Tuesday, October 02, 2007

Time to scout for offers before Holiday Season starts

As usual, the fourth quarter is normally the most busy and exciting period of the year. For stocks or options investors opportunities are aplenty since the trend is quite predictable. For retail businesses this period is the most profitable of all since it’s the holiday season such as Halloween, Thanksgiving and Christmas. For kids, this is the time for you to nag, cry or do your stunts to ensure your dad or mum buy whatever in your wish-list.

This is also the period when you’re bombarded with newspaper advertisements on sales with great discounts etc. CouponChief.com is one of the destinations you should start surfing to find out the goodies on the offering. As a start if you plan to replace your old notebook or desktop, probably 30% off a CTO HP Pavilion notebook deal or a $350 off for a Dell Inspiron desktop offer might interest you. I won’t mind if Santa could give me free instead of 10% off on memory cards from BestBuy.

Maybe I should seriously look at some of the comfortable and delicious-looking chairs that could reduce my back-pain while I’m blogging or trading the stocks or options. Office Depot is giving away $30 off for purchases of $150 or more but I still hope the discount could go higher *greedy me*.

Rate Cut, Financial Expectation & Window Dressing

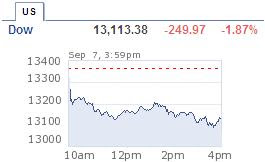

Level 14,000 could be the biggest boulder that Dow Jones needs to move if investors wish to celebrate a truly bull-run. Wall Street began the fourth quarter with a huge rally on Monday when it crossed over it. But just like how Dow did it in mid-July when it surpassed its closing back then to 14,000.41, the time is too early to predict if this round would be any different.

Nevertheless there were cheers everywhere when the important Dow rose 191.92, or 1.38 percent, to close at 14,087.55. If you had monitored the movement of the index, you would see it was a stable movement the whole day, no more zig-zag of uncertainties. So, what could be the reasons or excuses for such optimism?

First of all, the latest economic data released by the Institute for Supply Management indicated that the September’s manufacturing sector grew at a slower pace in 6-months at 52.0, below forecasted 52.5. Hence investors are getting more confident there is going to be an October rate cut.

- Secondly, while Citigroup and Switzerland's UBS AG issued third-quarter profit warnings, it nevertheless indicated the current period might see a return to normal earnings levels. Citi Chief Executive Charles Prince said that he expects profit to "return to a more normal earnings environment" during the fourth quarter and this is perhaps the most important indicators from a financial institution considering Citigroup has not release any public information before as to the extent of the damages due to subprime problem. UBS, the largest Swiss bank and Credit Suisse Group similar statements help the situation as well.

Thirdly, with the expectation that the housing crisis could be a thing of the past, investors are more willing to commit and ready for the“window dressing” which is just two to three months away. Furthermore holiday season could be the catalyst to speed up people’s confidence that the good time is here again. Sales are expected to pick up and if the promotional activities are anything to go by, soon it’ll be business as usual.

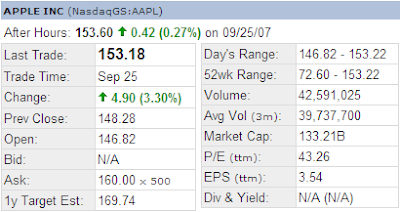

And boy, have you seen how Apple Inc.’s(Nasdaq: AAPL, stock) and oil-related stocks soared on Monday’s trading? But none of the above beats the elegant performance of Google Inc. (Nasdaq: GOOG, stock) stock which jumped US$15.28 or 2.7% to US$582.55 per share. Could Google’s stock price breach theUS$600.00 per share before the end of the year?

The rest of the regional stocks markets are expected to perform well taking the cue from Dow’s 14,000 cross-over. Already Malaysia’s Kuala Lumpur Stock Exchange is up 17 points to 1,364.33 in the morning session, not too far away from 1,500 points and definitely very near to the excited 1,400 points.

Other Articles That May Interest You ...

Monday, October 01, 2007

TM spin-off project, Wahid to exit with Jamal’s entry?

It was about three months ago when former Maxis Communications Bhd group CEO, Datuk Jamaludin Ibrahim, announced his decision to call it a day. On the day of the resignation announcement there were plenty of speculations as to which company that managed to win the heart of Jamaludin. Of course Jamal, as he was fondly known, refused to entertain the idea that he was fished to join another telecommunication company.

And when the state controlled Telekom Malaysia Berhad (KLSE: TM, stock-code 4863) announced the bold plan to spin off the cash-cow mobile service provider Celcom (M) Sdn Bhd, speculation on the new top management lineup was in the air again. Although it was reported

It was rumored that Omar Wahid will join Malayan Banking Berhad (KLSE: MAYBANK, stock-code 1155) while former Maxis CEO Jamaludin’s holiday is over and will finally report to work replacing Omar Wahid. However TM clarified today that Wahid Omar remains the group CEO and at the same time denied it has even approached Jamal.

The mere plan of the spinoff have already created the excitement when the stock price of TM jumped 9.3 percent to RM10.60 today, the most in seven years on the Kuala Lumpur Stock Exchange (KLSE). Considering the detail scope of the demerger plan will only be known to all in Dec-2007, perhaps the rumor about the departure of Wahid and the entry of Jamal will becomes fact after all. Let’s wait and see.

Other Articles That May Interest You ...

Sunday, September 30, 2007

The Rise of CELCOM Empire, Tales You Should Know

By now you and everyone should know that the once listed Celcom will be re-listed again. Who said deadman cannot rise and pig cannot fly in Malaysia? And to think of the possibility that Maxis Communications Berhad could be making its way back to the local stock market one of this day after Ananda decided to takes it private recently is enough to amuse everyone, at least me.

In a not so-distance star away, there was this galaxy whereby the planet was ruled by a powerful government who always got voted into power no matter what. Somehow there was this vision to nurture and create huge companies with international reputations led by some bumiputra businessmen who can make the ruling party UMNO proud and stand tall since successful businessmen often associated with ethnic-Chinese. After all, if the Chinese-ethnic can produce so many successful businessmen, UMNO can mould the same quality Malay-ethnic businessmen as well – how hard could that be?

The Ambitious Plan to Clone Success

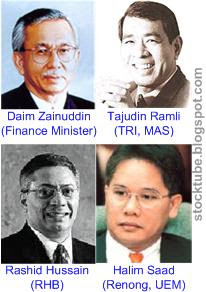

And so some candidates were identified and they were to be trained or rather fast-tracked to become amongst the most elite

While the intention was good (the plan to have more Malay-ethnic successful businessmen), the method of how it was being carried out was flawed. You simply can’t clone a businessman out from some sort of moulder (as if you're making biscuits in the production line) and expect him to be able to withstand the tsunami of the real corporate challenges if you throw in the “fast-track to become a billionaire businessman for dummy” book, can you? Even within the the Chinese-ethnic not everyone has the quality to achieve the desired dream of becoming another Teh Hong Piow, Lim Goh Tong, Li Ka-shing or Robert Kuok.

A thin line between Cronies and Walking Zombies

To cut story short we travel through the worm-hole in the galaxy. Tajudin controlled 47 percent of Naluri and 24.3 percent of TRI (Technology Resources Industries).

Everyone cried “bailout of the century” and“cronies” but Tajudin couldn’t care as he desperately needed the money to reinvest into TRI to rescue his sinking ship. TRI somehow was buried under debts of more than RM4.0 billion and was rushing against time to meet its outstanding US$375 million (the currency rate then was US$1 = RM3.80) euro-bonds repayment with only a couple of months left. With some elements of politic, the Securities Commission somehow rejected Tajudin’s plan to use the proceeds from MAS’s sale to rescue TRI.

The episode showed that managing and growing businesses are more than rubbing shoulders with politicians in hoping for sudden rise in the corporate world and waiting for bailout when disaster strikes. Even the government needs to set priorities of which entities to rescue when the coffer itself was running out of money. Successful people always advise not to wear a hat bigger than your head.

From Hero to Zero

During that period Telekom Malaysia Berhad (KLSE: TM, stock-code 4863) owned TM Touch which was bleeding profusely with losses of over RM100 million for the last four consecutive years despite having about 1 million subscribers. Later Malaysia state bad-debt agency Pengurusan Danaharta Nasional moved in and forced disposal of Tajudin’s 13.2% stake in TRI to Telekom for RM717 million (US$188 million) or RM2.75 a share. Tajudin cried and screamed that the forced-sale was a scheme by the government to enable Telekom to take over TRI cheaply.

Telekom then embarked on a series of purchases on the open market and through direct deals to raise its stake to the 31.25% level, making it the largest shareholder in TRI. Under a restructuring plan, fully-owned subsidiary Celcom (M) Bhd had taken over the listing status of TRI on the main board of the Kuala Lumpur Stock Exchange (KLSE). Pengurusan Danaharta Nasional then moved another step to sell Tajudin's 45 percent stake in Naluri to recover some of the roughly RM1 billion he owed Danaharta. Tajudin’s corporate presence was history. In Aug 2003Celcom Berhad’s shares were de-listed from Malaysia Stock Exchange after Telekom’s stake exceeded 90 percent of the paid-up capital resulting from the general offer.

The Rise of Celcom once again?

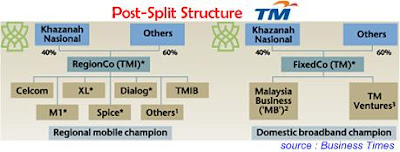

StockTube has blogged about how boring the Telekom Malaysia stock was. The growth story wasn’t there and investors simply weren’t impressed compared with the previous listed Maxis and DIGI.com Berhad’s (DIGI: stock-code 6947) exciting growth story. Hence the stock market could be set for another chapter of excitement with the announcement by Telekom Malaysia to split its cellular operation. Soon there will be two entities; Telekom Malaysia (TM) and TM International (TMI). While TM will be left with fixed-line, internet and other miscellaneous business, TMI will be loaded with mobile arm Celcom (M) Berhad.

However the actual plan is to expand regionally and thus foreign partner could have been already identified to grow the mobile business (Celcom). Also with Maxis’ exit, the timing couldn’t be better to tap into the floating money eagerly seeking to invest into another mobile business entity.

What could investors see pre-Celcom listing?

Celcom might not be Maxis and both are not the fruit of the same type. With the details of the whole plan still sketchy, TM stock price will definitely soar when the shares reopen for trade. Investors will buy in to capitalize on the fact that they would receive some TMI shares. Although TMI will be listed on June 2008, the question remains if the public will have a fair share allocation as if it’s a normal IPO. With the prospect of foreign investor(s) in the new TMI and existing TM shareholders to be allocated certain percentage in the new entity TMI, everything seems uncertain.

That’s the very reason why the government decided toannounce the RM15.2 billion contract to TM to build a high-speed internet network on the same day TM stock was suspended last Friday. It was hope with this contract investors might still see some values within TM and won’t abandon the stock in totality.

Could TM International be as attractive as Maxis?

In a nutshell, TMI is not Maxis and Maxis is not TMI. The values built within Maxis were in the management itself – the value of people. You have to understand that Celcom (019) was long in the market before the birth of Maxis (012) but somehow Celcom lost its shine to Maxis within a short period of time. Put in a competitor and you can see which is the better company by observing how consumers walk towards their preference.

Customer services were horrible and you would be lucky not to be screamed and scolded by Celcom’s staffs when you made enquiries. Things took for the better after Celcom was absorbed by Telekom from TRI but still, the services from Maxis were still better. Seriously whether Celcom could replace Maxis as the next“Replacement Killer” stock depends very much on the management, business direction and operational’s efficiency.

The most distinct difference between Maxis and Celcom/TMI is the fact that while Maxis’s boss was politically connected to former premier Mahathir, Celcom/TMI is closely related to the ruling party UMNO as a company via Khazanah. Could Wahid manage differently and most importantly better than Tajuddin? But with Khazanah controlling 40%, Wahid’s ballgame would be different from that of Tajuddin’s. Hence it would be interesting to see if business-sense will take the front seat instead of political-sense.

Other Articles That May Interest You ...

Saturday, September 29, 2007

3Com to Be Sold for US$2.2 Billion

3Com Corporation, a maker of networking hardware and software, will be sold to affiliates of private equity firm Boston-based Bain Capital Partners LLC for$2.2 billion and taken private. The cash deal will also gives Huawei Technologies, China's largest manufacturer of telecommunications equipment, a minority stake in 3Com. Shareholders will receive $5.30 in cash for each share of 3Com stock, or a premium of about 44 percent over the stock's $3.68 closing price on Thursday.

Those in Information Technology field will know who 3Com is. The company which has more than 6,000 employees in over 40 countries and annual revenue of $1.3 billion was the darling stock during the late 1990s technology boom. Once 3Com’s stock price was above US$100 per share but plunged to dust after the bust.

3Com previously teamed up in a networking product “Joint-Venture” called H3C (short for Huawei 3Com) but 3Com bought out Huawei's 49 percent stake for $882 million in November 2006. It is not known how large of a minority stake that Huawei would have in 3Com after the deal is completed, but said that information would be made public in coming weeks.

3Com would be required to pay a break-up fee of $66 million if it backs out of the deal, while Bain would pay at least $66 million and up to $110 million if it backs out, depending on the circumstances. In Malaysia Huawei Technologies together with H3C has their presence respectively in Kuala Lumpur.

Friday, September 28, 2007

Online purchases should be given discount

Competition is always the best way not only for companies to offer better service but also to provide the most cost-effective solution for consumers. A classic example will be how everyone can fly with AirAsia, without which consumers will still be paying top dollars to fly. And to continue with his vision to provide better offer along the line Tony Fernandes recently launched the TuneMoney.

The playing ground has changed considering you can purchase home insurance from RM60.00 per year, personal accident insurance from RM45.50 per year or even motorcyclist personal accident insurance from RM10.90 per year. But there’re still ways to further improve the existing offering. For example CIS Cooperative Insurance actually encourages you to purchase home insurance online, and if you do that you’re given 10% discount. This might only applicable to U.K. but CIS actually defines their home insurance coverage within the scope of not only the building itself but also the contents, personal possessions and caravan.

Also, I didn’t know that you can actually get NCD (No Claim Discount) of up to 40% on both buildings and contents coverage. Nevertheless with the wide spread of blogging popularity, I couldn’t find a blog within the website. It would be nice to hear what other people said about the offerings from CIS. But then so are TuneMoney and most of the businesses in Malaysia.

Make Money Investing Stocks – wait for CELCOM’s IPO

Are you previously one of the proud shareholders of Maxis Communications Berhad stocks who got a shocked by the privatization mooted by tycoon Ananda? If you are, you might either have relocated the money gotten from the disposal to other telco-stocks or maybe non-telco stocks. Maybe you’re still holding the money since you couldn’t find another telco worth buying. What choices do you have?

DIGI.com Berhad (DIGI: stock-code 6947) will be the best choice but considering the stock is already pushed up to current level, it’s not a cheap exposure. Forget about the loss-making Time DotCom Berhad (TIMECOM: stock-code 5031) which has its own problem at the backyard to solve. The only reason that you can justify to yourself going into Time DotCom's stock is betting that this fella will be bought over by another telco.

Telekom Malaysia Berhad (KLSE: TM, stock-code 4863) is too boring a stock to buy into. It might be the blue chip but the fact that it’s a GLC (government-link-company) which monopolizes the fixed-line market and essentially the money-printing machine makes the stock not attractive since it will neither goes up nor down. All is because the management is too complacent with its status as the protected big-guy in the industry.

Reuters reported that Telekom Malaysia's board agreed on Thursday to house its domestic and offshore mobile assets in one company, TM International, shares in which would be distributed to existing group shareholders and then separately listed. Since Telekom’s shares were suspended from trading on Thursday, the expected announcement from Telekom on Friday could spills the bean, provided what was reported is true.

Telekom owns Celcom which is the country's second-largest mobile operator. It’s time to unlock the jewel in Celcom so that Telekom could raises money and do whatever it wish to do while allow the public an opportunity to invest in a new telco stock. The time is right to bring back more quality stocks after the recent various privatizations.

Other Articles That May Interest You ...

Thursday, September 27, 2007

Jury System is still the better system

It appears blogging has taken the business industry in a big wave, so much so that even lawyers have their own blogs. Los Angeles Criminal Attorney Blog California Criminal Defense Lawyers Forum which is authored by lawyer Dmitry Gorin, is a Professor at UCLA and Pepperdine Law School. When I took some time minutes ago to read the blog about the California criminal law and proceeding in Los Angeles, I cannot help but to notice one of the important parts of the judiciary system – the jury system.

If memory serves me right, Malaysia’s Judiciary used to have jury trials before it was abolished in 1995 thereafter. It was supposed to provide another layer of independence and fairer trials as the jurors who made up the team would provide a majority verdict in a particular case. Furthermore it’s more difficult to bribe the whole team of jurors as compare to a single judge, not that there’s no case of corrupted judge before. Anyways, in an example of a trial against Spector Hung for murder (as blogged by Dmitry Gorin), it appears the twelve jurors were deadlocked in their decision and was split 10-2 for guilty. You might argue that there’re pros and cons but the California Criminal Law requires unanimity by jurors before someone is found guilty for murder. Nevertheless, ajury system is still the better method in determining the fate of an individual, or else U.S. would have abolish such system ages ago – at least you can be sure that the judge is not bought.

*sponsored*

Silver Bird might be yelling Give-Me-5, High-5

Bakery business is never easy, what more with the Asian culture where breads are never considered the main staple foods. People still opts for rice (nasi lemak anyone?) or noodles for their daily breakfast. Morning breakfast is the only time breads can stand tall with pride as it will seldom appear on the menu for lunch, dinner or even supper. Modern kids prefer cereals such as KoKo Krunch (yummy).

Mention the name Silver Bird and chances are you think either it’s another U.S. latest jet-fighters produced (who do not know BlackBird?) or another old model of car produced by Nissan (Datsun BlueBird, Hokkien people never buy this model for obvious reason). But if you mention High-5 then people instantly will know that it’s the bread sometimes mistaken for Gardenia due to its packaging design. Seriously if you want to enjoy cost-effective bread with taste almost comparable to Gardenia, High-5 would satisfy your need.

Silver Bird’s Crisis

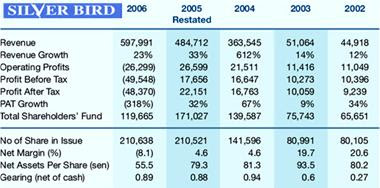

Somehow in Sept 2006, Silver Bird’s Nilai factory created the buzz in the consumer and media news when it was uncovered that particular factory was using non-halal cooking oil and was operating in unhygienic conditions. That crisis had cost the company its reputation, not to mention losses in sales. It posted a net loss of RM18.25 million for the first quarter ended Jan 31, 2007 which among other things inclusive of its operation start-up losses in Singapore as well.

The year 2006 wasn’t a good year for Silver Bird (KLSE: SILVER, stock-code 7136), that’s for sure considering the business of bakery depends very much on global commodity prices such as fuel (petrol), electricity and flour. Hence theescalated production costs ate into its profit for financial year 2006.

What’s the fundamental of Silver Bird?

From the revenue point of view, the company continues to register healthy growthfrom 2002 to 2006. However for the first half of financial year 2007 (ended May), Silver Bird plunged into a net loss of RM31.2 million despite a 10% rise in turnover to RM269.1 million from RM295.5 million. The second quarter of 2007 alone registered a RM12.9 million in net-loss.

It has been reported that Silver Bird planned to up its production capacity to over 400,000 loaves daily by 2009. However analysts said Silver Bird was actually facing an uphill battle in gaining a foothold in Singapore's bread market because market leaders such as Gardenia have a strong grip in the country.

Technical Analysis is saying otherwise

Wednesday 26th Sept 2007 was the day when Silver Bird stock finally breached its resistance of RM0.58 (with high volume) after the stock plunged from its high in 2005 to the low of pennies. After the closing bell today (27th Sept), the stock appeared to manage to stay above RM0.58 with equally good volume.

Shareholding changes – something’s brewing?

In Sept 6th, Perkasa Normandy Managers had purchased additional 4 million shares to raise its stake to 9.34 percent from the initial 5.87 percent. What was interesting is the filing which saw multiple acquisitions by Lembaga Tabung Haji within the month of Sept 2007 alone.

In early September, A UK-based venture capital company 3i Group plc, a substantial shareholder in Silver Bird Group Bhd since its listing in 2002, has exited the company after selling all its 21.56 million shares or 13%. The shares were then acquired by Lembaga Tabung Haji and the recent acquisition raised its shareholding to 21.56 million shares. More acquisition was registered by Lembaga Tabung Haji thereafter:

- On Sept 11th - raised its stake by acquiring another 4.82 million shares to a total of 44.61 million shares or 20.79%.

- On Sept 20th – raised its stake to 22.82% to a total of 53.54 million shares.

After reportedly reduced his stake (rumored to be to Perkasa Normandy Managers), existing major shareholder Dato' Tan Han Kook has started to accumulate. He acquired 20 million shares to raise its stake to 17.06 percent on 24th Sept.

With the excitement shown above, the rumor that Silver Bird might see a new substantial shareholder coming into the board-room is circulating. Some even said the business direction and its model might change for the better.

Punters’ new heaven

CIMB Research might be screaming “Sell” with target price of 20 sen (in June) due to its losses, the fact that the stock price might already hit the bottom created a betting table for the punters on Silver Bird’s mother shares or its warrants. So, let’s eat bread while monitoring the stock’s movement, High-5 bread, will ya?

Wednesday, September 26, 2007

Lawyers Long March to Save the Judiciary – Photos Talk

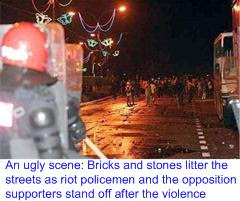

The morning on Wednesday, 26th Sept 2007 would be another milestone as far as about 1,000 lawyers are concern. Seven buses chartered by Bar Council begun their march for “Justice”, only to be stopped and barredfrom entering Putrajaya, the central government administration of Malaysia. In the history of Malaysia there were three marches by lawyers - lawyers first marched in numbers in 1978, then again in 1999 and now in 2007.

About 1,000 lawyers gathered at the Palace of Justice to march and hand over a memorandum to the Prime Minister's office, calling for a royal commission to investigate a video clip showing a senior lawyer purportedly brokering the appointment of judges with a senior judge. The peaceful march, organised by the Bar Council was also joined by other NGOs and public concerned with the judiciary scandal.

Despite the seriousness of the judiciary scandal hitting Abdullah Badawi’s administration, the news of the crisis was played down by government-controlled media. Thanks to the blogging that flourishing in the blogosphere, surfers are no longer kept in the dark of the true pictures. Realizing this, Jeff Ooi has decided to let the pictures do the taking in anticipation of media blackout. To do our part in pressing for “Save the Judiciary”, StockTube has selected some photos captured by Jeff during the long march.

Foreign Minister Datuk Seri Syed Hamid Albar who today said the current unrest in Myanmar is worrisome and leading to an embarrassment for ASEAN might want to think the same way about the equally embarrassing judiciary scandal that hit his own country. As much as it would be seen as a joke that Asean could not resolve the Myanmar issue, the joke is more amusing at the own yard of his country, Malaysia.

Although a three-man special independent panel headed by a retired top judge has been formed (out of pressure from the public) to investigate and determine the authenticity of a video clip, the opposition said the formation of the panel was unacceptable and a Royal Commission of Inquiry should instead be formed to conduct a full and comprehensive investigation to restore public confidence in the judiciary.

While the photos were taken by Jeff Ooi, the comments are from StockTube. Enjoy the photos and if your appetite cries for more Jeff Ooi has about 53 pictures published in his blog.

Desperate DRB-Hicom to sell EON Capital to Primus?

Having lost the battle in acquiring Rashid Hussain Berhad’s jewel RHB Bank despite putting the highest offer on the table to Utama Banking Group (KLSE: UBG, stock-code 6831), EON Capital Berhad (KLSE:EONCAP, stock-code 5266) was directionless since then. Many predicted EON Capital could be the target of other banks thereafter. Prior to that there were many rumors of M&A which might see EON Capital being wiped out from the map of Malaysian banking industry.

Early of the year, General Electric Capital, a unit of U.S. conglomerate General Electric Company (NYSE: GE, stock), was reportedly keen on DRB-Hicom's (KLSE: DRBHCOM, stock-code 1619) 20.2 percent stake in EON Capital with mind-boggling offer of RM9.00 per share which will values the stake at RM1.25 billion. The rumor however never materialized.

Later there was rumor that US private equity firm Newbridge Capital was interested in the same EON Capital stake. The repetitive statements from CIMB (Commerce International Merchant Bankers), an investment bank of Bumiputra-Commerce Holdings Berhad (KLSE: COMMERZ, stock-code 1023) pushing the idea of having smaller number of banks had created speculation that the brother of current Malaysia Deputy Prime Minister, Nazir Razak, himself was probably interested in EON Capital.

Interestingly, DRB-Hicom had denied reports back in July 2007 that Primus Pacific Partners Ltd. was interested in its stake in EON Capital. Whether DRB can sell its stake or not this time will depends very much on the offer price from Primus (or other interested parties not visible yet) and the government’s approval for the sale. Primus Pacific's major shareholders which include the Qatar Investment Authority, the Kuwait Investment Authority and Taiwan's fifth-largest financial holding firm, Fubon Financial might need to cough up nothing less than RM9.00 per EON Capital share. Such speculation will definitely create excitement in EON Capital’s stock price when the market opens tomorrow, Thursday.

Other Articles That May Interest You ...

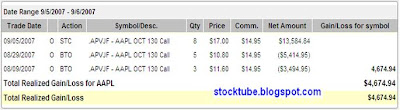

Apple at 52-week high, Funds flowing into Tech-Stocks?

Whoa! Did you see how Apple Inc.’s (Nasdaq: AAPL, stock) breachedthe strong resistance of $150.00 per share on Tuesday’s trading? I was about to lock-in the profit when I saw how it tried for more than 3 hours alone trying to push pass that level. Honestly I rarely saw such a stubborn stock constipating for 3 hours just to get out of that thin line. But the stubborn me decided to stay on and watch and by the lunch hour, I knew I was in luck againand will make the killing this time.

Really, there’s no news on Apple that would see the bull charged against the $150 level. The only news and justification from investors is that since the housing crisis (home posted steepest drop in 16 years for God sake) basically affecting other sector such as financial or banking and oil prices are still in the threatening level, most funds are trying out the less risky technology stocks.

Besides Apple Inc. it was reported that Research in Motion Ltd. also hit a 52-week high – rose to $96.82 after the closing bell. Nevertheless oil-related stocks took a plunge after NYMEX crude oil was traded below $80, losing $1.42 a barrel to $79.53 a barrel. Oh well, maybe it’s just the correction after the recent bull. But the fact that the oil prices didn’t react to the opposition group in Nigeria that announced it will resume attacks on oil installations does not spell good for investors who long on oil stocks. Anyways, let’s wait for Wednesday’s oil inventories report.

Tuesday, September 25, 2007

MAYBULK, the Shipping Stock You Can’t Ignore

When people talk about tycoons, you can’t float too far away without taking a hard look at shipping industry. Pre-technology age, building an empire (always associated with shipping) was a hard work which not only required huge resources but also tons of precious time. Shipping tycoons such as Y.K. Pao, Robert Kuok, Li Ka-shing, the late “Godfather” Henry Fok Ying-tung and even former Hong Kong Chief Executive Tung Chee-hwa built or inherited their wealth from shipping business, one way or another.

And so, when former premier Mahathir tried to create his own shipping tycoon in the form of none other than his son, Mirzan Mahathir, it raised everyone’s eyebrows. Public quietly accept while oppositions cried the model of nepotism or favoritism. The economy was booming and the stock price of Mirzan’s new petKonsortium Perkapalan Bhd (KPB), now known as Konsortium Logistik Berhad (KLSE: KONSORT, stock-code 6157), skyrocketed to market capitalization exceeding RM2.5 billion.

The jolly good time didn’t last, the 1997 Asia Economy Crisis hits and the glory of KPB was reduced to a pile of dust and debts estimated at RM1.8 billion. KPB was on the brink of bankruptcy and Petronas (the state oil giant) was roped in topurchase (bailout) KPB’s shipping assets at a mind-boggling US$220 million. Such scenario goes to show that the business needs real shipping acumen in order to stay afloat else you’ll sink faster than the Titanic.

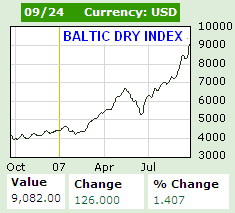

Knowing Shipping Terminology

Lately you heard of how shipping stocks are doing well due to some bombastic language such as Baltic Dry Index, Baltic Clean Tanker Index and Baltic Dirty Tanker Index. Just like energy-related stocks rely on the daily global oil price and telecommunication relies on ARPU (average revenue per user) as its measurement of business, shipping industry has its own terminology as well.

Bulk container carriers specifically carry unfinished goods such as building materials, cement, grain, coal, iron ore and so on. BDI is probably the most reliable and honest indicator of the economy simply because people don’t book freighters unless they need to move cargo around the globe. But the argument is always that the bullishness in BDI is merely due to China’s huge appetite for raw materials.

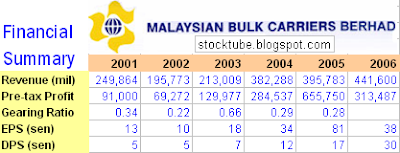

MAYBULK Fundamentals

Malaysian Bulk Carriers Berhad (KLSE: MAYBULK, stock-code 5077) is probably one of the shipping stocks preferred by most investors. While players such as Halim Mazmin Berhad (KLSE: HALIM, stock-code 7102) andMalaysian Merchant Marine Berhad (KLSE: MMM, stock-code 7040) found the hard way that the business is not as rosy as it looks after registered losses, MAYBULK is enjoying consistent and excellent business.

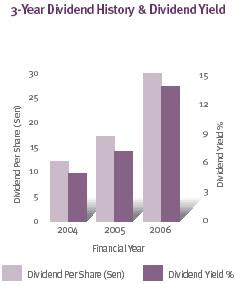

MAYBULK has been recording good and sustainable profit and has been paying good dividend. In fact it had paid double-digit in terms of cents per share since 2004, with 2006 registered the highest dividend yield or 30 cents per share. Revenue has been on uptrend since and market analysts are estimating another record dividend for the year 2007.

Technical Reading from Chart

Since MAYBULK breached the resistance level of RM3.60 on 9th July 2007, it has never look back. Thereafter the stock actually has been trading within the wave-range of RM3.60 – RM4.40 and the middle value of RM4.00 has been established as the support/resistance level.

What analysts said about MAYBULK?

AmResearch said dry-bulk rates were expected to rise further for two more years and it likes Maybulk for its sound manage and has a “Buy” call on the stock with target price of RM5.15 per share. OSK has forecast MAYBULK raking in as much as RM526.3mil in net profits on the back of RM517.2mil in revenue for the financial year ended December 2007. OSK has a fair value of RM4.88 based on MAYBULK’s 11 times price-earnings ratio.

When to jump into the vessel?

To stay afloat, you should trade based on the indicators from the technical chart – to maximize profit. Nevertheless the fundamental is strong and if you wish to long now believing the stock will jumps above RM4.40 comes the next earning announcement, nobody can stop you really. Alternatively you might want to studySwee Joo Berhad or Hubline Berhad as the shipping stocks (I’ll leave that as another discussion at another time). As part of the best practice in stocks investing, diversification is the name of the game and you should seriously consider a transportation stock in you portfolio. What better stock than MAYBULK which has the support of Robert Kuok?

Monday, September 24, 2007

PetroChina is Charging, not even Buffett can stop it

Of all the interest in foreign-stock Call Warrants in Malaysia, none of them has attracted the followers as PetroChina Company Limited(PETROCH-C1, stock-code 0500C1 and PETROCH-C3, stock-code 0500C3) since the oil price hit above $82 a barrel. In fact the volume for these two stocks counters which attracted punters intensified on 19th Sept after Ben Bernanke cut the rate by 50 basis points. You need to read why oil prices soared due to Uncle Ben's action.

Both PETROCH-C1 and C3’s exercise share price is HKD10.40 with exercise ratio of 5:1 (5 warrants per share), expiry-date is on 29-Feb-2008 (158 days to go). However while PETROCH-C1 was issued by OSK, PETROCH-C3 was issued by CIMB and based on market volume PETROCH-C1 is more actively traded. Stock market talks has it that the difference in volume and even the price is due to the fact that PETROCH-C1 is tightly held by public while PETROCH-C3 shares are mostly within the grip of issuer CIMB itself.

Of course logically shares within public possession will see more volatility, higher volume transacted and easier chased up than if it’s held by institution (in this case CIMB itself). Due to the fact that the issuer, which is also known as market-maker, held most of the shares, the spread between bid and ask sometimes can be huge (you need to closely monitor this) especially when the volume transacted on a particularly day is low. This concept applies in option trading whereby the market makers are trying to make profit out of you because the liquidity of the day is low.

Warren Buffett selling PetroChina Shares

Warren Buffett's Berkshire Hathaway's (NYSE: BRK.A, stock) has been selling its shares in PetroChina for the last 3-months with rumors ranging from public pressures to Warren to protest PetroChina’s support for the Sudanese regime to the investors reasoning that Buffett actually taking profit off the table.

Despite the three sales, Berkshire still owns nearly 9% of China's largest oil company, making it the second-largest shareholder behind the government-backedChina National Petroleum, which owns 88%.

- July 12th - sold 16.9 million PetroChina shares at an average price of HK$12.441 – stake reduced to 10.96 percent

- Aug 29th - sold 92.66 million PetroChina shares at an average price of HK$11.473 – stake reduced from to 9.72 percent.

- Sept 20th - sold 28 million PetroChina shares

Being an aggressive animal PetroChina plans (pending regulatory approval) to offer as many as 4 billion Class A shares on the Shanghai exchange. The company has indicated it will use the proceeds to boost output and build a pipeline, a justification that was mooted out of national mandate to ensure energy security for the ever-growing China. Money has never been a problem to PetroChina and if it really needs more, the government of China can always extend cheap loans anytime.

It’s time to buy PetroChina stocks?

As can be witnessed, PetroChina stock prices were not affected by numerouos sell-off by Warren. It appears the share might only show weakness if the global oil prices drop to below $80 a barrel. By the rate the company is expanding to feed the hunger of China’s economy, current stock price might be the attractive level to enter since it has breached the resistance of RM0.26 for PETROCH-C1.

Other Articles That May Interest You ...

Sunday, September 23, 2007

Volkswagen BOSS to visit Malaysia to conclude deal

The news was actually out (kinda like leaked) that Germany's Volkswagen (FRA: VOW) already agreed to take a stake in Malaysian loss-making car-maker Proton Holdings Bhd (KLSE: PROTON, stock-code 5304) but with some conditions attached. Knowing that Malaysia’s GLCs (government-linked-companies) are mostly tricky when comes to question of management control, Volkswagen earlier suggested that it would take 20 precent stake initially with the right to raise it to 50 percent majority stake in 5-years period.

Secondly – Volkswagen wants Malaysian government to clean up all the debts(or shits) accumulated by Proton. It makes business sense as Volkswagen is suppose to start its plan of putting everything on track to push the Proton out of red once the green light is given. That’s the plan and Volkswagen has no intention of studying and wasting time trying to clear the debts due to the previous weak management of Proton.

However when the above news was out, Malaysian Prime Minister Abdullah Badawi only confirmed talks were ongoing but said there was no formal request from Volkswagen for a stake in Proton. But then it could merely due to protocol or procedure that it would not be nice for Badawi to announce something which has already been reported and known to public, the same way the first Malaysian astronaut was identified and reported by foreign news before Badawi has the honour to announce it to the country.

While Proton desperately needs foreign technical expertise to halt its ever continuing decline in market share, Volkswagen hopes to have a base to strengthen its presence in the Southeast Asian region. It’s a matter of who is more desperate to get out from its trouble and hence give in to the conditions set by the other party.

Proton’s stock prices should get excited by the news of the coming visit by the Volkswagen’s boss and everyone would be listening and watching the final conclusion from Badawi. Considering Abdullah Badawi’s administration is currently hit by multiple crisis and scandals such as the RM4.6 billion ringgit PKFZ scandal and the latest Judiciary Scandal, not to mention tough economic decision in raising gas price, Badawi could put the meeting with Volkswagen boss as the last priority for the time being,

Other Articles That May Interest You ...

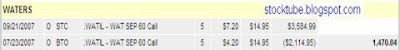

Slow turtle WATERS Stock finally turns into profit

Last Friday was the option expiration for the month of Sept 2007. One of the trades that made my blood boils over the last two months is Waters Corporation (NYSE: WAT, stock) which I talked about here. Waters is not really my favorite, having disappointed me before. Nevertheless I was sure this stock would continue to beat its estimated earnings on 24th July based on its track record. There was no reason why the strong resistance (it was a very very strong one indeed) of $64 cannot be broken, I thought.

After Waters delivered its earnings of which it beat by 2 cents of $0.60 per share againsts the market estimate of $0.58, it didn’t gap-up as expected. Worst still, it stubbornly floating within the price range of $58 - $64 – refused to break the $64 level. Luck turns for the better on 14th Sept when it finally breached the $64 level and never look back since then registering record 12-months high again and again. If not for the Friday Option expiration on 21th Sept, I would have leave it run as far as possible.

Saturday, September 22, 2007

Dell’s printers could drive up its stocks

Why most of the successful entrepreneurs who made it to the billionaire list are dropout? Could it be that these individuals have something not common to other people? Michael Dell might be a dropout but his simple yet successful business model of selling desktop computers to customers directly is a proven method not only in making profit but in making great fortune. He’s the 8th richest Americans in the latest Forbes 400.

His shares are up 38% since 12 months ago. One trick in making money investing Dell Inc.’s shares is the fact that the stock normally soar at the end of the year, mainly due to holiday season where sales are brisk. Dell’s forte has been in desktop computer and later notebooks before venture into storage by OEM with partners. They tried PDA but without much success.

However its’ success in desktop could be replicated with printers ranging from laser printers, printer scanner copier, color printers to inkjet printers. This could give its competitor especially Hewlett-Packard a run for their money. Where others failed miserably, Dell has the high percentage of success with its strong branding and loyal customers. Furthermore customers have been trying the reliability of Dell’s desktop and notebook before. So packaging the printers under a roof should not be a problem as everyone needs to print.

*sponsored*

Friday, September 21, 2007

Malaysia Judiciary Scandal? Don’t bet on it

To outsiders except for the British, corruption might not be as scary as the deadly H5N1 bird flu. Furthermore H5N1 kills but not corruption; physically the corrupted hands do not kill, do they? British government knew how corruption could bring disaster to a country, as was seen to their small colony which was under Britain’s rule till 1997 – Hong Kong. Hence the establishment of Hong Kong ICAC (Independent Commission Against Corruption) by Governor Murray MacLehose on Feb-1974 with the main objective of cleaning up corruption in the Hong Kong Government especially the Royal Hong Kong Police Force.

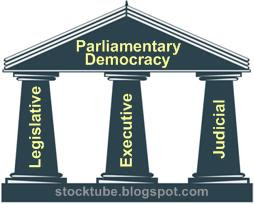

Malaysia’s laws have great similiarities to the British’s laws as majority of it were imported from the British, not surprising since the then Malaya was under British colonization. One of the greatest things in the Constitution is the “Separation of Powers” whereby the three pillars of parliamentary democracy namely the Legislative, Executive and Judicial are to be operates independent of each other.

Dewan Rakyat’s members are elected by the people and this is also the entry point where everything will get screw-up if the people did not elect their representative wisely. All proposed laws must pass through the Dewan Rakyat before escalated to the upper house of Dewan Negara. The Senate (Dewan Negara) which is supposed to act as the check on Dewan Rakyat has becomes rubber-stamp over the time due to various modifications. The fact that the Prime Minister belongs (overlap) to both Executive and Legislative pillars creates cloudy relationship to two of the three pillars, what more with people usually returns more than two-third majority to the government.

Powers-Overlapping

Hence the Prime Minister whose party controls the Legistative would make laws and at the same time implements it as if a small kid would say he wants to watch pornography and head straight to watch it, without any obstable. It wasn’t so bad because you still have the Judicial pillar to at least protect your interest and rights. But after former premier Mahathir crossed the bridge and land on the soil of Judicial back in 1988, all hell breaks loose. With the position of the highest court judge at the mercy of Prime Minister, you shouldn’t be surprise at the new title “Dictator” bestowed on him.

After two decades since the last Constitution Crisis, it appears Malaysia is going to have another one, at least Raja Petra believes it's already happening. With senior and qualified judges put on cold storage when comes to promotion, the unqualified or juniors were given preference. Goblok blogger or not, the signature petition initiated by Raja Petra sure attracts 10,000 signatures and International Herald Tribune calling on Malaysia's king to help resolve problems such as corruption.

The Latest Scandal – Judiciary Fixing

And the latest scandal which is blowing hard on the current government has everyone who cares to read alternative news from blogs such as JeffOoi, MalaysiaKini and Malaysia-Today in disbelieve. The scandal which involves Judiciary at the highest level was first exposed by former Deputy Prime Minister Anwar Ibrahim and picked up by MalaysiaKini and JeffOoi's blog. The Malaysian Bar Council equally surprised and jumped in mad. While the media which are all controlled by the government had playdown or even blackout the exposed scandal, most of the blogs are flooded with the latest revealation.

In the video clip, the lawyer was talking on the telephone to someone who seemed to be a senior judge about how he (the lawyer) had helped get this judge appointed to one of the top judiciary posts. According to the telephone conversation, the appointment was done through a prominent businessman and a politician. The lawyer was also heard saying that he was working through the two persons to get the judge elevated even further and get him a “Tan Sri” title.

Judiciary Scandal – business as usual

The video clip with crystal clear audio has been uploaded into YouTube. Unable to hide anymore, Deputy Prime Minister today wants the authenticity of the video clip to be established. But considering Anwar has produced only 8-minutes of the original video clip to safeguard the whistle-blower, it could be used as thereason (or excuse) by the government to declare that the video-clip as not original and thus cannot be used as evidence. Unless Anwar can submit the original clip, to which will put the head of the whistle-blower’s identity to the gallows, this might be another “case-close” in the making. In addition, who are you or even the opposition to argue with the government if the ruling government insists that the video clip authentication cannot be verified? The transcript of the clip is here.

As usual, the calls for Royal Commission of Inquiry to be setup, asking the Chief Justice to be suspended and so on were heard. However such calls are basically useless and waste of time as with previous scandals that spawned such inquiries, it’ll be business as usual in no time. Furthermore the government basically controls all the three pillars of powers, mind you. Of course the timing of the video clips being exposed definitely raise people’s eyebrows.

Whether the video-clip produced is to portray Anwar’s innocence while at the same time to splash more dirt water onto Mahathir or simply to embarrass the current administration remains to be seen. For all you know prime minister Badawi might just reuse the famous yet effective “I don’t know … I’m not aware … it (the video clip) didn’t happen during my time” phrase to pass the ball out of his court. While this may be the second Judiciary Crisis, it’s definitely the first Judiciary Scandal. Furthermore how serious could this scandal be compare to the RM4.6 billion ringgit Port Klang Free Zone scandal? If the US$1.3 billion PKFZ scandal can be twisted with the soft-loan trick, this Judiciary Scandal can be twisted the same way, only with much ease.

Desperate times require desperate measures

Prior to the current state where the Supreme Court is the highest court, appeals on criminal and constitutional (abolished in 1978) and civil (abolished in 1985) matters can still be taken to the Queen-in-Council, advised by the Judicial Committee of the Privy Council in London. Of course the country cannot revert back to Privy Council as that would be "unpatriotic".

Prior to the current state where the Supreme Court is the highest court, appeals on criminal and constitutional (abolished in 1978) and civil (abolished in 1985) matters can still be taken to the Queen-in-Council, advised by the Judicial Committee of the Privy Council in London. Of course the country cannot revert back to Privy Council as that would be "unpatriotic".What the nation need is to return the glory of independence of check and balance. Simple measures such as restructure the Anti-Corruption-Agency to one similar to Hong Kong’s ICAC with the Commissioner of the body report directly to Parliament and the King might do the trick. The same goes to the appointment of judges, especially the Chief Justice.

Should Stock Investors Care?

What the heck does the Judiciary scandal has anything to do with stocks investing? Well, if the appointment of top judges can be brokered, as long as the money play along, what do you think of the investment protection the minority shareholders have if the tycoon of your portfolio (shares) decides to play you out? Remember Transmile Group Berhad (KLSE: TRANMIL, stock-code 7000), Megan Media Holdings Bhd (KLSE: MEGAN, stock-code 7101) or even unlisted Maika Holdings Berhad? You don’t think some heads will be sent rolling, do you?

The bottom line – vote wisely; but considering even Rocky’s Bru never register in his entire life, the current government will definitely score another big win in the coming general election. Maybe not 90% votes win but probably 85%.

Other Articles That May Interest You ...

Do you have US$1.3 Billion? Then you’re in the list

It appears the stake has increased if you plan to squeeze yourself into the glamorous Forbes 400 Richest Americans. Just like playing poker at the gambling table, the stake has been raised to $1.3 Billion if you wish to see your name within the list. The new threshold meant 82 of America's billionaires didn't make it this round. Altogether the top 400 billionaires have wealth worth a staggering US$1.54 Trillion (go and punch that number and see how many trailing zeroes please).

The top four wealtiest was unchanged. However joining the top 10 are the founders of Google Inc., Sergey Brin and Larry Page who shared the fifth place. Surging oil price has indeed help the oil baron brothers Charles and David Koch sharing the 9th spot, jumped from 19th spot last year. The most spectacular achievement was by casino tycoon Kirk Kerkorian who doubled his wealth in one year to US$18 Billion from US$9 Billion a year ago, pushing him to 7th position from 26th in 2006.

William H. Gates III

Rank: 1 (2006 Rank: 1)

- Net Worth: US$59 Billion (2006: US$53 Billion)

- Fortune Source: Software

- Empire: Microsoft Corp. (Nasdaq: MSFT, stock)

- Age: 51

Warren Buffett

Rank: 2 (2006 Rank: 2)

- Net Worth: US$52 Billion (2006: US$46 Billion)

- Fortune Source: Stocks Investments

- Empire: Berkshire Hathaway's (NYSE: BRK.A, stock)

- Age: 77

Sheldon Adelson

Rank: 3 (2006 Rank: 3)

- Net Worth: US$28 Billion (2006: US$20.5 Billion)

- Fortune Source: Casinos

- Empire: Las Vegas Sands (USA), Sands Macau Casino (Macau), Venetian Macau (Macau), Marina Sands Bay(Singapore)

- Age: 74

Lawrence Ellison

Rank: 4 (2006 Rank: 4)

- Net Worth: US$26 Billion (2006: US$19.5 Billion)

- Fortune Source: Software

- Empire: Oracle Corporation

- Age: 63

Sergey Brin

Rank: 5 (2006 Rank: 12)

- Net Worth: US$18.5 Billion (2006: US$14.1 Billion)

- Fortune Source: Internet Search Engine

- Empire: Google Inc. (Nasdaq: GOOG, stock)

- Age: 34

Larry Page

Rank: 5 (2006 Rank: 13)

- Net Worth: US$18.5 Billion (2006: US$14.0 Billion)

- Fortune Source: Internet Search Engine

- Empire: Google Inc. (Nasdaq: GOOG, stock)

- Age: 34

Kirk Kerkorian

Rank: 7 (2006 Rank: 26)

- Net Worth: US$18 Billion (2006: US$9.0 Billion)

- Fortune Source: Casinos, Investments

- Empire: MGM Mirage, Mandalay Bay Resorts

- Age: 90

Michael Dell

Rank: 8 (2006 Rank: 9)

- Net Worth: US$17.2 Billion (2006: US$15.5 Billion)

- Fortune Source: Desktop Computers, Laptops, Storage

- Empire: Dell Inc (Nasdaq: DELL, stock)

- Age: 42

Charles Koch

Rank: 9 (2006 Rank: 19)

- Net Worth: US$17 Billion (inherited) (2006: US$12.0 Billion)

- Fortune Source: Oil & Commodities (chemicals, pipelines, ranching, refining operations)

- Empire: Georgia-Pacific, Koch Industries, Koch Family Foundations

- Age: 71

David Koch

Thursday, September 20, 2007

Vincent Tan banking on new name to strikes Fortune

When the Chinese talk about feng shui, they have a holistic view and approach to it and one of the most famous saying is “first is Destiny,second is Luck, third is Feng Shui, fourth is Virtue and fifth isKnowledge”. That’s the importance in ascending order to the Chinese. But at the same time, a very important component within an individual (to the Chinese) is the name. Chinese people always attach great importance to the choice of names,so much so that in ancient time, Chinese believed that name contained the invisible fate and the visible and meaning characters.

Even in the current modern day, when parents or elders named a new born baby, they will

Talk about changing name, unlisted pay-TV operator MITVCorporation Sdn Bhd yesterday announced that it is now known as U Telecom Media Holdings Sdn Bhd. It futher claimed that the name change was to better reflect the group’s plans in offering multiple technology-driven services, applications and content. Its subsidiary, U Mobile Sdn Bhd (formerly known as MiTV Networks Sdn Bhd) is the newest mobile service provider using the 018 prefix.

U Mobile’s jewel is definitely the 3G license it won from the government of which is still sitting collecting dust without any productive roll-out from it yet. The fact that the company has signed interconnection agreements with Telekom Malaysia Berhad (KLSE:TM, stock-code 4863), Time DotCom Berhad (KLSE: TIMECOM, stock-code 5031), Celcom (M) Bhd, Maxis Communications Bhd and DIGI.com Berhad (KLSE:DIGI, stock-code 6947) only proves that besides the 3G paper license, it has nothing as far as infrastructure is concern in rolling out 3G services.

So, what about the pay-TV business that Vincent Tan and his lieutenants have been screaming

With the announcement on the name changes, does that mean Vincent is pulling his last leg out from the pay-TV business to concentrate in the lucrative telecommunication sector? Having started the DIGI.com only to sell it off to Norway's Telenor ASA (OSL: TEL) for a huge profit, Vincent is indeed not a new kid on the block. But would it be a little too late to start all over again with the telco market already reaching its saturation stage?

It actually depends on whether he can attract a good management team who not only knows how to plan, execute and market the products but also how to create innovative services and offerings along the line. Furthermore it was after the Telenor’s team on board that DIGI.com managed to gain respect from other mobile service providers namely Maxis and Celcom and the stocks soar to the current level.

Other Articles That May Interest You ...

Mortgage with mform services

Ever since the housing crisis hit U.S. people who did not know the meaning of sub-prime and mortgage earlier now know the meaning of both words. From the soil of U.S. the plague spread over into U.K. The problem was so real that Federal Reserve Chairman Ben Bernanke had to announce the rate cut by 50 basis points. Behind the crisis, firms who smelt the opportunity began offering their services in helping affected people in comparing mortgages in the U.K. and U.S.

Existing customers who did not have good credit ratings were affected badly and most of them were looking for remortgages online. Remortgaging or refinancing is the simple process of changing your existing mortgage lender (the banks) to another who can offer a better deal. Typically you’re required to complete the mortgage application form after which the lender will evaluate your eligibility and probably do a valuation on your property.

First time buyer mortgages would finds the process of finding the right mortgage lender quite challenging. mform's first time buyer mortgage guide gives you all the information required to learn about buying a house ranging from choosing a property, choosing a mortgage and other mortgage features to consider. mform also provides multiple calculators in its website for the purpose of stamp duty, rate change, monthly payment and even affordability’s calculation.

*sponsored*

The tale of pay TV business, ASTRO and NBC

Don’t you hate it that despite paying for the programs on monthly basis, you’re still getting bombarded with advertisements? To make matter worse Astro All Asia Network Plc (KLSE: ASTRO, stock-code 5076) which monopolize the pay-TV sector is forcing more advertisements to its subscribers. You might not realize it but if you care to measure the time-frame of advertisements in between a show / drama over the popular channel, you will noticed the ridiculous long period of commercials. Some veteran subscribers claimed it wasn’t that bad 3 or 4 years ago.

With Ananda Krishnan’s investment in Indonesia’s Astro-venture screwed-up big time after it registered a net loss of RM54.18 million for the second quarter ended July 31 2007, things can only get worse. Astro reportedly has invested about RM230 million since it bought 20 per cent of PT Direct Vision (PTDV) in July 2006. With only slightly more than 120,000 subscribers, PTDV (a joint venture between Astro and PT Broadband Multimedia's subsidiary PT Ayunda Prima Mitra) is rushing against time to find a better working solution before the loss getting deeper into the investor’s pocket.

Meanwhile let’s travel thousands of miles away into the land of America. NBC Universal Inc. said yesterday that it would soon permit consumers to download many of NBC’s most popular programs free to personal computers and other devices for one week immediately after their broadcasts. The audience in U.S. is getting sophisticated and viewers are finding new methods to avoid watching the commercials such as using TiVo Inc.’s(Nasdaq: TIVO, stock) machines.

The smartest part with the service is that the files would be unwatchable after a seven-day period, kinda like Mission Impossible, minus the explosion and smoke. The requiremen is for you to have a PC or notebook with Microsoft Windows operating system. For Mac computers and iPods fanatics, you just have to wait for the next release.

You might have to wait another decade before Astro actually adopts such a methodology, not that it has to share the pie with any real competitor out there now. By the way, the service by NBC will starts in November, so watch out for it.

Wednesday, September 19, 2007

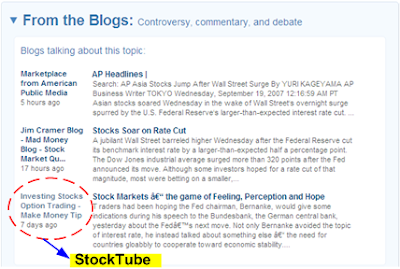

StockTube’s another article picked up by CNN Business

After StockTube’s article on “Reasons Why Oil Price might spikes to $90 and beyond” was picked up by Wall Street Journal, I was alerted via email by one of the readers that another of StockTube’s article was highlighted by another heavyweight financial portal, CNN.com. I couldn’t believe it but after checked it out, it shows how the top news providers actually paid attention to blogs around the world. It simply shows that blogging is here to stay and actually assists in presenting the independent voices of bloggers to readers. So, who says bloggers are Goblok (Indonesian slang for “stupid”) and have no value?

For the time being, StockTube is happy to know its articles are recognized and covered within CNN’s own blogosphere. Of course appreciation should be extended to regular and loyal StockTube’s readers, that’s you, and for that thank you for your continuous support.

Other Articles That May Interest You ...

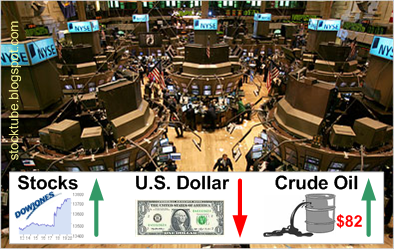

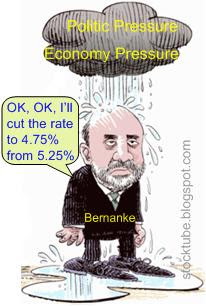

Rate Cut’s effect – high Oil Prices and weaker Dollar

You won people - you got your interest rate cut after months of chanting, so much so that U.S. Federal Reserve Chairman Ben Bernanke admitted defeat and cut the funds rate by a whopping 50 basis points. But really, can the current new rate of 4.75 percent (from previous 5.25%) help the ailing housing sector? Was it the right move? Nobody can or dare to answer that question. The safe answer would be – time will tells. While no one knows if this is the medicine needed, the rate cut has already presented some immediate effects.

Joyful stocks investors aside, Ben Bernanke is crossing his fingers hoping for the inflation risk to remains stagnant, if not go away. Oil prices rose immediately with light sweet crude for October delivery added 82 cents to $82.33 a barrel in Asian electronic trading on the New York Mercantile Exchange by midmorning in Singapore. Did anybody just say some days ago that $80 a barrel is a temporary level and won’t last? By cutting the rate, the growth in economy will accelerate and hence the demand for already tight crude supplies will increase, at least in theory.

If you’ve bought into oil or energy stocks or options, today’s (Wednesday)inventories data to be released by the U.S. Energy Department's Energy Information Administration (EIA) will be the key measurement that will determine if you would make good profit. Analysts surveyed by Dow Jones Newswires expect the EIA to show that crude inventories dropped an average of 1.5 million barrels in the week ended Sept. 14, while gasoline supplies fell by 1.3 million barrels. If so, you’ll see oil stocks to soar.

On the other hand, the dollar tumbled to a new all-time low against the euro and other regional currencies including Malaysian ringgit. As the gap narrow, funds might flows out from the U.S. looking for better place to park. Malaysia ringgit already registered its biggest gain since 18th June, traded at 3.4580 to a dollar after the rate cut. This sure brought the much needed relief to the Malaysian government who was worried sick of the falling stocks prices. It hopes foreign investors will restart buying local shares, at the same time allows the government to sing the song of praise right before the next general election.

Other Articles That May Interest You ...

Bernanke admitted defeat and Released the Pressure

If you do not know yet, the announcement is already all over the financial news portal. Federal Reserve Chairman Ben Bernanke and his central bank colleagues admitted defeat and lowered the interest rate to 4.75 percent, a half point cut from 5.25%, pressured by the political and economy built up over the months.

Wall Street responded happily sending stocks up over 335 points - its biggest one-day point jump in nearly five years. The first cut in over four years means borrowers who can obtain credit should see rates drop on a variety of loans such as credit cards and housing mortgages. Already Wells Fargo, Bank of America and other commercial banks dropped their prime lending rate charged to millions of borrowers by a corresponding amount to 7.75 percent after the announcement.

“"Today's action is intended to help forestall some adverse effects on the economy that might otherwise arise from disruptions in financial markets and to promote moderate growth over time … some inflation risks remain" the Fed said in a statement released after its closed-door meeting.

While some other analysts predict the Fed will lower rates again

Some people said Bernanke is dead worry that people and businesses will cut back on their spending and investment, throwing the economy into a tailspin, thus the rate cut to ensure it doesn’t happen. As expected the dollar tumbled to a new all-time low against the euro after the rate cut simply because lower rates make the currency less attractive while crude oil futures spiked into record high of $81.51 a barrel, up 94 cents.

Needless to say, Asian stocks jumped on Wednesday morning trading in the wake of Wall Street's overnight surge. Japan's benchmark Nikkei 225 stock index soared 531.49 points, or 3.36 percent, to 16,333.29 points on the Tokyo Stock Exchange while Hong Kong’s Hang Seng Index jumped 791.34 points. Malaysia’s KLCI jumped over 19 points in early morning trading with high volume after days of low transaction due to the uncertainties. Now the ball is in Malaysia Central Bank'scourt whether to follow the step in cutting the interest rate which can ease the suffering of homeowners.

Other Articles That May Interest You ...

Old couple getting Thoof about preference

Just how on earth do you pronounce “Thoof” and most important of all what does this word means? If you check the word against thesaurus, it’s a dead-end. If you split the word to “The” and “Hoof” it’s a dead-end as well. In a nut shell, no one really knows the meaning behind Thoof brand except the website actually provides personalized news to you and me. Thoof claims it is using"personalization algorithm" in presenting the info or news to its readers. Meaning users access news based on his / her likes and preferences on the very first visit. Talk about democracy.

Still it doesn’t answer how the founders got the unique name of “Thoof” in the first place. If it’s

Instantly the founder realized that even after years of marriage, a couple still have their own preference in such a simple thing. What about youngsters surfing the net searching for info, news or even gossips? And talk about gossips, every celebrity has their own fans. The founder decided to launch his own site with the flexibility of allowing readers to customize their preference, and named it Thoof – short for “TheHut Of Old Fanatic”.

Tuesday, September 18, 2007

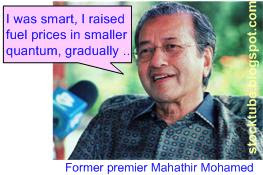

Gas Price to increase but IPPs remains unaffected

As expected, oil prices climbed to a fresh high with the light sweet crude for October delivery rose as high as $81.18 a barrel in Asian electronic trading on the New York Mercantile Exchange, before retreating slightly to $81.04, midmorning in Singapore. Basically the stocks markets across the globe have been quiet with most of the indexes in the red awaiting the result of the Fed meeting today.

I’ve actually left out one of the reasons why oil price will remain bullish from my recent article “Reasons Why Oil Price might spikes to $90 and beyond”. That factor is the coming winter season which at this point is still uncertain in terms of its severity. Really it’s an annual event as the winter season comes without a miss every year. What is the difference is whether the blizzards will create havocs this time around, not that the U.S. inventories are anything that can comfort the people of U.S., going by the recent announce figure.

To be precise it’s the heating oil futures that investors should watch out but generally when the winter season is super-cool, almost all energy-related commodities will go up. While U.S. has to face the uncertainty of higher fuel price and heating gas due to the winter season and natural disaster such as hurricanes, something quite difference is haunting the people of a nation thousands of miles away.

Government claimed Petronas paid out subsidies close to RM50bil in the last 10 years for gas and the time has come for it to raise the rate considering the global oil prices hitting above US$80 per barrel. As a wholly owned government business entity, the government Minister is helping in echoing the needs to raise the price of gas when the Cabinet committee meets next Monday. So a raise is imminent.

But the question remains if Petronas can actually continue subsidizing the gas. While Petronas sold subsidised gas at RM6.40 per mmBtu (Million British Thermal Units) when the unsubsidised gas cost about RM40 per mmBtu, the fact that Petronas’ accounting figures’ continuous secrecy has given impression that the massive profits have been abused. If it’s clean, why not disclose it to the public since the natural resources belongs to every individual citizen, goes the argument.

The government was criticized for sponsoring cronies in terms of heavily subsidized processed gas to companies such as Tenaga Nasional Berhad and a handful of IPPs (independent power producers). Petronas once said over RM25 billion of subsides were extended to IPPs such as Genting Sanyen Power, YTL Power, Malakoff Bhd and Tanjong Plc/Powertek Bhd, thus created instant tycoons associated with politicians. So why the people should suffers with price hike when these cronies are enjoying their massive profits from the subsidies?

Despite Petronas being the special entity created by Parliament via the Petroleum Development Act (144) 1974, it has a strange clause which amongst other stated that the Corporation shall be subject to the control and direction of the Prime Minister who may, from time to time, issue such direction as he may deem fit. Hence even Parliament has no power over Petronas. In another words Petronas belongs to the Prime Minister of Malaysia. And to see people cracking their heads wondering why former premier Mahathir appointed himself as the “Advisor” to Petronas after passed the baton to Badawi – it’s a gold mine, mind you.

Anyways, the hike in gas price will definitely bring in another round of price hike in other consumer products or finished goods and the chain-reaction will push up the inflation. Can the government take the heat of grumbling voters with the general election so near? Maybe the benefits of having the extra billions of dollars released from the subsidies outweight the unhappy people on-the-street.Furthermore the government can always gives another carrot to the people a week before election is announced.

On the side note, don’t you dream of the day when the Petronas finally list its’ shares in the local stock market? But considering Petronas does not need to raise money, it might just remains as the personal corporate of the Prime Minister.

Other Articles That May Interest You ...

The Mortgage’s plague spread into Britain from U.S.

It was a rare sight though it happened before but those were during the recession period. Sometimes you watched it during some television dramas but in actual fact it’s a rare occasion. What I’m talking about is the panicky depositors showed up in drove to withdraw their savings from financial institution. Well, believe it or not it happened in one of the most developed country in the world – Britain.

For the second straight trading day, the shares of lender Northern Rock Plc (LON:NRK) plunged by more than 30% to 302 pence in late trading on London's FTSE 100 index, forcing the stock to be suspended briefly in the early Monday morning trading. Last Friday, its shares closed down 31.46% after the Bank of England (BoE) agreed to rescue Northern Rock, the fifth-largest mortgage lender, which fallen victim to the global credit squeeze.

While Chancellor of the Exchequer Alistair Darling sought to assure depositors that their money was safe, former US Federal Reserve chairman Alan Greenspan add fuel to the fire and warned in an interview on Monday that British consumers were in for more pain as he predicted "difficulties" ahead in the country's housing market.

According to the Sunday Telegraph, one rescue plan involved carving up Northern Rock's mortgage book, totalling 100 billion pounds, and distributing it amongst other lenders. Even if Northern Rock can survives this round of onslaught by its depositors, the images of customers queuing up in the high street has done irreparable damage to the brand. With such fragile markets, everyone is watching Bernanke’s next move.

Other Articles That May Interest You ...

Monday, September 17, 2007

Reasons why U.S. rate cut is a Bad Idea

By far you’ve heard and read why everyone was and is still chanting for the Fed to cut its key rate from the current 5.25% to 5% or even 4.75%, if Bernanke is serious in wanting to make the investors “happy”. The investors are threatening (sort of) to boycott the stock markets by not participating (buy shares or Call options) at all, as can be seen with the low volume. They might increase their pace in selling though – sell shares or Call options (or buy Put options), reasoning that the stocks could not see any reason to be bullish but every reason to be bearish.

The Fed funds rate of 5.25% has been stagnant since June 2006 and Bernanke has been ignoring these market urges (to cut rate) because the other data shows the recession is not to be seen, at least to the Feds chaimain. Due to the overwhelming chanting for the rate-cut, almost every financial analyst predicted the cut is a sure thing to happen on Tuesday 18th Sept 2007. As such Monday is expected to be a very very quiet trading day with almost “ALL” the fund managers staying sideline sipping their coffee or coke waiting for the result. A news portal even calls this week the “mother of all weeks” – a reference to the Tuesday’s FOMC meeting.

So, are there people who actually do not wish to see a rate-cut? You bet and I guess the concept of yin and yang applies to basically everything in this universe.Amongst the reasons why these people do not want Bernanke to cut the rate are:

- It would bail-out the stupids – yes, I know it’s a harsh-word but that’s exactly the word some analysts used. This group of people thinks that since it was the stupid lending companies which lent it to the people with little or no credit histories they have no one to be blamed except them-selves when the credit crunch began in 2007. Warren Buffett actually has the same opinion, though he was short of using the “stupid” word during an interview on “Warren Buffett on Housing Crisis and Presidency”.

- The U.S. economy is not weak – while housing is weak, it’s not across the board as can be seen in states such as California or Florida whereby the real-estate sector is still bullish. Consumer spending is still strong with McDonald’s Corporation reported the August’s sales were up more than 8%. And you simply have to read the multiple new orders for Boeing Company’s (NYSE: BA, stock) planes and its stocks performance.

- China and India’s economy is too strong – the global economies especially China is still very strong, so much so that the China had just recently raised its interest rate to cool off its economy. As such the strong demand for commodities (coal, oil etc) and finished goods could cushion the relatively weak U.S. economy. It could create potential new issue (funds out-flow) if U.S. cuts its interest rate when the Chinese is busy finding slots to increase its rate.

- It would increase U.S. inflation problem – already the U.S. dollars had fallen to record low against the euro. A lower interest rate might cause dollars to depreciate further and the purchasing power of U.S. to decline. Higher price of goods will hinder consumer spending due to the potential inflation hikes.

It’s a tough decision for Ben Bernanke to make as he needs to weight from both flip of a coin whether he decides to maintain, cut or even raise the interest rate. They don’t call the Fed Chairman’s position a hot seat for no apparent reason.

Other Articles That May Interest You ...

Sunday, September 16, 2007

The Week Ahead – awaiting FOMC for direction

Next week will be an interesting week, especially with the FOMC meetingon Tuesday, 18th Sept 2007. Given the damage done and the meltdown in subprime lending, the expectation is extremely high from investors for Fed to cut interest rate.to help support the U.S. economic growth, which has indirect effect on the global stock markets with the exception of China. But there’re concerns that Bernanke might disappoints everyone again.

The more volatile household survey used for the unemployment statistics showed a 316K plunge in employment. Nonfarm payrolls fell from 138,041,000 in July to 138,037,000 in August - the decline of 4,000 is well within the margin of error. The average payroll gain in the past three months is just 44,000, with financial and construction sector announcing layoffs. The weak payrolls however are not happening across the the broader economy to other sectors.

Another critical fact that cannot be ignored is that the consumer spending trends remain steady. Consumer spending is almost two-thirds of the GDP calculation and there is no obvious sign that it is declining. In a recession, consumer spending would have weakening. Furthermore, the argument that consumer spending has to fall given the decline in payrolls simply does not add up.

So while the economy is sluggish, it’s still far away from the “recession”.Bernanke just might lower the feds rate at 18th September’s meeting and will just stop and move in “slow-motion” thereafter onwards.

Saturday, September 15, 2007