KLSE Stock Prices

Warrants Info

Call-Warrants Info

Warrants Analytics

70 Stocks for Short

Schaeffers Rating

Implied Volatility

Options Expiration Calendar

Option Chain Chart

Insider Transactions

Bloomberg Live-TV

Business Times

The EdgeDaily

Star Business

United States ...

MarketWatch

Reuters

CNBC

Bloomberg Asia

| StockTube Readers | |

|---|---|

| You! Join My Community | |

| View Reader Community | |

| Join this Community | |

| (provided by MyBlogLog) | |

Wednesday, February 25, 2009

Why Cut the OPR Rate My Genius? Aren’t we’re Insulated?

Iwas wondering if some hackers were recruited by the federal government to hack my notebook to either plant some Trojan horses or just to deny my access to the internet – surfing was bloody slow that I could leave my notebook to fetch its pages while I disappeared into kitchen to cook a bowl of instant noodle. Today, Streamyx admitted their broadband users will have to bear with sluggish surfing speeds until March 5 (since Feb 18) due to circuit faults on the Asia Pacific Cable Network 2 (APCN2) between Malaysia and the United States. It further claimed that only servers located at United States would be affected but when I tried to do some transactions via Maybank2U it was crawling and screaming for help. I’m doubted if Maybank2U hosted their applications out of Malaysia though.

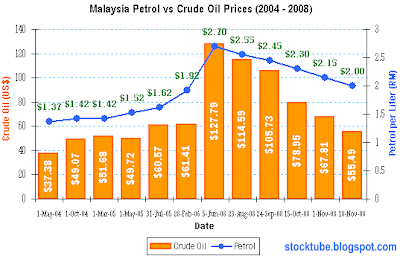

Anyway the breaking news was indeed the 50 basis point cut in OPR (overnight policy rate) by Central Bank to 2%, apparently because it was worried about growing risk of an economic contraction this year. The Central Bank has already cut the rate by a whopping 75 basis point about a month ago and to do so again with such quantum and span of time have indeed raised many eyebrows. If there’s one thing the federal government is good at, it is definitely its ability to lie through its teeth so much so that about half the analysts or economists interviewed were convinced the Central Bank will leave the OPR alone this time. How wrong they were but can’t blame them since even the PM-in-waiting Najib Razak almost swore that the country will be insulated from the current global Great Recessionand we should continue partying all day and night *grin*.

Now, to see how bad U.S. economy has become since its 2007 peak, we got to measure the shares performance from some big boys:

- General Motors Corp. (NYSE: GM, stock) shares have fallen from $30.30 to $2.22, less than the cost of a standard spark plug (about $3.79).

- A share of Citigroup Inc. (NYSE: C, stock), which cost $55.66 at the beginning of 2007, now costs $2.60. ATM fees can total $3 or more for using an out-of-network bank card.

- New York Times Co. shares have fallen from $24.27 to $3.95, cheaper than the $4 cost of its Sunday edition.

- General Electric Co. shares fell from $30.30 to $9.08, cheaper than a GE two-slice bagel toaster at Wal-Mart, selling Tuesday on the clearance rack for $12.

- Office Depot is down from $38.27 to $1.26, less than a 12-pack of medium point Papermate BallPoint Stick Pens which runs $1.89.

- US Airways has fallen from $53.89 to $3.66, less than the current $4 cost of two in-flight coffees.

Maybe, just maybe, you could witness the stock prices of the blue-chips tumbles and sit together with those so-called useless penny stocks.

Other Articles That May Interest You …- Ahoy there, Dow is sinking below 7,000-level

- What can Najib do to increase Rating and win Voters?

- Stocks Investing - what you can learn from PC Fair

- Here’s 10 cents for you beggar, I’ll take 50 cents myself

- Bailout of bankers is bad but Maika’s bailout is pure Stupid

- Stimulus Plans, to be spent Wisely or ended up Elsewhere?

- Let’s Close the Global Stock Markets, shall we?

- Panic again, $700 billion is insufficient to treat disease

Tuesday, February 24, 2009

Ahoy there, Dow is sinking below 7,000-level

U.S. financial crisis is getting worse and it seems the current cycle of recession could stretch deep into 2010. While it was a good sign for traders to short the stock or whack the Put Options when Dow Jones plunged below 8,000-level recently, the global financial systems could experience turmoil many times worse than 1997-1998 Crisis. It’s either Great Recession or Great Depression for you, there’s no two ways about it. And if you’ve patiently waited until now without committed any hard-earned money into the local stock market then give yourself a pat. I mentioned local stock market because if you’re trading U.S. stock market then you should be laughing all your way to the bank – provided you go along with the pulse of the market.

This is the best time to test your emotion (yeah, I’ve mentioned that boring statement yet again) and if you can filter between the diamond and glass then this is probably your time to make the first barrel of gold. And by this I meant you can differentiate if analysts / fund managers / economists were actually bull all their way to confuse novice investors. But you really can’t blame them because their boss was yelling at them to increase the transaction volume (else start packing) so here you are reading “Buy” calls from them. Sometimes I wonder if they know what they’re doing considering 7,000-level is quite vulnerable and have never been tested for its support strength for many years. Dow plunged another 250 points Mon to 7,114.78 and is starting threatening the 6,000-level.

If Dow never recover or show its muscle above 7,000-level then expect the worst to come any minute soon. All this while the Dow has been absorbing the pains of beating and it can only do so for so long after which it would probably drop like a rock. You might say “Nah, it can’t be that

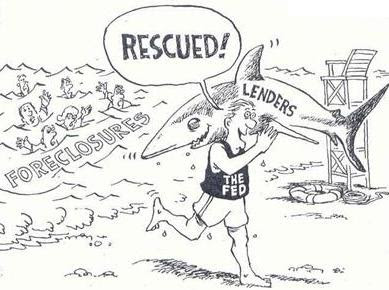

Sure, we shouldn’t talk ourselves into this gloomy and doomy thingy as it would just make things worse. But why fly against the wind when the writing is on the wall? Robert Shiller also believes that President Obama’s administration has yet to find the silver bullet to the current problem. To add salt to the wound, it appears Citigroup Inc. (NYSE: C, stock) is quietly taking advantage of the havoc by asking U.S. government (or rather taxpayer) to convert its $45 billion of preferred stock in Citigroup to common stock and hence increase government’s stake to 40% from current 8%. But the problem is if the government was to do so it should end up owning 80% of Citigroup and not 40%. This is just one of the many problems that could prolong the economic recovery process as the bailout or rescue plans seems to be getting complicated.

However with the pending installation of Najib Razak as Malaysian sixth Prime Minister in early Apr 2009 and the much talked about second stimulus package of about RM35 billion plus the coming UMNO general election, the local stock market “should not” experience any huge drop (invincible hands are supporting the KLSE) unless of course the U.S. financial market drops extraordinary bombshells to the already pessimistic investors.

Other Articles That May Interest You …

Sunday, February 22, 2009

UMNO begging QC’s help in London – a Mistake Coup?

Ever since the federal government (or rather UMNO) forcefully taken over one of opposition’s states of Perak the de-factor opposition leader Anwar Ibrahim couldn’t afford to smile as much as he used to be. Just like the stock market Anwar was charging like a bull as if the market was experiencing Super Bull-Run after his party PKR together with team-mates of PAS and DAP unexpectedly captured 5 states. For a moment he felt immortal and the reach to the Putrajaya was within sight. However unlike the outgoing Prime Minister Abdullah Badawi, the PM-in-waiting Najib Razak did not waste much time wrestling Perak state from Anwar. It was not many months ago that Najib via another UMNO warlord Muhyddin Yassin successfully forced Abdullah to agree to resign in Mar 2009.

Now it seems the hunter becomes the hunted and vice-versa. And just like the stock market Anwar feels vulnerable and is crawling like a bear while Najib becomes the bull charging like there’s no tomorrow. Suddenly the view of Putrajaya becomes so far away to Anwar while Najib’s wife, Rosmah, began to taste the power of those who walk in the corridors of power. She must have enjoyed herself to the fullest in her appearance in the government-controlled media during the campaign asking for donations for the Gaza. Like her husband Rosmah can smells the aroma of the number-1 seat currently held by Jeanne Abdullah. The clock is ticking and the vision of her being installed as the most powerful woman come this Mar is enough to make her climax, who wouldn’t right?

Unlike PR (Pakatan Rakyat) who managed to win over Perak state through peoples’ vote, BN (Barisan Nasional) used the back-door (intimidation, bribery and threat) in bringing down the Perak government. The last thing on federal government BN’s menu is a state-level snap election not because BN will fail miserably but because the scale of embarrassment could influence the state of Sarawak to deliver important State and Parliament seats to opposition PR coalition. Hence BN would rather play dirty to win battles than to fight like gentlemen. In fact the current dirty politics adopted by BN makes even the former Prime Minister Mahathir disgusted. When a former dictator felt irritated with the dirtiness it goes to show that the current situation is so pathetic that besides skin-color the future leader is comparable to Zimbabwe's President Robert Mugabe *scary huh?*.

This time the silver bullets were Selangor chief minister’s “Cows and Car”accusation. And the main actor used is none other than Malaysian Anti-Corruption Commission (MACC) chief Ahmad Said Hamdan who went beyond his job scope as the head of an independent body by “declaring” that there was strong evidence that Selangor chief minister misused his powers over the maintenance of his personal car and the distribution of 46 cows worth RM110,400 for slaughter during Aidil Adha celebrations in his parliamentary constituency of Bandar Tun Razak last December. If you do not know Ahmad Said he’s the person whose son, Ahmad Shauqi bin Ahmad Said, a former pilot with Malaysia Airline System (KLSE: MAS, stock-code 3786) who was caught importing child pornography when he arrived at Adelaide Airport early last year.

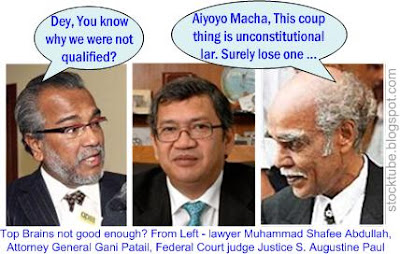

Sure, AG Patail has led his team to the defeat of Pulau Batu Puteh’s sovereignty to Singapore but that was because the International Court of Justice has 16-judges.It wasn't Patail fault that the judges couldn't be "persuaded" to swing the decision in favor of Malaysia. I’m willing to bet all my fortunes that if 3-local-judges led by Augustine Paul were to hear the Perak Constitution Crisis dispute; BN should have an easy victory over the opposition. Heck, I’m sure that Speaker V.Sivakumar would be crying arguing his case when Muhammad Shafee Abdullah opens his mouth in court. We’re talking about top brains here dude so it doesn’t make any sense for the government running helter-skelter booking tickets for the trip to London. You meant those foreign Queens’s Counsel knows better than Muhammad Shafee Abdullah, Gani Patail or S. Augustine Paul about the country’s constitution? Simply unbelievable that UMNO is reduced to such a pathetic situation that they’ve chickened away to London and is begging Queen’s Counsel for help!

Other Articles That May Interest You …

Saturday, February 21, 2009

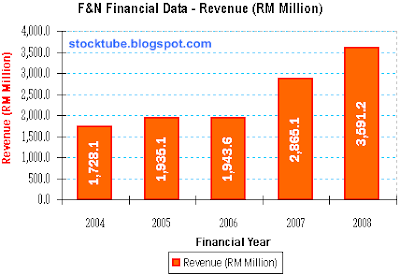

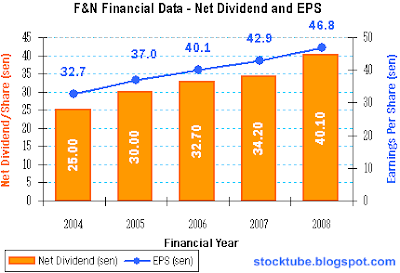

Defensive Stocks Screwed - more after F&N & Carlsberg?

One of the readers asked me about Genting Group’s (KLSE: GENTING, stock-code 3182) stock, a company I last wrote in June 2008 and since then I never look back. The stock was on free-fall back then and I presumed nobody dares to catch a falling knife. In fact when the group succeeded in its bidding for Singapore’s $5.2 billion Integrated-Resort project, investors had temporarily pulled their hand-brakes simply because the risk on the stock had increased many folds - the project will suck-up huge amount of money while the revenue would have to wait for some years. Hence why the rush for the shares? Genting is not a defensive stock and investors who bought the stock did so because they were in for long-term *like Warren Buffett, grin*.

However the problem with such huge project is the uncertainties in the overall cost especially the raw materials. Just like stock market either you’ve locked in cheaply or you were sucker for paying high price for the materials. Unfortunately there’s no crystal ball to tell and not even the late gambling tycoon Lim Goh Tong could predict the outcome of this game. And Genting’s latest announcement thatSingapore’s theme park opening costs has increased and will erode earnings this year was enough to send the stock price lower. Genting International Plc (SIN: G13) is optimistic the Singapore project is on schedule for the grand opening by early 2010 but it is still at the mercy of the global recession. So for the time being, I’ll give the stock the pass.

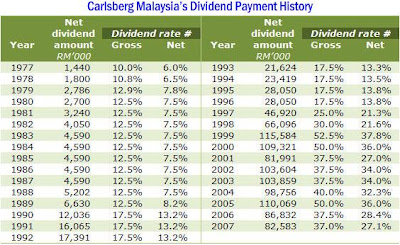

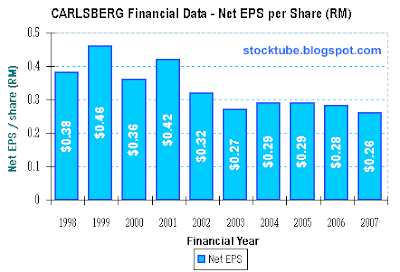

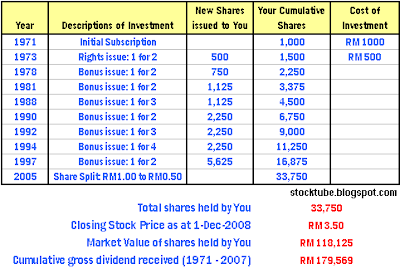

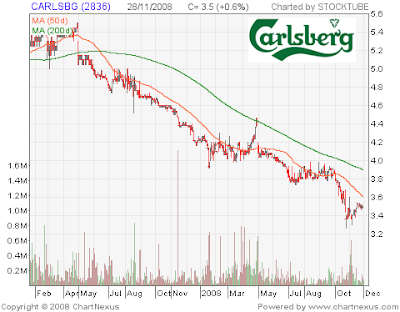

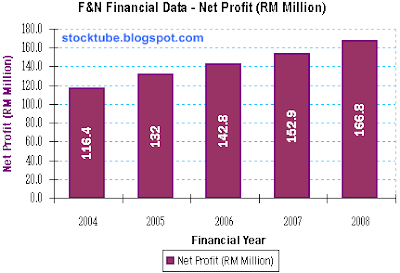

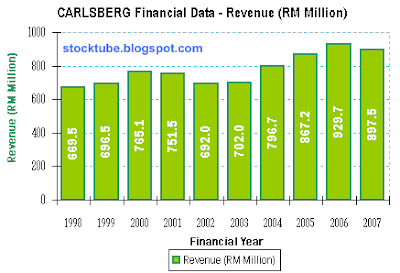

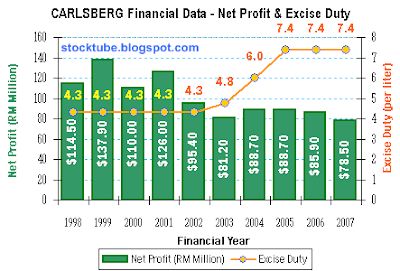

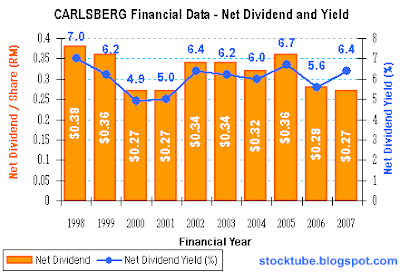

Talk about defensive stocks – perhaps the most shocking news came fromCarlsberg Brewery Malaysia Berhad (KLSE: CARLSBG, stock-code 2836) andFraser & Neave Holdings Berhad (KLSE: F&N, stock-code 3689). Surprisingly Carlsberg board decided not to declare a special dividend despite having cash reserve of RM227 million, up from RM217 million a year ago. Investors were furious that the company only maintained final dividend of 12.5 sen in 2008 (same as in 2007) without the normal special dividend. Without surplus payout (60% less from at least 35 sen) investors found little reason to hold on to their stocks and thus the sell-off. Carlsberg meanwhile justified that the company needs to preserve cash for investment and analysts believe the company may have set its eyes on company to acquire soon.

While F&N can now claims freedom from restriction under agreement with Coca-Cola, in reality you need times to market and penetrate new market. Here you’re talking about replacing a branded Coca-Cola soft drink so the impact from the lost-sales will definitely be felt else why repetitive explanations? Heck, nowadays you can even find Coca-Cola Chicken Rice as part of the menu. Frankly speaking if F&N could substitute Coca-Cola with its own drinks (regardless whether it’s carbonated soft drinks, coffee, tea, isotonic, fruits or Tongkat-Ali) without major business impact then why chose to be at Coca-Cola’s mercy all this while? Surely it’s better to be in control rather than being controlled in your business expansion and growth, no? The relationship between Coca-Cola and F&N was said to be quite fragile with both can’t see eye to eye.

Other Articles That May Interest You …

- Dividend Yield Stocks (Part 3) - Carlsberg Brewery

- Stocks Investing - what you can learn from PC Fair

- Cash is King but do you have the bullets?

- Dare to catch falling knife Genting now? It could be cheaper

- Malaysian Casino King, Lim Goh Tong, passed away at 90

- TOP Reasons Why Genting Agreed To Partner Stanley Ho

Wednesday, February 18, 2009

Perak Government – Now You See It, Now You Don’t

If there’s one thing that keep us all entertained and the Perak Constitutional Crisis still in play, it’s because the Speaker, V Sivakumar, has not been bought yet by the federal government known as BN (Barisan Nasional). And let’s hope this Sivakumar has the balls of steel and stays that way. The Perak state legislative assembly speaker V. Sivakumar has just suspended Menteri Besar Zambry Abdul Kadir and his six executive council (exco) members from attending the state legislative assembly for a period of 18 months and 12 months respectively – for contempt of the assembly.

Whoa! This drama is indeed better than making 100% profit in stock investing. Who would have thought that the Speaker post that was previously dominated by BN and “equipped” with such a power would one day fall into the hand of opposition and in turn being used to embarrass the BN instead? Maybe the karma has finally comes and it’s true that whatever goes around comes around. Of course the most fortunate thing was that the traitor former DAP Jelapang assemblywoman Hee Yit Foong who betrayed her party in exchange for more than RM20 million (and the pending Toyota Camry) was not the Speaker else it would be almost game-over for PR (Pakatan Rakyat). It’s funny that the architect (Najib Razak) who plotted the downfall of PR government in Perak could miss out this important aspect.

It will paint a foolish picture on the Ruler if such “now you see it, now you don’t”in relation to the Menteri Besar were to continue. Won’t it be wise for the Ruler to dissolve the assembly and return the power to choose a new government to the people initially? Of course business and money speaks louder than thunder but at the same time to sacrifice the Royal’s dignity? Sometimes you just got to admire the wonders money can do to human being. So what are the options Najib has now that the ball is in his court?

- Perform the David Copperfield magic again – Perak Speaker V. Sivakumar somehow has to disappear and there’s nobody that has master such skill-sets other than Najib’s team themselves.

- Re-use the controversial but highly effective ISA - Forcefully arrest Perak Speaker V.Sivakumar under the pretext that he needs to be protected as the government intelligence received information that Sri Lanka guerillas are on their way onboard AirAsia Airbus A320 to kidnap Sivakumar *convincing huh?*.

- Money speaks volume – Offer RM100 million cash to V.Sivakumar plus two units of Camry and penthouse with KLCC view. Throw in a Deputy Menteri Besar post if he’s still stubborn. In addition he has the option to own 20 hectares of land beside Samy Vellu’s in Australia for a token of RM1 Ringgit.

- Declare State Emergency in Perak – the fastest way to control the state indefinitely. With police, army, judicial at its disposal nobody dares to threaten or question the federal government decision. Highly unlikely and foolish to opt for this option.

- Deface V.Sivakumar personality – pay RM500 bucks to a photoshop specialist to doctor V.Sivakumar’s photo with a local Bollywood actress in a sexual intercourse position. In hours you’ve another Elizabeth Wong’s nude photos scandal. Now get Samy Vellu (Khir Toyo needs to rest) to demand V. Sivakumar’s resignation *simple huh?*.

Other Articles That May Interest You …

What can Najib do to increase Rating and win Voters?

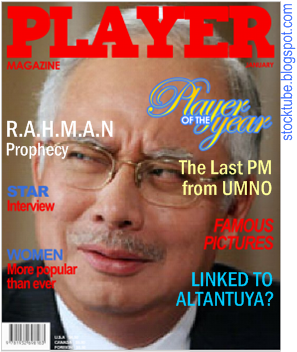

Public in general is getting sick and tired with the excessive politicking and the stalled economy which is directionless. The writing is on the wall that PM-in-waiting Najib Razak will take over the premiership from outgoing Abdullah Badawi in another month so the former does not have to overly panic but instead rejoice together with his wife Rosmah for the coming “Big Day”. Najib should start demonstrating that he knows Economy 101 and is miles better than the sleepy Abdullah. The fact that his political moves, including Perak’s recapture, so far are perceived to be dirty is enough to trigger alerts amongst his advisors to re-strategize the game-plan. People are sick with his tainted image especially with the Mongolian Altantuya baggage. Najib needs re-branding else the novice coalition of PKR-DAP-PAS will find it too easy to capture the Putrajaya.

Really, Najib can actually scores some points if he concentrate on the country’s economy in preparation for the recession onslaught scheduled to hit the shores not many moons away. It’s

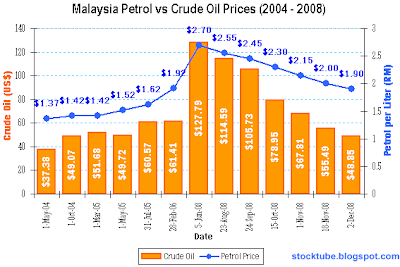

Stop insulting people’s intelligence when you hiked electricity by 24% in July 2008 but decided to reduce it by merely 3.7% starting Mar 2009. It’s your problem that you happily agreed to purchase excessive power from IPPs (independent power producers) at high price. It’s laughable to read that Tenaga Nasional Berhad’s (KLSE: TENAGA, stock-code 5347) president and chief executive officer Che Khalib Mohamad Noh was chosen as the Malaysia’s CEO of the Year 2008 Award. Not that I’ve any grudges against this person but to continue register losses and to take the easy way out by increasing electricity tariff to improve bottom-line is a pretty simple job, no? Going by the rate on how the company’s total debt increases from RM22.7 billion (Aug 2008) to RM24 billion (Nov 2008) it seems your children will continue to pay for the debts. Sure, go on and blame it on foreign currency conversion losses etc. Couldn’t they find a better CEO for the award?

Every Tom, Dick and his dog knows or at least have the perception that the latest Elizabeth Wong’s nude photos issue was politically motivated and all the fingers are pointed at Khir Toyo and Najib’s incoming administration. Even if it was done by enemy within Pakatan Rakyat coalition itself, people tend to believe it’s the hidden hands from BN. And this damaging image of BN that is cheap and willing to go so low to discredit the opposition is something that Najib’s new administration has to tackle. The joke is if Elizabeth Wong was to resign to take responsible for this privacy intrusion than the simple strategy to get Najib to resign is to take his photos when he answers nature’s call *grin*.

Other Articles That May Interest You …

- Go get Kedah and Selangor. Then focus on economy, deal?

- Dirty Politics and Economy – Choose Wisely, Najib

- Perak, PR, BN and Gamuda - It’s all about Business, Stupid

- Why Recession is important and we still need it?

- The Junk US Dollar Skyrockets but whose fault is it?

- In time of Cheap Lobster, Peoples Money are Robbed

- Windfall Tax - Punishment or Desperation for Money?

- Maths Genius Sufiah enjoys Sex career, no Regrets

Tuesday, February 17, 2009

Curse the Blogs, blogger to die before new PM sworn in?

Could you imagine what would happen if today is the year 1993 or better still1988? Both years are important because it was during these periods that Malaysia experienced her biggest Constitutional Crisis. And the mastermind who architected both Constitutional Crisis was none other than the father of Mukhriz Mahathir and its puzzling the son of the former prime minister is now crying wolf asking opposition DAP Chairman Karpal Singh to be charged under Sedition Act or the Internal Security Act (ISA). In the 1988 Judicial Constitutional Crisis Mahathir amended the Constitution so that the Judicial only has powers if the Parliament (Executive) thinks they may have it. In the infamous 1993 Monarch Constitutional Crisis Mahathir stripped the legal immunity of the royalty and with the amendments to of Articles 32, 38, 42, 63, 72 and 181 in the Constitution of Malaysia, the public can now criticize or even sue the Sultans or even the Yang di-Pertuan Agong without fear of Sedition Act.

It was reported that independent investigator Harry Markopolos knew something fishy was going on with Bernie Madoff years before the Ponzi scheme burst. Unfortunately he couldn’t get the SEC (U.S. Securities and Exchange Commission) to move their fat-asses to start an investigation. Indeed if only Harry Markopolos had blogged about his analysis and why he thought Madoff’s business model was a Ponzi scheme after all then this scandal could be stopped and many peoples’ hard-earned money could be saved. Blogs travel at lighting speed and could spread better than wildfire if its content is explosive. Remember how the Malaysian government was protective of Lingam and Chua Soi Lek over their videos’ scandals? Government-controlled media did not reveal the names but the blogosphere were already updated with the actors’ indentity. And now we have Elizabeth Wong who claimed she was a victim when her nude photos were distributed on the internet.

Other Articles That May Interest You …

Monday, February 16, 2009

Go get Kedah and Selangor. Then focus on economy, deal?

President Barack Obama has gotten the Congress to pass the $787 billion economic stimulus plan. There’s nothing to shout about because the U.S. economy will take at least another year, if you’re lucky, to see favorable result. Meanwhile over in Malaysia everyone is waiting for the coming second stimulus economic package to excite the sliding economy. The quantum is still unknown but it’ll be between RM7 billion to RM35 billion. Only certain top politicians and the governor of Central Bank knew the figures because they knew how the country was doing in fourth quarter of 2008. So if the country is about to grow at 0% this year then they may pump in RM35 billion which is equivalent to 5% of the country’s GDP (gross domestic product), if their intention was to declare 5% positive growth. Simple and you don’t need to become David Copperfield.

Investors are either still parking their money in the banks or already bought some stocks hoping to make some money when the mini-bull starts displaying its tail once the second stimulus plan is announced. But there’re other excitements other than the potential RM35 billion stimulus package. If the year 2008 was the year when the complacent BN (Barisan Nasional) government was given a knock on the head when it lost five states, the year 2009 could well become the year BN strikes back to reclaim its lost dignity and face. Compared to opposition PR (Pakatan Rakyat) the BN has the advantage of coaxing the Rulers to become one of them, not to mention the unlimited supply of money at its disposal.

Malaysia-Today made a lengthy explanation and justification why Sultan of Perak was playing a fair game to both PR (after they won the majority from the people) and BN (after they paid millions of dollars for defections and won back the majority now). It further claimed that the Perak state might fall again back to PR but franklyI’ve my reservation because money talks and at this moment PR does not have the deep pocket to turn the table around. In addition it’s beyond everyone’s understanding why the Sultan of Perak did not opt to dissolve the assembly for a state-level election when it was put on the table that the Ruler knew both BN and PR could not form a strong government. Why prolong the situation when the writing was already on the wall?

I suppose it’s true that everyone including politician has his / her price tag. Stop crapping about your struggle to help the communities and the people because given an envelope or briefcase, politicians would rather take RM20 million – RM50 million and abandon the people who voted them in. So can you blame the Rulers to put their business interest on top of other priorities? It was only natural for the Selangor Sultan to defend his uncle, Perak Sultan, and if PR were to go through the same cycle as their brother in Perak, consider the Selangor state gone. If Najib is smart enough, he should capture the Kedah follows by Selangor now that the PR is in disarray and would not be able to mount any effective counter-strike.

Other Articles That May Interest You …

Friday, February 13, 2009

RM35 Billion - did you make any money from Gamuda?

By now you are an idiot if you still think the global recession is not real and a confirmed moron to think that the current economy crisis will not affect your country. You can’t pretend to see no evil hear no evil simply just because you’re clueless on how to tackle this problem. It’s alright to admit that you’re clueless and helpless on how to go about it. Furthermore the most powerful person in the world, the President of the United States, is still searching for the magic potion so there’s nothing to be ashamed of. However it would be disastrous if you try to cook up misleading stories and pictures that the country is doing well and is insulated or shielded from this disease called recession.

Japan’s economy contraction is predicted at more than 10 percent in the fourth quarter. Job cutting is gaining momentum with Pioneer Corp., Sony Corp., Nissan Motor Co., NEC Corp.,

At this moment nobody knows if we’ve just entered the tunnel of another Great Depression but understandably most of us would rubbish such scenario. What about Great Recession then? It sure sounds better than Great Depression so it’s acceptable. Investors specialize in distressed debt and bankruptcy believes theUnited States is going through a “Great Recession”. Holly Etlin, a managing director at AlixPartners with 30 years of experience in restructuring, said financial distress will last three to five years due to a lack of liquidity in credit markets and lack of debtor-in-possession financing. Nevertheless there’re still opportunities to make money in the stock markets but before that you need to ask yourself what type of investors you are?

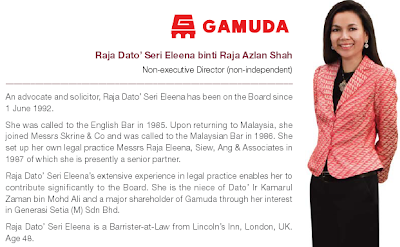

If you’re a long-term investor, are you flexible enough to adapt the method of short-term investing? And if you’re a short-term investor, can you get out of the box and adopt swing trading strategy? You would have made some pocket money if you know how to take advantage of situation around you. There’re opportunities in every crisis. Remember the Perak Constitution Crisis? Did you read StockTube's previous article - Perak, PR, BN and Gamuda - It’s all about Business, Stupid. Political anger aside, you would have made some bucks on Gamuda Berhad (KLSE: GAMUDA, stock-code 5398) if you read the little hint in the article. Today Gamuda shares jumped the most since Nov 10th and it’s all because of the believe that the company will enjoy the fruits of the coming second economic stimulus package scheduled to be announced on Mar 10th.

Anyway Gamuda seems to have hit the resistance of RM2.10 a share and if it can breach this level, the next resistance will be RM2.60. The fact is Najib Razak is almost guaranteed to be the country’s sixth Prime Minister in compliance to the R.A.H.M.A.N prophecy. And the new wave of companies or cronies closed to Najib is set to laugh all their way to the banks.

Other Articles That May Interest You …

Wednesday, February 11, 2009

Dirty Politics and Economy – Choose Wisely, Najib

Sometimes you can’t help but wonder if this old fox was really senile or just pretending. The explosion of Perak Constitution Crisis created dilemma to the same people who had been lauding the Perak Sultan as the most learned and respected Ruler ever seen. Suddenly they couldn’t accept the fact that their beloved Ruler has turn against them. They couldn’t swallow the bitter pill, what more with the tainted PM-in-waiting, Najib Razak, smiling from ear to ear appearing twice at the palace and ultimately “convinced” the Ruler to declare him the “winner”. It was like the people were being betrayed and slapped in the face. Instantly the memory of former premier Mahathir came into picture.

Mahathir single-handedly stripped the country's sultans of immunity from prosecution for any breaches of the law 16 years ago. It was a period of chaos whereby the rulers of nine of Malaysia’s 13 states gained spotlight for the wrong reasons. Sultan Ismail Petra of Kelantan refused to pay more than $800,000 in import tax to the federal government for a Lamborghini Diablo sports car that he had imported. Douglas Gomez, a Johore hockey coach, had been summoned to the palace and beaten up by Sultan of Johore, Sultan Mahmood. Even Shahidan Kassim (rice cartels warlord) claimed that the Sultan of Johore and his elder son had been implicated in 23 criminal acts in the last two decades, including rape, assault and manslaughter.

Back to Perak the local kopitiams (coffee shops) suddenly became alive and not so boring anymore. People have found new topics for their discussions. The joke of the town was that there was actually reason why Najib Razak won Perak Sultan’s heart while people’s Menteri Besar Nizar Jamaluddin lost. Najib left (the palace) and return the second time because he forgot to bring the check-book *grin*. Anyway now that there’re two pending by-elections around the corner the pressure has abruptly shifted from Anwar to Najib’s shoulder. Well, Anwar has lost a state and all the fingers were pointed at him. But the palace and Najib may have under-estimated the reactions from average-Joes. And these two by-elections may be the litmus test to measure the anger of people on the street. Between both it appears Najib will have more to lose than the Sultan of Perak. Due to the status of Sultan people might find the convenience of making Najib the next most hated leader next to President Bush *where’s the shoe?*.

“The main thing is to increase income so that the economy will rise through higher consumption of local products … Malaysia needs to conduct a careful study on ways to turn the country into a high-cost, high-wage one to ensure the sustainability of its economy in the years to come”, says Mahathir Mohamad in an interview with Business Times. He cited Singapore as a country that not only found its niche in financial services, but had managed to increase both its gross domestic product and per capita, disposal income of its people, to reach a developed nation status. Although it’s amazing he didn’t realize such a model when he was the PM before at least he admitted (indirectly) his mistake of adopting (forever) cheap-labour concept. One wonders where he was all this while. Hasn’t he heard of a city called Hong Kong?

Other Articles That May Interest You …

- UMNO is big Bully but that’s because PKR-DAP are Babies

- Perak, PR, BN and Gamuda - It’s all about Business, Stupid

- Yippee! State Governments for Sale - Any Top Bidders?

- Boycott US-made products? No Thanks, it won’t work

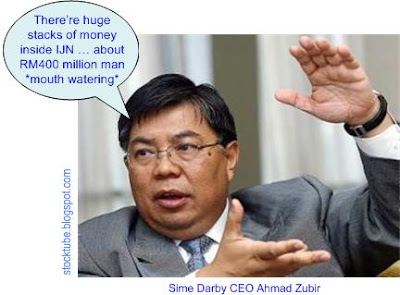

- Leave IJN alone you Greedy Sime and Corrupt Politician

- Take your pick – Yoga, Beer, Jobless or Corruption

- Out of Subsidy Mentality but into the Crocodile’s Mouth

- Stimulus Plans, to be spent Wisely or ended up Elsewhere?

- The New Great Depression is a Different Animal, Stupid

Monday, February 09, 2009

UMNO is big Bully but that’s because PKR-DAP are Babies

Ididn’t know that my previous article (read here) was picked and published by the famous and cotroversial Malaysia-Today (read here) until one of my readers alerted me (thank you). And from the comments received it appeared almost 100% of them are against the decision by Sultan of Perak’s decision to “award” the trophy to federal government BN (or rather UMNO). Government-controlled print and electronic media are still in the denial state and continue to play the one-sided and bias reporting as if the whole population of 20-plus million populations were born yesterday. DAP Tiger Karpal Singh and PKR People Champion The-Rock Menteri Besar Nizar Jamaluddin were the new targets selected by UMNO in their latest attempt to put the duo to fight with the monarchy.

What else can I say about Karpal Singh except that he’s a man with strong principle as far as politicians are concerned and for that you either hate him or love him (at least he calls a spade a spade) – there’s no two way about it. Sure, he’s famed for pick up fights with almost everybody – former dictator Mahathir, his former boss Lim Kit Siang and now the opposition de-facto leader Anwar Ibrahim. You may admire him because he’s a real cool and great lawyer but as a politician he can’t be a leader because he’s not a team-player and could be as stubborn as a mule. He talks and sleeps law and won’t blink twice about suing anyone he thinks have violated the laws and this includes the Royalty – the Sultan of Perak. And this game the UMNO new bullets to divert the whole Perak latest crisis from Najib to Karpal Singh.

As with normal bully UMNO hides their hand that steals behind their back and pointed their fingers that it was the decision by Sultan of Perak to give the state back to BN. They were not to be blamed and in fact the babies PKR and DAP should now be punished for seditious act for going against the Sultan’s decision. See how the master in work? Maybe it’s true that the former government of PKR-DAP-PAS is still not capable of running a state and I’m talking about defending your territory against the barbarians outside cruel wall, mind you. Perakians may have found their truly people’s champion but obviously PKR-DAP-PAS is not ready for the real survival in the dog-eat-dog world. Threw in a Toyota Camry and you can get DAP clerk Hee Yit Foong wagging her tail defecting to the new master UMNO, although I’m not sure if she dares to go back and meet eye-to-eye her Jelapang constituents.

Although the current new government of Perak may not survive come next general election at least the BN (and other cronies) has another four years to plunder the state. The RM12.5 billion (US$3.67 billion) double-track railway may regain steam after electrified by the latest crisis that saw the BN government back to power. Gamuda Berhad (KLSE: GAMUDA, stock-code 5398) needs no introduction here while another winner in this latest episode is indeed MMC Corp Berhad (KLSE:MMCCORP, stock-code 2194). Low-profile Syed Mokhtar Al-Bukhary who owns MMC Corp is a long-time supporter and fundraiser for UMNO and running the political party needs lots of money so it’s only normal to feed the people who give you back the money - from left to right pocket. Again, it’s all about money and nothing personal.

It’s time for PKR-DAP-PAS to stop sulking and scratch each other’s face about the lost pacifier. Instead they should re-strategize on how to move forward to capture the federal government in the next general election. Hey, who says the next general election is four-year away? It could be earlier if a nation-wide snap election is being called should the UMNO power-struggle enter another level. Again, see how brilliant UMNO is in diverting their internal problems to this Perak crisis? Anwar, via his previous experience in UMNO, perhaps should conduct a Basic-101 class to his partners, DAP and PAS about their common enemy – the bully UMNO. The next state to fall could be Kedah although new plans and more money might be needed to deploy the same model to the last two frontiers, Selangor and Penang.

Other Articles That May Interest You …

- Perak, PR, BN and Gamuda - It’s all about Business, Stupid

- Gamuda and IJM Corp on their way to Merge soon?

- The Richest Malaysians, Robert Kuok scored the perfect 10

- Gamuda’s Game-Over reveals Dark Side of Economy?

- Money is Evil? But it can buy you Frogs (Cheap Postman)

- MMC overpaying SATS, Albukhary sucking money out

- Windfall Tax - Punishment or Desperation for Money?

Friday, February 06, 2009

Perak, PR, BN and Gamuda - It’s all about Business, Stupid

Dubai is probably the best yardstick to measure the economy of the Gulf region; at least Dubai was the most prosperous city within the region. People might not know where Oman is but they can’t miss Dubai. For years people have been flocking to this city hunting for their first pot of gold. As with the normal cycle property market was booming with tons of first-time speculators snapping up properties as if they were buying tiramisu cakes. Money was stretched to the limit in order to buy maximum number of properties possible. These properties would then be rented out without much problem, thanks to the booming economy, and thus generating positive cash-flow. It was a no-brainer method to generate wealth until now.

Now that the property bubble has burst, thanks to global economy recession, these novice speculators are selling their once-cash-cow to anybody at fire-sale discount. Effectively most of Malaysian construction companies were crying asprojects agreed got hold or cancelled. Gamuda Berhad (KLSE: GAMUDA, stock-code 5398), the country’s largest construction and engineering with interests in construction, water, toll and property development is feeling the heat (7% of Gamuda's outstanding order book comes from the Gulf region) after the WCT Berhad and Meydan LCC joint venture to build a RM4.6 billion race-course in Dubai was cancelled. Gamuda generated investors’ interest recently when the founder and Managing Director Lin Yun Ling cashed-out early 2008 sending the stock price to the south.

Malaysian politics is perhaps the dirtiest but you can’t blame the public to have a perception that the federal government was twisting the arms of the Sultan (silly assumption, is it not?). However on the business perspective you do not need to wake Einstein up from his grave to tell you that Gamuda is basically at the mercy of the Federal government. With water taps closed by the federal government to three of the most developed states, Selangor, Perak and Penang, Gamuda is screaming for projects. Certainly the nation has the money. In fact the country is flushed with more money than before the Mar 2008 general election simply because the federal government does not know where to pump the money to since the most developed states such as Selangor, Perak (was) and Penang are controlled by opposition parties.

Anyway let’s imagine (it’s Friday dude) a conspiracy theory and this Perak crisis is just the tip of an iceberg. Let’s assume Anwar has the number to take over the federal government but at the same time he’s also aware that to do so could backfire badly. He needs to start the ball-rolling and he announced about the defection, 916 and so forth. After Permatang Pauh and Kuala Terengganu, he knew Najib is desperate for trophies so the plot was to sacrifice Perak. He accepted the bait (was it?) offered by Najib with this fella Nasarudin. A good strategy to test water (effect of defections) and to flush out traitors within PKR, Perak has to fall to BN. Now Najib has gotten Perak State as the trophy to show off during the coming UMNO election and claimed it was Anwar who started the defection plan and he simply finished it. The next episode will see that Anwar will snatch the federal government with the readied defectors while screaming “Najib started the battle so I'm just finishing the war”. What a wet dream!

Other Articles That May Interest You …

- Experience the Real Panic in Persian Gulf Slowdown

- More data coming, more volatility, lesser ammunition left

- Gamuda and IJM Corp on their way to Merge soon?

- The Richest Malaysians, Robert Kuok scored the perfect 10

- Litrak Capital Repayment, a nice way to suck money out

- Gamuda’s Game-Over reveals Dark Side of Economy?

- Gamuda tumbled, opportunity to Buy or reason to Sell?

- From desert to Tourism and Property Magnet

Thursday, February 05, 2009

Yippee! State Governments for Sale - Any Top Bidders?

Finally, the honeymoon is over for Pakatan Rakyat after 11-month running the Perak state. The Sultan of Perak seems to think that state assembly dissolution is not necessary over the current crisis. Interestingly police and FRU were speedily fast in taking over the State Secretariat building after outgoing Menteri Besar (Chief Minister) Nizar was reportedly refuse to resign. Why the Sultan of Perak disagreed to dissolve the state assembly is beyond many imaginations and it appears many netizens are not happy with the decision but to resists is futile – as the saying goes. It’s wise to remain calm and refrain from posting any seditious comments as that could be easily used as an excuse by the federal government to put more heads behind bars (no wonder Najib was grinning from ear to ear after his meeting with the Sultan).

In reality the chess-master Najib has planned the whole takeover brilliantly, easily outclassed Anwar in this battle. It doesn’t matter if it has costs RM200 million (RM50 million each) of taxpayer money to fish the four defectors to bring down the Perak government. Considering that the ruling government has spent a whopping RM500 millon but still lost the Kuala Terengganu by-election recently, this RM200 million is very well spent. Duplicate the same model on Selangor, Kedah and to some extent Penang you might be able to wrest back all those states lost in the 2008 Mar general election. People are fuming that if this is the way to topple (or rather buy) government then why bother vote for the party they desire? Sure, if the Perak state is dissolved then the possibility of Pakatan Rakyat gaining two-third majority is pretty high, as what some pundits said but I guess we'll never live to know this theory.

Anwar and his gang can get the 100,000 supporters for a showdown in Ipoh stadium but it can’t change the fact that the Sultan has made the decision (but the Constitution said otherwise about how Menteri Besar can be dismantled?). Maybe what the Sultan has done is a blessing in disguise. It will awaken the politicians and people that wresting a government by way of defections is simply sillybecause the betrayals could jump to the other site of the fence once again. Like it or not there’re still many assemblymen especially the opposition parties who has not smell the aroma of RM1 million, let alone RM10 or $50 million. The Sultan cannot take this (money politic) into consideration as according to the law, he has to agree to assemblyman who commands the majority of support and unfortunately Barisan Nasional has it. But hey, why Najib is leading the group and not the incoming Menteri Besar (Chief Minister)? Najib is not the one who’s going to be the next Menteri Besar so he has no business negotiating with the Sultan (see the link about the theory that Sultan was being arm-twisted here?).

Whatever it is the floodgate is now opened to anyone desire to jump to any party and this is not healthy although interesting *and fun*. What better way to become instant millionaire than to hop around? Assuming you’ll get RM10 million per-hop the dream of becoming a billionaire is definitely not far away *grin*. But then could this whole drama is just the starting episode of more explosive conspiracy plans by Anwar and Abdullah (or rather his son-in-law Khairy)? Nevertheless a crisis could be brewing between Pakatan Rakyat and the Monarchy.

Other Articles That May Interest You …

- It’s 100% Profit, small amount compared to RM10 Million

- Money is Evil? But it can buy you Frogs (Cheap Postman)

- Country is already in Recession – Forever a Liar

- I Have A Dream – A Day When Money Can’t Buy Votes

- Muhyiddin, the newly crowned AP King of the Kings?

- Take your pick – Yoga, Beer, Jobless or Corruption

- Flip-flop Badawi to the Exit Corridor – from Hero to Zero

- Economy Meltdown – Stop being Selfish and Stubborn

Wednesday, February 04, 2009

It’s 100% Profit, small amount compared to RM10 Million

The breaking and hottest news must be the current political crisis that is brewing in the state of Perak. In the latest twist it seems the Barisan Nasional Perak has secured the majority of state seats to form a new Perak Government after four Pakatan Rakyat assemblymen left their respective parties and pledges allegiance to the BN (Barisan Nasional). The ball is now in the Sultan of Perak’s court. After listened to the current Perak Menteri Besar Mohammad Nizar Jamaluddin's justification for a request to dissolve the state assembly it’s only natural for the Sultan to listen to what the mastermind Najib has to say tomorrow *cool, more actions!*.

It would be amazing if the Sultan would eventually grant the much needed dissolution but on paper it appears His Highness may satisfy that the Barisan Nasional commanded the majority thus hand-over the crown, depending on how Najib present his justification. While the perception from the public or at least mostly Perakians was that millions of dollars were paid to gain the defections, the Sultan needs some time to go back to the law books. It’s hard to say at this moment if His Highness will put this “Unwritten Law” (RM10 - RM50 million) into consideration but the fact is the Menteri Besar must step down when he loses majority support in the assembly. Going by how tactful Najib maneuvered the whole game to check-mate Anwar’s team, you just got to salute the former as with a stroke of dirty strategy the federal government manages to topple the state government. Hey! Politics is the dirtiest game ever created by human, is it not?

So what went wrong with the Pakatan Rakyat government in Perak so much so that it could collapse so easily after the short celebration when Bota Assemblyman Nasarudin Hashim defected over to Pakatan Rakyat less than a month ago? What are the lessons learnt from this latest political game?

Secondly many Pakatan Rakyat’s assemblymen are of low quality so you don’t have to be a rocket scientist to guess why a former postman and his buddy could be bought over with RM10 – RM15 million to cross-over. Besides, additional promise to let them free from the corruption charges should seal the deal. Of course the worst defector is former DAP Jelapang assemblyman Hee Yit Foong. She should be on top list (RM50 million) for the amount of money received in order to betray her party.

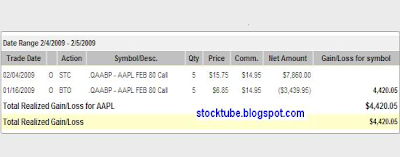

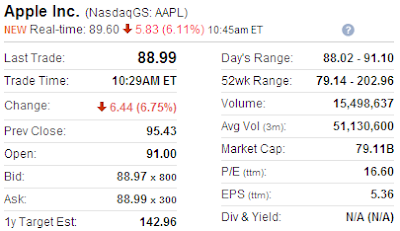

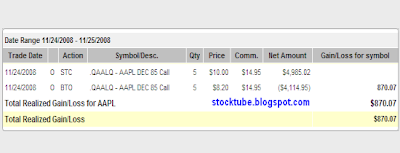

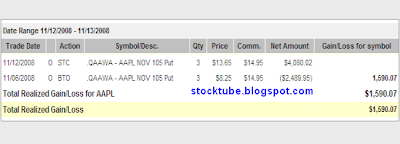

Thirdly the Pakatan Rakyat assemblymen should realize that they got their positions because the people voted them, period. Hence instead of startinginternal politicking they should instead strengthen their already fragile pact and work for the people. Maybe it’s true after all that while it’s extremely difficult to teach old dog new tricks, it’s equally hard to teach stupid dog new tricks. Newly found power could blinded these novice assemblymen and this latest political landscape should serve as a good and bitter lesson to both PKR and DAP parties that nothing is forever yours in politics. Sure, the BN is probably the dirtiest political party they can ever find in this planet but they’ve proven that they might be the ultimate survival of all. Talk about money, since it’s so useful I’ve decided to take money off the table after hit the 100% profit. I can’t bear the sight of losing my money if I were to let the greedy side of mine to show its color. Surprisingly the stock has breached the $95 bucks a share so my AAPL Feb 80 Call Option is ripe to be picked. It may not be $10 million for that matter but I earned it the legitimate way, unlike some dirty frogs who could sacrifice their souls and family names for that stacks of money. Hey! I should be made the new candidate for Pakatan Rakyat should there be a state election because I’ve strong principle – I won’t defect (I promise) *grin*.

Talk about money, since it’s so useful I’ve decided to take money off the table after hit the 100% profit. I can’t bear the sight of losing my money if I were to let the greedy side of mine to show its color. Surprisingly the stock has breached the $95 bucks a share so my AAPL Feb 80 Call Option is ripe to be picked. It may not be $10 million for that matter but I earned it the legitimate way, unlike some dirty frogs who could sacrifice their souls and family names for that stacks of money. Hey! I should be made the new candidate for Pakatan Rakyat should there be a state election because I’ve strong principle – I won’t defect (I promise) *grin*.

Other Articles That May Interest You …

Tuesday, February 03, 2009

Money is Evil? But it can buy you Frogs (Cheap Postman)

The saying goes that money can’t buy everything but then without money you can’t buy a single thing and so people still worship money till today. People still debates if money can buy true love, happiness and so forth but it’s quite subjective, really. Individual who can’t live without money thinks money can actually bring happiness. In fact how many of us can still declare that we’re still the same happy person without money due to retrenchment? I bet your sex life would turn for the worse if you’re suddenly jobless. You partner will probably give you the kick before you can even say “honey …” In reality the pros of having money overwhelmingly outshined the cons of having it.

While it’s feeling jolly good to have tons of money to your advantage, there’re many other factors that could turn the tide against you. In stock investing or option trading certain factors could turn your trades into a losing position and the losing game could snowball even after you tried to average down. In a nation’s economic crisis a decision to pump in $700 billion bailout package could do more damage – a sign or confirmation from investors that the country was indeed in deep trouble so it’s time to sell massively. In politics you chose to spend RM500 million in a by-election trying to buy votes but still you lost the battle. Strange world, isn’t it?

Fortunately there’re still many cases whereby money can buy your desired toys. For RM10 millions each you can buy over two “froggy” assemblymen (one is a former postman) to cross over to your side (why spent RM500 million on a single by-election campaign then? *scratch head*). Also money can empower you to miraculously convert a supposedly independent Election Commission to suddenly become devils and a judicial body overnight by overriding a decision made by the Perak speaker on the vacancy of two state seats. Of course in this crisis it’s strange the mighty ruling government with unlimited national funds and machinery at its disposal is simply too scare to go all out for two open by-elections, let alone a state-level election, to determine once and for all who the real winner is.

Mind boggling as it may appears, the battle for the crown is between Anwar Ibrahim (de-facto opposition leader) together with Abdullah Badawi (outgoing PM) against Najib Razak (PM-in-waiting) together with Mahathir Mohamad (former dictator PM). The excitement may have return but let’s hope there won’t be a last desperate dirty tactic of Operasi Lalang which could spoil the fun of the series. Tell you what, I’ll boycott US-made blockbuster movies if the tag-teams above could continue to entertain me with explosive actions and dramas *grin*. With more political uncertainties in the pipeline, who says it’s time to enter the local stock market?

Other Articles That May Interest You …

Friday, January 30, 2009

Unemployment – How Bad Could It Get?

It surely feels good to see Apple Inc. (Nasdaq: AAPL, stock) shares trading above $90 bucks a share after my previous article. I suppose it’s time to take money off the table *grin* today as Friday is always a good day to lock in profit, if you know what I mean. In fact the best time to cast away your greed and fear is during such long holiday whereby your determination to let your stop-loss (or rather stop-profit) do the work is put to final test. It will be even better if you do not have internet access thus denying you the ability to monitor the stock movement and manually override your earlier decision. Sometimes it’s amazing what the greed and fear could do to you.

Sooner or later you need to train yourself to put your trades on autopilot since it could put the strain off your muscles over long period of monitoring. Long hours of stock monitoring is never a good thing to your health, what more if you have many open positions. That brings to the topic of whether it’s wise to have many open positions and if not then how many is sufficient but that will be another discussion on another day. While autopilot has its advantages, it definitely robs you of the fun and excitement of predicting the stock movement in the next few hours or days. Nevertheless autopilot is your best friend when you do not have sufficient time or resources to digest macro and micro economic news and make decision thereafter.

Forget about PM-in-waiting Najib Razak’s claim that the country will never enter recession and Bank Negara’s (Central Bank) attempts to trumpet misleading signals because chances are high that Malaysia’s GDP may be in negative territory (0.7% contraction) against government’s forecast of 3.5% growth. That’s why Najib is desperate to get the so-called second stimulus package out. But the question is what happened to the first RM7 billion stimulus package? Has it been fully disbursed in the first place? If not then why ask for more money and if yes then why the effect is not felt? The last thing we want is another scandal whereby a staggering RM7 billion evaporated into thin air. On the other hand if the argument is the RM7 billion is too small a figure then why such figure in the first place?

President Barrack Obama may be right in calling Wall Street bankers “shameful” to be paid more than $18 billion in bonuses last year but I doubt he could do much with the U.S. economy even with another $1 trillion on top of Bush’s earlier $700 billion bailout package. The U.S. economy is in great mess and you don’t have to be a rocket scientist to know the country’s recovery requires a long journey. They have not even find the right medicine to their problem yet so you can imagine the scale of problem U.S. is facing now. And do I have to repeat that we’ve not even heard about Credit Card’s potential bubble?

Other Articles That May Interest You …

Friday, January 23, 2009

Country is already in Recession – Forever a Liar

Ithought I would be able to make another 100% profit on my AAPL Call Options after the company announced its earnings that beat analyst estimates. The stock jumped almost 10% after trading hours to $90.70 a share. For the quarter, the company earned $1.61 billion (or $1.78 per share) up from $1.58 billion (or $1.76 per share) a year earlier. Revenue grew 6% to $10.2 billion. Analysts were looking for EPS of $1.40 on $9.74 billon in sales. During harsh environment such as now analysts are complacent and happy if you can beat street expectation. So long as you do not announce that your company has been cooking the accounting books or your key person is having cancers naturally you can expect the stock price to jump and gap-up.

However the Dow Jones and Nasdaq’s stars were not aligned and hence Apple Inc. (Nasdaq: AAPL, stock) was not able to breach the $90 a share resistance, not that it could prior to the earnings release but I expect the stock to do so this time around. But I have to be contended that the stock closed above $88 a share. With Dow currently trading at the strong support of 8,000 I expect there would be limited chance of major sell-off Friday. I hope my prediction will come true and the stock will test the $90 again and above that level thereafter; failing which I’ve to take the money off the table, close shop and enjoy the Chinese New Year *grin*.

Of course my ranting is nothing compared to politicians who suck big times especially the PM-in-waiting who almost swore that the country will never goes into recession. Heck, the country might have already experiencing recession as we speak else why the drastic 75 basis points cut to 2.5% on Wednesday. In fact most of researchers and analyst expect more cuts to come after Chinese New Year. If indeed the PM-in-waiting is confident that recession will never hit the shore, why adamant about the RM7 billion stimulus package and is now toying with the idea of another stimulus package? If you need billions of dollars to generate a nice positive growth number, that is equivalent to cheating. I supposed you know why the standard of education in the country is falling compared to foreign universities despite record after record year of high scorers. If you lower the standard of passing marks so that the education minister can claims such artificial achievement, it’s cheating. So what if you have 10, 20 or even 50-straight-A’s scorer?

You don’t really have to look too far to see the consequences of creating production lines that create graduates with low quality. Go to Jakarta and ask those people squatting on the street. Most likely they’ve a degree from some sort of universities. Singapore has unveiled a massive S$20.5 billion plan in its 2009 Budget to help Singaporeans keep jobs while Malaysia is still hiding the actual situation from the public. It’s perfectly alright if you trumpet a false hope provided you’ve the mean to contain the situation. But when you’ve potentially hundreds of thousands of jobless people coming back from Singapore and more sectors to be affected besides manufacturing domestically then you’re playing with fire. I’ve mentioned that there’s nothing wrong to prepare the people mentally about the coming recession so that they can plan for themselves how to cope with the situation.

Maybe it’s time the country needs Malaysia Obama who can reverse the stupid policies from previous Bush (Mahathir) administration. That’s right, the current ruling government sucks and things can only get worse without political will to drive the country into a better shape. Now that President Barack Obama has signed executive order for the closure of Guantanamo Bay detention facility, it’s high time the PM of Malaysia do the same to the ISA detention center. Let’s see how Najib can lies when the official figures about the economic situation are revealed. But I supposed once a liar forever a liar! What the country needs now is “Hope”, “Change” and “Progress”.

Other Articles That May Interest You …

Tuesday, January 20, 2009

Barack Obama inauguration – the 17 minutes speech

Barack Obama’s inauguration will be televised as well as live-streamed and simulated in virtual worlds. Web sites such as Joost, Twitter, Flickr are some of the many sites readied in broadcasting Tuesday’s events live. Of course you can tune in to CNN (Astro subscribers) to enjoy the historical moment with popcorns, chips, Cokes or beers *watch that belly of yours*. The theme of Obama’s inauguration will be “A New Birth of Freedom” – a great theme that can be re-used in the current Malaysia political landscape *grin*.

The climax is definitely the moment (Jan 20 2009, 12pm E.T.) when Barack Obama places his hand on the Bible and takes the Presidential Oath of Office as specified in the Constitution that reads “I do solemnly swear that I will faithfully execute the office of president of the United States and will do the best of my ability preserve, protect and defend the Constitution of the United States”. Let’s wait if Barack Obama could match John F. Kennedy’s famous quote – Ask not what your country can do for you; ask what you can do for your country.

But there’re people who will make their fortunes specifically for this presidential inauguration. People who gotten free tickets that were initially given to congressman and senators to be distributed freely to constituents are auctioning it on the internet for as much as $40,000 each. How I wish I managed to rub shoulders with some congressman *grin*. Of course Barack Obama still has a long and challenging road ahead, thanks to the mess he’s set to inherit from outgoing President Bush.

Wall Street however has run out of steam from the Obamania’s effect as it points for a lower opening Tuesday. After today’s craze for Obama the next stop would be Apple Inc. and Google Inc.’s earnings result.

Other Articles That May Interest You …

I Have A Dream – A Day When Money Can’t Buy Votes

Citigroup Inc. (NYSE: C, stock) was splitting (what happen to the financial supermarket buzzword? *grin*) and Bank of America (NYSE: BAC, stock) was getting a whopping $138 billion government bailout. What a major milestone in the history of American capitalism. Nobody dares or cares to predict the bottom because the fact is the United States will keep spending billions or trillions, if need be, to revitalize the ailing economy. Intel Corp. reported its net profit plunged 90% to $234 million while Motorola, Oracle, Microsoft and even the Google Inc. (Nasdaq: GOOG, stock) is laying off their greatest asset – people. Who says Google wouldn’t chop their staffs even though it’s still very profitable? It’s a cruel world out there.

One day before Barack Obama is to be sworn in as the first black U.S. president, the stock market is closed in honoring the slain civil rights leader, Martin Luther King Jr. – famous for his “I have a dream” speech more than 45 years ago in 1963. Now everyone is waiting for Obama’s speech Tuesday with 85% polled said it will be an excellent or good one. On the contrary it appears the Malaysian PM-in-waiting, Najib Razak, could be having problem leading the country, let alone commanding the respect from the people in Mar 2009 when current PM Abdullah Badawi is expected to hand-over the crown to him. If the result of just concluded by-election, Kuala Terengganu, is any indication to measure Najib’s approval to become the new PM, he fails.

Not only did the opposition PAS won with a stronger majority of 2,631-vote margin, the opposition also gave the still-arrogant ruling party UMNO a run for their “money” and a hard kick on the butt by wrestling the parliamentary seat. The 2,631-vote margin might be less than the expected figure (5,000 to 8,000 majority) but there’s so much the opposition can do against the wealthy ruling government who has been claimed to be spending up to RM1,000 (per-vote) in vote-buying. Even two journalists were not spared when they suddenly given envelopes containing RM600 although the purpose for doing so is still unknown (to write that the loser has win instead *scratching my head*). It’s hilarious to read how the Chinese voters were bribed with early “ang-pows” worth RM200 each only to donate it to the opposition, not to mention for the dinner hosted by opposition.

But the icing of the cake was the theory that the Chinese voters somehow “knew” it would be the Malay voters who would swing big to the opposition hence there was no need for the Chinese votes. To save their businesses from being targeted as part of the “retaliation” operation by the ruling government later, the local Chinese voters decided to give enough votes to the UMNO to paint a picture that the Chinese are still with the ruling government but at the same time give the remaining votes (40% to 45%) to the opposition and let the Malay votes deliver the ultimate “punch”. It was a brilliant strategy if you ask me, if only this was made known to the opposition strategists. It was just like the “Art of War” whereby you lure the enemy into an area while you prepare the final assault on another main target. So while the Chinese voters were the red-herring where the ruling government spent days and nights trying to suck-up to, the Malay voters were slowly convinced to deliver the blow.

And to read that Najib (and his wife) was actually speechless with the defeat but brave enough to declare that the latest defeat was just a temporary setback is laughable. However credit should be given where it’s due and you should be proud to have a leader like Najib – how many of us could pull a thick skin and shamelessly hide our head under the denial-syndrome mask and smile over it? Yeah right, the country can never go into recession. Tell to tell that to the retrenched workers after the Chinese New Year dude.

Other Articles That May Interest You …

Saturday, January 17, 2009

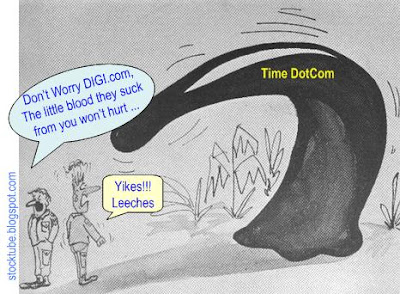

Time DotCom, the Blood-Sucking Leech that never dies?

Remember how one of the worst and dying companies in town was awarded the precious 3G license while another successful company was denied not many moons ago? The puzzle was solved when Time DotCom Berhad (KLSE: TIMECOM, stock-code 5031) was literally given free 27.5 million shares in DIGI.com Berhad (DIGI : stock-code 6947) in exchange for a piece of paper – 3G license. With a stroke of a pen (approval for the 3G license) the good for nothing Time DotCom was given RM700 million pocket money to fool around *spa anyone, grin*. Of course the icing of the bail-out deal was the fact that DIGI.com was actually leasing the 3G license for 10-year period, after which the playboy Time DotCom would charge again in exchange for that piece of paper (3G license).

Time DotCom has just reduced its stake in DIGI.com after it disposed 22.5 million shares for RM463.5 million cash or RM20.60 per share in order to reduce borrowings. Can you see how DIGI.com was actually paying Time DotCom’s huge debts? Sure, DIGI.com can choose not to pay for the 3G license and send the cash back to Norway but it could have done the arithmetic and found out that it stands to make profits even with the parasite stubbornly sticking to it, feeding on whatever leftover disposed by DIGI.com along the process.

To eat up DIGI.com alive is easy but the problem that the government faces by doing so is to find the replacement for DIGI.com’s management. The greatest asset of DIGI.com is the people that build the brand and subsequently the customer-base. Time DotCom on the other hand does not have the quality people who have the forte to grow the company even though the company was listed more than a decade ago. Fortunately Time DotCom has the backing of government who could help in other way (such as securing the 3G license) so that the company may stay afloat. Long-term wise it is no-brainer that Time DotCom needs to buck up but the question is will the company ever able to stand independent on its own without begging for money the cheat-way anymore? Already the people inside Time DotCom are more interested in playing politics instead of develop the company.

However it’s easier said than done considering the culture in Time DotCom resembles that of political party UMNO. Groups of cronies are flourishing and you would get culture shock if you’re not prepared to adapt the working environment. When another severe recession strikes Time DotCom could dies naturally the same way Renong died during 1997-1998 Economic Crisis.

Other Articles That May Interest You …

Friday, January 16, 2009

Part-2 of financial problems haunting the Stock Market

Share prices of U.S. banks are unbelievably cheap nowadays and if you think it’s already damn cheap it could go down further. Faith is fast fading for stocks such as Citigroup Inc. (NYSE: C, stock) and Bank of America (NYSE: BAC, stock). The problem could be bad enough for Citigroup to let go of controlling stake in its Smith Barney retail brokerage business, a crown jewel, to Morgan Stanley (NYSE: MS, stock). Bank of America, the largest U.S. bank, is seeking billions of dollars of government aid after it realized that credit losses at Merrill Lynch & Co, which it bought on January 1, were much higher than expected.

Investors are now betting the U.S. financial institutions could reveal its Part-2 of problems soon. Citigroup is expected to report its fifth straight multibillion-dollar quarterly loss (estimated at $10 billion or more) on Friday. In addition oil prices tumbled below $35 a barrel Thursday as new employment claims rose and government reports show that unused gas and oil inventories continue to build. The Energy Information Administration said Wednesday that crude inventories grew by 1.2 million barrels for the week ended Friday after jumping 6.7 million barrels the previous week. U.S. oil inventories have been rising for months, suggesting that the recession has slashed energy demand.

On the other hand the Dow is trading dangerously at 8,000 and I smell bloodsbelow 7,000-level. So, trade or invest with care as the bear is back. Chinese New Year rally could be stop here and never recover till next year *grin*.

Other Articles That May Interest You …

Wednesday, January 14, 2009

Muhyiddin, the newly crowned AP King of the Kings?

In case you missed this piece of classic jokes, here’s the headline whereby the bumiputra motor traders asked for APs (approve permits) system to beextended until 2020 and guess what, the International Trade and Industry Minister said “Aye”. Under the National Automotive Policy (NAP), the AP system is to be phased out by Dec 31, 2010 but I supposed those “AP Kings” knew they could just ask for extension without much hassle few years back. Now, this is not about the bumiputra making money but it’s about a handful of ruling government’s cronies making hundreds of millions or even billions of ringgit in profit while millions of other bumiputra were left to fend for themselves.

Interestingly you have this minister, Muhyiddin, who justified the extension of APs with lame excuses that a five-year plan is needed to help them (the AP Kings) improve their operations, increase their working capital and ensure sustainability of their operations. Huh? You meant the late Nasimuddin's empire that made billions of dollars of easy and pure profit from pieces of paper named APs for decades still need another 10 years to improve operations? How difficult it is to sell a piece of AP for tens of thousands of dollars in profit? What operations was Muhyiddin talking about? And just how much is enough for these AP Kings’ working capital? This is the easiest business in the world so stop crapping about the need for sustainability.

If they can’t rise to the occasion and need another 10-year to improve their pathetic operations, increase their working capital by additional billions and ensure non-existence sustainability after so many years, chances are definitely high that they will remain the same in the year 2020. Instead of insulting our intelligence as if we’re 3-year-old kid the minister might as well announced that the AP system will stay for good – hide and disguise under the name of bumiputra’s prosperity. But I suppose after the nation has seen the demise of the AP Queen (Rafidah) now you are presented with the new AP King of the King (Muhyiddin).

It’s true that it’s impossible to teach an old dog new trick. So these old dogs could do nothing but to ask for thousands of APs, sell it for handsome profits and repeat the same process again and again. Once a beggar forever a beggar and that’s precisely what define the current obsolete and flaw policies adopted by the ruling government – the assembly lines produce very low quality entrepreneurs.

Other Articles That May Interest You …

- Why Recession is important and we still need it?

- King of AP Kings Nasimuddin dies, Proton to beg VW?

- Will Malaysians wake up to face the Economic Challenge?

Monday, January 12, 2009

Why Recession is important and we still need it?

We can argue until the cows come back and debate until we foam at the mouth why do we keep experiencing this 10-year economic cycle. If we are capable of sending spacecraft deep into Mars ever since 1960s, can’t we plug this hole called “Recession”? There should be some sort of formulas to solve this mystery so that all of us can live happily and make money endlessly *sounds like heaven huh?*. It’s painful to watch innocent people got retrenched and struggles to put foods on the table, not to mention escalating social problems such as crimes, prostitution, marriages breakdown and so on.

Let’s not get too carried away with the problems associated with economy crisis. Instead of cursing the sky and blaming the stock market we should embrace the fact that life is about cycles. From the moment we were born until we’re buried under the earth everything is about cycles. And there’re two sides to it – up and down. As a baby we were taught by our parents what we can do and what we should not do. In school we were taught what is good and what is bad. In war good generals know when to attack and when to retreat. In the world of stock investing we should know when to buy and when to sell although amazingly this is the hardest thing to do to most investors, no matter how many years he or she was exposed to the ups and downs of the stock market.

Of course without this tipping point that turned the bullish into bearish cycle we won’t know that the U.S. economy is still so fragile, thanks to excessive lending by greedy financial institutions who chose to throw the risk-management book out of the window and gave away easy money to house buyers. It’s a dangerous game to have chief executives fighting to impress board of directors with fancy numbers. I bet you’ll never learn and hear the financial term “Subprime Lending” if this mortgage crisis didn’t burst. We’ll also not know how vulnerable the global economic is when the U.S. sneezes. That’s right - the BRIC (Brazil, Russia, India and China) can barely stand on their own feet.

If you compared the tourism industry in Hong Kong pre and post 1997-1998 Economic Crisis you can definitely see the difference – the Hongkies are now less arrogant. Recession miraculously has change human’s attitude to become a better and humble person although there are exceptions. Like it or not we still have bunches of arrogant people who were spared from economic downturn and politicians who are still in power making great money but the law of cycles will come soon. Last but not least we still need recession because it provide another round of opportunity for certain group of people to buy stocks at low price but whether they can sell at high price depends on the respective individual.

Other Articles That May Interest You …

Friday, January 09, 2009

More data coming, more volatility, lesser ammunition left

What have you been doing right after the fireworks to welcome the New Year 2009? To be precise, did you rush in to the stock market – local or overseas? I did write that Jan 2009 is the month of orgasm but I also pointed out that unless you’re a swing trader, don’t try to fool around with the current bull. Unlike fast-food bull does not like to be told to have a short orgasm. It like to enjoy its’ natural way of having orgasm. Therefore if you’re a long-term stock investor then you’re not fit to play this fast-game of making money. But it’s definitely a good time for you (if you’re a long-term investor) to unload some of your stocks, if you have not already done so previously.

I’ve also said that Dow Jones 9,000 mark is an important level to be observed simply because this is a strong resistance level. Of course there’re many reasons why the bull started to kick some butts but at the same time there’re equally many data queuing to be released, not to mention the earnings season report card.Retrenched workers are having difficulties finding new jobs and people are not spending. Wal-Mart Stores Inc. slashed its forecast for fourth-quarter earnings – a bad sign as discounters should do better during current tough times. Technology stocks are taking the bitter pills with Dell Inc., Lenovo Group, IBM, Intel Corp. and even Microsoft Corp. are grumbling about poor business and will lay off its work force.