Saturday, August 23, 2008

Reduced fuel prices – desperate action to win P44 voters

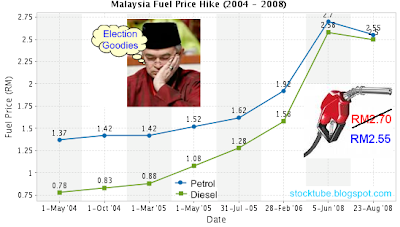

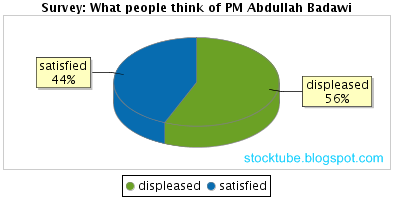

Most of my friends from Sibu were damn serious when they told me yesterday that there was consensus within the community not to pump their tanks until end of the month because the PM Abdullah Badawi said so – fuel price to remains until 1st Sept 2008. They were so adamant that they would rather take motorbike than to fill a drop of petrol into their car’s tank. I laughed at their silliness and even call them idiot. Of course we were so close that we can curse and name-call each other. I had pumped my tank full yesterday because the warning light was on. And guess what, the flip-flop PM Badawi did it again today when he suddenly announced petrol and diesel price will drop by 15 sen (to RM2.55 a liter) and 8 sen (to RM2.50 a liter) respectively at midnight today.

Before I manage to curse the PM I received calls from my Sibu friends – obviously with great pride because they would be buying cheaper petrol than me. I retaliated by saying I only made a loss of RM4.50 based on the 30 liters that I pumped yesterday – just nice for a plate of char-kuey-teow. I guess bad (or rather childish) habit never dies and in this case the strange hobby of the PM with his forever flip-flop decision. Less than three days ago, he almost swears on the grave of his grandfather that if there’s indeed a revision in fuel price, it would be on 1st Sept 2008 - the earliest. And today, he has the cheek to announce the fuel price reduction. It was so obvious that such decision was a desperate attempt to fish for votes in the current P44 Permatang Pauh’s by-election.

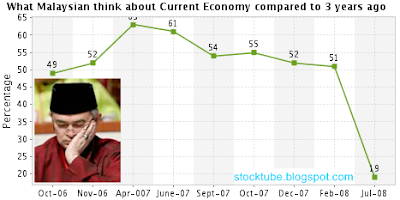

If you look at the ruling party’s strategy in this by-election you would notice that it still hasn’t change a bit, still arrogant (or rather give-up?) and adopted an obsolete game-plan. Play racial cards, give away money to schools, hijacked Lee Chong Wei, use electronic and print media to promote cheap propaganda, took a ride on LRT, utilized ACA (anti-corruption-agency) to its advantage etc. In short the ruling government still thinks the voters are stupid. But who can blame them when they’re in disarray and the whole government is not working towards revitalize the country’s economy? With the inflation hitting the roof (26-year high of 8.5 percent) and small businesses affected, its’ no-brainer that the Chinese and Indian voters are expected to give their votes to the opposition.

It’s a trend nowadays that whenever the government announces or denies something, the opposite usually holds the truth. If only we have such a pointer or indicator in stocks investment. Therefore the central bank’s governor might be resigning since the official denied it. At least I heard that Dr Zeti has resigned for the second time (her second attempt) from the top post.

Other Articles That May Interest You …

Friday, August 22, 2008

Watch out BN, you don’t want to wake up Dirty Harry

Looking at the persistent daily low transaction volume, there’s really nothing much you can do but to ignore the stock market for the time being. I know I’ve said this numerous times but it’s wise that you take a break. Smart monies are not flowing in and unless you wish to get slaughtered, you should just follow the big boys or the market makers. Sometimes if you do not know what to do, then do nothing. If you’re not ready to trade, then don’t trade. If you couldn’t find any good trade, then don’t trade. If you haven’t done your research and homework, then don’t trade. I would rather let go of a trade than to jump into it if I’m not ready.

If you’re hungry for money during the current hungry ghost festival, then go straight to P44 Permatang Pauh. What? The boring by-election again? Hey! Like it or not the candidates are just warming up. The latest news has it that a component party (MCA?) of the ruling government is giving away easy money in return for intelligence feedback. If you’re Chinese you’ll get RM50, if you’re Indian you’ll get RM150 and if you’re Malay your prospect is RM200. Not sure why the different rate but I suppose that’s the order in terms of the intelligence’s value. So go and peek or spy at your neighborhood and pass the information back to the ruling government in exchange for some pocket money?

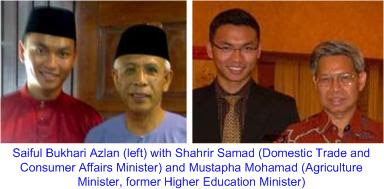

And boy, the mother of by-election’s campaign is getting dirtier. Despite his promise not to hit below the belt the deputy PM Najib did just that when he can’t resists the temptation to link Anwar with sodomy during his campaign. Frustrated, Anwar threatens to “open can of worms” against Najib. Anwar was referring to the latest allegation of him ogling at the wife of Larut member of parliament (MP) and Deputy Housing and Local Government Minister Hamzah Zainuddin a decade ago. Anwar warned Najib that he would not hesitate to expose "Port Dickson"(scandal) if the latter did not stop the personal attacks against him.

He said "I am being very patient all this time, but I would like to warn them not to push me beyond the limit. If I open my mouth on personal matters, Najib will be kept busy answering them for a very long time. I have refrained from doing so, as this is not a personal battle but about the political future of the country … Remember, I too was in the government and I was privy to a lot of information. Najib knows what I know and he knows what I am talking about. Don't push me to respond or he will regret it”.

Grow up Anwar! You can’t fight the 50-year-old corrupt organization which you were part of it before. Now the ruling government has started to trap your Perak Exco members with corruption, never mind that the housing project doesn’t exist in the first place, and soon the whole Perak government might just collapse. So what if the ruling government abuse military airplane to hijack Lee Chong Wei and force him to go to the Permatang Pauh for cheap campaign publicity? Unless Chong Wei was willing to kiss his hard-earned RM300,000 and monthly RM3,000 pension reward goodbye, he actually has no choice but to act as a clown when he should be with his parents in the first place. So, let’s see if the P44 voters would give the ruling government another kick on its arse again. But watch out BN (ruling government, National Front) – you do not want to wake up the Dirty “Anwar” Harry because he has a huge “Magnum”.

Other Articles That May Interest You …

Wednesday, August 20, 2008

PERWAJA – example why you should avoid IPO for now

Looking at how all the heavyweights, including the PM himself, rushed to P44 Permatang Pauh to try their best (or luck) to fish for as many votes as possible for the coming by-election this is no doubt the mother of all by-elections. Two PM-in-waiting are fighting tooth and nail – one tries to return to the Parliament while the other tries to stop him. While Anwar’s supporters are already complacent that their charismatic leader could win easily a sudden drop of postal votes could spoil the result and give a perception that Anwar’s popularity had shrunk. Despite the huge resources machinery and dirty tactics from ruling government the turnout for its talk was nowhere near the one conducted by Anwar.

Sure, Anwar is no angel and when he was sent behind bars for sodomy 10 years ago, many applaud. Anwar was as dirty as the current ruling government when he was part of the team back then. But people are ready to give him a chance –hoping he’s a different person now after his suffering behind bars. In fact the people has no other choice but to look at Anwar as the only hope they have since the ruling government under Abdullah Badawi’s leadership is still screwing up the country’s economy after the Mar-2008 general election. In order to cling to power there’s no other choice but to perform an express sodomy part II to stop the ambitious Anwar.

Just how bad did Abdullah’s team screwed up the country’s economy? Bad enough that the ruling government has no other way but to slap IPPs to raise money via Windfall-Tax and it won’t be the last. The government will announce its budget for 2009 on August 29 and there’re already speculations the government will raise gaming taxes by 5 percentage points. Who said it’s hard for the government to raise money *grin*. The local currency is already going down the toilet bowl and HSBC Holdings Plc. predicts that the currency (ringgit) will weaken to 3.5 per dollar at the end of this year *hooray!*. A weaker ringgit against the dollar is definitely good news to people who’re making U.S. dollar before converting it back to ringgit.

Sometimes you need to read analysts’ report with a pinch of salt. Hwang-DBS’s target price for Perwaja was RM5.00 a share (6 times FY2009 earnings per share) while other brokerage values the company at RM5.75 per share (7 times FY2009 EPS). If indeed the company could register a net profit of RM452.1 million for FY2008 and RM460.2 million for FY2009 then those who dumped the stocks today must be idiot. In comparison iron and steel companies listed on U.S. are traded between P/E (price per earning ratio) of between 6 to 16 times. Maybe Malaysian’s steel companies worth only half of the lowest P/E company from U.S. Of course you’ve to beware of BRIC’s (Brazil, Russia, India and China) demand for such commodity.

Other Articles That May Interest You …

Monday, August 18, 2008

Forget about oil prices, it’s the Inflation you should worry

Tropical Storm Fay, the sixth storm of the 2008 Atlantic season, caused some worries that it could disrupt oil operations in the Gulf of Mexico although nobody expect it could match the Katrina. Nevertheless oil prices were up as high as $115.35 a barrel today in electronic trading on the New York Mercantile Exchange. However the main attention should be on 9th Sept 2008 at Vienna – the day OPEC will be holding its next official meeting to discuss about oil production.

With the recent strength in dollar and subsequently the plunge in oil prices, the meeting will generate some serious debate or argument on whether OPEC should agree to cut its official output limit. Iran's oil minister recently said he thinks the market is oversupplied and that additional barrels should be removed if producers prefer a balanced market while Kuwait's oil minister said there won't be any cut in production. Since the decision by Saudi Arabia to raise its output by 500,000 barrels per day in June and July to prevent the oil prices from escalating further, the black gold which hit its peak of $147.90 on July 11 has plunged 24% ever since.

The unknown factor is whether Saudi Arabia will reverse its decision or decide to do something in order for the global oil prices to tumbles further (and affect the kingdom’s profit). OPEC would like to have a steady supply-demand balanceand definitely not a ridiculous high price which could lead to demand destruction. Therefore the focus is on the OPEC meeting as well as how the dollar will performs as a stronger dollar will pull down oil prices and vice-versa.

In OPEC’s monthly oil report, the organization forecast world appetite for oil this year would grow by 1 million barrels a day, a reduction of 30,000 barrels a day from its previous forecast for demand growth for 2008. It also said growth for 2009 will be 900,000 barrels a day, which it said would be the lowest growth in world demand since 2002 – reported AP. There are already reports that the demand for steel is already slowing during the current Beijing 2008 Olympic Games and this is yet another yardstick that the demand for oil could just be cooling down.

The Consumer Price Index for all items shows the inflation rate averaged 2.6% a year from 1992 through 2007 but has doubled since January, reaching an annual rate of 5.6% in July. It was estimated that by next year, the monthly figure could hit double digits, and the inflation rate for 2009 overall could triple 2007's 2.85%. What this means are American consumers will be facing double-digit inflation as early as 2009 simply because China is no longer the cheap manufacturer as it used to be.

Under the pressure from U.S. the Chinese government has let its currency float upward by a whopping 21% against the dollar since de-pegging it in July 2005 (followed by Malaysian Ringgit). Oh yeah! If you haven’t been living in a cave for the last couple of weeks you should know that the Malaysian government is set to lower the petrol price – probably by RM0.20 a liter (from the current RM2.70 a liter).

Sunday, August 17, 2008

Eyes on Lee Chong Wei to deliver the first Gold Medal

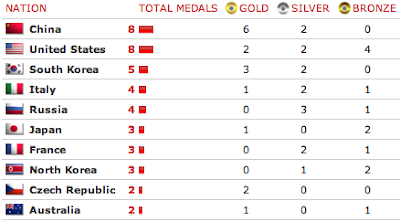

Michael Phelps won his record eighth gold medal at the Beijing Olympics 2008 breaking a tie with Mark Spitz for most golds in a single games. In 1972, Spitz entered four individual events and three relays and set world records in all seven events - 100m freestyle, 200m freestyle, 100m butterfly, 200m butterfly, 4×100m freestyle, 4×200m freestyle relay and 4×100m medley relay. American retired swimmer Spitz, now 58, hail Phelps as "the best Olympian of all time". That’s for the U.S. but to the entire nation of Malaysia all eyes are looking at Lee Chong Wei to bring back the first-ever gold medal in the history of Malaysian sports.

Tonight Lee Chong Wei will play against world number one Lin Dan of China. With silver medal in his bag the RM300,000 is secured but compared to RM1 million (gold medal), Chong Wei would rather have the gold medal for the nation.The pressure is definitely on Lin Dan and not Chong Wei. If this game were to be played in Malaysia, my money would be on Lin Dan but with the local crowds chanting for nothing more than gold medal from Lin Dan, I think Chong Wei stand a 50:50 chance. He has beaten Lin Dan before and as long as he can stay focus and not get distracted, Chong Wei could deliver the points. Super Dan’s bad temper could be his weakness and it would be fun if Chong Wei could force him to lose it and start whacking everyone on sight with his racket *grin*.

Thousands of police were mobilized to control the situation. Already supporters from ruling government were yelling “Sodomy! Sodomy!” while Anwar’s supporters were having fun singing “Altantuya! Altantuya!” But with police’s accusation that out of 8 ceramahs only 5 has police permits and all of these belong to UMNO, fingers were pointed at the police who took sides. Anwar was not taking this election lightly and he prepared the people (mentally) who attended his talks to take the RM500 offered by ruling government but voted for him (Anwar) instead. It would be interesting to see if Samy Vellu could help to swing the Indian votes or to deliver more damages instead.

Anyway, should Lee Chong Wei succeeded in securing a gold medal tonight I hope the PM Abdullah Badawi could move his heavy buttock to the airport to greet and congratulate the national hero. Nothing less is acceptable lest he wish to be seen as practicing double-standard and a racist *grin*. Lee Chong Wei also should deserve a Datukship for that matter, not that it’s a privilege nowadays. The PM would have nothing to lose but everything to gain by doing so as he could claim credit for the country’s first-ever Olympic gold medal – at least his predecessor Mahathir didn’t manage to do so during his 22-year dictatorship.

Other Articles That May Interest You …

Friday, August 15, 2008

Brother of RM24 billion vessel scandal to unseat Anwar?

Local banks are selling the ringgit again – head of currency trading at Affin Bank Berhad said today. This is cool *grin* - at 5pm, the ringgit was lower against the greenback at 3.3295/3325. But who can blame the currency traders after the news broke that Europe’s biggest economy powerhouse, Germany, contracted for the first time in almost four years in the second quarter. Adding salt to the wound was the United Kingdom’s unemployment which rose the most in almost 16 years. In U.S. the latest consumer prices shot up in July at twice the expected rate pushing the inflation to 17-year high.

The joke of the town was that remisiers (brokers), dealers, traders or investors should just stay at home with coke and popcorn – enjoy the Beijing Olympic 2008 at channel 318 (Astro). That was why when the Bursa Malaysia Berhad (KLSE:BURSA, stock-code 1818) and Securities Commission were busy debating the decade-year-old issue on whether the stock trading hour should be shortened in view of the low daily transaction volume, almost all the brokers were believed to support such proposal. At least the remisiers do not need to sit in the office waiting to “die” (to quote a statement from a broker).

In 1998, PSC Industries Bhd (KLSE: PSCI, stock-code 8133) signed a RM 24 billion deal to build 27 patrol vessels for the Malaysian Navy. The 10-year contract also gave PSCI

It’s funny that the ruling government couldn’t find any other candidate to face Anwar. It could meant that nobody dares to face the giant although the ruling government has all the resources in terms of money and machinery. Tactics were set to reduce opposition’s 13,398-vote majority if not to capture the seat. The fact that the polling day was fixed on a working day speaks volume about ruling government’s intention to prevent voters from turn up to vote. Ruling government is playing reverse psychology-game, trumpeting that Anwar will win handsomely and easily. With such tactic it hope opposition parties and supporters would be complacent. The more people who think that Anwar will win no matter what, the higher the chances are for the ruling government to create surprises.

Other Articles That May Interest You …

Wednesday, August 13, 2008

The Myth behind Big Mac Index – better to get Honda

Frisolac 1 Gold costs RM49.50 today when it was only RM45.00 two months ago – a whopping 10 percent increase within a span of only 2-month. With the current high petrol price, it’s not worth scouting around hoping to find cheaper Frisolac at some secluded shops. That’s a freaking high inflation if the basket of inflation was set to better reflect the actual daily consumption goods. People are getting used (or rather forced) to pay more but sadly served with smaller portion of foods. Politicians from ruling government are still screaming the country’s economy and fundamental are in superb condition though.

You’ve heard how some poor parents are substituting pricey infant formula with diluted condensed milk, rock sugar water or even black coffee and plain tea to feed their poor little infants. Instead of switch gear to boost economy and attract foreign investors, the ruling government still plays the racial card to stay in power. Guess it’s easier to move a mountain than to change a 50-year-old’s mentality. After an eight-day losing streak, its longest since its peg to the dollar was scrapped in July 2005, the ringgit finally staged a technical rebound today. The ringgit climbed 0.3 per cent to 3.3170 per dollar as of 4.45 pm in Kuala Lumpur compared to 3.3372 yesterday *phew*.

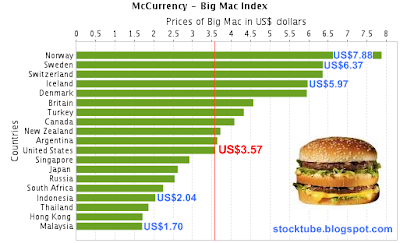

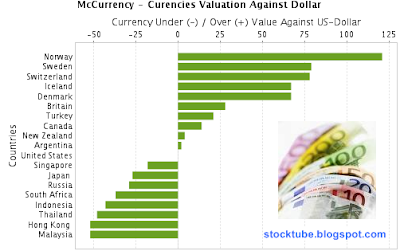

Strangely there are economists who will tell you Asian currencies are mostly under-valued including Hong Kong. The reason – Big Mac Index says so. The Big Mac Index is based on the theory of purchasing-power parity (PPP), which says that exchange rates should move to make the price of a basket of goods the same in each country. The so-called basket however contains a single product – a Big Mac hamburger.

Other Articles That May Interest You …

- Governor Dr Zeti to resign, getting rid of final gatekeeper?

- Fuel hike from RM1.92 to RM2.70, Char-Kuey-Teow RM7.50?

- Things are getting uglier; I wish ringgit goes back to 3.80

- Why Can’t Public Enjoy the Benefits of Strong Ringgit?

- Oil price hike – Badawi’s greatest Economic Challenge

- Maths Genius Sufiah enjoys Sex career, no Regrets

Monday, August 11, 2008

Races are on for Gold Medals, Black Gold and the Throne

The week ended with a spectacular Beijing Olympic 2008 opening ceremony held in the China’s National Stadium – known as the Bird’s Nest. The date chosen was also said to be very auspicious, Aug 8th 2008 or 08-08-08. Some 34.2 million viewers watched the Opening Ceremony, smashing the previous record of 27.3 million for NBC's coverage of the 2000 Summer Olympics from Sydney, Australia, according to Nielsen Media Research. The largest U.S. television audience for a Summer Olympics Opening Ceremony however was 39.77 million for the 1996 Atlanta Games.

China, known as the “Middle Kingdom” spent multi-billions of dollars to make the event one of the successful in the history of the Olympic Games. China’s GDP growth has been expanding on double-digit figures since 2003 and the fastest growing economy in the world is set to overtake Germany as the world’s third largest powerhouse this year. China’s reserves peaked at US$1.81 trillion as at end of June-2008 and this was one of the important tickets most Chinese stock speculators (or rather gamblers) believed would shield the country’s economy from a bubble burst – if there’s any. Even if the stock market were to crash, it would only happen months after the Beijing Olympic 2008 – goes the argument.

On the local front, Anwar is also on the race to win the upcoming Permatang Pauh’s by-election. Former premier Mahathir doesn’t think the ruling government could wrest the seat from the de-facto opposition leader though. After denied the rumors that he might offers himself as an independent candidate for the by-election, Mahathir also said he might consider migrating to another country (to his buddy Robert Mugabe’s Zimbabwe?) if Anwar becomes the next Prime Minister of Malaysia. He might be sarcastic but if he was serious with his statement then he might believes that Anwar’s threat (of becoming the next PM) is a real one after all.

Other Articles That May Interest You …

Friday, August 08, 2008

Are you a good Negotiator or a good money Spender?

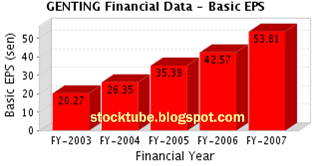

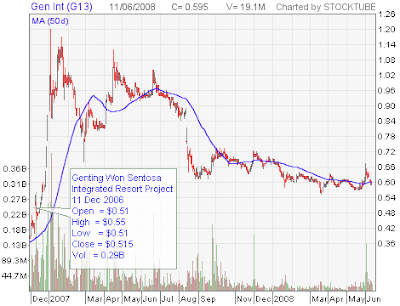

There’re always two sides of the same coin. Certain people argued that you can’t re-negotiate a contract particularly in relation to the IPP. They asked how I would feel if I’m one of the IPPs owners. They strongly condemn any changes to the lop-sided agreement and would blacklist Malaysia as their investment destination if anyone dares to review the agreement. Whoa! We have scary and violent “investors” who would form the first-line of infantry to protect the interest of IPPs. I envy Syed Mokhtar Albukhary (MMC Corp), Lim Kok Thay (Genting Group), Francis Yeoh (YTL Group) and Ananda Krishnan (Tanjong Inc.).

Sure, it was not the fault of these tycoons when a bunch of idiots from the ruling government were sent to the negotiation table. Wait a minute! they are not idiots though if you really study how fool-proof the agreement was drafted in the first place. Where else could you find IPPs in other parts of the world which could seal such a deal – sell every single unit of electricity generated with zero inventories left for the next day? Fine, you don’t like the agreement to be re-negotiated then I guess it is fine to slap them with Windfall Tax then. And since U.S. practices such (windfall tax) creative way to tax certain companies, I suppose critics won’t say Windfall-Tax is unacceptable. All right, I’ve to declare that I don’t own a single share in any of these IPPs *grin*.

Speaking of minority shareholders, I was surprised that the Minority Shareholder Watchdog Group (MSWG) finally showed their little fangs when it says it is against the Maybank-BII deal for three reasons: the bank was late in entering the market, the pricing and the timing. The Watchdog Group barked and asked Malaysia biggest lender Malayan Banking Berhad’s (KLSE: MAYBANK, stock-code 1155) board of directors and senior management to step down if the bank fails to get back its RM480 million deposit for the PT Bank Internasional Indonesia (BII) (JAK: BNII) deal. I’m not very sure if the bank was late in entering the market but the pricing was definitely not right. Any successful investors such as Warren Buffett would tell you that any time is a good time to enter the stock market provided the price is right.

Other Articles That May Interest You …

- Maybank’s losses before it can even make a penny

- MPs grill Maybank CEO – let the worms come wriggling

- Why you should avoid Maybank stock – Money Sucked Out

- Hanky-Panky in Maybank-BII deal? How about MAS?

- Maybank’s stock punished after $2.7 billion BII purchase

- Windfall Tax - Punishment or Desperation for Money?

Wednesday, August 06, 2008

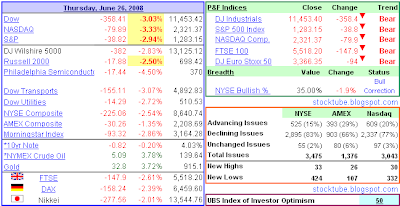

Many happy faces but Dow is still below 12,000 level

There were many happy faces who long the stocks especially in the last hours of trading when all the major indexes had gains of almost 3 percent. Dow Jones alone shot up more than 330 points. In a widely expected rate decision, the central bank reported that "economic activity expanded in the second quarter, partly reflecting growth in consumer spending and exports." Now some analysts are convinced that Bernanke’s team will keep rates on hold until the early part of 2009.

Meanwhile crude oil finished the day just above $119 a barrel - its lowest settlement price since early May after it tumbled as low as $118 a barrel Tuesday. Light, sweet crude for September

But the excitement is not over yet. As with other instruments, oil prices were filled with speculators and this time around hedge funds who long oil-related contracts are being punished. Already a large hedge fund SemGroup LP folded after losing $2.4 billion in bad bets on oil futures. Other funds were seen busy dumping huge amount of natural gas contracts to free up cash.

So, Anwar was right after all when he mentioned that the oil prices had reached its peak during his debate with ruling government’s Information Minister recently. Interestingly the ruling government now is toying with the idea of lower the petrol prices now. Nevertheless I’m more interested to see if Dow Jones can climbs back to above 12,000 mark.

Other Articles That May Interest You …

MMC overpaying SATS, Albukhary sucking money out

On paper the proposal to inject Senai Airport Terminal Services Sdn Bhd (SATS) into MMC Corp Berhad looks yummy. Besides container haulage company JP Logistics Sdn Bhd, the MMC Group’s two main ports - Port of Tanjung Pelepas (in southwest Johor) and Johor Port (in Pasir Gudang) could provide the logistics synergies with the addition of freight (SATS) into the group. MMC will issue 696.4 million new shares at an issue price of RM2.80 per share to pay for SATS.

However it didn’t take analysts hours to realize that the all-share RM1.95 billion deal was too pricey and hence the stock price was severely punished. The stock price tumbled more than 20 percent, its biggest plunge since Sept 1998, after analysts dump the shares and downgrade the stock. It’s another plan by tycoon Syed Mokhtar Albukhary to transfer the ownership of SATS to MMC Corp – also controlled by him. The problem of the deal – SATS is a loss-making company with unaudited losses of RM25mil and net tangible asset (NTA) of RM295mil as of FY08 June 30. SATS’ FY07 audited accounts are not any impressive - a negative NTA of RM64 million.

Sure, SATS acquisition comes bundled with 2,718.68 acres of land as the sweeteners but these lands are not located anywhere near KLCC or MidValley so the deal is still a lousy one, frankly speaking. So what if SATS had a 50-year a government concession to manage Senai Airport? SATS handled pathetic 1.6 million passengers only in 2007 and nobody in their right minds would think Senai Airport could flourish in anyway into the future. Hmmm, Maybank should be able to smile now that its local buddy is over-paying for SATS.

Other Articles That May Interest You …

Monday, August 04, 2008

U.S. auto sales tumbled, Proton to develop hybrid car?

One of the biggest items on the table for next week is definitely the FOMC meeting and its policy announcement slated for Aug 5th at 2:15 ET.The Bernanke boys are expected to do nothing and let the rate unchanged at 2.00 percent. There’re hundreds of companies that would be releasing their earnings and amongst the big boys are Cisco System, Warren Buffett’s Procter & Gamble, Whole Foods, Transocean and Archer Daniels Midland.

It would be a bumpy week after General Motors Corp. which is burning a whopping of US$1 billion in cash every month reported a $15.5 billion second-quarter losslast Friday, the third-worst quarterly performance in its nearly 100-year history. GM blamed its July sales which fell 26 percent on high gas prices. Nissan Motor Co. also reported slower sales - its net profit for the quarter dropped 42.8 percent while BMW AG reported a 33 percent profit decline. U.S. auto sales slumped to a 16-year low in July as automakers failed to keep up with consumers' growing demand for smaller, more fuel-efficient vehicles.

While everyone is on the mood for the Beijing Olympic Games 2008 scheduled to start on 08-08-2008, economists and analysts are still debating whether the demand for oil will fall after the event. However a member of Kuwait's top oil council, Khaled Boodai, said despite the falling prices from record $147 to $125, the black oil is unlikely to fall below $100 per barrel as strong demand from economies such as China and India would provide the support. Boodai also said Kuwait’s proven oil reserves stood at 100 billion barrels and not just 48 million barrels as reported by industry newsletter Petroleum Intelligence Weekly (PIW) in 2006.

On the local front, Malaysia PM Abdullah Badawi claimed that national carmaker Proton Holdings Bhd (KLSE: PROTON, stock-code 5304) is developing a new, fuel-efficient hybrid car to beat rising costs and address environmental concerns. Fighting a survival series to stay on power, Badawi also claimed he had already test-driven the car and urged the company to continue researching energy-saving techonologies. Well, I’m surprise that Proton has the “local” knowhow and expertise to develop hybrid cars when it can’t even fit all its models with the standard life-saving feature – Airbag. But then how hard could it be to import such (hybrid) technologies elsewhere.

Of course everyone hope Proton could really develop something on its own this time around but the next question would be the maintenance cost. Would such hybrid car cost more to maintain after the recent controversial Proton Perdana V6 scandal which shows the maintenance cost was higher than the car’s price after the fourth year?

Other Articles That May Interest You …

Friday, August 01, 2008

Twilight Zone is zapping people and money away

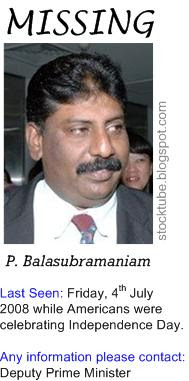

One of the reasons that have gotten foreign investors flabbergasted yet amusing at the same time was how the Malaysian government enjoys playing the game of “Now you see it; now you don’t”. Get real, the ruling government basically has no time to manage the country’s economy with the naughty-boy Anwar keeps barking that he’ll be back by September this year for the throne that was taken away from him 10 years ago. You saw the bull running and now it’s gone. You saw private investigator P. Balasubramaniam (hired by Abdul Razak Baginda) P. Balasubramaniam claimed (via his “Statutory Declaration”) that Deputy PM Najib had a sexual relationship with Altantuya and now he’s gone.

You also saw the doctor from hospital Pusrawi who examined Saiful (claimed to be sodomised by Anwar) and found his treasure-hole was still virgin has disappeared. The country’s biggest lender, Malayan Banking Berhad, (KLSE:MAYBANK, stock-code 1155) might join the gang and it was estimated aboutRM480 million (US$148 million) in deposit would possibly vanished if the regulatory issue is not resolved by September. It appears many more exciting things will happen from now till September this year. Whether PM Abdullah Badawi was sincerely concern about people’s welfare or it was a decision hopefully could increase his plunging popularity prior to Anwar’s assault, the government spread the news that the fuel price could go down on 1st September. It was reported that the petrol price of RM2.70 a liter could shed 6 sen based on global oil prices of RM129 a barrel. Crude oil costs have fallen about 23 dollars since Malaysia introduced a 41-percent fuel price hike in June 2008.

Other Articles That May Interest You …

Tuesday, July 29, 2008

Maybank’s losses before it can even make a penny

Iwas having lunch appointment with my fellow friends from Singapore the other day and the conversation somehow found its way to the topic of politics and economy. While Malaysia celebrated its’ highest annual inflation rate (7.7 percent) in 27-year last month thanks to the government’s fuel hike, the same rate of inflation has already reached Singapore’s soil. Singaporeans are grumbling about the high inflation as well especially the hike in the GST. They also grumble about high price of health-care and they admire how lucky Malaysians are in enjoying RM2.00 medical fees from the government hospital *grin*. I told them that they should be thankful because their government takes good care of the basic necessities such as education, transportation, housing and even allowance for their kids but they seemed to be unsatisfied and want more *sigh*.

Then our conversation entered the topic of Anwar and it appears Singaporeans are enjoying the latest happenings very much and you should hear with your own ears their admiration for RPK (Raja Petra Kamarudin). They wish somehow they could have their own version of RPK but then I told them their version of RPK would be freaking boring compared to Malaysian’ simply because their politicians, police and other agencies are too obedient and are not as creative as Malaysian *feel proud for a moment*. My Singaporean friends agreed and asked me whether it was true that there were hanky-panky in the Malayan Banking Berhad’s (KLSE: MAYBANK, stock-code 1155) US$2.7 billion offer for PT Bank Internasional Indonesia (JAK:BNII) as per-rumors. I wish I could tell them straight on their face that the transaction was as clean as Clorox.

Under the New Take-Over Rule, Indonesia's capital market has raised the threshold for tender offers in takeovers to 50 percent from 25 percent and requires a buyer to sell some shares to ensure the target company will have a 20 percent free float within two years after the tender offer. It was reported that Maybank had a meeting with Indonesia's Capital Market Supervisory Agency to ask for a waiver from the new ruling but its appeal was rejected last week. Considering that Maybank had paid a whopping 23 percent premium on BII’s shares, the highest premium ever paid by a foreign buyer for an Indonesian bank, could Maybank suffer the same quantum of losses from potential stock selling down? It’s no fun to lose money before you can even make a penny out of it, don’t you think? Sure, blame it on Indonesian authorities again.

Other Articles That May Interest You …

Sunday, July 27, 2008

Perdana V6, Mercedes Benz, Camry or Accord?

The latest fiasco about the Proton Perdana versus Mercedes Benz was really the much awaited dessert after the heavy meal of Anwar’s sodomy conspiracy. Already people are getting sick and tired of the sodomy case and without Anwar’s DNA, the part-2 of the supposedly Indiana Jones thriller will not make it to the box-office. Without a proper script-writer (and budget) to create suspense and new plots, the story is so “low-class” that it’s not qualified to be screened at Cineplexes. But if it’s true that the semen found inside Saiful’s poor little hole was from his uncle and not from Anwar, then cinema-goers might find reason to spend the little money left for some entertainment.

Back to the little story about Proton Holdings Berhad’s (KLSE: PROTON, stock-code 5304) top range Perdana V6 Executives. It’s awesome just how much the cost of ownership is to maintain a V6 and taking the cue from the estimatedRM132,357.36 maintenance cost for a single car from 2004 as reported, it would whack a cool RM33,089.34 a year just to ensure the national car can roll on the road. Holy cow! That’s really a good money generator for Proton and could easily put Mercedes Benz and BMW to shame. No wonder the Terengganu’s Chief Minister (Menteri Besar) was quick to conclude it would be more economical to change the fleet to 14 RM245,000 (I thought such model costs at least RM340,00 each?) Mercedes E200 Kompressors (for RM3.43 million) as it’s no brainer that in the long run the Germany car was the solution to prevent such huge “leakages”.

Nevertheless you do not need a rocket scientist to jack-up the repairs or services charges at other workshops since Proton said its records showed that there had been no warranty claims made on that particular vehicle (cost more than RM100,000 in repairs and maintenance) since October 2004. However Proton Holdings Bhd managing director Syed Zainal Abidin Syed Mohamed Tahir claimed the average maintenance cost for each Perdana car sent by the Terengganu Government was only RM542 per year (huh?). So some geniuses must have pocketed the differences. Terengganu Chief Minister might be having fun poking at Prime Minister Abdullah Badawi’s head with the purchase but the irritated PM could not do anything judging from his decision to allow the state to keep its Mercedes-Benzes to be used for foreign dignitaries.

Other Articles That May Interest You …

Tuesday, July 22, 2008

Nuclear Plant – Tenaga’s new Toy worth RM10 billion?

Tokyo Stock Exchange suspended its stock index futures and options trading from 9:21 am to 1:45 pm after hit by computer system glitch, thanks to programming mistake by Fujitsu. Tokyo Stock Exchange’s managing director Yoshinori Suzuki immediately told reporters that the trading house is considering seeking compensation from giant Fujitsu. Fortunately they managed to identify the problem and the resolution fast or else Bursa Malaysia’s CEO Yusli might just laugh and justify that Bursa’s recent one-day failure was acceptable after all.

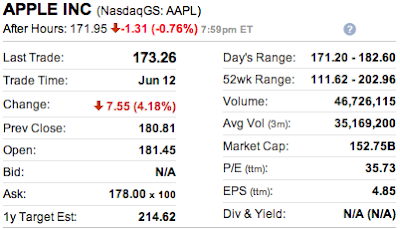

Investors are dumping Apple Inc.’s stock as of this hour after the iPod and iPhone maker issued cautious guidance despite earnings that beat Wall Street’s expectations by 11 cents a share. Revenue jumped 38 percent and earned $1.07 billion for the quarter with iPod sales up 12 percent and over 717,000 units of iPhone shipped.

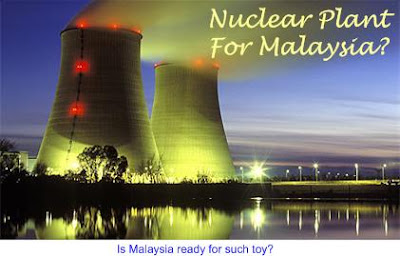

Although the plan is at its infancy stage the public is expected to object to such a dangerous toy, not so much of the nuclear plant itself but more on the operation and how the small nation could survive any deadly radiation from possible negligence. Malaysian especially the government officers (to certain extent its servants) is known to have first class infrastructure but third class mentality. Of course with the proven system deployed in other developed countries there should be little problem in building such a mega structure but could Tenaga handle such a deadly generator?

If the 1986’s Chernobyl’s nuclear reactor disaster were to happen again, you can be sure that all the Asean countries would become sitting ducks. The question is whether Malaysia is ready mentally to operate and maintain such toy.

Other Articles That May Interest You …

Monday, July 21, 2008

Gamuda and IJM Corp on their way to Merge soon?

Gamuda Berhad’s (KLSE: GAMUDA, stock-code 5398) was as good as dead the moment it’s Managing Director Lin Yun Ling threw in the towel and cashed-out from the company he co-founded. Of course the stock would not die the same way as junk stock PECD Berhad (KLSE: PECD, stock-code 5093) but the impact was great enough to wipe out millions of market capitalization. Unlike PECD, the branding of Gamuda enables the stock to stay afloat but just like the Titanic tragedy time is running out and the rescue boats better arrive soon or else.

TheEdge reported that Gamuda’s single largest shareholder, Perak royal family via Generasi Setia (M) Sdn Bhd., who has a stake of 7.5 percent had given its consent to sell its holdings to a Persian Gulf fund. The Middle Eastern group was rumored to be potentially acquiring 23% or more in Gamuda. After the acquisition this Persian Gulf fund

Just like how the government was rushing against time to gain Anwar’s DNA profile / sample to fabricate evidence in this second episode of sodomy, Gamuda’s shareholders are rushing against time to put up a new business roadmap. While the government has Anwar’s 10-year-old DNA profile, it can’t be used just in case an independent foreign expert was to be called to re-check the evidence. It would be an embarrassment if the world were to know a decade-old DNA was used as evidence that Anwar had left his “semen” on Saiful’s underwear *grin*. So, just like the government badly needs Anwar’s new DNA profile, Gamuda badly needs new management and direction profile in order to deliver the message that Gamuda is not dead, yet.

ADKM, a unit of Abu Dhabi Investment Authority is said to have received the clearance from Securities Commission to own 35 percent in UBG Berhad. However IJM Corp’s Managing Director who is also a Certified Public Accountant, Krishnan Tan Boon Seng, was said to be unhappy with the offer price and if Gamuda were to merge with IJM then nothing less than an attractive premium should be proposed on the table. Nevertheless with the bearish market especially in the construction sector, Gamuda might just be able to find an acceptable bargain.

Other Articles That May Interest You …

Sunday, July 20, 2008

Stop beating around the bush and Call a Spade a Spade

There’re many ways to skin a cat and in the case of ambitious Anwar Ibrahim, the de-facto opposition leader whose chance of becoming the next Prime Minister is now or never, his marketing plan to topple the ruling government of half a century was inviting troubles. The ruling government might be out of creative ideas but instead of doing nothing it was worth a try to reuse the decade-old sodomy conspiracy against Anwar though obviously they can’t have his eyes blackened and his half-cracked body beaten again. No doubt the whole idea was a cheap conspiracy from the start – at least that was the perception of the public.

However the paranoid ruling government couldn’t just let Anwar off the hook without having some fun. It’s been such a long time since the police attracted the global intention and what better way to show its muscle than to mobilize a contingent of ten police cars inclusive of about 20 balaclava-clad masked commandos (UTK) to arrest Anwar. But the game didn’t stop there and Anwar claimed he was stripped naked and had his private parts examined and even measured – front and back. Hospital Kuala Lumpur director Dr Zaininah Mohd Zain denied the PKR leader was asked to strip. Regardless whether the ruling government hated Anwar so much that they even wanted to know if Anwar’s little brother was superior than theirs’; the country’s economy is obviously stripped naked in the eyes of foreign investors.

And talk about responsibility, it’s high time for the government to call a spade a spade and nothing else. Former twice Finance Minister Daim Zainuddin was equally frustrated and

The infamous former Finance Minister once tried to own banks in Malaysia but luck seemed to be not at his side mainly due to political reason. Daim took control of Malaysian French Bank as early as 1982 from its owner when the French government nationalized all French banks but Malaysian laws did not allow foreign owned banks to operate in the country. Daim later sold tha bank to Multi-Purpose Holdings Berhad in 1984. He later acquired UMBC (United Malayan Banking Corporation), the country’s third largest bank but had to sell it when he accepted the position as Finance Minister. When he was called by former premier Mahathir to help solve the country’s financial problem during the 1997-1998 Asia-Crisis and appointed as Finance Minister for the second time, Daim was forced to sell his controlling stake in Hock Hua Bank in 1999.

Daim Zainuddin doesn’t think U.S. subprime problems could turn for the better anytime soon and with U.S. national debt breaching US$10 trillion, we could revisit the 1929 depression if the wrong button is pressed. So, if you were to ask me what to do in such a bearish stock market I can only subscribe to the decades-old strategy – keep lots of cash, lots of them for the next Crazy-Sales!

Other Articles That May Interest You …

- Stocks weaken further, radar & focus on Anwar’s arrest

- Bear the Responsibility? Walk the Talk, KLSE

- Governor Dr Zeti to resign, getting rid of final gatekeeper?

- The law of Gravity works either in Stocks or Politics

- MPs grill Maybank CEO – let the worms come wriggling

- Maybank’s stock punished after $2.7 billion BII purchase

- The Rise, Fall and Re-emerge of Rashid Hussain Again?

- The Rise of CELCOM Empire, Tales You Should Know

Thursday, July 17, 2008

Local stocks are temporary Game Over, eyes on GOOG

Just before the election early this year lots of beautiful numbers were being trumpeted to the investors about how rosy the economy was, never mind how serious was the U.S. subprime crisis back then. The incredible Malaysia was immune from almost all other external factors, so went the marketing talks. Even after the unexpected poor result that saw the ruling government lost the precious two-third majority, finance minister was still optimistic about the growth although the big-talks had since been shut-off. In the latest twist the MIER (Malaysian Institute of Economic Research) has finally revised its growth forecast for the Malaysian economy to 4.6 per cent this year from 5.4 per centearlier.

The reason for the 0.8 percent drop in growth was blamed on external factors (high oil prices) and the current political instability (finally they admitted it) but the serious note came from MIER’s executive director who said that the country’s major trading partners are slowing down – a sign of trouble in FDI (foreign direct investment). The country’s stock exchange operator, Bursa Malaysia Berhad (KLSE: BURSA, stock-code 1818), reported a 56 per cent fall in second-quarter net profit as volumes shrank when it only posted a net profit of RM28.6 million (US$8.87 million) for the three months ended June 30 compared with RM65 million in the year-ago period. Basically the local stocks are on temporary life-support and depends very much on Dow Jones to determine its’ trading direction the next morning.

Meanwhile all the eyes will be on Microsoft Corp. (Nasdaq: MSFT, stock) and Google Inc. (Nasdaq: GOOG, stock), both of which will be announcing their earnings after the closing bell today. While I do not like to trade Microsoft’s stock or option for obvious reason, Google’s consensus estimates this time around is $3.87 billion in sales (42.1 percent year-on-year growth) and earnings of $4.74. Bernstein's Jeff Lindsay is calling on Google to report revenue of $4.04 billion and EPS of $4.91. Doug Anmuth at Lehman is estimating revenue of $3.93 billion and EPS of $4.90 billion while Citi's Mark Mahaney is estimating revenue of $3.82 billion and EPS of $4.72 per share.

Interestingly Google is sitting on the cushion of $512 support but the analysts are expected to put on their glasses on its paid-click as well as earnings from DoubleClick. The last quarter earnings saw how foreign revenues brought in strong result to the company and this time the same expectation is on the horizon. As tomorrow is the Friday’s expiration for options the volatility is expected to be very high. However I noticed the bet on the Call Option seems to be on the boring level. Yahoo Inc. (Nasdaq: YHOO, stock) is expected to perform the opposite way from Google after the earnings – Google’s gain is Yahoo’s lose.

Wednesday, July 16, 2008

Stocks weaken further, radar & focus on Anwar’s arrest

Local stock market sentiment was crushed over the arrest of de facto opposition leader Anwar Ibrahim, less than 15 hours after he appeared live on television in a debate with Information Minister. The turnover or transaction volume traded plunged to 315 million shares from 395 million yesterday. The ING Investor Dashboard Survey reported that Malaysian investor sentiment registera 82 per cent drop, the second largest dip after Thailand.

Gosh! It appears the journalists could forget about taking leave if the current trend of explosive news were to continue till the year-end. Let’s get one thing straight, I do not think Anwar is Gandhi and it would be too insulting to even compare both of them. The fact remains that Malaysian’s politic is one of the dirtiest the world ever seen. It has come to a stage whereby you simply can’t differentiate between the sheep and the fox. But people need to make a choice because your life, your children’s future or even your career depends very much on it, whether you like it or not.

If the government couldn’t manage the country and economy well, it’s a matter of time before the storm hits us, again. Go ahead and blame the Dow Jones’ performance, oil speculators, opposition parties or even the President of the United States for having this strange hobby of yet another attack on Iran for the current market's weakness. Assuming the figure released by Petronas that over RM400 billion was paid to government since 1974 is correct, I somehow still can smell huge leakages over the years. And what’s wrong to have two-party system in this country? Since the local ministers like to subscribe to the idea of comparing the country with others such as Singapore when talk about oil prices and African countries when talk about development, why not compare to U.S. when talk about two-party system to achieve better transparency and accountability? At least you have a choice.

The question is do you need such a massive mobilization to arrest the de-facto opposition leader; lest the time is indeed running out to put him behind bar to prevent him from running for by-election and possibility forming the next new government? Osama bin Laden could be furious to learn that Anwar was given such a grand welcome because he himself might not enjoy such recognition. Funny they never mobilize the Polish PT-91M tanks for such exercise, what a waste. It might be a desperate move to provoke the opposition to take to the street the same way it happened 10 years ago when Anwar was accused of the same old sodomy charges – so that an emergency rule can be declared?

Other Articles That May Interest You …

Oil Prices Debate – Shabery slaughtered by Anwar

After watching the debate between opposition de-facto leader Anwar Ibrahim and Information Minister Shabery Cheek, I finally understand why the Prime Minister Abdullah Badawi and his deputy Najib refused to enter the ring but instead sent the Information Minister instead. Anwar had earlier challenged both the PM and his deputy to debate with him – two against one. It is without doubt that the sleepy PM would be cooked alive while his deputy would be trembling like Mr Bean the moment the word

Obviously Anwar won the applause for tackling the questions the smart way and chewed up Shabery alive. Anwar wasn’t so convincing with his opening statement and to a certain extent looked quite nervous, probably he felt somewhat intimidate with the presence of police force outside the building where the debate was taking place. Hey, who can blame him for being suspicious of an arrest immediately after he step out of the building? After all, about 15 police officers were sent to his house in an apparent effort to harass and intimidate his family members especially his grandchild even though he had promised to co-operate to give his statement to the police earlier on. In fact the smart police had even obtained a court order barring Anwar from coming within three miles (five kiilometers) of Parliament but strangely the police station to which Anwar was suppose to attend is located inside this perimeter. So Anwar was perplexing whether to go or not to go.

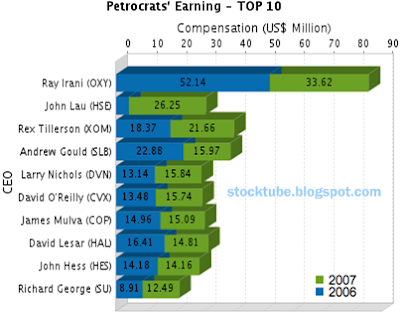

Today, Petroliam Nasional Bhd (Petronas) Group announced that it posted a record profit of RM61bil for the financial year ended March 31, 2008, which was a 31.5% increase from RM46.4 billion a year ago. Petronas Group’s revenue rose 21.2% to RM223.1 billion from RM184.1 billion; its total assets rose 15.2% to RM339.3 billion from RM294.6 billion while shareholders’ funds rose 17.6% to RM201 billion from RM170.9billion. Its’ chief executive officer Tan Sri Hassan Merican said the national oil corporation also decided to pay out a special dividend of RM6 billionto the Federal Government.

For the year, Petronas Group paid out RM67.6 billion (63.1% of the Petronas Group profits) to governments, bringing the group’s total payments to governments to RM403.3 billion since its incorporation in 1974. Of the RM67.6 billion payment for the year, he said RM62.8 billion was paid to the Federal Government comprising RM30 billion dividends which included a RM6 billion special dividend, RM20.6 billion in the form of petroleum income tax, RM5.4 billion in corporate income tax, RM2.1 billion in export duties and RM4.7 billion of royalty payment.

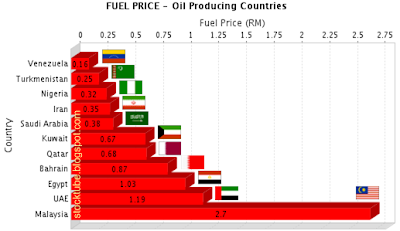

Credit should goes to Shabery at the initial debate because he argued well but as the debate continues the vessel seems to be losing steam and focus when he started to launch personal attack at Anwar, while the latter slowly gained his composure. Shabery also never learnt from the past mistake by constantly compared Malaysia with Venezuela, Iran and other countries in an attempt to run away from the question raised by Anwar’s representative – where was the promise from the RM0.30 petrol hike in 2006 to improve public transportation? Shabery went around beating the bush by repeatitively say the global oil prices affect all the countries including

It was funny that Shabery chose to compare

At one point Shabery tried to create fear and confusion (and hope to score some points) when it was his turn to ask Anwar question about his subsidy policy when the country would have no more oil to export by 2015. Of course the well-equipped Anwar cheekily questioned Shabery from where did he get the fact that it was a sure thing that there would be not more oil after the date as the job of Petronas is to continuosly explore more oil fields; the same way when it was predicted 30 years ago that the country’s reserve would be empty by 2005 (smart ass).

The soldier who was sent by Abdullah Badawi to be slaughtered tried to trap Anwar by accusing him as dirty as his accusation since he was part of the government when the concept of IPPs started together with the lopsided PPA (Power Purchase Agreement). Anwar replied that he didn’t agreed to the IPPs clause in pushing all the 100% of electricity generated into the throat of TENAGA (regardless whether the utility body needs it or not) so much so that former TENAGA boss Ani Arope resigned in protest.

But the funniest part was when Shabery’s representative asked a stupid question when it was his turn to do so. Come to think of it, it was more like an attack statement rather than a question. He (can’t remember this dumbo’s name) accused Anwar of deviating from the original topic of oil by linking it to IPPs. Every Tom, Dick and his dog know that IPPs is related to oil and gas but it’s super-strange that such a stupid person was chosen as the government’s representative. No wonder we won some rocks while

Other Articles That May Interest You …

- KL under siege – frighten of own shadow of collapse?

- Windfall Tax - Punishment or Desperation for Money?

- Windfall Tax - why Discriminate and Petronas not in?

- Still steamy hot with fuel hike? Why not kick Badawi’s arse?

- SIME aborts cable, no more cheese or the Rats move it?

- Fuel hike from RM1.92 to RM2.70, Char-Kuey-Teow RM7.50?

Tuesday, July 15, 2008

KL under siege – frighten of own shadow of collapse?

Desperate people not only do desperate things but also stupid and childish things as if they are begging to be laughed at. Malaysia has been the laughing stock for quite some time but things got more hilarious with today’s total lock-down by the police. Roadblocks were setup at numerous access points into the capital of Kuala Lumpur as if Osama bin Laden had sneaked into the country planning to blow-off the Petronas Twin-Towers, causing massive traffic jams. The excuse given by the police who often labeled as the bully – opposition was planning a huge demonstration which of course didn’t materialize.

It’s both funny and puzzling that the police could mobilize such massive police presence and barbed wires on the Parliament bridge to scare and intimidate the people but is still helpless in their efforts to rescue missing kids such as Sharlinie. If only the police was half as efficient in locking down the capital to search for Sharlinie, maybe we could have another happy family since. Somehow I sensed some similiarities in today’s military-style exercise to the recent Grand Saga’s gangster method to rob and hurt the innocent civilians. While Grand Saga recruited thugs to take care of their concreate slabs in their effort to block residents of Bandar Mahkota Cheras (BMC) going home via short-cut, today we witnessed the ruling government used the police to setup road-blocks and barbed wires to intimidate potential peaceful demonstrators – if what the bald headed minister claimed is true.

As expected the Parliament Speaker Pandikar Amin refused to allow the debate on a "crisis of confidence in the government." The speaker who is a member of the ruling government even shooed the opposition Member of Parliaments away yelling that they have make the Parliament a laughing stock, after they (opposition) staged a walk-out. You can’t blame the speaker for not knowing that the country has long been a laughing stock but the panic behaviour of the ruling government was simply mind-boggling. The police even obtained a court order barring Anwar as well as the public from coming within three miles of Parliament – a sign of a very frightful ruling government of the shadow of collapse. Isn’t the Parliament a symbol of democracy?

Of course the authorities’ fingers including the Prime Minister Abdullah Badawi’ were all pointed at the opposition but could the ruling government the shepherd boy who “cry wolf”? Was the war-zone created necessary? Perhaps it was a good publicity to attract tourists in their effort to boost tourism industry but motorist who were caught in the traffic jam were not amuse at all. It goes to show that the ruling government will do anything to stay in power, the same way Mahathir’s buddy - Zimbabwe’s President Robert Mugabe stubborn way to stay in power.

People on the street do not really care who the Prime Minister is as long as the PM knows the basic 101 of economy and can drive the country forward. Stop deceives the public that big fish can be caught with the detention of two top Immigration Department officers by the Anti-Corruption Agency. Stop playing the Consumer Price Index because every Joe Public knows how retarded the PM is in economy. Get someone qualified and clean to revitalize the economy and the stock market will take its course. With 24 months to go before the PM passes the baton to his deputy only new sets of policies that promote transparency, accountability, efficiency, good governance and justice could save him from going down the history as the weakest and useless PM the country ever had. When everyone prospers nobody would care about the demonstration.

Other Articles That May Interest You …

Sunday, July 13, 2008

Windfall Tax - Punishment or Desperation for Money?

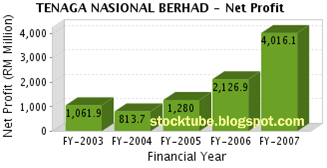

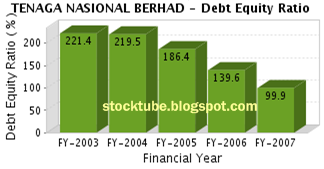

It’s funny that the brother of deputy Prime Minister expressed his pessimism of the country’s economy so much so that he urged the government to review the windfall tax imposed on independent power producers (IPPs). Huh? The CEO of CIMB group is protecting the IPPs who are making tons of money because of lopsided agreement which saw the electricity generated being pushed into Tenaga Nasional Berhad’s (KLSE: TENAGA, stock-code 5347) throat, regardless whether TENAGA needs it or not?

Wait a second. Didn’t Nazir’s brother, deputy PM Najib screamed there was no problem with the country economy and everything was in freaking good condition despite investors closing their trading book “temporary” and wait for a better time to pour their money? The trading volume on the Kuala Lumpur Stock Exchange has already shrunk to new low. Attack where it hurts the most and in this case the pocket of CIMB’s CEO. Of course this guy was worried about the stagflation – stagnant economy with escalation inflation. Going by the rate the economy is being run, you should not be surprise if such virus (stagflation) could arrive at the nation’s doorstep soon.

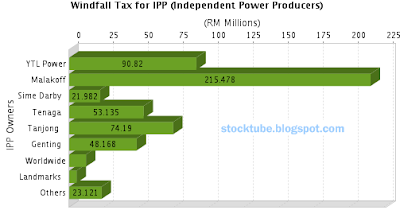

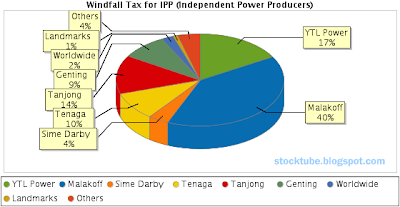

Critics said the government was short-sighted and too anxious to get hold of the estimated RM540 million from the windfall tax on IPPs without looking at the bigger picture. Since the date the tax effective (1st July 2008) MMC Corp Berhad’s stock which controls Malakoff Berhad has lose over RM1 billion in market capitalization while Francis Yeoh’s YTL Power International Berhad was poorer by RM330 million. It wasn’t a surprise plunge since Malakoff and YTL Power made up the lion share of IPP market segment with 40 and 17 percent respectively. One of the losers is EPF (Employess Provident Fund) who besides holding a gigantic huge chunk of the debt papers issued by IPPs, also owns 30 percent shares in MMC Corp which in turns own Malakoff Berhad who is expected to pay more than RM200 million annually for the windfall tax. Malakoff is screaming that the company will close shop within 3 years due to groups’ huge borrowing – a staggering RM1.2 billion annual interest for its RM16 billion debts. Investors who weren’t happy with MMC’s RM16 billion privatization of Malakoff exercise two years ago have all the reason to cheers and smiles now, out of vengeance.

Other Articles That May Interest You …

Thursday, July 10, 2008

Candies for Najib, Badawi’s tactical move to stay longer

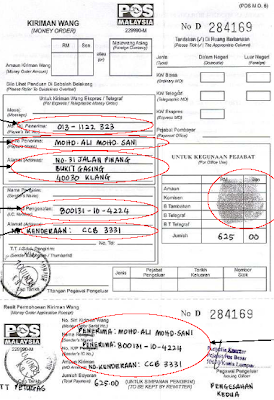

Strangely I couldn’t claim my RM625 rebate on the 1st July 2008 even though I’ve renewed my road-tax and insurance about two weeks before the expiry at the end of June. I was told that some processing need to be done before they can hand-over my money and it would take about four working days. Slightly panic I had no choice but to wait and finally I’ve gotten the money. I’ve spent it all though but on my mortgage although I was tempted to use it to pamper myself with the Apple’s new 3G iPhone which is scheduled to be on sale tomorrow. Guess the iPhone has to wait.

Another day another bombshell - Malaysian Prime Minister Abdullah Badawi finally announced his retirement date – mid 2010, another two years away. I began to respect this so-called sleepy head because it appears he has all the quality of a master with all the ingenious strokes of political movement, just like the legendary chess player Kasparov. He might not have the braincells like Mahathir in managing the country’s economy and he might sleeps more hours than newborn babies but I bet he was actually planning his next political moves during his nap *grin*.

Furthermore Badawi could have sensed that his deputy might just pull a rabbit from his hat to challenge him for the President seat. Badawi could have the financial muscle but this time around, money might not be able to solve UMNO’s internal problem. It would be super embarrassing for him to be booted and the only honourable exit route was to copy what Mahathir as done to him about five years ago. The plan was to offer some sweets to Najib with the hope to buy some time (for the next action) and his (Najib) temporary loyalty. Yes, this is an ingenious move because it would be suicidal for Najib to challenge his boss after Badawi promised to handover the President chair lest Najib fancy people call him ungrateful. But would Najib be able to see the shine and walk the corridors of powers ultimately?

Other Articles That May Interest You …

Wednesday, July 09, 2008

Dow Jones gained but VMware founder booted

Dow Jones industrials gained more than 150 points as the oil prices tumbled more than nine bucks for two days of trading alone. Phew! I thought the oil prices will shoot up to $200 as what some experts predicted. But hey, this is not the end of the story yet – just like stock or option trading, commodities are no difference from the ups and downs. And so you’ll hear this is just a correction, a huge one if you were to ask me, and the bear could turns to bull again. However if you look at where the DJIA is currently, even if the oil prices drop another ten bucks the Dow might not be able to go above 12,000 markconfidently.

As the earning season starts, it will take many good and extraordinary earning results to give a jab to the gloomy stock market. World’s third largest aluminium producer Alcoa Inc. posted stronger-

The prospect of the software attracted the attention of EMC Corp, the leader or “Taikor” in the storage market, who then acquired 86% of VMware for $625 million in 2004. However as with the risk of and M&A, the EMC’s Chief Joe Tucci

But what really puledl the EMC stock down was the lower revenue projection for the financial year 2008 - modestly below previous guidance of 50% growth. I supposed it’s hard to stay independence especially if you still wish to strike deals to sell your solutions to your parent’s competitors.

Tuesday, July 08, 2008

Bear the Responsibility? Walk the Talk, KLSE

So, the rumors of troubles ahead of last Sunday’s “One Million People Protest Rally” organised by the Opposition in Petaling Jaya is just a rumor. Maybe the poor turnout as what the deputy PM Najib proclaimed helped to contain the situation but nevertheless the spectators were given free “butt” entertainment. As what I’ve blogged not many moons ago, this time around people are not so “obsessed” with protest or demonstration despite the staggering 40.6 percent fuel hike because of the RM625 rebate. That’s human nature as people have yet to feel the pain in the long run and RM625 is a huge amount of money (at least to some) compare to the little extra they’ve forked out “so far”.

In a way the government was smart in giving out this little carrot or else I can’t imagine the possible havocs that could have erupted. Talk about havocs, it appears the stock market investors, traders, gamblers and speculators are still talking about last Friday’s embarrasing system failure. The crisis has also invited tons of speculations and jokes. Whether there was indeed hardware or software mulfunctions, the damage to the Kuala Lumpur Stock Exchange’s (Bursa Malaysia) reputation has been done. Some people nevertheless think the stock exchange has done a marvellous job in handling the crisis. Yeah right, as if their lame excuse of hard-disk failures was super-convincing.

As usual, the mentality of the Bursa’s CEO reflects certain degrees of Denial Syndrome disease when he was quick to say other stocks exchanges had failed before, without naming any of the past cases. CEO Yusli of course later said he is willing to bear the responsibility but did not go any further from the statement. It would be too much for him to resign, considering the country’s culture, but heads need to be rolled. Why not start with the head of IT (information technology)? The head of IT should know how critical the trading systems are and how such mission critical hardwares and softwares should be protected and made available 24x7. Furthermore the top IT management was paid handsomely in terms of bonus during the good time and now accountability needs to take its course.

And if the required systems availability couldn’t meet the SLA (service level agreement) agreed due to dependency, then let’s cross the IT border for more heads. With huge IT allocation, I don’t think Finance was stingy but if there was then you have more names in your list. How about Audit? Who are the committee members of the (DR) disaster recovery team? To declare that the DR works only when all the components fail but not when one component such as the stock trading system fails is an insult to our intelligence. Let’s think over it. If there’s any truth to it, then manually fail all the components in order for the so-called DR to kicks in so that "all the systems" can be failed over to the backup system. It’s either all or none at all.

But then the whole DR design is flawed, don’t you think? I bet Hewlett-Packard Co was the main contractor who designed the DR system so let’s cannabalise the company as well, shall we? Hmmm, I heard they have the obsolete Tandem system also. I also heard they’re running the world-class Symantec-Veritas Netbackup data protection softwares to protect the lifeblood of the data. So the backup data are basically useless I suppose. Why bother to backup then.

Other Articles That May Interest You …

Sunday, July 06, 2008

A week full of Tensions, Rumors, Sex and Lies

In times of uncertainty rumors fly as fast as those spirits released from the underworld as per-according to Chinese Ghost Day which traditionally falls on the thirteenth day of the seventh month in the lunar calendar. I’ve lost count of the number of calls I received last Friday reminding me to stock up essential goods. The rumor – this Sunday, 6th of July 2008, could be another day of, well, troubles. I supposed people felt the local political tensions are building up especially between two Prime-Ministers-in-waiting – opposition de-facto leader Anwar and Deputy PM Najib.

Another interesting rumor I heard over the phone was the story behind local Stock Exchange’s embarrassing system failure. Apparently people believe the KLSE was deliberately shut-down in order to prevent a major panic sell-off after the bombshell dropped by private investigator (hired by Abdul Razak Baginda) P. Balasubramaniam when he claimed (via his “Statutory Declaration”) that Deputy PM Najib had a sexual relationship with Altantuya. It was not a normal sexual intercourse, mind you, but one which was almost the same with what Anwar was accused of doing – anal intercourse. The only difference is that Anwar did it to a man while Najib did it to a woman, so goes the accusations.

Of course Najib denied P. Balasubramaniam’s Statutory Declaration (SD) but what was more

Despite the unbelieavable politicking for the past few days one person can finally smile and sleep happily. For months PM Abdullah Badawi didn’t have good night sleeps, until now. The story-line is pretty straight forward. Somehow Malaysia has an incapable PM, probably the weakest (and laziest?) since independence, who would like to stay on till his term ends four or five years from now. However his deputy saw the opportunity to seize the throne after his sleepy boss led the ruling coalition to its worst performance ever. The deputy who initially pledged his support to his boss come rain or shine was spotted making a small U-turn. It wasn’t that suprise though as the deputy has great track records of switching sides at the eleventh hour as can be seen during UMNO’s Team-A and Team-B struggle for power ten years ago.

How hard is it to have UMNO-military-police rule over the land? Just recruit the same thugs who were paid to guard the concreate slabs belonging to Grand Saga to do some damages and chances are it is game over for anybody who dares to challenge the PM. If you watched how somber he was during question-and-answer session after Balasubramaniam’s explosive revelation, you might believe he was at lost then. For all you know the PM was the mastermind of the whole episode and might be smiling all his way to the bed that very same day.

Other Articles That May Interest You …

Thursday, July 03, 2008

Stock Exchange down, CEO lies about computer glitch?

Frustration and cursing were all over the day when the local stock exchange, Kuala Lumpur Stock Exchange (KLSE), was down for the day – the worst in the exchange’s history. Initially Bursa Malaysia Securities said trading would be suspended for at least the morning trading session from 9am to 12.30pm following a multi hardware failure in its core trading system. The exchange blamed the problem on computer glitch and promised the trading would resume in the afternoon session but after lunch the system was still down until end of the day’s trading hour.

Now, Bursa Malaysia chief executive Yusli Mohamed Yusoff confidently told reporters that the day-long closure, which resulted from the failure of a computer hard disk, will resume tomorrow.

When you thought the excitements from the local political landscape is due to take a rest after opposition de-facto leader Anwar was accused of sodomy “again” days ago, suddenly P. Balasubramaniam, the private investigator hired by Abdul Razak Baginda released a shocking statutory declaration alleging the police haddeliberately omitted pertinent information about the Altantuya Shaaribuu murder case.

In the declaration, he claimed that he had told the police that Razak said he was introduced to Altantuya by Datuk Seri Najib Tun Razak at a diamond exhibition in Singapore and that Najib told him that he (Najib) and Altantuya had a sexual relationship and that "she was susceptible to anal intercourse."Balasubramaniam said Razak told him that Najib had asked him (Razak) "to look after" Altantuya aka Aminah because he did not want her to harass him now that he was deputy prime minister.

While Bursa CEO Yusli was cool about the trading problem today saying it was normal, Prime

Heard of RAID-5, RAID-1, RAID 0+1, mirroring, clustering, replication, data protection and disaster recovery plan Mr Yusli? Of course he heard of it and obviously these were in place else he should be sacked immediately. Bank Negara (Central Bank) and Securities Commission should have audit their DR (disaster recovery) plan, no? It’s puzzling to hear such ridiculous statement from the CEO. Come on, tell us the actual reason and we might just forgive the stock exchange but to lie and follow the foot-steps of politicians is simply unacceptable.

Other Articles That May Interest You ...

Wednesday, July 02, 2008

Another yardstick on Economic’s Health - Starbucks

When I tried my first sip on that RM10.00 or US$3.00 “Ice Blended Mocha” from Coffee Bean more than 10-years ago, I was hooked. It was a trend back then to have a cup of those dark brews at least once a week but I was basically almost had it everyday. When Starbucks arrived thanks to tycoon Vincent Tan, I tried the new brew but somehow I still prefer Coffee Bean. Personally I found that Coffee Bean’s aroma and taste was “stronger”, not to mention it was slightly cheaper than Starbucks. If my old memory serves me right they have this special card to collect the leaf-stamp everytime you spend a cup of Coffee Bean, regular or large. When the card is fully stamped, then you can get a cup of Coffee Bean free although I’m not sure if such thing exists now.

In U.S. Starbucks was the favorite among the hippies and youngsters. The green-and-white mermaid brand was so popular that when it was introduced in China in 1999, the trademark-logo was immediately imitated by Chinese firm Xingbake (although the Chinese firm claimed otherwise) – the same name used by Starbucks in China. Eventually Starbucks Corp. won a two-year legal fight after a Chinese court found that a local coffee store chain had violated its trademark. Subsequently Shanghai Xingbake had been ordered to stop using its name and to pay the US retailer 500,000 yuan ($62,000) in damages.

Some analysts had predicted Starbucks (Nasdaq: SBUX, stock) could get intotrouble with the over-expansion plan and Starbucks Chief Financial Officer Pete Bocian finally acknowledged that between 25 and 30 percent of a Starbucks shop's revenue is cannibalized when a new store opens nearby – a very close statement to mean saturation. Starbucks has 16,226 stores around the world with 7,257 in the U.S., 1,867 abroad and 7,102 by partners.

Other Articles That May Interest You …

Tuesday, July 01, 2008

More plans for 3G iPhone from AT&T, costlier service

Many people outside of U.S. can’t wait for the iPhone to reach their shores and ended up cracking or unlocking the phone so that the cool gadget could work with their local telco. U.S. residents meanwhile criticized Apple Inc. and AT&T because the two-year contract requirement with AT&T actually costs more than the first generation iPhone. So when Steve Jobs announced the price cut to $199 and $299 for 8GB & 16GB respectively, there were mixed feelings.

Today AT&T announced new pricing details for people who do not wish to tie-up with the carrier – at a whopping $599 and $699 for the 8GB and 16GB iPhone respectively. This means it would be $400 more than the price with a two-year plan but still this will only be available in the future. But with the $199 and $299 version (new 3G iPhone) to go on sale on July 11th, it is expected the number of units of iPhone could multiply for overseas shipment (after being unlocked). However if you wish to enjoy the $199 and $299 3G-iPhone offer in U.S. there’re some pre-requisites:

- iPhone customers who purchased before July 11

- Customers activating a new line with AT&T

- Current AT&T customers who are eligible, at the time of purchase, for an upgrade discount

If you’re not any of the above, then you’re not eligible for an upgrade discount which means you still can purchase the new 3G-iPhone but at $399 and $499 for 8GB & 16 GB respectively. AT&T also announced Tuesday that iPhone 3G buyers will have no choice but forced into more costly service plans than those offered alongside the original iPhone - plans will now start at $70 for a month for a package that includes 450 minutes and no text messages.

Other Articles That May Interest You …

External and internal factors point to gloomy economy

While it’s entertaining and exciting to read the spectacular development in Malaysian politic with the latest twist of which the former Deputy Prime Minister was accused of sodomy “again”, you got to pay a little attention to the global economy because if it’s going to slow down continuously chances are you might want to thank for what you’re having now. If you think the fuel pumps are going to remain at RM2.70 a liter for the rest of this year, think again. If you think unemployment will not get any worse and you won’t be affected, think again. If you think Malaysian economy will reverse overnight for the better after Anwar somehow miraculously managed to become the new PM, think again.