Eyes on Stimulus Plan – Can Najib do the Magic?

Economists at the World Bank predicted that the global economy will shrink for the first time since World War II with trades at its lowest in 80 years.You may not like it but it seems this Great Recession that we’re riding on is going to be the longest since World War II, making the 1981-82 and 1973-75 recessions which lasted 16-months each like a tame-rabbit. The 1981-82’s recession was considered the worst in America’s history since the 1929’s Great Depression. The good news – unemployment hasn’t reached 1982 levels, at least not yet. But the Dow’s tumble since its peak in Oct 2007 is worse than the 1929-32’s period with a mind-boggling $11 trillion in market capitalization wiped out.

Even the new U.S. president couldn’t save the day - U.S. stocks have lost $1.6 trillion in market-cap since Barack Obama's inauguration. Billionaire Warren Buffett admitted the U.S. economy has “fallen off the cliff” over the past six months *as if we do not already know*. While it’s true that it’s too late to sell your stocks now many investors are still divided if they should scoop now in anticipation of a mini-rally since the stocks are so, well, cheap now. Nobody dares to declare that the stocks are cheap and we should buy like crazy, not after these so-called experts were burnt on numerous occasions. They’re still haunted by Bear Stearns, Freddie Mac and Fannie Mae, Merrill Lynch, AIG and now Citigroup and General Motors. Time will tell if Barack Obama is another Ronald Reagen *grin*.

Basically everyone is waiting for the worst to come and go and hopefully they can weather it. Yes, that’s right. The worst is yet to come and in certain countries such as Malaysia whose population of less than 30 million were duped by their leader that the country was insulated from the global recession, the havoc that’s coming could create the mess people have not ever seen before. So far unemployment has only affected the manufacturing sector and people are still enjoying themselves as if they’re insulated. Youngsters are swiping their credit cards like there’s no tomorrow and the Mega-Sales still attracted huge crowds, just like during the old good times. But who can blame them when they were not even aware of the previous 1997-98’s Asia Economic Crisis?

All the eyes are towards the much-hyped mini-Budget scheduled to be announced the PM-in-waiting Najib Razak tomorrow, 10th Mar 2009, which would see RM25 billion to $35 billion in stimulus package. Anything less would see severe punishment to the already ailing stock market. Besides the big numbers analysts are also wary if there’re substances to the project or plan associated with the stimulus package. If analysts think that it was another marketing talk (or sloganeering) with little justification and many grey areas as to the implementation and execution then you will witness another round of stocks dumping. People are extra cautious about their investment nowadays and it would be wise to keep their money close to their chest than to put it into local stock market especially with the current political turmoil.

Other Articles That May Interest You …

Friday, March 06, 2009

Citi Stock at $1 a share – Cool; Right Issues - Boo

Who would have thought that the mighty Citigroup Inc. (NYSE: C, stock) could become a penny stock one day? It was unthinkable as the American brand was once the most powerful bank on the planet earth and to flash your Citibank Credit Card was a privilege that Mr. Bean would not get tired of. Citigroup has lost more than 85% of its value so far in 2009 and is 95% below where it was the same time last year. The stock was so worthless that it should be taken out from the NYSE but the authorities relaxed its listing rules to allow stocks under a dollar to maintain their listing. That’s right! Citigroup stock plunged to less than a dollar to RM0.97 a share Thurs 5th Mar 2009 before closed at $1.02 a share.

As superstitious as it may sound Citigroup could fare better if it were to maintain its 137-year-old former red umbrella logo which it sold back to its original owner St. Paul Travelers in 2007.

Bumiputra-Commerce has market value of over RM22.2 billion against Citigroup’s RM20.5 billion ($5.56 billion), which has since slides as the 184th biggest bank by market value. Citigroup which was worth more than $277 billion in late 2006 is now under pressure and could see the stock taken out from the DJIA’s 30 blue-chips companies. At this juncture you might be wondering if you should get yourself a cup of coffee, a pack of chewing gum or a share of Citigroup. After China failed to deliver the much-hype stimulus package and General Motors Corp.’s warning of a collapse, the Dow plunged another 280-points *yawn* to 12-year low at 6,594.44. And the freefall to test the 6,000 support level could be reached within this month alone *scary*.

You do not need to become a rocket scientist to know that to have Permodalan Nasional Berhad (PNB) and Employees Provident Fund (EPF) agreed whole-heartedly in subscribing 55.7% and 13.7 % respectively of the RM2.74 a piece right issues are tantamount to “bailout” Maybank. And PNB is asking for another 20% in excess of the right issues? This is almost the same like AIG holding the U.S. government hostage at gunpoint when it demanded another $30 billion in loans, in addition to the $150 billion it has already been given. Therefore why should you subscribe to the right issues especially during current bearish market?

Other Articles That May Interest You …

- Great Recession’s Scope is Deep and Broad

- Why Cut the OPR Rate My Genius? Aren’t we’re Insulated?

- Ahoy there, Dow is sinking below 7,000-level

- Stocks Investing - what you can learn from PC Fair

- Forget about rate cut, AIG may Crash the Stock Markets again

- Should we rejoice or mourn on Maybank-BII deal?

- Why you should avoid Maybank stock – Money Sucked Out

Wednesday, March 04, 2009

Great Recession’s Scope is Deep and Broad

Like it or not we may be entering the Great Recession without us realizing it and only time will tell if we’re indeed walking into the history. So how does it feels or just how comprehensive is this so-called Great Recession? In reality unless you’re in the manufacturing or other vulnerable sectors and have been laid off you would probably making fun about this recession. What recession? You may ask. But you may want to save that for another day because it’s still too early to tell if you would be the next victim. In the United States the job losses demonstrate both deep and broad with almost every state affected as if were plague by incurable disease.

Some points for your consumption:

- This (Great) Recession is causing much more job loss among the less educated than among college graduates - construction workers, hotel workers, retail workers and others without a four-year degree were affected the most.

- This (Great) Recession is hurting men more than women, hurting homeowners and investors more than renters or retirees.

- The city affected the most in U.S. is El Centro, an agricultural area of California, of which the unemployment rate registered a staggering depression like 22.6 percent.

This morning’s recovery in Dow Jones is merely technical rebound after 5-days of selling and investors or traders should take profit (if there’s any). Obviously investors are overly optimistic that China will soon announce a big stimulus package. In the current situation any measure that could help to calm investors are welcome but to overly depend on such (China) stimulus package is suicidal.

Other Articles That May Interest You …

Tuesday, March 03, 2009

We don’t live on trees. We conduct Assembly under the tree

Two scariest (or rather amazing) things are to be remembered as we entered the month of Mar 2009. First – the Dow Jones Industrial Average has finally breached the 7,000-level when it closed at 6,763.29; a loss of almost 300 points. The Dow hadn’t traded below 7,000 since Oct. 28 1997 – 11 years ago. It was selloff right from the beginning of trading bell thanks to American International Group Inc.’s (NYSE: AIG, stock) after it reported a staggering losses of $61.7 billion in the fourth quarter, by far the biggest quarterly loss in the United States corporate history. The government said it would give American International Group Inc. another $30 billion in loans, in addition to the $150 billion it has already given the insurer. Sometimes you wonder if it was a mistake to rescue this AIG as the debt-hole could be bottomless.

New York-based AIG said it lost $22.95 per share in the last three months of 2008 and its revenue fell to negative $23.8 billion. It’s true that AIG is holding the U.S. government hostage at gunpoint. This beast will continue to suck up many more billions of taxpayer money and the President Obama can’t even lift a finger because AIG is simply too huge to be killed. With over 74 million customers worldwide and operations in more than 130 countries AIG can basically relax while asking for tens of billions more whenever the need arises. It’s a never-ending parasite that has so far consumed about $173 billion of taxpayer money. Now people who rubbished the “Depression” but adopted the “Great Recession”word are now worrying about “depression” (smaller “d” to mean mild depression, if that will make you happier).

I’ve wrote about the potential of depression months ago and why you should not enter the stock market yet (unless you’re a swing trader who knows how to scalp for fast profit) so I’m not going to nag about it again, lest your hobby is to catch a falling knife so that you can show the trophy to your grandchild of your achievement *grin*. By now you should know that one of the rules in stock investing is not to follow the crowds especially the wrong crowds during such moment. Stay sideline, preserve cash and wait for the right moment to make the killing. Of course if you’re into U.S stocks then you should be laughing all the way to the bank with Put Options, Writing Covered Puts, Short-Selling, Spreads and etc. Tips: KLSE still has a long way to go *down*.

- First motion: confidence in Mohammad Nizar Jamaluddin as the legal Perak mentri besar;

- Second motion: an agreement to seek Royal consent for the dissolution of the state assembly

- Third motion: the adoption of the suspension of Zambry Abdul Kadir as the menteri besar and six executive councillors he appointed.

The shivering and probably the shortest-term serving menteri besar (if you think he’s the legal one), Zambry Abdul Kadir, who rushed his team to London seeking professional advices and assistance from the Queen Counsels (QCs) was at lost on how to salvage the situation mainly because his path to the chief minister-ship was being architected with haste and consists of many loopholes. Besides the biggest flaw in buying over the wrong person (Deputy Speaker instead of Speaker) it also did not understand the concept of prorogued and adjourned. In another words if it was prorogued (dissolved) then only the Sultan of Perak (Ruler) can summon the Assembly else if it was adjourned (postponed) then the Speaker can convene.

It’s not game-over yet for the powerful BN government, mind you. Rest assured that the BN government will be using the controlled-Judicial from now onwards to the fullest to frustrate its opponents. With the police (and army?) at its disposal the desperate government could easily invoke Internal Security Act (ISA), State of Emergency or Operasi Lalang (Part II). However the old and obsolete method of using the Operasi Lalang may backfire judging from the Hindraf case-study. People are more connected nowadays thanks to technology such as hand-phones and blogs. Also it would be foolish to choose a State of Emergency strategy since it would send foreign investors packing. You don’t think foreign investors do not follow on such developments, do you? Nevertheless the ball is not in the court of the Sultan of Perak now.

Other Articles That May Interest You …

- Can the Street Gangsters face Recession Alone?

- Ahoy there, Dow is sinking below 7,000-level

- UMNO begging QC’s help in London – a Mistake Coup?

- Wild Swing to continue as long as the Worse is Not in Sight

- It’s all about Stimulating the Right Way on the Right Part

- Forget about rate cut, AIG may Crash the Stock Markets again

- Nightmare on Dow Street & the shadow of Deep Depression

Monday, March 02, 2009

Can the Street Gangsters face Recession Alone?

Malaysia‘s GDP (gross domestic product) registered a growth of 4.6% for 2008, shrunk from 6.3% recorded in 2007 and lower that earlier projection growth of 5% (for 2008). However the fourth quarter’s (Oct-Dec 2008) growth was at disturbing 0.1% growth compared with 4.7% in the third quarter. That’s if you believe these numbers have not been cooked *grin*. Anyway giving the honest politician and finance ministry the benefits of doubt Malaysia was actually doing better *applause* than neighbor Singapore which was in negative territory – 4.8% contraction in the fourth quarter.

Previously Second Finance Minister Nor Mohamed Yakcop claimed that the government expects a 3.5% growth for 2009 despite a global economy downturn because the trick was the RM7 billion fiscal stimulus package. Immediately the PM-in-waiting and Finance Minister Najib Razak rushed to declare that there’s no possibility that Malaysia will enter recession this year. Now the Second Finance Minister who was also said to be the person who wiped out a whopping RM30 billion of nation’s money from forex speculation losses between 1992 to1994 issinging a different song, asking Malaysians to accept the reality that the global financial havoc is expected to prolong till next year and probably will affect the country.

You may not like it and the politicians especially the PM-in-waiting who will be sworn in as the country’s sixth Prime Minister in another month may want to hide the fact but it appears that Malaysia may need to fight this recession alone.Despite President Obama’s jaw-dropping ambitious $1.75 trillion deficit budget to turnaround U.S. dying economy the first black president is expected to meet huge obstacles from both the Republican and the Democratic. Europe is having its own economic problem as its eastern poor members such as Hungary, Poland, Bulgaria, Romania, Slovakia, Czech Republic and others are begging for help. Even China with its 4 trillion yuan ($586 billion) plan to shield the country from economic slowdown is talking about the potential of the global recession disease spreading into the country. Everyone has their own problems.

Hence, instead of fighting a losing battle of regaining BN (or rather UMNO?) dignity via back-door capture of opposition states and in the process loses the people’s support it’s wise for Najib’s new administration to concentrate in combating the Great Recession (yeah I know I’ve wrote about this previously but you have to remind the empty vessel how to sail back home). The country may have the money to implement the much awaited second stimulus package (don’t ask me what happens to the first one) but the biggest question mark is whether there’s political will to be transparent and put in place an effective execution or implementation for the plan to succeed. But looking at how the leaders behave and manage their respective institutions you don’t need a rocket scientist to tell if leakages will prevail ultimately.

You can’t simply have a properly functioning brain if you think it’s alright to have a government whereby over 20 UMNO Youths were given easy access to an institution such as the Parliament so that these thugs can harass a helpless and wheelchair-bound Member of Parliament Karpal Singh. Strange as it may look but these disgusting, shameful and barbaric gangsters are nothing more than a bunch of cowards who only knows how to bully the weakest and if you happen to suggest they put on the same act against the Israel troops in the Gaza territory (one-way free tickets sponsored) or probably to have one-to-one fight with PAS supporters, chances are they would run or cry like babies begging for mercies. And don’t think for a second that these mobsters will not come to steal and rob from you if the economy turns for the worst *let’s pray this will not happen, shall we?*.

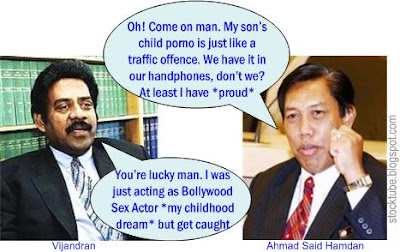

Equally sad is to have chief commissioner of the newly cosmetic-upgraded Malaysian Anti-Corruption Commission (MACC), Ahmad Said Hamdan, who thought it was perfectly alright for his son to import child pornography into Australia as he believes it was comparable to just a minor traffic offence. As long as you pay the summons then the story should ends there *and commit the same offence again?*. Also the chief commissioner does not think he should be linked to his son’s (child pornography) offence as if he didn’t play any part in his son’s upbringing. But the most puzzling yet amazing part was he actually endorsed his son’s action when he exclaimed that his son’s disgusting child pornography could be found on most men’s cell-phones. Now this is what I call a pervert mentality and I dare not imagine the contents of his hand-phone. He could have video clips that if revealed, would be more explosive than former deputy Speaker Vijandran’s 1988 sex video scandal.

Equally sad is to have chief commissioner of the newly cosmetic-upgraded Malaysian Anti-Corruption Commission (MACC), Ahmad Said Hamdan, who thought it was perfectly alright for his son to import child pornography into Australia as he believes it was comparable to just a minor traffic offence. As long as you pay the summons then the story should ends there *and commit the same offence again?*. Also the chief commissioner does not think he should be linked to his son’s (child pornography) offence as if he didn’t play any part in his son’s upbringing. But the most puzzling yet amazing part was he actually endorsed his son’s action when he exclaimed that his son’s disgusting child pornography could be found on most men’s cell-phones. Now this is what I call a pervert mentality and I dare not imagine the contents of his hand-phone. He could have video clips that if revealed, would be more explosive than former deputy Speaker Vijandran’s 1988 sex video scandal.

Hey Ya'll,

ReplyDeleteBelow is a list of the most recommended forex brokers:

1. Most Recommended Forex Broker

2. eToro - $50 minimum deposit.

Here is a list of money making forex tools:

1. ForexTrendy - Recommended Odds Software.

2. EA Builder - Custom Indicators Autotrading.

3. Fast FX Profit - Secret Forex Strategy.

Hopefully these lists are benificial to you...