock-code 4863) was the biggest and the only player who monopolized the telecommunication sector. Before the emerging of mobile or cell phones, the land-lines were the cash-cow of Telekom. Telekom ruled the land of the nation's telecommunication.

Malayan Banking Berhad (KLSE: MAYBANK, stock-code 1155) being the largest bank with the most number of branches throughout the country is synonym with national bank status of a nation. With limited and near to impossible for other banks to expand their branches, Maybank monopolizes the domestic market.Tenaga Nasional Berhad (KLSE: TENAGA, stock-code 5347) is the only electricity provider and the monopoly is obvious in the energy sector. The latest report from theStar which picked the source from Bloomberg shows that foreign investors are slowly shifting the decades old choice from TMT to new candidates. The catalyst was indeed the surging prices in palm-oil. IOI Corporation Berhad (KLSE: IOICORP, stock-code 1961) appears to have beaten all the TMT candidates when its market capitalization has ballooned to RM47 billion compared with Maybank’s RM43.2 billion and TNB’s RM40 billion. Public Bank Berhad (KLSE: PBBANK, stock-code 1295) further put the TMT to shame when the company took the fourth place with market capitalization of RM39 billion.

The latest report from theStar which picked the source from Bloomberg shows that foreign investors are slowly shifting the decades old choice from TMT to new candidates. The catalyst was indeed the surging prices in palm-oil. IOI Corporation Berhad (KLSE: IOICORP, stock-code 1961) appears to have beaten all the TMT candidates when its market capitalization has ballooned to RM47 billion compared with Maybank’s RM43.2 billion and TNB’s RM40 billion. Public Bank Berhad (KLSE: PBBANK, stock-code 1295) further put the TMT to shame when the company took the fourth place with market capitalization of RM39 billion.

IOI Corp which is headed by its founder Tan Sri Lee Shin Cheng has a weighting of 6.24 percent on the benchmark KLCI should thank global palm-oil prices for the wealth created. On the other hand the Malaysian version of Warren Buffett, Public Bank founder Tan Sri Teh Hong Piow, has shown that good management and the practice of meritocracy in running the banking operation will ultimately win the hearts of investors. Of course his latest expansion to China contributes to the soaring stock price of his baby Public Bank.

Other Articles That May Interest You ...

Can’t trade stocks or options without calculator

When is the happiest time in an investor’s (or punter) life? When his / her stocks or options in the profitable territory of course. If you invest in equity markets such as Malaysia or Singapore stock markets, you can only celebrate when the stocks go up. On the other hand if you trade the more mature, transparent and fairer markets such as U.S. where the market makers competition actually offset the unfairness on small investors, you can cheer whenever the stocks skyrocket or plunge down from the 50-storey building (depending whether you long or short the stocks).

If you noticed, the next thing you’ll normally do when your trades are in the green is to whip out your best calculator and start punching some numerical keys to see what the profit is. Sound familiar huh? Yes, your trading platform might be able to tell you your precise profit but when you’re not in the rush to sell, then calculator is your best friend. I can never survive without a calculator, not that the Windows-XP doesn’t have the built-in calculator. Yeah, call me primitive or whatever.

But there’s another reason why I still depend on calculator. The fact that the types of stock options I trade every now and then are highly volatile and I’ve my objective to compete against myself in terms of percentage gain, I often use the calculator to determine if my target has been achieved. And talk about percentage gain, did you notice how Google tried very hard the whole day but fails to breach the $700 level?

According to Wize, the best calculator somehow produced from the country named Japan and the reason behind that is very obvious. Do you have a calculator close to you during your trading hours? What's your best calculator you've ever used?

Tuesday, October 30, 2007

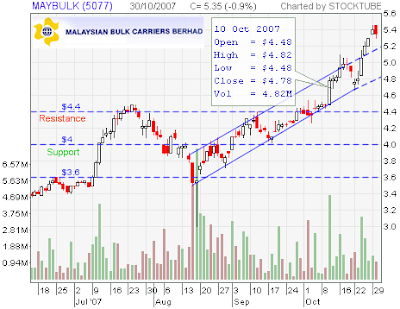

Revisiting MAYBULK’s Stock after One-Month

Diversification, diversification and diversification – that’s one of the strategies in stocks investing if you wish to make money. Why diversify? To old birds (veteran investors) you should know what does that mean. To new birds (newbies) it simply means not all stocks will go up or down at the same time. And if you do not know which sector is going up then how can you possibly pick which stocks to invest? Well you don’t and won’t know but in order to get maximum exposure (if you can afford it) the best bet is always diversify.

A classic example was when the U.S. subprime crisis blew off. The dust of the housing explosion affected not only property sector within U.S.’s shore but also the United Kingdom, Europe and even Japan. If only I can transport you back to the future in say, 2005, you would be thrilled trading housing stocks. And if you’re one of investors trading or investing U.S. stocks or options, you would smile the moment I mention companies such as Eagle Materials Inc. (NYSE: EXP, stock) and KB Home (NYSE: KBH, stock).

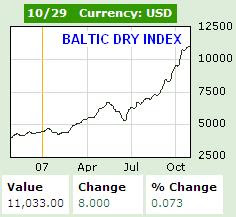

A month back (25th Sept 2007 to be exact) I talked about Malaysian Bulk Carriers Berhad (KLSE: MAYBULK, stock-code 5077) and why it’s one of the stocks you can’t ignore. Read the article if you haven’t. If you were looking for fundamental stocks to add to your portfolio in align with the best of practice of diversification then you’ve every reason to smile with MayBulk. The stock breached the resistance level of RM4.40 on 4th Oct and the price-action-volume on 10th Oct should give you the signal to go in.

Looking at the prices of commodities, can you imagine the potential uptrend of Maybulk stock if the BDI continue to increase by another 20 percent?

Other Articles That May Interest You ...

Another 25 basis points rate cut overshadow Oil Prices

Oil prices continue to surge but that is not going to stop investors fromfeeling optimistic about the stock market. At least the expectation from the Federal Reserve to cut interest rate again is high and strong. And this (optimism) is sufficient for the investors to ignore the fact that crude oil futures had soared above $93 a barrel for the first time in overnight trading, after Mexico's state oil company said it was suspending about a fifth of its oil production due to a storm. This will temporarily halt as much as 600,000 barrels of daily crude production.

The Fed begins its two-day meeting on Tuesday, and the market widely expects a rate reduction the following day after the 50 basis points cut last month (September). While Ben Bernanke’s team remains concerned about inflation it is likely to lower the target federal funds rate by a quarter-point (25 basis points)due to overriding credit worries. Earnings so far have shown weakness in the financial and housing sectors but strength in others.

The likelihood of the central bank in cutting rates again will further boost oil prices but will send more pressure to the US-dollar. I’ve wrote that Ben Bernanke’s team has ample room to play with the interest rate. He has 4.75 percent to toy aroundand if the new round of 25 basis points cut doesn’t make the investors happy he can continue to cut it in the next meeting. The ball is on his court and it’s up to him to do whatever he thinks will work for U.S. economy.

And to think of the potential of the funds rushing to find parking lots in the rest of the markets including Malaysia stock market, you should start drooling.

Other Articles That May Interest You ...

Sunday, October 28, 2007

Why Can’t Public Enjoy the Benefits of Strong Ringgit?

It’s not difficult to become a Finance Minister, especially when you’re also holding the position as the Prime Minister cum Minister of Internal Security.Malaysian Prime Minister (PM) could easily be one of the most powerful positions in the world, holding the other two very important ministerships as he walks the corridor of powers. As the Finance Minister, basically the nation’s coffer is at PM’s mercy and disposal. As the Minister of Internal Security, basically the PM is empowered to arrest and detain anyone without trial for an indefinite period based on mere suspicion that one "may be likely" to commit an act deemed dangerous to national security.

Except for all the local Government-control media, almost all foreign media and local blogs (including StockTube) have wrote that somehow the snap general election is very near. Of course if you care to read other political blogs, then you won’t be surprise if the dates such as 25th Nov 2007, 15th Dec 2007 and 15th Mar 2008 are mentioned as the possible election date, at least those are the prosperous dates consulted from feng-shui masters by the ruling party – as the claims goes.

Election’s “feel good” factors

Feng shui or not, it’s no brainer that you need “feel good” factors, lots of them, to attract voters to put a cross on the voting paper. It’s not easy to get all the stars aligned. You should know that there’re couple of daily stuffs which will see price hike next year, 2008. Amongst them are the toll-rate, fuel prices, electricity rate and gas prices. No prizes if you can guess what else will be affected. As with the economic equation, the chain reaction could be unstoppable.

The ruling government is a hell lucky government. This doesn’t mean the government is effective in governing the small nation of only 26-million people though. It actually implies that the nation is blessed with too much natural resources, so much so that Singapore senior Lee Kuan Yew’s envy was obvious during an interview recently. The government naturally depends on these natural resources, one way or another, to spring fairy-tales and subsequently feel-good stories.

The stock market closed last Friday to a fresh high to 1,398.55, just an inch from the 1,400 mark, mainly due to gains from palm oil companies. Largely influenced by high crude oil, the prospect of demand for biofuels from palm oil lifted the composite index. The currency ringgit meanwhile strengthened to a 10-year high of 3.3480 against the US dollar.

Finance Minister who talks Myth

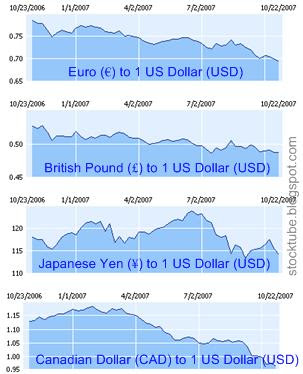

So, when the Malaysian PM cum Finance Minister cum Minister of Internal Security said that the strengthening of the ringgit is due to investors' confidence in the local currency, the expanding economy and strong foreign exchange reserves, you should take that with a pinch of salt and not putting an ounce of trust.Investors or currency speculators are not buying ringgit because they’re confident the ringgit will appreciate due to fundamental reason. They’re buying because theU.S. dollars are weakening. And there’s obvious difference between them.

Now why I equate U.S. dollar to cancerous instant noodle? Because Bernanke had chop off a whopping 50 basis points (0.50 percent) in interest rate and he’s expected to cut more in the coming months. This means the value of U.S. dollar has greatly reduced and will continue to weaken. People don’t buy currency that depreciated by 0.50 percent if there’re better choice elsewhere. If this is not enough to scare you, remember that the Feds Chairman still has 4.75 percent to play around. He can still cut 0.25 percent for 10 more times to bring the rate to 2.25 to tame the likely-recession into submission (example).

So, it’s a myth and definitely not true what the PM told you.Nevertheless you can bet that if U.S. dollar continues to show weakness, more foreign funds might decide to park in the local stock market. I said “might” because Malaysia is not the only choice for these cash-rich funds. There is still Singapore, Indonesia, Thailand or even Vietnam stock markets that are on the race to attract the hot money. In factevery major currency appreciated against the U.S. dollars after “Uncle Ben” cut the rate by 50 basis points to 4.75 percent on 18th Sept 2007, mind you.

Will the public enjoys the benefits of Strong Ringgit?

On the other hand, there’re hidden reasons why the government favors strong ringgit. It will heal some of their headaches, at least temporary until after the election. Both higher crude oil and strong ringgit will greatly reduce the fuel subsidy. Strong ringgit also will make import goods less expensive and in theory imported food and materials’ prices should be lowered. But you won’t see any price reduction in these goods as the chain of governance is simply too messy.

I wonder where’s the prepared text used repeatitively that justify weaker ringgit as stronger ringgit will make the nation’s export less competitive. Who says you need a PhD to become a Finance Minister?

Other Articles That May Interest You ...

Hope for bad credit consumers in U.S.

With most of the Americans do not really save for the rainy day, it only get worse when a housing problems hits. Just like any bubbles, after the technology dot com bubble burst a decade ago, the housing bubble burst this time around. It’s not that hard to spot if there’s any bubble that you should be aware of since the law says “whatever goes up must comes down.”

But does that mean Americans who do not have good credit rating should be left to rot? How can consumers with a less-perfect credit rating apply for facilities such as credit cards, housing loans, personal loans, auto loans etc? Get real; if these people have a good credit, they won’t be cracking their heads scouting for loans in the first place.

There’re multiple free consumer resources that you can visit to get the best bad credit offers. Not only can you get assistance on multiple loans, you also get to know how to repair your poor credit rating and consolidate your monthly bills into one lower payment.

*sponsored*

Anniversary Gift from Google to StockTube – PR 5

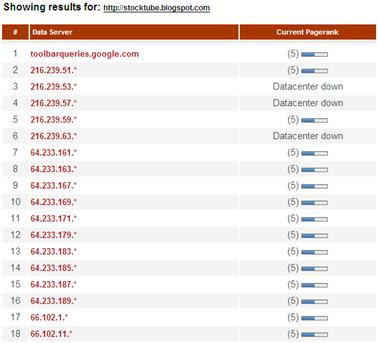

You might not know this but time really flies. I have almost forgotten that this month is actually StockTube’s “1st Anniversary” in the blogosphere. It was a year ago when I discovered the fun of blogging and immediately started with Google Blogger’s platform. Since then StockTube had blogged about 720 posts which translate into about 2 blogs per day. Am I sick and tired of blogging? Not for a single moment.

I might not be the specialist when come to bait-linking and marketing of this blog compare to bloggers such as Darren Rowse, John Chow or Shoemoney who made tons of money from blogging. But then my area is different from them. My focus is in stocks investing and options trading while at the same time introduce some alternatives in making pocket money of which you can leverage on while you’re too free doing nothing simply because the stocks do not present the opportunity for you.

And speaking of the above three top bloggers, if you read about the hoo-haa in the blogosphere about how Google’s PageRank, a trademark of Google Inc. (Nasdaq: GOOG, stock), created havoc when even Darren Rowse was slapped with the punishment of PageRank’s plunge from PR6 to PR4 days ago. However Darren’s PageRank has since recovered to its original PR6 (as of today). As for John Chow, Google’s servers are confuse which PR to award – still undecided whether PR4 or PR5. Still, not many people know what actually happens and why Google’s PageRank ran amok (guess what, youtube itself was punished with PR3 from PR8). The only speculation was that blogs were punished because if their involvement in links-selling.

Other Articles That May Interest You ...

Saturday, October 27, 2007

Home buyers switching to home improvement

Another week ended with another achievement by none other than crude oil prices. Light, sweet crude for December delivery rose $1.40 to settle Friday at a record $91.86 a barrel on the New York Mercantile Exchange after rising overnight as high as $92.22, a new trading peak. Analysts can argue till the cow comes back that the underlying fundamentals don’t support such high prices and put the blame squarely on speculators but the fact remains one after another factor haunting the oil prices.

The factor being the markets are becoming increasingly uneasy and upset over the prospects of entering the winter high-demand season with inventories at too-low levels, hence driving the oil prices up. In the meantime, the housing problem appears to be still around for some time and it’s not out of wood yet. People who was hit by the recent sub-prime crisis are thinking twice about speculating on housing, at least for the time being.

Not far away business such as garage conversions to convert under-used space into a bigger and roomier area is picking up. Anglian home improvements for example could expect good business as more people are scaling down from expansion and instead concentrate on upgrading their existing house, probably to create better home while waiting for the right time (for the housing prices to pick up again in future) to dispose it.

*sponsored*

Friday, October 26, 2007

Scalped small profit from Akamai during boring time

Yesterday, Thursday, was rather a boring trading day as both my Google Inc. and Apple Inc. were not performing as expected. If you were monitoring both stocks yesterday, you will know what I mean. Anyway, you can always scout for some of the stocks and scalp some profit out of it. Really, there’re many way to skin a cat, not that I like to devour exotic meats in real person.

Akamai Technologies Inc. (Nasdaq: AKAM, stock) used to be my pet stock but since it disappointed me last year, I’ve totally put it in cold-storage. Obviously when you’re investing stocks especially trading option, you should be flexible to dump stocks that deviate too far away and fails to deliver according to your trading methodology. There’s nothing wrong in doing so.

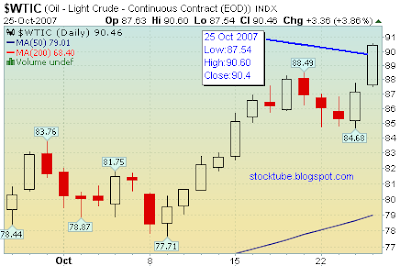

Oil prices establishing $90 as the new base

Oil prices closed above $90 a barrel for the first time officially Thursday, on news that Lebanese troops had fired on Israeli warplanes. Even though the new conflict will not affect oil supplies directly, it would however indirectly “invite” other Middle-East countries such as Saudi Arabia and Iran into the whole hostile situation. The NYMEX Crude Oil closes at $90.46 after reaching the high of $90.60 earlier of the day in U.S.

During Friday Asian trading, the oil prices posted another new trading record at $91.10 on renewed concerns about oil supplies and news that OPEC won't further increase output. Organization of Petroleum Exporting Countries Secretary General Abdalla el-Badri told The Wall Street Journal Asia on Thursday that the cartel is not in discussions to boost production by 500,000 barrels. The comments counter rumors that Saudi Arabia is pushing for another production increase after pressuring the group into one of similar size that goes into effect Nov. 1.

But the reality is here to stay and you better prepare for the worst. Instead of worrying whether there’ll be fuel hike, why don’t you worry about the quantum of the hike? Hypothetically, I had blogged how the current administration might have found the solution to the high oil prices. But I stopped short of talking about the $100 a barrel possibility as I don’t think anyone can chew more than the $90 level then. Given the same hypothetically formula, now you might need to dig deeper into your pocket to pay additional 30 cents a litter to the petrol station to fill-up your fuel tank.

Other Articles That May Interest You ...

Thursday, October 25, 2007

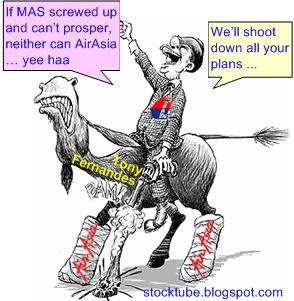

Monopoly No More, AirAsia to fly to Singapore

Tony Fernandes’s grumbling about the bias protectionism rule in favor of Malaysia Airline System (KLSE: MAS, stock-code 3786) appears to bring positive result after all. Today Malaysian Prime Minister Abdullah Ahmad Badawi said that budget carrier AirAsia Berhad (KLSE: AIRASIA, stock-code 5099) has won a battle to fly the lucrative Singapore-Kuala Lumpur route, breaking the national carriers' monopoly.

Reports said the cabinet agreed yesterday to open the routes to budget airlines from the two countries under a reciprocal arrangement, starting in December 2007 or January 2008. The Cabinet has given approval for AirAsia to operate two daily flights each from Kuala Lumpur, Penang, Kota Kinabalu and Kuching to Singapore.

Earlier this week AirAsia's founder Tony Fernandes said (with great sadness) that with Singapore indicating it wants to open the sector to competition ahead of a January 2009 deadline, Malaysia Airlines remained the only roadblock. Tony who is reportedly to be in Singapore could not comment as he claimed he isn't aware of the government’s decision.

Earlier this week AirAsia's founder Tony Fernandes said (with great sadness) that with Singapore indicating it wants to open the sector to competition ahead of a January 2009 deadline, Malaysia Airlines remained the only roadblock. Tony who is reportedly to be in Singapore could not comment as he claimed he isn't aware of the government’s decision.MAS, the government-linked company that has been pampered since its birth and never knows the word competitiveness and survival through-meritocracy had opposed the move, saying it needs more time to execute its recovery and that Malaysia and Singapore should adhere to the original timeline for liberalization – a reference to the Asean Open Sky Policy, scheduled to take off on Jan 1, 2009.

With this new development, it appears the rumorabout AirAsia’s possibility of getting the direct flight to Singapore in exchange for the goodies given to MAS’s own version of low-cost entity FireFly is true. FireFly which was allowed to operate from Subang and even fly the same routes as AirAsia (talk about copycat) in the latest local aviation news is said to emulate the business model of AirAsia.

With this new development, it appears the rumorabout AirAsia’s possibility of getting the direct flight to Singapore in exchange for the goodies given to MAS’s own version of low-cost entity FireFly is true. FireFly which was allowed to operate from Subang and even fly the same routes as AirAsia (talk about copycat) in the latest local aviation news is said to emulate the business model of AirAsia.Tony who is in Singapore currently might be there to finalize the details of the new route including logistic and fares. Already there’s news that prices for the Singapore flights are expected to start at RM9.90 for return trips. This will deal a severe blow to MAS which is currently serving the exclusive and lucrative Kuala Lumpur-Singapore route which together with Singapore Airlines fly 20 times a day between the two cities.

But what prompted Malaysian Government to become business-conscious all of a sudden? It can’t be the articles written by StockTube. Definitely it couldn’t be the continuos grumbling from Tony Fernandes. It could be a combination of several factors. On top of the table, it could be the “request” from Singapore Airlines itself to allow its Tiger Airways to fly direct to Kuala Lumpur. Tiger Airways’ profit is Singapore Airlines’s profit since the latter owns 49 percent stake in Tiger Airways.

It could also due to the fact that the tourists’ arrival during the current 2007 Visit Malaysia Year is bad, so bad that the Tourism Ministry is talking about extending the program into 2008 (of course the ministry could twist the fact that the extension is due to the overwhelming response so much so that it would be cruel not to prolong the program). Tourism is one of the industries that bring in good, easy and hot money into the country.

It could also due to the fact that the tourists’ arrival during the current 2007 Visit Malaysia Year is bad, so bad that the Tourism Ministry is talking about extending the program into 2008 (of course the ministry could twist the fact that the extension is due to the overwhelming response so much so that it would be cruel not to prolong the program). Tourism is one of the industries that bring in good, easy and hot money into the country.Whatever the reason, AirAsia is seeing the early arrival of Santa Clause as the profit from the new routes will definitely contributes to the company’s bottomline. The stock should rejoice with such a piece of news.

# Note: It’s been extreamely difficult to post articles, check Google’s gmail and moderate comments for the past 2 days. The performance is so bad (yes, the problem still persists till now) that I thought I’m connected to internet via 28.8kbps dial-up. It appears accessing Google’s products are taking ages – that’s the risk of putting all the eggs inside the same basket. Wonder what could be the problem(s). Heck if not for the reason that Google stock has made good money for me, I would start cursing it.

Other Articles That May Interest You ...

Wednesday, October 24, 2007

RHB needs to merge to stays Relevant

Rashid Hussain Berhad (now delisted) was started with a big-bang under the ambitious mission to turn the empire under the founder Tan Sri Rashid Hussain into a major financial supermarket in the 1990s. Although no longer the captain of the ship, Tan Sri Rashid should be able to smile as the RHB brand still survives until today. But given time and behind the door’s plan, it won’t be long before the name vaporizes into thin air. Furthermore there’ve been too many owners coming in and out the top executive’s door to make the RHB brand relevant anymore.

You’ve have heard from both EPF-RHB and AmBank Group who denied that they’re talking over a nice cozy dinner about a merger plan. It’s a rather complex decision. On one hand you’ve foreign parties namely Kuwait Finance House, Bank of Nova Scotia and unidentified party who expressed their interest via Goldman Sachs Group Inc. Goldman Sachs was appointed by EPF to manage the sale of its equity interest in the financial services group.

Today, RHB Group managing director Michael Barret said RHB is "highly unlikely" to achieve its own goal of becoming one of the top three banks in Malaysia by 2012 and in the region by 2020 without merger and acquisitions (M&As). It’s not easy to acquire foreign quality financial institution with RHB’s current strength. It had tried with PT Bank Niaga Indonesia and should know the potential rewards against risks. You need to have very deep pocket to purchase foreign banks which can contribute instantly to your bottom line.

Hence the best bet is still to merge with another strong local bank such as Ambank or even CIMB. If it materialized, the chances of seeing the RHB logo again could be slim.

Other Articles That May Interest You ...

Stock Jumps, Google Phone on the Analyst Day?

You might get sick and tired with me for being so obsessed about Apple Inc. and Google Inc. Forgive me but somehow I couldn’t think of any other technology stocks that grow as fast as these two mean machines. Contrary to the basic rule of fundamental investing that says you shouldn’t invest in stocks that have very high P/E, there’s exception to the fast growing stocks such as Apple and Google.

Shares of Google Inc. topped $675 for the first time Tuesday, nearly one week after the

Google Inc. (Nasdaq: GOOG, stock) is set to host an Analyst Day meeting on Wednesday, October 24, 2007 in Mountain View, California. The presentations that everyone is waiting for are scheduled to begin at 10:00 a.m. Pacific Time (1:00 p.m. Eastern Time) and conclude by 2:30 p.m. Pacific Time (5:30 p.m. Eastern Time). As the saying goes – when the internet search giant speaks, all of Wall Street listens. There could be some surprises which among others the announcement of Google’s Phone.

Google’s stock was partly boasted by the news that Google and television ratings company Nielsen will announce a multi-year deal on Wednesday to provide demographic data to Google's system for selling television advertising. Google will combine the data it receives from television set top-boxes with information that Nielsen, the dominant TV ratings company in the United States, provides on viewers by gender and age.

Tuesday, October 23, 2007

Malaysian Casino King, Lim Goh Tong, passed away at 90

Malaysia’s third richest man and the founder of Genting Group(KLSE: GENTING, stock-code 3182), Tan Sri Lim Goh Tong, passed away at 11.20am Tuesday at the Subang Jaya Medical Centre. The tycoon who was 90, leave behind a diverse business empire worthUS$22 billion. He survived by wife Puan Sri Lee Kim Hua, and their six children and 19 grandchildren.

The fifth child in a family of seven children, Lim migrated from China's Fujian province in 1937 at the age of 19 with only a small suitcase and US$175. He battled against the odds to build

He made his first fortune by trading in second-hand heavy machinery in the 1940s after the end of Japanese occupation, and later ventured into mining. While working on a hydroelectric power project in 1964 in Cameron Highlands, a popular hill resort patronized mostly by British colonials at the time, Lim dreamt of building a similar hill resort nearer to the country's biggest city, Kuala Lumpur, as a getaway for local residents.

Besides the flagship casino in Malaysia, Genting group’s empire includes Singapore-listed Genting Interntional, Hong Kong-listed Star Cruise Ltd., 46 casino properties in Britain under the Stanley Leisure group and casinos in Australia and Philippines. Late last year (2006) under the stewardship of his son Lim Kok Thay, Genting International-Star Cruises consortium won the Singapore’s Sentosa integrated resort project and is set to open a casino resort by 2010 that will include a Universal Studios theme park, a giant oceanarium and film production facilities.

Other Articles That May Interest You ...

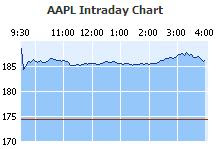

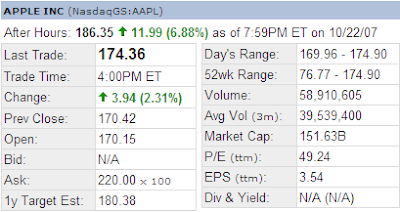

Knight Apple Saves the Day and the Tech-Stocks

YES! Apple did it again. Apple saved the day. Apple is incredible. What a wonderful Apple stock. You simply got to love Apple Inc. and Steve Jobs. I might sound exaggerated with all the praises for Apple but it's simply lovely. Not only it re-injected the optimism into the stock market especially Nasdaq, it also revitalizes the rest of the technology stocks, especially Google Inc.

For the three months that ended Sept. 30, Apple Inc. (Nasdaq: AAPL, stock) said on Monday (after market closed) it earned $904 million, or $1.01 per share, compared with $542 million, or 62 cents per share, in the year-ago quarter. Revenue totaled $6.22 billion, compared with $4.84 billion in the same quarter last year. This easily beat by a wide margin the expectations of analysts polled by Thomson Financial, who predicted earnings per share of 86 cents on sales of $6.07 billion.

Apple said it shipped a record 2.16 million Macs in the quarter, an increase of 34 percent, while it sold 10.2 million iPods, up 17 percent. In the first full quarter of iPhone sales - a number many on Wall Street were waiting for -Apple said it sold 1.12 million units, bringing the cumulative total to 1.39 million since the product debuted on June 29. Sales of the iPhone picked up in September after Apple knocked $200 off the price of the 8-gigabyte model, bringing it down to $399.

Apple said it shipped a record 2.16 million Macs in the quarter, an increase of 34 percent, while it sold 10.2 million iPods, up 17 percent. In the first full quarter of iPhone sales - a number many on Wall Street were waiting for -Apple said it sold 1.12 million units, bringing the cumulative total to 1.39 million since the product debuted on June 29. Sales of the iPhone picked up in September after Apple knocked $200 off the price of the 8-gigabyte model, bringing it down to $399.I believe what actually excited the stock price was the fact that iPhone sales figure was fantastic considering that the highly successful iPod took Steve Jobs’ team a whopping two years to arrive at the number achieved by iPhones (within 3 months). I guess the tactic of slashing iPhone’s price worked after all. Investors now are upbeat that iPhone will be another lucrative cash-cow for the Apple Inc.

Apple reiterated Monday its previous target of selling 10 million iPhones in 2008, helped by the launch of the iPhone in Europe next month, then in Asia next year. Some analysts are betting that Apple’s earning might continue to grow materially at a 50 percent annually for the next three year. The higher guidance issued by Apple that said for the current quarter it expects earnings of about $1.42 per share on revenue of about $9.2 billion also help in pushing the stock price higher during after-hours trading. Analysts on average had been expecting earnings of $1.39 per share on sales of $8.58 billion for the current quarter.

Apple stock price rose $3.94, or 2.3 percent, to close at $174.36 and after the earnings report, the shares happily climbed about $12, almost 7 percent, in extended trading. So to the StockTube readers who have positions in Apple Inc. (stocks or options) – Congratulations!! I just hope there’re tons of short-sellers rushing in to cover their positions as this could push the Apple stock price higher when the market opens on Tuesday.

Apple stock price rose $3.94, or 2.3 percent, to close at $174.36 and after the earnings report, the shares happily climbed about $12, almost 7 percent, in extended trading. So to the StockTube readers who have positions in Apple Inc. (stocks or options) – Congratulations!! I just hope there’re tons of short-sellers rushing in to cover their positions as this could push the Apple stock price higher when the market opens on Tuesday. Now, do you think Apple can cross the $200 a share since it breached the $150 level on 26th Sept, the same way Google Inc. is aiming for $700 after breached the $600 level?

Now, do you think Apple can cross the $200 a share since it breached the $150 level on 26th Sept, the same way Google Inc. is aiming for $700 after breached the $600 level? Other Articles That May Interest You ...

Anxiously waiting Apple’s earning announcement

Somehow I like this thing about bargain hunting. And I like the law of whatever goes up must comes down and vice versa. We saw the Dow plunged by 366 points last Friday and today we saw a slight rebound in the afternoon after a three-digit plunge in the morning trading. Traders are still nervous obviously. The Dow, Nasdaq and S&P500 are trying very hard to stay alive within positive territory.

This is good news especially when the market appeared optimistic about Apple Inc.'s earnings, which were scheduled to be released after the closing bell. Apple’s stock has been trading with gain throughout the whole morning and upon seeing this, Google Inc. and the rest of the technology stocks follow through. Fed Governor Randall Kroszner at a speech in Washington reaffirmed that the central bank will "act as needed" to calm the financial markets.

With such volatility I’m glad Apple is trading above $173 level and hopefully it’ll stays that way throughout the day. Google Inc. in the meantime is trading above the $646 level but fails to jump above the $654 resistance level. If Apple’s earning could not impress investors the stock could be punish to the price below $170 and below after-hours trading. But if Apple could impress the same way as Google’s then both Apple, Google and most of the technology-stocks could heave a sight of relieve.

Other Articles That May Interest You ...

Monday, October 22, 2007

Add chat functionality with LiveHuman

One of the reasons why MNC (multi-national company) are so successful and making billions of dollars in profit is due to the internet. A classic example would be Dell Inc.’s business model whereby to get the best price you’re encouraged to purchase their products from their website. When you have issues or problems you can either call their hotline or email their support team. Both method of getting support involves costs nevertheless.

For small and medium businesses looking for better support which is cost-effective, they can actually implement live chat within their corporate website, be it intranet, extranet or internet. LiveHuman offers support chat which could transform your boring looking corporate website into something that could potentially lock-in your existing customers while attracting new customers.

The live support software can be either web-based or hosted within your server. As far as broker firms that offer stocks investing platform out there, not many has this feature. I’ve tried live chat with one of the providers to solve some technical problems or getting some queries during the trading hours and I can safely say this feature would be the deciding factor when you choose which stock-broker house to choose.

LiveHuman Chat which is at their fifth version could be started in three simple steps. First you need to register (it’s free), then you just download the software and finally insert one line of HTML code onto your website and voila your website has that distinct professionalism. You can try the trial version for 7-days and thereafter you can subscribe it for $13 per month.

*sponsored*

How to do business if Meritocracy is not welcomed?

Meritocracy is perhaps the last word a government would like to hear that practice nepotism, cronyism or racism policies. You can bet your last penny such government would have pathetic policies implemented in large-scale ranging from education to corporate business. There’s nothing wrong with such policy except that it generated and will continues to generate walking zombies demanding 30 percent stake in your businesses, putting hurdles to successful companies out of jealousy to hinder it from progress further and using intimidation to force you to submit in the name of M&A (merger and acquisition).

Government-controlled media and even Tony Fernandes might be too scared to report or express it but the fact that the successful story of AirAsia Berhad(KLSE: AIRASIA, stock-code 5099) was put into the chamber of torture by both the national airlines Malaysia Airline System (KLSE: MAS, stock-code 3786) in a cohort of the Malaysia government only proves that meritocracy is not welcomed in the country. And Tony Fernandes is no foreigner mind you – he’s a Malaysian citizen.

MAS Hates AirAsia's Success

Government-linked conglomerate DRB-Hicom (KLSE: DRBHCOM, stock-code 1619) initially thought the low-cost freight business was an easy one and could create another success story and score another bumiputra point. They ended up with two Boeing jets and $37 million in debt. Tony Fernandes bought the bankrupt-airline for a token of 1 ringgit (26 cents), assumed $12 million of Air Asia debts and transformed it into the most successful low-cost airline in the Asia. But the more successful Tony is and the bigger AirAsia grows the jealousy of MAS runs deeper.

Long story short, AirAsia was proposing to use the old international airport Subang as the country’s low-cost carrier terminal. However the governmentrejected the proposal justifying that the government wanted to make KLIA (Kuala Lumpur International Airport) a regional hub which means both premiums (MAS) and low-cost (AirAsia) services should be centralized within KLIA. In actual fact KLIA was boasted with first-class infrastructure but couldn’t see the traffic commanded by first-class airlines such as Singapore or Hong Kong it dreamt of. The government further justified that Subang airport would be used as a hub for aircraft maintenance, repair and overhaul activities.

Government's Evil U-Turn Policies

Subang airport was strategically located compared to KLIA and you can see people grumbling with the huge costs and the lengthy time required to travel to KLIA. And both MAS and the government knew that granting AirAsia the permission to operate from Subang is tantamount to sending MAS to gallows. After AirAsia was relocated (it didn’t have an option) to KLIA, somehow MAS launched its own version of low-cost carrier in FireFly. The purpose was to give AirAsia a run for its money. AirAsia couldn’t be bother with the new startup as it was busy with its ambitious AirAsia X, the long-haul service which could cause MAS to press the panic button. AirAsia also asked for two daily flights to Singapore but was rejected point blank.

To rub salt into the wound, the Malaysia Cabinet now ruled that FireFly can now fly to the same places that AirAsia Bhd serves, out of the Subang airport. It was reported that FireFly is planning to buy bigger planes to fly to 25 local and regional destinations, mostly the same routes being serviced by AirAsia. In the battle synonym to David against the Goliath, it appears MAS is out for vengeance and won’t blink twice about crushing AirAsia to pieces.

MAS's Jealousy & Government's Inconsistency

Why the government is contradicting itself with the whole affair? Why Firefly suddenly given all the priviledges and advantages not granted during AirAsia’s earlier requests? Why a father (the government) would give sweets and chocolates to the second son (FireFly) but directed the first son (AirAsia) to bed without sweets when the first son asked for it in the first place? Could the whole plan is to kill AirAsia although Fernandes has done a fantastic job in putting the country on the world’s map? One wonders if the government would treat AirAsia the same way if it was started by another bumiputra company such as DRB-Hicom.

Given choice, Tony would gladly sell off its stake at premium to MAS and watch with popcorns if the government-backed entity could further grows AirAsia, or rather bankrupts the company once again, the same way DRB-Hicom did it. I would avoid AirAsia stock for the time being.

Other Articles That May Interest You ...

Sunday, October 21, 2007

Bad Friday for U.S. but Black Monday for Asia

Call it coincidence, myth, haunted, eerie or whatever you wish but the fact is on 20th anniversary of Oct 19th 1987’s “Black Monday” crash that saw Dow Jones plunged by 26 percent, the same happened last Friday (19th Oct 2007). Only this time the Dow fell by a lower percentage which is 2.64 percent but the quantum of 366 points drop is nevertheless disturbing.

For the week, the Dow lost 571.06 points, or 4.1 percent, to close at 13,522.02. The Standard & Poor’s 500-stock index fell 61.17 points, or 3.9 percent, to close at 1,500.63. The Nasdaq composite index dropped 80.52 points, or 2.9 percent, to close at 2,725.16.

Last week, two-month Treasury bills rallied the most since Sept. 11, 2001 - which shows that investors have re-embarked on a flight-to-quality trade, perhaps betting that the economy is weaker than expected and that the Federal Reserve is likely to cut interest rates again. The CBOE Volatility Index, often called the fear index, added 24% Friday to a reading of 23, its highest reading in a month.

This is what you can never control, the macro and external factor that created fears into the soul of investors. I believe if not for the fear across the board, my Google would have create another history with its gap-up – at least that’s what I hoped for. And the whole set of Nasdaq investors would shift their intention to Apple Inc.’searning announcement next week, Monday after market closes. Investors would be presented with other set of earnings thereafter from Motorola Inc., Boeing Co, Baidu.com Inc. and of course the infamous Countrywide Financial Corp.

To add fuel into fire next week, global economic leaders warned of inflation risksin advanced countries when IMF (International Monetary Funds) noted rising food and oil prices and other indications of inflation. Whether the bear from last week will continues to haunt investors this week is still unknown but you can be sure of a double-digit plunge when Asia stocks markets (including Malaysia) open on Monday.

Friday, October 19, 2007

Bad News for You and Good News for Me

First the bad news! You’re just inches away from having to pay the biggest quantum of fuel hike next year (I said next year because it would be silly for the Malaysia government to increase the rate this year), probably after general election. At the same time the government is just inches from announcing the prepared-memo that as much as the caring government would like to absorb the global oil increases, it can’t and the people need to brace themselves to become “smart consumers” (again). People need to change their mentality about subsidy and it’s better to start taking the bullet now than later, never mind that the 26-million populated nation is producing top-quality petroleum.

Now the good news! Google Inc. (Nasdaq: GOOG, stock) had just released its third quarter results that surpassed analyst expectations and demonstrated why Google has emerged as Silicon Valley's most prized company with a market value of about $200 billion after just nine years in business. Google might had surpassed Cisco Systems Inc. as Silicon Valley's most valuable company but it still has some running to do in order to beat Microsoft Corporation.

Revenue for the period totaled $4.23 billion, a 57 percent increase from $2.69 billion last year and after subtracting commissions paid to its thousands of advertising partners, Google's revenue stood at $3.01 billion - about $70 million above the average analyst estimate. It simply means for every $10 bucks in revenue, the partners earned $3 bucks while Google earned the remaining $7 bucks – a 30:70 ratio of profit-sharing.

Other Articles That May Interest You ...

Change in plan for Google, going for “Top Greed”

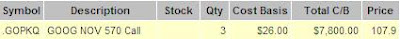

Google Inc. stock was trading in a very narrow range and for the most of the morning session it was trying to breach the $632 resistance. It managed to do so at 1:45pm trading time (as of writing). So some crazy ideas pop-up into my brain and I’ve decided to let my little GOOG Nov 570 Call Options run till the end of the trading bell and leave it’s fate to the earning announcement.

Yeah, I know I said earlier that I’m gonna take the profits and let a small contract to try the luck and see if I can get the trophy of my own making. Well, screw the plan. Somehow I feel good about Google Inc.’s earning this round (heck, wish me luck) and I think the volume is picking up as we speak. Although the Nasdaq is struggling the whole day to enter the green territory, I just hope no more stupid speech, data or announcement to be released today that can affect the stock price.

So, I’m going for the “Top Greed” to maximize my profit (if everything turns well). It could be a disaster and this could be my biggest risk I ever take. Let’s wait and see.

Other Articles That May Interest You ...

Thursday, October 18, 2007

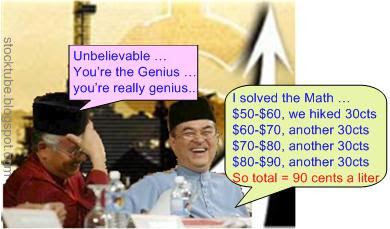

Fuel Price Hike of 90 cents to RM2.82 a liter next year?

Oil prices dominated most of the businesses, stocks and economies discussion lately. Due to the fact that the fuel prices affect our daily life, we simply cannot ignore its impact no matter how hard we try. One of my friends who bought a brand new BMW 3-Series recently somehow didn’t looks happy after spending some weeks showing off his new toy. I found out later why. While he can afford the monthly installments, he didn’t put other hidden-costs into consideration such as maintenance and you guess it – fuel or petrol.

What surprised me the most was his grumbling about inflation which includes flour, foods, drinks, groceries or even hawker-style Char Kway Teow; a topic which shouldn’t comes out from the mouth of a person who didn’t know and care much about economy-101. So suddenly he became a genius. My guess is the economy is not that rosy after all (was it in the first place?) or the inflation in Malaysia was injected with a huge dose of steroids under the current administration.

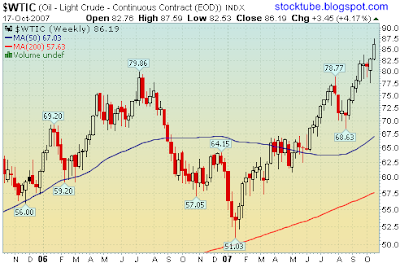

Last month, I’ve blogged about the reasons why oil prices might spike to $90 a barrel and beyond. At the time of writing, oil prices dipped in Asian trading Thursday but held above US$87 a barrel thanks to U.S. inventory report that showed unexpectedly large gains in U.S. crude oil and gasoline inventories but not before the crude oil traded at a record high of $89 a barrel. While the consumers are waiting anxiously for the Malaysian government to announce another fuel hike, the administration of Abdullah Badawi is perplexing on how to deal with the situation.

If the crude oil that appreciated by about $10 a barrel from $50 to $60 had mobilized the government to increase the fuel price quantum by 30 cents a liter back then, could you imagine how much would be the next increase? Assuming the government has mercy on you and Abdullah somehow managed to recall the simple arithmetic he did during his school time. And assuming by end of 2007 somehow the crude price amazingly managed to plunged to $70 a barrel which is very unlikely, the quantum of fuel hike will be another 30 cents a liter (from the same arithmetic of $10 a barrel appreciation will translate into 30 cents increase). But if the crude oil decides to stay above $80 and worst still charge above $90 a barrel then you better get ready psychologically for the 90 cents a liter increase.Regardless whether the quantum is another 30 cents, 60 cents or 90 cents a liter, one thing is for sure - the fuel price hike is imminent. What you can hope and pray for is the current high crude oil prices are largely due to speculators and the bubble will burst.

But if the crude oil decides to stay above $80 and worst still charge above $90 a barrel then you better get ready psychologically for the 90 cents a liter increase.Regardless whether the quantum is another 30 cents, 60 cents or 90 cents a liter, one thing is for sure - the fuel price hike is imminent. What you can hope and pray for is the current high crude oil prices are largely due to speculators and the bubble will burst.

Of course you should stay away from stocks that rely on fuel price such as airlines and certain manufacturing sectors. On the local front, some of the companies to benefit either directly or indirectly from the bullishness of oil price include:

- Kencana Petroleum Bhd (KLSE: KENCANA, stock-code 5122),

- Scomi Engineering Berhad (KLSE: SCOMIEN, stock-code 7366),

- Wah Seong Corp Berhad (KLSE: WASEONG, stock-code 5142),

- Muhibbah Engineering Berhad (KLSE: MUHIBAH, stock-code 5703),

- Pantech Group Holdings Berhad (KLSE: PANTECH, stock-code 5125)

Other Articles That May Interest You ...

Multiple loans mushrooming from subprime crisis

When the subprime crisis exploded, the U.S. largest mortgage lender, Countrywide Financial Corp was perhaps the most talked about company after Merrill Lynch analyst ticked off the possibility of a bankruptcy. And now The Securities and Exchange Commission is investigating the obvious insider-trading when Countrywide CEO Angelo R. Mozilo sold some $130 million in Countrywide stock in the first half of the year through a prearranged 10b5-1 trading plan.

Meanwhile, with the recent rate cut people are depending on the internet to findcheap loans after learnt their lessons (or did they?) All of a sudden the net was filled with companies that offer various types of loans, not something you should be surprised of considering the bulk of you money could be for the loans payment. DM Loans for example do not only provide cheap loans but secured loans, meaning the loans are secured because your home is used as collateral against the homeowner. This is a traditional but smarter way of reducing the risk to the lender, though it was ignored most of the time during the housing boom.

As saving is not the forte of most American as they prefer to spend, little wonder that most of them have multiple types of debts. And that’s how debt consolidation loans come into the market to adjust the liabilities. Depending on your credit history and overall credit rating, you might end up with different terms from the lending agencies. And you can be sure of other lending companies improve revenue canabalizing from Countrywide’s own problem.

Wednesday, October 17, 2007

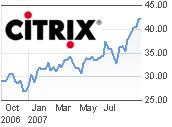

Web applications require Citrix’s performance

It appears both Apple Inc.’s (Nasdaq: AAPL, stock) and Google Inc. (Nasdaq:GOOG, stock) behave very well in the morning trading session today. So I’ll just let it trade whichever direction it wish to. As blogged earlier, Google is expected to announce its earning tomorrow, Thursday 18th Oct 2007 after the market close. What would be my strategy this time around?

Although I’ve only small amount of contracts in GOOG Nov 570 Call Options, I planned to take some money off the table tomorrow before the announcement while leaving one contract as the gambling-chip to see if I can set a new record in terms of profit percentage. If the plan goes well, I’ll be a happy person as the stock will register another gap-up (and a trophy) but if things do not work accordingly, my profit (you will know by tomorrow of the quantum) should be enough to cover for any losses. Nevertheless the Nov Call Option still has some intrinsic value so I can take the risks.

As for Apple stocks, obviously it’s trying to establish a new support level of above $172 level this morning after tried for the last six trading days. Whoa! Go Go Go *crazy me*. If my strategy works for Google, I plan to apply the same to Apple Inc.

I’m considering CTXS Jan 2008 40 Call Option which will give me 93 days before the expiration. Another stock that is on my radar is eBay Inc.

Other Articles That May Interest You ...

Little Secret in Making Money trading GOOGLE

StockTube has been bashing Yahoo Inc. (Nasdaq: YHOO, stock) whenever the opportunity presents itself in favor of Google Inc. (Nasdaq: GOOG,stock). While you might see me as a mean-creature just short of sexually abuse both Jerry Yang and David Filo, in contrast my intention was for “Yahoo’s own good” *evil grin*. I simply can’t live in a world full of monopolization, not that I can put all the blames on the younger brother Google for its effectiveness and innovative products that makes elder Yahoo looks like a sicko good-for-nothing company.

You should know that consumers will never benefit from any type of monopolization doctrine although I know Warren Buffett will definitely argue with me (how he hoped PepsiCo Inc. never exists). And when Jerry Yang kicked Chairman Terry Semel to drive the company himself as CEO, stock price had fallen by 5 percent in the months since then. Google's shares on the other hand soared by 20 percent during the same period.

And with this article you should know by now how to make great money by knowing the earnings performance of Yahoo. Still have no idea huh? Well, if you care to search for my past profit on Google Inc. you should be able to identify and determine my trading method in the U.S. options. I “never” trade Yahoo’s stocks or its options. The reason was quite simple – it wasn’t a leader in online advertising market and hence it tends to disappoints everytime. The second reason was Yahoo Inc. will announce its’ earning prior to Google Inc. I’ve blogged about the concept of Yahoo’s Weakness is Google’s Gain and vice-versa.

Other Articles That May Interest You ...

Tuesday, October 16, 2007

Google and Apple stocks, my money making machine

Google Inc. might have breached the $600 level and currently floating comfortably above this level but the stock’s vulnerability has increased with the current market pulses. If Dow Jones keeps on dropping as if there’s no tomorrow, sooner rather than later the stock price will follows. Even though I’m still holding GOOG Nov 570 Call Option, somehow I’m undecided whether to let it go, take the money and run or let it takes its course with Google’s earning announcement scheduled on 18th Oct (that’s another 2 days on Thursday). The first 5-minutes of trading this morning saw Google’s stock pricetesting the $612 support before regain consciousness and rebound thereafter. I’m pretty comfortable with its behavior although the Dow, Nasdaq and S&P500 seems to be in the red the whole morning.

The first 5-minutes of trading this morning saw Google’s stock pricetesting the $612 support before regain consciousness and rebound thereafter. I’m pretty comfortable with its behavior although the Dow, Nasdaq and S&P500 seems to be in the red the whole morning.

On the other hand, I’ve taken new position this morning (just some minor contracts) on Apple Inc. by scoopingAAPL Jan 2008 165 Call Option after the stock showed price-volume behavior which met my entry condition. Apple Inc. is expected to announce its earning next Monday, 22th Oct 2007. If you’ve invested Apple before you know that this stock is almost sure to beat earning estimate by Thompson Financial again. The only things that nobody knows except Steve Jobs is how well did Apple perform from other perspective which includes revenue growth, iPhone’s sales, inventories etc etc.

While the earnings season had started, it’s too early to jump into the boat (except for Apple and Google). Furthermore the stocks which interested me are not up the list yet. After Ben Bernanke said the night before that the slumping housing market remains a "significant drag" on the economy, I hope the Feds chairman has no more negative news in his list.

Other Articles That May Interest You ...

The first Airbus A380 for Singapore Airlines

In early Monday morning trade, New York's main oil futures contract, light sweet crude for delivery in November, was 16 cents higher than the US$86.13 a barrel amid mounting tension between Turkey and Kurdish rebels in Iraq.This is a bad news for airlines which are stupid enough not to hedge their fuel price but definitely good news for investors who long oil-related stocks.Thousands of miles away, a small but prosperous nation had a little celebration after waited for about two years.

Singapore Airlines, one of the most successful and profitable airlines in the world took the delivery of the Airbus A380 yesterday. Singapore Airlines which is the first carrier to take full commercial delivery of the long-awaited superjumbo will waste no time and is scheduled to flies the double-decker Airbus A380 into Sydney next week for the first time. In an all-economy configuration, the A380 can a maximum of 853 passengers.

A standard return fare for a suite will cost you around 10,500 Singapore dollars ($7,160) on the Singapore-Sydney route, which is about 20-35 percent more than the current top-class fare. Showers, mini-casinos, gyms and beauty salons won’t be available as earlier imagined. However a staircase at each end links the two levels and the business and first class areas have a self-service bar with food and drinks.

Other Articles That May Interest You ...

Six more months of good time before Election?

Now that the Muslim festival, Hari Raya Aidilfitri, has entered its third or final day before the stock market re-open tomorrow, the shift has been on the sustainability of the bull which could see the charges gaining momentum towards the year-end window dressing. After that you have the Chinese Lunar Year celebration which falls on early of Feb-2008. Analysts, investors, punters and traders are equally excited with the stock market as almost all of them are optimistic the bull will be around - at least till the middle of next year, 2008.

Just like how the Chinese are damn sure their government will not let the stock markets crashing down before the Beijing 2008 Olympic event, Malaysian are doubly sure the current bullish sentiment will remains as any huge sell-off will not be "nice" for the current ruling government which is expected to call for snap election, rumored to be in the first quarter of 2008. Already, unpopular decisionswhich might backfire had been put in cold-storage temporarily although more and more scandals were trying to squeeze out from the Pandora box.

Pre-Election - play down problems, crisis and scandals

Malaysia's Petronas pushing for gas price hike was discussed but no concreate decision was made (or rather delayed?). The scandal of which Port Klang Authority has racked up debts totaling about 4.6 billion ringgit (US$1.3 billion; euro960 million) because of problems with the Port Klang Free Zone was quickly swept under the carpet. The announcement by Works Minister Samy Vellu that the nation will see yet another toll-hike on Jan-2008 saw a fast response from Deputy Prime Minister Najib who said it has not been approved (yet). With the global oil price above US$80 a barrel, the government can’t wait for the election to be over to announce a fuel-hike.

“Feel-Good” propaganda machinery on the move

Of course in the process you saw Minister in the Prime Minister's Department Nazri Aziz took

Really, it’s not that difficult to check the authenticity of the video clip. Since the authority already flew their people to United States for a holiday trip to beg the FBI (Federal Bureau of Investigation) to help enhance the clarity of the blurred web-camera image of the person carrying the sports bag in which Nurin Jazlin Jazimin’s body was found, you don’t need a rocket scientist to ask for assistance from the same FBI on the video-clip’s authenticity. Furthermore if the United States can determine the authenticity of video-clips of terrorist Osama bin Ladin, how hard could it be to determine Malaysia’s own videp-clip?

Oppositions Always Lose