Friday, January 19, 2007

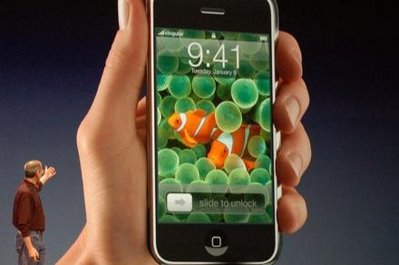

Why You Shouldn't Buy iPhone Now

According to Silicon Valley market research firm iSuppli (BusinessWeek), the estimated cost for 4GB iPhone (retailed at $499) is $230 while 8GB iPhone (retailed at $599) is only $265 giving aprofit margin of over 100% per unit. iSuppli specializes in tearing down popular electronic gadgets to figure out how much they cost to make.

The single most expensive part will be the 3.5-inch touch-sensitive display - costing $33.50. The costs of NAND-type flash memory chips supplied by Samsung will be in the region of $35 to $70.

Potential partners for iPhone:

Potential partners for iPhone:

- CSR Plc [formerly Cambridge Silicon Radio] (LON: CSR) - to supply the Bluetooth wireless chip

- Samsung Corporation (SEO: 000830) - to supply the audio chip

- Texas Instruments (NYSE: TXN, stock) or Freescale Semiconductor Inc - to supply digital signal processor

- Supplier of iPhone screen - not known yet!

# TIP: If you can wait, end of 2007 should be a good time to get iPhone as the production will increase to cater for Europe and Asia market. With higher volume Apple can negotiate for a lower components' price.

Other Articles That May Interest You ...

How To Call Directory Assistance For FREE?

You can now do so with 1-800-FREE411 which was inspired by the business model of none other than, Google Inc

(Nasdaq: GOOG, stock). Just like Google which make billions of revenue from online advertisement, Free411 survives through audio advertisement.

(Nasdaq: GOOG, stock). Just like Google which make billions of revenue from online advertisement, Free411 survives through audio advertisement. George Garrick, the president and chief executive ofJingle Networks Inc., which runs the 1-800-FREE411 service says callers aren't turned off by the 10 to 12 seconds long ads as people have just come to accept that advertising is a way of getting free stuff. In the U.S. directory-assistance market which had revenue of $6.5 billion in 2006, caller from mobile phone is charged an average of $1.50 per 411 call while fixed-line phones costs an average of $1.15 per call.

George Garrick, the president and chief executive ofJingle Networks Inc., which runs the 1-800-FREE411 service says callers aren't turned off by the 10 to 12 seconds long ads as people have just come to accept that advertising is a way of getting free stuff. In the U.S. directory-assistance market which had revenue of $6.5 billion in 2006, caller from mobile phone is charged an average of $1.50 per 411 call while fixed-line phones costs an average of $1.15 per call. Other free 411-service-provider includes 1-800-411-SAVE and 1-800-411-METRO but you need to try all these out to see which one is more efficient. Google might have the plan to acquire one of these 411-providers since they share the same business model. Furthermore Google bought over dMarc back in january-2006 for $102 million in cash - signal that Google recognise the revenue potential from audio-advertisement. dMarc is a company that works with radio advertisers in the sales, scheduling, delivery and reporting of radio ads.

Other free 411-service-provider includes 1-800-411-SAVE and 1-800-411-METRO but you need to try all these out to see which one is more efficient. Google might have the plan to acquire one of these 411-providers since they share the same business model. Furthermore Google bought over dMarc back in january-2006 for $102 million in cash - signal that Google recognise the revenue potential from audio-advertisement. dMarc is a company that works with radio advertisers in the sales, scheduling, delivery and reporting of radio ads.My Apple Trade And Why You Should Be Bearish On Tech

and earned $1 billion, or $1.14 per share, compared with $565 million, or 65 cents a share, a year earlier. Revenue for the quarter hit a record, reaching $7.1 billion, up 24 percent from $5.7 billion the previous year. The stock was actually trading as high as 4% above the Wednesday's closing at the after-market trading.

and earned $1 billion, or $1.14 per share, compared with $565 million, or 65 cents a share, a year earlier. Revenue for the quarter hit a record, reaching $7.1 billion, up 24 percent from $5.7 billion the previous year. The stock was actually trading as high as 4% above the Wednesday's closing at the after-market trading.- Cautionary words from Federal Reserve Chairman Ben Bernanke. In testimony to Congress Thursday, Bernanke said that the current structure of the government's two major entitlement programs, Social Security and Medicare, may soon pose serious problems to the economy.

- L

abor Department's consumer price index for December showed stronger-than-expected inflation. The CPI was up 0.5%, compared with expectations for an increase of 0.4%. Core inflation, is now up 2.6% over the past year. The core PPI (measures inflation at the wholesale level) was up 0.2%, also ahead of forecasts. These numbers, while not prompt Feds to increase rate, it will neither give the justification for Bernanke to cut rates.

abor Department's consumer price index for December showed stronger-than-expected inflation. The CPI was up 0.5%, compared with expectations for an increase of 0.4%. Core inflation, is now up 2.6% over the past year. The core PPI (measures inflation at the wholesale level) was up 0.2%, also ahead of forecasts. These numbers, while not prompt Feds to increase rate, it will neither give the justification for Bernanke to cut rates. - Some attribute the widespread and sudden decline of tech stocks to Jim Cramer, the host of CNBC’s show “Mad Money." On Wednesday, he urged investors to avoid some of those companies, saying tech stocks are in a peak period.

# TIP: With the above factors, I would justify that you either HOLD or SHORT technology stocks because you simply cannot go against the overall market sentiment. You can either short the stocks or options or both. You might want to play Bear-Call Spread to make some fast but limited money.

Other Articles That May Interest You ...

Thursday, January 18, 2007

NSTP And UTUSAN Merger Is OFF

Both companies had previously set a 60-day period from Nov. 30 for talks on a possible merger. "After a series of discussions, NST and Utusan were not able to reach a scheme of merger that would be beneficial to both parties and its stakeholders," NSTP said in a statement. "As such, the company wishes to announce that the proposed merger between NST and Utusan is now aborted."

The proposed merger has not been smooth from the beginning with much opposition surfaced and the fate of the proposed merger appeared to be hanging as reported by Star Publications (Malaysia) Berhad (STAR : stock-code 6084)here. Sources said several party supreme council members voiced their concern over the deal and also the long connection between the party and Utusan Malaysia. Umno president Datuk Seri Abdullah Ahmad Badawi who is also the prime minister of Malaysia had sent the merger deal back to the drawing board in Dec-2006. The two publishers have slightly different editorial viewpoints - Utusan is more closely aligned with a Malay and Islamic agenda than the more mainstream NSTP.

The proposed merger has not been smooth from the beginning with much opposition surfaced and the fate of the proposed merger appeared to be hanging as reported by Star Publications (Malaysia) Berhad (STAR : stock-code 6084)here. Sources said several party supreme council members voiced their concern over the deal and also the long connection between the party and Utusan Malaysia. Umno president Datuk Seri Abdullah Ahmad Badawi who is also the prime minister of Malaysia had sent the merger deal back to the drawing board in Dec-2006. The two publishers have slightly different editorial viewpoints - Utusan is more closely aligned with a Malay and Islamic agenda than the more mainstream NSTP.

NSTP, which publishes the top-selling Malay daily Harian Metro, has a market value of about 543 million ringgit ($155 million), more than three times the size of Utusan. NSTP also owns broadsheet daily Berita Harian and English-language daily the New Straits Times. The two publishers wanted to put their Malay dailies under one roof to cut costs and attract more advertisers.

I'm pretty sure the party who proposed this merger has already benefited from the earlier proposed merger when the stock rises.

Other Articles That May Interest You ...

First Case Of Bloggers Being Sued In Malaysia

"I am now looking for a lawyer to represent me," said Ahirudin, a former editor of Malay Mail, one of the newspapers in the NST stable. Opposition leader Lim Kit

Siang said the suits would have a "chilling effect" onfreedom of bloggers and citizen journalists. "It will have far-reaching consequences for the healthy, mature and democratic growth for free speech and expression, not only on the Internet but in the country as a whole," he said in a statement.

Siang said the suits would have a "chilling effect" onfreedom of bloggers and citizen journalists. "It will have far-reaching consequences for the healthy, mature and democratic growth for free speech and expression, not only on the Internet but in the country as a whole," he said in a statement.This is the first case of bloggers being sued for libel in Malaysia, where Internet chatrooms are mushrooming amid tight government controls on mainstream media.

Ahirudin Attan's whose blog is known as Rocky's Bru [blogger platform owned by Google (Nasdaq: GOOG, stock)] has indicated in his blog that the parties who are suing him comprises:

- The New Straits Times Press (Malaysia) Berhad

- Kalimullah Bin Masheerul Hassan

- Hishamuddin Bin Aun

- Syed Faisal Albar Bin Syed A.R. Albar

- Brenden John a/l John Pereira

Jeff Ooi's blog, Screenshots, is flushed with comments after the news broke. Jeff said in his blog that his lawyers are looking into the suit.

The fate of both bloggers in this law-suit will likely set the direction for the rests of the bloggers in Malaysia in future. Will freedom of speech and thinking prevail?

Wednesday, January 17, 2007

Faster Way To Make Cheque Payment In Citibank Malaysia

- Stesen Minyak Sentral Kiosk (opposite Eastin Hotel)

- 3.5km Arah KL-Lebuhraya Damansara Link - Petaling Jaya

- Petromart Trading, Stesen Minyak Shell, Persiaran Kewajipan - Subang Jaya

- RNZ Activity Enterprise, 5km Section 9/1, Jalan Cheras - Kuala LUmpur

[2] Penang: Stesen Minyak Desa Relau, Stesen Minyak Shell, Mukim 13, Jalan Paya Terubong

[3] Johor: Fook Heng Service Station Sdn Bhd, Jalan Johor Jaya, Taman Johor Jaya

Citibank, the banking arm of Citigroup Inc (NYSE: C, stock) is one of the largest financial services organisations in the world. In Malaysia, it has a 20% market share for credit card spending.

Can't Explain Oil Price Drop? Blame Speculators

But now, the oil-price has dropped to below $52 per barrel(yesterday, 16-Jan-2007, the oil price dropped to $51.21 per barrel). What are the reasons for this price "U-Turn"? Everyone offers their own reason. Analysts blamed it on the warm winter weather and now they pointed to comments by Ali Naimi, the Saudi oil minister, who said that an emergency meeting by the Organization of Petroleum Exporting Countries (OPEC) to cut their oil production isn't necessary at this time.

But now, the oil-price has dropped to below $52 per barrel(yesterday, 16-Jan-2007, the oil price dropped to $51.21 per barrel). What are the reasons for this price "U-Turn"? Everyone offers their own reason. Analysts blamed it on the warm winter weather and now they pointed to comments by Ali Naimi, the Saudi oil minister, who said that an emergency meeting by the Organization of Petroleum Exporting Countries (OPEC) to cut their oil production isn't necessary at this time. the energy markets. Fusaro reported that there are currently 530 energy hedge funds, up from just 180 in October, 2004. Of the total funds now, 177 are strictly energy commodity funds trading oil or oil futures and options, as opposed to the stocks of energy companies such as Exxon Mobil Corporation (NYSE: XOM, stock) and Chevron Corporation (NYSE: CVX, stock). Larger financial institutions such as Goldman Sachs Group (NYSE: GS, stock) and Morgan Stanley (NYSE: MS, stock) have also stepped up their participation in the energy markets recently.

the energy markets. Fusaro reported that there are currently 530 energy hedge funds, up from just 180 in October, 2004. Of the total funds now, 177 are strictly energy commodity funds trading oil or oil futures and options, as opposed to the stocks of energy companies such as Exxon Mobil Corporation (NYSE: XOM, stock) and Chevron Corporation (NYSE: CVX, stock). Larger financial institutions such as Goldman Sachs Group (NYSE: GS, stock) and Morgan Stanley (NYSE: MS, stock) have also stepped up their participation in the energy markets recently. traders were net short on oil prices as of Jan. 9. So in the short-term, it seems the energy price will keep heading south. However if the speculators play a major role in the current oil-price slide, can the same be said when the oil-price was heading north to as high as $78 at one time ago? If yes, then the actual consumption by nations' industrial sector is not that significant after all. Maybe the world should ban oil-speculators who have cause hardship to low-income citizen - to borrow the statement from former Malaysia premier, Mahathir Mohamad who once blame the 1997 Asia Economy Crisis on speculators in general and George Soros in particular.

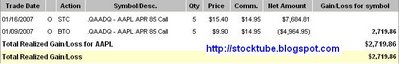

traders were net short on oil prices as of Jan. 9. So in the short-term, it seems the energy price will keep heading south. However if the speculators play a major role in the current oil-price slide, can the same be said when the oil-price was heading north to as high as $78 at one time ago? If yes, then the actual consumption by nations' industrial sector is not that significant after all. Maybe the world should ban oil-speculators who have cause hardship to low-income citizen - to borrow the statement from former Malaysia premier, Mahathir Mohamad who once blame the 1997 Asia Economy Crisis on speculators in general and George Soros in particular.Ring Register On APPLE Option After 5 Days Trading

reached $97 plus ... you shouldn't be greedy ... etc". There're some reasons why I hold to my position (Nobody including me know how high can this guy goes). First, the uptrend looked sustainable as it went above the highest price of the first 45 minutes trading with good volume. Second, the earning season started and traditionally Apple demonstrates sustainable uptrend days before the actual earning right up to the last minute.

reached $97 plus ... you shouldn't be greedy ... etc". There're some reasons why I hold to my position (Nobody including me know how high can this guy goes). First, the uptrend looked sustainable as it went above the highest price of the first 45 minutes trading with good volume. Second, the earning season started and traditionally Apple demonstrates sustainable uptrend days before the actual earning right up to the last minute. Then came the second bomb-shellwhen the Government authority started investigating the back-dated options of which Apple's board gave Jobs 7.5 million stock options in 2001 without the approval of the company's board. Was I worried about this news? Nope, because this case was highlighted earlier and Steve did not benefits from it and and independent investigators "found no misconduct by any member of Apple's current management team."

Then came the second bomb-shellwhen the Government authority started investigating the back-dated options of which Apple's board gave Jobs 7.5 million stock options in 2001 without the approval of the company's board. Was I worried about this news? Nope, because this case was highlighted earlier and Steve did not benefits from it and and independent investigators "found no misconduct by any member of Apple's current management team."SIME Won RM15 Billion Cable Project

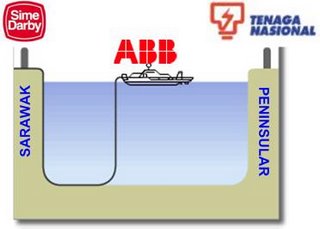

Sime will partner a unit of Swiss engineer ABB group

(NYSE: ABB), the world's biggest maker of power transformers, to carry out the project. Besides listed in New York Stocks Exchange, ABB also listed inZürich Stock Exchange(VTX: ABBN), Stockholm Stock Exchange andBombay Stock Exchange (BOM: 500002). ABB Asea Brown Boveri, was the result of a merger between Asea AB of Sweden and BBC Brown Boveri Ltd. of Baden, Switzerland in 1988 and has presence in more than 140 countries with about 180,000 employees.

(NYSE: ABB), the world's biggest maker of power transformers, to carry out the project. Besides listed in New York Stocks Exchange, ABB also listed inZürich Stock Exchange(VTX: ABBN), Stockholm Stock Exchange andBombay Stock Exchange (BOM: 500002). ABB Asea Brown Boveri, was the result of a merger between Asea AB of Sweden and BBC Brown Boveri Ltd. of Baden, Switzerland in 1988 and has presence in more than 140 countries with about 180,000 employees.The daily quoted unnamed sources involved in the contract talks as saying: "A decision to award the contract was made very recently and that Sime will be informed officially soon." Malaysia's monopoly power distributor, state-controlled Tenaga Nasional Bhd (KLSE : TENAGA, stock-code 5347), is likely to pay between 15 and 18 Malaysian cents per kilowatt hour for the Bakun power.

Tuesday, January 16, 2007

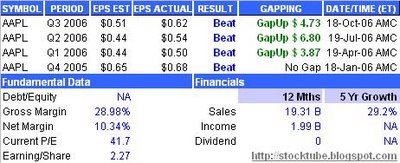

Option Trading - Will APPLE Make Me Money Again?

Some of the analysis indicators for AAPL:

- StockScouter rating: 10 out of 10

- Whisper Number for this stock: 0.86

- Smart-Estimate for this stock: 0.81

- Schaeffer rating for this stock: 5 out of 10

- Power Rating: 5 out of 10

- Insider Trading (last 52 weeks): ($174.61M)

- Option Trading: Apr 2007 90 Call

- IV for Feb 2007 $90 Strike: 40.48%

Analysts, on average, are looking for earnings of 78 cents on sales of $6.42 billion, according to a Thomson Financial poll. Merrill Lynch analyst Richard Farmer sees Apple to posting higher results than what Wall Street is expecting - raised his outlook to earnings of 81 cents per share on sales of $6.5 billion. Based on data from the NPD Group, December is the best selling month for iPods, typically making up about 36 percent of the year's business.

Financial poll. Merrill Lynch analyst Richard Farmer sees Apple to posting higher results than what Wall Street is expecting - raised his outlook to earnings of 81 cents per share on sales of $6.5 billion. Based on data from the NPD Group, December is the best selling month for iPods, typically making up about 36 percent of the year's business.

In summary I'm optimistic Apple will beat its' earning again this time and hopefully it'll gap-up and make some money for me. I'm still holding some calls which I invested prior to the Apple iPhone announcement. I think I need to ring the register today (I know I've said that before but the stock was simply too bullish and volatile that I was thinking of maximizing the profit).

# TIP: Consider trading option instead of stocks but remember to balance it with sufficient time-value, just in case, as the expectation for Apple to beat by huge margin is too high. Nevertheless with the buzz of iPhone, this fundamental stock should perform in medium to long-term.

Other Articles That May Interest You ...

GOOGLE Remains Champion, Yahoo and Microsoft follows behind

Time Warner Network (4.9 percent).

Time Warner Network (4.9 percent).Finally RHB SOLD To KFH

loan stocks (ICULS) A and 403.47 million ICULS-B.

loan stocks (ICULS) A and 403.47 million ICULS-B.Wish To Turn Your Windows Mobile Phone Into iPhone?

available in June-2007 (Europe and Asia will get theirs in 2008), that's 6 months away. And can you blame Apple crazy-fans for crying aloud waiting that long? So what would you do if you're one of them? I bet you would be crazy enough to create the skin which looks similar to the iPhone user interface and upload it into your Windows Mobile Phone fantasizing you already own one such as this. So, most of these people already own iPhone (sort of) days after the launching.

available in June-2007 (Europe and Asia will get theirs in 2008), that's 6 months away. And can you blame Apple crazy-fans for crying aloud waiting that long? So what would you do if you're one of them? I bet you would be crazy enough to create the skin which looks similar to the iPhone user interface and upload it into your Windows Mobile Phone fantasizing you already own one such as this. So, most of these people already own iPhone (sort of) days after the launching.Macau Casino Tycoon To Buy Into STAR CRUISES

Shares in Star Cruises have been suspended since Friday. The stock had surged by a third to 38.5 US cents late on Thursday before the suspension. The deal is part of a plan by Star Cruise Ltd (SIN : S21) and Genting International (SIN : G13), both part of Malaysia's gaming mogul Lim Goh Tong's empire, to raise funds to develop a $3.4 billion casino resort on Singapore's Sentosa island.

Shares in Star Cruises have been suspended since Friday. The stock had surged by a third to 38.5 US cents late on Thursday before the suspension. The deal is part of a plan by Star Cruise Ltd (SIN : S21) and Genting International (SIN : G13), both part of Malaysia's gaming mogul Lim Goh Tong's empire, to raise funds to develop a $3.4 billion casino resort on Singapore's Sentosa island.Monday, January 15, 2007

GENTING & RESORTS WORLD Propose Share Split

This is a good news as more investors would be able to trade/own these two heavyweights since theoretically the stocks price will be reduced to 20% of what it were trading now.

This is a good news as more investors would be able to trade/own these two heavyweights since theoretically the stocks price will be reduced to 20% of what it were trading now. while Resort World's has 1.09 billion shares floated in Bursa Malaysia (KLSE). Upon completion of this share-split, Genting will have 3.69 billion shares whereas Resort World's will have 5.47 billion shares trading in Kuala Lumpur Stock Exchange.

while Resort World's has 1.09 billion shares floated in Bursa Malaysia (KLSE). Upon completion of this share-split, Genting will have 3.69 billion shares whereas Resort World's will have 5.47 billion shares trading in Kuala Lumpur Stock Exchange.Other Articles That May Interest You ...

Is GM Really Interested In Proton?

The stock rose as much as 0.65 ringgit to 7.05 ringgit, its highest since Nov. 30, 2005. The Business Times said on Saturday GM was prepared to offer as much as 10 ringgit ($2.85) for each Proton share, valuing the Malaysian firm at $1.6 billion, provided the U.S. firm is given control of the

finances of Proton and manages its vendor system.

finances of Proton and manages its vendor system.The Malaysian daily, quoting sources familiar with GM's operations in Malaysia, said the U.S. car maker planned to submit a bid for state-controlled Proton this week.

Malaysia's Second Finance Minister Nor Mohamed Yakcop said on Friday initial discussions with various local and foreign suitors -- including Germany's Volkswagen (FRA : VOW) and France's PSA Peugeot-Citroen (EPA : UG) -- for a strategic stake in Proton have ended and the government was now evaluating the proposals and would make a decision soon.

Other Articles That May Interest You ...

Laser Weapon onboard Boeing to ward off Missiles

Later this year, the ABL project will begin firing the plane's two illuminator lasers in flight at a missile-shaped target painted on a test aircraft. The 747's crew will use those low-power, solid-state lasers to track the target and to assess the atmospheric conditions. The high-energy chemical laser that will serve as the actual weapon won't be installed until 2007, according toBoeing (NYSE : BA, stock).

Later this year, the ABL project will begin firing the plane's two illuminator lasers in flight at a missile-shaped target painted on a test aircraft. The 747's crew will use those low-power, solid-state lasers to track the target and to assess the atmospheric conditions. The high-energy chemical laser that will serve as the actual weapon won't be installed until 2007, according toBoeing (NYSE : BA, stock)."While the low-power system may not be as sexy as the high-power engagement laser, it's the heart of the system. It's what turns an interesting engineering project into a lethal weapon system,"Obering said.

Donald Trump - A Billionaire or Just A Millionaire?

The question everyone is asking is whether Donald’s fortune is indeed in the billions or merely millions in figure after author Tim O'Brien, in his book Trump Nation, claimed Donald’s net worth isas low as $150 million only. While Trump is suing Tim O'Brien claiming he’s losing deals because of that, O'Brien’s lawyers say the suit is without merit.

While Forbes estimated Donald’s empire is worth $2.9 billion, Trump produces his chief financial officer (CFO), Allen Weisselberg to show documents which put his net worth at roughly $4.1 billion as of June, 2006, with assets totaling $4.8 billion and liabilities of around $700 million. This figure includes $370 million for Trump Tower which has $25 million mortgage and $900 million for “club facilities and related real-estates”. Through The Trump Organization, Donald owns Trump International Hotel & Tower, Trump Tower, 40 Wall Street, Trump Entertainment Resorts (Nasdaq : TRMP, stock), Trump Taj Mahal, Trump Plaza, and Trump Marina

While Forbes estimated Donald’s empire is worth $2.9 billion, Trump produces his chief financial officer (CFO), Allen Weisselberg to show documents which put his net worth at roughly $4.1 billion as of June, 2006, with assets totaling $4.8 billion and liabilities of around $700 million. This figure includes $370 million for Trump Tower which has $25 million mortgage and $900 million for “club facilities and related real-estates”. Through The Trump Organization, Donald owns Trump International Hotel & Tower, Trump Tower, 40 Wall Street, Trump Entertainment Resorts (Nasdaq : TRMP, stock), Trump Taj Mahal, Trump Plaza, and Trump MarinaBut Donald claims the “hottest brand on the planet” is the value of his name. While the name is not comparable to Coca-Cola (NYSE : KO, stock) or Starbucks (Nasdaq : SBUX, stock), his name indeed sells.

Donald is one of those rich-guys who loves the attention of being famous, the celebrity feeling and he always make sure he’s as famous as before. The most recent news being the press conference in Dec-2006 announcing he’s letting Miss USA Tara Conner keep her title, despite her hard-partying ways. But after that, Katie Ress, the 22-year old former Miss Nevada USA who was stripped of her crown when party pictures of her hit the internet of which she was stripping off her jeans to show her thong said she hope Donald will give her the second chance the same way Tara Conner was forgiven. Nothing has change on Katie Ress case since.

Donald is one of those rich-guys who loves the attention of being famous, the celebrity feeling and he always make sure he’s as famous as before. The most recent news being the press conference in Dec-2006 announcing he’s letting Miss USA Tara Conner keep her title, despite her hard-partying ways. But after that, Katie Ress, the 22-year old former Miss Nevada USA who was stripped of her crown when party pictures of her hit the internet of which she was stripping off her jeans to show her thong said she hope Donald will give her the second chance the same way Tara Conner was forgiven. Nothing has change on Katie Ress case since.Nevertheless, Donald is someone who will never have to worry about food or clothes as he’ll always find a way to get the money to enjoy the life as the rich and famous.

Other Articles That May Interest You ...

Friday, January 12, 2007

Where To Get Free Real-Time Stock Quote?

Investing Which Telco Stock - MAXIS or DIGI?

DIGI.com Berhad (DIGI : stock-code 6947) surprised everyone when it failed to secure a 3G license despite being one of the fastest and profitable mobile phone company - losing to the loss-making Time DotCom and new unlisted pay-TV operator MiTV Corp.

Telecommunications growth in Malaysia has reached saturation considering nearly four out of five Malaysians now own mobile/cellular phone. It's now depending on these players to increase the value per-user in terms of new applications or services to generate additional revenue.

DIGI.com Berhad - is the clear winner if the stock price is used as comparison amongst the players (stock price jump from RM 7.80 to RM 15.20 in 2006). Based on the estimated 2007 earnings of 106.4 cents per share (EPS), this stock is now trading (based on today's price of $ 15.90 per-share) at 15 times it's earning or P/E. But DIGI.com is reported to have the biggest cash pile with lowest CAPEX (capital expenditure) amongst the players.

DIGI.com Berhad - is the clear winner if the stock price is used as comparison amongst the players (stock price jump from RM 7.80 to RM 15.20 in 2006). Based on the estimated 2007 earnings of 106.4 cents per share (EPS), this stock is now trading (based on today's price of $ 15.90 per-share) at 15 times it's earning or P/E. But DIGI.com is reported to have the biggest cash pile with lowest CAPEX (capital expenditure) amongst the players.

Maxis Communications - commands the largest domestic mobile market's pie with  a comfortable cash flow from its' local operations. Trading at P/E of 12 times its' earning, Maxis provide the cheapest exposure for investors who wish to diversify their portfolio to include a telecommunication company. Unlike DIGI.com which depends solely on its' parent company, Telenor Asia Pte Ltd to make decision on regional expansion, Maxis needs to worry and ensure any of its' foreign diversification will create values to the shareholders. It's investment in Aircel India is already making profits while the Indonesian' division is still in red.

a comfortable cash flow from its' local operations. Trading at P/E of 12 times its' earning, Maxis provide the cheapest exposure for investors who wish to diversify their portfolio to include a telecommunication company. Unlike DIGI.com which depends solely on its' parent company, Telenor Asia Pte Ltd to make decision on regional expansion, Maxis needs to worry and ensure any of its' foreign diversification will create values to the shareholders. It's investment in Aircel India is already making profits while the Indonesian' division is still in red.

In terms of dividend, DIGI.com has previously announced a minimum 50% dividend payout policy while Maxis targets distribution of up to 60-65%. Should DIGI.com secured a 3G license, I believe the scenario will be such that all other players will follows what DIGI has to offer - furthermore DIGI.com is the leader in pre-paid market with its' excellent innovative marketing plan.

Summary of P/E Ratio:

- Telekom : P/E - 16.1

- DIGI : P/E - 15.0

- Maxis : P/E - 10.2

# TIP: Considering the already high price run-up of DIGI, I would be more comfortable with Maxis which has the cheapest P/E and aggressive overseas expansion - not to mentioned its' status as the largest local mobile company with well political-connection boss. Re-consider DIGI if the stock-price pull-back.

Thursday, January 11, 2007

Top Reasons Apple So Successful

- Apple’s tight privacy policy whereby many Apple employees aren't allowed into the large open studio where designers are located, for fear they'd catch a glimpse of some upcoming product.

- Steve Jobs’ trust on his low-profile, Senior Vice-President for Industrial Design, Jonathan Ive.

- Apple makes it clear to employees and business partners that they will be dismissed and possibly prosecutedfor leaking company secrets.

- Apple will sue bloggers and other independent journalists for posting purported advance information about unannounced Apple products.

- Supply business-partners [ including Cingular Wireless, Yahoo Inc. (Nasdaq : YHOO,stock) and Google Inc. (Nasdaq : GOOG, stock) ] with a fake-out user-interface design that bore no resemblance to the final one, so that its programmers wouldn’t know what they were working on.

- Apple crafted bogus handset prototypes to show not just to Cingular executives, but also to Apple's own workers.

It was reported that at one point, when Cingular executives pointed out that the phone lacked a certain button, Apple reported response - “Don’t worry, we can always add that after the phone ships.” It was a reference to the fact that on a touch-screen phone, adding a button is just a software upgrade but that reply indeed kept Cingular executives cracking their heads in disbelief until the official launch of iPhone.

Nevertheless the success of Apple is largely due to Jobs' capabilities in setting the direction and provides the inspiration for the company. But the great and innovative design and culture plus policies which was much needed gel very well resulting in an excellent business model.

Other Articles That May Interest You ...

Have You Grab Your FREE SEATS?

# TIP: Check FREE SEATS availability here

# TIP: Check FREE SEATS availability here

# TIP: As indicated earlier in my blog, I'm bullish on AirAsia stock and would accumulate on stages on any pullback as part of long-term investment strategy. At the same time I'm bearish on Malaysia Airline System (MAS).

Other Articles That May Interest You ...

Mr Apple You're Sued

have use another name. But with this new development, it seems Apple lawyers had not signed and returned the final contract (according to Cisco), if it's true both parties have been at negotiation table for years and agreed in principal. So I think the lawyers should get fired first before settle out-of-court withCisco System Inc (Nasdaq : CSCO, stock) with a cup ofStarbucks Corporation (Nasdaq : SBUX, stock) coffee.

have use another name. But with this new development, it seems Apple lawyers had not signed and returned the final contract (according to Cisco), if it's true both parties have been at negotiation table for years and agreed in principal. So I think the lawyers should get fired first before settle out-of-court withCisco System Inc (Nasdaq : CSCO, stock) with a cup ofStarbucks Corporation (Nasdaq : SBUX, stock) coffee. Me Moneyand I might take-profit yesterday but I didn't. Reason being the behavior of the stock during the first 45 minutes - sellers were well absorbed when the stock price went higher than the highest of the 45-minuts. This is how I gauge the emotion of the stock market. It was very bullish the whole day with profit-taking emerge along the line every now and then. Since the stock went so wild, the sentiment from the market-place is the $100 level. So I set my limit-order to something between $98 and $100 but it never get triggered. We'll see how it goes when the market open today.

Me Moneyand I might take-profit yesterday but I didn't. Reason being the behavior of the stock during the first 45 minutes - sellers were well absorbed when the stock price went higher than the highest of the 45-minuts. This is how I gauge the emotion of the stock market. It was very bullish the whole day with profit-taking emerge along the line every now and then. Since the stock went so wild, the sentiment from the market-place is the $100 level. So I set my limit-order to something between $98 and $100 but it never get triggered. We'll see how it goes when the market open today.Wednesday, January 10, 2007

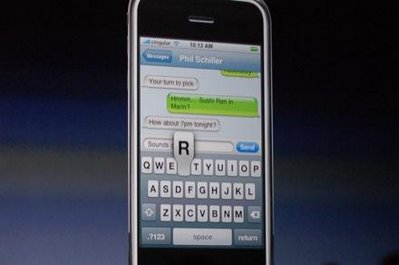

iPhone Definitely Make Me Money

At last, Apple (or rather Steve Jobs) reveals the rumored iPhone and Apple TV (instead of iTV) together with a name-change to Apple Inc (from Apple Computer Inc) – a great moves which bring applause to Wall Street, and me of course. I actually bought April 2007 85.0 Call Option about 2 hours into the trading yesterday. Out of fear (I’m just another human-being), I didn’t buy a lot as there’re equal chance of Jobs not unveiling anything so revolutionary.

Captain Steve looks like a God to many – with this iPhone introduction, an estimated USD6 billion was created instantly when Apple Computer’s (Nasdaq : AAPL, stock) shares jumped $7.10 to close at $92.57 on the Nasdaq Stock Market with 4 times the average volume. I was taken by surprise that the phone is called iPhone (despite Cisco (Nasdaq : CSCO, stock) own the trademark name under Linksys since 2000) so I guess Steve has already talked and almost agreed to some sort of agreement with Cisco on the name.

Steve estimates the new iPhone would take away about 1% of the current cellular phone pie of about 960 millions – meaning 10 millions iPhone sales to Apple in 2008 which I think is pretty good and achievable after I saw the iPhone and the functionalities (virtually). iPhone will operate exclusively on AT&T Inc.'s (NYSE : T) Cingular Wireless network for the time being. The costof $499 on 4-GB model and $599 on 8-GB model is rather on the high-side but if you happen to carry a smart-phone and an iPod, it makes great sense to only carry one iPhone. Anyway since it’ll only available in June-2007, you have lots of time to consider it.

I’m impressed with the graphic and the cool animation of how the iPhone functions. Instead of stylus, what you need is your little finger to touch a name or number to make a call – conference calls is easily done as well. Visual Voicemail allows you to go directly to any of your messages without any particular order. The SMS application with the nice-looking QWERTY soft keyboard makes this baby more reliable than the small plastic mechanical keyboard. Built-in 2-megapixel camera and photo management software makes you want to own this iPhone immediately – of course you can sync it with your Mac or PC. Take a virtual demo at here. You need QuickTime to view though.

The phone supports Wi-Fi and Bluetooth wireless technology and can detect location from Global Positioning System satellites. Apple is partnering with Yahoo Inc. (Nasdaq : YHOO) on Web-based e-mail and Google Inc. (Nasdaq : GOOG, stock) on maps. I like the wide-screen design (3.5 inches diagonally) with the body of 4.5 inches high, 2.4 inches wide and less than a half-inch thick – embedded with slimmed-down of Mac OS X operating system.

While Apple emerge hero, its competitors such as Research in Motion (Nasdaq : RIMM, stock) and Palm (Nasdaq : PALM, stock) suffered when the stocks price dropped by $11 (7%) and 84 cents (5%) respectively. Motorola (NYSE : MOT, stock) and Nokia (NYSE : NOK, stock) also suffered the same fate when dropped by about 1%.

If you are residing outside of United States, then the iPhone will available to you in 2008 only (Europe & Asia). Anyway I think I need to lock-in profit with my Call Option today - but somehow the internet is so slow. Some of the photos captured by engadget who has been keeping realtime-update of the whole session during the period Steve Jobs took to the stage:

Other Articles That May Interest You ...

Other Articles That May Interest You ...

Tuesday, January 09, 2007

Mahathir Admitted Malaysian Cabinet's Stupidity

- Anti-Toll Demonstation on 7-Jan-2007 At Sunway Pyramid

- Photos During The Demonstration Captured by Paul Choo

- Demonstration reported by theSun

Fly With 1 Million FREE SEATS

The campaign will be launched to the public online at www.airasia.com for the booking period between Jan 10 and 19 and for travel between April 1 and Oct 27, 2007.

The campaign will be launched to the public online at www.airasia.com for the booking period between Jan 10 and 19 and for travel between April 1 and Oct 27, 2007.

"This is the second major regional free seats campaign we are launching and the timing is perfect to coincide with Visit Malaysia Year 2007," said executive vice president-commercial, Kathleen Tan. One of the success factor is the highly popular e-commerce online booking which generate interest from over 180 countries.

Earlier, AirAsia signed contracts to buy 50 medium range Airbus A320 airliners with a catalogue price of USD 3.3 billion (before discount) and took an option for another 50.

# TIP: Check FREE SEATS availability here

# TIP: As indicated earlier in my blog, I'm bullish on AirAsia stock and would accumulate on stages on any pullback as part of long-term investment strategy.

Other Articles That May Interest You ...

Consider RHB SOLD to KFH

company together with such a headline? The fact is RHB is ailing with cancer as bad as Proton and the only way to save it is toSELL it. Given a choice, based on Government of Malaysia's policy of close protectionism, it wouldn't want to part of any of its' assets if not desperate. As far asProton Holdings Bhd (KLSE : PROTON, stock-code : 5304) is concern, there's no Islamic country which has a strong automobile industry which can roped in to save it, so Volkswagen Aktiengessellschaft (FRA : VOW) is the only option. But for financial sector, the story is different as almost all the countries in the globe has its' own financial companies.

company together with such a headline? The fact is RHB is ailing with cancer as bad as Proton and the only way to save it is toSELL it. Given a choice, based on Government of Malaysia's policy of close protectionism, it wouldn't want to part of any of its' assets if not desperate. As far asProton Holdings Bhd (KLSE : PROTON, stock-code : 5304) is concern, there's no Islamic country which has a strong automobile industry which can roped in to save it, so Volkswagen Aktiengessellschaft (FRA : VOW) is the only option. But for financial sector, the story is different as almost all the countries in the globe has its' own financial companies.BattleStar Gates-Jobstica Continues

At the Consumer Electronics Show in Las Vegas that started on Sunday's night, Microsoft’s Bill Gates announced Windows Home Server software, to be made available in the second half of 2007, will serve as the center of a home's computer network, from photo and video storage to television to accessing computers files at the office away from home. Microsoft also mentioned the Xbox 360 gaming console would be acting as a set-top box for high-quality, interactive Internet protocol television (IPTV) by the end of the year.

At the Consumer Electronics Show in Las Vegas that started on Sunday's night, Microsoft’s Bill Gates announced Windows Home Server software, to be made available in the second half of 2007, will serve as the center of a home's computer network, from photo and video storage to television to accessing computers files at the office away from home. Microsoft also mentioned the Xbox 360 gaming console would be acting as a set-top box for high-quality, interactive Internet protocol television (IPTV) by the end of the year. Meanwhile, Jobs is preparing for the Apple Computer’s (Nasdaq :AAPL, stock) MacWorld in San Francisco today where he is expected to provide details on the rumored iTV set-top box. But this is just the appetizer - the main menu will be the highly talk-about Apple phone or iPhone (unlikely to be called that due to

Meanwhile, Jobs is preparing for the Apple Computer’s (Nasdaq :AAPL, stock) MacWorld in San Francisco today where he is expected to provide details on the rumored iTV set-top box. But this is just the appetizer - the main menu will be the highly talk-about Apple phone or iPhone (unlikely to be called that due to  the brand name is property of Cisco (Nasdaq : CSCO, stock)). There was abundance of Apple phone designs circulating on the net, such as this one. “Apple is about to touch off a nuclear war,” said Paul Mercer, a software designer and president of Iventor, a designer of software for hand-helds based in Palo Alto, Calif. “The Nokias and theMotorolas will have to respond.”

the brand name is property of Cisco (Nasdaq : CSCO, stock)). There was abundance of Apple phone designs circulating on the net, such as this one. “Apple is about to touch off a nuclear war,” said Paul Mercer, a software designer and president of Iventor, a designer of software for hand-helds based in Palo Alto, Calif. “The Nokias and theMotorolas will have to respond.”

Monday, January 08, 2007

The Cheapest Bank To Clear Your Foreign Check In Malaysia

You would normally choose wire-transfer but what if you prefer check(ignore the issue of why you want to choose the snail-slow check approach at the first place)? Supposing your check was being issue by Citibank (NYSE : C) New York (maybe due to the global presence, your trading account with most brokerages in U.S. somehow ended up with Citibank) - once you received it, you might want to know which banks in Malaysia charge you the cheapest fees so that you can maximize the value from the check.

You would normally choose wire-transfer but what if you prefer check(ignore the issue of why you want to choose the snail-slow check approach at the first place)? Supposing your check was being issue by Citibank (NYSE : C) New York (maybe due to the global presence, your trading account with most brokerages in U.S. somehow ended up with Citibank) - once you received it, you might want to know which banks in Malaysia charge you the cheapest fees so that you can maximize the value from the check.Once, I tried to shop around with some banks in Malaysia - the first one I approached was Hong Leong Bank (KLSE : HLBANK, stock-code 5819). I've to say the customer service sucks big-time (extremely slow and rude), not to mention almost none of the bank officers know what to do when I ask the clearing-charges for an oversea check from Citibank New York. The officers somehow have little or no experience with such scenario - they were searching for old files filled with dust trying their luck to find if there're historical transaction sample, while I was waiting for the answer. In the end, the officer just gives me a figure which I think was plucked from the sky - it is RM 10.00 (the actual figure is much higher, I believe).

The second bank I tried was Public Bank (KLSE : PBBANK, stock-code 1295), the customer service is much better than Hong Leong Bank but when come to the process of clearing overseas check, the officer still need to make some calls to get clarification but at least they serve with a smile. The processing charges - RM 25.15 (RM 20 for commission, RM 5.00 for postage and RM 0.15 for stamp-duty).

Other Articles That May Interest You ...

Sunday, January 07, 2007

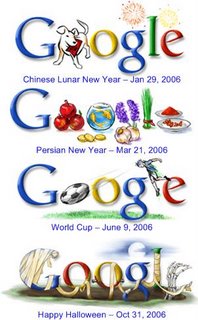

From Korea To Google Doodles

- Has created doodles on holidays, events & celebrations across the world since 2000?

- Favorite doodles are those that celebrate artist's birthdays?

- Created a logo to celebrate the Mars Rover landing in less than 24 hours?

The Google Doodles creator is a 27-year-old Webmaster, Dennis Hwang (Hwang Jung-moak),whose work is seen by millions every time he publish on the Google homepage. He said: "Before I joined Google, the founders Larry Page and Sergey Brin were already thinking about holiday logos. ... and when I joined, one of my managers knew I was studying art, and they said I should give it a shot. Since then, I've been doing it solo and my career has gone from strength to strength!"

Dennis was born in Knoxville, Tenn., but moved to Gwacheon, Korea when he was about five years old. He spent six years at Gwacheon Elementary School and two years at Munwon Middle School and his childhood life in Korea was the seeds which will be transformed into valuable ideas at later stage. Hwang went back to United States in 1992 when his father received a Fulbright Scholarship to do research.

Dennis was born in Knoxville, Tenn., but moved to Gwacheon, Korea when he was about five years old. He spent six years at Gwacheon Elementary School and two years at Munwon Middle School and his childhood life in Korea was the seeds which will be transformed into valuable ideas at later stage. Hwang went back to United States in 1992 when his father received a Fulbright Scholarship to do research.

In terms of letter manipulation, Dennis thinks the "O" and the "L" are the easiest and the first "G" being the most difficult to deal with. The letter "E" somehow couldn't utilize to its' max potential due to its' location. The "O" has become a Halloween pumpkin, a Nobel Prize medal, the Korean flag symbol and the planet earth while The "L" has been used as a flagpole, the Olympic flame cauldron or a snow ski.

# TIP: If you're of age from 4 to 18 and staying in U.K. you might want to enter the Google's Doodle Design competition (2007 has yet to be open) here. View the 2006 Winners here.

Plan To Protect Malaysian Minority Shareholders

One of the proposals is to allow statutory derivative action which enables minority shareholders to bring action on behalf of the company in situations where the company does not take any action because the person who is to be sued controls the company, and prevents, or is able to prevent the company from suing him.

This is a long overdue measure to protect the interest of minority shareholders which

should be in place even before the 1997 Asia Economy Crisis. I don't see any CEOs or directors who blatantly making huge fortunes for himself/herself leaving the companies to rot being prosecuted in Malaysia business history. On contrary these untouchable individuals were being rewarded with golden hand-shake when the crisis hit causing the companies unable to survive - some companies were being forced to de-listed due to huge losses with minority shareholders left with the only shirt on their bodies.

should be in place even before the 1997 Asia Economy Crisis. I don't see any CEOs or directors who blatantly making huge fortunes for himself/herself leaving the companies to rot being prosecuted in Malaysia business history. On contrary these untouchable individuals were being rewarded with golden hand-shake when the crisis hit causing the companies unable to survive - some companies were being forced to de-listed due to huge losses with minority shareholders left with the only shirt on their bodies.Some classic example of companies where the former directors were flushing companys' money as if they own a money-printing machines are United Engineering Malaysia (UEM), Renong Berhad (defunct), Malaysian Resources Corporation Berhad (KLSE : MRCB, stock-code 1651), Rashid Hussan Berhad (KLSE : RHB, stock-code 1309), Technology Resources Industries Berhad (defunct), Malaysia Airline System Berhad (KLSE : MAS, stock-code 3786) and many more.

- What if the director(s) the minority shareholder(s) is suing counter-sue instead? Just like the case of Tajudin Ramli who counter sues Danaharta, the Malaysian Government and several other companies for RM13.46 billion. What other protection does a whistle-blower has in Malaysia business scene? None, I'm afraid.

- What if the director(s) the minority shareholder(s) is suing has strong political connection or influence? Try to sue the previous director of Malaysia Airline System Berhad whose position is now being taken by Idris Jala for mismanagement and you'll know what I mean.

- Can the minority shareholder(s) sue a former director of the company which created the mess previously?

# TIP: According to the CEO, CCM welcomes feedback at http://www.ssm.com.my/. You might want to send email on any suggestion - the website does not have English-version though.

Other Articles That May Interest You ...

Saturday, January 06, 2007

From London-Eye To Malaysia-Eye At $43 Million?

There are 40 air-conditioned gondolas with a capacity of eight passengers for each gondola. There will also be one VIP gondola, which will be equipped with leather seats, DVD player, a mini fridge, plasma TV and a phone facility. The ride will be open to the public at RM15 for adults and RM8 for childrenwith operation period from 10am to 10pm daily.

There are 40 air-conditioned gondolas with a capacity of eight passengers for each gondola. There will also be one VIP gondola, which will be equipped with leather seats, DVD player, a mini fridge, plasma TV and a phone facility. The ride will be open to the public at RM15 for adults and RM8 for childrenwith operation period from 10am to 10pm daily.The wheel is also the first in Malaysia to be built with the latest

German-Swiss observation wheel technology. But the "Malaysia Eye", similar to the "London Eye" invited criticism over the viability against the huge costs when Tourism Minister Tengku Adnan said it would cost RM30million (according to Oriental Daily dated 3rd January 2007, the cost is RM43 million) to set-up the wheel. If the figure reported by Oriental is correct, then the estimated two million tourists to tour the Ferris will result in a loss of RM 13 million based on RM15 entry ticket per person. Current plan is to have the wheel for a year before dismantling it.

German-Swiss observation wheel technology. But the "Malaysia Eye", similar to the "London Eye" invited criticism over the viability against the huge costs when Tourism Minister Tengku Adnan said it would cost RM30million (according to Oriental Daily dated 3rd January 2007, the cost is RM43 million) to set-up the wheel. If the figure reported by Oriental is correct, then the estimated two million tourists to tour the Ferris will result in a loss of RM 13 million based on RM15 entry ticket per person. Current plan is to have the wheel for a year before dismantling it. Some background info on "The London Eye"- it is the largest observational wheel in the world and since it officially opened in 1999 it has quickly established itself as a celebrated landmark on the south bank of the River Thames and has flourished as a tourist attraction -- 3.5 million people took a "flight" in 2006. Designed by Marks Barfield Architects, "The London Eye" weighs in at 1,900 tones, 135 meters tall and has 32 passenger capsules which complete a full rotation in 30 minutes.

Some background info on "The London Eye"- it is the largest observational wheel in the world and since it officially opened in 1999 it has quickly established itself as a celebrated landmark on the south bank of the River Thames and has flourished as a tourist attraction -- 3.5 million people took a "flight" in 2006. Designed by Marks Barfield Architects, "The London Eye" weighs in at 1,900 tones, 135 meters tall and has 32 passenger capsules which complete a full rotation in 30 minutes.

# TIP: Get a group of 5 (five) to get a 20% discount if you're interested

What's Your Bet Now Oil Is At $55?

Warmer winter weather also means the distillate inventories record surplusfigure as reported Wednesday - diesel fuel and heating oil increased by 2 million barrels to 135.6 million barrels due to lower demand. Analyst such as Oliver Stevens at IG Markets maintain that price could rise again but should the $55 per barrel support level be broken oil may well trade lower to find support at the $50 level.

Warmer winter weather also means the distillate inventories record surplusfigure as reported Wednesday - diesel fuel and heating oil increased by 2 million barrels to 135.6 million barrels due to lower demand. Analyst such as Oliver Stevens at IG Markets maintain that price could rise again but should the $55 per barrel support level be broken oil may well trade lower to find support at the $50 level.It'll be interesting to see if the Malaysia Government will reduce the fuel (petrol) price since it previously mentioned the government will only consider lower the price if the oil pull-back to below $ 60 per-barrel. I won't be surprise if the government cook-up the same old boring story on how the government actually still subsidizing fuel and the citizen should continue to help share the burden. What is your bet on this?

Friday, January 05, 2007

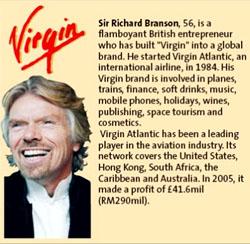

Fly To London At Less Than 3 Dollars

Tickets can be purchased online beginning February on AirAsia's website. The company is offering unbelievable promotional fares of9.99 ringgit (about $2.85) one-way on the Kuala Lumpur-Britain route.AirAsia X plans to fly to India, Australia and other parts of Europe at a later stage. Fernandes targets the new airline to carry 500,000 passengers in its first year.

Tickets can be purchased online beginning February on AirAsia's website. The company is offering unbelievable promotional fares of9.99 ringgit (about $2.85) one-way on the Kuala Lumpur-Britain route.AirAsia X plans to fly to India, Australia and other parts of Europe at a later stage. Fernandes targets the new airline to carry 500,000 passengers in its first year.

Transport Minister Chan Kong Choy, who officiated the launching ceremony of the new airline, gave assurances that AirAsia X would not have any impact on state-owned carrier Malaysia Airlines, of which I doubt very much.

"Within the next 7 years, I am convinced we (AirAsia) will be the largest airline in the world with 50 million passengers a year," Fernandes said. He further commented that AirAsia X plans to tie-up with other low-cost carriers to boost connectivity but talks of an alliance with either U.K.-based Virgin Atlantic and EasyJet PLC are premature.

"We are looking at a maximum 200 planes, including the 100 firm orders of Airbus A320," AirAsia's executive director Kamarudin Meranun said on the fleets expansion.

Investing Stocks - Latest 4 Call-Warrants You Should Know

The four call-warrants are being listed as AIRASIA-CB (stock-code 5099CB),ASTRO-CB (stock-code 5076CB),TM-CC (stock-code 4863CC) andYTL-CA (stock-code 4677CA). Are you confused with all those acronym of CA, CB and CC? Well, don't take it too seriously as it's just another way to distinguish one call-warrant from another but with different Exercise-Price or Strike-Price and Exercise-Price or Conversion-Price. In fact the codes here are pretty straight-forward compare to Options Trading in U.S. (call-warrant is to some extend similar to Call-Options)

The four call-warrants are being listed as AIRASIA-CB (stock-code 5099CB),ASTRO-CB (stock-code 5076CB),TM-CC (stock-code 4863CC) andYTL-CA (stock-code 4677CA). Are you confused with all those acronym of CA, CB and CC? Well, don't take it too seriously as it's just another way to distinguish one call-warrant from another but with different Exercise-Price or Strike-Price and Exercise-Price or Conversion-Price. In fact the codes here are pretty straight-forward compare to Options Trading in U.S. (call-warrant is to some extend similar to Call-Options)In U.S. an option-able stock might have very short expiry-cycle with 4-month interval from one another. Add this to the different strike-price available and you have a massive complex but flexible option system at your trading disposal. For example, Google's Jan-2007 480 Call's code is "GOPAI" and Jan-2007 490 Call is "GOPAK" whereas different month such as Mar-2007 480 Call's code is "GOPCI" and so on.

- When the share price of AirAsia = 1.58, AirAsia-CA = 0.35 and AirAsia-CB = 0.585.

- The Exercise/Strike price of AirAsia-CA = 1.96, so stock price for AirAsia-CA of 0.35 is entirely consists of time-value (expired on 19-Oct-2007) since its' already out-of-money.

- The Exercise/Strike price of AirAsia-CB = 1.45, the intrinsic-value is 0.13 (1.58 minus 1.45) leaving the 0.455 (0.585 minus 0.13) as the time-value. Hence, AirAsia-CB trading share-price of 0.585 consists of both intrinsic and time-value.

But why AirAsia-CA which has a longer expiry-date commands a lower time-value than the newly launched "CB"? It could be due to other factors such as IV (Implied Volatility) and other Greek's language that might scare the head out of you such as Delta, Gamma and Theta etc. Such is the exciting world of option trading - or rather call-warrants.

# TIP: For more detail-data related to Bursa Malaysia (KLSE) call-warrants, you can visit OSK188 at Warrants Pricing Table

Other Articles That May Interest You ...

After 8-Days Investing GOOG - Take Profit Today

As a matter of fact, immediately after I opened the position on that day, Google seems to having fun playing with my emotion when it

decided to settle below $461 level for the next 3-days before gap-up a little to trade above $461 thereafter, to my relieve.

decided to settle below $461 level for the next 3-days before gap-up a little to trade above $461 thereafter, to my relieve.

# TIP: Never open or close position using market value, use limit-order instead to get the better price. Take profit when your stock investment reaches your target - don't be greedy. Option trading can be lucrative compare to stocks investment.

Other Articles That May Interest You ...

Thursday, January 04, 2007

IronPort Should Fit Into Cisco Stable Well

of the security market, followed by Check Point Software Technologies Ltd (Nasdaq : CHKP, quote) andJuniper Networks Inc (Nasdaq : JNPR, quote) at less than ten percent each. The addition of IronPort will enhance Cisco's total security solution offerings in achieving a unified IP network for email, voice messaging, instant-messaging, and security. The deal will enable Cisco to compete directly with Symantec Corporation (Nasdaq : SYMC, quote), the world's largest maker of security software especially in the anti-spam market, which according to Gartner Research is growing at 42% annually. In April, Cisco purchased SyPixx Networks Inc for $51 million that enabled it to deliver video surveillance as part of an Intelligent Converged Environment.

of the security market, followed by Check Point Software Technologies Ltd (Nasdaq : CHKP, quote) andJuniper Networks Inc (Nasdaq : JNPR, quote) at less than ten percent each. The addition of IronPort will enhance Cisco's total security solution offerings in achieving a unified IP network for email, voice messaging, instant-messaging, and security. The deal will enable Cisco to compete directly with Symantec Corporation (Nasdaq : SYMC, quote), the world's largest maker of security software especially in the anti-spam market, which according to Gartner Research is growing at 42% annually. In April, Cisco purchased SyPixx Networks Inc for $51 million that enabled it to deliver video surveillance as part of an Intelligent Converged Environment.Fernandes To Fly LongHaul With FlyAsianXpress

Earlier it was reported that AirAsia (KLSE : AIRASIA, stock-code 5099) had agreed to double an existing order of 100 Airbus SAS A320 planes to meet the low-cost carrier's expansion plans. Existing, AirAsia has a fleet of 50 aircraft, comprising 15 A320s and 35 Boeing 737-300s.

Earlier it was reported that AirAsia (KLSE : AIRASIA, stock-code 5099) had agreed to double an existing order of 100 Airbus SAS A320 planes to meet the low-cost carrier's expansion plans. Existing, AirAsia has a fleet of 50 aircraft, comprising 15 A320s and 35 Boeing 737-300s.Wednesday, January 03, 2007

Does Fernandes Has Silver Bullet For AirAsia?

AirAsia chief executive Tony Fernandes, however was not immediately available for comment. AirAsia has said it will make an announcement on Friday in Kuala Lumpur with the Malaysian transport minister set to attend. AirAsia stock rised about 7.28% today to 1.62 ringgit while the call-warrant was up 50% to 0.36 ringgit on the speculation.

AirAsia chief executive Tony Fernandes, however was not immediately available for comment. AirAsia has said it will make an announcement on Friday in Kuala Lumpur with the Malaysian transport minister set to attend. AirAsia stock rised about 7.28% today to 1.62 ringgit while the call-warrant was up 50% to 0.36 ringgit on the speculation.- An announcement of a team-up with other players other than EasyJet and Virgin Atlantic but there're not many quality players left to partner with.

- An announcement of a new service (cargo and long-haul) of which AirAsia is going lone-ranger for the time being - most likely since the Friday's announcement involves Malaysia transport minister.

- An announcement of a team-up with either EasyJet or Virgin Atlantic but not both - a phase partner rather than a big-bang.

Whatever the announcement, it has to be positive knowing Tony Fernandes who's not short of great and innovative ideas in creating values for AirAsia.

# TIP: With this denial, AirAsia stock price should correct itself tomorrow, Thursday 4-Jan-2007, but for risk-taker this will be the opportunity to buy in anticipation of an optimistic announcement by Tony on Friday.

Other Articles That May Interest You ...

Global Payments Should Beat Earning Again

- Wall Street consensus: 0.42

- Whisper Number: NA

- Smart-Estimate: 0.45

- Schaeffer Rating: 6

- Power Ratings: 6

- Insider Trading (last 52 weeks): $0

- Option: May 2007 45.0 Call

- Implied Volatility for Feb 2007 $45 Strike: 32.37 %

I'm optimistic Global Payments will beat the coming estimate earning again tomorrow and I think another gap-up might occurs thereafter. In early Dec-2006, Citigroup reiterated a "Buy" rating on Global Payments, Efunds Corp., Checkfree Corp. and Heartland Payment Systems Inc. Citigroup estimate electronic purchasing volume will probably grow 12.8 percent in 2006 and expect the growth to slow a little to 11.9 percent in 2007.

# TIP: How to make money on this company? Consider option as alternative to stock due to the leverage power. Since I'm bullish on this stock, I'll consider option trading on GPN with 45.0 Strike Call - with sufficient time-value.

Tech Giants Boosting Real-Estate Value

customers bought in New York city would be the same as the ones purchased in California, London, Seoul or Kuala Lumpur. By the time Kroc passed away from old age in January 1984 at the age of 81, McDonald almost sell its' 50-billionth hamburger. But when he was asked what the business of McDonald was, guess what the answer? Nope, it's not hamburger – its’ real-estate.

customers bought in New York city would be the same as the ones purchased in California, London, Seoul or Kuala Lumpur. By the time Kroc passed away from old age in January 1984 at the age of 81, McDonald almost sell its' 50-billionth hamburger. But when he was asked what the business of McDonald was, guess what the answer? Nope, it's not hamburger – its’ real-estate. huge war-chest. Mercury News reported that Google(Nasdaq : GOOG, quote) has bought up real-estates in Mountain View's Shoreline Technology Park for $319 million. Not to be left out, Apple (Nasdaq : AAPL, quote) announced plans to buy 50 acres in Cupertino for more than $160 million while Yahoo (Nasdaq : YHOO, quote) is working to buy 46 acres in Santa Clara for about $50 million.

huge war-chest. Mercury News reported that Google(Nasdaq : GOOG, quote) has bought up real-estates in Mountain View's Shoreline Technology Park for $319 million. Not to be left out, Apple (Nasdaq : AAPL, quote) announced plans to buy 50 acres in Cupertino for more than $160 million while Yahoo (Nasdaq : YHOO, quote) is working to buy 46 acres in Santa Clara for about $50 million. market for locations by boosting its' value.The giant search engine's acquisitions plus negotiations with the city of Mountain View to build another 310,000 square feet and talks with NASA/Ames Research Center to build a 1-million-square-foot campus at Moffett Field has been dubbed the Google Effect.

market for locations by boosting its' value.The giant search engine's acquisitions plus negotiations with the city of Mountain View to build another 310,000 square feet and talks with NASA/Ames Research Center to build a 1-million-square-foot campus at Moffett Field has been dubbed the Google Effect.Tuesday, January 02, 2007

Cheaper Way To Send Money Back Home

But companies such as Western Union (NYSE : WU, quote) and Moneygram International Inc. (NYSE : MGI, quote) which profit margins are estimated at 30% are being criticized for charging exorbitant fees and not having customer's best interests at heart.

But companies such as Western Union (NYSE : WU, quote) and Moneygram International Inc. (NYSE : MGI, quote) which profit margins are estimated at 30% are being criticized for charging exorbitant fees and not having customer's best interests at heart.Monday, January 01, 2007

Globalization Of Low-Cost Air Giant?

of EasyGroup, the parent of EasyJet (LON : EZJ), and Datuk Tony Fernandes of AirAsia (KLSE :AIRASIA, stock-code 5099) are in discussions to form an alliance to realize a deal that will see the formation of the world’s first low-cost global network.

of EasyGroup, the parent of EasyJet (LON : EZJ), and Datuk Tony Fernandes of AirAsia (KLSE :AIRASIA, stock-code 5099) are in discussions to form an alliance to realize a deal that will see the formation of the world’s first low-cost global network. fares between RM300 and RM2,500 while for destinations in China the tag is as low as RM100. Malaysia national carrier Malaysia Airline System Berhad (KLSE : MAS,stock-code 3786) currently operates 18 times weekly to London and charges up to 5,000 ringgit (1,420 dollars) for economy class and 18,000 ringgit for business class.

fares between RM300 and RM2,500 while for destinations in China the tag is as low as RM100. Malaysia national carrier Malaysia Airline System Berhad (KLSE : MAS,stock-code 3786) currently operates 18 times weekly to London and charges up to 5,000 ringgit (1,420 dollars) for economy class and 18,000 ringgit for business class. several European low-cost carriers might be an option to AirAsia as the hub but AirAsia is said to prefer Manchester as it has build the brand there.

several European low-cost carriers might be an option to AirAsia as the hub but AirAsia is said to prefer Manchester as it has build the brand there.# TIP: Would you pay a mountain if you have the option of flying to Britain for a fraction of the cost? I wouldn't buy MAS stocks for the time being - I never invest it previously anyway due to its' management in-efficiency. But AirAsia stocks is a different story altogether - it's getting more attractive.

Friday, December 29, 2006

StockTube Wishing All Readers A Happy 2007 New Year

Everyone was and still is in holiday mood from pre-Christmas, post-Christmas and pre-NewYear busy planning for their trips or shopping schedules. It's just a period of happy moments where you suddenly forgot all the sad and frustrating things happened during the soon-to-be-end 2006. You want to forget the time when your idiot boss went berserk and raised his/her voice on you for no apparent reason. You want to forget the time when your boy-friend or girl-friend declared cold-war with you. You want to forget the period when the Murphy-Law strike and somehow whatever you did doesn't seem to solve the problem(s). You want to forget the time when your colleagues back-stab you till you almost transformed into the Incredible Hulk. You want to forget the people who got promoted not through of his/her capabilities but because these jokers play dirty-politics - the best part is now you've to report to him/her. You want to forget the time when your financial problems kept following your shadow.You want to forget the time when the stock immediately made the u-turn right after you long or short the position - you swear you heard the stock was laughing at you.

Everyone was and still is in holiday mood from pre-Christmas, post-Christmas and pre-NewYear busy planning for their trips or shopping schedules. It's just a period of happy moments where you suddenly forgot all the sad and frustrating things happened during the soon-to-be-end 2006. You want to forget the time when your idiot boss went berserk and raised his/her voice on you for no apparent reason. You want to forget the time when your boy-friend or girl-friend declared cold-war with you. You want to forget the period when the Murphy-Law strike and somehow whatever you did doesn't seem to solve the problem(s). You want to forget the time when your colleagues back-stab you till you almost transformed into the Incredible Hulk. You want to forget the people who got promoted not through of his/her capabilities but because these jokers play dirty-politics - the best part is now you've to report to him/her. You want to forget the time when your financial problems kept following your shadow.You want to forget the time when the stock immediately made the u-turn right after you long or short the position - you swear you heard the stock was laughing at you.Bloggers Bribed By Microsoft With Free Ferrari?

- 2GB RAM 667MHz DDR 2 memory configured in dual-channel mode

- ATI Mobility Radeon X1600 graphics processor with 256MB

- 15.4" WSXGA or WXGA, 16 ms, widescreen

- 160GB SATA HDD;- HD-DVD R/W

- Bluetooth 2.0;- carbon fiber casing

- 802.11 a/b/g wireless LAN

- 5-in-1 media card reader built-in

- 1.3 megapixel digital camera built-in

But Microsoft doesn't make laptops, does it? It didn't send out a loan laptop with a free copy of its operating system, it sent out a laptop to keep. That's the problem being argued by readers. Blogger Scott Beale said Microsoft's PR company, Edelman, had contacted him and offered him a "present" of a free laptop with "no strings attached".

But Microsoft doesn't make laptops, does it? It didn't send out a loan laptop with a free copy of its operating system, it sent out a laptop to keep. That's the problem being argued by readers. Blogger Scott Beale said Microsoft's PR company, Edelman, had contacted him and offered him a "present" of a free laptop with "no strings attached".Internet Tsunami - Which EMail Is Still Running?

However today, Friday 29-Dec-2006, while it gets better for Google's (Nasdaq : GOOG) blog and email, things arestill patchy for Yahoo (Nasdaq : YHOO) when its' main page and email are crawling like the 200-years-old turtle. A basic testing by "pinging"www.yahoo.com and www.google.com or www.blogger.com demonstrates which service is up and running - lost traffic packets are so obvious with Yahoo (even with Yahoo Finance).

However today, Friday 29-Dec-2006, while it gets better for Google's (Nasdaq : GOOG) blog and email, things arestill patchy for Yahoo (Nasdaq : YHOO) when its' main page and email are crawling like the 200-years-old turtle. A basic testing by "pinging"www.yahoo.com and www.google.com or www.blogger.com demonstrates which service is up and running - lost traffic packets are so obvious with Yahoo (even with Yahoo Finance). Another test was done with email servicebetween both Yahoo and Google. Trying to attach a 2.5 MB Microsoft document file took ages (in fact, the operation was terminated manually after 45 minutes) with Yahoo email but with Google's mail, it took less than a minute to send.

Another test was done with email servicebetween both Yahoo and Google. Trying to attach a 2.5 MB Microsoft document file took ages (in fact, the operation was terminated manually after 45 minutes) with Yahoo email but with Google's mail, it took less than a minute to send.This does not mean that Yahoo Mail sucks - it could be due to routing or infrastructure not properly designed or configured for optimum performance during such disaster. Yahoo Messenger however works fine. But a failure to satisfy users is still a failure no matter what's the reason(s) or excuse(s). So in time of disaster, I would say Google performs better than Yahoo in terms of service availability.

Get Yourself One Of These Present In Christmas 2007

(1) Vista - the long-awaited operating system upgrade fromMicrosoft (Nasdaq : MSFT) is expected to spur a boom in PC buying. Features likely to appeal to consumers include a quicker wake from sleep mode and Windows SideShow, a minidisplay that will let users check e-mail and instant messages even when the PC is off. It was said that Vista's AERO delivers a new graphics engine to produce stunning new icon, menu and desktop visuals.

(1) Vista - the long-awaited operating system upgrade fromMicrosoft (Nasdaq : MSFT) is expected to spur a boom in PC buying. Features likely to appeal to consumers include a quicker wake from sleep mode and Windows SideShow, a minidisplay that will let users check e-mail and instant messages even when the PC is off. It was said that Vista's AERO delivers a new graphics engine to produce stunning new icon, menu and desktop visuals.- Expected availability: Jan. 30 2007

- Expected Costs: A basic home version of Vista will retail for $199.

(2) Apple (Nasdaq : AAPL) is due to release a new system, code-named Leopard. It, too, is expected to generate demand for computers—and a whole lot of switching from Windows-centric PCs to Mac machines. Leopard's Time Machine will help users search for deleted or lost files, and a feature called Spaces will help organize on-screen windows into categories such as work and play.

(2) Apple (Nasdaq : AAPL) is due to release a new system, code-named Leopard. It, too, is expected to generate demand for computers—and a whole lot of switching from Windows-centric PCs to Mac machines. Leopard's Time Machine will help users search for deleted or lost files, and a feature called Spaces will help organize on-screen windows into categories such as work and play.

- Expected availability: Spring 2007

(3) Code-named Santa Rosa after the city in Northern California's wine country, this version of Intel (Nasdaq : INTC) Centrino mobile technology chips will allow greater power savings and faster access to memory. A feature called Robson, designed to take advantage of Vista, will help systems load applications up to two times faster. Santa Rosa will also feature an IEEE* 802.11n latest Wi–Fi adapter, codenamed Kedron for fast video streaming. It is also expected to include an improved graphics chipset, codenamed Crestline.

(3) Code-named Santa Rosa after the city in Northern California's wine country, this version of Intel (Nasdaq : INTC) Centrino mobile technology chips will allow greater power savings and faster access to memory. A feature called Robson, designed to take advantage of Vista, will help systems load applications up to two times faster. Santa Rosa will also feature an IEEE* 802.11n latest Wi–Fi adapter, codenamed Kedron for fast video streaming. It is also expected to include an improved graphics chipset, codenamed Crestline.

- Expected availability: First half of 2007