Wednesday, September 05, 2007

Ready to take profit on Apple’s Special Event today

Apple Inc.’s (Nasdaq: AAPL, stock) was trading up 6 points yesterday ahead of today's "Special Event" at 1:00 pm E.T. The company however has not given any indication of the subject of the event, so in turn there has been a lot of speculation over the last few weeks regarding what will be announced, as is always the case ahead of an anticipated event for the widely-followed company. For the most part, the speculation we've read relates to incremental improvements to existing product lines, rather than some radical new product announcement.

Some of the possibilities that have been mentioned in the widely publishedspeculation include the following:

- the new iPod may be able to download music wirelessly from iTunes,

- iPod nano will be revamped, there could be a new case design with a new color scheme and the skinny design is rumored to be sacrificed to add a video-friendly display,

- the new iPod video may come with a wide-screen multi-touch panel similar to the iPhone, high storage capacity and Wi-Fi connectivity

- an announcement regarding the Beatles catalog

- the possibility of ring tones being sold via iTunes.

Additionally, AppleInsider has reported that retailers, including Best Buy andTarget, are gearing up for a big product release. Broker UBS expects the company to upgrade both the nano and video products. The firm is expecting higher capacity nanos at aggressive price points, as well as a flash based widescreen video iPod likely using multi-touch technology present in the iPhone for about $300 (firm expects higher capacity HDD versions as well).

Gene Munster, senior research analyst at Piper Jaffray, recently spent some time counting iPhone and Mac sales in Apple retail stores across the country. Here is what he found: Apple will likely hit its goal of 730,000 iPhones in the September quarter. Specifically, the analyst wrote, his checks indicate Apple could sell 804,000 iPhones, essentially in-line with his estimate of 800,000 units.

As for Mac sales, Munster said that those sales appear to be tracking ahead of plan. His research implies two million Macs sold in September, representing a slight upside to his estimate of 1.9 million. He maintains an "Outperform" rating on Apple with a price target of $211.

Apple is trading just below its late-July all-time high of 148.92, after trading up ~30% over the past few weeks from its 8/16 low of 111.62. Given the strong run in AAPL ahead of today's event, StockTube expect the sell-on-news event to kickin pretty fast. So if you’re trading Apple’s stock, you might want to sell it before 1:00 pm E.T today if your trade is already in a profitable position.

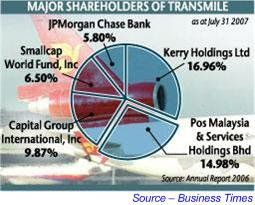

Learn from Mistakes - better days ahead for Transmile

On the personal note, since the news that Ling Liong Sik had resigned as the President of MCA (a component party of the ruling government) as well as Transport Minister in 2003 after a political battle with his former deputy Lim Ah Lek which split the party into Camp-A and Camp-B, he has not been targeted by journalist until Monday, 3rd Sept 2007 when a filing in the KLSE (Kuala Lumpur Stock Exchange) revealed he has resigned as the Chairman of Transmile Group Berhad (KLSE: TRANMIL, stock-code 7000).

It would be just a normal resignation which would not raise any eyebrows if not for the fact that Transmile’s recent accounting scandal skyrocketed Transmile on the world map as the Enron of Malaysia. To add salt to the wound, it is one of the companies that pride the name of the tycoon Robert Kuok being its major shareholder. Billions of ringgit was wiped out from the market capitalization when Transmile’s share price plunge from as high as RM15.00 per share to as low asRM3.50 per share within 4 months when the accounting scandal exploded.

The fact that Ling decided to quit (or was he asked to leave?) two days before its directors are due to face shareholders who will definitely demand to know more about the scandal that had caused huge losses to its minority shareholders speaks higher volume and created more rumours. Transmile will have its shareholders’ meeting (AGM) today, Wednesday 5th Sept. It was reported that although Ling holds some 75,000 Transmile shares, he will not attend the shareholders'

Coincidently Kuok Brothers Sdn Bhd in the filing on the same date as the day of Ling’s resignation on 3rd Sept 2007 announced it had acquired up to 800,000 shares of Transmile on 30th Aug 2007, raising its stake to 17.22%. And Transmile’s share price jumped since then, registering a high of RM0.44 (13%) gain yesterday (Tuesday 4th Sept) and as high as RM4.20 per share or a gain of RM0.48 (13%) in today’s morning trading.

Soh Chee Wen used to controll eight listed companies and was the biggest stock market player the regulating agency had investigated over his two counts of defrauding now-defunct Omega Securities Sdn. Bhd. Among the companies he controlled during his heyday were marine engineering and property concern Promet Bhd., Autoways Holdings Bhd., Kelanamas Industries Bhd. and tin-plate maker Perusahaan Sadur Timah Malaysia Bhd.

Soh Chee Wen had also claimed that he had hooked up Liong Sik and his family to businessmen in Singapore, Hong Kong and Taiwan and enriched the Lings by millions of ringgit. However, Ling Liong Sik did not rebut claims made by his former close aide Soh Chee Wen regarding how he (Ling) made use of his Transport Ministry's office and facilities to conduct personal business dealings.

Interestingly all the individuals in the corporate world are related, one way or another. Wong Yoke Meng who has been appointed the new Managing Director of Transmile was formerly Chief Operating Officer (COO) at RHB Capital. The founder of RHB, Tan Sri Rashid Hussain who married Robert Kuok’s daughter, Suraya, has since retired after his company was acquired by Utama Banking Group, controlled by Sarawak Chief Minister Abdul Taib Mahmud.

Regardless of the unforeseen future for Transmile, there’s no doubt investors are relieve now that almost all the obstacles are cleared and things indeed look better now than ever. If Transmile is a gem, Robert Kuok will definitely unlock it by way of privatisation, if the market still does not match its value.

Other Articles That May Interest You ...

Tuesday, September 04, 2007

Pre-Budget 2008 – What’s your wish? Take a Vote

One of the greatest moments everyone is waiting each year will be the Budget announcement. The Budget 2008 will be presented by Malaysia premier Badawi this Friday, 7th Sept 2007. The corporate as well as individual will be waiting anxiously to know what the goodies are that Badawi will bring to the table.

With the general election around the corner, it is expected the one-term prime minister will give away more sweets to calm unhappy voters who have been burdened by government policies which caused escalating cost of living and hardship in other ways. Experience has taught the ruling government that small giveaways could do wonders in attracting voters to re-vote the government again in the next election.

Meanwhile, the Malaysian Institute of Accountants (MIA) and the Malaysian Institute of Taxation will operate a budget hotline on Sept 8. The hotline, to operate from 9am to noon, will provide a channel for the public to seek advice from tax experts on the implication of any changes to the income tax law affecting individuals and businesses. And the number is03-2274 4447, not a very prosperous number.

By the way, have you seen how Transmile Group Berhad (KLSE: TRANMIL, stock-code 7000) stock price jumps more than 12%this morning after the former chairman, Ling Liong Sik resigned yesterday?

Other Articles That May Interest You ...

Monday, September 03, 2007

Ling Liong Sik Resigned (or Fired?) from Transmile

Iguess it must be too painful for the Chairman of Transmile Group Berhad(KLSE: TRANMIL, stock-code 7000) to accept the fact that he indeed screwed-up big time with the recent accounting irregularities, so much so that the richest man in Malaysia Robert Kuok has no other choice but to tell him to resign. You don’t think the Chairman resigned voluntarily from the comfort of the 5-figure monthly income, do you? Furthermore Malaysia is not known to have any leaders who accept responsibility by resign voluntarily during any scandal or crisis of confidence.

Even though the Securities Commission has finally charged three key executives of Transmile namely the founder and former

The audit by Moores Rowland Risk Management Sdn Bhd showed Transmile posted a pre-tax loss of 172 million ringgit ($49.78 million) instead of profit of 207 million ringgit in financial year 2006 and a pre-tax loss of 67 million ringgit in 2005 instead of profit of 120 million ringgit. In addition, it also reported a smaller pre-tax profit of 8 million ringgit for the 2004 financial year than the 87 million ringgit previously announced.

Other Articles That May Interest You ...

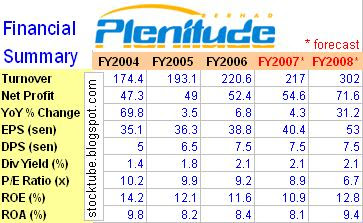

PLENITUDE – the Turtle of Property Stocks

There’re basically two sectors which will flourish when a country’s economy is picking up – banking and property. On the same note should the recession hits, these two same sectors will suffer on equal quantum. StockTube had written some articles on property stocks and amongst others, the favorite would be Mah Sing Group Berhad (KLSE: MAHSING, stock-code 8583). Others include E & O Property Development Berhad (KLSE: E&OPROP, stock-code 3468), Sunrise Berhad (KLSE: SUNRISE, stock-code 6165) and SP Setia Berhad (KLSE: SPSETIA, stock-code 8664).

Having said so, it doesn’t means other property stocks are crap or un-attractive. It simply means there’re just too many choices to choose from and realy, it depends on how you as an investor “feel and know” about the companies. Sometimes you just need to have that “click” with the company before you actually have the intangible justification to say that this stock is what you’re looking for. It could be that you’ve bought property developed by such company or you know someone close to you who works within the company who can provide you with the independent views.

Plenitude – Slow and Steady

One of StockTube readers recently asked about another property stock, Plenitude Berhad (KLSE: PLENITU, stock-code 5075). What I can say about Plenitude is that it sure has the characteristics of a “mini MahSing”. I’ve to admit Plenitude wasn’t on investors’ radar until it made a net gain of RM24 million from the disposal of a 37-acre plot of land in Tebrau to Permodalan Eramaju Sdn Bhd (Ikana Group) for RM64.4 million.

Plenitude was reportedly owns a landbank of about 1,950 acres with half of it located in Johor while the remaining 835 acres in Kedah (Sungai Petani). Unless the buzz about NCER really takes off in a big way, I’ll just put this Kedah’s land on reserve as far as profit contribution is concern. Furthermore the commercial value of lands or buildings in the northern part especially in Kedah is not that interesting.

Listed in 2003, the company has been consistently declaring dividends though the amount is nothing to shout about. The company owns the 200-room Tanjung Bungah Beach Hotel in Penang and has been on lookout for more lands surrounding it. At the southern part, it has the Desa Tebrau project with GDV of about RM280 million which is located just 14km northeast of Johor Bahru city.

Listed in 2003, the company has been consistently declaring dividends though the amount is nothing to shout about. The company owns the 200-room Tanjung Bungah Beach Hotel in Penang and has been on lookout for more lands surrounding it. At the southern part, it has the Desa Tebrau project with GDV of about RM280 million which is located just 14km northeast of Johor Bahru city.Its maiden foray into the high-end residential market started with its acquisition of four parcels totaling 20.1 acres in the exclusive Sri Hartamas, Kuala Lumpur. The proposed development on these four plots of land will feature 11 units of bungalows, 84 units of semi-detached houses and 796 units of condominiums with each one having a different and unique concept. The total GDV (Gross Development Value) at Klang Valley totaled RM333 million, not to mention Taman Putra Prima project at Puchong with a GDV of RM233 million.

Fundamental of Plenitude – Cash-Rich

What is attractive about this company is its sizeable cash pile of over RM48 million, not to mention the additional RM20 million in fixed deposits as of end of Mar-2007. Hence, with the net gain of RM24 million from land sale to Ikano, Plenitude has about RM92 million of cash to play around – 68 sen a share. Based on the trading share price as of writing (RM3.04) and 2006 EPS of 38.8 cents, the stock is trading at P/E ratio of 7.83 only.

Thus it’s not surprise that OSK Investment Bank has a target share price of RM5.00 per share on Plenitude which will translate to P/E ratio of 12.88 times, well below the average property stocks P/E ratio of 16.7 times. And with the company having a gearing of zero, the juicyness of this stock becomes more obvious.

Thus it’s not surprise that OSK Investment Bank has a target share price of RM5.00 per share on Plenitude which will translate to P/E ratio of 12.88 times, well below the average property stocks P/E ratio of 16.7 times. And with the company having a gearing of zero, the juicyness of this stock becomes more obvious.Of course if you were to take the earnings forecast of 2007 and 2008, the current share price is trading at 7.52 and 5.73 times respectively. The ROE is definitely something to be noted as it shows the efficiency and the determination of the management in creating values for its shareholders.

Technical Analysis on Plenitude

Since the stock breached the RM2.40 per share level and established it as the new support in early Apr-2007, it has created two new highs of RM3.10 and RM3.60 per share. These two highs however becomes the current resistance since the U.S. subprime spooked all the investors who were previously chasing the property stocks.

Nevertheless, the stock has not traded below the 200-D moving average and any correction to the RM2.40 level should be well-supported. With the current housing problem not completely cleared, I would not jump into the bandwagon now as it’s testing the resistance of RM3.10 per share. But it depends very much on your risk appetite.

Nevertheless, the stock has not traded below the 200-D moving average and any correction to the RM2.40 level should be well-supported. With the current housing problem not completely cleared, I would not jump into the bandwagon now as it’s testing the resistance of RM3.10 per share. But it depends very much on your risk appetite.The Problem with Plenitude

Ok, so if Plenitude is so promising why the stock is trading at such a low level of P/E ratio? As most investors will tell you, stocks are trading at their current level because there’re reasons for it to be at that level. The fundamental is good, gearing is at zero, management is efficient and it has abundance of cash. So what could be the problem?

For one, the floating shares of Plenitude amounting to 135,000.000. The company’s largest shareholders are:

- Ikatanbina Sdn Bhd – 45.5%

- Ong Bee Kuan – 19.6%

- En Primeurs Sdn Bhd – 7.3%

- Bus Info Plus Sdn Bhd – 4.9%

Hence the combination of the above four largest shareholders already owns a whopping 77.3% collectively. Assuming the remaining 22.7% (this is not the correct figure, mind you) or 30,645,000 shares floating in the market, the stock is illiquid – meaning it’s not easy to buy or sell. Add in the

The second reason could be due to the fact that the company is very conservative - as a matter of fact it could be viewed as too cautious that the company might not be attractive for medium-term investors. Traders do not like stocks which are too boring and conservative. But then it could be this reason that the company managed to gather such a huge cash-pile. Remember the story about the Rabbit and Turtle running a race?

# TIP: Wait for the stock price to consolidate to RM2.40 if you’re really obsessed with this stock. Unless you do not have property stock in your portfolio, you shouldn’t chase the stock especially at current price and global housing uncertainties.

Other Articles That May Interest You ...

Sunday, September 02, 2007

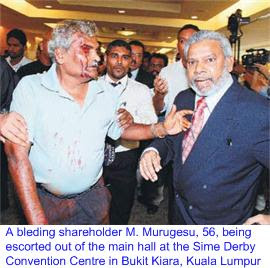

Poor’s Hope in MAIKA – the Last Robbery

Maika Holdings Berhad, which was established a quarter of century ago in 1982 to allow the Indian community in Malaysia to take a share in the country's economic development, has been a disaster from the beginning. The company was launched with much hope and hype by MIC (one of the component parties within the ruling government) president Samy Vellu to assist the Indian community and had attracted an estimated RM106 million from 66,400 shareholders – many of whom are estate workers who had pawned their family jewellery and withdrew their life savings to invest in the company.

The largest individual shareholder with almost 2.8 million shares was MIC president Samy Vellu. It was said that the amount invested in Maika was even larger than that obtained by the MCA’s Multi-Purpose Holdings when the company commenced business.

The Scandal

In the Maika-Telekom scandal in 1992, it was disclosed by newspapers and magazine that instead of 10 million Telekom shares, Samy Vellu actually advised against allocating all the shares to Maika. Instead Samy Vellu was reportedly saidMaika should deserved only 1 million shares while the remaining 9 million shares allocated to “other MIC bodies”.

It was alleged that Samy Vellu’s son and brother-in-law were directors of of the RM2 companies, SB Management Services Sdn Bhd and Advance Personal Computers Sdn Bhd. which received three million shares each. The third company that received the remaining three million shares was Clearway Sdn Bhd. Over the years, those who sought to find the answers and clarifications regarding Maika at MIC meetings were either threatened or beaten up.

Maika's Cash-Cow Sale - Puzzling

Earlier, many members felt that the board deliberately selected the date (the same day as the 50th Independence Day celebration) to prevent many shareholders from attending the important AGM, not to mention the choice of venue (Sime Darby Convention Centre in Mont Kiara) which is “located too far from the city centre” and could therefore deter shareholders from attending the meeting.

At the company’s 24th AGM on 31st Aug 2007, its shareholders passed five resolutions including the sale of its 74.17% stake in insurer Oriental Capital Assurance Bhd (OCAB) to Salcon Bhd for RM129.81 million and the distribution of surplus to shareholders as a result of disposal of the entire assets in the company, but not before some ugly and untowards incidents.

Interestingly Salcon Berhad (KLSE: SALCON, stock-code 8567) is a company dealing in maintenance of water treatment and severage treatment plants, so it’s a mystery why Salcon would buy an insurance company, not to mention it does not have the expertise in running the insurance business. However the puzzle could be due to the fact that Razali have been offered lucrative road construction jobs in India in deals brokered by Samy Vellu, who is also the Malaysia Works Minister.

AGM - All Hell Breaks Loose

Shareholder Dr A. Letchumanan claimed he was pushed, kicked and thrown out of the meeting. Lawyer G. Rajasingam later said it was ludicrous that some shareholders were manhandled and thrown out of the meeting. "Some men behaved like thugs, dragging people out. This is not at all like a shareholders’ meeting," he said.

R. Rajannan, a representative of Koperasi Nesa Pelbagai Berhad, a company which has 625,000 shares in Maika Holdings, said he was threatened and had curry powder thrown at him. It is understood that an elderly man was left bleeding after being assaulted during the meeting attended by about 1,500 people.

"We are hoping to give back one-to-one because they (the shareholders) invested a RM1 (per share). We plan to buy the mother shares for RM1 (per share) and we have given 25 million in bonus shares, which will also be bought back at RM1 (per share) … We want to give the shareholders the option to do what they want. They can take their money back or opt to continue with the company" Maika’s CEO Vell Paari told reporters after the AGM.

The End of Maika's Myth

Whatever the reason behind the demise of Maika now (you don’t think it can survives without any profitable business entity, do you?), it only goes to show again that politic and business should not be mix together as its’ near to impossible to practice good corporate management, governance and transparency in order to create value to shareholders. The fact that Maika couldn’t list itself even during the profitable stage only goes to show how “messy” the accounting figures were. Anyway luckily Maika was so badly managed that it didn't manage to sucks more of other public's money into investing its stock.

It’s definitely sad to witness the hard-earned savings of the poors being ripped off and is now on the verge of bankruptcy after 25-years of mismanagement.Worst still, the poors are still holding the worthless pieces of paper once were their hopes - only ended up in debt to repay loans taken to buy Maika shares. Based on the last closing share price of Telekom Malaysia of RM9.75, the 10 million shares allocated could worth a whopping RM97.50 million, not to mention the huge returns that the shareholders could enjoy from the dividends declared over the last 25 years.

Even if you put those initial RM106 million into fixed-deposit, the shareholders would be jumping in joy to learn that after 25-years of the pathetic average 3 percent compound annual returns, the balance sheet will shows a mind-boggling RM221.94 million in the account balance as of 2007. You don’t have to be an investor-god like Warren Buffett to realize that you’re at least making more than100 percent profit by doing so (fix-deposit).

Other Articles That May Interest You ...

Saturday, September 01, 2007

Great Gift - Stock in a Frame for your love one

Remember those days when you will get to bring back certificates of shares that you bought from the stock exchange? Before computerization, stock investors will be given certificates which stated the number of shares of a particular listed company you bought as proof of your ownership. However due to the frequent certificates theft, the certificates (or known as share scripts) were replaced with digital format since.

If you wish to buy one share of a publicly traded company as a gift for your love one, you can count on ShareInAFrame. Basically you can order a frame with a stock certificate and probably wrap it with a ribbon and present it as a gift. I think the idea is cool. Yes, the stock is a genuine registered share. You can purchaseDisney stock, Harley Davidson stock or others including eBay, Gillette, Microsoft and many more. What better way to educate your young kid the value of investing with the certificate within a frame of your choice?

However, you need to wait for 3 to 5 weeks for the delivery of the actual share certificate. So you’ll get the frame and plaque as soon as it is assembled with a temporary stock certificate after you ordered.

Thursday, August 30, 2007

Bernanke Prepared to Act, Hint to Cut Rate?

In the yo-yo trend, Dow Jones industrials gained almost 250 points after Wednesday's closing. Reason - many investors believe the Federal Reserve will cut interest rates at its next meeting on Sept. 18 or even sooner and were preparing for Fed Chairman Ben Bernanke to hint at such a move on Friday at a speech in Jackson Hole, Wyo.

The cheer began when the news spread that Bernanke said in a letter to Sen. Charles Schumer, D-N.Y., that Fed policymakers are "prepared to act as needed" if the market's turbulence hurts the economy helped pad the market's gain.

While the Dow rose 247.44, or 1.90 percent, to 13,289.29, the Standard & Poor's 500 index added 31.40, or 2.19 percent, to 1,463.76, while the Nasdaq composite index gained 62.52, or 2.50 percent, to 2,563.16. The Russell 2000 index of smaller companies rose 19.49, or 2.54 percent, to 787.32.

Michael Sheldon, chief market strategist at Spencer Clarke, said he believes investors are positioning themselves ahead of Bernanke's speech. He believes the rebound during the session shows that perhaps investors are becoming more confident the Fed will lower interest rates and that financial institutions can weather their exposure to distressed mortgages and loans.

The regional markets are expected to pickup and trade with the same trend as Dow when market open on Thursday including Asian stock markets. Malaysia's Kuala Lumpur Stock Exchange which will be close on Friday for its 50th Independence Day might experience a more volatile market trend the whole Thursday ahead of the holiday.

Wednesday, August 29, 2007

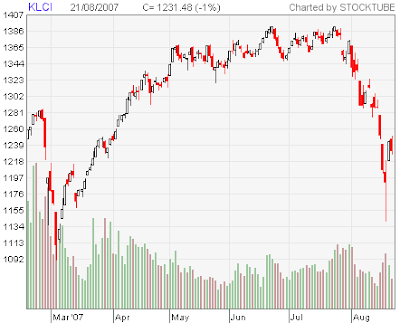

Celebrating 10th Anniversary of Stock Market Crashes

This year, 2007, marks the 10-years anniversary since the last recession in 1997 Asia Economiy Crisis which saw the local Kuala Lumpur Composite Index plunged from the pride of 1,230 points to the lowest of merely 262 points (Sept 1998). 1997 crash was also the most severe to the extend that the former premier Mahathir went berserk and point his finger at George Soros as the moron who started the crisis by pulling out from the stocks market, not to mention how Mahathir appealed to all the Malaysian to chip in theirjewelleries to help save the nation. Of course nobody gave him a damn, not that the people are unpatriotic but because basically everybody on the street were suffering as badly, if not worse, than Mahathir’s cronies.

Below is the extract from the summary of the ten-year cycle of market crashes in Malaysia published by theStar. So, instead of celebrating 50th Independence Day in less than 2-days away, you might want to take the moment to celebrate the 10th Anniversary of Market Crash as well.

The market crash in 1987/8

However, from Oct 12 to 16, the Dow Index tumbled by 9.5%. On Black Monday of Oct 19, it plunged 22.6%, or 508 points, within a day. It was the largest single fall since 1929, in both absolute and percentage terms.

In Malaysia, the KL Composite Index (KLCI) tumbled by 12.4% on Black Monday. As a result of the overnight crash in US, the KLCI plunged another 15.7% the next trading day.

The market crash in 1997/8

The Asian stock market crash of 1997/98 began with a currency crisis in July in Thailand and quickly spread to neighbouring nations. One by one, overheated markets crashed in Thailand, Indonesia, Malaysia, the Philippines, Hong Kong, Singapore, Taiwan and South Korea. This was mostly due to the rapid industrialisation in these countries.

The US market was affected by the turmoil in Asia. Its share prices began to collapse at the beginning of October 1997. On Oct 27, the Dow Index tumbled by 554 points, or 7.2%, within a day. However, it recovered by recording a rise of 337 points the next day.

In Malaysia, the KLCI tumbled from 1,231 points in the beginning of 1997 to the low of 262 on Sept 1, 1998, representing a total percentage drop of 78.7%.

Comparing the three market crashes, the KLCI suffered its biggest daily drop of 21.5% on Sept 8, 1998. The crashes in 1997/8 and 1987/8 were also far more severe than Malaysia's other recent market crash.

The market crash in 2007/8 ?

The recent heavy sell-down on the bond and stock markets caught a lot of retail and institutional investors by surprise. What appeared to be a haven in investment like the bond market was still subject to panic selling from institutional investors.

Analysts believe the crash in the bond market was mainly due to the withdrawal of some foreign funds. As a result of tight liquidity, unwinding of yen carry trade and potential high losses in some hedge funds, some foreign funds might have beenforced to withdraw their investments from the Asia-Pacific market.

The plummet in Malaysia stock market was mainly due to the fear of sharp drops in the US, Hong Kong, Singapore, South Korea and Japan markets. Even though Malaysia's banking institutions were not really affected by the US subprime issues, the international contagion and fear of more crashes, margin calls and panic selling from retailers caused heavy losses on Bursa Malaysia.

Note from StockTube: For people (including so-called professional stock-markets analysts and fund-managers) who keep on argueing that Malaysia will not be affected by the subprime mortgage or housing crisis currenctly experienced by U.S. simply because Malaysia’s fundamentals are still strong and the country’s exposure is almost nil, it only shows these peoples are either ignorant or just gave their opinion for the sake of giving it out.

It’s the perception and the emotion which runs during such crisis. Any market rebounds will just prompt fund managers to continue offloading their equity exposure – that’s the job of the fund managers. And if the fund managers who have the highest stocks holding among all the investors are selling, what do you think the small players will do? It’s the chain-reaction of how human behaves when fear is in the air. So nobody knows for sure if 2007 will be the year where the market will crash again, or maybe it’s already started?

Other Articles That May Interest You ...

Tuesday, August 28, 2007

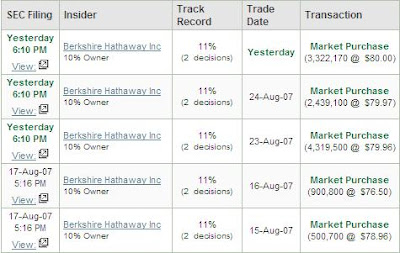

Warren Buffett the upcoming RailRoads Tycoon?

In the latest filing with the Securities and Exchange Commission, Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A, stock) revealed it has bought additional 10.1 million shares of Burlington Northern Santa Fe Corporation (NYSE: BNI, stock) since 23rd Aug 2007, raising its stake in the nation's No. 2 railroad to nearly 14.8 percent. The new shares were bought by Berkshire subsidiary National Indemnity Company.

In fact, Berkshire has been buying the stock the whole month of Aug 2007. The transactions are as below:

- 27th Aug – purchased 3,322,170 shares at $80.00 a share

- 24th Aug – purchased 2,439,100 shares at $79.97 a share

- 23th Aug – purchased 4,319,500 shares at $79.96 a share

- 16th Aug – purchased 900,800 shares at $76.50 a share

- 15th Aug – purchased 500,700 shares at $78.96 a share

- 7th Aug – purchased 62,400 shares at $79.78 a share

- 6th Aug – purchased 424,300 shares at $79.45 a share

- 3rd Aug – purchased 1,133,000 shares at $80.40 a share

Just what is in the mind of the Oracle of Omaha? Could Warren planning to increase his stake further to become the largest shareholder of BNI? Would he hold on to BNI for long-term investment the same way he did to Coca-Cola Company (NYSE: KO, stock)? Could there be a major M&A in the railroads sector with Buffett becoming the new RailRoad Tycoon (remember that piece of computer game)? Well, if you’re a die-hard fan of Warren, you might just want to follow his trail - stocks investing or option trading.

Other Articles That May Interest You ...

IDR – Could Middle East do the Trick this time?

Since the last durian-eating session between Singapore’s Prime Minister Lee Hsien Loong and Malaysia’s premier Badawi with the pledge by the former to support IDR (Iskandar Development Region), everthing has quiet down until today when the ambitious IDR project was awaken again by the local media.

This time, it was reported that a group of investors from Abu Dhabi, Kuwait, Saudi Arabia and Lebanon are expected to join Malaysian investors to develop 2,000 to 2,500 acres in the Iskandar Development Region (IDR) into a high-end integrated city. The initial development investment is projected at US$3 billion but the huge chunk would be in the construction of which an estimated US$10 billionwill be spent.

A local newspaper quoted a source as saying the land would be purchased from South Johor Investment Corp (SJIC), the developer of IDR, but jointly developed by the Middle Eastern parties and SJIC. Mudabala Group of Abu Dhabi and the Abu Dhabi Investment Authority are said to be among the investors that would be building high-end properties in IDR.

A local newspaper quoted a source as saying the land would be purchased from South Johor Investment Corp (SJIC), the developer of IDR, but jointly developed by the Middle Eastern parties and SJIC. Mudabala Group of Abu Dhabi and the Abu Dhabi Investment Authority are said to be among the investors that would be building high-end properties in IDR.The market was optimistic that Putrajaya Perdana Bhd will be the major player after Swan Symphony Sdn Bhd has proposed to buy a 50.6% stake in Putrajaya Perdana (KLSE: PPEDANA, stock-code 5117) for RM390mil cash recently fromEastern & Oriental Berhad (KLSE: E&O, stock-code 3417). Swan Symphony, a consortium comprising Middle Eastern, Malaysian and Singaporean investors, is 51%-owned by the Abu Dhabi-Kuwait-Malaysia Investment Corp and 49% by Autron Investment.

The details of the IDR development by the Middle-Eastern however are still very conceptual and sketchy at this moment. So, would the IDR finally take off in a big wave with both Middle Eastern and Singaporean driving it? Will Malaysian give the consortium the free hand in the development project and prevent another similar disaster such as the PKFZ’s scandal of which the Dubai-based Jebel Ali Free Trade Zone Authority pulled out from the pact?

Other Articles That May Interest You ...

Monday, August 27, 2007

Budget 2007 with New Tax on Everything - GST

In the upcoming 2008 Malaysia Budget, the government may implement thegoods and services tax (GST) and single-tier corporate tax. Deloitte KassimChan Tax Services Sdn Bhd technical director K Sandra Segaran said the GST was likely to be accompanied by further reductions in both corporate and personal income tax rates as has happened in countries such as Singapore.

The government could also suggest the possibility of lowering personal income tax, as the current rate of 28% for those in the top income bracket was still high. A company with paid-up capital of less than RM2.5 million would enjoy a differential tax rate of 20% on the first RM500,000 that it earned. As comparison, an individual earning RM500,000 has to pay close to RM125,000 while such a company would only pay RM100,000. Not a fair system in the tax-payment, isn’t it?

GST was introduced in several countries such as Australia, New Zealand, Canada, Hong Kong and the nearest is the Singapore. GST in Singapore started back in 1994 at a flat rate of 3% and subsequently raised to 4% in 2003, 5% in 2004 and 7% in July 2007.

The government would love to see GST goes through because it solves the problem of tax evasion. But the real objective of the government is to increase the income to the government’s coffer as it’s a broad-based system. Regardless whether you’re in the lower, medium of higher income bracket, you’ll pay to the government indirectly everytime you spend, even on a can of Coca-Cola. Singapore did it because its’ income from the normal income-tax is expected to decline with the ageing population.

StockTube couldn’t write more before the government announce the “scope of the coverage” which will be covered within the GST framework. Basically with the GST, the government can announce any items which will be “GSTed” anytime it desires. But with the coming general election, the scope of coverage could be small in order not to upset the voters. If the GST indeed materialized, the government is expected to announce an increment to the size of the scope gradually “after the general election”, taking the cue from the Singapore government.

Already burdened with multiple taxes, high inflation, tolls, low buying power, increase in living expenses etc, it would be very interesting indeed to know how the government plans to implement the GST without getting people to put up banners in objection. But then the GST could be put up only next year, 2008, after the general election.

Other Articles That May Interest You ...

Sunday, August 26, 2007

Regional Stock Markets to pickup from Dow's tone

The Dow Jones industrial average rose more than 140 points on Friday, closing at 13,378.87, mainly due to stronger-than-expected reading on new homes sales for July. The Commerce Department said new home sales rose 2.8 percent in July, after falling 4 percent in June. The increase in July lifted sales to a seasonally adjusted annual rate of 870,000 units.

Even though the housing report appeared to ease concerns that the U.S. economy might tip into recession because of a skidding housing market and tightening access to credit, the upbeat reports could still disappoint investors who had been hoping weak readings would goad the Fed into cutting its benchmark fed funds rate.

The Chicago Board Options Exchange's volatility index, known as the VIX, and often referred to as the "fear index," has fallen for six sessions, signaling investors are regaining some confidence.

It is expected the Asian stock markets will open in the positive territory when the trading bell starts on Monday morning, including Malaysia Stock Exchange.

Protect your online Identity while surfing and blogging

As much as you like to surf the internet for great information to either help you in your daily work or to do research for your blog, there is the possibility of your computer being exposed to other unfriendly parties. When your notebook or computer is online, your computer will constantly broadcasts your IP address, the identity which tied to your notebook, to the cyber world.

If you do not wish your IP to be tracked by other websites which might want to monitor your notebook with the intention of retrieving your personal info from your service provider, then you need to hide them. Hide My IP Address can help you, well, hide IP address using its specially created customized security module, which routes your requests through two separate anonymous high-speed servers.

Technically, the two anonymous servers are secure because the data transfer is done at a hardware level - meaning that the computer software, which sits on top of the hardware, running on the servers can’t read the data. In addition the company claims it doesn’t keep any log file and with zero logs, it means nobody knows who you are and you’re anonymous.

As long as your computer or notebook is running on Windows XP, Windows Vista, or Windows 95/98/NT/ME, the tool works for you. I wonder if it works for Mac computer as well. However it’s not free but with one time subscription, you’re entitled to 100% FREE upgrades for life plus lifetime support as well. And that’s really a good bargain.

Apple – Skinned the Cat since the Subprime Crisis

Ever since the subprime mortgage mini crisis ruled the U.S. financial news end of July 2007, every single stock was affected regardless of whether it’s financial or technology stock. And you should have noticed StockTube had stopped trading options temporary since then. Coincidently the housing problem blown-off at the same time of the earnings season and this only add more uncertainty to the stock market’s pulse. Even if I’ve identify some stocks which should be able to make some money as the research said the stocks should beat earnings and so on, the overall market sentiment is simply not aligned with the trading plan.

One thing I learnt throughout the journey of trading is that you should not force yourself to click that little poor mouse to execute trades for the sake of trading in the hostile environment. Yes, it was hostile as people just dumped their stocks and 3-digit index plunge was a norm. Hence, how could you possibly expect to make money if the external forces are going against your analysis and research? You need to follow the crowds.

After waited patiently for some hours, I decided to enter some contracts after other indicators satisfied my trading’s requirement. It’s not easy to push the stubborn Bernanke to make such move and the feel-good factor should not fade so quickly. And there I was waiting for another three more trading days before I finally take the money off the table. It wasn’t an easy decision to lock the profit and run, simply because Apple had dropped so much – from the high $148 per share to $110 in less than a month since the eruption of subprime.

Other Articles That May Interest You ...

Friday, August 24, 2007

Chinese Banks adding fuel to U.S. Subprime Crisis

While the Federal Reserve is busy fighting and calming the internal subprime mortgage crisis internally, one external force could and might be the catalyst that would add fuel to the already spooky wildfire. This factor is none other than the U.S. economic rival China.

Starting with banks, Chinese banks are sending some early alerts that might create a second wave of tsunami of panic at the later stage.

China's biggest lender, Industrial & Commercial Bank of China (ICBC), reported earlier that its subprime mortgage-backed securities were valued at $1.23 billion at the end of June, accounting for only 0.3 percent of its total securities investment.

- Bank of China reported that it holds $9.65 billion in subprime asset-backed securities and collateralized debt obligations, equivalent to about 3.8 percent of its total securities investments. Its’ Hong Kong stock price fell by as much as 8.1 percent on Friday in reaction to the disclosure.

- Bank of China's Hong Kong unit, BOC Hong Kong (Holdings) reported it had $1.6 billion in subprime-linked securities, making up 1.2 percent of its total assets.

At this stage, it appears the fire is within control if it’s true that the biggest bank exposed to subprime mortgage is Bank of China. Analysts also noted that since all the asset-backed securities had ratings of "A" or above, the risk should be minimal. Nevertheless, we’ve to wait for the full earning reports from other banks to determine the risks and exposures.

Even if other Chinese banks have higher percentage of exposure to the subprime problem, it’s unlikely that the dollar-reserve-rich China will allow its banks to be dragged into the crisis to the level which can undermine the country’s economy. China government does not worry about the losses in terms of dollars and cents. What the government worries is the psychology effect which could create panic and fear into the equity markets spanning from Shanghai to Hong Kong if it’s not handled properly.

Other Articles That May Interest You ...

Investing All Singapore Champions Stocks

Most of the professional foreign investors do not limited their investment into a single basket, meaning they put their eggs into lots of baskets –diversification is the name of the game. They realized long ago that U.S. financial markets do not give them a safe and guarantee returns not matter how good they are in their analysis. They simply do not know when the bull or bear will rule the markets. Couple that with the uncharted water of currency variation, oversea investments had proved to be rewarding not only during the fluctuation of currency rate but during crisis period such as the existing subprime mortgage problem whereby the investment elsewhere could be pulled in to cover the losses within the U.S. soils.

Singapore, without doubt, is one of the most promising Asia countries in terms of political stability, financial hub, transparency, good governance, social security and corporate efficiency. According to investor Jubak, Singapore is the preferred platform country when comes to investment in Asia.

What does this means? It simply means that the best-managed, most-competitive and most-farsighted companies within the country have outgrown the limits of their domestic economies. Using their own economies as bases, they've expanded to attack opportunities in surrounding developing economies. The companies of a platform economy are better-managed and more-experienced international competitors than most of the companies in the surrounding developing economies.

A platform country has a relatively small but extremely vigorous economy – Singapore’s 250 square miles in size has gross domestic product worth USD141 billion as compare to 3 million square miles Australia with USD675 billion gross domestic product.

A platform country has a relatively small but extremely vigorous economy – Singapore’s 250 square miles in size has gross domestic product worth USD141 billion as compare to 3 million square miles Australia with USD675 billion gross domestic product.Singapore Telecommunications (SIN: SGAPY) on its own might not be attractive but collectively with its empire of associates its’ pretax profit growth is at 16% year-on-year. It owns:

- 21% of Thailand's Advanced Info Service (17 million subscribers and 52% market share),

- 31% of India's Bharti Group (42 million subscribers and 29% market share),

- 45% of the Philippines' Globe Telecom (14 million subscribers and 37% market share),

- 100% of Australia's Optus (7 million subscribers and 33% market share),

- 45% of Bangladesh's Pacific Bangladesh Telecom (1 million subscribers and 5% market share) and

- 35% of Indonesia's Telkomsel (29 million subscribers and 55% market share)

Singapore’s banks are perhaps the most promising of all with the name like DBS Group (SIN: D05) and United Overseas Bank (SIN: U11). UOB's banking subsidiaries include United Overseas Bank (Malaysia), United Overseas Bank (Thai), PT Bank UOB Indonesia, PT Bank UOB Buana and United Overseas Bank Philippines. DBS has reach out into Hong Kong, China, Indonesia, Philippines, Thailand, USA and India.

In addition real-estate conglomerates such as CapitaLand Limited (SIN: C31) spans more than 90 cities in over 20 countries and has residential projects in Singapore, China, Thailand and Australia with commercial developments in Kuala Lumpur, Hong Kong, Shanghai, Beijing, Bahrain and London. On July 30, CapitaLand announced the formation of two retail-property funds, CapitaRetail China Development Fund II and CapitaRetail India Development Fund, with a combined size of $1.2 billion. The new funds will bring CapitaLand close to its target of $18 billion in assets under management by the end of 2007.

If you intend to get exposure into the entire great platform companies mentioned, you can leverage on the ETF (exchange traded fund) which has the combination of all the champions. You can buy iShares MSCI Singapore Index Fund (NYSE: EWS).

Thursday, August 23, 2007

What if Telenor refuse to sell-down DIGI.com?

End of 2007 is suppose to be Judgement Day for DIGI.com Berhad(DIGI: stock-code 6947) of which the company is required to reduce its interest to below 50 percent. Earlier, the Malaysian authority indicated that there won’t be any extension for Norway's Telenor ASA (OSL: TEL), DiGi's main shareholder with a controlling 61 percent stake, to reduce its stake to the allowable level.

Nevertheless, Reuters today quoted Telenor as saying that it will probably not have to reduce its stake in Malaysian mobile operator DiGi.com to below 50 percent, despite rules ordering it to do so before 2008. Telenor Chief Executive Jon Fredrik Baksaas said Telenor has been a positive player in helping Malaysia's telecoms market develop and said he was in talks with authorities to find a solution, possibly by extending the exemption.

StockTube was wondering as well what could possibly happen if Telenor refuse to sell-down by way of holding to its 61% well into end the of 2007. You can’t simply point a gun at the head of Baksaas to sell it. So would the government extend the deadline until the country join the WTO (World Trade Organization) to which the pathetic foreign ownership is no longer valid?

Probably certain government officials could be “talked” into giving the leniency to extend the deadline until a win-win solution can be found. It actually doesn’t make business sense to Telenor to hold on to 49% stake as it could mean its’ roadmap to continue wrestling the market share might be met with multiple red-tapes from other majority shareholders. DIGI.com is already the leader in pulling the nose of other mobile operator in moving forward with its innovative marketing plan and services. You just need to take one lousy yet useless majority shareholder to create havoc by showing power within the board of directors, not that he or she can contribute positively.

Other Articles That May Interest You ..

The timing is right for Transmile to have New Auditor

Transmile Group Berhad (KLSE: TRANMIL, stock-code 7000) which was haunted by accounting irregularities and more than halved the fortune of billionaire Robert Kuok in the company is reported to be toying with KPMG to replace auditor Deloitte & Touche. The Transmile-Deloitte relationship was said to have blossomed many years ago, even before Transmile was listed, until the crisis in accounting cracked.

One of Transmile shareholders, Trinity Coral Sdn Bhd, which owned 16 per cent of the air cargo carrier as at July 31 and an associate of PPB Group Bhd (controlled by tycoon Robert Kuok) is in favor of KPMG instead of the old-guard Deloitte. Deloitte was the audit firm which discovered accounting irregularities in Transmile's recent accounts.

StockTube think the timing is right for the replacement as the confidence in Transmile was greatly eroded by the irregularities. Deloitte might be the firm which discovered the problem but it’s still not justifiable to continue its service as the problem was tracked back to 2005 and the quantum was huge. This is not a small issue such as a student who didn’t do his homework but a catastrophe which turned shareholders’ investment into red overnight. Even a student who didn’t do his assigned homework would probably be punished, so Deloitte should consider itself lucky to be able to continue its business without a single cent poorer.

Regardless whether the accounting irregularities was discovered because of a sudden stringent audit processes by Deloitte or because the worms were too huge to be kept inside the can, the fact remains that Deloitte has failed in its duty to protect the shareholders.

Other Articles That May Interest You ...

Dubai World in Casino Business

Dubai World, a government-owned holding company which made headlines last year when its subsidiary, Dubai Ports World, was forced to sell its U.S. port operations after an uproar in Congress over security concerns will invest about $5 billion in MGM Mirage, the casino operator. The investment includes $2.7 billion for CityCenter and up to $2.4 billion in purchases of MGM Mirage common stock.

The deal will give Dubai World a minority stake in MGM, with both companies entering a joint venture for CityCenter. The joint venture, CityCenter Holdings LLC, will be owned equally by MGM Mirage and Infinity World Development Corp., a subsidiary of Dubai World. The joint venture will fully own the CityCenter development when it closes.

Dubai World this month signed an agreement for control of the Barneys New York department store. A division of Dubai World spent $100 million this year to buy the QE2, the majestic ocean liner that has carried millions of people across the Atlantic during its 40-year history. The company plans to turn the giant passenger ship into a first-class floating hotel, retail and entertainment destination, berthed off Dubai's manmade Palm Jumeirah island.

Hey, I thought gambling or casino is prohibited within the law of Islam but then this is business and money talks. It could be argued that Dubai World is just an investor and play no role in running the casino business but still. I'm just wondering if Chua Ma Yu who paid RM1.168bil cash to acquire a 14.02% stake in Star Cruises Ltd from Resorts World (KLSE: RESORTS, stock-code 4715) will resell it to Dubai World for a handsome gain.

MGM shares jumped more than 10 percent, or $7.53, to $81.85 at the open of trading Wednesday.

Wednesday, August 22, 2007

Malaysia Ringgit Falls, Funds Out and Party Over?

Remember those days when the exchange rate was RM2.50 to USD1.00? Not to give away my age, not that I’m that bloody old, I somehow fantasized how cool and happy everyone would be if that currency rate remains, if not better, till today. Considering that the amount of things we can buy today doesn’t differ much from 20 or 30 years ago, you can imagine how the inflation has eaten up into our pocket, thanks to the government’s incompetency in governing the country.

If you have doubts just go and ask your father or someone elder than you. Best still, the take-home salary of a graduate today is almost static compare to 10 years ago but you should be able to feel the pain of inflation. Consider this, a liter of fuel cost less than RM1.00 while it’s almost double today. Same goes for the daily foods, groceries, health-care, tuition-fees and etc. No wonder everyone sings the same song – "everything up but salary never up". Who can blame them?

Of course the government’s argument for the last 20-years still remains – that Malaysia need to have lower currency to be competitive as far as export is concern. Until 1973, the Malaysian dollar was exchangeable at par with the Singapore dollar and Brunei dollar, meaning with the same RM1.00 you can cross over the bridge to Singapore and buy anything there without the need to exchange your curency. The Monetary Authority of Singapore and the Brunei Currency and Monetary Board still maintain the exchangeability of their two currencies until today at the 1 to 1 rate.

Singapore's prosperity started in the manufacturing and when the sector peaked in the late 1980s, Malaysians were flocking into Singapore’s manufacturing section to earn more after the currency conversion. Seeing this, Malaysian government decided to follow in full-speed into the manufacturing. But the currency rate which is in favor of Singapore saw huge migration of semi-skilled and skilled Malaysian (mostly Chinese) into the small nation, leaving unskilled workers back in Malaysia.

The currency exchange was about RM2.80 to USD1.00 before the 1997-1998 Asia Crisis hit. Almost all Asian countries were affected and the currencies took the free-fall into the Niagara waterfall thereafter. Malaysia being the outstanding and proud nation as it was, refused to take the pill of IMF and took the unexpected path instead. The former premier Mahathir surprised every single people in the globe by implementing capital control, instantly locking all the foreign funds within the country. Foreign investors are not allowed to repatriate their hard earn money back home.

It created panic and every single foreign soul dumped their stocks in the Malaysia stock market. And so the legendary Malaysia Composite Index nose-dived from more than 1,000 points to 200+ points. Without IMF-assistance, Malaysia was alone in fighting the recession. The currency was fixed at RM3.80 to USD1.00 and that was the time when everyone, except the top government officials of course, felt the pain of having such a low currency power. Yes, it gave the country the advantage of “cheap-export” but at the same time, the nation’s import suffered in the same quantum as well. Import goods were at the historical high and the high inflation was eating into the flesh.

It turns from bad to worse during the current Badawi administration when the high inflation was allowed to multiply. While the Singapore already in high-gear into high-tech engineering such as bio-tech and services sector, Malaysia seems to back-tracked into agriculture-age, not to mention the pathetic beliefs of the government that the manufacturing could still survive when almost all of them were relocated to China. I would rather have stronger ringgit; at least I don’t have to spend so much to go on an oversea holiday or foreign education, not that you can assured of a seat in local university even if you’re one of the brightest.

Weak currency is for an export-oriented country, not a very smart solution for a developing country which aims to become a developed nation in 2020, less than 13 years away. With almost all the developed countries have a strong currency Malaysia’s path couldn’t be right, could it?

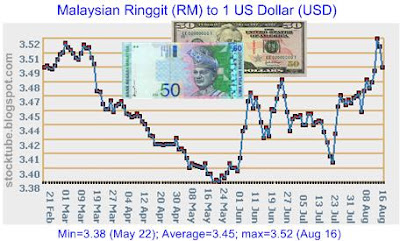

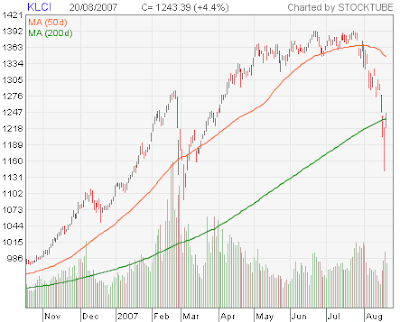

Weak currency is for an export-oriented country, not a very smart solution for a developing country which aims to become a developed nation in 2020, less than 13 years away. With almost all the developed countries have a strong currency Malaysia’s path couldn’t be right, could it?And so, the Malaysian ringgit was appreciating after the Badawi finally let go of the RM3.80 to USD1.00 tag. At one time it was at RM3.38 to USD1.00 and talks on the street were that the ringgit will further strengthen to RM3.00 to a dollar. Somehow it has weakening to the current level of almost RM3.50 to USD1.00.Interestingly the strengthening and weakening of the ringgit appears to be synonym with the Composite Index.

Looking at the graph, if both the currency rate and performance of stock market can be co-related, it shows the ringgit is actually depends on the foreign investors who poured in hot-money into the equity markets. If so, does that mean the ringgit will continue to weaken since the foreign investors have pulled out majority of their funds since the subprime mortgage erupted?

Looking at the graph, if both the currency rate and performance of stock market can be co-related, it shows the ringgit is actually depends on the foreign investors who poured in hot-money into the equity markets. If so, does that mean the ringgit will continue to weaken since the foreign investors have pulled out majority of their funds since the subprime mortgage erupted?Other Articles That May Interest You ...

Tuesday, August 21, 2007

Malaysia’s Biggest Scandal – Business as Usual

Malaysian authorities are facing a scandal over debts allegedlyexceeding US$1 billion (euro750 million) incurred by the country's main port authority, sparking concerns about a possible government bailout – reported AP. The fact that this scandal, which could be the biggest bailout since Badawi took over the premiership in 2003, caught the headline from external financial news provider could spell trouble to the ruling party.

The issue is politically sensitive for Prime Minister Abdullah Ahmad Badawi - who is widely expected to call for general elections before mid-2008 - because he has repeatedly pledged to boost transparency and battle the financial mismanagement that has plagued high-profile Malaysian projects in the past (under the former premier Mahathir).

Fears mounted that troubles with the 1,000-acre (400-hectare) PKFZ could hurt investor sentiment after the Dubai-based Jebel Ali Free Trade Zone Authority said last month it was pulling out of a pact to manage the zone due to what it called strategic reasons. Port Klang Authority Chairman Chor Chee Heong said Tuesday he was “busy with meetings” and declined to comment. Chor Chee Heong is also the MCA international affairs bureau chairman, one of the party components within the ruling government.

Shahrir Samad, the chairman of a parliamentary committee that looks into government accounting and fund allocations, said his panel is likely to look into the issue because it might involve public accountability concerns. "Is there (going to be) a bailout? If it involves government funds, we just want to find out what has happened," Shahrir, a parliamentarian in Abdullah's ruling coalition, told Associated Press.

Badawi who vowed not follow on Mahathir's path of costly projects had since made a 360 degrees turn by launching multi-billion mega-projects joked as “Multi Corridors” of which were seen as the last effort to boost the economy to fish for votes for the not-so-distance general election.

Just how serious is the scandal? As a comparison, the Bumiputra Malaysia Finance (BMF) scandal in the 1980s which involved slightly less than RM2 billion which shocked the nation had prompted the government to set up a Royal Commission of Inquiry, although the issue had since faded and swept under the carpet without anyone being put behind bars.

It’s both puzzling and mind-boggling to note that the PKFZ have ballooned to RM4.63 billion from the original estimate of RM519 million, mainly due to the 1,000 acres land acquisition which were valued at RM10/sq foot but bought by PKFZ for RM25/sq foot. The cost overruns were unauthorized and therefore illegal as any RM100 million increament in a project’s cost had to be first approved by the Ministry of Finance, of which PKFZ didn’t. It would be more amazing if whatMalaysiaKini reported is true – that the “same lawyer” has acted on behalf of both the buyer (PKFZ) and seller (Kuala Dimensi Sdn Bhd) of the land.

So, will the current premier act differently from his predecessor, Mahathir, with this new financial scandal? Most probably not and if the SOP (standard operating procedure) is to be followed, the next action plan would be to divert public’s attention and a black-out on the scandal using the government-controlled media. It’ll be business as usual.

It’s Hunting Season for Warren Buffett

While most investors were cracking their head on what should be their next step in the current mini economic crisis in U.S., one person is grinning with smile. Such crisis actually presents an opportunity for those who are contrarian in their investment methodology. But such method is not for everyone, at least not for those who do not have deep pocket and easily panicked when the bloodshed spills all over the trading counters.

Warren Buffett, the legendary investor whose empire, Berkshire Hathaway(NYSE: BRK.A, stock) is worth a whopping US$120,700.00 per share in the New York Stock Exchange, is said to be eyeing the troubled and largest mortgage lender, Countrywide Financial Corp. Warren already has stakes in Bank of America Corp and Wells Fargo & Company, the six and second largest mortgage lenders in U.S. respectively.

Meanwhile, Warren had increased his stake inBurlington Northern Santa Fe Corporation(NYSE: BNI, stock) which StockTube had highlighted back in April 2007. Warren’s Berkshire is reported to have bought 1.4 million more shares BNI from 15th Aug to 16th Aug at prices around $76.5 and $78.96 per share. After the 1.4 million shares purchased last week, Berkshire now owns 42,049,230 shares of BNI which is about 12% of total outstanding shares - these shares are worth more than $3.3 billion today.

Besides, Warren also had added Union Pacific Corp. (NYSE: UNP, stock) andNorfolk Southern Corp. (NYSE: NSC, stock), two other railroad companies into his portfolio. Buffett together with his long-time partner Charlie Munger, Vice Chairman of Berkshire Hathaway, said both of them never like railroad business because they needed large amounts of capital, had tough unions, and stiff competition from the trucking business.

But now the railroad industry has a competitive advantage by double-stacking freight and with all of the imports from China, the U.S. has a huge amount of freight being sent across the county. "I've got an elephant gun, I just can't find the elephant," Warren Buffett said during an interview. With about $50 billion in cash, Buffett is seen to look into other new areas for investment ideas.

Other Articles That May Interest You ...

Monday, August 20, 2007

KLCI up 51 points – has the knife reach the bottom?

Kuala Lumpur Stock Exchange saw some “bargain hunting” today and there’s a reason I used that word. Analysts have been using “bargain hunting” as a mean to tell you to buy some, probably 20% of what you would normally buy in a “normal” day. And it normally associated with the period after the stock markets took some beatings or consolidations. Also the name bargain-hunting sounds cool, don’t you think?

And so, the KLCI (Kuala Lumpur Composite Index) surged by a whopping 51 points, the first within the last 6-years. And you happen to bargain-hunt some stocks “hoping” the worst is over, it’s not easy to see such a jump in index barometer, anyway. Can’t blame you as you might not want to miss the boat, right? But what will happen if today’s surge is a one-day affair? What if today’s U.S. close is the reverse from Friday’s gain? I bet you’ll hold on to your stocks tomorrow even if KLCI decides to plunge on 2-digit close.

What could make the investors’ optimism sustainable? No doubt it’ll be lowering the federal funds rate after nearly 14 months of leaving it unchanged. Most of the investors are hoping that the Fed might act again before its Sept. 18 meeting as it did Friday, when it cut the discount rate to 5.75 percent from 6.25 percent.

So, did you make the right move by following the crowds into the buying spree today at KLSE? I wish I could tell but one thing is for sure – there’s no “panic buying” today obviously. There’re more people watching the show than participating in it. Technically, it neither show the knife has reach the bottom nor does it show it’s a temporary rebound. It depends solely on the direction of Bernanke and if you happen to make profit, it’s time to lock it.

Other Articles That May Interest You ...

The Man who can Change the Market’s Tone – Bernanke

With the exception of China, almost all the stock markets worldwide depend very much on U.S. Wall Street. The Wall Street in turns depends on the internal American’s economy data of which depends on one person who set the tune of the financial pulse. This person is said to be more powerful than the President of the United States. For a very long time, we were being fed with the name synonym with the master who dictated the direction of the financial market – the Federal Reserve chairman, Alan Greenspan.

Ever since the baton was passed down to his new student, Ben S. Bernanke, the new master seems to enjoy his tenurer till the month of August 2007. For multiple times, Bernanke had consistently re-used the same phrases and refused to back down from the calls to cut the interest rate. However the man was put to test when the subprime mortgage issue crawls out to the sunshine to expose itself.

It was reported by New York Times that Bernanke was believed to be the mastermind for both flip-flop statements. Bernanke who might be facing his greatest challenge since taking over as Fed chairman in February 2006 is now being watched under microscope if he’s the right man for the position after all.

Bernanke received both praises and criticisms on the latest moves. Some saidBernanke might have misread the market’s signals and acted too timidlywhen the statement on Aug 7th which gave a rosy outlook was issued. By changing the tone ten days later, the credibility of the Fed is being questioned.

Nevertheless some who stand behind Bernanke said when the facts changes, the Fed chairman had to change his mind. The former chairman of Princeton’s economics department who earned his doctorate at the Massachusetts Institute of Technology and an undergraduate at Harvard University has written extensively about Great Depression. Ed Yardeni, president of Yardeni Research, said that Mr. Bernanke’s studies of the Depression and other financial catastrophes have taught him that the Fed’s role is not only to keep inflation in check, but also to deal with upheavals in the markets.

Whatever it is, the market will shows in the next couple of weeks if the measures taken so far are sufficient to tame the anxiety. If not everyone will be watching Bernanke on his next action plan which could either push him to stardom or perish into something worst than anyone could imagine. The bone thrown so far might not be sufficient to satisfy the market and with the Fed's next meeting not scheduled until Sept. 18, investors may choose to stay jittery.

Friday, August 17, 2007

Google, are you aware of the Legal Suit by Malaysia?

Slightly more than 12 hours a go, StockTube blogged that the investors should “Get Ready for Asian Black Friday” as the U.S.’s Countrywide Financial Corp decision to borrowed $11.5 billion from a group of 40 banks would be used as the scape-goat by investors to further punish the stock markets. And looking at the steep plunges in Malaysia stock market today which is giving away 60 points as at 2:45pm trading hour now, it sure is a sight to watch.

Of course in this type of scenario, no researchers in their right mind will tell you to jump into the market simply because they (the elite researchers themselves) are equally stunned by this phenomenal crisis. However you can hear some weak voices especially from the bourse operator urging investors to bargain-hunt, a word often used by people who really do not have the guts to buy the stocks using their own money. So you should just take this call with a pinch of salt and forget their urges.

After days looking at the reddish board of stock prices, you should be able to stabilize and recover from the trauma of shock by the current 2-digits of composite index plunge by now. If it’s true that Malaysia had attracted tons of hot money before the current external crisis erupts, then it’s justifiable to say the foreign funds are pulling out from this region to save their own mess back in U.S. If it’s not true (assuming the Bursa Malaysia had created a fictitious story on it) then you can only assume the government is selling. Either way, the bear rules the market pulse as of now. So you have no reason to jump into the market unless you’ve tons of cash and you wish to try your theory of scooping the bottom.

The rapper who is currently studying in Taiwan could not be recalled from the Taiwan university as it was (the video) conducted in foreign land and since the student is neither on government scholarship nor both countries have andy extradition treaty, the government has chosen to target his family in Muar to apologize for their son’s “wrongdoing”. Days after the student apologized, Minister in the Prime Minister’s Department Nazri Abdul Aziz said the Cabinet was not in the position to forgive Wee and could be charging the student under Sedition Act, the weapon often used to muzzle critics.

The Minister also said that he wanted action to be taken against Google Inc.’s YouTube and other bloggers who allowed sensitive material which went against the laws of Malaysia to be published. So, finally the government has decided to pull its’ resources to fight the giant search engine Google and this should be seen as a healthy and interesting fight between the government and the super-rich Google. StockTube is not sure if Google has been alerted of this latest development, what StockTube knows is as long as there’s a word or statement of legal charges against Google, the case will be passed to the internal Google’s Legal Department. Could Google's shares suffer as a result of this suit? I doubt so.

At the same time, there’re opinions that the student with his video could not have come at the right time for the government to divert the public attention from the current social-economy problems which were echoed equally by Raja Muda of Perak Raja Dr Nazrin Shah’s call for good governance in the country and former premier Mahathir who blames rising crime 'rot' under govt. By the way, Jeff Ooi had blogged on the translation of the song into Malay language.

Other Articles That May Interest You ...

Get Ready for Asian Black Friday

More bad news hitting the Wall Street again on Thursday. Countrywide Financial Corp., the nation's largest mortgage lender said it had borrowed $11.5 billion from a group of 40 banks to fund loans in a move that shows just how deep the lending crisis has become - reported AP.

Countrywide shares fell $5.14, or more than 24 percent, to $16.15 in afternoon trading. The stock has lost more than half its value since January. President and Chief Operating Officer David Sambol said "Countrywide has taken decisive steps which we believe will address the challenges arising in this environment and enable the company to meet its funding needs and continue growing its franchise."

On Wednesday, Merrill Lynch & Co. downgraded Countrywide to "Sell," just days after calling it a "Buy," attributing the change to the rapid deterioration of the credit market. Credit rating agency Moody's Investors Service downgraded Countrywide's senior debt rating to "Baa3" (lowest investment-grade mark) from "A3," citing Countrywide's funding problems. A ratings downgrade essentially makes it more expensive for a company to borrow money. Countrywide could be further downgraded if it continues to face liquidity problems.

So, with this latest confirmed problem with Countrywide, it's expected the falling knife will continue to do its work to the other regional stock market including Asian when the trading bell starts on Friday. I wonder if any future traders made any great fortune from such plunge.Thursday, August 16, 2007

EPF finalizing steps to let go of RHB to KFH

This is not something new but rather to re-confirm the market’s expectation of the next subsequent steps to be taken by EPF (Employees Provident Fund) after it successfully or forcefully acquired Rashid Hussain Bhd(KLSE: RHB, stock-code 1309) of which its jewel in the form of RHB Bank attracted numerous players, both local and abroad.

As discussed earlier, any Middle-East organizations would have advantage over other foreigners in acquiring a majority stake not only in financial institution but other energy-related production company in Malaysia. Today, just five months afterUtama

What will be the most interesting event to watch would be the potential selling price of the banking to Kuwait Finance House. EPF paid RM1.80 per share for RHB and RM4.80 per share for RHB Capital (which holds the license of the banking arm) from UBG.

Another thing to watch - who will be the second partner to join in the badwagon since EPF has said it wants at least two partners to help build value in RHB, with their contribution either in strategy, Islamic banking, financial strength or risk management. Could the second partner be CIMB Bank, an investment bank of Bumiputra-Commerce Holdings Berhad (KLSE: COMMERZ, stock-code 1023)?

Other Articles That May Interest You ...

Stock Markets Knife is falling down, Should You Buy?

Asian stocks tumbled today, Thursday, heading for their biggest daily fall since the attacks on the United States in September 2001, as persistent fears about a global credit squeeze sapped investor appetite for risky assets. The latest scare was set off by worries that Countrywide Financial, the largest U.S. mortgage lender, could face bankruptcy if liquidity worsens after aMerrill Lynch (NYSE: MER, stock) analyst issued the Red-Alert.

If you’re superstitious, it’s time for you to blame it on the Chinese Hungry Ghosts festival which coincided with the worst accident in history – all signs point to Putrajaya. Only this time, the hungry ghosts might be from the elite investors or speculators who are out to create havocs in the global stock markets. Be scared, be very very scared.

MSCI's (Morgan Stanley Composite Index) measure of Asia Pacific stocks excluding Japan fell 5 percent to four-month lows. The MSCI index is down more than 16 percent from the July 24 record high, but is still up about 6 percent for the year. Japan's Nikkei and Australia's S&P/ASX 200 index have both wiped out gains for this year.

Almost all the investors are dumping financial stocks after the housing stocks were beaten to their low recently. So you should know what stocks to avoid temporarily.Nobody knows when this falling knife will reach the gound. If you wish to play safe, wait for the knife to reach the ground, or at least wait for it to lose its momentum. If you wish to take some risks, then you might want to buy in stages.

A Cartel of Accountants – Who will Police them?

The plan and proposal by the Securities Commission (SC) to introduce new rules that will make it mandatory for companies to choose from a select group of accounting firms when they submit rescue plans and initial public offerings (IPOs) would be a positive move to instill confidence lost from the recent accounting irregularities.

However the concerns expressed by certain accountants should not be ignored in totality. The worries of the possibility that the move may create a cartel that could push aside smaller firms make sense from the business perspective. But to the minority shareholder, the concern is not too much on the monopoly for the lucrative business by certain accounting firms only.

What we had heard so far was the CEO, COO, CFO or directors resigned and in some handful of cases, charged (pending hearing which might take ages). The very top chief officers in the influential and conglomerates are almost un-touchable. But if these chiefs can be charged, why not the accounting firms which had acknowledged and verified the accounting figures of the companies?

If there’s no third agency powered to audit this selected group of elite accountants, the whole proposal will be back to the square one as nothing can stop these selected accounting firms from closing one eye either.

Other Articles That May Interest You ...

Wednesday, August 15, 2007

New PROTON Model with Old Design Launched

Sometimes thing will never change for the better if the cancer-cells never removed. Worst still when a national-status company couldn’t recognize the basic flaw in its designing methodology and production. Days before the country’s 50th Independence celebration, Proton Holdings Bhd (KLSE: PROTON, stock-code 5304) today launched the so-called new model, Proton Persona. But somehow I couldn’t find any reason to jump in joy, no matter how hard I try.

The latest addition to the PROTON family is the fifth model fully built by PROTON after the introduction of the Waja in 2000, the Gen.2 in 2004, the Savvy in 2005 and the Satria Neo in 2006. Designed to replace its 14-year-old Wira model, the sleek new 1,600-cc Persona sedan is suppose to bring back its status as the country's leading car seller to local rival Perodua.