Friday, August 03, 2007

Mega-Sales needed to attract Rio Tinto to revives Bakun

The country might have successfully pushed for the construction of one of the largest hydroelectric dam projects in Asia. The Bakun project in Malaysia's Sarawak State was nevertheless hit by several postponements from the period of it being proposed till now, as if there was a curse trying to stop it from completion. It was more than a decade ago when the former premier Mahathir issued the go-ahead, regardless of the concerns on the environmental effects raised and the objection of the relocation of the original settlements within the area.

In the name of development, everything was bull-dozed to

In late June 2007, the stubborn government seems to have found the pulse to continue the project when Malaysia offered Japan's Sumitomo Corp. (TYO: 8053) a $1.5 billion deal to lay a 700-kilometer long submarine cable which will transmit electricity from Bakun to Peninsular Malaysia despite the fact that the country has excess of 40% of un-used capacity currently.

So, there you go; you have the area the size of Singapore for you to play with by flooding it with waters. The people who stayed on the original lands were forced to settle somewhere else. The economy is back to pre-1997 crisis level (or is it?) and the government needs to spend in order to create business activities. The main contractor is more or less has been finalized and it’s none other than another GLC (government-linked-company) conglomerate Sime Darby Berhad (SIME: stock-code 4197). You have roped in the expertise from Japan to lay the cable and state-owned utility company Tenaga Nasional Berhad (KLSE: TENAGA, stock-code 5347) is surely the buyers of the electricity generated, regardless whether the nation really needs the extra capacity of 2,400 megawatts or not.

Earlier StockTube had blogged about the solution to the extra excessive

Yesterday, Aug 2, Rio told Reuters that it will sign an agreement next week with its Malaysian partner, Cahya Mata Sarawak Berhad (KLSE: CMSB, stock-code 2852) to pave the way for a feasibility study on a $2 billion aluminium smelter.Cahya Mata is part-owned by the family of Sarawak Chief Minister Abdul Taib Mahmud.

Whether Rio Tinto will proceed to build an aluminium

For the time being, the other Malaysia government agencies might want to take a look and solve of the problem of “sex-slaves” crying for help trapped inside the Bakun perimeters currently. It’s disturbing to learn that while the gangsters and syndicates are known to supply the women, nothing is being done to rescue them. If you’ve not read this hot story, you can click here to read it. Just because there’re 2,000 workers working within the project doesn’t gives the police the right to justify that the law-enforcers can’t do anything about it.

Other Articles That May Interest You ...

Thursday, August 02, 2007

Bad Economy & Crimes Eat into Petrol Stations?

With or without government approval, the 3,200 petrol stations nationwide in Malaysia, including those along highways, will close at 10pm and open at 7am. Most newspaper reported the news and the decision was decided at the annual delegates conference of the Petrol Dealers Association of Malaysia (PDAM) here yesterday.

The justifications for such action: frequent armed robberies, increased security costs, higher wages for workers, low night sales, soaring rentals and electricity bills. To make matter worse, the dealers also want customers who use credit cards to buy petrol to fork out the 1% commission, previously absorbed by the dealers.

“The association’s acting president, Major (Rtd) Wahid Bidin, said the decision was likely to go into effect in two months and added “Last year, every petrol station was robbed at least once … The average collection of only about RM1,000 daily after 10pm did not make it worth their while.”

“However, Federation of Malaysia Consumers Association chief executive T. Indrani said that petrol stations should not be allowed to close early because “The dealers are making profits and, if they were losing, they would not be in business … If they are truly making losses, they should show their income and expense statements to prove that they are making losses.''

While I do not agree with the decision to close the petrol stations at 10pm, I can’t deny the fact that from the business perspective, it’s really not worth the operating cost if what the PDAM claimed is true. City drivers might be able to adapt to the early closure but those operating along highways should remains open.Can you imagine what will happen during the peak season if drivers need to refill gas along the PLUS highway but couldn’t find any petrol stations, not to mention the normal traffic jam even on the pay-highway itself?

While I do not agree with the decision to close the petrol stations at 10pm, I can’t deny the fact that from the business perspective, it’s really not worth the operating cost if what the PDAM claimed is true. City drivers might be able to adapt to the early closure but those operating along highways should remains open.Can you imagine what will happen during the peak season if drivers need to refill gas along the PLUS highway but couldn’t find any petrol stations, not to mention the normal traffic jam even on the pay-highway itself?Unless the dealers can prove they’re making losses, the government should not allow this to

happen. But what if the dealers are right? It might be true that the business is not that rosy though, considering the petrol prices were increased multiple times during the current administration headed by premier Badawi. You might still remember those days when the petrol was at RM1.10 per liter not too long ago and with a stroke of an announcement (the nation’s coffer is drying?) it’s now more than RM1.90 per liter.

happen. But what if the dealers are right? It might be true that the business is not that rosy though, considering the petrol prices were increased multiple times during the current administration headed by premier Badawi. You might still remember those days when the petrol was at RM1.10 per liter not too long ago and with a stroke of an announcement (the nation’s coffer is drying?) it’s now more than RM1.90 per liter.The chain-reaction was that almost all your can think of in your daily expenses has risen – transportation, foods, car-parts and just anything. It’s normal now that car owners drive daily to the nearest LRT (light-rapit-transit) only to park their car and board the LRT. Some resort to cheaper transport alternative – motorcycles, thanks to the forever in-efficient bus transportation.

And due to the government’s policy to import foreign workers especially from Indonesia, the social problems had began to show its’ color – increase in crimes such as arm-robberies, rapes, hijacking, snatch-thefts and anything related to crimes which you can name it. It might makes sense to utilize these foreign cheap labors during the good times but once you’ve a leader who’s not capable to maintain, not to mention increase the nation’s economy expansion, you should get ready to combat battalions of walking zombies terrorizing public’s security.

And due to the government’s policy to import foreign workers especially from Indonesia, the social problems had began to show its’ color – increase in crimes such as arm-robberies, rapes, hijacking, snatch-thefts and anything related to crimes which you can name it. It might makes sense to utilize these foreign cheap labors during the good times but once you’ve a leader who’s not capable to maintain, not to mention increase the nation’s economy expansion, you should get ready to combat battalions of walking zombies terrorizing public’s security.Other Articles That May Interest You …

Moody Says Smaller Deficit, Malaysia Said Otherwise

Moody's Investors Service said Malaysia needs a smaller budget deficit and faster economic growth to earn its first credit rating upgrade since 2004. Standard & Poor's on July 31 raised the outlook on the Southeast Asian nation's foreign currency borrowings to positive from stable, which means the company's first upgrade on Malaysia since 2003 is more likely – reported Bloomberg.

Moody's however said today a stable outlook is more appropriate. Malaysia's government, which has spent more than it earns for nine straight years, plans to maintain a budget deficit this decade to fund a $58 billion development program. Second Finance Minister Nor Mohamed Yakcop in June argued that foreign investment, economic growth and the state's ability to repay debt weren't factored into the nation's credit ratings.

Malaysia's government plans to post a deficit of 3.4 percent or less of gross domestic product until 2010, Yakkop said on July 10. The government expects the economy to expand 6 percent this year after growth of 5.9 percent in 2006.

On July 31th 2007, Standard & Poor's left the rating on Malaysia's foreign currency debt unchanged at A-, the fourth-lowest investment level. Moody's rates Malaysia's foreign currency long-term debt as A3, the equivalent level.

It would be interesting to see how on earth can the government spend less to decrease the budget deficit when the premier Badawi has been promoting one mega-project after another, starting with IDR in southern region of Peninsular Malaysia to NCER in the northern part and now he’s getting ready to launch another one in the eastern part of Kelantan, though on a smaller scale as Kelantan is governed by opposition party.

Looking at the pattern of how Badawi going around the nation promoting new projects one wonders in amusement how could the premier who are known to often fall-asleep even on official functions could suddenly wide awakes giving away all the goodies. The premier could be flying off to Sabah and Sarawak to hand more good news to the locals in the last effort to fish for votes before calling the next general election.

Nevertheless in order to put the chart to shows smaller deficit, the government needs to either increase exports or reduce imports but it’s easier said than done.Artificial figures could do the trick though.

Other Articles That May Interest You …

Wednesday, August 01, 2007

Murdoch’s $60 a share Offer and Fees-Paid Wins

Rupert Murdoch claimed victory today, Wednesday 1st Aug 2007, in his battle to acquire Dow Jones after securing support from enough Bancroft family members to clinch majority backing for his $5.6 billion cash offerfor the owner of The Wall Street Journal. The breakthrough came after nearly four months of often torturous negotiations between the media mogul and the fractious clan of heirs to a family which has controlled the leading US financial newspaper for more than a century.

Mr Murdoch overcame objections from inside and outside the family that his hands-on editorial style and tabloid newspaper sensibility would tarnish the Journal's reputation for high editorial standards and independence. The 76-year-old mogul, who has in the past 50 years built News Corp from a small Australian newspaper group into a global media giant, has had his eye on the Journal for at least a decade.

The Bancrofts control 64 per cent of Dow Jones's voting shares, held through a complex series of privately-held trusts. More than half the family votes, representing more than 30 per cent of Dow Jones's overall voting shares, are needed for News Corp to be confident that its offer will be voted through by a majority of the company's shareholders. A turning point came on Tuesday after a Bancroft family trust holding around 9 per cent of Dow Jones's voting shares dropped its push for a higher price from Mr Murdoch. Instead, it agreed to back the deal after receiving assurances that the family's fees would be paid as part of the deal.

The Bancrofts control 64 per cent of Dow Jones's voting shares, held through a complex series of privately-held trusts. More than half the family votes, representing more than 30 per cent of Dow Jones's overall voting shares, are needed for News Corp to be confident that its offer will be voted through by a majority of the company's shareholders. A turning point came on Tuesday after a Bancroft family trust holding around 9 per cent of Dow Jones's voting shares dropped its push for a higher price from Mr Murdoch. Instead, it agreed to back the deal after receiving assurances that the family's fees would be paid as part of the deal.Murdoch's $60 a share offer, a 65 per cent premium to Dow Jones' share price before news of News Corp's interest emerged carried the day after he agreed to a last-minute deal sweetener by helping to cover millions of dollars of legal and advisory costs incurred by the Bancroft family. By adding it to a stable of media properties that run from tabloids such as The Sun in London and the New York Post, to Fox News Channel and MySpace, Mr Murdoch cements his position as the dominant force in global media.

Based on Murdoch’s vision for Dow Jones to establish The Journal as the rival to The Times in setting the daily news agenda of the country, there is little doubt that he will directly aim at luring both readers and advertising away from The New York Times and The Financial Times, The Journal’s closest rivals. His strategy will probably include aggressively undercutting advertising and investing heavily in editorial content – reported New York Times.

When he repurchased The New York Post in 1993, he focused on raising the paper’s circulation by cutting the cover price of the paper several times and handing out copies free. “If he hadn’t come in, there wouldn’t have been a New York Post,” said Jerry Fragetti, senior vice president for media and operations at Newspaper National Network, who worked as chief financial officer of The Post in the 1980s and as an executive for the News Corporation in the early 1990s.

After IDR now NCER – Segregating Pies

Just what happens to the highly marketed and the buzzling of IDR (Iskandar Development Region), the first mega-project initiated by Malaysia’s premier Badawi which is suppose to be another clone of Hong Kong or Dubai spanning over 20-year whileattracting 105 billion dollars?

Before anything has taken off in a scale which can instill confidence that IDR is not a fantasy but a real thing, the premier today ambitiously launched the Northern Corridor Economic Region (NCER) project which will see the transformation of Penang into a modern, vibrant city and a major logistics and transportation hub. The NCER is said to be the bullet to turn Penang into the “Gateway to the Northern Corridor”. Excuse me but aren’t Penang has been the “gateway” to the northern Malaysia all this while? Either this is another nice marketing strategy to further segregate projects to the ruling party’s linked companies (or cronies) or the Chief Minister of Penang has done a damn bad job in maintaining, not to mention developing, the status of Penang as the northern gateway.

Anyway, compare to IDR, NCER seems to have a stronger and clearer blueprint, at least on the paper. To start the ball-rolling, at least a China company has been secured to finance and build the Penang second bridge. Among some of the sub-projects within the high-level blue-print for NCER are:

- Penang Sentral integrated transport hub – a RM2 billion modern transportation and logistics hub to transform Butterworth into a modern metropolitan area, covers 557,418 square metres. The hub will integrate rail, ferry, monorail and land transport modes – the came concept as KL Sentral. Winner - MRCB

- Penang Global City Centre – a RM18bil project to transform Penang Turf Club into a modern city center which will have international exhibition and conference centre, shopping complexes, two five-star hotels, commercial and residential properties, a state-of-the-art cultural centre and a 10.5ha park. Winner – Equine Capital Berhad (KLSE: EQUINE, stock-code 1147). Does this sound like KLCC to you, both also on the land of turf club with the same concept?

- Second Penang Bridge – a RM2.7 billion bridge connecting mainland and Penang which will be the South-East Asia’s longest bridge. Expected to be complete by 2011, it will be built under a joint-venture between UEM Builders Bhd and China Harbour Engineering Co Ltd.

- Pulau Jerejak premier medical tourism centre

- Penang-Butterworth fast ferry

- Penang Port expansion

- Bayan Lepas Airport expansion

- Penang 37km Monorail

- Swettenham Pier redevelopment

- Micro-Electronics Centre of Excellence

- Hospitality college

- Khazanah Nasional Bhd regional office

In June MRCB was awarded a contract by Pelaburan Hartanah to build houses and apartments with a combined gross development value (GDV) of RM500mil on three sites on Penang Island. Analysts expect MRCB to secure additional projects in the state such as the construction of the proposed monorail and Penang Outer Ring Road (PORR).

Neverthless it’s definitely the people’s hope that all these billions of dollars would put to full good use and development to benefits everyone rather than another wasteful mega-project which only benefits a few cronies as accustomed to the Malaysia’s ruling party’s business policy.

Other Articles That May Interest You …

Tuesday, July 31, 2007

STEMLIFE Skyrocket without anyone notice

It was merely about two-weeks ago when StockTube wrote about TMC Life Sciences Bhd (KLSE: TMCLIFE, stock-code 0101) stock any justify why you should own it in your portfolio. Yes I know the stock has not move yet (you’re really impatient when come to stocks investing, aren’t you?), in fact it has consolidated from the peak to current RM1.38 per share, well above the support of RM1.24. Isn’t this a good level for you to accumulate, you greedy investor (or rather punter?) who always thinks of making fast money overnight?

Well, this post is not to talk about TMC Life but rather on StemLife Berhad(KLSE: STEMLFE, stock-code 0137). Between the two devils, StemLife’s stock obviously performs better. Just to refresh, it was about two-weeks ago on the same article, I was nagging about how I should not have sold my positions in StemLife, even though I’m still holding a very small amount of shares as of now. On the date of that article being written, the stock price of StemLife was about RM4.00+ per share. Can you please go and take a look at the price now?

But if you have found StockTube’s blog and read the article on why you should invest in TMC Life and StemLife stock back in Jan 2007 when it was trading at about RM1.00 per share, you would have gained a whopping 400 percent in profitif you had just follow the recommendation blindly. If only life is so predictable, it would be a wonderful world, won’t it?

Having said that, aren’t StemLife expensive at the current share price? You bet, it’s obvious the stock is being “fried” but considering the stock has Goldman Sachs (8.85% stake) and JP Morgan (4% stake) in its shareholders list (as of Mar 2007), it’s not that difficult to convince others the stock could goes up further. The latest would be Capital Group International Inc. which acquired 5.27 percent stakeon 4th July 2007. Furthermore StemLife is the main player in the stem-cell storage in town with TMC Life set to kick-in sometime in September 2007 to give StemLife a run for some money. It was said that come 2008, the number of players would increase to 7 (seven) in the stem-cell banking business giving more competition.

Other Articles That May Interest You …

Monday, July 30, 2007

Could the Eagle Fly Against the Weak Housing?

Eagle Materials Inc. (NYSE: EXP, stock) is set to announce its earning today, Monday 30th July 2007, after market close. Eagle Materials Inc. is a manufacturer of basic building materials, including gypsum wallboard, cement, gypsum and non-gypsum paperboard and concrete and aggregates. The CompanyGÇÖs primary businesses are the manufacture and distribution of gypsum wallboard and the manufacture and sale of cement. Gypsum wallboard is distributed throughout the United States with particular emphasis in the geographic markets nearest to its production facilities. It sells cement in four regional markets.

Rating Indicators for EXP:

Sales, Income & Growth - For the past 12-months, Eagle Materials registered $922.4 Million in sales versus the industry’s $14,313 Million. Income amounted to $203.00 Million against the industry’s $1,334 Million. While Eagle’s 12-months sales growth is at 7.30% the income growth is 25.90% (the same industry sector sales growth is at 12.00% and income growth of -0.20%).

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 22.0%. Eagle Materials has a debt/equity ratio of 0.37 compare to industry’s ratio of 0.62.

Stock Resistance & Support Level – The resistance is at 44.88 (200-day moving average) while the first level support is at 31.76 (52-week low)

Risks – The shares are heavily sold by financial institutions.

Based on its’ track record in beating earning estimate, it could be the most valuable bullet in investing its option or stock. We have not heard much news on the merger of cement players since May when a German cement company said it’s considering to buy over Hanson PLC.

The War between Bloggers and Government Peaks

It’s very disturbing to note the war between Malaysian bloggers (political bloggers to be specific) and the UMNO, the main party component of the ruling Malaysian Government has started to peaks and potentially couldspread into other categories of bloggers – financial, personal, mum-and-dad or even food and recipe blogs.

Almost all printed and electronic licensed medias in Malaysia are controlled, one way or another by the ruling Government which has been in the power since the 1957 Independence. People were said to be fed with positive news only by these controlled medias but everything changes when the “blog” (or web log) was created and gains momentum. Thanks to the technology, people who know the basic internet surfing can now turn to read the other side of the stories.

Authorities have not made clear which of Raja Petra's articles were allegedly seditious but most readers suspected that the government started the war againts Raja Petra (and others?) after his article (read here) on allegations against Inspector General of Police (IGP) Musa Hassan. The Attorney General was surprisingly fast in passing the verdict to clear the IGP and thus government leaders used it as the reason to calls for bloggers to be controlled.

Authorities have not made clear which of Raja Petra's articles were allegedly seditious but most readers suspected that the government started the war againts Raja Petra (and others?) after his article (read here) on allegations against Inspector General of Police (IGP) Musa Hassan. The Attorney General was surprisingly fast in passing the verdict to clear the IGP and thus government leaders used it as the reason to calls for bloggers to be controlled.Nazri, another minister sparked concerns over online freedom last week after he said the government was drafting new laws for bloggers and would not hesitate to use the Internal Security Act, which allows for detention without trial, against bloggers who insult Islam or stir sensitive topics.

Khairy Jamaluddin, deputy youth leader of the ruling Malay party and the prime minister's son-in-law called for legal action taken against bloggers who spread lies and slander. "There are no laws in the cyberworld except for the law of the jungle. As such, action must be taken so that the monkeys behave," Khairy was quoted as saying by Bernama.

And today, the government continues the war when Information Minister Zainuddin told the newspaper that the public should be wise in identifying the websites of goblok (Indonesian slang for “stupid”) bloggers, who are willing to be tools of others to destroy the nation. He added that these writers do not have an Asian mentality but lean towards a Western thinking because they were educated overseas.

In his latest salvo, Raja Petra wrote an interesting article titled Raja Petra seditious? Hogwash! after his previous mild article on See you in hell Muhamad son of Muhamad. Raja Petra claimed and pointed out a few IDs that belonged to the 25 UMNO cyber-troopers recruited by UMNO as the persons who actually left the sensitive comments in his blog (read the article a comedy of errors). Malaysia Today is so influence that Raja Petra claimed there was DOS attack launched against the blog.

It’s time for the ruling government to learn the rope of cyber-blogging and accept the fact that bloggers are here to stay. It’s sad to read that while the U.S. Democrats are taking the debate to a higher level of YouTube, Malaysia’s government is still struggling to learn the basic of e-mail and surfing (readhere), let alone blogging. If you practice good governance (the same way in corporate governance), nobody will cares about Raja Petra’s blog but if you’ve barrels of worms planted all over the place, then any Tom, Dick and Harry’s article would make you jump up in the middle of your sleep.

Sunday, July 29, 2007

GreenPacket – Light at the End of the Tunnel?

The last entry StockTube touched on Green Packet Berhad (KLSE:GPACKET, stock-code 0082) was on June 25th, 2007 when the stock plunged the second time since it broke the support of RM4.80 per share. I’ve wrote about what StockTube see from the RSI and Stochastic technical reading. The post also highlighted what could be the concerns or problems haunting Green Packet stock back then. StockTube also mentioned that from the perspective of technical and fundamental, the stock will surely rebound from the support of RM4.00 per share – and it did rebound beautifully. You can read more about the post here at Relook at GreenPacket Stock - Problem or Opportunity?

So I hope those who have confidence in the stock had made some money from the rebounce after the stock touched the support of RM4.00 per share on 25th June 2007. And if you care to relook at the chart of Green Packet it soared and hit the resistance of $4.80 per share before plunges back thereafter. Between RM4.00 and RM4.80, that’s 20 percent of good and easy money to be made, only if you traded within the range.

July 13th 2007 was the date that changed the landscape of Green Packet stock’s pattern; it was also the day of bonus issue and share consolidation. The chart that you’re seeing on this post has taken that into consideration – I’ve since re-map the support and resistance level.

July 13th 2007 was the date that changed the landscape of Green Packet stock’s pattern; it was also the day of bonus issue and share consolidation. The chart that you’re seeing on this post has taken that into consideration – I’ve since re-map the support and resistance level.What’s the Technical Lookout of GPacket?

Since there’s no change in the fundamentals of Green Packet, we can only analyze from the technical perspective of the stock. The concerns are still the high receivables which might prompt investors in dumping the shares recently. But whether the stock’s plunge has anything to do with the shares restructuring or thepiece of important news which will be revealed at the later part of this post (so, continue reading) is still up to everyone’s guess.

StockTube does not apply hundreds of technical reading to confuse and scare the shits out of readers as it is assumed most readers are not technical-savvy. To make money investing stocks or trading option should be fun and not boring and complicated to the extent of costing your good night sleeps.

Referring to the chart that has been blown-up above, you can see how volume plays a very significant but almost ignored role in giving you hint of what’s actually happened or about to happen. On both occasions that saw the stock rebound when it touched the support of RM5.40 (RM4.00 before shares restructuring), it were followed or had accumulation signals prior. These accumulations by buyers indicate that investors (outsiders or insiders) are ready to bargain hunt on such scenario as the stock was seen to be attractive.

Referring to the chart that has been blown-up above, you can see how volume plays a very significant but almost ignored role in giving you hint of what’s actually happened or about to happen. On both occasions that saw the stock rebound when it touched the support of RM5.40 (RM4.00 before shares restructuring), it were followed or had accumulation signals prior. These accumulations by buyers indicate that investors (outsiders or insiders) are ready to bargain hunt on such scenario as the stock was seen to be attractive.However, if you look at the consolidation after the bonus issue and shares consolidation, there were obvious sign of sellers’ distribution. Why investors didn’t see this as an attractive level to scope the shares are beyond normal investors’ basic understanding. You should take such price-volume-action with a pinch of salt and not scratching your head till you become bald. There’re many reasons to this and if you’ve trade U.S. stock market long enough, such pattern is normal. It could be the investors “knew” some bad things are going to happen and these investors are not you or me. They’re the insiders or professionals. So am I saying insiders are selling or insiders are feeding crucial info to others to sell or refuse to buy? Your guess is the same as mine.

Often “invinsible hands” are playing the advance game of buying or selling before normal investors can even blink their eyes. And by the look at the distribution volume, the chart is telling you the stock could have more falling to go before testing the support of RM3.75 or even RM3.30. Don’t you like to have the choice of shorting the stock now *evil grin*?

Angel to the Rescue

Now, I mentioned there’s a piece of news that is rather important to the development of GPacket’s stock action next week onwards. If you care to check the filing in the Kuala Lumpur Stock Exchange, you would notice that there’s one very crucial new shareholder emerged in GPacket. It’s none other than Goldman Sachs Group, the global investment group which has a capitalization of a whopping USD78 Billion.

Goldman Sachs acquired 455,275 shares on 18th July 2007 and another 1,000,000

shares on 19th July 2007. Both were done via open market. Altogether, Goldman Sachs owns 17,987,275 shares representing 5.4% in GPacket. While such acquisition is normal in U.S. stock market, it’s something that should raise your eyebrows as Goldman Sachs is notorious for making acquisition with high probability of making good money from their investment decision.

shares on 19th July 2007. Both were done via open market. Altogether, Goldman Sachs owns 17,987,275 shares representing 5.4% in GPacket. While such acquisition is normal in U.S. stock market, it’s something that should raise your eyebrows as Goldman Sachs is notorious for making acquisition with high probability of making good money from their investment decision.It’s not easy to make US$10 Billion income on revenue of over US$76 Billion in the last 12 months of operation. So you got to give this new shareholder some respects with the decision to invest in GPacket. And since GPacket’s shares were acquired at the price of lower than RM5.40 per share (based on the date of purchase), it only makes sense to conclude that Goldman Sachs has confident the stock price will goes up above the acquisition price in order for it to make money before exit.

Hence, could it be the Goldman Sachs is the light at the tunnel for Green Packet? It could be the sunshine that would make you tons of money; it could also be the main reason why the stock plunges since then. One way or another, you’ve to accept the rules of the stocks investing game.

Other Articles That May Interest You …

Friday, July 27, 2007

China’s Syndrome – ICBC Stock Exposure

Of late, there has been great interest in foreign-stock Call Warrants among the Malaysian stocks investors, simply because the local growth stories could be boring or seems to be ending. Couple with the fact that the Composite Index is trading at the range of 1,300+ without the ability to bypass the 1,400 mark, the audience just got inpatient – people wants to see stocks move up so that they can make money.

So, when the Call Warrants which were based on foreign-stocks hit the bourse,people just scrambled into the counter without knowing what it is, resulting in the warrants being pushed up in 2-digit gains within the listing day. Little did these punters know what are the factors affecting the Call Warrants’ stock performance.

To refresh everyone, there’re basically two factors which will enable you to make money if you plan to play with this new Call Warrants. First if the respective foreign share price goes up, then the call-warrants will be in-the-money (a term which I hijacked from option trading). Second, if the foreign currency (of the original foreign-stock) appreciates against Malaysian Ringgit, then you’re in luck because the value of the Call-Warrant will have higher value.

The two investment banks which dominate the foreign-stock Call Warrants locally are CIMB (Commerce International Merchant Bankers, an investment bank of Bumiputra-Commerce Holdings Berhad (KLSE: COMMERZ, stock-code 1023)) andOSK. While CIMB likes to issue the Call Warrants in European-style, OSK prefers the American-style and there’re definitely differences between both styles, mind you.

Tired of CIMB, let’s talk about OSK which had issued some American-style foreign-stock Call Warrants. Among them are:

- PetroChina Company Limited (PETROCH-C1, stock-code 0500C1)

- China Mobile Limited (CHMOBIL-C1, stock-code 0501C1)

- Industrial And Commercial Bank Of China Limited (ICBC-C1, stock-code 0502C1)

Due to the request from one of StockTube readers, let’s focus only on ICBC Call Warrant at this particular moment. ICBC-C1 was listed in local stock market on 5th June 2007 with approximately 50 million of floating shares. To summarize the important data an investor should know:

- Expiry-date – 29th February 2008 (9 months)

- Issue Price – RM0.12 per share

- Exercise / Conversion Price – HKD 4.38

- Exercise / Conversion Ration – 2 Call-Warrants for 1 ICBC-share

How Big is ICBC?

Industrial And Commercial Bank Of China Limited (HKG: stock 1398) is the mainland’s largest lender which was founded as a limited company on Jan 1st 1984. As of June 2006, it had assets of over RMB 7,000 billion (US$893 billion) with 18,764 outlets including 106 overseas branches and over 2.5 million corporate customers plus 150 million individual customers. ICBC was listed both in Hong Kong Stock Exchange and Shanghai Stock Exchange on 27th Oct 2006.

Already, ICBC overtook Citigroup as the new world’s biggest bank early of the week when its stocks’ surged to give it a market capitalization of $254 Billion versus Citigroup’s $251 Billion. However in terms of profitability, Citigroup is still the leader with income four times larger than its nearest competitor. But while Citigroup is only trading at 11 times its 2007 EPS (earnings per share), ICBC is trading at the hot and dangerous multiple of 28 times level. ICBC benefits mostly from the appreciation of Yuan against the Dollar.

ICBC recently was reportedly said it might announce more than 50 per cent growth in net profit for the first six months of the year 2007, as compare to a net profit of 25.14 billion yuan in the first half of 2006

Technical and Fundamental Analysis

A glance at the chart of ICBC since it went public will tell you that the immediate resistance is at HK$ 5.00 with the first level support at HK$ 4.40 and second level support at HK$ 4.00. The HK$ 4.40 became the support level after it was breached sometime in the middle of June 2007. So you should know how to trade this stock with this piece of information, if you’re trading the ICBC shares itself in Hong Kong Stock Exchange.

Should You Invest in ICBC Call Warrant?

As of today, 27th July 2007 (2:50pm trading time) ICBC is trading at HK$ 4.70 per share while ICBC-C1 (Call Warrant on KLSE) is trading at RM 0.135 per share. If you decide to convert the Call Warrant to ICBC share (or mother share), it will be:

- (2 x RM 0.135) + (4.38 / 2) = RM 2.46 (assuming 1 RM = 2 HK$)

- Translate into 2.46 x 2 = HK$ 4.92 per share

- Which means you’re paying a premium of 4.68 % over its’ actual value.

But the premium of HK$ 0.22 (RM 0.11) is a small and attractive value to payfor the remaining time-value as the expiration is on 29th Feb 2008. If you compare to most Malaysia’s warrants which are way out of money, ICBC-C1 is indeed very attractive.

Other Articles That May Interest You ...

AvalonBay provides Apartment and Stock Dividend

When people talked about money, somehow the conversation topics couldn’t run too far away from stock investing and property or real-estate investment. StockTube have blogged about Mah Sing Group Berhad and E & O Property Development Berhad as the favorite stocks in property sector. Now, let’s fly out of the country and travel a couple of thousands miles towards U.S.

Avalon Bay is actually a REIT (real estate investment trust) company which focused on developing, operating and owning apartment communities in the Northeast, Mid-Atlantic, Midwest, Pacific Northwest, Northern California and Southern California regions of the United States. As of March 31, 2007, AvalonBay owned about 171 apartment communities containing 49,402 apartment homes in ten states in U.S.

Through the Investor Relations segment, Avalon Bay claimed that its average annual Funds from Operations (FFO) per share growth and dividend growth have exceeded the industry average. Considering Avalon’s Compound Annual Growth Rate of 19.5%, it is definitely a set of impressive data out-beating the S&P500 and Nasdaq’s growth. Since the company went public back in 1994 (trades on the New York Stock Exchange and under the ticker symbol "AVB"), AvalonBay Communities, Inc. has consistently paid dividends each year since then.

So, if you happen to think about owning an apartment in California, Massachusetts, Washington, New York or elsewhere in U.S., you probably might want to give Avalon a thought.

Dow Jones Plunges 300 - Expect Regional to Drop

Wall Street suffered its second-biggest plunge of the year Thursday, extending its weeks-long streak of volatility after disappointing home sales figures added to investors' increasing uneasiness about the mortgage and corporate lending markets. The Dow Jones industrials briefly fell more than 300 points (as of trading hour at 2pm), while Treasury yields plunged as investors moved money from stocks to bonds.

Investors who had been able to shrug off concerns about subprime mortgage lending problems and a more difficult environment for corporate borrowing were clearly worried once again. The Dow's drop is the biggest since it plummeted 416 points on Feb. 27 after a nearly 10 percent decline in Chinese stock markets.

The anxiety on Thursday increased after the Commerce Department reported thatsales of new homes fell 6.6 percent last month to a seasonally adjusted annual rate of 834,000 units, more than triple what had been expected and the largest percentage drop since sales fell by 12.7 percent in January.

Thursday's trading was the latest in a series of frenetic sessions over the past month - many accompanied by triple-digit swings in the Dow - as investors sold on worries about the subprime fallout or bought on optimism that there wouldn't be any widespread problems caused by mortgage failures. Many analysts have described the back-and-forth trading as overwrought and based more on gut emotion than careful consideration of market and economic fundamentals.

So, expect the regional markets including Malaysia to open lower when the Friday stock market resumes trading for the last day of the week. The week market definitely pulled down the performance of Apple Inc as most of the indexes are in red. Apple would have performs better if not for the plunge.

Thursday, July 26, 2007

China Mobile the Actual Rescuer for TIME?

Who would have guess that Malaysia loss-making Time DotCom Berhad (TIMECOM: stock-code 5031) had quietly sneaked out of the country desperately looking for life-partner? Everyone thought this hopeless stock would either partner with a local telco company (DIGI.com or Telekom) or be bailed out by the government. Hence, Time Engineering (KLSE:TIME, stock-code 4456) together with Time DotCom’s stocks price were bid up when the rumor hit the street that Hong Kong-listed China Mobile Ltd is interested in Time Engineering which holds 40.68 percent stake in Time DotCom.

However, Second Finance Minister Nor Mohamed Yakcop said today the Malaysian government is not aware of the interest by China Mobile. As usual, you’ve to take the statement by Yakcop with a pinch of salt as he seldom issues concreate statements. China Mobile(HKG: 0941) could indeed be talking to Time Engineering and unless China Mobile denies it, the rumor and possibility of Time DotCom finally being rescued will continues.

However, Second Finance Minister Nor Mohamed Yakcop said today the Malaysian government is not aware of the interest by China Mobile. As usual, you’ve to take the statement by Yakcop with a pinch of salt as he seldom issues concreate statements. China Mobile(HKG: 0941) could indeed be talking to Time Engineering and unless China Mobile denies it, the rumor and possibility of Time DotCom finally being rescued will continues.With more than RM850 million in debts, Time is dying and if the country’s coffer allows it, the government would definitely not think twice about bailing it out, the same way billions of public money was being used to do so during previous premier Mahathir’s rule, not to mention Time is one of the important business entity within UMNO, the biggest party component in the current ruling government.

StockTube would not be surprised should the acquisition

goes through if the recent contract to provide soft-loan, design and build the second multi-billion Penang bridge by a Chinese-based company is used as the gauge of Malaysian Government’s approach towards Malaysia-China business relationship. While former premier adopted pro-Japan policy, current Badawi could be adopting pro-China policy which makes sense looking at how the emerging giant is giving even U.S. a headache on the huge trade inbalance in favor of China.

goes through if the recent contract to provide soft-loan, design and build the second multi-billion Penang bridge by a Chinese-based company is used as the gauge of Malaysian Government’s approach towards Malaysia-China business relationship. While former premier adopted pro-Japan policy, current Badawi could be adopting pro-China policy which makes sense looking at how the emerging giant is giving even U.S. a headache on the huge trade inbalance in favor of China.Nevertheless StockTube would be interested to know the final stake that Time is willing to let go – definitely China Mobile will not accept anything less than a controlling stake, would it?

Other Articles That May Interest You …

APPLE Jumped, StockTube Jumped

You could be wondering why StockTube was not updated since I blogged about APPLE Should Beats Earning but Other Number Counts, that’s one day ago. In actual fact, I was re-researching Apple stock and could only find optimistic data that point to Apple will definitely beats earning. I’ve to admit I was quite nervous if Apple will join Google’s party. After the earning announcement, I jumped in joy, not too much on the news that it indeed beaten the earning estimate again but because the new set of numbers indicating the iPhone sold is double of what reported by AT&T Inc. (NYSE: T, stock) earlier.

Apple Inc.'s fiscal third-quarter profit soared more than 73 percent and it sold 270,000 iPhones in the first two days on the market. That’s the headline which sent Apple stock up by more than 9 percent ($12.92 in extended trading hour), enough to send short-sellers to cover their shorts when the trading starts on Thursday. Although the iPhone figure didn’t contribute to the earning announced, it simply means Apple future earning can depends on iPhone to bring in cash into the coffers.

For the quarter ended June 30, Apple's profit rose to $818 million, or 92 cents per share, up from $472 million, or 54 cents a share in the year-ago quarter – easily beats the estimate of $0.72 per share by Thompson Financial. Sales grew to $5.41 billion from $4.37 billion last year against estimate of $5.28 billion. The conservative figures from Apple itself were projected earnings of 66 cents per share on quarterly sales of $5.1 billion.

“Steve Jobs said “We're thrilled to report the highest June quarter revenue and profit in Apple's history, along with the highest quarterly Mac sales ever … iPhone is off to a great start … We hope to sell our one-millionth iPhone by the end of its first full quarter of sales … and our new product pipeline is very strong”.

The company said it shipped a record 1.76 million Macs, up 33 percent from the year-ago period, accounting for $2.5 billion, or more than 60 percent of the quarter's revenues. Unit sales of iPods increased by 21 percent from last year to 9.8 million and generated $1.57 billion in revenue. You should wait and see the numbers when Apple announce the iPhone sales in the next subsequent quarter.

The reason for the discrepancy between Apple's and AT&T's numbers on iPhone sales was unclear and the only reason raised at this moment is the service activation problems. There was initially some disappointment in the 270,000 iPhone units, but as people realized the gross margins came in at 37 percent, they were very encouraged by the profitability of the company as can be seen with the Apple stock price’s reaction during the extended hours.

The reason for the discrepancy between Apple's and AT&T's numbers on iPhone sales was unclear and the only reason raised at this moment is the service activation problems. There was initially some disappointment in the 270,000 iPhone units, but as people realized the gross margins came in at 37 percent, they were very encouraged by the profitability of the company as can be seen with the Apple stock price’s reaction during the extended hours. Before Apple's results were announced, its shares rosed $2.37, or 1.8 percent, to close at $137.26. Then in a heavy-volume trading after hours, shares fell as much as 6 percent before they rose more than 9 percent to $150.18. What can you learn from these 3 lines of information? DO NOT trade during extended hours, period. Extended hours are not designed for small investors to trade the stocks (option trading stops completely at 4:00pm) in the hope of making money. You should work as a professional investor in the U.S. to know what I meant. These market makers made transactions faster than you can blink your eyes during this hour, trading against the opposite side of the market makers. So, you small boys or girls should just grab a cup of coffee and sit there watching the show.

# TIP: Do not trade stocks during extended hours, it’s not for you.

Other Articles That May Interest You ...

Tuesday, July 24, 2007

APPLE Should Beats Earning but Other Number Counts

Top U.S. telecommunications service provider AT&T Inc. (NYSE: T, stock) said on Tuesday quarterly profit and revenue rose, helped by growth in wireless and Internet subscribers. AT&T, which began selling Apple's iPhone on June 29, however said it activated 146,000 iPhone subscribers in the first two days of the launch with more than 40 percent of those subscribers were new customers.

The data immediately sent stock price of Apple Inc.’s (Nasdaq: AAPL, stock) plunge 4 percent (off $5.70 to $138.02) this morning’s trading before recovered to minus $4.00 or down by 2.85 percent (as of 10:30am Tuesday). The 146,000 iPhone sales were well below analyst estimates.

Apple Inc. is set to announce its’ earning tomorrow, Wednesday 25th July, 2007 after market closed. So would Steve be able to announce another round of earning which will beat the estimate $0.72 per share? It has to if Apple wishes to see today’s disappointed figure of iPhone sales and the share’s drop be compensated and set a dynamic and uptrend or possibly gap-up.

If the investors smell any earning figures which do not looks impressive enough, it could be punished a second time. And the second time of punishment would not be a nice view to look at, that’s for sure. Nevertheless going by the normal conservative figure given by Steve as usual, Apple is on the high probable of beating the estimate. It’s a question of whether the set of numbers are impressive enough for analysts to say the current stock price is trading at the lower range (and substantially raise their targets).

Trading at P/E (price to earning ratio) of 45.50, Apple’s stock price is not cheap. It’s even higher than Google Inc. which is trading at 43.60 multiple of its earning. Not an easy decision to make if you should long or short the stock, don’t you think? Well, depending on how long is your investment for Apple, you might want to long it if you’re optimistic the iPhone numbers will eventually go above analysts’ estimate.

Dividend Yield Stocks (Part 1) – Berjaya Sports Toto

There’ve been numerous requests from readers of StockTube on recommendation on stocks which give away good “dividend yield”. This type of stock is also one of the favorites among the long-term investors who see it as a better alternative to banks’ fix-term-deposit saving or even the EPF’s (Employees Provident Fund) pathetic annual dividend. The latter is applicable for retirees who are planning to grow their hard-earned savings.

Basically stocks which can provide good and “consistent” dividend pay-out are normally defensive stocks, meaning comes rain or shine the stocks will still pay you dividend. I’ve previously blogged about two stocks (upon request from a loyal reader) which consistently pay relatively good dividends. The reader couldn’t make the decision as to which stock to invest, so StockTube published the article onWhich Stock to Invest - GENTING or Public Bank? back in end of May 2007 to summarize the comparison.

StockTube New Mini Project

StockTube will starts (in no particular order) to publish several articles on stocks that provide “Good and Consistent Dividend Yield”, one stock at a time with more fundamental and technical information. I’ll neither commit on the time-period of the next subsequent article nor would I commit on the number of stocks which fit the topic. I’ll just let the flow takes its course. Let’s kick-start with one of my favorites, Berjaya Sports Toto Berhad (KLSE: BJTOTO, stock-code 1562).

Sports Toto Malaysia Sdn Bhd was incorporated in 1969 by the Government of Malaysia, was privatised on 1st August 1985 and thus separated its’ status quo as a state-owned gaming enterprise. Sports Toto is currently a wholly-owned subsidiary Berjaya Sports Toto Berhad which is listed on the Bursa Malaysia or Kuala Lumpur Stock Exchange.

Sports Toto is the sole national lotto operator with over 680 outlets throughout Malaysia and offers a variety of games – digit-type games (namely, 4D, 5D and 6D) and lotto-type games (namely, Toto 6/42 Jackpot, Super Toto 6/49 and Mega Toto 6/52). The Company has total staff strength of more than 450 working at its head office in Kuala Lumpur and branches throughout Malaysia, and over 1,500 staff employed by agents of the Company.

The Man behind Berjaya Sports Toto

If you do not know yet, Berjaya Sports Toto Berhad is part of Berjaya Corporation which is owned

As the “King of bonus and rights issue”, it wasn’t a surprise that the share prices of his Berjaya companies rarely hit above 2-digit figure due to enormous floating shares in the market, with the exception of Berjaya Sports Toto. Due to the nature of the business, Berjaya Sports Toto is undoubtly the ultimate cash-cow for Berjaya Corporation and Vincent Tan as the largest shareholder.

Sports Toto’s Fundamental

Fundamentally, Berjaya Sports Toto, just like any other gaming (or gambling) stocks is a defensive stock. Despite the regulation which only allows certain days of the week for punters to bet on their luck, all the outlets continue to attract customers. Since 1997 (and prior to that) the revenue has never once registered below RM 1 Billion figure. During the 1997 Asia Economy Crisis the company saw a jump in revenue to breach the RM2 Billion mark – a proof that people will bet even more during the difficult time.

Technical Analysis on the Stock

Looking at the 3-year chart, Sports Toto has since rebound from the boring RM3.00 per share to above RM4.00 per share. Due to the consistent and expected result of the gaming stocks revenue, the share price rarely jumps (or drops) beyond imagination.

However, if you analyze the volume distribution and accumulation pattern, the technical chart seems to comply with the rules, meaning the opportunity to buywhen it consolidate to the support of RM4.90 nears.

Dividend Analysis

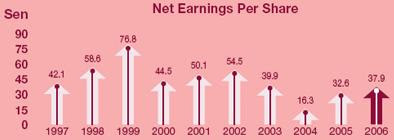

A glimpse on the gross dividend per share summary chart will shows that the Berjaya Sports Toto is a stock to own if you’re looking at the rare 2-digit return on investment. It wasn’t so attractive pre-2005 with a single-digit of dividend returns. For the financial ended 2005, it declared a total RM0.45 per share of dividend while the attractiveness increased in 2006 when it declared RM0.51 per share. This is about 10 percent annual return, not a bad figure for dividend hunters.

Should you go in now?

This is perhaps the most popular question I received in my mailbox. While I can give you a 100-pages analysis, I simply cannot tell the future if some external factors beyond my control will take a particular stock out of the trading range as pictured in the technical chart. What I can tell is if everything goes by the book, the best time to go in is at RM4.90 or slightly lower, provided you are lucky enough.

On June 23, Berjaya Sports Toto launched the Mega 6/52 Jackpot with a minimum RM2 million jackpot. This gave its daily lotto revenues a 25% boost and with three lotto games in its belt, it is believed the stock will continue to performs.

Having said that, if you happen to see an abnormal high volume or selling, please raise the red-flag. This stock is perhaps another good example of how you can make money trading within the range. Stay tune for the next part of investing dividend yield stocks to make money out of it.

Monday, July 23, 2007

Could Crane’s Stock Price Be Lifted-Up?

Crane Co. (NYSE: CR, stock) is set to announce its earning today, July 23rd, 2007 after market close. Crane Co. (Crane) is a diversified manufacturer of engineered industrial products. The Company operates in five segments: Aerospace & Electronics, Engineered Materials, Merchandising Systems, Fluid Handling and Controls.

The Aerospace & Electronics segment consists of two groups: the Aerospace Group and the Electronics Group. The Engineered Materials segment consists of Crane Composites and Polyflon. The Merchandising Systems segment consists of two groups: Vending Solutions and Payment Solutions. The Fluid Handling segment consists of the Crane Valve Group (Valve Group), Crane Pumps & Systems and Crane Supply. The Controls segment consists of Barksdale, Azonix, Dynalco, Crane Environmental and Crane Wireless Monitoring Solutions. During the year ended December 31, 2006, Crane acquired Dixie-Narco Inc., Noble Composites, Inc. and Telequip Corporation. In 2006, it acquired certain assets of Automatic Products International and substantially all of the assets of CashCode Co. Inc.

Rating Indicators for CR:

- Wall Street consensus : 0.78

- StockScouter rating : 8 / 10

- Whisper Number for this stock : N/A

- Schaeffer rating for this stock : 7 / 10

- Power Rating : 6 / 10

- Insider Trading (last 52 weeks) : ($5.00 M)

- Zacks Analysts Rating: Hold

- Option Trading: Dec 2007 45.00 Call

- Implied Volatility (IV) for Sep 2007 $45.00 Strike : 25.92%

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 7.4%. Crane has a debt/equity ratio of 0.44 compare to industry’s ratio of 2.13.

Stock Resistance & Support Level – The resistance is at 44.98 (52-week high) while the first level support is at 44.59 (50-day moving average)

Risks – The ratio of Crane's price-to-earnings multiple (17.00) to its five-year growth rate is above the average of all stocks within the same sector. The volume is relatively low so you might not be able to get a good price on the option.

Another stock which is on StockTube radar is Waters Corporation (NYSE: WAT,stock) which is expected to announce its earning on Tuesday, 24th July, 2007 before market open. However you need to have lots of time-value on Waters as it normally trend-up rather late.

Major Crackdown on Malaysia Political Bloggers Started?

In yet another breaking news (how StockTube wish there’s a similar CNN “Breaking News” in Malaysia), theStar reported that UMNO (the main party of the current ruling government) has lodged a police report againstMalaysiaToday for carrying a series of comments and remarks that it deemed as insulting the Yang di-Pertuan Agong, degrading Islam and as inciting hatred and violence in Malaysia's multi-racial society.

Party information chief Tan Sri Muhammad Muhammad Taib lodged the report at 12.57pm at Tun H.S. Lee police station here Monday. He said the comments and remarks, consisting of criminal elements and inciting religious and racial sentiments which could affect the country’s security, were carried by the blog on July 11.

Could this mark the start of a major crackdown on political bloggers who wrote the other side of the stories as compare to the traditional pro-government news? A visit to MalaysiaToday today often could not get through, most probably due to high traffic to the famous news portal which attracts tens of thousands of visitors per day. However the author was said to know in advance that his portal will be closed down on Monday and he will be charged and arrested.

What could be the reason for the possible charge or arrest of Raja Petra Kamarudin, the author of MalaysiaToday? Could it be due to this article which has many theories or could it be earlier articles which highlighted what could be thegreatest exposure since the creation of George Lucas’s Star Wars or Steven Spielberg’s Jaws? Though many reasons could be presented as to why certain bloggers were being pulled into court, the latest crackdown on Raja Petra could spell that the General Election is indeed around the corner and the government is not taking any chance which will deny it the overwhelming winning ticket.

Time DotCom – to Acquire or be Acquired?

It was reported that the loss-making but 3G-awarded Time DotCom Berhad(TIMECOM: stock-code 5031) has been asked by controlling shareholder Khazanah Nasional Bhd to put its third-generation (3G) rollout plan on hold. BusinessTimes also reported that Time had been granted the necessary bank loans and was ready to roll out its 3G infrastructure in March before the"instruction" came in.

"It is basically a shareholder issue. Khazanah is in talks that involve several parties, which may result in changes in the shareholding of Time. So, it is believed that the best solution (for now) is to put the 3G plans on hold," said a source. By putting the plans on hold, which will satisfy its shareholders and potential new shareholders, Time is said to be at risk of losing its 3G licence.

But then, what Time is lacking is a team of efficient management with experience in marketing and operation as well as driving the company in the right business direction, not to mention the vital people in taking care of dollars and cents. Time has the rest of the chips such as government support, 3G license, inefficient teams, tons of losses and even a bail-out should things turn ugly. You can read how DIGI - If You Can't Beat Them, Suck the Coffer Dry article, a brilliant plan by the DIGI.com to prevent Time from taking over DIGI.com forcefully – a famous tactic which has been used by government-linked-companies repeatedly in the past.

So I won’t blink my eyes even once out of the worry that Time will risk losing its 3G licence as it always can be extended by a simple government announcement should the period of roll-out not met. For all you know, Time could be still sitting on the 3G licence awarded earlier this year without any plan to even test the workability of the 3G. It shouldn’t surprise you as the 3G was awarded to Time as the bargaining chip to force DIGI.com to acquire Time (or the other way round?) and thus solves Time’s losses once and for all.

One way or another, Time DotCom definitely needs to go if the shareholders (in this particular case Khazanah) do not wish to see more red in the profit-and-loss spreadsheet. Nevertheless the interest on Time stocks will surely attracts punters or speculators.

Other Articles That May Interest You …

Sunday, July 22, 2007

The Good, the Bad and the 5-Figure Profit

Last Friday’s Option-Expiration was another exciting trading day at least it was for me as I’ve to monitor two of my favorite stocks, Apple Inc. and Google Inc., almost with higher than normal heartbeat. If you do not know, Expiration Friday is the day where all options with a particular month contract will expires worthless, the same way a stock’s warrant becomes zero in its worthiness as it matured.

As for Google, it was exciting as I had blogged in GOOGLE Tumbles, Expect Nasdaq to be Pulled Down, the first 45 minutes would be crucial to determine if the stock will take a freefall. Looking back then, Google showed it’s muscular when it decided to stay above the lowest of the low withn the 45 minutes – thus I did nothing (buy Put to scalp) as I can’t execute the plan since the price action says otherwise (still suffering from the paper losses).

But my trade was without any roller-coaster. The AAPL Oct 120 Call was entered in two batches on June 11th, 2007, at 3 contracts and 6 contracts respectively. Since it was Oct expiration, I’ve tons of time-value on my side. I was bullish on Apple because everyone was bullish and the fact that APPLE iPhone Sales Top US$100 Million on Day-1 only reinforced the confidence in Steve Jobs.

Friday, July 20, 2007

Does CIMB Plans to acquire more Banks?

CIMB (Commerce International Merchant Bankers), an investment bank of Bumiputra-Commerce Holdings Berhad (KLSE: COMMERZ, stock-code 1023) has been mulling the idea of having smaller number of banks via numerous press reports. And if the latest statement by its chief executive officer Nazir Razak (brother of current Malaysia Deputy Prime Minister) is anything to goes by, StockTube would interpret it as the readiness of the group to start gobbling another bank or two.

The chief of CIMB predicted that the number of Malaysian lenders may be down to six in the near term. He said "We need to accelerate consolidation, and it is my personal opinion that, perhaps, regulatory intervention is necessary to get it done quicker ahead of liberalization … Otherwise, the local players may not be able to withstand the forces of liberalization."

Nazir might be speaking from his comfort zone of being the chief of the second biggest bank in Malaysia, giving him the advantage of being an acquirer than acquiree. I wonder if he would have opens his mouth should he be the chief of one of the smallest banks. While it makes perfect sense to consolidate further to face the full force of globalization and liberalization, the decision to merge nevertheless should come from shareholders themselves, with minimum regulatory intervention – as reported by BusinessTimes.

So if you’re a punter which bank should you watch-out to potentially make money out of the merger news (if it indeed happens)? Going by the normal trend, the three smallest banks namely EON Capital Berhad (KLSE: EONCAP, stock-code 5266),Malaysian Plantations’ Alliance Bank (KLSE: MPLANT, stock-code 2488) andAffin Holdings (KLSE: AFFIN, stock-code 5185) should be your choice. But then in Malaysia corporate world whereby the smaller piranha could gobble up a buffalo, you simple won’t know if there’re still surprises in the closet.

One thing is sure though, CIMB is preying one of the banks sitting at the bottom in terms of capitalization.

GOOGLE Tumbles, Expect Nasdaq to be Pulled Down

Finally the giant tumbles and the chain reaction is expected to crawl into the Nasdaq market when it opens for trading on Friday. Earlier StockTube mentioned that Yahoo’s Weakness is Google’s Gain and I’ve considered Call Option on Google's (Nasdaq: GOOG, stock). Everyone on Wall Street is expecting revenues of $2.68 billion, up 60% over the same quarter last year, nothing less.

And so, when Google reported a mere 28 percent earnings increase, analysts viewed the result as a “major” letdown since the Mountain View-based company's quarterly profits had never before improved by less than 60 percent. And to prove how disappointed Wall Street is with such figure, Google’s stock was severely punished and the shares plunge more than 7 percent (that’s a whopping $39) in extended trading.

Already well-known for pampering its employees, Google poured even more money into expanding its work force during the spring. Google hired 1,548 additional employees during the quarter, compared with the 1,152 workers it added at the same time last year. Google Chairman Eric Schmidt told analysts in a conference call that the company would be more "careful" about adding employees in future quarters.

Brin reiterated that sentiment in an interview, saying the company would be more disciplined in its future hiring now that it has attracted enough employees to pursue its ambitions. Google ended June with 13,786 employees, a 74 percent increase during the past year.

So, how to salvage the trade that’s in the loss? First, let’s relax and be cool about the trade as you should have anticipate such thing will happens sooner or later in investing world. This is a major letdown, so let’s dissect what would be the majority investors’ perception. The gap-down will definitely follow through the early morning trading and every Tom Dick and Harry is going to dump the shares. It will becomes worst as its’ Expiration Friday so the first 45 minutes of trading is very important. Since your option is not expiring Friday (I hope you didn’t buy the option with 2 days of expiration, did you?) it could provide you with opportunity to make fast money scalping this stock. Expect very high volatility and volume – short the stocks with Put Option.

How to View and Interact with Investment Directors

Won’t you like to be able to connect and see some of the investment directors' actual and real account portfolios? What about being able to receive updates whenever transactions occur due to the changes made by the investment directors? You might think that’s not possible and even if there’s such option, you need to pay a leg and an arm for it.

It might be a dream if you’re reading this from a country like Malaysia or Singapore but in U.S. the concept of value-added and investing creativity had taken a twist so much so that you can view it for free. One of such providers is Vestopia, a site where you can meet the investment directors, well, virtually. What you need to do is to register for free and then you would be able to view their transaction.

For example, I know Brooke Synder, CFA, who claimed to have over a decade working in the financial world as equity researcher, analyst and advisor has sold 100 shares of Citrix System Inc at $38.77 on July 19th 2007. You can also click on his blog which will tell you his reason for buying (or selling) and you can submit your comment on that particular entry.

What’s cool is I can view Brooke’s performance in a graph format, the interactive performance grid will shows the stocks which was bought or sold by hovering your mouse over it. Also you can see the portfolio composition in a pie-chart format to determine which sector was the investment director bullish on. Vestopia has a list of Premium Investment Directors who you can view – together with their approach in investing, strategic profile and equity strategy.

Thursday, July 19, 2007

Yahoo’s Weakness is Google’s Gain

As much as I like Yahoo Inc. (Nasdaq: YHOO, stock) to be strong and muscular in order to prevent Google's (Nasdaq: GOOG, stock) from becoming too monopolize in the online search and advertisement market, I never really like the stock. I’m not sure what to say about Yahoo. Despite started early in the dotcom boom and survive thereafter, it never seems to be able to lift a finger to fight Google’s domination. I’ve tried trading Yahoo stock before but it simply disappointed me, so I dumped it and never look back.

However Yahoo’s earning result could prove to be the ultimate weapon to make money, not on Yahoo's stock or option, but on its enemy – Google. So when Yahoo announced its weak earning Tuesday (inline), it simply gives a bonus point to investors to invest on Google. As Forbes pointed out, Yahoo’s weakness is not the Internet that’s suffering – it’s just Yahoo.

Having said that, expectations are high (as usual) for Google to turn in another impressive result when the search giant is expected to announce the earning today, Thursday, July 19th, 2007 after market closed. Analysts and investors have learned that they can continue to raise the bar for Google, and Google will continue to deliver it.

They expect revenues of $2.68 billion, up 60% over the same quarter last year, and earnings of $3.59 cents per share, up 44%. The company’s advertising business, which accounts for nearly all of its revenue, is still growing. So the result would be another earning being beaten up again.

However, investors will want to hear about new ways Google plans to make money when CEO Eric Schmidt speaks to them Thursday. They’ll listen for clues about how and when the company will wring dollars out of video-sharing service YouTube and new mobile products. They’ll also want details about how much headway the DoubleClick acquisition will give Google in the growing field of display advertising once the deal is completed.

# TIP: Even though Google stock is trading at all time high, it can go higher should the result impress investors. I’m considering Call Option on Google at $550 Strike.

Wednesday, July 18, 2007

Three Stocks to Watch – ISIL, eBAY and ATR

Intersil Corporation (Intersil) (Nasdaq: ISIL, stock) is set to announce its’ earning today, July 18th, 2007, after market close. Intersil Corporation (Intersil) is a designer and manufacturer of high-performance analog integrated circuits (IC). The Company focuses on broadening its portfolio of application-specific standard products (ASSP) and general purpose proprietary products (GPPP), which are targeted at four markets: high-end consumer, industrial, communications and computing. The Company markets its products for sale to customers, including distributors, primarily in China, the United States, Taiwan and Japan.

Rating Indicators for ISIL:

Sales, Income & Growth - For the past 12-months, Intersil registered $729.38 Million in sales versus the industry’s $21,917 Million. Income amounted to $152.02 Million against the industry’s $3,237 Million. While Intersil’s 12-months sales growth is at -6.30% the income growth is 2.10% (the same industry sector sales growth is at 0.70% and income growth of 6.70%).

Profitability & Financial Health – For the past 12-months, net profit margin is in the region of 20.8%. Intersil has a debt/equity ratio of 0.0 compare to industry’s ratio of 0.09.

Stock Resistance & Support Level – The resistance is at 34.08 (52-week high) while the first level support is at 31.41 (50-day moving average)

Risks – The ratio of Intersil's price-to-earnings multiple (30.90) is above the average of all stocks within the same sector.

AptarGroup is a supplier of a range of dispensing systems for the personal care, fragrance/cosmetic, pharmaceutical, household and food/beverage markets while eBay provides online marketplaces for the sale of goods and services, online payments

Funniest Malaysian Story – Who’s the Fool?

Ireally have to stop blogging about investing stocks for a while as I found this story to be amazing yet funny. I would give my thumbs-up to the thief and thumbs-down to the Malaysian police, not that I endorse what the thief did but what lesson could be learnt from the police force.

It was just yesterday and barely nine hours ago when the same smartly dressed man coolly walked into a showroom at Auto-City (Naza Premier Auto Bhd) in Juru and asked for the key of the RM963,000 Porsche 911 Targa 4 before sped off crashing it through the showroom’s glass pane. Somehow the man forgotten to fill up the gas and had to abandon the car some 2 km away.

I bet most of the police force and public was laughing at how idiot the thief was. Before you conclude that, you better think twice of who is the “real fool”.Guess what, the same man pulled it off for the second attempt – this time rightunder the noses of the police. The thief stole back the Porsche 911 Targa 4 from the compound of the police headquarters. He managed to do so because he had the keys and this time he was ready with a container of petrol (okay, please stop laughing).

Ever wonder why car-theft cases have been going up in this country? Maybe the government needs to recruit thiefs to do a random "audit" on the alertness of police force.

Dow Jones finally Crossed the 14,000 Mark

The world well-known stock market indicator, Dow Jones Industrial Average (DJIA), crossed 14,000 in the first half-hour of trading today (Tuesday) and rose as high as 14,011.79, having taken just 57 trading days to make the trip from 13,000. The Standard & Poor's 500 index advanced 0.34, or 0.02 percent, to 1,549.86, having set its own record highs in recent sessions. The Nasdaq composite index rose 9.05, or 0.34 percent, to 2,706.38.

Stocks have risen fairly steadily since the spring amid a continuum of buyout news and evidence that despite higher fuel prices and the ongoing problems in the housing market and mortgage lending industry, consumers are spending and companies remain optimistic about the future. The move higher Tuesday came as Wall Street sorted through a mixed inflation reading and profit reports from blue chip names including Coca-Cola Co. and Merrill Lynch & Co.

But the Dow's latest accomplishment does raise questions about whether investors are buying more on speculation than fundamentals. A week ago, the average tumbled nearly 150 points after disappointing forecasts from Home Depot Inc., Sears Holdings Corp. and homebuilder D.R. Horton Inc., but only two days later, the Dow barreled 283 points higher as investors chose to put a positive spin on a generally lackluster series of retail sales reports.

Light, sweet crude rose 49 cents to $74.64 per barrel on the New York Mercantile Exchange, after trading over $75 per barrel. Oil hasn't closed above $75 since August.

The short time that it took the Dow to pass this its milestone recalls its ascent during the dot-com boom, especially because it took only 129 days to make the passage from 12,000 to 13,000. In the late 1990s, the Dow took just 24 days to go from 10,000 to 11,000, and 89 days to go from 6,000 to 7,000. The end of the high-tech boom plus the recession and the aftermath of the Sept. 11, 2001, terror attacks helped send all the major market indexes into reverse.

Tuesday, July 17, 2007

Personalize Stories that Interest You with Thoof

If you’ve been long (or old) enough in the information technology world, you would realize how the technologies and contents have changed over the last ten years. During its infancy period, websites were static and most of the information was about the company profile without pulse. Now, most of the contents are dynamic, so much so that you can personalize a site according to your interest and preference.

One such site is thoof which allows you to personalized news based on your taste showing interesting news, videos and other links. After browsing the site, it tends to have the characteristic of a social bookmark such as ability to submit links or news that interest you so that you can share it with friends and others. It also allows you to vote (same concept like digg) on certain story that interested you.

The concept of allowing anyone to submit news links is perhaps one of the smartest moves because the owner of the site does not have to spend precious time moderating hundreds or thousands of submission daily. But thoof goes another step by allowing you to improve on certain submission by giving your opinion on how the story summary should appear. Besides using collaborative filter technology to actually understand a reader’s interest and thus pushing similar stories from the same topic to the reader, thoof also offers simple yet tidy option of either hide (bury it) or tell the system that you’re not interest in the story by clicking “not interesting”.

You can also add more tag to better reflects the category of the story. Overall, the site design is easy yet comprehensive to use. Could thoof becomes another digg or technorati in terms of popularity? Times will tell. In the meantime, just click the stories that interest you and let Thoof do the rest.

*sponsored*

50th Independence yet MAS Cannot Take the Turbulence

Malaysia might be celebrating its 50th Independence Day in about a month time but judging from the turtle pace on how she compete in a globalization market is definitely disturbing. On one hand you have politicians screaming at the top of their voice about how successful the country is, with obvious credit taken by the ruling government. On the other hand, it’s indeed a shameful policy to continue with the iron-fist protection of highly sensitive entity such as the Malaysian Airline System Berhad (KLSE: MAS, stock-code 3786).